Executive Summary

When consumers shop around before buying a good or service, many factors can play a role in their final decision, from previous experiences to the recommendations of friends and even to the companies’ branding. And when it comes to how a consumer perceives a brand, there are three critical components that come into play: brand awareness (simply knowing that the brand exists), recognition (recognizing a brand for its unique components and features), and brand equity (the value associated with a specific brand). These factors, especially brand recognition and equity, are often used to help fill in knowledge gaps when contemplating the purchase of a product or service, especially when the consumer isn’t clear about the actual value of what they’re considering.

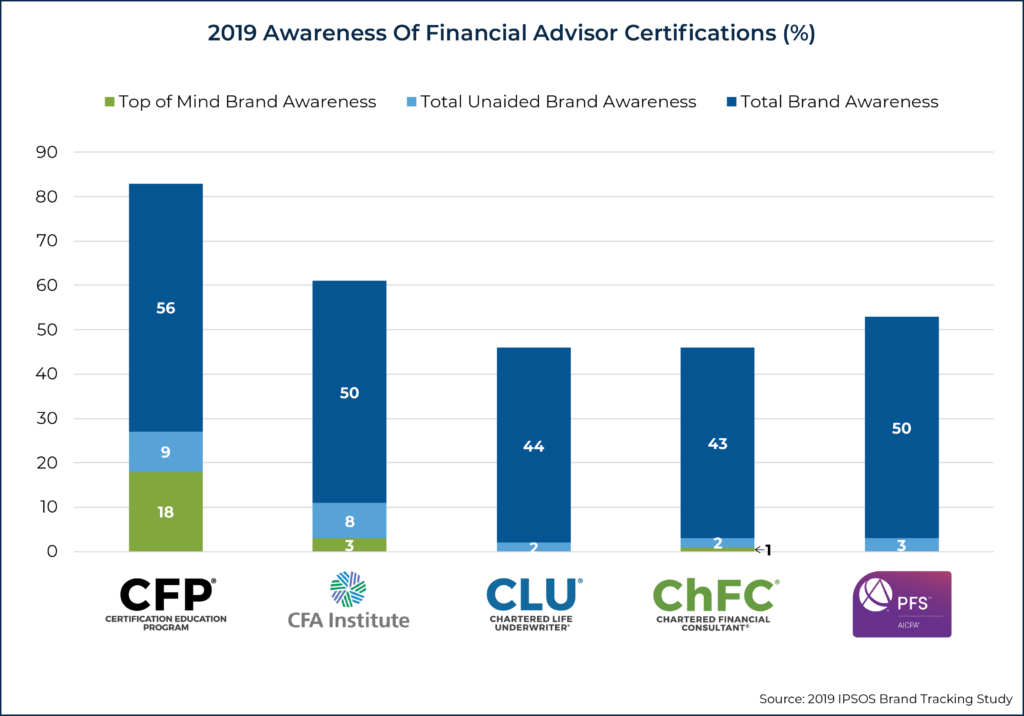

In the context of financial advisors, surveys have shown that CFP certification serves as an important branding signal for consumers seeking the services of a qualified advisor. For instance, a 2015 study found that consumers had higher brand awareness of the CFP marks, even more than the well-known ChFC, CFA, CLU, and PFS designations. In addition to having better brand awareness, research has also suggested that the CFP marks tend to have better brand recognition, and that consumers were just as likely to associate the CFP marks and CPA designation with professionals who offered financial advice, with an increasing inclination toward using a CFP professional for financial planning.

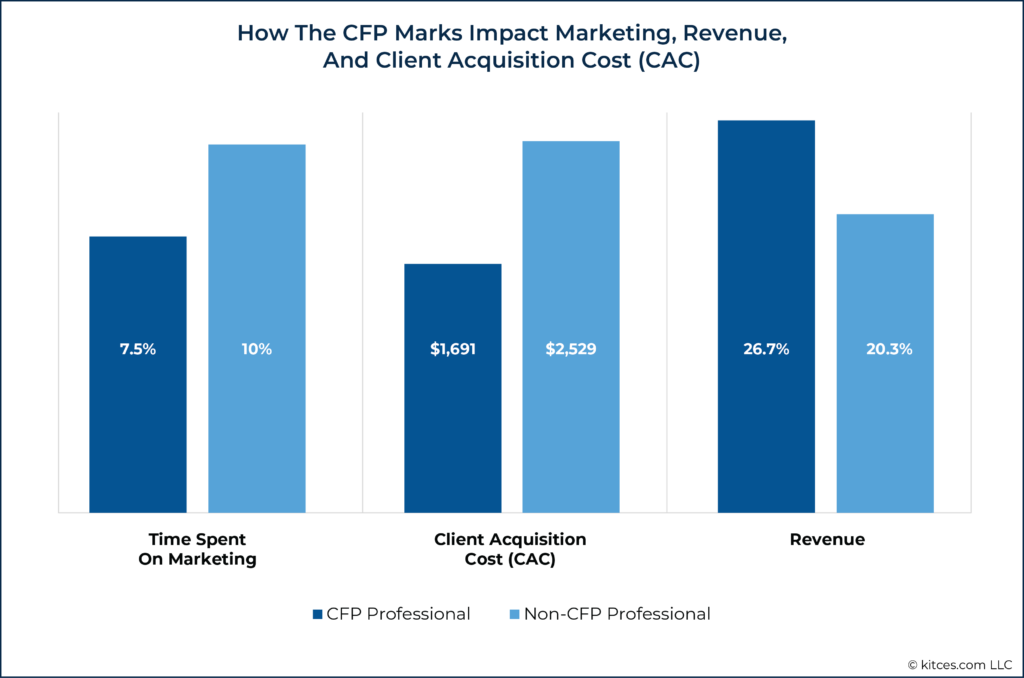

Further, the benefits of how the CFP marks are perceived as a valuable brand appear to have a meaningful impact not only on how advisors spend their time, but also on their revenue growth as well. According to the 2022 Kitces Research study, “How Financial Planners Actually Market Their Services”, advisors without the CFP marks typically spend more of their time on marketing activities relative to CFP practitioners (allowing them to spend more time on higher-value tasks). Similarly, CFP practitioners were found to have a lower practice-wide Client Acquisition Cost (CAC) and greater revenue growth in 2021!

Accordingly, promoting the brand of the CFP marks to the public can be a good way for advisors to boost their own personal brands in the minds of consumers, and at the same time serve to promote recognition of CFP certification more broadly as a sign of high-quality financial advice (and supporting CFP Board’s own publicity efforts). Some strategies to do so can include simply talking about their own experiences as CFP professionals more intentionally (e.g., in meetings with both prospects and centers of influence, such as accountants and lawyers, who might provide referrals), and promoting the marks in their social media posts and other marketing strategies (e.g., SEO tactics, drip marketing campaigns, and online advertisements).

Ultimately, the key point is that CFP certification not only provides advisors with the technical knowledge they need to provide high-quality service to their clients, but also is a valuable signal that can influence a consumer’s decision on who to look to for financial advice. And by promoting the marks to the public, advisors can further build brand recognition and equity for the marks, elevating all CFP professionals in the process!

Signaling Theory: CFP Means Quality To Consumers

When it comes to consumer behavior, the factors that drive buying and decision-making are complex and often involve how the consumer perceives the product or service’s branding; in particular, brand awareness (simply knowing that a brand exists), brand recognition (recognizing a brand for its unique components and features), and brand equity (the value associated with a recognized brand) all play important roles in a consumer’s decision to make a purchase or not.

For example, Kitces.com readers have awareness that we are an education provider for financial planners. Many of them also associate the site with education that actually teaches financial planners something and content provided by financial planning nerds – this is brand recognition. And for many members, the brand equity of Kitces.com includes the articles and CE credits that are reliably offered on a regular basis. Importantly, a consumer’s perception of a company’s brand recognition and equity is often used to help fill in knowledge gaps about whether to purchase a potential product or service, especially when the consumer isn’t clear about the actual value of what they’re considering. This reliance on brand recognition and equity is an example of what Signaling theory is about – when consumers do not have full knowledge about the company or product they’re considering, they rely on the signals (e.g., the brand recognition and equity) to make a decision about the best product for them.

Signaling theory, developed by economics professor Michael Spence, co-winner of the 2001 Nobel Memorial Prize in Economics, addresses how important knowledge gaps are filled between parties with information they provide (through signals) to each other. In the case of a consumer deciding whether to purchase something they are not completely familiar with, signaling is often used when the consumer has limited time and resources to invest in systematically and objectively determining what something should cost. In other words, when a consumer isn’t sure if they should buy something, and they don’t have time to do the research themselves, they’ll consider the brand’s equity (i.e., the value they perceive the product has based on brand recognition) as signaling cues to help them make their choice.

Notably, a corporation’s reputation can play a significant role in a company’s brand equity and can therefore influence a consumer’s buying decisions. For example, my husband recently bought a cooler and was considering an Igloo versus a Yeti. While they both keep things cold, we came home with the Yeti because my husband believed that, since it was branded as ‘bear-proof’, it was the better product (although we still don’t know if the Igloo is bear-proof, too). Companies and organizations use signals (brands) to influence consumer decisions, with the implied premise that communicating good brand equity can help consumers make better decisions faster and with less information.

In the context of financial advisors, CFP certification serves as an important branding signal for consumers seeking the services of a financial advisor. The work that CFP Board has done to promote the CFP marks through its consumer-awareness efforts over the years (most recently through their “Let’s Make A Plan” campaign, which launched in 2018) has paid off. In a 2015 study that examined consumer awareness and recognition of various financial designations, the CFP marks were more well-known than all other designations assessed (including ChFC, CFA, CLU, and PFS) except for the CPA. And a 2019 Brand Tracking Study conducted by global market and research consulting firm, Ipsos, shows that brand awareness of the CFP marks continues to surpass those of other popular designations.

In addition to having better brand awareness, these studies have also suggested that the CFP marks tend to have better brand recognition, and that consumers were just as likely to associate CFP certification, as they were the CPA designation, with professionals offering financial advice, with an increasing inclination toward using a CFP professional for financial planning. This suggests that by increasing both brand awareness and recognition, CFP Board’s consumer advocacy efforts have even elevated brand equity of the CFP marks by signaling the high standards of CFP professionals, who have unique skill sets and tend to offer better services for those in need of financial planning. Which means that an increasing number of consumers are specifically seeking out CFP professionals for financial planning services, even more so than other professionals in the industry.

CFP Designation Saves Advisors Marketing Time And Dollars While Increasing Revenue

Given the impact of CFP Board’s advocacy efforts on the brand awareness, brand recognition, and brand equity of the CFP marks, we were curious to see how CFP professionals leverage their CFP marks in their own marketing efforts. In the most recent 2022 Kitces Research study, “How Financial Planners Actually Market Their Services”, we found several interesting trends.

First, we found that those without the CFP marks generally spend about 10% of their time on marketing activities, while CFP practitioners spend only 7.5% of their time on marketing. While these differences may not seem very dramatic, a very interesting picture emerges when examining other factors around Client Acquisition Cost (or CAC, the cost of getting a new client) and revenue growth.

Whereas CFP practitioners were found to have a practice-wide Client Acquisition Cost (CAC) of just $1,691, non-CFP professionals had a higher estimated CAC of $2,529. And when it comes to revenue growth, revenue for CFP professionals grew 26.7% in 2021, higher than the revenue growth of non-CFP professionals at 20.3%. Which suggests that even though financial advisors with the CFP marks spend less time marketing themselves and their firms, and less money acquiring new clients, they still make more than those without the marks!

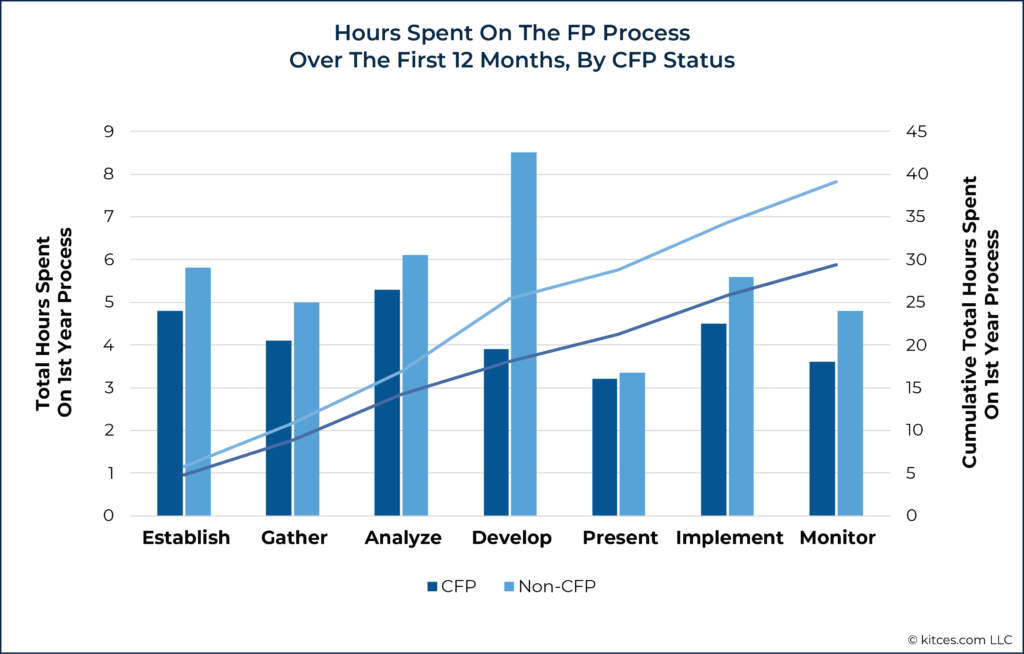

Furthermore, an earlier Kitces Research study in 2020 found that having the CFP marks also influences how efficiently an advisor is able to do financial planning for clients. In the 2020 study, “How Financial Planners Actually Do Financial Planning”, survey respondents with CFP marks reported needing less time to complete each step of the financial planning process – and dramatically less time in the step of actually developing the plan, ostensibly supporting the public awareness signaling around the ability and competence of CFP professionals.

Which means that CFP professionals may not have to spend as much time on their marketing efforts (or in meetings!) to persuade clients that they have the requisite skills to provide them with good financial planning; because prospects already consider the CFP marks as a signal for high brand equity, the advisor is able to spend their time more efficiently when it comes to building relationships and managing the financial planning process.

How Financial Advisors Can Get More Out Of Their CFP Marks

So how can financial advisors leverage the fact that they are CFP professionals in their marketing efforts? As while clients may never directly ask their advisors about their CFP marks, it does not mean that they don’t care about whether their advisors are CFP professionals or not. To the contrary, clients do care about CFP certification a great deal and often check an advisor’s status before they ever meet with them. Prospects who become clients often don’t ask about CFP certification in a meeting because they already know the answer.

So, for advisors who want to leverage more from their CFP certification, here are a few ideas.

Talking About The Profession

Simply because some prospects may be familiar with the CFP marks and may actively search for an advisor based on CFP certification doesn’t mean that everyone knows about it. CFP certification is becoming increasingly popular, especially among high and ultra-high net worth clients, but there are still many high-net-worth individuals and others in a range of socio-economic strata that do not know what the CFP marks represent. As such, advisors should not assume that everyone they meet knows about CFP certification, and can feel comfortable talking about their own experience earning their CFP credentials and how the CFP marks pertain to their work, ability, and knowledge.

Furthermore, communicating more broadly about the merits of CFP certification helps to raise brand awareness. CFP professionals can write and talk about their experience obtaining the marks and the value they’ve gotten from the process and can even put their marks on everything they release in the public space to support brand awareness even more. As while CFP Board continues to promote the brand through their own public campaigns, every CFP professional can also help to raise consumer awareness in the marketplace.

Celebrate your own achievements, but also recognize the achievements of other CFP professionals. Imagine the impact that brand awareness and recognition of CFP certification would have if all advisors who earned their CFP marks spoke on podcasts across different niches, won awards, or joined charitable boards and regularly shared their experiences and publicly acknowledged the CFP Board for the high standards for education and quality of service they set for all certificants.

To that end, CFP Board provides a toolkit to help financial advisors promote the CFP marks. It includes suggestions such as retweeting and sharing CFP Board’s social media #LetsMakeAPlan messages, and even offers sample scripts that could be read as a part of a podcast or radio show to promote awareness of CFP certification.

Other ideas may include getting involved in local organizations or one’s own alma mater to support education programs for CFP certification, financial literacy, or World Financial Planning Day (first Wednesday in October). Talking about the CFP marks, the CFP Board’s initiatives, and the value of the education requirements are excellent ways to increase brand awareness and recognition not only for clients and prospects, but for other stakeholders such as COIs as well.

Low-Cost, High-Efficiency Marketing Strategies For Financial Advisors

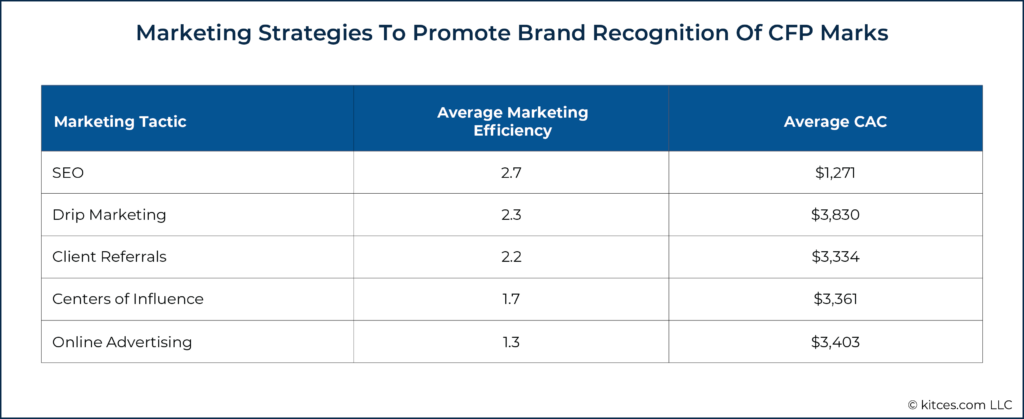

Beyond talking about the CFP education and marks as a cornerstone of the amazing work that CFP professionals carry out, advisors can consider 5 marketing strategies that the latest Kitces Research study identified as having the lowest Client Acquisition Costs (CACs) and highest efficiency (calculated from dividing new client revenue by marketing expenditure). These include SEO tactics, drip marketing, and online advertising (as well as relying on referrals from clients and centers of influence, which are best leveraged through talking about the profession, discussed above), which can be effective ways to leverage the brand recognition and equity that the CFP marks hold.

Search Engine Optimization (SEO)

Using Search Engine Optimization (SEO) terms such as CFP, CFP Professional, Certified Financial Planner, and Certified Financial Planner Professional as part of an SEO campaign can have a significant impact on search engine results, as those who are aware of the value of the CFP credential are going to base their searches on these terms.

Drip Marketing

Not all consumers are ready for a professional financial relationship the moment that they have a financial problem, making drip marketing campaigns – where familiarity is built over time, and prospective clients are ‘dripped’ with periodic communication to keep the advisor top-of-mind until they are ready to do business – an especially valuable tool.

Drip campaigns can leverage the brand recognition and equity that come with the CFP marks as a way to convey the competence, trustworthiness, and knowledge that consumers want, and to continually remind them of what it means to engage with a CFP professional can be an effective way to move prospects to take action and reach out for help.

Online Advertisements

Placing advertisements on high-impact websites that feature CFP professionals with high esteem can be a constructive way for advisors to build an online presence, as consumers who are seeking CFP professionals will be more likely to find those advisors. When creating marketing content to be featured online, it’s especially important to convey messaging that is relatable and that focuses on the consumer (not the advisor!) as the main character.

Ultimately, the key point is that the CFP marks matter to prospects and clients. Those who specifically seek an advisor with CFP certification are likely more satisfied with the relationship, knowing that their advisor has at least met a high standard of education and experience requirements. Furthermore, the Kitces Research study findings around brand awareness of the CFP marks and the efficiency of CFP professionals also support that clients may tend to have more satisfying relationships with advisors who have the CFP marks.

Importantly, by leveraging the CFP marks in their own marketing efforts, financial advisors take part in increasing brand awareness and brand recognition of CFP certification, boosting CFP Board’s own publicity efforts. Imagine a day when all CFP professionals intentionally strive to educate others about the certification process and what it means to have the CFP marks; the additional brand recognition and equity created would only serve to elevate all CFP professionals... because after all, all boats rise with the tide!

Leave a Reply