Kitces Financial Planning Value Summit 2024

See How Successful Advisors Are Communicating And Demonstrating The Ongoing Value Of Financial Planning

Registrants of the December 12, 2024 Summit have been sent a recording of the live event.

See How Successful Advisors Are Demonstrating Their Value To Clients

Instead of telling you what you ‘should’ be doing as an advisor, our Kitces Financial Planning Value Summit guests are all practicing financial advisors who will actually show you what actions they’ve taken to demonstrate their upfront and ongoing financial planning value to clients and prospects, so you can see what’s really possible for yourself.

The transition from “pure” investment management services to providing more holistic financial planning has been underway for more than a decade, as advisory firms either try to expand their value to defend against fee compression, or increasingly offer advice as a standalone service to generate standalone advice fees. Yet the challenge is that historically, financial planning was always paid via subsequent product implementation, or as a part of an AUM fee… such that advisors have never really had to ‘prove’ their financial planning value the way they do now with a more fee-for-service approach.

At the Kitces Financial Planning Value Summit, you’ll have a chance to see what ongoing financial planning value looks like when it’s done successfully, with a unique behind the scenes look at real financial advisors’ tactics to demonstrate their value upfront to prospects and ongoing with clients.

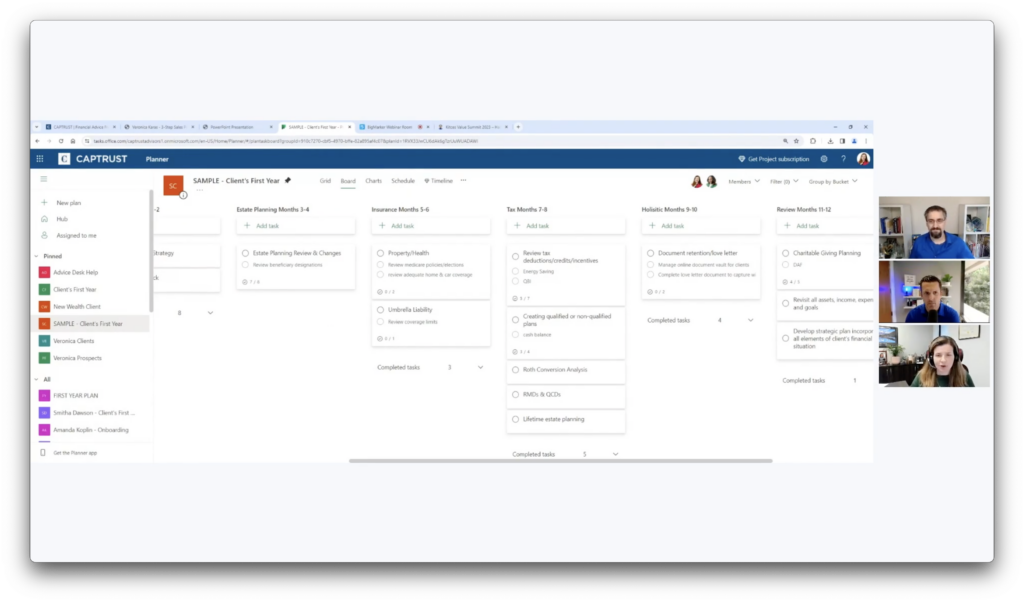

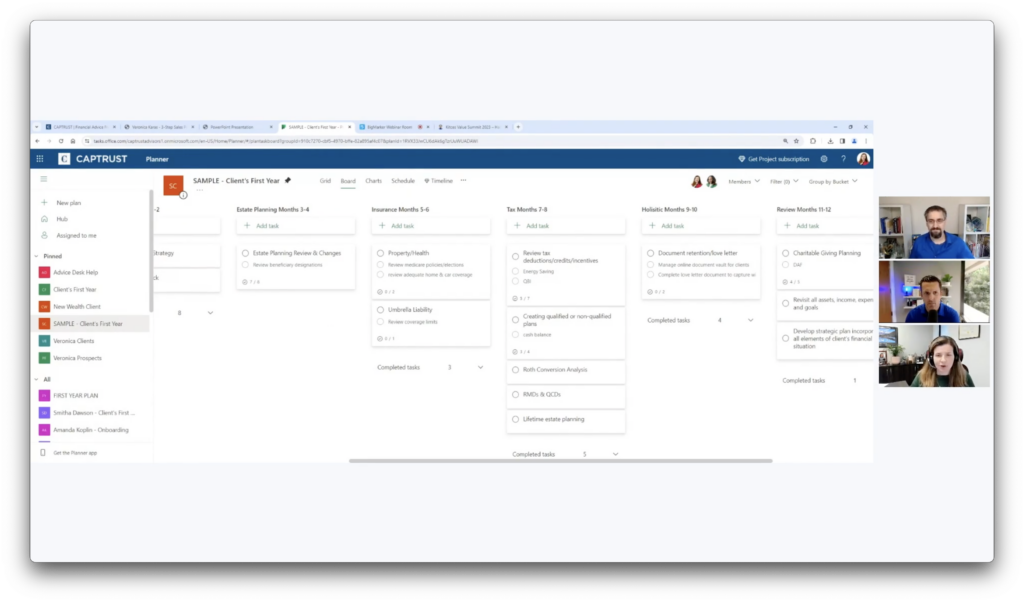

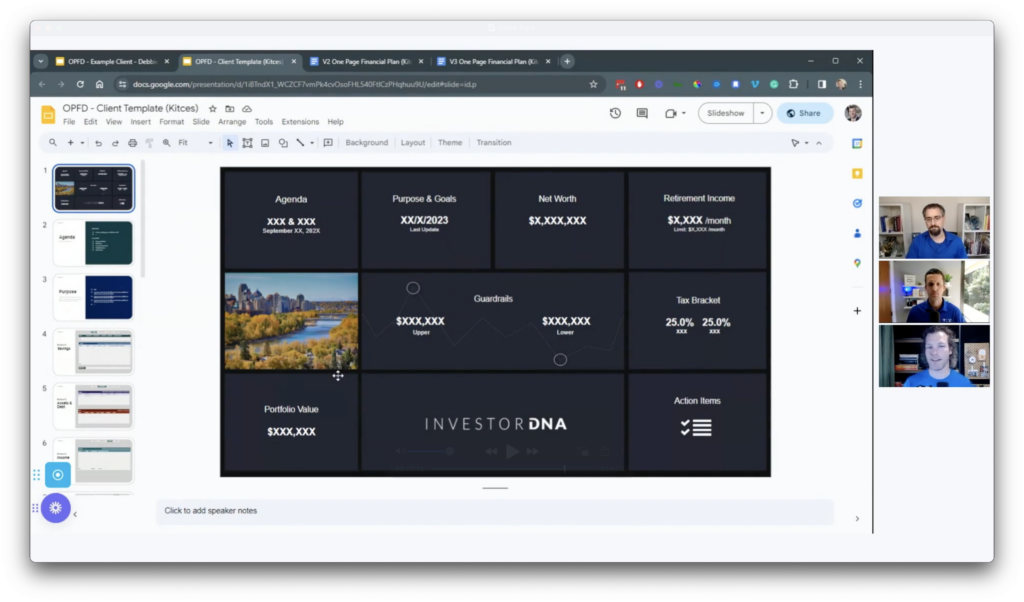

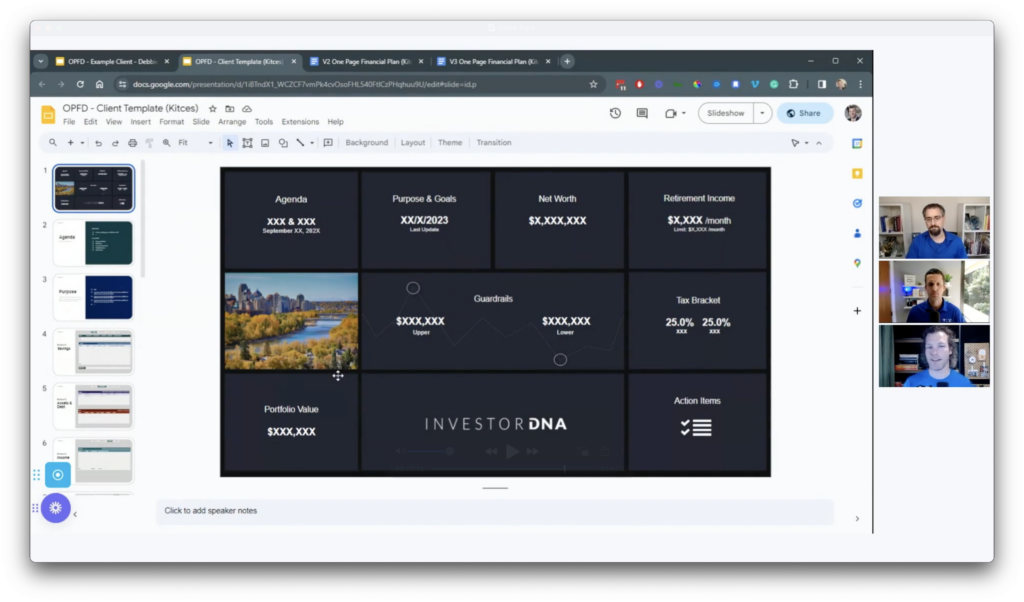

No vendors. No sponsors. Just a series of 30-minute real conversations between our co-hosts – Michael Kitces and Taylor Schulte – and our expert guests, financial advisors who will screenshare their actual financial planning deliverables and show how they communicate their value to prospects and clients.

30-Minute, Real World Conversations With Advisors Who Know What Success Looks Like

Each guest will screenshare their actual strategies and show how they demonstrate value to prospects before they engage, during the initial plan delivery, and between meetings throughout the year.

Yohance Harrison

Agenda

Get ready for a unique behind-the-scenes look at strategies that demonstrate the ongoing value of financial planning including a client dashboard, personalized client websites, systematized agendas, first-year rubrics, and a value pitchbook.

Showing Your Planning Value to Build Fee Confidence And Charge What You're Really Worth

Don’t miss the must-see co-host presentation from Michael Kitces and Taylor Schulte that kicks off the Summit! Drawing on their personal experiences and the latest industry research, Michael and Taylor will share exclusive insights into how top advisors are setting and charging fees that reflect the value they deliver. Attendees will gain practical strategies and data-backed takeaways to refine their pricing models and confidently charge what they’re truly worth. This exclusive session sets the stage for a Summit full of actionable insights and advisor-to-advisor learning.

Presenting A Clear Menu Of Planning Services And Fees To Close Prospects In One Meeting

Having systematized his sales process to explain his Menu of Services, Yohance organically increased his firm’s revenue by 20% over the last 12 months and converted 68% of his prospects into clients. Yohance will share:

- What his process is for scheduling prospect meetings and collecting important information in advance

- The rehearsed scripts he uses to set expectations and communicate his value throughout the prospect meeting

- How he leverages a menu of services to clearly align his fees with different service tiers, and convert 68% of prospects into clients in just one meeting

Using A Structured Meeting Agenda and Proposal Playbook To Explain The Value To Prospects

By systematizing prospect meetings with her structured agenda and proposal playbook, Kristen’s firm brought on 37 new clients since 2023, while also adding $321k in new recurring revenue. Kristin will share:

- How she builds and presents her structured meeting agenda for prospect meetings

- What information she includes in her Proposal Playbook to show her planning value to prospects

- What proposal generation software she adopted to create and present her proposals, and how it has improved efficiency and effectiveness

Creating A Written Implementation Plan To Clearly Show A New Client What Will Be Accomplished Together

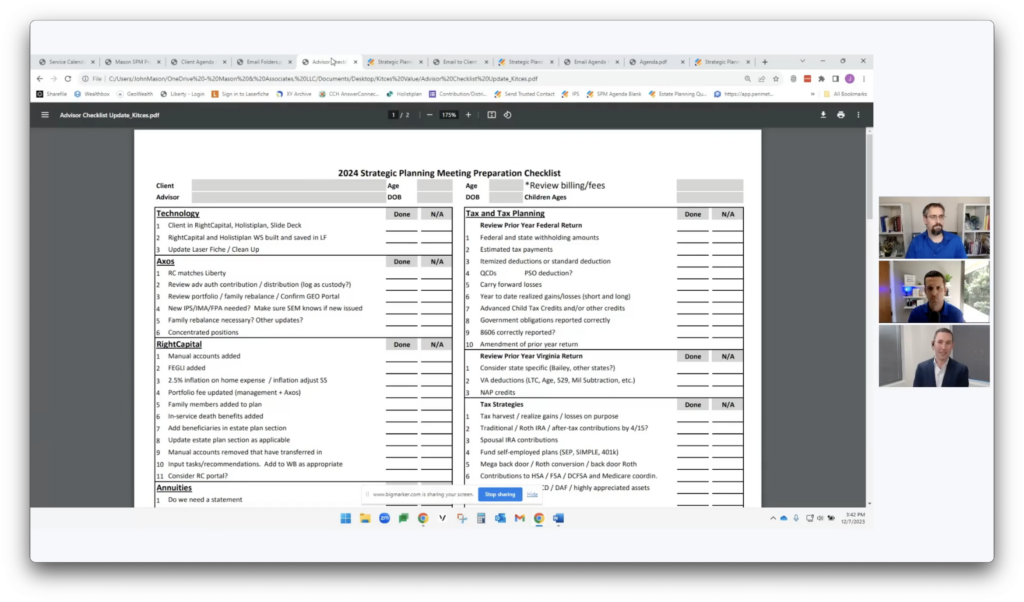

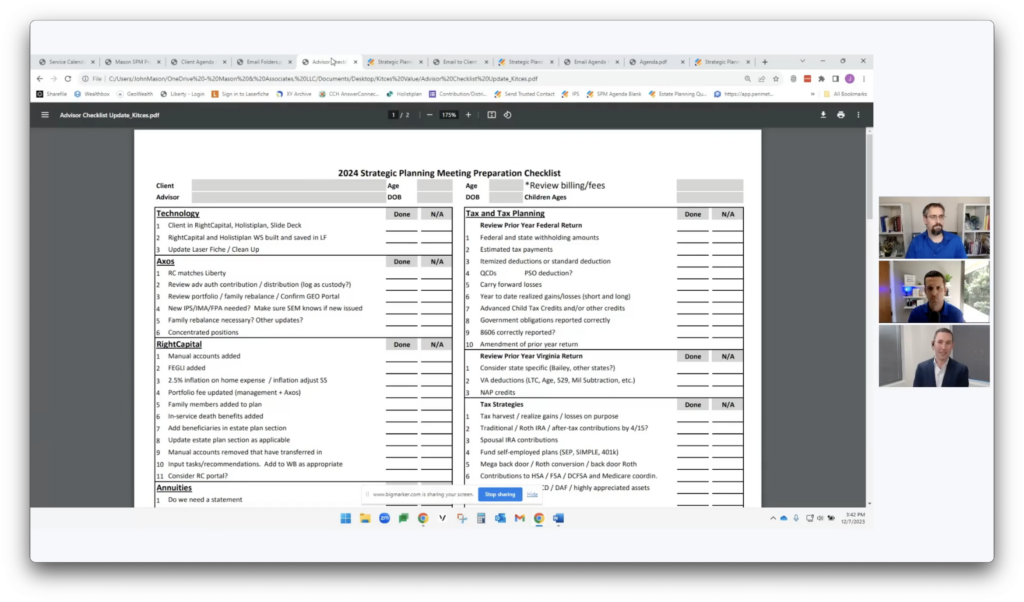

By leveraging the implementation schedule he creates for each new client, John has increased his AUM from $7.8M to $27M in one year, while also growing monthly recurring planning fees to $3,300/month. John will share:

- How he systematized summarizing important financial planning data for each client in an internal spreadsheet to be able to better showcase his value to clients

- The way he created implementation schedules for new clients, and works collaboratively with them to prioritize action items and track progress

- How he builds and presents initial financial plans for new clients to clearly communicate what will be accomplished together

Systematically Creating Year-End Planning Summaries to Document Achievements And Next Action Steps

By developing a template to easily create a year-end planning summary for each of his 67 clients, Brian has grown revenue by nearly $120k while not appreciably increasing work hours. Brian will share:

- What his annual service model includes, and the way he has structured 3 distinct review meetings throughout the year with each client

- How he creates year-end planning tax and investment summaries to document key information, show clients what has been accomplished, and communicate future action items

- His approach to leveraging systems and technology to more efficiently create his year-end tax and investment summaries for clients

A Structured Process That Turns Initial (Paid) Planning Clients Into Ongoing (AUM) Clients

By iterating on his financial planning process to not only deliver recommendations but highlight the value of an ongoing planning relationship, John has converted 26 of his last 28 initial $2,500 planning clients to be ongoing $700k+ AUM clients. John will share:

- Why (and how) he charges a one-time fee of $2,500 to create and deliver an initial financial plan instead of bundling the planning into his AUM fee

- What the 3-steps are in his (paid) financial planning process to show value in a limited-scope engagement

- What scripts he uses throughout each stage of the planning process to set proper expectations and be able to turn paid planning clients into (ongoing) AUM clients

Building A Complexity-Based Fee Calculator To Ensure You Charge What You're Really Worth

By using their fee calculator with prospects and annually at client renewal, Emily’s firm maintains a nearly 100% plan renewal rate while ensuring planning fees are aligned to the value provided (varying from $1,800 to over $10,000 per plan year), ultimately generating $160k in financial planning fees in addition to their $590k of AUM revenue. Emily will share:

- What her annual Client Experience Timeline looks like and how she uses it to help clients visualize the planning process

- How she created a custom complexity-based fee calculator to clearly align the value provided with the appropriate fee in each client engagement

- How she communicates annual fee renewals (and potential price increases or decreases) to clients, leading to successfully renewing nearly 100% of her client agreements each year

Screenshare Sessions

Get ready for engaging sessions led by successful advisors who will share their proven tactics.

What Others Have Said About Kitces Summits

Purchase The Recording Of This Event

This Kitces Summit registration is $397 for a full recording of the event.

Advicers who have joined the Kitces Members Section can register at a discounted rate of $297.

Premier Users - Login to Purchase

Reader and Basic Members

Summit + Premier Subscription $486

Interested in being a guest presenter at a future Kitces Summit? Click here to learn more

Interested in becoming a Premier member to receive the Member Discount? Click here to learn more

Become a Premier Member

Kitces.com Premier Membership includes Kitces-Courses discounts, free monthly webinars, over 100 Hours of CE on-demand, CFP ethics, and more!

Group Discounts

Discounts are available for group enrollments. Additional discounts apply with a Kitces Premier Group Membership .