Executive Summary

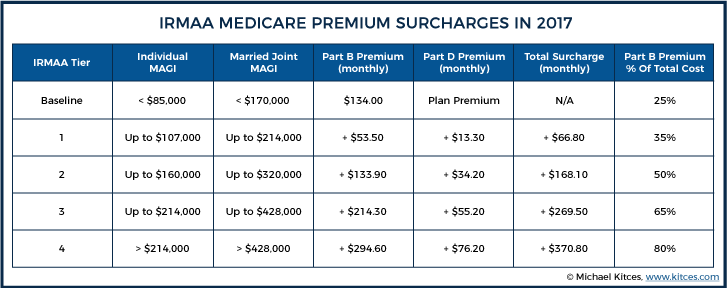

Since 2007, the Medicare Modernization Act of 2003 has required high-income Medicare enrollees to pay an “Income-Related Monthly Adjustment Amount” (IRMAA) surcharge on their Medicare Part B premiums, which lifts the Medicare Part B premium from covering “just” 25% of costs up to as high as 80% of results, increasing Medicare Part B premiums by as much as 219% in 2017. And since 2011, a similar IRMAA surcharge has applied to Part D premiums, applying a flat dollar surcharge of as much as $914/year in 2017.

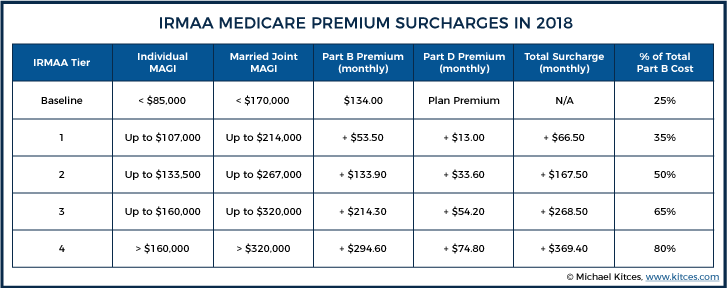

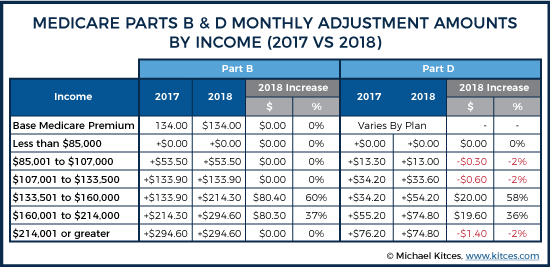

Beginning in 2018, though, the IRMAA surcharges on Medicare premiums will apply even more quickly, as changes under the Medicare Access and CHIP Reauthorization Act of 2015 will reduce the top Modified-AGI threshold from $214,000/year down to “just” $160,000 (for individuals, or $320,000 for married couples). And individuals with MAGI as low as $133,500 (or married couples at MAGI of $267,000/year) will be forced into a higher IRMAA tier, resulting in a nearly $1,000/year increase in IRMAA surcharges.

Which means going forward, it will be even more important to engage in proactive income tax planning for affluent retirees, to manage their exposure to IRMAA, especially in a low-inflation environment where being impacted by IRMAA also renders the household ineligible for the so-called “Hold Harmless” rules that limit annual inflation increases to Medicare Part B premiums. Especially since even “one-time” income events, like a sizable Roth conversion, or liquidating substantial capital gains, can be IRMAA triggers (at least for that one year the income event occurs).

On the other hand, it’s important to recognize that IRMAA surcharges still only amount to a roughly 1% to 2% cost increase, relative to the income the household must have to be subject to IRMAA in the first place. Which means that while managing taxable income (or really, MAGI) is important, it’s equally crucial not to let the tax tail (or the IRMAA tail) entirely wag the dog.

Nonetheless, the new 2018 IRMAA rules will just make Medicare-related tax planning more popular than ever. Although notably, for new retirees, the best IRMAA planning strategy is simply recognizing the opportunity to file Form SSA-44 to receive an exception to the IRMAA surcharge, as the act of retirement itself is a valid “life-changing event” that can allow new Medicare enrollees to avoid IRMAA premium surcharges on Part B and Part D in their initial Medicare years!

Origins Of Medicare Premium Cost Sharing Subsidies

Health insurance is expensive, including and especially for retirees who tend to have more frequent health complications associated with their age.

To help manage the cost, in 1965 President Johnson signed into law the legislation that established Medicare as the health insurance foundation for senior citizens over the age of 65 (further supported by Medicaid for certain especially-low-income populations).

The basic formula (which has changed over the years) is that the Federal government pays for 100% of “Part A” insurance (generally, hospital care) and about 75% of the cost of Part B (other medical insurance); the revenue to cover those implicit “subsidy” payments is, in turn, generated through the 2.9% Medicare component of the 15.3% FICA tax on employment income. The other 25% of the cost of Medicare Part B is paid directly by Medicare enrollees, in the form of a monthly Part B premium that is set annually by the Centers for Medicare and Medicaid Services (CMS).

Since 2006, under the Medicare Modernization Act, Medicare enrollees also pay a portion of the Medicare Part D (prescription drug) coverage with ongoing monthly premiums as well.

For most, the Medicare Part B and Part D premiums are simply paid by being withheld from their monthly Social Security checks, though those who are delaying Social Security benefits but have already enrolled in Medicare must pay their premiums directly.

Medicare Modernization Act Introduces Income-Related Monthly Adjustment Amount (IRMAA) Rules

The Medicare Modernization Act of 2003, which introduced Medicare Part D prescription drug coverage for the first time, also made a shift to how Medicare Parts B and D are funded, by requiring “high-income” Medicare enrollees to pay a higher-than-25% portion of their Medicare premiums, beginning in 2007.

Specifically, the rules require that Medicare enrollees whose (Modified Adjusted Gross) Income exceeds $85,000 (as an individual, or $170,000 as a married couple) must pay 35% of the total Part B premium (up from 25%), rising as high as paying 80% of the total Medicare Part B premium cost once income exceeds $214,000 of Modified AGI (for individuals, or $428,000 for married couples).

Similarly, beginning in 2011 under the Affordable Care Act, higher-income individuals are now also required to pay a (flat dollar amount) surcharge on their Medicare Part D prescription drug coverage. Unlike the Part B surcharge – which adjusts enrollee premiums to cover a target percentage of total cost – the Part D income-related surcharge is simply a flat dollar amount, starting at $13.30/month and rising as high as $76.20/month for those in the highest income tier.

Notably, these “income-related monthly adjustment amount” (IRMAA) surcharges are applied based on Modified Adjusted Gross Income (which in this case is simply the individual’s Adjusted Gross Income, or AGI, plus any tax-exempt bond interest that must be added back to determine if the thresholds are reached). And each of the four surcharge tiers are “cliff” thresholds – meaning even $1 of income past the threshold results in the entire (higher) surcharge amount being applied.

Because Medicare premiums are set for the upcoming year at the end of the current year – for instance, 2018 premiums are set by October 2017 – even as the 2017 tax year isn’t over yet, a household’s IRMAA tier for Medicare is determined by using prior-prior year income instead. Thus, for 2018, the household’s Medicare Part B and Part D surcharges (or lack thereof) and the ultimate issuance of an IRMAA Determination Notice (if applicable) will be based on the 2016 tax year (the prior-prior year), using the tax return data filed in 2017.

The annual MAGI thresholds for IRMAA Medicare Premium surcharges are adjusted annually for inflation, although under the Affordable Care Act, the inflation adjustments to the MAGI thresholds were frozen in place from 2011 to 2019. As a result, the impact of inflation on household incomes itself will cause at least some people to creep into a higher IRMAA tier, although overall the IRMAA surcharges are still projected to impact fewer than 5% of Medicare enrollees.

New MAGI Thresholds For IRMAA Medicare Premium Surcharges In 2018

Although the Medicare IRMAA thresholds have only been in place for barely a decade now, they have already experienced several changes – from the additional of the IRMAA premium charges to Medicare Part D in 2011, and the freezing of the MAGI threshold inflation adjustments. And under Section 402 of the Medicare Access And CHIP Reauthorization Act of 2015, the IRMAA rules were changed again, substantially decreasing the MAGI threshold to reach the top “5th tier” at which households must cover 80% of their Premium Part B premium costs (and pay the maximum $76.20/month Medicare Part D surcharge).

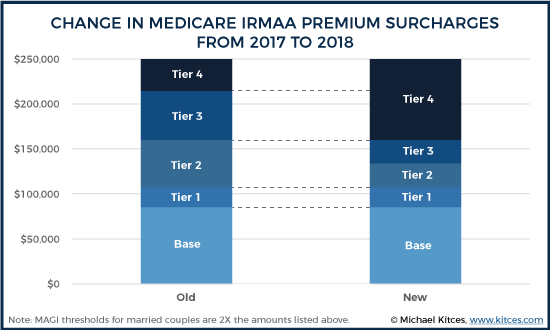

Specifically, the new rules shift the top 4th income tier of IRMAA down from $214,000/year for individuals ($428,000 for married couples) to only $160,000/year for individuals (or $320,000 for married couples), which previously had been “just” the 3th tier of Medicare surcharges. In turn, what was previously the 3th tier shifts down to the upper end of the 2nd tier, and the prior 2nd tier is further compressed.

The end result of these changes is that it now takes far less income for a household to reach the top IRMAA tiers. As an individual’s income moves from $85,000 to $160,000 of MAGI, they will move through all four tiers, shifting Medicare Part B premiums up an additional $294.60/month (or $3,535.20/year), on top of adding another $74.80/month of Medicare Part D IRMAA surcharges (for a total of $369.40/month or $4,432.80/year). And a married couple will experience these surcharges twice – once for each member of the couple, as he/she enrolls in Medicare – as household MAGI rises from $170,000 to $320,000/year. These amounts are in addition to the baseline Medicare Part B premium itself – $134/month in 2018 – plus the cost of the household’s chosen Medicare Part D premium (if applicable).

For those who were previously in the 2nd or 3rd IRMAA tiers, though, the impact is even more substantial, as they will effectively be shifted up an entire tier, boosting the IRMAA surcharge from $133.90/month (IRMAA Tier 2 in 2017) to $214.30/month (the next tier up in 2018), or from $214.30/month (the third tier in 2017) to $294.60/month (the top tier in 2018). This amounts to a nearly $1,000/year increase in IRMAA surcharges!

It’s also notable that those who are subject to IRMAA Medicare surcharges are not eligible for the so-called “Hold Harmless” rules that cap the annual increase in Medicare premiums at the dollar amount increase of Social Security’s COLA increase… which, as occurred in 2016, can cause Medicare Part B premiums to spike for those impacted by IRMAA. However, for better or worse, given that the 1st IRMAA surcharge tier – the threshold where the first actual surcharge applies – is still the same $85,000 for individuals and $170,000 for married couples, the new IRMAA thresholds won’t impact high-income Medicare recipients any more/worse now than it has in the past.

Requesting A Reconsideration Or Appealing IRMAA Surcharges For A Life-Changing Event

While many higher-income individuals will find themselves perpetually subject to IRMAA, based on ongoing income that exceeds the MAGI thresholds, others may find that IRMAA impacts them only periodically, in occasional years where the first (or higher) IRMAA tiers are reached.

Accordingly, it’s important to recognize that even if a household has been subject to IRMAA in the past, he/she will not automatically be subject to the IRMAA surcharges in the future. Instead, the determination is made based on his/her income (as reported on the tax return) each year. With the caveat that, due to the nature of the “prior-prior year” income calculation, that a household could have a reduction in income in the current year, and still be subject to IRMAA due to higher income in prior years.

For instance, a married couple that had higher income in 2016 and 2017, due to a series of substantial Roth conversions in retirement that put their household income (MAGI) over $170,000, would be subject to IRMAA surcharges on their Medicare Part B and Part D premiums in 2018 (and 2019). Even though, in 2018, their income might be well below the specified threshold (as they’re no longer doing Roth conversions anymore). Still, because the 2018 premiums and surcharges in 2018 were calculated based on their 2016 income, IRMAA will apply. Notably, the couple will “benefit” from their lower income in 2018 – which makes them not subject to IRMAA anymore – but the lower Medicare Part B and Part D premiums, without IRMAA surcharges, won’t apply until 2020 (which uses income from the 2018 tax year).

On the other hand, sometimes a household’s income declines due to bona fide “life changing” circumstances beyond their control, such that using prior-prior year income is no longer an accurate reflection of the household’s current financial status. In such situations, those impacted by IRMAA may submit Form SSA-44 – “Medicare Income-Related Monthly Adjustment Amount Life-Changing Event” – to request a reduction in IRMAA surcharges.

However, to have IRMAA surcharges reduced due to a life-changing event, it must be one of the specific life-changing events listed on Form SSA-44, which includes:

- Marriage

- Divorce/Annulment

- Widowing/death of a spouse

- Work stoppage (i.e., retired or laid off)

- Work reduction (i.e., material reduction in work hours)

- Loss of income-producing property due to a disaster or similar circumstance

- Loss of pension income (e.g., due to a pension default)

- Income for the year was due to a settlement with an employer for the employer’s bankruptcy or reorganization

Notably, newly minted retirees over age 65 (who start Medicare immediately after retirement) will usually need to file Form SSA-44 to report their “Work Stoppage” and avoid having their pre-retirement wages treated as part of their MAGI when determining IRMAA surcharges in the first full year of retirement. Fortunately, in subsequent years, it’s typically a moot point, as the post-retirement years with lower income often reducing MAGI below the first IRMAA threshold anyway. Nonetheless, in the initial year or two of retirement, this can produce a multi-thousand-dollar savings on Medicare premiums for a married couple!

For those who have had some other type of “life-changing” circumstance that does not fit the specific list of choices on Form SSA-44, it’s also possible to file a more formal appealing on Form SSA-561-U2. Officially dubbed a “Request for Reconsideration”, Form SSA-561-U2 is used to appeal a number of Social Security retirement or disability scenarios – including the application of Medicare IRMAA surcharges, which are technically determined by the SSA.

It’s important to recognize, though, that “mere” substantial changes in portfolio and investment income, including various types of retirement withdrawals, are not treated as “life changing” events eligible for an IRMAA surcharge exception. Thus, a household who has a single (or even multi-year) big income event, from liquidating substantial portfolio capital gains, to selling a primary residence (where the value was over and above the up-to-$500,000 capital gains exclusion under IRC Section 121), taking sizable IRA withdrawals or engaging in substantial (partial) Roth conversions, etc., will have to pay IRMAA surcharges on Medicare premiums associated with that high income year. Though, again, if the income event only lasts for a year or two, so too does the IRMAA Medicare premium surcharge.

Planning To Minimize IRMAA Medicare Premium Surcharges

While it’s fortunate that Medicare enrollees that experience (income-reducing) life-changing events may be able to file Form SSA-44 to avoid IRMAA surcharges on Medicare premiums, ideally it’s preferable to just manage income to stay below the thresholds in the first place.

At the same time, though, it’s crucial to recognize that – relative to the income levels it takes to hit IRMAA thresholds in the first place – that at the most, IRMAA is really just the equivalent of a modest income surtax.

After all, the first IRMAA tier applies at a MAGI of $85,000 (for individuals), and will result in a $53.50/month premium surcharge, which amounts to $642/year of additional Medicare premiums. Except on an income of $85,000/year, that’s a loss of less than 1% of household income to the IRMAA surcharge. An upper-income household in 2018 will face an IRMAA surcharge of $294.60/month (which is $3,535/year) once income exceeds $160,000/year, yet even that still only the equivalent of “just” a 2.2% surtax on income.

Viewing IRMAA surcharges relative to income is important. because it means that engaging in strategies like pre-retirement Roth conversions – in an attempt to reduce post-retirement IRMAA below the income thresholds – could cost far more than they save. After all, contributing to a Roth for someone in the 33% tax bracket during the working years, instead of contributing to a pre-tax 401(k) plan and simply taking withdrawals in retirement at a 25% tax rate, is inferior even with IRMAA boosting that individual’s tax rate on those pre-tax 401(k) withdrawals by another 1%-2%. Similarly, purchasing a non-qualified annuity to shelter taxable income to get below the IRMAA threshold may not make sense if the Medicare premium savings is only $642/year (the first tier of IRMAA surcharges) if it requires paying a 0.50% expense ratio on a $200,000 annuity (which amounts to $1,000/year in annuity costs). As always, beware letting the tax (or IRMAA) tail wag the dog.

Instead, the optimal IRMAA planning strategies will typically be to manage those already close to the threshold – where a relatively small shift in the timing of recognizing capital gains or harvesting capital losses can get a household below the threshold – will be more appealing. Which makes it all the more important for advisors to be acutely aware of which clients have household income that is approaching an IRMAA threshold – as again, a mere $1 over the line can instantly result in a $600 - $1,000 Medicare premium surcharge. And be cognizant of clients whose income is over the IRMAA threshold but may legitimately be able to claim a “life-changing event” exception via Form SSA-44 – especially recent retirees where the act of retirement itself will render them eligible for the exception (and the reduction of work income may reduce them to being one or several IRMAA tiers lower!).

Nonetheless, with the looming 2018 changes to the IRMAA thresholds as a part of the Medicare Access and Chip Reauthorization Act of 2015, the upper IRMAA tiers now impact a wider range of retirees, increasing the value of IRMAA planning. Especially for those individuals above a MAGI of $133,500 (or couples over $267,000), who will suddenly find themselves lifted an entire IRMAA tier higher in 2018 than they were in 2017!

So what do you think? Do you plan around IRMAA surcharges for your clients on Medicare? In what other “surprising” situations have you seen IRMAA have an impact? Please share your thoughts in the comments below!

One strategy for a client in RMDs would be to take a QCD to reduce their AGI + tax exempt interest to reduce their Medicare Premiums.

Thanks for the excellent summary which I’ve forwarded to my friends.

I do my own financial planning and determined early on in retirement that I could smooth my forward year income and very likely reduce lifetime taxes with Roth conversions. I started in 2010 and have been pretty aggressive with a goal of 50% conversion before my RMD’s begin in 2019.

As you mentioned, the cost of higher premiums might not be so significant compared with taxes but, as you also mentioned, the problem is it’s a step function. That first dollar over the line has a very high marginal rate! For that reason, I use the Medicare break points to determine my “budgeted” AGI each year and recharacterize enough Roth conversions to ensure my MAGI is just below the break point. One good thing — although tax-exempt interest is included in this definition of MAGI, the non-taxed portion of Social Security benefits is not included.

If Roth recharacterizations are eliminated under the new tax bill (thanks for your previous article on the tax proposal), I will lose the ability to fine tune my taxable income. That means I will have a lot of work to do at year end next year and beyond to estimate my taxes accurately to ensure I’m not crossing Medicare brackets. Even if I were to do a QCD once my RMD’s begin, I believe that also has an end-of-year deadline.

In the article you mention that it is superior to contribute to a Roth while in the 33% bracket, as opposed to a pre-tax IRA, even if you’d be in the 28% bracket during retirement.

Can you explain the logic behind this? Wouldn’t you prefer the deduction while in the 33% rate, as opposed to the tax free withdrawal while in the 25% rate?

John, I think you are correct. I did a double-take when I read the same sentence as it’s clearly the opposite of Michael intended to say. Michael, I think you meant to use ‘inferior’ rather than ‘superior’ in the sentence John references.

Oy, yes indeed, this is written backwards. Fixing it now. Sorry for the confusion! 🙁

– Michael

Actually your (original scenario) is plausible, It’s possible you could increase your marginal rates, MAGI & Medicare premiums for a few years in order to decrease your RMDs, and MAGi and MC premiums for the remainder of retirement and come out ahead.

You’ll need to consider indeterminable factors, like how long you expect to live, and what future tax rates & means-testing limits will be – but it’s perfectly plausible.

One very sad part is that all winning sessions at the casinos are considered part of your MAGI. If you’re in the red for the year. you may take losses as an itemized deduction, but they don’t reduce MAGI. Therefore, many retirees who who spent lots of time at the casino, and have losses for the year, are still getting hit with higher premiums.

Thanks for the great article Michael. As far as tax planning goes – the IRMAA is a major disaster. First it’s a ‘tripwire’ tax – as soon as you exceed the limit by $1 you are forced to pay perhaps several $K/couple. So you need to create a MAGI near but below the next ‘tripwire’. It would be far better if the tax had a linear phase-in (just as PEP & Pease are linear phaseouts). The 2nd major headache is that the location of these tripwire amounts is unknown at the time of tax planning.

For example the CSA just (12/17) published the 2016 MAGI amounts that ‘trip’ the excess medicare premiums during 2018 – and these changed radically (e.g. top bracket declined from $428k to $320k!!). But the individual’s ability to ‘engineer’ MAGI for this period ended on 12/16 or at best on 4/17 – long before the ‘tax’ implications were knowable. It’s a sort of “declare your income now, and we’ll determine the premiums based on that later” scheme. I pity the ppl who tried hard to to stay under some IRMAA trip-limit only to find it shifted downward by 25% a year later.

At the moment I am CHOOSING a Roth conversion amount, which directly affects my 2017 MAGI based on the recently released 2016MAGI Medicare ‘tripwires’. This system is reagent grade baloney

I just turned 66, and have been doing Roth conversions to hopefully lower my RMDs from my Rollover IRA. I am widowed, so threshholds come at me fast, and this year I have to pay double for Medicare Part B. Now, I’m stressing over when I turn 70, and the RMD throws me way up. I am not complaining because I have this income, I just question, at this point, should I really bother with trying to strategize around the IRMAA?

This is insane. Who cares about Russian collusion when MC costs are going to eat us alive!!

There was no Russian collusion.

How can a retiree thoughtfully control their portfolio withdrawals each year and thus their MAGI for that year when the SSA can go back two years and apply a revised tier system for IRMMA? If this law was passed in 2015, why was the SSA still stating all through 2017 in their own publications that the second IRMMA tier for “Married, Filing Jointly” was still $214-$320K? The SSA is applying a new 2018 tier structure to income received in 2016 when they supposedly knew in 2015 that the law and these tiers were going to change. Sounds like a massive amount of incompetence on the part of the SSA. And then folks wonder why some taxpayers are inclined to cut a few corners now and then!!!

Is one allowed to use the Life Changing Event form SS-44 twice for the same event, e.g. for each of the first two years after you retire?