Executive Summary

When it comes to focusing on a niche for financial advisors, business owner clients can be an appealing target as they can have complex financial planning problems ranging from cash flow management to tax planning to acquisition strategies. However, while business owners can be compelling clients, they can also be difficult to find and prospect in the first place. One component that feeds this dynamic is that business owners have many people vying for their attention; another is that business owners have limited time and resources. So, the dilemma for advisors looking to find business owners and convince them to become clients often comes down to finding business owners who can benefit from (and want) financial planning services and demonstrating expertise in a way that can build trust.

An effective strategy for attracting business-owner clients is to engage with a CEO Peer Group. These support groups, typically comprising 10–12 business owners, generally meet monthly and allow members to discuss issues, brainstorm solutions, and share resources. Most importantly, CEO Peer Groups provide space for business owners to work 'on' their businesses – rather than 'in' their businesses – with highly trusted peers.

Advisors have a few options for getting involved in a CEO Peer Group. One is to become a Strategic Partner (SP) and create a new group, serving as both sponsor and host. This option allows advisors to establish themselves as experts and resources for other Peer Group members, where they can also better understand what business owners want and need from the complex situations they discuss with their Peer Group. Additionally, when the advisor shows up and facilitates fruitful discussions every month, providing relevant resources as the group's SP, business owners begin to see the real value the advisor can offer. Group members get to know and trust the advisor in a non-sales environment, making them more likely to become prospects (and then clients) of the advisor.

Instead of engaging with a CEO Peer Group by serving as a Strategic Partner (which can be relatively time intensive), a second way for advisors who are firm owners to engage with peer groups is to become members themselves. This lets them reap the benefits of having both the support and guidance of a Peer Group and access to a level of prospective outreach through networking within the group as a group member. A third way for advisors to engage with a CEO Peer Group is to partner with a peer group moderator to serve as a Center of Influence for the group, allowing the advisor to connect their own network of resources with group members to help solve their various problems, or even providing members with resources through their own planning services to answer questions on issues such as taxes, insurance, and scaling.

Ultimately, the key point is that for advisors who work with (or would like to work with!) business owners, CEO Peer Groups can provide an organic way to connect with, market to, and ultimately onboard new clients. Whether serving as a Strategic Partner, a group member, or a Center of Influence, CEO Peer Groups can provide advisors with a valuable opportunity to learn from like-minded business owners to help them expand their own network of trusted peers!

Like many financial advisors, it didn't take me long to realize that small business owners were amongst my most lucrative clients. As Michael Kitces often says, having a niche is essential to separate yourself from other advisors. And I chose the niche of small business owners.

However, I found that wanting small business owners as clients and actually getting them, as well as understanding them, were very different things. However, once I discovered the CEO Peer Group concept, everything changed. By being a member of a local peer group now since 2017, I have benefited from multiple referrals to other business owners and new client engagements from my existing peer group business owners, but also, interestingly, it is what I learned about business owners.

I'm in a confidential environment where business owners are working on their businesses, sharing challenges and opportunities that help me understand and interact with my business owners' clients much more effectively and confidently. I get the inside track into a business owner's fears and mindset giving me an edge in working with these clients over other advisors. As a result, I have developed credibility in the marketplace as the go-to financial advisor for business owners. That is invaluable to my practice. (Mike Jones, CFP, CEPA Ataraxia Advisory Services)

What is a CEO Peer Group? Peer groups, also called Peer Advisory Councils or Mastermind groups, are groups of typically 10–12 privately held business owners who meet once a month to work on their business. Most small business owners can't afford and don't need a formal Board of Directors. What they do need, however, is a board of advisors. Their peer group becomes their informal board that provides a safe environment for them to share and get input on any issues they are struggling with to grow and build value in their business.

The peer group concept dates back to as early as the 1920s in the United States, with Napoleon Hill's book "Think and Grow Rich" introducing the concept of mastermind groups. Vistage, a global peer group organization, modernized the concept in the 1950s. 20 years later, multiple other organizations, such as Entrepreneur Organization, The Alternative Board, Young Presidents Organization, and Tiger 21, helped bring the peer group concept into the mainstream.

The peer group concept dates back to as early as the 1920s in the United States, with Napoleon Hill's book "Think and Grow Rich" introducing the concept of mastermind groups. Vistage, a global peer group organization, modernized the concept in the 1950s. 20 years later, multiple other organizations, such as Entrepreneur Organization, The Alternative Board, Young Presidents Organization, and Tiger 21, helped bring the peer group concept into the mainstream.

After becoming a top franchisee for the Alternative Board myself, I sold my franchise and founded LXCouncil to take peer groups – CEO Peer Groups specifically – to the next level with a new model that was more successful and lucrative for anyone running groups, no matter the geography.

If you have not heard of this concept, you are not alone. When I speak to a group of financial advisors, I always start asking for a show of hands from those who are either in a peer group themselves or believe they have clients who participate in such a group. Typically, only a third of the hands get raised. But once I explain what a CEO Peer Group is and how it operates, the light bulbs start to go off. The advisors would quickly realize they now have a tool to connect with and build trust among potential small business owner clients.

The methodology of CEO Peer Groups generates 4 options for advisors to become involved with: To participate as a group member (if you choose to also work on your business), to sponsor a group, to become a center of influence with the leader of a group, or to ultimately start and lead your own CEO Peer Group. There are many factors to consider that can help you determine the right fit for you.

Why Small Business Owners Will Join Your CEO Peer Group

If you ask a small business owner why he or she is a member of a CEO Peer Group, you may get one or more of these answers:

"It's lonely at the top. Who else do I have to talk to that can give me unbiased feedback?"

"It's my best opportunity to take time to work 'on' the business versus 'in' the business."

"It's my one opportunity each month to set time aside for strategic thinking versus tactical thinking."

"I gain the perspectives from other members on how to best address COPIs (Challenges, Opportunities, Problems, or Ideas.")

"I learn what I don't know that I think I know about running the business."

"I can share topics that I'm not comfortable talking about at work and cannot Google for an answer."

"It's a safe environment because everyone signs a non-disclosure agreement and adheres to it."

"It's the one time each month I can spend with my very best business friends."

A business owner once said to me, "Peer groups are the avenue that gives owners the confidence and clarity to do what they know they need to do." The other main concept of peer groups is the experience shared by peers who are also running companies. Nothing is more effective than peer pressure. In addition, a business owner will listen to another business owner over anyone else about business concepts. This is a concept where experience trumps academics.

As Mark Twain once said, "I have never let my schooling interfere with my education."

"Peer groups are the avenue that gives owners the confidence and clarity to do what they know they need to do."

As an example, my Dad was always on his cell phone working the sale. On one particular day, I observed him take a call from Jimmy, a client of his. Jimmy wanted to buy one of Dad's concrete mixer trucks. Dad listened while Jimmy pitched him on why Dad needed to lower the price from $38,000 to $34,000. After listening for a few minutes, I wondered if Dad was going to cave into the lower price or do what Negotiation 101 teaches, which is to meet in the middle or split the difference.

Now, my Dad loves to make a deal, so I expected negotiation, but that was not what happened. Instead, Dad said, "Jimmy, how about I sell you that mixer for $40,000?" Complete silence by Jimmy; I'm thinking it's because he was thinking what I was thinking, which was that my Dad had lost his memory and that he had forgotten the original price he quoted. On the contrary, Dad knew exactly what he was doing. Jimmy suddenly began laughing and said to my Dad, "Oh, that's okay; the $38,000 will be just fine… assuming that price is still available?"

I learned right then and there that there is no substitute for real-life experience. No textbook or Google search can answer real business owners' Challenges, Opportunities, Problems, or Ideas (COPIs). And that is why the peer group concept is so powerful: because it's based on real-world insights, perspectives, and experiences of other peers. Knowledge that can be directly applied to other's situations, taking into account each personal unique situation.

You probably have surmised that the camaraderie is high, and the bond is deep between peer group members. You are right; they are. Sound like something you wish you were involved with to meet, interact, and gain business owner clients? Well, you can be! Now let's look at how you can make this happen.

Putting Together A CEO Peer Group

The ideal CEO Peer Group size is 10–12 members. If a group has fewer than 10 members, it will lack the diversity and range of experience to benefit the group. Once you get beyond 12 members, you run the risk of the group becoming too large to connect with each other and spend an adequate amount of time addressing each member's issues. And the connection is the key. Once each member describes the group as "their group", you know the group has bonded.

Members need to feel free to share their unique business problems. Therefore, ideally, each member would come from a different industry and/or region. Owners would naturally be reluctant to share openly during peer group meetings if their competitors are in the room. With this in mind, advisors who want to put together their own CEO Peer Group can start by looking over their own list of small business owner clients. If you already have 10 or more of those, you are well on your way to creating your list of potential members. Now add in your small business owner prospects. The CEO Peer Group concept gives you a whole new reason to talk to them. If they end up joining the CEO Peer Group and subsequently see the value, it will be you who they thank. Once that occurs, how hard will it be to get them as a client?

Another great source of potential members is referrals from your current small business owner clients. Even if they are not already in a peer group, they will likely each have an informal network of small business owners whom they talk to regularly. There will already be a level of trust between them; therefore, this will significantly speed up the process of helping members feel like the group is truly theirs.

Your Role As The Group's Strategic Partner (SP)

Every financial services conference will have an exhibit hall full of sponsors. These sponsors provide both financial support and content in exchange for exposure to you and your peers. You fill a similar role to that of a sponsor for the group. As the person hosting the entire CEO Peer Group meeting, you become a Strategic Partner (SP) of all of theirs. As the group members grow their business, they will credit you for introducing them to this unbelievable resource. They will see you as a connector who has their true interests at heart and that you also understand what they need to reach their goals.

To steal a term from Michael Kitces, you will be viewed as their #1 trusted financial advicer.

Your role with the group should include all of the following:

- Hosting the group each month in your conference room, assuming the group is meeting in person. Can you think of a better way to make sure existing clients come regularly to your office and introduce prospects who have joined the group to you and your firm?

- Setting up any marketing events for prospective group members. I always suggest staging a mock meeting so that potential members can experience the concept before committing to becoming a member. This is the responsibility of the leader running the group, and would basically involve running a shortened mini version of a full-length meeting to showcase the value of the peer group concept.

- The opportunity to talk for 10–15 minutes at the beginning of each meeting on a topic that you deem relevant. This will showcase your expertise, build trust, and illustrate a sense of abundant mindset of giving without expecting something in return.

Being an SP gives you the following ongoing benefits:

- Regular recurring access to the group each month to develop relationships.

- Education on what business owners want and need, as the moderator, who will serve as the leader of the group (as discussed in more detail below), will relay to you what the group wants you to speak about.

- Clients in the group are likely to become better, more profitable clients.

- Prospects often turn into clients because they get to know and trust you naturally in a non-sales environment.

- You'll receive positive press in the community for your support of business owners.

My experience is that well-run peer groups will generally allow you to convert at least 50% of the prospects to clients. In addition, you will get a bigger share of your wallet from the members who are existing clients. Why? First, as the host of the meeting, you will see them regularly. They will be coming into your office and seeing your professionalism and expertise. How often do you think the prospects are in their current advisor's office? For that matter, how often are your existing clients in your office?

In addition, you will get regular opportunities to talk to the group about topics of interest to them as a business owner. That is invaluable airtime. As an SP, you also get access to social events and retreats if they have them. Those are times of immense bonding and sharing experiences you do not have to create. They are created for you.

Sharing The SP Role With Another Can Lessen The Workload And Broaden Networking Opportunities

Putting together a CEO Peer Group can be hard work – especially if you don't have many existing small business owner clients or prospects. But you are not the only entity that would love more small business owner clients. Banks, CPA firms, and law firms also covet these clients. In fact, you probably have relationships with many of them already. You will therefore find them quite willing to partner with you.

In exchange, you should ask them to provide referrals to possible group members (after all, they, too, have small business owner clients and prospects) and assistance with setting up the marketing events. In addition, ask them to contribute to any costs you incur in establishing the group and to ongoing costs for hosting the meetings.

You'll Need a Professional Moderator

I've established and personally run dozens of peer groups over the years, and if there's one thing I can tell you for sure, it's that the group won't succeed unless it has a professionally trained moderator. The moderator needs to be able to set and follow a structured, proven agenda that allows the members of the group to learn insights and best practices from each other. They will also be responsible for holding the members accountable to each other and themselves, coordinating the meetings, working with you to speak to the group regularly, and onboarding new members. There are most likely moderators already running groups in your geography that would be happy to work with you. I am also here as a resource for advisors who need help finding a moderator or want to learn more about this option.

Becoming A Member Of An Existing CEO Peer Group

If you don't have the time or connections to start your own CEO Peer Group, you can get many of the same benefits by simply becoming a member of an existing group. This approach can be particularly effective if you believe that you need to work on your own business, which is what Mike Jones, quoted earlier at the beginning of the article, decided to do when he joined a CEO Peer Group.

You must want to grow, operate a better firm, and bring COPIs just like the other members. The added upside is that you'll have a front-row seat to the real challenges and mindset of business owners. You will witness vulnerability like you have never seen, which will educate you on how you can better serve these types of clients. You will hear how owners speak, what their fears are, and what's most important to them. This will help you as an advisor when talking to your existing clients and, just as important, to prospects.

It's an invaluable avenue to be educated on what a business owner thinks and needs. By being a member, you will show not only your vulnerability in running your own business, but also your knowledge, compassion, and expertise, which will result in the members trusting you. And when they trust you, they want to work with you.

So many times, potential members worry that if other members know all the 'dirty laundry' of their business, it will cause them to not work with them. But the absolute opposite happens. Everyone knows every business has issues, but seeing how problems are handled and knowing that you can trust the business to do the right thing actually increases the affinity between members to work together.

Being a member is not about networking. However, networking is a natural by-product of the peer group process because of the trust that is created between the members. There are countless examples of members doing business with each other over time, and, commonly, most members do business with each other because of the bond that is created. It's a natural way to gain new clients without 'selling' to them but by building a deep relationship.

By being a member, you experience 3 major benefits: improving your business, getting new business, and understanding more about business owners that will help you with your clients. There is a cost to be a member and a time commitment every month as compared to choosing the SP option and creating your own CEO Peer Group, where the only real costs involve establishing the group, hosting meetings, and the time commitment of working with the moderator on how to be a resource for the members.

Serving As A Center Of Influence (COI) For The Peer Group

Centers Of Influence (COIs) are well-connected people or groups that can enhance your credibility through referrals, testimonials, and word-of-mouth. Since every successful moderator is essentially a 'Resource Connector', they are always looking for another COI for their members. Hardly a meeting goes by without at least one member asking, "Do you know someone who can (fill in the blank)?". Sometimes, this is a request for an outsourced human resource expert, or it can even be a personal request like needing a referral for landscaping.

Every moderator of a peer group looks to develop their own COI connections they trust and can use as a referral for their members. They typically look for COIs in the areas shown in the graphic below. Notice that you are one of those listed:

You have an advantage over being a COI over all other COIs. Why? Per the Exit Planning Institute's 2023 National State of Owner Readiness Report, the financial advisor is the #1 trusted advisor for business owners, up from # 5 in 2013. That's a lot of movement in just 10 years and a testament to how much your services are needed.

By finding a peer group moderator and cultivating a relationship to be a COI for them, you position yourself to give knowledge and assistance when the group or someone in the group needs your expertise. We're back to the example of when someone needs a resource, you want to be the name that the moderator thinks of. Often, a peer group moderator looks for an expert to speak to the group on important topics the group needs to hear about. As a COI, that can be you. As a result, you will be looked upon to give a short presentation and possibly be invited to social events or events that the moderator has with the members.

It is an efficient way to interact and develop deeper relationships with owners that lead to new clients. Business owners do business with those they know and trust. They take referrals and introductions seriously when made – it is like being an automatic shoo-in when endorsed by the moderator. The members believe the COI has already been vetted and screened and has a proven track record if the moderator is endorsing them.

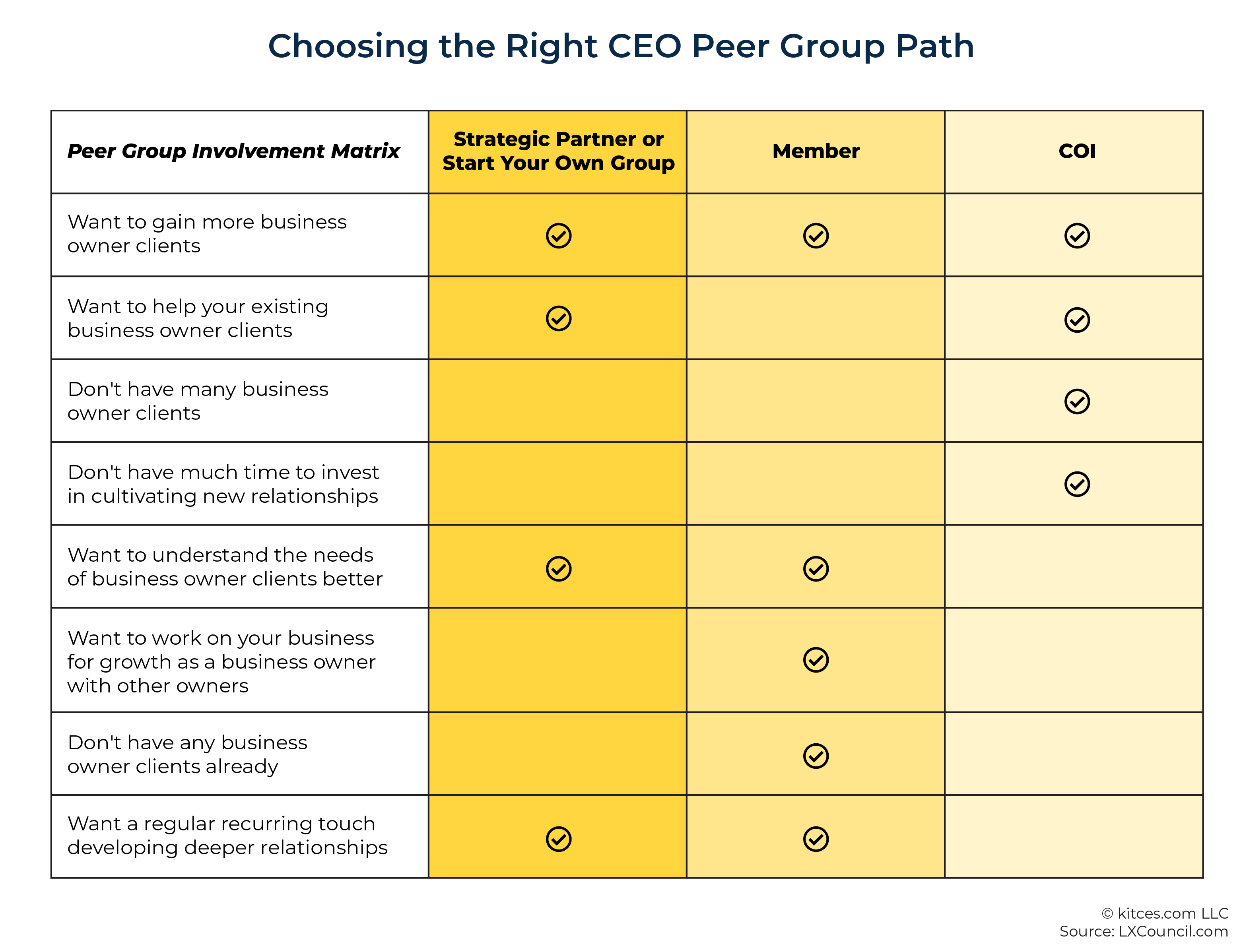

How do you choose the right path? If you want regular access to prospects and help your existing clients, then being an SP or even starting your own group, as first mentioned, would be the right choice. If you want to work on your business primarily with other business owners, then being a member would be the right choice. If you are challenged with time and are more of a connector and collaborator, then being a COI would be the right choice.

The graph below illustrates these options.

Assuming you don't want to start a peer group yourself, you may be asking yourself how to find the right one to be involved with. Locating a local CEO Peer Group can be done 4 ways:

- Search by typing in "business peer groups" in your city. Be sure to scroll past the sponsored ads.

- Ask your local chamber of commerce. They often are aware of local CEO Peer Groups.

- Ask any of your local networking groups. While CEO Peer Groups are not networking groups, local groups are familiar with all types of other local business groups and will likely know who in town is organizing them.

- Last, if you cannot find a local group, you can always explore virtual groups. Virtual groups are based on the same concept but meet virtually instead of in person. While local groups often bring together business owners from different industries to avoid competition and conflicts of interest, virtual groups offer the unique benefit of bringing together professionals from the same industry without those concerns. Since virtual groups draw members from different geographic regions, participants in the same field – whether construction, electrical, marine, or other sectors – can collaborate without the risk of overlapping client bases or competitive tensions. Many virtual groups may meet in person a few times a year for a retreat or elongated meeting. As an advisor, there are also advisor-only groups you can join. If this concept interests you but you don't know where to start, contact Mike Garrison at [email protected] or David Trent at [email protected]. They are executive business advisors and are both well-connected with advisor-only groups.

Once you find who to talk to, here are some key questions to explore about the peer group:

- Do they have the same client profile as you? Dig deep into their client profile to be sure it also matches your ideal client.

- Do they have an abundant mindset? You want someone who is always looking for the right people to collaborate with and who can be helpful to their members. If they're not interested in that, then they won't be a good fit.

- Do they have any other strategic relationships? You want to know who else they are connected to and to determine their level of openness to the concept of forming new relationships.

- Who else do they consider as part of their COI team? Finding out who else they work with may uncover common connections and reveal who they like to work with. This can help determine, at least on the surface, whether they might be a good fit.

- Are they natural connectors and collaborators? Natural connectors are open to understanding who you need to meet that you can benefit and can benefit you based on your goals. They look to connect professionals to help each other as a resource. Collaborators are genuinely interested in working with others versus working alone. They know that collaborating with others produces better results than working alone. It's the old saying “better together”. These 2 traits are important to vet, because you are looking for long-term relationships with peer group members. These will not be transactional relationships.

Once you have a conversation with the moderator of the group, you should be able to determine if there is a right fit between what you want to accomplish and the needs of the moderator of that peer group.

I've yet to meet a financial advisor (or advicer) who doesn't want more business owner clients. Even so, I continually hear these same advisors say, "I just can't get them to make time for me, or if they do, they don't seem to be able to make me a priority." The business owners you want as clients are now running businesses that are much bigger than they ever imagined. And with that comes problems they never imagined. Peer groups, therefore, become their refuge. Whether you start the group, join the group, or just sponsor the group, they will be more likely to thank you for it with their business!

Leave a Reply