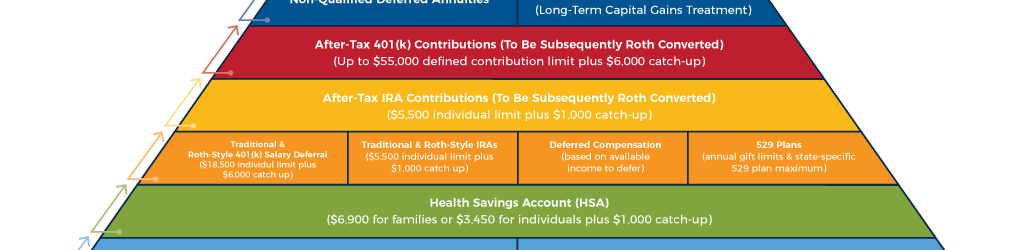

The Hierarchy Of Tax-Preferenced Savings Vehicles For High-Income Earners

The Federal government has long incentivized saving for retirement and other financial goals by offering some combination of three types of tax preferences: tax deductibility (on contributions), tax deferral (on growth), and tax-free distributions. As long as the requirements are met, various types of accounts – traditional to Roth IRAs, and annuities to 529 plans … Continue reading The Hierarchy Of Tax-Preferenced Savings Vehicles For High-Income Earners

0 Comments