Executive Summary

Welcome back to the 96th episode of the Financial Advisor Success podcast!

Welcome back to the 96th episode of the Financial Advisor Success podcast!

This week's guest is Stephanie Bogan. Stephanie is a successful practice management consultant who built and sold her first consulting firm and now has gone on to found a new one called the Limitless Adviser Coaching Program.

What's unique about Stephanie, though, is that despite the fact that she doesn't need to build another practice management coaching business for advisors, she's doing so anyways as a means to have a greater positive impact on the advisor community, and in the process, teaching other advisors how to build their businesses to achieve their ideal outcomes as well.

In this episode, we talk in depth about what Stephanie calls the seven pillars or simply the 7P's of building and running a successful advisory firm. Starting with the key step of planning for what outcome you want to create for your firm, then figuring out how to position the firm to reach the right clientele, and then following through with the packaging, promotion, process, platforms, and people that are needed to implement the vision. Because the irony is that, while most financial advisors are independent entrepreneurs, very little practice management in the industry actually teaches the real methods to build and run a business.

However, we also talk about how in the end improving the methods in your advisory business really actually creates any real breakthroughs, as most of the time the ceilings we hit in our businesses are not actually just a function of how we're doing the business or whether we're doing it wrong, instead, most growth ceilings are actually a mindset problem. And once you make the decision to change your mindset, the status quo, and do something differently, it suddenly opens new doors to execute the business differently. And it's then walking through the newly opened doorways that can really create business breakthroughs.

And be certain to listen to the end, where Stephanie talks about how in the long run the key to success and satisfaction with your advisory business isn't really about the size of the firm or what you build at all, it's about figuring out what outcome will make you happy in the business and then crafting a pathway to achieve that vision. Because, just as we as advisors experience with our own clients, few people find satisfaction even with tremendous financial success until you can articulate the non-financial goals you're really trying to achieve in the first place.

What You’ll Learn In This Podcast Episode

- One of the major challenges that holds solo-advisors and lifestyle advisors back. [04:12]

- How advisors create complexity for themselves. [12:06]

- A fundamental question that advisors and entrepreneurs need to ask themselves. [26:26]

- The seven P’s of building and running a successful advisory firm. [29:55]

- What Stephanie says is the cornerstone of any successful business. [37:10]

- Advice for confidently setting and quoting fees. [44:57]

- Three things that prospective clients need to be before they’re ready to buy. [54:51]

- Why she recommends naming and branding your financial planning process. [1:07:40]

- Stephanie's advice on hiring. [1:14:21]

- The thing that holds a lot of advisors back. [1:26:59]

- How Stephanie's program is structured [1:34:12]

Resources Featured In This Episode:

- Stephanie Bogan

- Limitless Adviser

- #FASuccess Ep 93 with Sunit Bhalla

- #FASuccess Ep 7 with Matthew Jarvis

- #FASuccess Ep 88 with Nancy Bleeke

- #FASuccess Ep 24 with Stephanie Bogan

- eMyth Revisited by Michael Gerber

- SimplyParaplanner

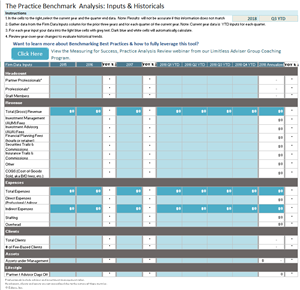

- Practice Benchmark Analysis Tool

- Educe Success Shifter

Full Transcript:

Michael: Welcome, Stephanie Bogan, to the Financial Advisor Success podcast.

Stephanie: Thank you, Michael. It's a pleasure to be with you again.

Michael: Yeah. I should really say, like, welcome back, because you are, I think officially, our first repeat guest. Not that I'm running out of, like, awesome people who have things to say in the industry. But I love a lot of the stuff that you are doing these days around advisor coaching and consulting, and you've been doing this new program - I know it's been getting a little bit of buzz lately -- called Limitless Advisor, around kind of formalizing what it takes to really run your advisory business as a business. I just love the framework of what you've been building. So I'm excited to have you on the podcast, just talking about, like, how do you really run an advisory business as a business?

Stephanie: Well, it's certainly a pleasure and a privilege to be back, and I think that's the big issue for a lot of advisors is, right, when you are an entrepreneur, so to speak, whether you're on your own or part of a much larger firm, when you start out, we sort of have this concept and vision of what it's going to be like. I'm going to do work that I really enjoy, I'm going to serve clients in a way that I think is better and that I feel good about, I'm going to earn a great income, I'm going to deliver massive value, I'm going to have the most amazing time and freedom, and then, as we talked about in the last podcast, sort of that, when you start to build that success, it creates what I call the stress of success.

One Of The Major Challenges That Holds Solo-Advisors And Lifestyle Advisors Back [04:12]

It doesn't matter whether you're a lifestyle advisor or an ensemble advisor, or even, right, a CEO, founder, partner, of a larger enterprise. At the end of the day, it's all about how you sort of scale the service you deliver in a business model, and I think that's one of the challenges and the things that hold solo advisors or lifestyle advisors back, is in the context of being a solo or a lifestyle, there's sort of this misconception that you don't still need to run the business in sort of an efficient and effective way. You know, I always believe that it should be enjoyable as well, and that that sort of rarified air safe for advisors who are building, you know, big advisors or billion dollar firms...and I assure you, right, yeah, those are the things we're doing with those firms in terms of the coaching and the consulting work, but the same practices and principles apply for the advisor that's starting out as the advisor that's scaling to that million dollar mark that wants that time and freedom that we always talk about, right? How do you build that million dollar practice and take off a lot of the time that you want, and build this really wildly successful business and life that you love, whether it's you or, right, you're running a billion-dollar firm on your way to $10 billion, the principles and sort of the pillars of what create a successful practice or business are largely the same.

Michael: Yeah. It just strikes me that, for this business where so many advisors are kind of independent practitioners, independent business owners, we like to talk a lot about financial advising as, like, a very entrepreneurial endeavor of building businesses...one of the growing frustrations I've had over the past couple of years, I guess just my own realization as I go through the process of growing and scaling some of the business that I'm involved with, is that there's basically nothing in the financial advisor world that actually literally teaches you how to run a business as a business. There's a lot about how to get more productive as an advisor: get an administrative assistant and delegate some of those operational tasks, and then get a paraplanner and, like, go...some of those planning prep activities that you don't really need to go, and maybe get an associate advisor so you can hand a few clients off and increase your personal capacity, but those are basically all about how do you leverage a more productive you as you.

Not literally, how do you build a business? Like, this thing that is creating value. You're not just trying to get evermore productive with your personal time and what you're doing in advising with clients. Just, there's such a gap to me in what are the things you're actually supposed to do to run a business as a business? Even just, how do you think about a business, the advisory business literally as a business?

Stephanie: Well, it's the big question, but it really requires a pretty strategic shift. Again, it's not about whether someone's on their own, or they're part, right, of a 30 person firm. It's the shift from the sort of the entrepreneurial state, right, the E-Myth state of producer practitioner, to your point, where it's really about leveraging your individual time, and moving to that next phase, again, irrespective of whether there's one other person or 100 other people...what you're really talking about at that next stage is sort of scaling beyond the individual producers practitioner to a professional business environment. Again, you can be one person and still have the, quote, "client service piece" be dedicated to you and dependent on you. But at the end of the day, the success that you meet with, the ability to deliver massive value to your clients and then create real value for your business and your life in exchange, has very little to do with your advisory skills and a lot to do with your business skills, right? Sales, marketing, operations, financial management, human resources, creating processes, right?

All the business stuff that there's so much talk about, and yet it seems to be the area where advisors struggle the most. So we've sort of built out a model over the 20 years, and as you point out sort of in the Limitless Model, that we've been able to sort of bring in these different pieces that really contribute to success and define them and distill them down to, here's how you run a business, and hers how you show up as the best leader in that business irrespective of, again, whether it's running, right, a small lifestyle practice, or you running a billion dollar firm that wants to grow to something bigger. It's really how you systematize and scale the deliver of what I think in our space are considered specialized services. I think there's this real misconception in people's minds that if you scale up, that you're somehow watering down. What we've found at a business level is it's the scaling and the efficiency and the effective models that actually allow you to deliver better service with a lot more ease and efficiency, and a lot more enjoyment, and actually get the results that you want from the ability to deliver service and value to your clients, but also to get it back for yourself and your business and your life in terms of income, time off, right, quality of life, enjoying the work that you do.

Michael: Yeah. You mentioned E-Myth, and truly, for any advisor that has not read "E-Myth Revisited", which is sort of the updated version of the original E-Myth, "E-Myth Revisited" by Michael Gerber, it was hands down the most transformative book that I read fairly early in my career, probably out of dumb luck. Just, someone recommended it and I read it, because I didn't have anything better to do that weekend.

Well, first of all, the essence of E-Myth is basically that most entrepreneurs aren't actually entrepreneurs. Like, they don't actually set out to build businesses. We have a thing that we do that we think should be done a certain way, that we start doing, and other people like enough that they pay us for it, and then all of a sudden we're making money at the thing that we do. So the classic story that gets told in E-Myth is, I think it was a woman named Sarah and, like, Sarah is a pie maker. You know, she makes pies for a hobby. She makes really delicious pieces. He friends convince her, you should open a pie shop because you make these wonderful pies. So she does. She opens a pie shop, and people start coming in and buying the pies, and now she's got a pie shop. So she's an entrepreneurial business owner.

Except Sarah really just enjoys making the pies, and as the business grows, she has to hire a cashier, and then two and then three in shifts, and then she has to hire a couple of supporting bakers to help her out and, like, someone to manage the finances of the business. All of a sudden, after a little bit of growth, you know, Sarah sued to just spend all of her time making pies because she really liked it and she was good at it, and people paid her, and now she spends, like, 80% of her time managing people and not actually making very many pies, and not having a very successful business anymore because she's not making the pies that she's good at making, and she's kind of miserable, because she turned her hobby into a job that's not actually doing much pie making anymore.

It's this trap that we tend to fall into in almost any business where you start out as what I think Gerber calls the technician. Like, the doer with some kind of expertise. Then you try to start growing a business around you, and then you end up drowning in your business because you didn't actually set out to build a business in the first place. You were just doing this thing you were good at. While you can build a business out of almost any of these, whether it's pie making or financial advising, you have to ultimately go through this shift from, you're not the pie maker or you're not necessarily the financial planner. Sarah is the owner of a pie-making business, and you are the owner of a financial planning business. One of the things you might do in your business for a while is do some financial planning for clients, but you start doing it differently when you say, "I'm not actually here to be a financial planner. I'm here to run a financial planning business that happens to do financial planning."

How Advisors Create Complexity For Themselves [12:06]

Stephanie: Yeah. At the end of the day, we're all pie makers. That show we all start, right? Everyone listening to his podcast either took a job in a firm or started a firm, and there's sort of an evolutionary process that we all go through, right, from that sort of solo entrepreneur, E-Myth model of the producer or the practitioner, to what we'll call professional firm, which might just be you, right, and one staff person, but you would still have the systems and the processes, sort of what we'll call the business method, that would make that, quote, "practice", run a lot more efficiently and effectively. Again, I think one of the misconceptions that advisors have, and really all entrepreneurs, is that as we start to meet with success, it creates that complexity. What most of the advisors that I work with want at some level is they have problems they want to solve or opportunities they want to capture, and for people that are starting out, it's about how to create that success without the structures and complexity.

But for people or advisors who are already there, it's about how do I simplify that success, and/or, how do I create a success without boundaries that can still be simple and satisfying and sustainable and scalable, and I think that's where we sort of impose on ourselves limitations on what we can or should do because of those misconceptions. But there are so many advisors out there. You know, the countless examples I've shared with you in the Limitless Advisor program, where even lifestyle practices can be hyper-efficient, super effective, incredibly enjoyable, and leverage all the, quote, "benefits" of running a business, but still maintain a really successful lifestyle practice. Another contingent in that group, they are true ensembles, right? They are multiple people, they have partners, they're going through succession. Another contingent, they're already over that seven-figure mark. What they want to do is simplify success, and in every single one of those examples, Michael, the common denominator is, whether you love it or like it, at the end of the day you do have a practice, which is a business, and how you show up for that as a CEO, as a leader and a manager, are entirely different than how you show up as the practitioner.

In that, we get off balance, and that's where things start to go sideways for people.

Michael: Yeah. We had just a few episodes ago, episode 93, we had an advisor named Sunit Bhalla on, who runs an incredibly lean focused practice. He is a solo advisor. He has 17 clients, but he does almost $300,000 of revenue because they're fairly affluent clients. Incredibly high profit margin, and you know, spends a huge amount of time volunteering at his community and at his kids' schools, because that's what's very important to him. So he runs what most people would classically call a very lean lifestyle practice, but he still has rigorous systems and processes, he's doing continuous process improvement with a whole lot of different technology that he works on integrating while doing, like, literal annual business planning as a very formal business with a practice that's still run very simple and lean, because he's still running it as a business, notwithstanding the fact he's a lifestyle practice sort of structurally.

Stephanie: Well, and I think it's a perfect example, no different, right, from Matthew Jarvis. He did, right, you did, I think it was number seven last year...

Michael: Yeah.

Stephanie: ...right, the advisor that I do the Limitless coaching with. I mean, he's wildly successful, seven-figure business, takes home 55%. He takes off...it just goes up every year, 80, 90, 100. It's up to 120 days, and this year he's actually working from a catamaran that he bought as he takes a year off and tours the Caribbean with his family.

Managing his practice and participating in Limitless coaching, and the reason he's able to do that as a lifestyle advisor is because the practice is still run like a business in terms of meeting what we would consider, right, sort of the seven pillars of a really successful, or what we would call a wildly successful practice and a life that you love. Irrespective of whether you're that, right, lone wolf lifestyle advisor on your own, or that billion firm, or that firms calling to $10 billion, the pillars, they don't change, because it's not about your size. It's not about your situation. It's not about the scope of your services. What it is all about is, are you building a machine, if you will, that allows you to do what you want to do, and to have the influence, the impact, and yes, the income that you want in doing it.

So what I spend a lot of my time now doing with industry influentials and larger firms is what we call scaling influence. So, right, the advisor that you mentioned, that scale is very limited because that's the scope that he's put around it. There's absolutely nothing wrong with that.

It's an extraordinary business model, whether…

Michael: He's happy, making fantastic money and gets all the time with his kids that he wants.

Stephanie: Yeah.

Michael: It's a glorious thing.

Stephanie: You know this. I have never been the consultant that said, you know, this is good. This way good, that way bad.

Michael: Right.

Stephanie: What I always say is, if anyone tells you that there's only one way, it means it's their way and you should run the other way. There are always options. There's always a different way to capitalize on that opportunity. What each of us have to decide for ourselves is, what does that wildly successful business look like for me? What does it look like for you, Michael, right? For that advisor, it was a much smaller scale, which meant that, to create the influence, impact and income that he wanted, he had to learn how to really specialize, how to saturate that space in really powerful way from a personal perspective, a practitioner perspective, but also from the perspective of running it like a professional business, which is how he gets those results. If he ran it like the average advisor, he'd never be able to get those results.

That's what I think you and I get really passionate about, is sort of sharing that knowledge and information, which is, if it's available to him, it's available to every single person listening to this podcast. There's no difference between the person starting out and the person running the $10 billion firm, except that they're showing up and applying the principles in a different way. When you figure out how to crack that code, that's when you can really accelerate your success, gain back your time and freedom and do what I love to do, which is to build a wildly successful business and a life that you love.

Michael: Yeah. It's a fascinating phenomenon to me, just to try to make that shift from, you know, I am a financial advisor to I am a financial advisor business owner who simply happens to currently have a role in the business where I deliver the financial advising. Like, I just happen to be the primary person delivering the process, and the value is not sort of literally me. It's the process of what I do in planning, how I do it, in a manner that in theory someday I could train someone else to do it. You may not decide to grow to the point where you're training others to do it, but you can still treat it as, I have a product or I have a process, and my value proposition isn't literally me. It's the process of the planning that I'm doing and how I do it.

When you start thinking about it that way, all of a sudden it opens the door to, well, what would it look like if you trained someone else to do the same process you do? Because now you're starting to actually build enterprise value as a business because it's not just reliant on you to do the advising. It's reliant on advisors that you hire to do the advising process that is uniquely you. That's the value. That's the vision that you set. That's the spark that you create in building an advisory business, is it's a process that you may just do naturally on your own, because it's just the way that you do things. But that's the real value part. When you start thinking about your value as not doing the advising, but doing your advising process, it starts to open interesting doors. Like, well, what would happen if I wrote that down, systematized it and trained someone else to do it?

Stephanie: Well, and I think one of the challenges there, and you and I talked about this in the last podcast and it's a very common conversation in our space, which is, at the end of the day, we create a lot of complexity for ourselves out of the confusion that we create due to sort of a lack of clarity. What I mean by that is, the first question that I ask anyone that reaches to to me is, what s the outcome that you want to create?

Not how, because we get really hung up on the how, and then we just stop, right, because our brains kicking and give us all of the reasons that it's hard or it's difficult, or it should wait, or, right, I don't know how to hire that person, or I don't want it to be that way. But when you're really clear on the outcome that you want to create, it puts you in a position of consciously creating it. The reason that I share that is sort of, right, tying into what you just said, is we do serve all of these different roles. You and I talk about this, right? Is about, in one capacity, whether you're on your own or you're running a big firm, you are the CEO / visionary. Even if you're an employee advisor in a firm, you still serve that role in terms of the vision that you have for your clients in the practice. You know, sort of the book of clients that you serve.

But anyone who has started a firm certainly fills that role, and we tend to fill that with pretty big enthusiasm in the beginning because, right, that's where the energy and the vision and the enthusiasm are, but over the course of those years and, right, building on success over time, those other roles kick in, right? Then now only are we the practitioner, now we're the managers, we're hiring people and we've got to lead, we've got to create a culture for clients, right? We've got to integrate all of the knowledge that we read on blogs and podcasts and magazines and conferences, and we've got to figure out the way to do this. So often times advisors get really lost in that process. It's not intentional. It's not even a lack of intellectual ability. It really does come from what I call the background noise, is we just get so busy working in the business that it's really hard to get time to work on it.

That's separate and apart from really getting strategic and asking my selves, what is the outcome I really want to create? Because when you ask that question with utter simplicity, and you answer it with real honesty, there are no halves. Right? Somebody decides they want to be, right, an ensemble and they want to build something that has millions of dollars in value, and yet every study we read says that there are solo advisors who are, right, taking home the same amount or more than them with a lot less complexity in their lives. So what is the outcome we're really trying to accomplish? Is it size and scale for the sake of that, or is it, hey, here's the outcome I want for my business, for my income, for the clients that I serve, for the time off that I get, for the quality of life, for my own happiness quotient. When we define that and then apply the business principles and practices that do all those things we talk about, building a hyper-efficient, highly effective, really enjoyable practice, then that's when the magic happens, and that's what I get really excited about.

Michael: Yeah. There is a tendency, I find, that we have...we've all sat across from clients where, you know, like, they're saying, "I want to grow my portfolio. I'm trying to make more, you know? I need higher returns," and at some point you say, like, "Well, hey, just curious. Well, why? What goal are we working towards here exactly that's driving this, you know, more and more and more on portfolio of returns or more money? It usually opens up a pretty interesting conversation about what's really the motivator and what's driving it, and usually if you keep asking, you know, why, why, why over and over again, after the first two or three follow-ups, like, why do you want that, why do you want that...eventually it moves past the money, and it moves to something else.

It's about more time with family, or about security, or about status or about ego, or, like, it's almost never about the money. It's about something else, and the money kind of becomes a symbol or a measurement, or a surrogate for it. I find the same thing, like, we do the same things to ourselves as advisors with our business, that we get, I think, stuck in the same sort of more mentality. Like, I just need a little more venue, a little more growth, a little more assets in our management, a few more clients. Like, if I could just get a few more all this stuff with get easier or better. My income will get better or my time will get better. Like, something will improve, and it usually never does, so then we just keep shooting for a little bit more and a little bit more, instead of taking a step back to really ask, like, as you put it, like, what outcome are you actually trying to create in the first place?

I mean, I've seen firms, like, I just want to get a little more time. So we just keep growing a little bigger and hiring more staff so I can get more time, and they don't get more time. They just have to spend...

Stephanie: Right.

Michael: ...the extra time they freed up managing all the staff they just hired, because the way to actually have gotten the more time would have been to systematize and have fewer clients, not keep adding clients and adding more staff. But they got stuck in the more, more, more, instead of the what outcome are you actually trying to create. The same thing, as you said, with even just getting the more income. You know, the truth is, high profitability solos still, when you look at the benchmarking sites say, like, the best high profitability solos are taking home about the same income as half billion, a billion dollar firm owners. At least multiform owners, because usually you have to split the profits across a couple of owners at that size.

So, like, you can spend 10 or 20 years growing bigger and not take home any more money than you would have as a highly profitable solo. Not to say it's bad to grow. Some advisor really want to grow, they want to grow reach, impact, help more clients, create more opportunities for their team. They actually take pride or have personal financial goals that require building a sizable enterprise. So I don't want tosecond-guesss the people that so do grow, because they really have a vision of doing that. But rarely, as you said, do we start with the outcome of what we're trying to create, and then figure out how to work towards it. It almost always ends up being, if I can just get a few more clients and a little more assets in our management, I can finally get over this hump.

Then you get over the hump, like, you get over the mountain, and you just see there's another, bigger mountain on the other side of the thing.

A Fundamental Question That Advisors And Entrepreneurs Need To Ask Themselves [26:26]

Stephanie: Well, and it's really common. We talked about it, like, again in that last podcast, and it's that idea that half the phone calls I get are not from people that are struggling for that next-next level, they're people who are there who just want to simplify their success, or turn that success into something that's more fulfilling in terms of impact and reach and influence. But you highlighted what I think is sort of a fundamental question that every advisor, really every entrepreneur, needs to ask themselves, which is - and answer it honestly - which is, am I an advisor that happens to be running a business, or am I a business person that happens to be an advisor, because those firms that you mentioned, right, where they're at a million and they get to $5 million in revenue and $10, and they're growing, and they're opening offices...those advisors almost always just tend to love building businesses, and being an advisor is sort of the profession that they happened upon or choose...

Michael: Right.

Stephanie: ...to move into. There's a whole other swathe of advisors that truly just love being advisors in a professional capacity that just sort of have to deal with the business of running a business, because they made the choice to own their own firm largely because they wanted to do it, in most cases, right, a better way and in a way that they felt good about. So the reward for that level of responsibility is, I now have a huge job that I don't really love, or maybe I'm not even really great at, and yet it is utterly and absolutely fundamental to my ability to do what I do really well, and in a way that adds value to the clients and back to me personally and professionally, which is a relationship exchange that I think truly should exist, and far too often doesn't.

I think if we can answer that fundamental question, and then approach the business, again, whether it's 1 person or 100, from the perspective of, right, what are the things I actually need to do to run an effective business? Then it helps you figure out how deep you go. If you're an advisor running a business, right, then you figure out what is the outcome that you want to create, and then we'll go through the model of, right, what are the areas that we need to focus on? Then you apply and you execute. We'll talk about, right, what I think are the major hindrances and stumbling blocks to execution, which is never just the business knowledge, right? It's sort of how we approach it.

If you're a business person who happens to be an advisor, you can and should approach that process fundamentally differently, both in terms of the outcome you want to create and - and this fundamentally really important - the steps that you take to consciously create it are different depending on which side of that equation we are on. The problem is, I find, we lose the sense of why along the way, and then what happens is on a day to day basis, the what-ifs become bigger than the why, and we lost in the background noise. Then, as you point out, we're just spinning our wheels struggling to make incremental process, wondering, my gosh, why is the success thing so hard? It was supposed to be a lot easier than this.

Michael: So I think this is a good point to kind of delve into this a little bit more. Like, we've talked a few times about sort of the hows of just, you know, what do you actually do to start running...like, what are the things I need to do to run an effective business? So can you talk about that a little? Like, I know you have a whole framework around this of, like, what are the things we need to do to run an effective business? Like, what's the stuff we need to be focusing on if we're trying to think about it as a business?

The Seven P’s Of Building And Running A Successful Advisory Firm [29:55]

Stephanie: Well, so as you know, right, sort of the Limitless Model is sort of based on a very simple construct, which is, I think there are four fundamental areas to help anyone build a wildly successful business and a life that they love, and they are mapping, mindset, methods and momentum. Then what you and I are talking about in this specific context is really what we'll call the business methods. So really what I've done is sort of taken, right, the last 20 plus years of experience working in the trenches with advisors to build top-tier firms, and then sort of applied all of the knowledge of learning in those other three areas that I mentioned, put all of them together, and really come up with what we call the seven pillars of a limitless practice, right?

Again, whether you're one person working on your own or, right, you're a $10 billion firm with 100 people running around. The first is planning and progress, and that is pretty much self-explanatory. But the idea is, right, what is the outcome you want to create personally and professionally? How do you evaluate the business in a 360 degree process, what performance management and benchmarking tools that you're doing to manage and monitor that to the absolute maximum and optimal output that you can create, what is your approach to leadership in a firm, right, leadership and management, how are you creating a culture and progress in the organization, and, right, how are you doing management structures and team communication and check-ins and sort of, right, all the planning and progress infrastructure at a business level that you need to ensure that you know where you are, you know where you're going and you have a really effective process for monitoring the path that you take and making sure that you're getting there at the pace that you want, or you can pivot and make changes as you need to.

Michael: So this classically, like, your strategic planning process of, like, this is why you've gotta sit down and have your business plan..? Like, you have to figure out literally where you're trying to steer this ship? You know, the strategic plan is less about the how and more about the, what outcome exactly are you actually trying to build towards, and then just map how we're getting from here to there, but you've gotta know where you're pointing?

Stephanie: Yeah. This is actually a layer that comes even before, or truly on top of the business plan, which is, this is the layer that exists at a business level irrespective of what the strategic goals are. It starts strategically, right?What are the vision, values, goals of the organization? But then it should layer through every element of the organization, right? How does that planning and progress piece elevate the business from the CEO / visionary perspective? In that context, the way that it has to be done is, right, there has to be a transfer, a creation and a management and a transfer of culture, and then there's training and mentoring, right? At a leadership level, those are the things that happen.

At a management level, there's planning and progress from an HR perspective, from a financial management perspective, right, from an operational improvements perspective, right, staying on top of compliance, and then at an individual level, right, how do teams and individuals manage performance and productivity, again, right, at a business model level to the maximum outcome? So that is a model that you can take and apply to any business, whether the goal was to, right, go from 0 to $100,000 in revenue, or from $100 million in revenue to a billion. The construct for planning and progress is, it's a piece of starting and running and growing a business that can be done thoughtfully and intentionally, and when you do it, it will improve your results.

It just tends to be the part that we often skip, or we do in haste. Like, oh, I think we'll double next year, and then we just, right, get...I call it the cowboy model. Which is, we sort of jump on our horse with our six-shooter and we ride off into the sunset and we're just, right, we're going to work hard and make it happen.

Michael: Yes. I'm definitely guilty of that form of planning a few times over the years. Like, I know where we're going. Let's just...you know, we'll--

Stephanie: Let's do it. That's right.

Michael: We'll figure it out as we get there.

Stephanie: Yes. Let's ride, as we like to say.

Michael: Let's ride. We'll figure it out on the trail.

Stephanie: Exactly.

Michael: So, like, for firms that are large and have lots of employees, I mean, I get...like, we're trying to figure out how to set a good culture of accountability and develop our people and such. But when you're doing this down to, you know, most of us are still solo advisors, very small partnerships, maybe a handful of staff at the most. Like, for most of us that are on our own, what does this planning and progress piece look like? Like, what am I doing?

Stephanie: It's the same exact process. It just doesn't have as much, as many components and as much complexity, right? So even if you're one advisor on your own or it's you and one staff person, the process model from a business perspective is largely the same, which is, one, right, what is it that you're trying to accomplish, right? So I'm trying to progress from point A to point B. How am I going to monitor that progress? So, right, we use a series of meetings, strategic meetings, and then quarterly reviews and benchmarking tools, which is, okay, what do I as a business owner / advisor need to look at in terms of, right, how do I create the outcome I want to create, what do I need to look at every year, every quarter, every month, every week.

Michael: Right. It's like if my goal really is to double in three years then, like, okay, how much do we have to grow by the end of this year to be on track? How much do we have to grow by the end of this quarter to be on track? What kind of activity do I need to see every week to be on track, and then let's track that thing every week and we'll just see how we're doing on an ongoing basis.

Stephanie: Right, and you hit on really the key word. It really, Michael, it mirrors exactly what advisors do for their clients. Which is, your goal is to progress from your current state to the future state, from here to there. Here are the variables in that equation. Here are the outcomes that, right, here's how we need to influence those available to get to a certain outcome, where it's an investment return, right, or new assets in a given quarter. Then it's about creating accountability, which means that you've gotta have that clearly defined, laid out and know what that path to progress is.

When you've got that, whether you're a one-person shop, right, or a much larger, then what you've got is clarity about the path. One of my favorite sayings, and I don't think it can be underscored in terms of real truthfulness, is when your vision is clear, your decisions are easy.

For most advisors, there's just a lack of clarity around the outcome that they truly want, either because they've gotten busy and they haven't thought about in a long time, or they haven't given themselves the luxury of doing that, or b, there's just enough complexity in their day to day lives now, right, that the business is running them instead of them running it, and they don't have the time to really stop, pause and reflect on all of those things that we just talked about. When you do that, it makes the process a lot more efficient and effective. It's just that we don't ever feel like we ever have time for it, and then to your point, we don't know how. What does planning and progress management mean?

What Stephanie Says Is The Cornerstone Of Any Successful Business [37:10]

To your point, very few people run around teaching the particulars of that, which is why we think it's so important, because it's a cornerstone of any successful business. It's just not a skillset that most advisors have developed, and we don't believe it has to be that way. We've seen that shift take place many times very successful, and we've seen the results that happen when it does.

Michael: I think there's a powerful statement there, just to say, when your vision is clear, your decisions are easy. So for anyone out there who still feels like they're just struggling with some business decisions about what to do, is the problem the decision or is the problem that you're not actually getting clear on what you're trying to build towards in the first place?

Stephanie: Yeah, and it doesn't mean that execution won't be hard, right, if you're letting a key person go or if you're making a decision to hire that first person, you're making a capital investment, right? There's fear and there's risk and there's uncertainty, but when the vision is clear, the decision is easy. It's about how we get ourselves to the place where we can make those decisions thoughtfully and intentionally, and in ways that really serve and support our success. So that's why I think the planning and progress piece is really so important.

Then from there, right - so that's an overlay - and then from there, all businesses start and all planning processes should start with what we call positions, right? Think of that as another way of saying sort of the business plan or the blueprint, which is, what are the services that you're offering? Who are the clients or the client segments that you're servicing? What are the standards of practice, right, account sizes, fees, minimums, right, sort of the blueprint for how is this business going to be constructed, and sort of that creates the framework that says, okay, here are the guardrails. Within these guardrails, you need to create the vision and the outcome that we laid out, and that makes it a lot easier and it make sit a lot more effective in terms of time, energy and effort to figure out where to apply yourself so that you can actually realize the vision that you're creating.

Michael: Right. So I might go and say, okay, I've got an income goal. I want to get to (whatever it is) $250,000 of income. So I'm going to need about 300,000 of revenue and, you know, I don't really want to serve more than 100 clients. I've gotta make sure I'm getting $3000 of revenue from each client, and then in order to get there, that means I, you know, really can't have minimums much lower than about $250,000 or I'm not going to be able to get the revenue or client that I need. You can kind of start working backwards from there and get a pretty darn good clear perspective on who realistically are you trying to work towards, who are you trying to reach, what are those client, what are their minimums, what fee structure do you need to get so that you can hit the planning target you just set in the prior step?

Stephanie: Yeah, and it's absolutely true. In fact, I think the thing that's so surprising to most advisors when we did this in the last year, or actually earlier this year at the beginning of the year as part of the Limitless coaching, in an hour and a half session, we literally went through this and have everyone go from, right, the status quo to what is the outcome they truly wanted to create, identify all of the gaps, and then literally in the span of an hour, identify every place there was a gap and clarify what that compromise is, and is that a compromise that they're going to make going forward?

Michael: What do you mean by a gap here?

Stephanie: So most advisors aren't brand new, right? So you've been in practice 2, 3, 4, 5, 5, 8, 10, 12 years and you have a goal, right? I can't tell you how many times I've asked advisors, right, what's your target client profile or what's your account minimum or your minimum fee, and there's always an answer. It's in the ADV, right? It's in the materials. But if you were to do a client analysis, which we do all the time, and you were to parallel or actually plot where clients are in terms of meeting those position standards relative to where they are, you'd notice a lot of gaps. So one of my favorite examples is, I worked with a firm probably 10 or 12 years ago. It was about an $800,000 practice. We went through this exercise and identified what the, right, the optimal fee schedule was, very quickly figured out that that's not what we were generating in terms of revenue...

Michael: I like that. I really want to have a half million dollar minimum. Great. How many of your clients meet a half million dollars? Oh, like...

Stephanie: Right.

Michael: ...half.

Stephanie: Look, on the back of a cocktail napkin in three minutes I can tell you whether you're adhering to the standards that you've laid out or not. It's a very easy thing to measure. What really matters is, what are the compromises that everyone listening to this podcast has made that's compromised that success that we're not even aware of, or for those of you that are newer and starting out, there are so many compromises that it's so common to make that will compromise that success that are in no way required or necessary. It's just literally a force of habit, and in the example I was sharing this advisor said, "Oh, I've made a few exceptions to my fees over the year," which, as a consultant, is code for, "take a deeper look."

So, of course, we did. We had, right, this very nice spreadsheet, calculated what every client should be paying based on their account value and the fee schedule, and then of course what they were actually paying and calculated the difference, and Michael, in an $800,000 practice, it was $80,000 a year.

Michael: Basically, just fee discounts, you know, I'm supposed to charge this, but I gave them a little break because such and such a situation..?

Stephanie: Yes. Forfeited the revenue, as I like to call it. We just forfeited. $80,000. You go, now--

Michael: It didn't feel like a forfeit at the time. We were trying to close the client.

Stephanie: No, it felt like "yes" was the only right answer. But so often the perspective that we're answering the questions from is so limited that we lose sight of the real business case. There's no business case unless you are truly just starting out and you've got to put milk in the baby's bottle. If you have $200,000, $300,000 in revenue and you can pay your rent and you can pay your mortgage and there's food on your table, there's no really good business case for making those compromises unless you have, in an informed and intentional way, said, "I know that I set standards, but I've gone ahead and compromised them because I think doing so will get me there faster and better," in which case you should have just changed the standard. Right?

If you think that's the better way, we should do it that way. So when we lay it out in that positioning exercise, it becomes really obvious to advisors what the gap is between where they are and where they want to be, and how they're going to need to bridge that gap, and literally this...right, this is not like a giant, firm exercise. In the span of an hour you can go through and have complete and crystal clarity about what your business model needs to look like to get you to the outcome you want, right? With five basic points with math, we can recalculate a firm in a very short order. Then it becomes the function of plotting the balance of your methods, packaging and presentation, platforms, people, process and promotion against those gaps and how you fill them.

That makes it actually, for any advisor, relatively easy to say, "Oh, when I break it down, if I'm going from point A to point B and these are the gaps, and I know what I need to fill in terms of gaps, here are the business methods I can apply." That model literally tells you pretty quickly what leverage you need to pull. Hey, I need, right, more clients, larger clients, more revenue. I need to provide less services. Right?

There's only, like, five basic levers you can pull. When you figure those out, it makes it much easier to say, "Okay, in the other areas, right, those other pillars, what are the changes that we need to make and then what's our path to making them?"

Advice For Confidently Setting And Quoting Fees [44:57]

Michael: So can you talk a little bit more about what these other pillars are then, and some of the, just the levers we can pull or the things we can do in the other pillar areas?

Stephanie: Sure. Packaging and presentation is pretty straightforward, right? That's where you're building out your brand, your messaging. You're creating that wow client experience, what we call depending client engagement, right? How are you really engaging with clients and really creating real value through your engagement and communication with them? How are you confidently quoting your fees, right? What value add do you--

Michael: Confidently. I like confidently quoting fees.

Stephanie: Yes, yes. We always want our advisors to be confidently quoting their fees, because they are fully aware of the value that they are bringing to the table. I think the biggest compromise that I see advisors make, if I could change one thing for advisors, it would be that I would eradicate the crisis of confidence that I see in our space. We have standards and ideals of what we want to do in terms of the clients we want to serve and how we want to serve them, and the outcome we want for ourselves and our businesses, and yet we compromise all the time on our fees, on our services, on our minimums on the people we hire or the reasons that we don't, taking referrals that are too small because we don't know what else to do, and we make all of these compromises out of a crisis of confidence.

When advisors have a full sense of their value and what they bring to the table, they stop making those compromises. The funny thing is that we noticed this last year, Michael, is when our advisors stopped making those compromises, everything got better.

Michael: It's an interesting challenge to me. I think we've touched on this once or twice in some other recent podcast episodes. You know, in the early days of advisors, we sold products, we sold insurance and investment products, and in that world, our compensation was set by the company. Like, the commission rates were what they were. You either closed the deal or you didn't. If you did, you got paid, and here's how it worked. You know, while you could try to control the outcome of just whether the client said yes and decided to work with you, you didn't really control any of the other levers of compensation. Like, clients showed up with whatever they had, and that's what was available to invest. The compensation was whatever the company said it was going to be on that commission.

You just got what you were going to get if you could close the business. But you didn't literally have to price it. Even in an AUM world...well, this is maybe starting to shift. The classic 1% on a million dollars was so ubiquitous for so long that, particularly, I find for advisors around that level, there still wasn't much fee variability. Like, you didn't have to negotiate fees much because, look, we charge about a 1% on a million like everybody else. So if you had much, much more affluent clients, maybe you had to make some fees concessions. If you had much lower clients, maybe you charged a little bit more because fee schedules tend to be graduated. But there still wasn't usually a lot of negotiating room, except maybe around minimums, whether you were going to take someone below a minimum.

The more we move into these fee for service models and start particularly pricing planning fees and pricing planning fees separately, like, you gotta kind of pull this number out of thin air. Hopefully you estimate the value you're providing the client or the cost of your time, or how ever it is that you arrive at your fees, but the more we move into planning advice and the more our fees get detached from insurance and investment products, the harder it is to quote a fee that you can stick with, unless you're just flat out confident in your value to say, like, "Yeah, here's how much we cost. If you don't like that, I wish you the best." Because you can always, like, when it's your fee, you can always compromise that fee down to get to yes. Couldn't do it with the commission products. Hard to do it with the AUM fees. Really easy to do it with standalone planning fees.

That seems to be where all the problems then start cropping up. Like, as you said, very few of us are confidently quoting fees right now.

Stephanie: Well, and I think that the question that I would always challenge that with, right, for any advisor listening, is why would an advisor set a fee if they don't believe enough in the value that they're delivering for that fee in the first place? Right? At some point, we have to sit down and say, "My fees for services A, B and C are...." And my assumption as a business owner, right, is that that we should at that point sit down and say, "Okay, here's the market landscape that I'm operating in. Here's what I would like to generate in terms of return on time. Here's the value that I think I can bring to the equation and where I fall in the spectrum," right? So one end of the spectrum, right, is high volume, lower fees, right, sort of more of the mass market. Other end of the barbell, right, much lower volume, higher fees, much more boutique and specialized services, right? We're sort of seeing, right, that that barbell is getting squeeze and people are getting pushed to the outsides, which is what's really sort of, right, making it more challenging for advisors in the middle.

But where you form that value spectrum is a huge factor in your pricing, and then at the end of the day it truly is the mindset and the confidence that you bring to the table. We literally had countless advisors increase their minimums, raise their fees...one of our advisors raised her fee from $4000 to $10,000, and it was as white-knuckle a moment as they get. Of course, we took her through the process, taught her how to do it, right, dealt with the underlying crisis of confidence, resolved that, literally got her to a place where, very quickly, where she could do that, and lo and behold the whole thing happened with no fanfare whatsoever. It wasn't an issue for the person on the other end. The only person it had ever be an issue for was her. You can only work by reasonable estimates with 100 to 200 people per advisor, and there are far more people than that in the world that need planning. So if you're truly just trying to put 100 or 200 people on your bus, do we really need to make those compromises?

It's okay if we do. I am not ever going to say you should work with large clients or small clients, or you should do it this way or that way. What I am going to say is that you should make your decisions in an informed and intentional way so that you're really clear on the decisions you're making, why you're making them and the impact that they're going to have on your ability to get to the outcome that you want. Most of the compromises that advisors make aren't made in an informed and intentional way. It's just sort of a habit of instinct. You wake up, someone asks you, they refer you a client that's too small, a client asks you to do something that you have no model for charging for, right, a client, a prospect, asks you for a discount, and in that moment your instinct, your mindset, your underlying belief system says yes is the only good answer here. Yes equals we eat.

No equals we don't get the client, we make no money, we run out of money and we die. That's sort of the process that's literally going on in our brains. So in the absence of an informed and intentional position statement, right, that's why we go through those exercises in the beginning, is so that we get really, really clear on what the standards need to be to get us to the outcome that we want. Packaging and presentation is all about how you show up and define and deliver those value to the marketplace so that your success rate is really, really high.

That leads you into, right, the promotion piece. Your brand methods, how you tell your story, how you engage with centers of influence and clients on referrals, right, networking, marketing, events, all that stuff.

Michael: That's literally the next pillar then, is emotions.

Stephanie: Yes. Yeah.

Michael: Like, we've packaged it up. We know how we're going to talk about what we're doing. Now we actually have to get in the process of promoting it and showing what we're doing.

Stephanie: Exactly, right? That's the sales and marketing piece. It's how you take that story to the marketplace through your various channels and activities and campaigns, right, whatever your marketing strategy is and, right, there's no one way to be successful. We have advisors do it every which way under the sun. So that's just one of those common misconceptions, right? That there is a good way and a bad way. It depends on every, right, every person, size and situation are different in terms of what their comfort is, right? What capital they have to invest, what kind of style they have. But the idea is, at some level, we do have to get out there and promote our services. I think the other big mistakes that advisors make is - and I say this with all love and respect, because I think it's one of the most impactful jobs on the planet - is we sort of have this crisis of confidence on one end, and sort of this sort of over...what's the word I'm looking for?

It's sort of this really developed sense of credibility, and we just are so concerned about being the cheeky sales people that we sort of put ourselves on this professional podium of, right, I can't lower myself to that standard, because no one wants to be perceived that way. Nor would I ever suggest that someone do anything that would cause them to be perceived that way. But we're so concerned about that as a profession, about that perception that we literally pull back, and we sit in our offices waiting of people to find us, all while the cheeky sales people are out there actively marketing.

Michael: So, in essence, we've got stuck in the trap of saying, "I don't want to be a sales-y advisor," and we end up just being an advisor that literally does no business development and waits or hopes for the phone ring, or referrals to come in, when in reality there was a valid midpoint between I don't want to be too sales-y, and I'm going to do nothing and just wait for client referrals to show up.

Three Things That Prospective Clients Need To Be Before They’re Ready To Buy [54:51]

Stephanie: Right. It's one of the things we talk a lot about in the coaching program, and I've always talked about, right - you know this - for 20 years. I don't believe in selling. Selling is a product and a transaction, right? Yes, we are in that moment where we are giving someone the opportunity to work with us. Yes, that there is a sales transaction in that moment. But in general what we always talk about is that at the end of the day, we're persuasive educators. We want to give people the information that they need to make informed and educated choices about their financial life, choosing an advisor and whether they want us to be an advisor, and to give them the opportunity to make one.

That's our job. No to sell them, cajole them, persuade them, twist their arm, because our job is to meet them where they are, and when they're ready, they'll take us up on it. Our job is to do everything we can to define and articulate that value in the most compelling way so they get what we do. Then if they're ready...and I always say that clients need to be three things. Motivated, able to see the value and be willing to pay. Two out of three doesn't work. We were talking about--

Michael: So they've gotta be motivated, able to see the value, and willing to pay?

Stephanie: And willing to pay. Two out of three doesn't work. So I can't tell you, when I started, right, 24 years ago in a practice, I can't tell you how quickly my follow-up list grew, because people didn't want to make a decision. They could say maybe or give me two weeks, or we'll think about it, and I bore the burden of responsibility following up. So they would always just say, "Yeah, call us in a couple of weeks." So my list just grew longer and longer and longer, and what I realized one day, Michael, was that if they could sleep at night without having a plan, I should be able to sleep at night without them having a plan.

That was literally where a client has to be three things, motivated, able to see the value and willing to pay came from, because through the science of failure, I figured out, this is what all these people have in common. They're willing to let me spin my wheels chasing after them, but they're not ready. They can't see the value where they are, and so what I need to do is move this firm to a place where we're promoting and talking to people who are ready to see the value, and when we made that shift, right, our closing rate went from under 40% to over 90%. We doubled our fees. All these great things happened.

But you have to be willing to make really clear and confident choices, and then to be able to execute them in the marketplace, and I think both because of the crisis of confidence and that desire to stay on the podium of credibility, if you will, we really hamstring ourselves in terms of our ability to create a greater level of success for ourselves.

Michael: Yeah. We had a very popular podcast episode from a few months ago with Nancy Blakey, episode 88...so for anyone who wants to go back. Kitces.com/88 for the episode. Nancy has a sales training program, and you know, sales training is a bad word in portions of our industry, but her whole focus, very much as you said, is around, like, the point of selling is not to convince someone who doesn't want to buy something from you to buy something from you. The point of selling in the good sense is to help someone who really would be a great fit for your services, to just get through the decision-making process and connect for them the dots of, here's the problem you've got, here's the value I provide, here's why the value I provide solves the problem that you've got, because we don't always perfectly connect those dots all on their own.

So what can we do to help? The things that she says, you know, motivate them to take an action or to make a decision. There's a good professional side of, quote, "sales", that I think is just not understood or not acknowledged in segments of the industry that have seen so much of the bad selling that happens in the bad parts of our industry that, rather than trying to learn good selling, they've tried to learn how to grow with no selling. That doesn't work terribly well.

Stephanie: It's not the most effective growth strategy I've found. But those are the mental constructs that really, right, that really do hamstring us, is that I think a lot of times we sell features and benefits, we believe that the value we provide is investments or information, when I ultimately believe that the value that we provide is advice. Not information. So when we can create those shifts and, I mean, you know this because we've talked about it a lot, you can create a small strategic shift in your thinking and in the approach that you take with your sort of day to day business methods, and you can create, you know, sort of extraordinary lift in terms of your ability to move the needle.

But we put out so much effort in sort of really just trying to get those sort of slight incremental improvements. That's the beauty of kind of going through the seven pillars model, is that it kind of takes you through all the core pieces that you need to get to, because, right, the next stop on that journey is process, which is not everybody's favorite thing. It's not super sexy. It doesn't sizzle. But it is, right, it is the efficiency engine inside the practice or a business. We look at every single process in a firm, from how we answer the phone to the prospect intake process, to what we call client enrollment, right, or what we'll call our say yes ales process, how you conduct your client reviews, how you ask for referrals, how you name referrals when you get them, how you engage with your centers of influence on a regular basis, what's your actual client onboarding process, what about your ongoing service model process, what about all your checklists and scripts and tools and templates, right?

Right? You can go down that list, and it's deep and it's wide, but what a lot of advisors are doing is the great entrepreneurial way, is sort of the wing it model of running our businesses. We get up, we have great intention, we have great energy, we have great ideas, and we just sort of get in and plow through it every day. We don't create sort of the scale and the ability to up level the success of the business, both in terms of delivering greater value to clients and, right, delivering greater value to the owners and advisors in the team inside that business. That, I think, is one of those big misconceptions, is that when we start talking process and scale and systems, that's where I see advisors sort of shut down, and the lights go off, right? One advisor walked up to me and he said, "If I scale up, I gotta water down." I was, like, absolutely not. It's the exact opposite.

When you have clearly defined systems and workflows that say how things get done, who's doing it, what's being done, when are they doing it, by when are they doing it, how long is it going to take, what are the contingencies with relationship to every other step in that process, and when you define those processes and systems and workflows, that's when you get that super-efficient engine, a machine that everybody says they want. But the trick is we have to get beyond ourselves to do that, whether, again, we're on our own with one person, or we're larger is, we can't just show up and run a firm based on our instinct or how we feel in that moment, and that's part of the both the challenge as the owners affirm, but it's also the challenges of the people working in the firm, if you have people working around you...is those lack of processes make us really inefficient and create a lot of complexity that really does sort of compromise our success unnecessarily.

Michael: Yeah. That whole line, like, well, will scaling up make you water down? I feel like that's only what happens when you scale up badly. Like, that's...

Stephanie: Yes.

Michael: ...that's a bad scaling up. That's a consequence of bad scaling up. That's not a consequence of scaling up. Like, the piece that always fascinates me from the other end is when you look at, so I feel like there's a mentality in our industry that, as you work with more affluent clients, and they have more demands and they need things that are more customized, it becomes impossible to standardized and build process in your firm, because all the clients want different things. If you're going to deliver good customized service for affluent clients, you need to be flexible enough to do that.

The irony is that when you actually look at some of the businesses that deliver the best, consistent high-quality experiences, you know, places like Disney and Starbucks, like, the key to their success is they systematize the heck out of everything. Like, every minuscule step of every process is articulated and standardized and formulated, and the reason why it works is once you really do a good job of standardizing all of the pieces, you can now consistently customize, right? Like, that's why I can go to any one of however many million Starbucks there are, and I get my, you know, vanilla venti skim chai, and I get it made exactly the same way I like it, to my personal specifications, no matter where I go, because they systemized every single minuscule part of the process, from when you approach the line down to when the drink is served up at the end. I think they do it in, like, 10 or 15 second process increments just to get every minuscule part, bit by bit, more efficient. That, to me, is why it's so powerful just to think of it as, your value is not literally just the advice you give to clients. Your value is the advice process that you bring to your clients, and if you try to separate the advice process that happens to naturally be you, that's when you went out and made your own advisory firm. If you separate the process that you created from you, you can then begin to teach that process, train that process, share that process with others, have others replicate it, and then begin to mix and match parts of the process to each client.

Now you're starting to create repeatable, consistent, potentially very customized processes. You know, if you want more customization, just make your processes into smaller pieces so you can mix and match them. It doesn't mean that you don't have processes, just make them into smaller pieces so you can mix and match them to customize them more.

Stephanie: But I don't think most advisors even, I think a lot of the times we're not even sure what the issue is. Like, I was just at FP National. I was talking to, right, that whole audience, and one of the questions I asked, no joke, was, "How many of you spend as much time as you'd like with your top clients?" There were over 2000 people in the room, and I think I saw two hands go up. It was a very honest room. When I talked to 300 or 400 or 500 people, literally no more than three hands ever go up, ever. This is with our top clients, and so this is where I always give people my favorite...my client surface example of how scaling up doesn't water down, which is, what's really happening, if we're really honest with ourselves, is I want you to think about your next client event, right? Everybody's had one, or we all know what it is. But we're not going to do it the same way. We're going to identify our top clients. For their name badges of the event, we're going to put a gold star on their name badge. We're going to sit one of our top clients at every table. Let other clients fill in around them, and at the end of the evening when we go to give our thank you and goodbye speech, instead of saying, you know, "Thank you for being a client of this firm, it's our honor and privilege to work with you," what we're going to instead say is, "I want to thank you for being a client of this firm, but you really shouldn't thank me. I want you to find the person at your table with a gold star, and I want you to thank them, because their fees are underwriting your relationship with this firm."

Michael: Oh, zing.

Stephanie: Yeah. That's the response I get every time I tell that story, and do you know why?

Michael: Because we do it because it's true.

Stephanie: Because it's true. if I think about fee discounts. Here's what someone is really saying to you when they ask for a discount. "Thank you for spending the last hour or two hours learning about me and my goals. I love everything you have to say, and I'd love to hire you to help me with that, except I don't see the value being as much as you think it is. So do you think that you'd mind, like, lowering that? But, hey, could you still feel really great about working with me?"

That's what they're really saying. When we say yes, we say, "Okay." You value what I'm going to deliver to you less than I do, but I'm willing to make that compromise because I agree that it's not worth what I think it is. I think that's a compromise that we don't need to make. If we genuinely think the fee is too high, we should just lower the fee. If we genuinely believe the fee is reasonable, we should have the confidence to quote it and hold to it confidently, right? We've trained hundreds, probably thousands of advisors how to have that conversation, and every single time they're, like, "Oh my god, I didn't realize it could be that easy."

Why She Recommends Naming And Branding Your Financial Planning Process [1:07:40]

Michael: So there's a piece you said in there that I want to circle back to for a moment. You talked about naming and branding your financial planning process. Can you talk about that a little bit more? I feel like I'm seeing this a little bit more lately, you know, "Here at Smith Financial Advisors we have the Smith Planning Process to, you know, get you to your financial goals," and I don't know. You know, I'll admit I sometimes feel like it looks a little bit hokey when planning processes get named and branded that way. So am I thinking about that wrong? Have I just looked at, like, a really bad example? Because substitute the advisor's name, that is a true example of a firm that I've seen that...

Stephanie: Right.

Michael: ...that branded their planning process. Just, you know, advisor's name, planning process. What's the point of this? What is this supposed to look like if you do it well?

Stephanie: Well, look. The fundamentals of planning are the same from firm to firm to firm. What you're trying to do is, A, from a promotion standpoint, you're competing for attention. We're not competing for anything anymore, except attention. That's the world that we live in 24/7, right, 17-second soundbites. Everybody's competing for attention. Now, if we were having a conversation about mindset and how your brain works, what I would tell you is that the only way to compete through all that background noise is that something has to be different and unique. Because that's what tells your brain, A, I need to pay attention, it could be bad, right, it could come with threat or danger...but that's sort of what creates that uniqueness, is sort of a unique concept. But here's what we're really trying to solve for. Think about what advisors do. You can't really quantify the value of a relationship with an advisor, right? My mother in law, when we refer to our advisor, right, she'd been a school secretary, raised three boys on her own, right, literally would sew, would go to the swap meet, buy corduroy shorts and hand embroider the O and P in my husband and brother's shorts when they were kids, because that's how much money they didn't have. Right?

Fast forward, she puts her way through school, gets her masters degree, her aunt dies, leaves her $400,000, she now has something to plan, goes to her advisor, and right after the meeting, and everybody's got these stories. She comes out with tears in her eyes, because what they told her was that she basically had permission - which she had, she just needed it - to get out of her 800 square foot condo and buy a little three bedroom, two bath house so that she could have a yellow room for the girls and a blue room for the boys. That's all she wanted, and she came out of that office with tears in her eyes.

How do you quantify the value of that? $250 an hour doesn't cut it. What about the advisor that, in our coaching program, that called me last week and said, "I'm so glad that I just raised my fees." I said why, and he said, "I just saved the client $40,000 because I caught something that their accountant missed." How do you quantify the value of that? Right? So those are just the little things along the way. The real value that advisor provide is, we create an outcome for people. An outcome that, for the most part, they're not going to get to on their own. Every single person has a meaning of that outcome that's different to them, and that's what makes marketing a challenge, is you've gotta find a way to compete with all the background noise, cut through it, reach in, get their attention and say something in seven seconds that they want or need to hear enough that they'll give you their attention. If you just say we provide financial planning and investments, that doesn't do it anymore.

So when you can brand and package and message an outcome, what the process does is it gives it validity and credibility. Here's an intangible outcome we're going to deliver to you. Everybody wants that. Here are the steps that we're going to take to get you there, and then people buy into the process, which means that when the market goes up or the market goes down, they're still in the process. If I put you in a car in LA and say your goal is New York, and things go sideways in the middle, are you going to jump out? But if I just say, "Get in the car you're going somewhere," and things go sideways in the middle you're much more likely to leave the car. That's the power of kind of packaging a process. It's not about just, you know, putting the five steps on a page. It's about kind of turning the intangible value of the outcome we deliver into a tangible thing that you can articulate to people in a way that starts to help them understand the value that you're actually going to deliver, which is a really hard thing to even begin to quantify.

Michael: It's an interesting framing, just to say that people don't find it by financial planning, or certainly a financial plan. They buy a planning process to achieve certain outcomes that are important to them.

Stephanie: I think most of the time people buy outcomes. All the time, people buy outcomes from a neuroscience and a brain perspective based on their emotions. Even people that don't think that they're making decisions emotionally, all people do, and the reason question is, how do you articulate your ability...A, you have to know what someone's outcome is, right? That's how you engage with a prospect on your website, in the conversation, in the phone call, right, all of that.

Michael: So talk to us about the other two Ps in your pillar here. People and platforms.