Executive Summary

Welcome to the June 2018 issue of the Latest News in Financial Advisor #FinTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors and wealth management!

This month's edition kicks off with the buzz from the Envestnet Advisor Summit… that Envestnet is shifting from a focus on investment management, financial planning, and wealth management, towards a new category it calls “Financial Wellness”. Which is not meant to be the employer-delivered-financial-education version of a Financial Wellness program, but a more holistic advisor technology platform aiming to cover all of the relevant areas of a client’s financial health, including not only planning, investments, and insurance (protection), but also credit/debt, and budgeting/cash flow as well. Which leaves Envestnet incredibly well positioned for the ongoing shift of financial advisors from products to advice, and makes its 2015 acquisition of Yodlee look increasingly savvy as holistic financial wellness requires holistic account aggregation to power it!

From there, the latest highlights also include a number of interesting advisor technology announcements, including:

- Principal Financial acquires RobustWealth as yet another old-line insurer aims to get more digitally savvy

- Private equity firm Aquiline acquires a majority stake in RIAInABox as compliance software becomes an advisor tech category of its own

- LearnVest shuts down its financial planning offering but may still be a success for Northwestern Mutual as its financial planning and PFM technology is integrated into the Northwestern core

- AdvicePay announces the first ever “advisor crowdfunding” initiative, in an effort to raise $2M of new capital without taking on the conflicts of Venture Capital firms

Read the analysis about these announcements, and a discussion of more trends in advisor technology, in this month's column, including Vestwell partnering with payroll processor Namely to expand distribution of its small-business 401(k) offering, Vestmark launches a new Model Trading Service as the shift to centrally managed portfolios in RIAs and IBDs is leading to a new desire to outsource the implementation, and Fidelity showcases the prototype of a new “Cora” virtual reality assistant for clients as Schwab launches two new Digital Accelerator Hubs. In addition, we highlight the rise of another new category of advisor software: Student Loan Analysis and Modeling tools, as the shift to pursue Gen X and Gen Y clients leads to a demand for new types of software to service them.

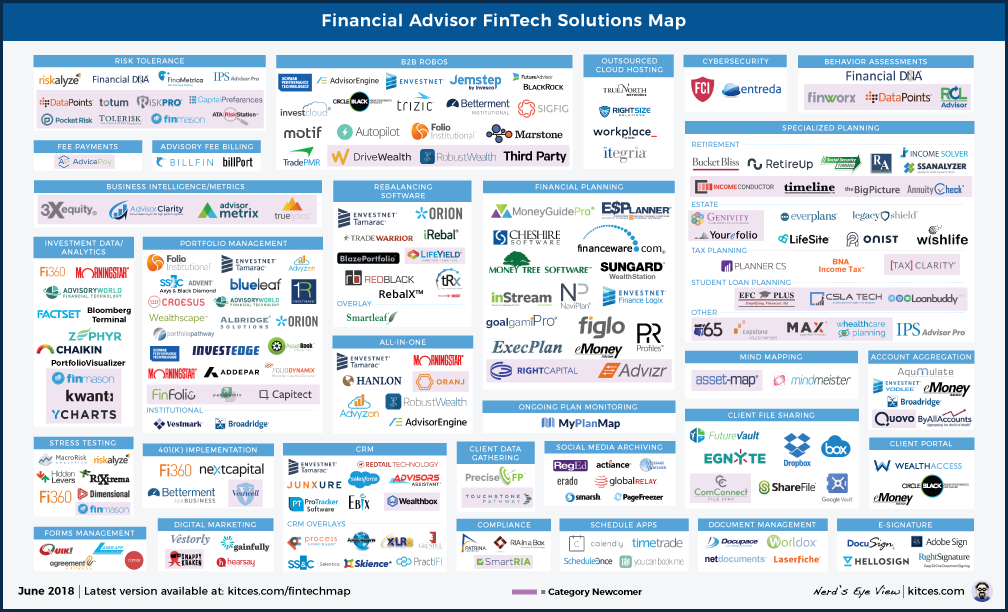

And be certain to read to the end, where we have provided an update to our popular new “Financial Advisor FinTech Solutions Map”, including a number of new companies and categories!

I hope you're continuing to find this new column on financial advisor technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Envestnet Begins Pivot To The Future Building Towards A Holistic “Financial Wellness” Platform. The big buzz from this year’s Envestnet Advisor Summit is the company’s shift in positioning from its core asset management and wealth management technology business to become a “financial wellness” company instead. Not in the context of how “financial wellness” is typically used today – to refer to non-advice-oriented financial education and literacy programs delivered via workplace channels – but as a more holistic approach to financial advice, covering five core areas: Planning, Budgeting, Investing, Credit/Debt, and Protection. By contrast, “traditional” financial planning and wealth management typically only covers three of those areas (“planning” for retirement, investing, and protection/insurance). In this context, Envestnet’s decision to acquire Yodlee becomes clearer and clearer – as its account aggregation tools for not just investment accounts but also various bank accounts, along with credit cards and other debts, are essential to powering the budgeting and credit/debt components of financial wellness. In other words, Envestnet is aiming to become a platform that truly covers everything relevant to a client’s financial life, beyond “just” the insurance and investment focus of today – a big (and smart) bet that advisors of the future will be increasingly holistic in their advice focus (where cash flow, budgeting, and credit/debt advice matter). At the same time, though, Envestnet is also expanding its core capabilities to increasingly position itself as the central all-in-one platform for advisors, as the company announced new digital onboarding (i.e., “robo”) capabilities for Tamarac, additional financial planning tools that will integrate more deeply and directly with Tamarac, and a coming new feature that will allow insurance to be purchased directly through its platform – which, if successful, could make Envestnet as successful as a technology-based insurance distribution intermediary to RIAs in the future as it has been for separate account managers in the past, providing the opportunity for a tremendous new leg of growth for the company as an insurance product marketplace while the insurance industry itself struggles to figure out how to reinvent its own distribution strategies for a fiduciary-advice-centric future. The bottom line, though, is that Envestnet is once again the company to watch, despite ongoing questions about its Yodlee acquisition, and appears to have the clearest vision yet of what’s relevant to both the truly-advice-oriented advisor of the future, and their clients, with a shrewd purchase of Yodlee to power a strategy of delivering relevant technology to enable real advice-oriented advisors (and make money by doing so).

Principal Financial Acquires RobustWealth Robo-Advisor-For-Advisors Platform In Play For RIA Channel. Continuing the theme of reconfiguring traditional insurance and annuity product distribution channels to reach RIAs through technology, this month Principal Financial Group announced that it was acquiring RobustWealth, one of the early “robo-advisor-for-advisors” companies that was founded in 2015 and launched as a “pure” advisor play (unlike competitors like AdvisorEngine, JemStep, SigFig, and FutureAdvisor, which were all B2C companies that were pivoted to advisors later). The software is expected to be used to better power Principal’s financial advisors across the country – akin to how Northwestern Mutual has leveraged its LearnVest acquisition internally – with an improved client portal and trading and rebalancing tools. However, RobustWealth is expected to still remain an open architecture platform that works directly with RIAs outside of Principal as well, and in reality it appears that Principal may be viewing RobustWealth as a distribution channel for its various insurance, annuity, and investment products (akin to how Blackrock envisioned leveraging FutureAdvisor, and Invesco aimed to leverage Jemstep). In other words, the traditional “old-line” insurer and 401(k) provider that has traditionally relied on its own commission-based salesforce to distribute its products appears to be hoping that RobustWealth’s technology will provide it a way to connect more directly to RIAs, in a world where the relative appeal of such products for RIAs is driven as much by the insurer’s ability to integrate with RIA systems as “just” the design of the product itself. Of course, the question remains as to whether traditionally-anti-commission RIAs will tolerate an “insurance-company-owned” robo platform, and whether they will ever actually buy Principal insurance and annuity products (or use Principal 401(k) solutions) through the platform. Nonetheless, the deal signifies a growing hunger for old-line insurance and annuity companies to both upgrade their technology through acquisition, and try to somehow make themselves more relevant to and connected to the rapidly-growing RIA channel.

RIAInABox Compliance Firm Acquired By Private Equity Firm Aquiline As #RegTech Heats Up. This month, private equity firm Aquiline acquired a majority stake in compliance consulting firm RIAInABox (for an undisclosed sum), in a stunning industry first of private equity investing into “compliance” services. However, the reality is that RIAInABox is not “just” a compliance consulting firm; since the original consulting business was purchased in 2011 by entrepreneurs GJ King and Will Bressman, the firm has developed its own compliance technology platform to help its RIAs manage their year-round compliance calendar to remain compliant with SEC and state RIA regulations on an ongoing basis, and now has more than 1,500 RIAs paying at least $225/month for its services. In fact, RIAInABox is now a three-peat winner of the “Best In Show” technology solution at the annual Orion Fuse Hackathon, with features including cross-checking the home addresses of client accounts against states the RIA is registered in (to avoid any gaps), and cross-referencing advisor trades against client trades to alert compliance to potential front-running, demonstrating how much room is still available for technology to ease especially the ongoing RIA compliance burden. In other words, RIAInABox had evolved over the past 6 years from compliance consulting into a bona fide #RegTech software-as-a-service platform (that includes some human compliance consulting as a part of its support services). And now Aquiline is aiming to scale up the solution further, with both capital and the guidance of former Schwab executive and Cetera president Barnaby Grist (who will serve as Executive Chairman of RIAInABox). Which speaks not only to the rising opportunities in compliance technology for advisors, but how eager private equity firms are to continue capitalizing on the rising trend of RIAs – both by investing in the firms themselves, and now increasingly the Advisor FinTech and service firms that support them, too.

Northwestern Mutual Shuts Down LearnVest Planning But Its Core Tech Platform Is Still Growing. One of the big news items this past month was the announcement from Northwestern Mutual that it would be “taking the next step in integration” with LearnVest… which would involve shutting down the LearnVest financial planning service (and associated LearnVest@Work offering). When the news broke, the industry began almost immediately into the post-mortem autopsy analysis of how Northwestern Mutual could spend nearly $250M barely 3 years ago on LearnVest, only to shut the service down now. Yet the key bit of overlooked information that accompanied the news was that Northwestern Mutual has actually tripled the LearnVest staff in New York, from 150 at acquisition to more than 450 today. Which means the reality is that the LearnVest technology from the acquisition, including its financial planning software and PFM portal, are actually alive and well – and being ever-more-deeply-integrated to the Northwestern Mutual core – even as the LearnVest planning business is shutting down. In fact, it appears that the opportunity to integrate LearnVest technology as a tool to make Northwestern’s existing 6,000+ financial advisors more productive and successful may have been the focus all along, as arguably the LearnVest software has far more ROI potential to leverage Northwestern’s existing $30B+ revenue business, than LearnVest’s own <$2M/year revenue business line providing financial planning services. In other words, the Northwestern Mutual acquisition of LearnVest wasn’t the acquisition of a financial planning service business with its own technology platform, but the acquisition of an advisor technology platform with an unnecessary (and now defunct) side business providing planning services. Which suggests that Northwestern Mutual’s acquisition may still be a resounding success for the company, even as the LearnVest planning business is shut down. Especially when you consider that the LearnVest deal brought Northwestern Mutual 1.5 million prospects (i.e., former LearnVest users) as well!

AdvicePay Eschews VC Funds In First-Ever Advisor Crowdfunding Capital Raise. When it comes to financial advisor technology, a disproportionate number of solutions are “homegrown”, where a financial advisor made software to solve a problem in their own business, then offered it as a solution to peers, and eventually scaled it up to a separate software company… from CRMs like Redtail, Junxure, and ProTracker, to rebalancing software solutions iRebal, TradeWarrior, tRx, and RedBlack, risk tolerance software like Tolerisk and RiskPro, financial planning software like eMoney Advisor, and portfolio performance reporting solutions like Orion, Tamarac, and Capitect. Yet despite a litany of successful companies in financial advisor technology, new investment dollars into advisor tech has remained sluggish, in a world where building a $10M, $20M, or even a $50M advisor technology business is still “too small” for even relatively small Venture Capital firms to want to invest, as even FinTech-oriented VC firms continue to focus primarily on the much-larger direct-to-consumer startups that may have a far greater risk of failure but nonetheless at least have a “chance” to become a billion dollar unicorn. Accordingly, the advisor founders of AdvicePay – a payment processing solution to help fee-for-service advisors bill financial planning fees directly to a client’s credit card or bank account – announced the first-ever “advisor crowdfunding” effort to raise $2M of capital directly from the financial advisor community. Raising the question of whether “created by advisors, for advisors, and funded by advisors” will become the new path for advisor technology startups that are seeking investor capital?

Vestwell Partners With Payroll Provider Namely To Facilitate Small Business 401(k) Adoption With Advisors. One of the biggest challenges in the world of employer retirement plans is that a huge portion of workers are employed by very small businesses, many of which find it too confusing or time-consuming to open a 401(k) plan… with the end result than a mere 5.6% of businesses with fewer than 10 employees have a plan in place. And unfortunately, the economics of small business 401(k) plans are so weak that it’s even a challenge for advisors to be sufficiently compensated for the administrative time and hassles it takes to set one up. In this context, it’s notable that “401(k)-robo-for-advisors” platform Vestwell has announced a partnership with Namely, an “all-in-one” payroll and HR benefits provider, that will integrate Vestwell directly into its payroll system, to make it easier for advisors working with small businesses on Namely to quickly and easily establish a plan. The appeal for Namely is the ability to easily offer 401(k) services to its small business clients, Vestwell opens up a new and unique distribution channel to reach small businesses (as Namely already spends dollars marketing to them in a world where few other businesses do), and advisors get the opportunity for easier (and therefore more profitable) setup of a 401(k) plan. Of course, the caveat is that advisors may not know if a business is using Namely until they’ve already invested the time to reach the small business owner, may not want to effectively become wholesalers for Namely, and it’s not clear whether/how Vestwell will “introduce” an advisor if Namely generates the small business lead directly. Nonetheless, as 401(k) providers seek out new distribution channels – and Financial Engines itself announced a similar, albeit much larger, deal with ADP’s payroll services earlier this year, while Fidelity already integrates its payroll and 401(k) services – the fact remains that as 401(k) services themselves get more and more automated with technology, the growing focus now is not on how to serve small business 401(k) plans profitably, but simply how best to reach them in the first place!

Vestmark Launches Model Trading Service To Capture Rising Trend Of Portfolio Outsourcing By Advisors (And Their Firms). As financial advisors increasingly shift from a focus on product sales to actually getting paid for financial advice, not only is there a shift away from commissions towards fees, and from broker-dealers to RIAs, but there is also a shift in how the firm directs its resources to deliver value to clients. As a result, while historically many financial advisors prided themselves on their ability to select superior investment managers for clients, or developed an internal investment team for the firm to do it themselves, now increasingly advisory firms are outsourcing their investment management altogether… including its implementation. Of course, this was always feasible with mutual funds – which in the end, is outsourcing investment management to a fund manager who is also responsible for implementation – the costs of the mutual fund distribution system, including layers of 12b-1 and sub-TA fees, have opened the door to separately managed account providers that can offer a similar solution to clients directly, but at a lower cost (and with the added benefit of owning investments more granularly, to allow for better tax loss harvesting). Which has spurred first the rise of TAMPs as a total outsourcing solution, then the rise of Model Marketplaces where advisory firms could retain control of trading but outsource the creation of the models themselves, and now the desire of larger firms to create their own proprietary models but outsource the implementation of those models to a third party. In this context, it’s notable that, following on the heels of Orion Advisor Services purchasing FTJ Fundchoice last month to provide outsourced trading and implementation, now Vestmark has announced the launch of a new Model Trading Service as well, which will allow “home office” investment solutions (the centrally managed models that are increasingly popular from both RIAs and IBDs) to be implemented directly by Vestmark, eliminating the need for the firms to even be responsible for their own trading and rebalancing… while allowing them to retain hold of the arguably-more-lucrative “management” fees for designing the models their advisors will use in the first place (even as they’re implemented by an outsourced Model Trading Service provider).

Morningstar Launches Home Office Version Of Direct As Centralized Investment Management Trend Accelerates. Historically, Morningstar software was used by one advisor at a time to track the performance of their mutual funds (or stocks) of choice, and identify new potential investment opportunities for clients. The role of home office staff was simply a compliance function of overseeing investment recommendations, to ensure they were suitable for clients. Yet as large firms, from RIAs to independent broker-dealers, increasingly shift towards centralizing their investment management with a series of standard “in-house” model portfolios, Morningstar’s tools themselves are becoming less relevant and necessary for the end advisor, as now it’s the advisor’s responsibility to determine the suitability of the centrally managed portfolios for clients, and it’s the home-office staff that relies on investment research tools to construct those portfolios in the first place. Accordingly, Morningstar announced this month the rollout of a new “Morningstar Direct for Wealth Management” solution, that aims to provide a single unified solution for all the relevant home office staff that might be involved with the investment management process (from manager research and due diligence to risk management and compliance), and the ability to push one-to-many notifications out to the home office team (and down to advisors). Thus, for instance, the firm can analyze its entire advisor and client base to score portfolios on ESG factors, or run scenario stress tests on the firm’s portfolios, or easily gather and communicate relevant information down the line to all the advisors when an investment changes (or has relevant “news”). In fact, Morningstar indicates that as advisory firm business models become more refined, they are aiming to create more discrete versions of Morningstar Direct based on particular advisor business models and use cases (streamlining the experience for targeted users over trying to be an “all-in-one-for-everyone” solution).

Fidelity Labs Showcases “Cora” Virtual Reality Assistant As… The Future Of Client Service? Last year, Amazon announced “Sumerian”, a platform and toolbox designed to make it easy to build virtual reality experiences. And now Fidelity Labs, the innovation and research division within Fidelity, has built a prototype of a new virtual customer service host called “Cora” on the Sumerian platform. The idea of the service is that a client might be able to interact directly with Fidelity by “seeing” Cora and interacting with her directly through Virtual Reality goggles (and delivering voice-activated commands, as it’s not very feasible to type on a keyboard wearing VR goggles!), from requesting to view stock charts (e.g., “show me the latest chart on AMZN”) to do investment research, provide financial education, working collaboratively with a Fidelity customer service representative, or even interacting directly with a financial advisor and a recommended plan (e.g., to actually see and visualize the impact of various savings or investment strategies, or to serve as a coach to the client in between advisor-client meetings). Fidelity also sees applications for Cora to do employee training for advisors and customer service representatives themselves, and reports that one internal experiment to train client support staff in empathy training is already showing increased customer satisfaction scores. Thus far, Cora is only a prototype and not being put into full release yet, but provides a fascinating perspective on the ways that virtual (or at least augmented) reality may change the nature of how advisors and clients interact in the future!

Schwab Launches Digital Accelerator Hubs To Improve Digital Client Experiences. Nearly 20 years ago, Harvard Business Professor Clayton Christensen wrote “The Innovator’s Dilemma”, which formally introduced the concept of “disruptive innovation” and showed how large incumbent firms can “do everything right” and yet still be challenged by upstart competitors, who innovate a new solution with a niche underserved market that isn’t relevant to the incumbent, yet allows them to gain market share and move upmarket until suddenly the incumbent is threatened after all. In response, large firms realized even more the importance of spending on “Research and Development”, and creating their own “Innovation” labs to foster more creative innovation within their own large firms. In fact, Fidelity Labs was created just a year after Christensen’s book was first released, and recent years have seen additional launches of “Accelerator” and “Innovation” programs for FinTech in particular, like Wells Fargo’s Startup Accelerator, Barclay’s Accelerator, UBS FinTech Accelerator, and BMO Harris’s Innovation Program. And now, Charles Schwab has announced the opening of two of its own “Digital Accelerator” hubs (in its hometown of San Francisco, and also in Austin), not necessarily to attract outside FinTech startups, but simply with a stated focus of trying to more quickly iterate and improve on its own digital client experiences (both for its retail and advisor businesses), citing the success of its recent Schwab Intelligent Portfolios initiative (now over $30B in AUM) as an marker of the opportunity in delivering a better digital experience for the client. Of course, the challenge remains that not all innovation labs necessarily innovate successfully… but given Schwab’s history of disruption in the industry, from leveraging technology to fuel the original discount brokerage movement, to the shift to online brokerage in the 1990s, it’s worth watching to see what Schwab’s Digital Accelerator hubs come up with in the coming years!

Schwab Launches Digital Accelerator Hubs To Improve Digital Client Experiences. Nearly 20 years ago, Harvard Business Professor Clayton Christensen wrote “The Innovator’s Dilemma”, which formally introduced the concept of “disruptive innovation” and showed how large incumbent firms can “do everything right” and yet still be challenged by upstart competitors, who innovate a new solution with a niche underserved market that isn’t relevant to the incumbent, yet allows them to gain market share and move upmarket until suddenly the incumbent is threatened after all. In response, large firms realized even more the importance of spending on “Research and Development”, and creating their own “Innovation” labs to foster more creative innovation within their own large firms. In fact, Fidelity Labs was created just a year after Christensen’s book was first released, and recent years have seen additional launches of “Accelerator” and “Innovation” programs for FinTech in particular, like Wells Fargo’s Startup Accelerator, Barclay’s Accelerator, UBS FinTech Accelerator, and BMO Harris’s Innovation Program. And now, Charles Schwab has announced the opening of two of its own “Digital Accelerator” hubs (in its hometown of San Francisco, and also in Austin), not necessarily to attract outside FinTech startups, but simply with a stated focus of trying to more quickly iterate and improve on its own digital client experiences (both for its retail and advisor businesses), citing the success of its recent Schwab Intelligent Portfolios initiative (now over $30B in AUM) as an marker of the opportunity in delivering a better digital experience for the client. Of course, the challenge remains that not all innovation labs necessarily innovate successfully… but given Schwab’s history of disruption in the industry, from leveraging technology to fuel the original discount brokerage movement, to the shift to online brokerage in the 1990s, it’s worth watching to see what Schwab’s Digital Accelerator hubs come up with in the coming years!

New Product Watch: Student Loan Repayment Analysis Tools. In recent years, there has been a growing obsession in the advisory industry to seek out younger clients; in some cases, it’s because advisory firms see their client assets attritioning down as retirees take withdrawals and older clients pass away, while in other cases it’s because the RIA custodians and broker-dealers are themselves concerned about their clients-via-advisors demographics. Yet the challenge is that getting Gen X and Gen Y clients is not as easy as just putting a “robo-advisor” on the advisor’s existing website to collect assets, because the reality is that contributing to investment accounts (for an advisor to manage) is often not the top advice need for younger clientele in the first place. Instead, the issues that matter to them are more commonly oriented around cash flow and budgeting challenges, including and especially how to manage the mountainous $1.5 trillion of student loan debt currently outstanding (most of which is held by Gen X and Gen Y). Except unfortunately, no financial planning software has student loan debt repayment tools! As a result, a growing number of startups are aiming to fill the void with specialized student loan analysis and repayment modeling tools, built specifically for financial advisors, including CSLA Tech, LoanBuddy, and EFC Plus. Of course, the frustration is that ultimately, a student loan repayment plan should be integrated with a total financial plan – which isn’t feasible with a standalone analysis tool. Still, given the total gap of student loan analytics within financial planning software itself, standalone solutions like CSLA Tech, LoanBuddy, and EFC Plus appear to be well positioned for success. At least until/unless they’re acquired and actually integrated into the financial planning software itself!?

In the meantime, we’ve updated the latest version of our Financial Advisor FinTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Is Envestnet right that the future of financial advice is “Financial Wellness” that includes cash flow/budgeting and credit/debt advice? What will happen to RobustWealth now that it’s owned by Principal? Was the LearnVest acquisition really a success for Northwestern Mutual? Is “advisor crowdfunding” a feasible way to raise capital for Advisor FinTech? And will Student Loan Analytics tools really become a viable advisor software category?

Disclosure: Michael Kitces is a co-founder of AdvicePay, which was mentioned in this article.

Leave a Reply