Executive Summary

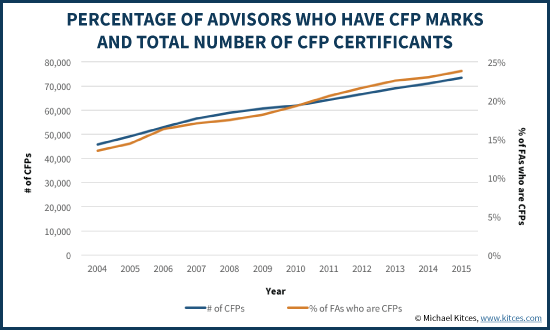

Even as the total number of financial advisors is in decline since 2000, the number of CFP certificants has been on the rise, driven by both the rising demand from consumers for financial planning advice, and a need and desire for financial advisors to differentiate themselves by providing financial planning services.

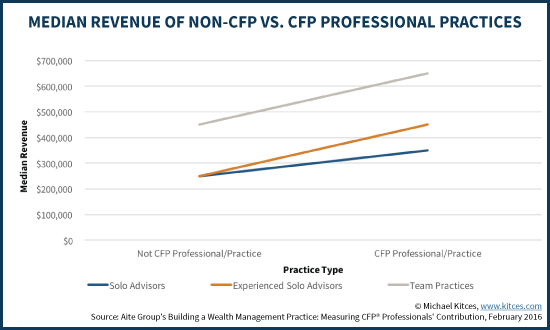

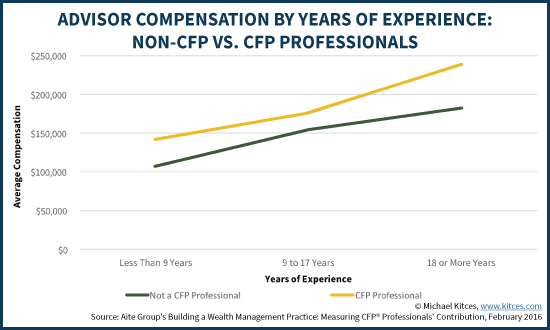

And according to a recent study by Aite Group, it turns out that getting the CFP marks really are good for business, with the average solo CFP certificant generating 40% more revenue, the average experienced solo CFP certificant generating 80% more revenue, and financial advisor teams generating 44% more revenue when they include at least 1 CFP professional. In turn, this results in the average CFP professional generating 14% to 33% more income than non-CFP advisors, even after controlling for years of experience.

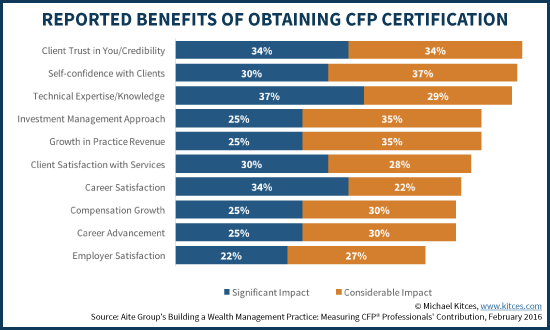

Notably, though, the study also finds that while CFP certification is associated with higher income, it’s not necessarily because advisors get new clients simply by showing off their CFP marks. Instead, the positive impact derives primarily from enhanced credibility, improved technical expertise and knowledge (which also leads to better self-confidence as an advisor), and greater client satisfaction with the advisor’s (more comprehensive financial planning) services.

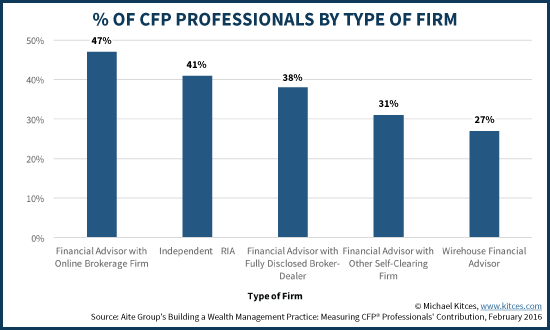

And given that some of the fastest-growing channels for CFP certification are now employee advisor roles at either independent RIAs or “online” brokerage/investment firms with retail advisors (i.e., Schwab, Fidelity, and TD Ameritrade, and now Vanguard), it appears that obtaining the CFP marks are increasingly becoming a key step to climbing the employee ladder as a financial advisor as well.

To say the least, though, with the potential for a 14% to 33% increase in lifetime earnings, at this point the CFP marks continue to more-than-sufficiently-justify the $3,000 - $10,000 required investment into a CFP educational program to obtain the certification!

The Impact Of CFP Certification On How Much A Financial Advisor Makes

A recent study entitled “Building A Wealth Management Practice: Measuring CFP Professionals’ Contribution” was commissioned by the CFP Board and produced by respected industry analyst Aite Group, and aimed to study the differences in business metrics between advisors and advisory teams that included CFP professionals, vs those that did not.

And the results were striking. When measuring the median revenue of non-CFP professionals vs CFP professionals, the Aite study found those who had earned CFP certification generated substantially higher revenue in their businesses. The results were true amongst both solo advisors (CFP vs not), and team practices (that either included a CFP professional on the team, or not). And notably, the results were not merely driven by the fact that CFPs may be more experienced (given that it takes time to earn the certification itself); when looking at the subset of more experienced advisors (those with at least 12 years of experience), the solo CFP professional had an even bigger jump in median revenue compared to experienced non-CFP advisors.

Notably, though, revenue generated by CFP professionals is not necessarily the same as their personal income. Whether it’s due to operating under a broker-dealer where only a percentage of gross dealer concession revenue is actually paid to the advisor, or in an RIA where the advisory firm owner has his/her own expenses, or even working in a large financial services firm that has its own salary-plus-bonus structure, revenue is not necessarily directly related to actual advisor compensation. Nonetheless, when surveyed about their actual personal take-home compensation, the study still found that CFP certificants enjoy a significantly higher average compensation, even after controlling for years of experience.

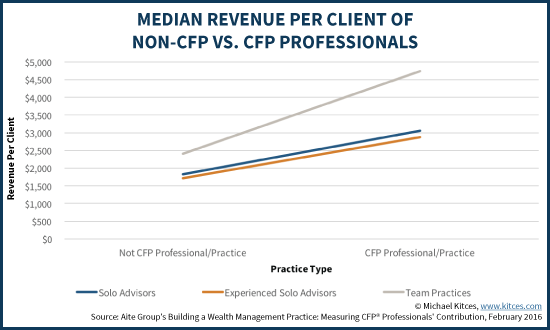

When delving deeper to determine how CFP professionals generate greater revenue and income, the researchers found that the results are driven not by CFP certificants serving significantly more clients; instead, they grow income by generating more revenue per client. And this outcome doesn’t appear to simply be a result of engaging the client more holistically (e.g., generating more revenue by providing a wider range of products and services), though CFP professional do generate revenue from a wider range of sources. Instead, it’s a result of CFP certification enabling them to work with more affluent clients in the first place; in the average CFP practice, 41% of clients are high net worth (HNW = >$1M of investable assets) or ultra high net worth (UHNW = >$10M of investable assets), compared to only 27% of HNW/UHNW clients in non-CFP practices.

The Real Benefits Of Getting CFP Certification?

While the Aite study’s results show that CFP certificants generate more total revenue, more revenue per client, and more personal income (based on that revenue), and do so by working more often with affluent clientele, the question still arises as to how, exactly, a CFP professional achieves these results. Is it simply that affluent clients see the CFP professional has the CFP marks and volunteer to do business, or something more nuanced?

When asked about the impact that CFP certification had on their careers, the researchers did find that the number one self-reported benefit was the enhanced credibility and trustworthiness with clients by having the CFP marks. However, this was followed closely by the advisor’s self-confidence in working with clients, and the actual technical expertise and knowledge conveyed by going through a CFP educational program, along with the greater client satisfaction that resulted from those more advanced services.

In other words, while the CFP Board’s public awareness campaign does appear to be moving the needle on the perceptions of the affluent about the CFP marks, and CFP professionals do report an improvement in credibility with clients, ultimately the benefits of CFP certification are internal as much as external – expressed in factors like the actual increase in technical competency and expertise of the advisor, and the self-confidence that comes with really knowing your craft.

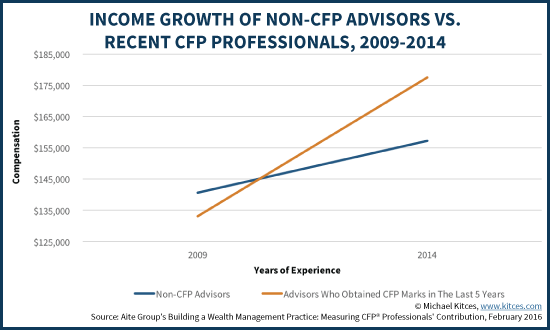

Accordingly, when Aite Group examined the compensation of advisors who had obtained their CFP certification in the past 5 years, versus those who weren’t CFP professionals at all, they found that recent CFP certificants had experienced significantly more recent income growth than non-CFPs (a 33% increase vs just a 12% increase from 2009 to 2014).

Growing Adoption Of CFP Certification

Ultimately, there is perhaps no better expression of the positive impact of CFP certification than the sheer growth in the adoption of the CFP marks themselves.

For instance, despite the fact that the overall total number of financial advisors has declined about 10% since 2004 (from nearly 340,000 down to barely 300,000), while the number of CFP certificants is up over 60% (from 45,000 to 75,000). And given the number of CFP professionals is rising even as the total headcount of financial advisors is in decline, the percentage of financial advisors who are CFP certificants is rising even faster, from just 13% in 2004 to over 24% today.

Even more notable, though, is the trends in adoption of CFP certification across various advisor channels. As the Aite Group study results reveal, the most rapid adoption of CFP certification is occurring in large online brokerage firms with retail branches (i.e., the retail divisions of Schwab, Fidelity, and TD Ameritrade), followed by the independent RIA community, and then advisors at various independent or captive broker-dealer firms.

Notably, the study deliberately “oversampled” CFPs to ensure a good comparison group of CFP vs non-CFP advisors (thus why the average number of CFPs across all channels is higher than the overall 24% adoption rate of CFP certification); nonetheless, the relative trend of where CFP marks are being adopted is notable, as the highest share of CFP certificants are now found in channels most likely to operate with salary-based employee advisors rather than brokerage salespeople, suggesting that the nature of CFP certification may be shifting from a sales-oriented job to a salaried-employee-based professional career (for which earning CFP certification is a key step to advancing up the career ladder). And the study does not appear to include Vanguard’s Personal Advisor Services, which would fall into a similar category of employee advisors, and is a rapidly growing segment of CFP certificants (given Vanguard’s immense size and scale).

Regardless of the channel, though, the Aite Group’s study shows that CFP certification appears to be associated with significantly higher advisor income – upwards of 30% higher compensation – both in the short term after earning the CFP marks, and in the long run. And the trend appears to be holding even as the adoption of CFP certification grows, and shifts from a sales-oriented job to a more common employee advisor role. Which suggests that going through a CFP educational program, which may cost anywhere from $3,000 to nearly $10,000, still provides an incredible return on self-investment!

So what do you think? What was the impact of earning CFP certification on your career trajectory? Or are you still trying to decide whether it's worthwhile to pursue the CFP marks? Please share your thoughts or questions in the comments below!

Why is it that either you’re a salaried advisor or a brokerage salesman? Really no other compensation/role set up legitimately exists?

The switch to salaried advisors is not a good thing for those advisors, I can assure you of that.

I find it hilarious when RIA owners/partners act like salaried employees is somehow more pure, but apparently not for them… they’re above that because they’re partners (and get paid based on the production of the firm). They’ll never admit how self serving this type of language is.

I’m wondering where to look for firms that may be in the market for Service Level Advisors. I would be interested in knowing if there is a source. Do you need to use a headhunter? My Google searches for available CFP positions rarely returns anything but commission based sales jobs.

-CFP Job Board

-Contact your local FPA and see if they can spread your resume around

-New Planner Recruiting

-Advisors Ahead

Or put together your own custom list and drop by, call, or email them one by one and see if they’re interested in hiring. I think you would be surprised how many will at least entertain the idea.

Custom list:

-State specific or state by state RIA lists (investment news, brightscope, barrons biggest advisors, etc. Google is your friend for your local situation).

-Use google maps and use boolean search methods to pull a list of financial firms and go to the websites one by one

-NAPFA firm list in the area

-Linkedin boolean search for firms, but probably best to try to find through searching for high quality people and then see where they work.

Thank you!

Also use http://www.adviserinfo.sec.gov/ to determine if the place even has the assets to support another hire. If they don’t have at least $25M per existing employee, you can expect it to be hard sell for them to take you on in such a capacity. Typically, they start with admin support and junior advisors only come after more scale.

Also be preparered to take non client facing “paraplanner” work first because few firms that consider having junior advisors will let you go in front of clients until you’ve worked on plans, agendas, financial planning software, etc. first.

Am I the only one bothered that not all CFPs are created equal? Are the CFPs that are employees giving proper disclosures that their advice is biased?

Also am I the only one bothered at the rise of “investment” advisors becoming CFPs who don’t help with any of the other areas of financial planning?