Executive Summary

When a financial advisory firm owner first starts their business, much of their time is spent on finding clients that they can serve. But as they (hopefully) onboard more clients and get busier with servicing those clients, they will also find that they eventually start to run short on time. Because in addition to providing ongoing services (e.g., annual plan reviews) to their current clients, they will continue to prospect and onboard new clients as well. And at some point, they might find they hit a 'capacity wall' where they no longer have the resources to service new clients (often once they reach 30-40 clients) and where their wellbeing starts to suffer because of the time demands of a growing client base that they can no longer manage without recruiting additional help or outsourcing financial plan preparation.

One potential solution for advisors nearing such a capacity wall is to hire a full-time employee to take on some of the tasks that are eating up the advisor's time (e.g., a client service associate to handle various administrative and client communication tasks, or a paraplanner or associate advisor to work on more planning-centric issues such as building out drafts of financial plans). However, some advisors might not be ready to take on the burden of hiring an employee (from the time spent recruiting and managing the hire to the dollar cost of providing a salary and benefits). For these advisors, an alternative approach would be to outsource the tasks they want to remove from their plates.

Looking at the financial plan development process specifically, a variety of outsourcing providers are available that can perform the range of required tasks, from data entry to scenario modeling to the creation of plan deliverables. Given that most advisors probably won't want to outsource the entire plan development process, they can take a methodical approach to identify the tasks that they do not enjoy and/or that take up too much of their time (i.e., creating a "Stop Doing" list) and then review the range of outsourcing partners, assessing their core proficiencies, fee models, rates, and company structures, to find the best fit for their work needs and budget.

Ultimately, the key point is that because solo firm owners who approach their capacity walls can become overwhelmed with the wide range of responsibilities on their plate, finding ways to outsource certain financial planning tasks can help free up time and help them avoid hitting their capacity wall in the first place! And while some advisors might choose to make a full-time hire to handle items from their "Stop Doing" list, others who do not feel ready to do so (or simply prefer not to bring on full-time employees) can consider outsourced planning providers as an alternate solution. And while choosing this option does involve time and monetary costs, doing so could pay worthwhile dividends – not only for the firm's growth and profitability but also for the advisor's overall wellbeing!

While financial advisory firms typically start out with a single advisor/owner who performs all of the tasks required to attract and serve clients, many do not remain solo shops forever. Because as a firm's client base grows, the advisor eventually might find that they are stretched thin both serving clients and managing the business itself.

When a firm owner reaches this stage, they often consider hiring an employee to share some of this burden. But some advisors might be reluctant to do so, particularly given the financial requirements to provide a salary and benefits to an employee. With this dilemma in mind, a variety of outsourced planning providers have emerged that can allow an advisor to reduce the time they spend preparing financial plans. And by taking a methodical approach in deciding which tasks they want to outsource (or stop doing altogether), advisors can find the outsourcing partner that best matches their needs.

How Hitting A Capacity 'Wall' Can Hurt Solo Advisor Wellbeing

For solo advisors of newly formed planning firms, getting new clients is typically their first priority. But as more and more clients are onboarded, these advisors might eventually find that their time starts to become stretched, not only because of the time spent prospecting for and onboarding new clients, but also because of the need to continue servicing their ongoing clients (e.g., regular annual meetings and plan updates). Kitces Research on Advisor Productivity has shown that, on top of the demands of business development and ongoing client service, plan breadth (i.e., the number of topics covered in a financial plan) has increased over time, along with the corresponding time needed to produce these more extensive plans, further straining these solo advisors' schedules.

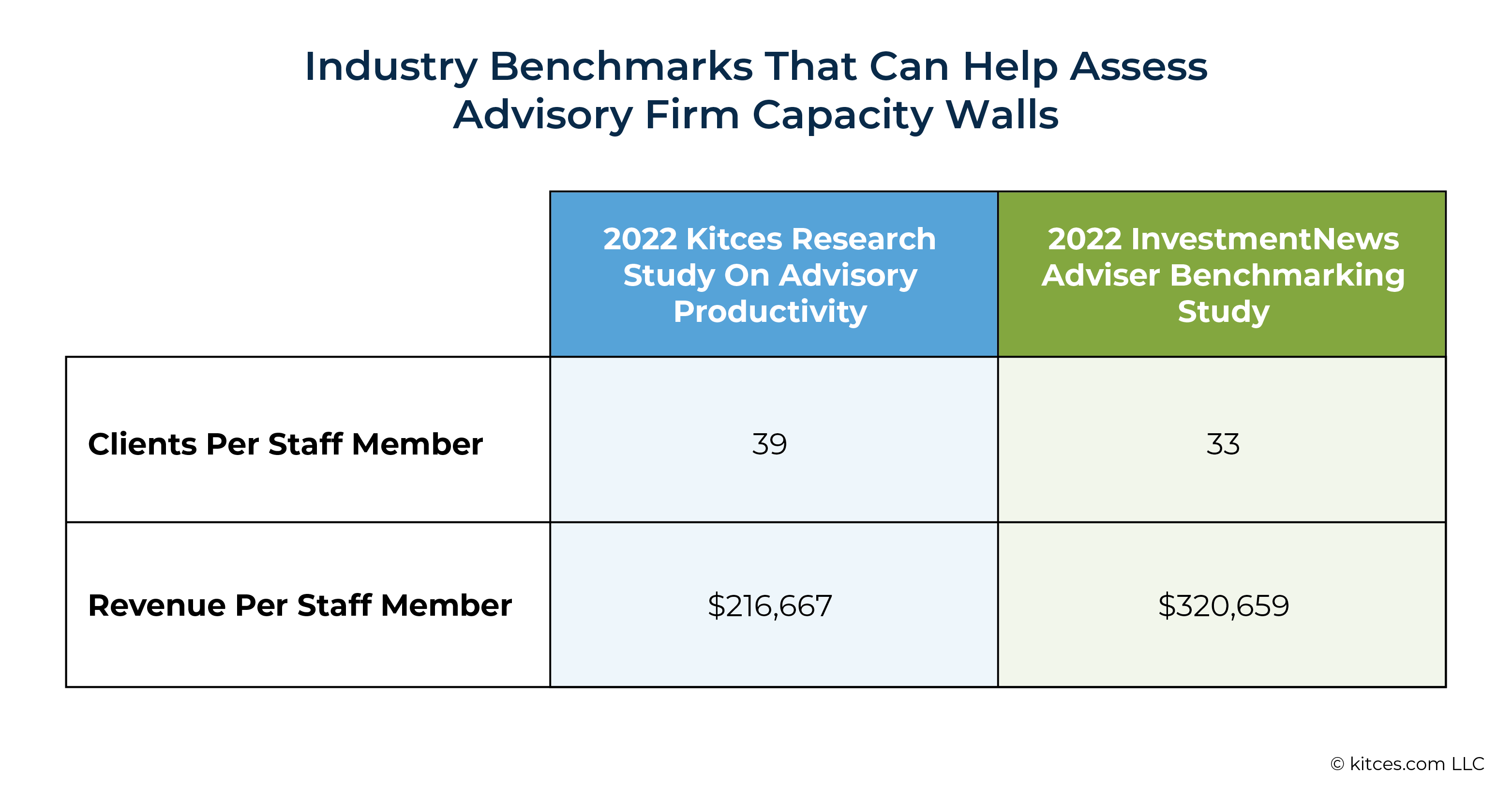

In fact, industry benchmarking studies reporting average revenue and numbers of clients served per financial advisory firm staff member have been used to assess solo advisory firm 'capacity walls', which represent the point where a firm is strained to serve its clients with its current staffing levels. For solo advisors, the first capacity wall is estimated to limit an advisor once they reach about 30-40 clients, or $220,000-$320,000 in revenue.

At this point, an advisor's overall wellbeing, which typically rises as their revenue and income grows from $0, can see a dip as they might not have enough time to handle the growing number of tasks on their plate (even as their revenue and income continue to grow!). This relates to the concept of "time poverty" (i.e., not having enough time to do what one is currently doing), which research has found can serve as a negative mediator of the association between income and wellbeing experienced on a day-to-day basis.

Given this time crunch, some solo advisors might prefer to focus on prospect- and client-facing tasks rather than administrative or other 'behind-the-scenes' work. At the same time, solo advisors who have gotten used to doing everything on their own in their business may find it hard mentally to transition some of this work, particularly as it relates to financial plan development, to others, as they might not feel like it is 'their' plan anymore.

Nonetheless, given the wide range of tasks that go into creating a financial plan, there are several pieces that could potentially be done by someone else while still allowing the advisor to add their expertise. For instance, data entry into the planning software, preliminary scenario modeling, or preparing the plan deliverable could be completed by another individual while the advisor performs the core analysis and crafts and delivers the planning recommendations. In this way, advisors could save significant time while still delivering 'their' plan to the client.

Solo advisors who are approaching the capacity wall (or just otherwise want to free up more hours in their days) and are ready to move certain tasks off of their plate might choose to hire a full-time employee, such as a client service associate to handle various administrative and client communication tasks. Other advisors might find that the actual preparation of financial plans (for both existing and a growing number of new clients) is what is taking up much of their time. In this case, the advisor might hire a paraplanner or associate advisor who can work on more substantive issues (e.g., data entry or preliminary scenario modeling).

But for some advisors, making a full-time hire is not an attractive proposition. Perhaps because they do not feel 'ready' to take on the financial and time burden of hiring, training, and managing a full-time employee, or possibly because the advisor wants to continue operating on their own, at least for the near future. Because while an advisor might enjoy the business of financial planning, they might not actually want to run a business with staff members who they have to manage on an ongoing basis. For these advisors, a range of outsourced financial planning solutions are available that can help them save time that could be used for more profitable activities (e.g., gaining new clients) or just more time for personal activities, both of which could ultimately improve the advisor's wellbeing!

How Outsourced Financial Planning Services Work

A wide range of outsourcing options are available that allow advisors to delegate a variety of duties, from virtual assistants that handle administrative tasks (e.g., processing client paperwork) to outsourced lead generation services. In addition, given that the development and maintenance of financial plans can take up a significant amount of an advisor's time, a number of firms have emerged that provide services related specifically to these processes, ranging from data entry and migration (i.e., moving client data from one financial planning software program to another) that require less experience, to more advanced planning work, such as synthesizing data and modeling scenarios.

With this in mind, when it comes to choosing outsourcing options to support the financial plan creation/development process, reviewing the range of planning tasks available to be outsourced, how engagements with outsourcing providers are structured, and how different providers operate can give advisors a better idea of which planning solutions might be the best fit for them.

Planning Functions Offered By Outsourcing Providers

Outsourced planning providers offer services across the plan preparation process to match the needs of advisors. This can allow the advisor to outsource the specific tasks that perhaps take up too much of their time or that they just do not enjoy. Outsourcing providers tend to have expertise in multiple financial planning software programs, but confirming that a specific provider has experience with the program the advisor uses (or that the firm would be willing to gain proficiency in it) can reassure advisors that their needs and expectations will be met. For instance, the advisor might ask for sample financial planning analyses and/or deliverables the provider has created in the software the advisor uses.

Among the more 'manual' planning tasks, outsourcing providers can help advisors with entering client data into the advisor's financial planning software. For instance, an advisor might (securely) send client account statements and other information to the outsourcing provider, who will input it into the software programs so that the advisor can then synthesize and analyze the information (though this is a service some outsourcing providers offer as well).

At the other end of the plan development process, outsourcing providers can also support advisors by creating plan deliverables. Using this service, an advisor might analyze client data, model scenarios, and draft recommendations, but have the outsourcing provider create a physical plan to deliver to the client (whether in hard copy or digitally). In this way, advisors can spend more time on the 'meat' of the plan and have the outsourcing provider handle the design elements of the plan.

For advisors curious about outsourcing but who want the plan to feel like 'their' plan, outsourcing data entry or the creation of plan deliverables could be a way to save time while still conducting plan analysis and the development of recommendations themselves.

In addition to data entry and the creation of plan deliverables, certain outsourcing providers also offer services related to plan development, from analyzing and synthesizing client information to modeling scenarios. By outsourcing these tasks, advisors could spend more time developing draft recommendations and on client-facing functions rather than being 'in the weeds' inside the planning program itself.

Further, certain outsourcing providers (many of whom previously worked as client-facing planners themselves) can also develop potential planning recommendations for the advisor's clients. While some advisors might be reluctant to outsource this function (as they might see recommendation development as a key part of their personal value-add for clients), solo advisors might find value in having a 'thinking partner' available who can help generate planning ideas or serve as a second set of eyes to review certain plan elements before delivering them to the client.

Fee Models Used By Outsourcing Providers

Engaging with outsourcing providers can provide advisors with more flexibility to focus on their highest-priority tasks. And given that firms choosing to outsource their planning tasks will have different needs of different scopes and sizes, a variety of fee models are available across the range of outsourcing providers.

Hourly Fee Model. Many outsourcing providers work on a straight hourly basis. This can provide advisors with significant flexibility, as they might have more or less work for the provider to do in certain months given the advisor's workload. In terms of the hourly fee, some outsourcing providers have a flat fee (e.g., $80/hour for all tasks), while others have varying rates depending on the complexity of the task (e.g., $60/hour for data entry and $100/hour for plan development and scenario modeling). While some companies work on an hourly basis with no minimums, others require the advisor to use a certain number of hours per month.

Project-Based Model. Some outsourcing providers operate on a project basis, where they offer a quote for the given work needed by the advisor. For instance, a firm might charge the advisor a flat $1,000 fee for data entry, plan analysis, and the production of deliverables for each new client. This option could be valuable for advisors whose outsourcing needs might involve large single projects (e.g., creating a plan for a new client) rather than ongoing services (e.g., regular updates of current client plans).

Retainer Model. Other outsourcing providers charge on a retainer basis, where the advisor receives a certain number of hours of service per month, often with the option of adding additional hours if necessary. Depending on the outsourcing provider, committing to a certain number of hours per month for a given time period (e.g., 1 year) can lead to a lower per-hour cost than working on a strictly hourly basis. This option could be useful for advisors who expect to send a steady stream of work to the outsourcing provider.

Contract Workers. Another option to outsource planning work is to hire an individual part-time paraplanner (rather than an outsourcing firm) on an independent contractor basis, negotiating the number of hours to be worked and an hourly rate directly with the professional. For advisors who have a significant amount of work they want to outsource but might not have enough for (or do not yet want to hire) a full-time employee, this could be a helpful option.

Types Of Outsourcing Providers

Financial planning outsourcing providers vary not only in terms of the services (and expertise) they offer and how (and what) they charge, but also in how they are structured. While some outsourcing providers are single-person companies, others might have 2-3 employees, and a few have a much larger staff.

Working with a smaller company often allows the advisor to work with a single contact who both serves as a point of contact and conducts the work themselves (as opposed to engaging with a team to complete the work). This can allow the outsourcing provider to have an intimate and ongoing familiarity with the advisor's needs and their clients' individual situations. At the same time, the advisor would need to find an individual with expertise in the advisor's financial planning software (and other tech stack tools) and perhaps the issues facing the advisor's ideal target client to be most effective.

Larger outsourcing providers sometimes have a broader range of capabilities (e.g., financial planning software proficiency, planning expertise, or types of services offered) given their larger staff. Having multiple people on the team can also allow for different price points for types of service (e.g., the provider might charge less for data entry work performed by a junior staffer, while a smaller provider who is an experienced planner might charge a higher fee for all services).

Altogether, outsourced financial planning providers offer a broad array of planning services and fee models that offer advisors flexible solutions to meet their particular needs. With a better understanding of how these firms operate, advisors can then decide how their particular needs can be met by appropriate providers.

Choosing An Outsourced Financial Planning Provider

While the ultimate outcome of outsourcing certain planning tasks is to free up time for the advisor, actually starting the engagement requires them to invest some of their time in up-front work. This includes deciding what tasks they want to outsource, finding the right outsourcing provider based on those needs, and then clearly explaining what they want the provider to do for them – and how they want those things done – because while the advisor might not have to train the outsourcer on the financial planning software they use, they might have certain style or other preferences that the provider will have to learn. But by taking a methodical approach to identify and onboard the outsourcing provider at the start of the engagement, an advisor can ultimately save the advisor time and money in the long run compared to taking a more haphazard approach.

Selecting The Financial Planning Tasks To Outsource

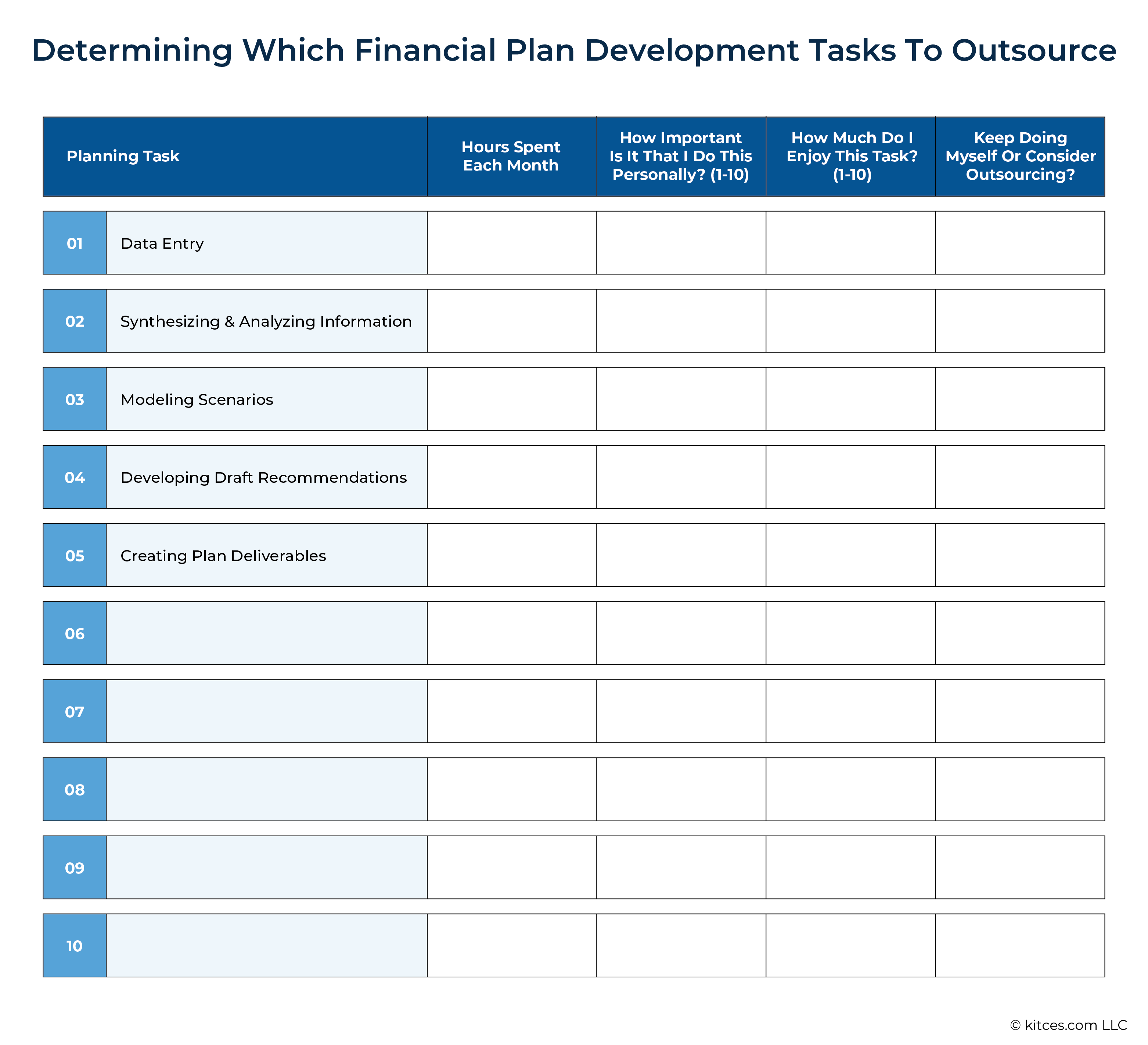

Creating and developing a financial plan involves a wide range of tasks, from data entry to scenario modeling to preparation of plan deliverables. With this in mind, advisors considering outsourcing certain tasks can start by writing down each step of the plan development process, how long each task takes, how important it is that they do the task themselves, and how much they enjoy each responsibility (e.g., an advisor might feel that it is very important that they continue to develop recommendations because of their unique experience and they may love creating plan deliverables, but they may not enjoy or be interested in handling the data entry and modeling that goes into creating the plan).

After preparing this information, the next step would be to identify a "Stop-Doing" list of tasks they no longer want to do on their own and might want to outsource instead (perhaps because it takes up too much of their time or because it is something they do not particularly enjoy doing).

Nerd Note:

Creating a "Stop-Doing" list could be a useful exercise for advisors, whether or not they are considering outsourcing some tasks and responsibilities beyond plan development. For instance, some advisors might find that they have enough tasks on their list to justify hiring an (additional) employee. Alternatively, an advisor might find that certain tasks no longer need to be done at all (perhaps a tool in their tech stack added new functionality that no longer requires the advisor to do a certain task manually), which could free up time without having to find someone else to take on these responsibilities!

By creating a "Stop-Doing" list and checking in with it regularly, advisors not only can get a better handle on their full range of responsibilities (and how long they take) but also are able to identify the specific services they might want from an outsourcing provider. Further, regularly going through this exercise can help advisors prevent themselves from hitting a capacity wall by offloading certain tasks before they become overwhelming!

In addition to tasks identified on the "Stop-Doing" list, solo advisors can also consider parts of the planning process where they would like to have a thinking partner or second opinion. For instance, while the advisor might want to develop planning recommendations on their own, they might want to have an experienced fellow planner from an outsourcing provider review their initial recommendations to see if they have additional input.

Vetting Outsourced Planning Providers

Once an advisor has an idea of the tasks they want to outsource, they can then explore the various outsourcing providers to find the one that best matches their needs across a range of criteria, which could include elements such as services offered, proficiency in the advisor's financial planning software (both their 'core' program [e.g., eMoney or Right Capital] as well as any specialized planning programs [e.g., Holistiplan or Income Lab]), fee model and rates, and company size.

The below chart provides an outline of this information for a variety of outsourced planning providers.

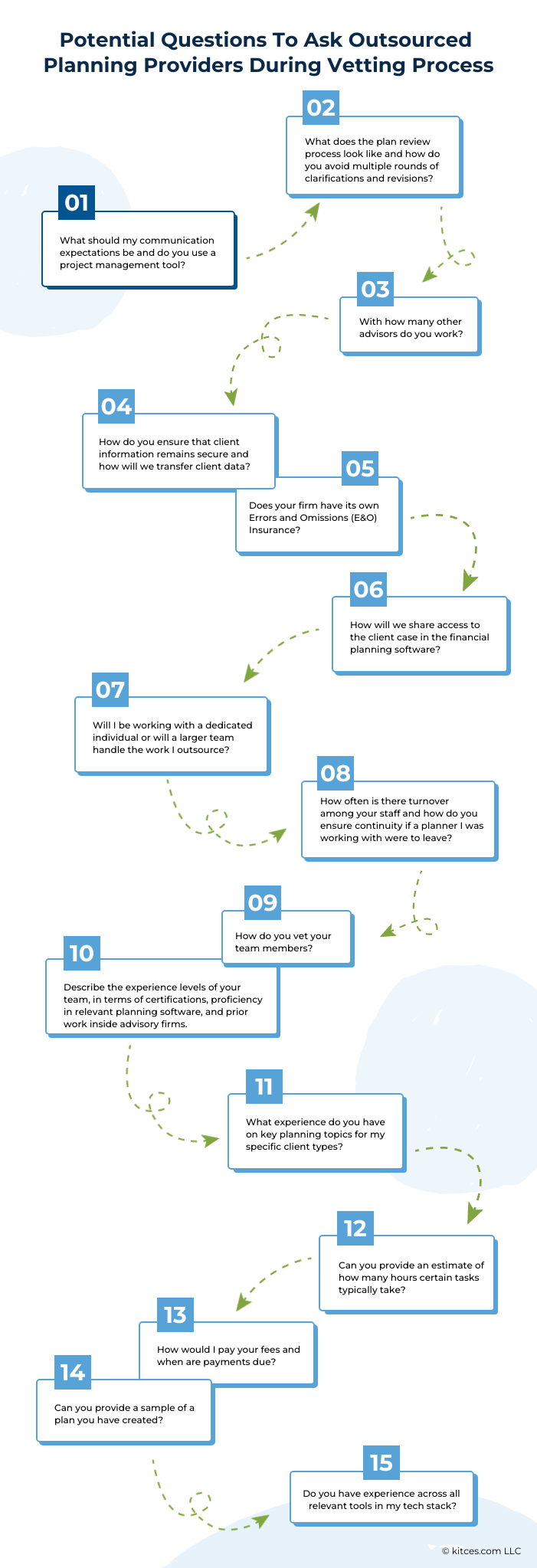

Notably, these data points only skim the surface of what an advisor might want to know about a potential outsourcing partner. After narrowing down the options to a few potential choices, advisors can reach out to these firms to conduct further vetting. This due diligence process is important not only to ensure the advisor finds the right partner for their needs (as they will have a close, ongoing working relationship and the advisor, to a certain extent, will be putting their own success in the hands of the outsourcing provider), but also, if the firm is an RIA, to the advisor's fiduciary duty to their clients.

The following is a (non-exhaustive) list of potential questions an advisor could ask when interviewing an outsourcing provider (in addition to questions developed based on the advisor's individual needs):

After the vetting process is complete, advisors can select the outsourcing provider that best meets their needs and start the process of transferring tasks from their "Stop Doing" list over to their new planning partner!

Ultimately, the key point is that because solo firm owners can eventually become overwhelmed with the wide range of responsibilities on their plate, finding ways to outsource certain financial planning tasks can help free up time and help them avoid hitting a capacity wall. And while some advisors might choose to make a full-time hire to handle items from the advisor's "Stop Doing" list, others who do not feel ready to do so (or simply prefer not to bring on full-time employees) can consider working with an outsourced planning provider as an alternate solution. And while doing so involves time and monetary costs, it could ultimately pay dividends for both firm growth and the advisor's overall wellbeing!