Executive Summary

Creating a financial plan starts with gathering the client data, which many advisors request by providing clients with a “data gathering form”, typically structured in a manner that makes it easy to input the data into their financial planning software.

The caveat, however, is that in practice clients often don’t fill out the data gathering form. For some, they feel it’s too much work. For most, the problem is simply that they aren’t organized enough to provide all the requisite information. And may even feel guilty or embarrassed about the fact that they’re “failing” in the very first step of the financial planning process.

So what’s the alternative? Ditch the data gathering meeting, and have a “Get Organized” meeting instead. In other words, make the first meeting with the client about getting them financially organized in the first place. Have them bring in their jumbled files, and give them a file box with sorted folders to organize the information. Scan the key documents and statements and put them into a newly created client vault. Set up a client PFM portal, show them how to use it, and help them to begin connecting their accounts on the spot.

By having the Get Organized meeting, the financial planner still has the opportunity to collect all the data that’s needed to move forward with the financial planning process – but done in a client-centric manner that recognizes the client’s challenges and provides them an immediate, tangible benefit. In fact, for some people, a “Get [Financially] Organized” service might be so valuable, advisors could even charge for it separately and get paid to market and demonstrate their value to prospective clients!

The Problem With The Data Gathering Meeting

The 6-step process of financial planning starts with establishing the client-planner relationship, and then immediately proceeds to gathering client data. This natural sequence forms the basis for all the actual financial planning “work” that will follow – after all, it’s impossible to analyze a client’s situation, make recommendations, and implement them, if the advisor doesn’t have the underlying data in the first place.

Unfortunately, there’s a major problem with the typical data gathering with clients: many clients don’t actually have the data in the first place, or at least don’t have an easy way to put their hands on it. Their financial lives are not well organized. “Important” documents like Wills and life insurance policies are stashed away in a filing box… somewhere. There are paper statements for a few of the investment accounts, but the rest require an online login… using a password long since forgotten. Sometimes clients aren’t even certain exactly where all their assets are. “I think there’s still some money left in that old 401(k) from my job back in 2007?”

Which means when the financial advisor asks a new client to fill out a data gathering form and bring it to the first meeting to start the financial planning process, the process hits an immediate wall. The client doesn’t know all the details to fill out the form! Even the thought of getting the data together may seem daunting, as it will clearly require a lot of work. In other words, the desire to “do” financial planning with the advisor has turned into a giant homework assignment for the client on Day 1!

And sadly, the implicit pressure from the financial advisor can even make the situation worse. Clients who aren’t organized enough to comply with the “simple” advisor request of “fill out this form and bring us all your data so we can begin the process” may feel guilty or inadequate.

“Does everyone else have this information put together except for me? My planner seems to expect that I should have all this material at my fingertips. I feel like I’m failing and I haven’t even started yet!”

And then the natural human responses start to kick in.

“This is going to take a ton of time and effort. I’ll just put this off until later.” (Procrastination)

“Ugh, I’m realizing now that I don’t even know where some of this stuff is! I’m going to have to reschedule the meeting. It’s too humiliating to go into the advisor’s office and have to admit my financial house is in such disarray.” (More procrastination, rescheduled meeting)

“I’m so embarrassed I don’t have all the data my advisor needs to start the process. If I ignore the advisor and how awkward this whole experience has become, maybe it’ll just go away.” (Client never agrees to reschedule)

Of course, many experienced advisors have long since “learned” that asking clients to bring in all their data up front rarely works, precisely because clients usually don’t have the data handy and available. So instead, we just say “bring in what you can” and try to flesh out the rest of the rough details verbally in the meeting.

Yet in practice, this still drags out the financial planning process. The initial analysis turns out to be ‘wrong’ because crucial information was accidentally left out, or turned out to be incorrect based on subsequent details that changed the client’s original foggy recollection. The subsequent implementation stalls, as the final steps can’t be taken because some key data and materials are still outstanding.

The fundamental problem: starting financial planning with a data gathering meeting implicitly assumes that clients are organized enough to provide that data, even though we know the reality is that many people aren’t actually that organized. We’re trying to solve “our” problem as advisors – gathering the data – rather than truly focusing on the client’s problem of being financially disorganized (and the feelings of shame that can arise from “getting [financially] naked” in front of an advisor and admitting to being so disorganized).

Introducing The ‘Get Organized’ Meeting

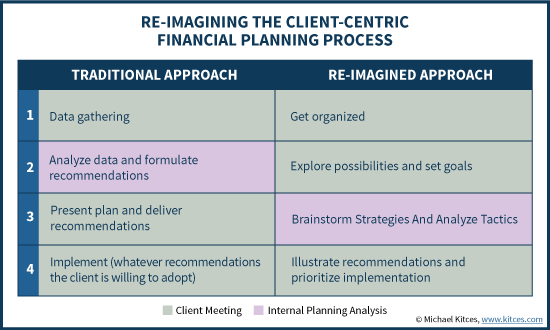

So if the reality from the client’s perspective is that they often aren’t financially organized enough to begin the financial planning process with data gathering, then why not make the first meeting about getting organized!? In other words, forget the advisor-centric data gathering meeting, and offer a client-centric “Get Organized” meeting instead.

The starting point would simply be introducing the concept to clients, and what they should expect. For example, a prospective new client might be sent the following:

In order to move forward with your financial plan, we need to understand the details of your financial life.

However, we realize that like most people, your financial life probably isn’t in perfect order already. Statements end out buried in drawers and at the bottom of piles. Insurance policies are buried who-knows-where. Sometimes we even lose track of old accounts.

So at our first meeting, we’re going to work together to help you Get Organized. Please bring with you whatever financial information you can easily put your hands on. If you just want to bring in a box full of scattered papers (or even unopened envelopes!), that’s absolutely fine, we’ll work with you to sort through it. If your accounts are mostly set up online, we’ll help you track those down too.

By the end of the meeting, though, our goal is to help you Get Organized. Together we’ll start you on your way to getting your financial information in good order, and set you up with a system to keep things organized in the future. And along the way, we’ll gather the details we need to take your financial plan to the next stage."

And then in the meeting itself, the goal is to get the client organized – both their physical paper documents, and their online financial world.

Getting Paper Statements And Physical Files Organized

The first step to helping clients to their physical paper statements and files in order is to literally help clients get their statements and files in order.

Accordingly, the advisory firm process would begin with setting up a file box for clients – for instance, a storage box like this with ample room for hanging files – which would be pre-configured with labeled folders for the typical categories of client financial information, including Wills & Trusts, Insurance Policies, Bank Accounts, Investment Accounts, etc. (The box could even be privately branded to the advisor, for additional marketing value.) Keep a label maker handy to add labels to new folders relevant for the client’s particular information.

From there, it’s time to actually go through the client’s piles of files. Having an intern or associate planner involved may help with the process of sorting through all the information and getting it filed properly. (And it’s a good experience and learning opportunity for the intern or newer advisor!) Guide clients about what information really needs to be kept, and what does not. Have a shredder there in the conference room so old information can be trashed on the spot (no reason for the client to carry it back home!).

Once the files have been initially organized, ask the client if there appear to be any significant accounts or insurance policies that are missing. If they are, look up the contact information for the financial services firm on the spot (from the computer in the conference room), and either call the company or submit a request online immediately to request the information. Make an empty folder with an appropriate label so the client knows exactly where to put the file when it arrives. Remember, the goal is to make it easier for the client to be organized, and minimize the post-meeting homework they don’t want to do anyway!

Notably, handling all these key client files and information also provides an important data-gathering opportunity for the advisor. In addition to sorting through all the various historical files, the advisor should have a high-quality portable scanner in the conference room, to allow for the most recent statements and other key documents to be scanned on the spot. This allows the advisor to have as much up-to-date information as possible coming out of the Get Organized meeting to continue the financial planning process!

Configuring The Client Vault And Online Portal

In addition to scanning key documents and recent statements for the advisor’s data gathering needs, the scanning process creates the opportunity for the advisor to set up an online vault for the client’s digitized financial information. Depending on the advisor’s technology setup, this might be done with a standalone “vault” solution like Sharefile or EverPlans, or a client document vault tied to portfolio accounting tools like Orion Advisor Services or financial planning software like eMoney Advisor.

In fact, as the process of organizing the client’s physical files nears its completion (or at least, once your intern or associate advisor is busy going through the rest of the files and sorting or shredding the documents as appropriate), the next stage of the “Get Organized” meeting is introducing your client vault and showing clients how to access and navigate it (including where you’ve already put their initial files).

Once the vault is configured to capture the digital version of paper files, it’s time to get the client fully organized in the digital world as well, by setting them up to use a full Personal Financial Management (PFM) dashboard, such as the one that eMoney Advisor includes with their financial planning software, or a standalone solution like Wealth Access.

As with the organizing of physical files, the goal of configuring the PFM portal is to get clients organized at the meeting – not just give them homework to do later. So if possible, the advisor should actually help the client log into the portal for the first time, and begin connecting accounts on the spot. (Show the client that you’re using the “private browsing” or “incognito mode” for your web browser, to ensure the protection of their private information and that their login details are not saved in the local browser.)

And of course, as with the process of getting physically organized, connecting client accounts through a PFM is appealing for the client because it gets them (digitally) organized, but also for the advisor because it provides a means to get additional data for the client’s financial plan (that will be continuously updated thanks to account aggregation!).

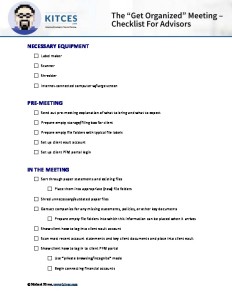

The "Get Organized" Meeting -

Download Checklist For Advisors

Benefits Of The Get Organized Meeting

For some advisors, I suspect that completing the steps on the “Get Organized” meeting checklist will feel too “basic” or beneath them. Is it really valuable to spend your time as a CFP certificant helping a client file some documents and scan them? Or showing clients how to log into a website and connect their accounts?

The short answer: Yes. Because the meeting isn’t about the advisor. It’s about what an often-not-very-financially-organized client needs.

After all, consider this experience from the client’s perspective. The data gathering meeting isn’t just a bunch of homework anymore, or a stressful and embarrassing situation where the advisor asks for information the client can’t (easily) produce. Instead, it becomes a meeting where the client is expected to be less-than-completely organized, and has a clear, tangible outcome to become more organized.

This cannot be emphasized enough. The benefit to the client of the Get Organized meeting is that the client will literally be more organized at the end of the meeting, and walk out holding the box of files that makes them more financially organized than they may have ever been in their lives, and set up with a system to maintain that organization in the future. Now the client leaves the first meeting with a sense of accomplishment, that they’re actually taking measurable, tangible positive steps towards improving their financial future!

Along the way, of course, as the advisor you actually did get all the information you would have been seeking in a data gathering meeting anyway. The client did bring in all the statements. You did get to scan all the key documents to reference in the future development of the plan. The client has connected all of their accounts via aggregation so you can get continuously updated client data in the future.

The distinction is that rather than gathering data in a manner that’s focused on the advisor – fill out this ‘data gathering form’ in a format that’s convenient for my financial planning software – it’s done in a client-centric manner, resolving an actual pain point of the client: the all-too-common feeling of being financially disorganized.

What Happens After The Get Organized Meeting?

Of course, one important caveat is that spending this much time on just the raw financial information and data – between sorting out physical paperwork and files, and connecting client vaults and online account aggregation – means there may be little time to do a deep discovery process of talking through the client’s actual goals, and all the important non-financial information.

But this isn’t necessarily a problem. Now that you have the financial information, the next meeting can be spent mind mapping through the client’s non-financial details, and even beginning to use the planning software in a real-time collaborative manner with the client to explore the possibilities and identify potential goals! This second stage “Personal Discovery” meeting should actually be even more effective, because you’ll already have the underlying data in place. And the client will likely be even more interested in progressing to this next stage of this reimagined client-centric planning process… having achieved such a positive tangible outcome from the first Get Organized meeting!

Skipping The Get Organized Meeting… Or Sometimes Getting Paid For It?

Notably, for that subset of clients who really are financially organized already – and don’t need the “Get Organized” meeting – they may be able to just skip directly to the second meeting and begin exploring their potential goals.

In other words, the point of the “Get Organized” meeting is not to be mandatory for every client, but simply to be available for what are likely the large number of prospective clients who could benefit from it.

On the other hand, you may even find that for some prospective clients – many of whom are likely daunted by how much “work” it is just to find a financial planner and begin the financial planning process – the availability of a “Get Organized” meeting actually turns them into clients. Because they weren’t about to do all the homework required to get themselves organized, and weren’t going to admit to they couldn’t complete the advisor’s data gathering form. But when the data gathering meeting is about the client, and valuable to the client, the process is far more appealing.

In fact, some advisors might find they can even charge for the Get Organized meeting as a separate service for clients! This could become an option for existing clients (some of whom are still not financially organized), or a ‘pre-engagement’ service for prospective clients – a form of getting paid to market by offering a useful and relevant service for non-clients that’s worth paying for and can turn them into full clients.

The bottom line, though, is simply this: the data gathering process is fundamentally broken for many potential clients, who simply aren’t organized enough to provide the requisite data in the first place. So if the reality is that most clients aren’t actually financially organized in the first place, don’t pressure them or make them feel guilty about being unable to complete your data gathering form in a manner that’s convenient for your financial planning software. Have a Get Organized meeting and offer them a service that actually solves their problem… and gets you the data you need along the way!

So what do you think? Do you struggle to get clients to go through the Data Gathering process and provide all their information? Do you think the Get Organized meeting would be a viable alternative? Please share your thoughts in the comments below!

Michael,

What a wonderful concept! I can envision a “get organized” meeting as a stand alone chargeable service for adding clients. Why couldn’t also this be a client seminar topic instead of the same tired Social Security claiming or estate planning stuff? A seminar on helping clients organize their financial lives. It adds great value and decommoditizes the advisor from just being another investment management person.

I would make the this meeting a “pizza night” where the clients feel like they sitting around their table at home getting their financial life in order. What a great way to tie the client to the advisor and deepen the relationship.

Wonderful post, Michael, and right on time for our firm. Thanks for all you do.

Great post, Michael. A great example of how human advisors can use technology to provide real value for current and new clients.

Hey Michael, excellent post and something we have been incorporating. With the proliferation of virtual advice, have you thought of ways to do this online for people in an efficient manner. Bringing in the shoebox is not as easy since we can’t see and scan the financial junk drawer that they have. Would love your thoughts.

We often just let clients use our laptops to log into their accounts, and we download their statements on the spot.

It would also be a good time to scan MissingMoney.com to see if any lost money shows up.

I’m always amazed at how often I find money when I look up people (including $6,500 for my own mother).

Margie,

Wow, what an awesome suggestion! Thanks for pointing this out!

Great way to demonstrate “ROI” in the first meeting – literally helping a new client “find” (old) money! 🙂

– Michael

I think an initial meeting like this is fantastic for many individuals. If working virtually with clients, do you think it’s worth setting up the client with a virtual scanning service such as shoeboxed.com so they can get all their docs scanned for them on an ongoing basis? They could simply send all their docs in for scanning via a prepaid envelope, have them scanned, digitally stored, and securely shredded. Or might there be concerns around having strangers seeing sensitive data on certain documents?

Hi Michael, a great article – well done. I am though of the opinion that all of the ‘financial organisation’ should be accomplished in the second interview rather than the first. Building trust with a client I feel is the core of the advice relationship and this is the first priority and should not be bypassed . I also feel that by developing trust during the first interview helps to foster a far more open and honest approach from the client, when it comes to getting personal financial details from them.. Regards Adrian

Adrian,

I presumed that this would only happen after the person has agreed to become a client. Which means you’re already likely 1-3 meetings into the process with the client already, before you ever get to the start of a data gathering discussion.

But yes, if the person is literally a stranger and this is an approach meeting for the first time, I certainly wouldn’t advocate this (or any) formal data gathering process when the prospect hasn’t even decided if he/she trusts you enough to do business yet… 🙂

– Michael

I think you could do this as a stand-alone service at the outset. Some people might not really hit the threshold for you or your firm’s minimum but still need and want to get organized. That is one of the chicken/egg problems with our industry. Client doesn’t have enough $ to meet an advisor’s minimum but they don’t have the financial sophistication to get there without an advisor.

To address the trust building comment, I think this is where advisors get in their own way. How many people walk into H&R Block every year with their entire financial life in a box and hand it to a perfect stranger! If you are a CFP working with a reputable firm and offer this as a standalone fee-for-service I don’t see a problem overcoming the trust objection. Make it clear that this is a one time fee and there is no obligation to work with you in any other capacity.

Great article Michael! Thanks for posting. Again, you have changed my life!

Love it. While we are at it, any tips on the best way to organize all the passwords?

this article does a fantastic job in describing one of the reasons clients & advisors love Asset-Map: http://www.asset-map.com

I was searching for “software to assist with financial planning data gathering” and this article came up! THis is one of the most important articles I have read. I am going to implement this into my practice today! I would be curious to know if advisors are doing this and charging a fee for it. I used to charge fees for planning because I felt like the clients were more invested in the process when they had skin in the game and i was also able to take a much more comprehensive approach to planning if I was paid for the service. I got away from that and the data gathering aspect suffered. I was thinking something nominal to help people get organized like $250-500 or something for an estimated 2 hours of time. Any thoughts?