Executive Summary

The very essence of financial planning is about helping clients to formulate the strategies to achieve their goals. In this context, the role of the financial planning is to help clients articulate their future goals, and then provide recommendations for how the client can best achieve them.

There’s just one problem: research suggests that we’re not actually very good at figuring out what our future goals will be. The fundamental challenge is that, despite recognizing how much we change over time (think back on how different you were 5, 10, or 20 years ago!), we just don’t know how to envision the ways we’ll be different in the future. In fact, researchers have dubbed the phenomenon the “End Of History Illusion” – we just don’t know how to project a future that’s any different from today (which is the end of our personal history as we know it).

From the perspective of financial planning, and the rising popularity of goals-based investing, the challenge of the End Of History Illusion is that we may be encouraging retirees to save towards a vision of retirement that they won’t actually care about when retirement comes. This doesn’t mean that retirement itself won’t be relevant, but that vision of a particular retirement home, vacations, a boat on the lake, or a certain lifestyle, may not actually be very desirable when the time comes.

Which means investors should actually be cautious about tying their saving and investing habits in a way that over-commits to a particular and specific long-term goal. Instead, if we recognize the uncertainty of future goals themselves, planning for flexibility to adapt to future goals may be more effective than investing for the goals themselves!

The End Of History Illusion: An Inability To Vision Our (Different) Future Selves

The concept of the “End Of History Illusion” comes from a 2013 study by Quoidbach, Gilbert, and Wilson published in Science.

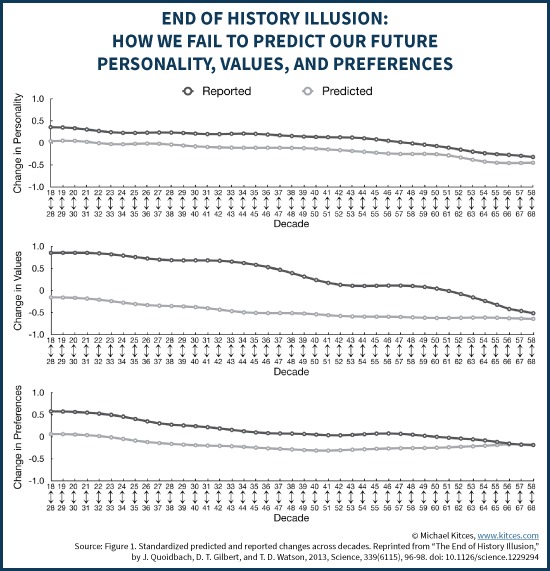

The study (actually, a series of four studies) surveyed people across a wide range of ages, and asked them to either report on how much they had changed over the past decade, or how much they expected to change in the next 10 years, regarding their personality (based on the Big Five personality traits), their core values (e.g., achievement, conformity, security, tradition, etc.), and their preferences (e.g., likes and dislikes amongst music, food, hobbies, vacations, and friends).

This comparison makes it possible to estimate how much people change over a 10-year period, and how effectively they predict their own change. For instance, the 48-year-olds were asked to predict how different they’d be when they’re 58 (a decade in the future), and the 58-year-olds were asked to predict how much they’d changed since they were 48 (a decade ago).

The startling result: people persistently predicted that they would change very little over the coming decade, even as people who had just lived that decade looked back and found that they had in fact experienced significant change. Across the age spectrum, the results showed that for any given 10-year period of time (from 18 to 68), we report far more change after the decade ends than we predict heading into it (though the gap does shrink as we get older and our lives stabilize).

In other words, the study found that we expect that who we are today is who we’ll be in the future, and fail to recognize the change that will almost certainly occur. And we misjudge how much we’ll change, despite the fact that we recognize how much we’ve already changed over the past decade!

And so the researchers dubbed this phenomenon the “End Of History Illusion” – no matter how much historical information we have about our own lives, we just cannot seem to predict future change beyond the end of history as we know it (i.e., beyond today).

How The End Of History Illusion Makes Us Overpay For Our Current Preferences

Another way to look at the End Of History Illusion is to recognize that we’re not very good at predicting what we’ll actually like and dislike in the future. We presume that whatever we like (and dislike) today will be the same a decade hence, only to later discover that our preferences have actually shifted once the time comes.

This is problematic, because it can lead to a significant distortion in what goals we save for, and how we value them – which is exactly what Quoidbach, Gilbert, and Wilson found in a follow-up to their original study.

Accordingly, the researchers did a new survey, asking people either how much they’d pay to see their favorite band from 10 years ago, or what they’d pay to see their current favorite band 10 years from now. The result: on average, people were willing to pay $121 for a ticket to see their current favorite band 10 years from now, but they’d only pay $80 to see today their favorite band from a decade ago.

In other words, people were overpaying by 51% to indulge their favorite band in the future (despite the fact they’d have to wait 10 years to see it!), failing to recognize that by the time the future comes, they’re probably not going to be nearly as into the band by then! Or viewed another way, we’re too willing to pay current prices for our current favorite band, and fail to properly discount how much less valuable that concert ticket will probably actually be to us when we show up for the event 10 years from now for a band we’re not that into anymore.

How The End Of History Illusion Creates Problems For Goals-Based Investing

The essence of the End Of History Illusion is that it suggests we have remarkably little insight into our personality and preferences in the future. Even as we recognize how much we’ve changed in the past, we project the future to basically just be the same as today (with perhaps a little more gray hair). We literally can’t seem to visualize our future beyond anything we’ve ever already known.

And even though the End Of History Illusion does appear to decline with age – i.e., we’re ‘less wrong’ in our predictions of our future selves when we’re older – it’s still not because we get better at predicting our future selves, it’s merely because we actually change less so when we predict we won’t change anyway, we’re not as far off.

From the perspective of goals-based investing, though, this has potentially profound implications, in a world where it’s increasingly popular to try to tie investments and portfolios to specific future goals. It’s one thing to save for “retirement”, but another to save for a particular retirement home, specific vacations, or a long-desired boat. Because the research suggests that those retirement preferences are much more likely to represent what we want today than what we actually want in the future.

And the risk is that if we save in a too-targeted manner for those specific goals, we may find when the time comes that we “over-saved” for a goal we turn out not to care about nearly as much as we’d expected. While the researchers studied our desires for a “rock band” concert, it could have just as easily been a particular vacation destination, retirement in a certain location, or living a lifestyle enjoying particular favorite (now, but not necessarily in the future) restaurants.

All of which raises the serious question:

What if we’re encouraging clients to save towards a retirement that isn’t actually the one they’ll want when the time comes?

To some extent, the risk of saving for the “wrong” retirement may be partially ameliorated by the fact that a change in particular preferences doesn’t necessarily mean a change in lifestyle or overall standard of living. In other words, we might not want that rock band (or hobby, or vacation) in the future, but if we like rock bands (or hobbies, or vacations), we’ll probably be into something similar when the time comes.

Planning For A Flexible Future Instead Of Specific Goals?

The fundamental challenge of goals-based investing, along with the growing use of financial planning software that helps us to set specific goals, is that the research suggest we don’t really have any real clue what our goals actually are. And encouraging people to set specific goals could potentially even exacerbate the problem, hyperfocusing clients on current goals that may not be relevant in the future, and leading them to oversave for something they won’t actually want when the time comes.

Fortunately, the reality to some extent is that if our retirement goals are all “long-term” goals anyway (because retirement is still distant), they may still get similar long-term investment portfolio allocations, even if we’re not positive exactly how we’re going to use the money when the time comes. And as retirement looms closer, we do appear to be somewhat more accurate in predicting our future desires and preferences (if only because they’re actually more likely to be the same as what we like today), and then we can decide which specific goals to prioritize our accumulated dollars towards.

Still, what this suggests is that at a minimum, the way that we save and invest towards retirement (and other long-term) goals should probably be deliberately flexible. Save towards an example of your dream retirement home, but don’t buy the land today or put in an early downpayment. Try out what it’s like to rent where you want to retire for a period of time, before committing to retire there “for the rest of your life.” And recognize that until you’re VERY close to retirement, no matter what you think you know about your desires in retirement, you’re probably just projecting what you like today and hoping/expecting it won’t change (even though it likely will).

In turn, this also implies that the younger you are, the more that “good” financial planning is really about flexibility, not working towards specific long-term goals. After all, the end of history illusion was already significant for those in their 50s just projecting 10 years forward; consider the situation may be even worse for 40-year-olds projecting 20 years forward. And for those in their 20s and 30s, the end of history illusion suggests we don’t even know what we’ll want to be doing in our 40s and 50s, much less for retirement in our 60s and beyond!

In this context, it’s more about doing financial planning to understand what goals would be possible, rather than pursuing any one in particular, and ensure that goals aren’t so risky that no (tolerable portfolio could achieve them). And planning strategies like “avoid or minimize debt” become highly relevant, not because “debt is bad” but simply because “debt limits choices” and reduces flexibility… in a world where, as noted, we can’t really predict what we’ll like and want to do in the future. Similarly, “emergency savings” isn’t just about having available cash for an “emergency”, but any number of significant life choice changes, from getting married to having kids to getting divorced, or going back to school or changing jobs or starting a business.

Perhaps the one caveat to the “don’t have specific goals” approach is that specific goals – especially when they’re broken down to be smaller and more bite-sized goals – may be more motivating (to take the steps to actually achieve them). Saving is hard for a fuzzy ephemeral goal like retirement – “trust me, in 20-30 years you’ll be thankful for all that money you didn’t spend and enjoy along the way” – and having a vision of retirement, even if it’s the wrong vision, may help create more of a savings focus. Nonetheless, it’s still crucial to recognize that our brains don’t seem to be wired to really envision what we’ll be like in the distant future – even as we recognize how much we’ve changed in the past – so be cautious not to lock yourself too tightly into your future goals, nor the investments you tie to them!

So what do you think? Have you witnessed the End Of History Illusion with your long-term clients, whose preferences changed in retirement from what they said they’d want a decade ago? In your own context, when you reflect back on how much you’ve changed in the past, how do you feel about trying to vision your future?