Executive Summary

The final weeks of the year are some of the busiest for financial advisors as they help their clients not only plan for the upcoming year but wrap up their planning for the current year before it ends. Often, that work is heavily geared towards end-of-year tax planning strategies, such as partial Roth conversions, tax loss (or gains) harvesting, and now deduction bunching under the Tax Cuts and Jobs Act. But the end of the year also offers advisors the opportunity to help clients over 65 potentially save money (or preserve access to key doctors) during the Medicare Open Enrollment Period, which runs each year from October 15 through December 7, by making changes to their coverage (which then take effect on January 1) that generally can’t happen during the other 44 weeks of the year.

The first key adjustment opportunity – and important annual review process – is to assess whether any changes need to be made to a Medicare enrollee’s Part D prescription drug plan, as providers do change formularies (the list of available favorably-priced drugs) from year to year, and failure to monitor the situation can lead to a spike in medical costs if key drugs are suddenly no longer covered.

For those who are over age 65 and don’t have a Part D prescription drug plan, the next option during the annual Open Enrollment Period is to add one. The caveat, however, is that, for individuals that did not sign up for Part D during their initial enrollment period (which is a six-month window spanning the three months prior to and after their 65th birthday) they will almost certainly have to pay an ongoing “late enrollment penalty” in addition to their regular premiums, unless they have “creditable coverage” from another prescription drug plan in retirement. Though for those who already face a late enrollment penalty, waiting further will just further increase the penalty from here!

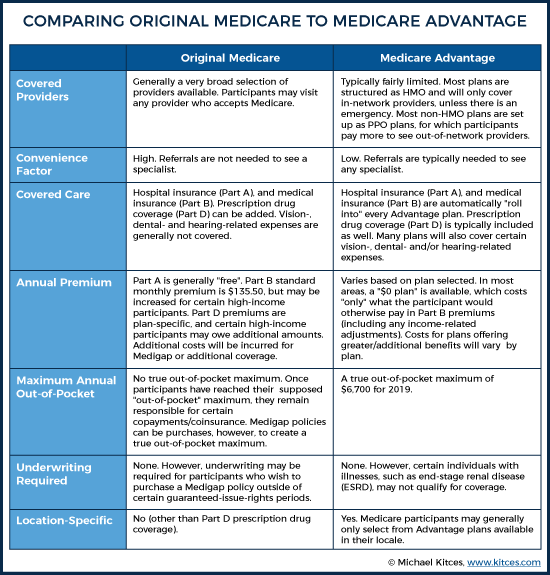

In some cases, though, the key Medicare change opportunity is not just to switch Part D prescription drug plans, but to change the entire Medicare plan itself – from original Medicare to a Medicare Advantage (Part C) plan, or vice versa. Medicare Advantage plans are offered through various private insurance companies (rather than through the Federal Government) and are often lower cost than traditional Medicare (with often an even wider range of benefits, including not only Part B and Part D coverage but sometimes even dental and vision coverage as well). However, Medicare Advantage plans encourage (or really, require) individuals to utilize providers with whom the carriers have negotiated concessions and discounts (i.e., in the Advantage plan’s “network”)… which means it’s necessary to monitor the plans each year to ensure that the desired doctors are available, or otherwise switch plans to another that includes the desired doctors. And those who relocate may wish to switch altogether into (or out from) a Medicare Advantage plan, as the quality of network (and therefore popularity of the plans) varies tremendously from one geographic region to another.

Ultimately, though, the key point is simply to recognize that, while the last couple of months of the year are especially hectic, there are several opportunities for planners to add real value for their clients. And for older clients, it goes beyond just end-of-year tax planning, but also helping them perform an annual “check-up” on their Medicare coverage, which can end up saving them not only time and money, but can ensure that they continue to see the doctors they want to see (and take the prescription drugs they want/need to take) in the first place!

As 2018 comes to a close, advisors and clients across the country are getting set for – or in some cases have already begun – the annual ritual that is year-end planning. While much of an advisor’s end-of-year work focuses on tax planning, and rightfully so, there are plenty of non-tax end-of-year planning opportunities as well. Case in point: The annual Medicare Open Enrollment Period (OEP), otherwise known as the Annual Election Period (AEP).

Each year (since 2011), the Medicare OEP begins on October 15th and runs through December 7th. During this time, Medicare participants have the opportunity to make changes to their coverage that are not generally allowed at other times during the year (though they may be available during Special Enrollment Periods after certain qualifying events). Potential changes that can occur during the end-of-year Medicare OEP include:

- Switching from one Medicare Part D prescription drug plan to another Medicare Part D prescription drug plan;

- Adding a Medicare Part D prescription drug plan for those who don’t already have one;

- Changing systems from “original Medicare” (e.g. Medicare Part A and Part B) to a Medicare Advantage Plan, or from an Advantage plan back to traditional Medicare; and

- Switching from one Medicare Advantage plan to another Medicare Advantage plan.

Changes made during a Medicare OEP are effective January 1st of the following year, so changes made by December 7, 2018, will be effective January 1, 2019.

Switching Between Medicare Part D Prescription Drug Plans

Once someone has made a choice to use traditional Medicare and purchase a Part D prescription drug plan (as opposed to a Medicare Advantage plan), they tend to stick with that choice.

But even if that’s the case, and there are no plans or need for any big changes to overall Medicare coverage for the upcoming year (e.g., a switch from traditional Medicare to a Medicare Advantage plan), it’s worth giving any existing Medicare Part D prescription drug plan a “check-up” of its own.

As from year to year, it’s not uncommon for Medicare Part D plans to change their drug formulary (their list of covered prescription drugs), and if left unchecked, this could come as an unwelcome surprise for clients left footing the bill for previously-covered-but-now-removed high-cost prescription drugs.

Fortunately, by September of each year, Medicare participants should receive an Evidence of Coverage (EOC) document, which provides details about plan coverage and expenses. In addition, also by September, Medicare participants should receive a Plan Annual Notice Of Change (ANOC). This document includes explanations from the plan about any changes in coverage and costs that will be effective for the following year.

That said, many Medicare participants are likely to mistake these documents for “junk mail” and throw them out… or simply lose them within a stack of other “important” documents. In such cases, participants can contact their plan and request a new copy of the material, but oftentimes, it’s simply better to go to Medicare’s website to review and compare plan information. This is particularly important for drug formularies, which can change significantly from one year to the next, often with the addition of new drugs, and the removal of old, brand-name drugs for which a generic version has been recently made available.

Using the Medicare Plan Finder site, you can estimate a client’s annual drug costs (both with and without a plan), and you can see if all their drugs are (still) covered by a plan’s formulary.

To be clear, this “review” should be completed every year, and by every Medicare Part D participant who is taking important (and potentially expensive) prescription drugs.

Adding a Medicare Part D Prescription Drug Plan

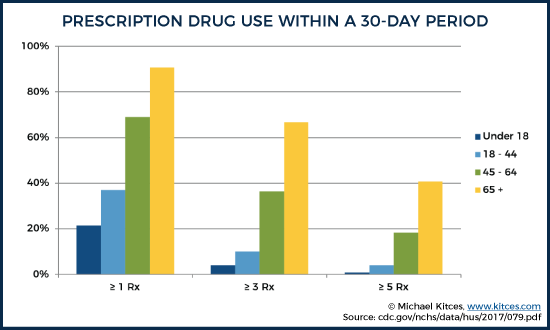

It’s no secret that prescription drugs can be brutally expensive, especially for senior citizens… as the older people get, the more medications they are likely to need. In fact, according to recent data from the Centers for Disease Control and Prevention (CDC), between 2011 and 2014, a whopping 90.6% of those 65 and over were using at least one prescription drug (compared to 69% for those ages 45 – 64). During the same time frame, 66.8% of those 65 and older were using at least three prescription drugs (compared to “just” 36.4% of those ages 45 – 64). And some 40.7% of those 65 and over were using at least five prescription drugs (compared to “just” 18.3% of those ages 45 – 64).

Given older Americans’ high likelihood of requiring one or more prescription medications – at least at some point – and the potential costs associated with those drugs, it’s generally a prudent planning move to ensure that there is some sort of prescription drug insurance coverage in place. For those on original Medicare who do not have some sort of outside “creditable coverage” (a plan that is expected to pay, on average, at least as much as standard Medicare drug coverage), such as a retiree health insurance plan from a former employer that includes drug coverage, that typically means signing up for a Medicare Part D prescription drug plan.

Getting Medicare Part D During Initial Enrollment

In general, individuals using original Medicare and who don’t otherwise have creditable drug coverage should sign up for Medicare Part D during the Initial Enrollment Period for Part D Coverage. This enrollment period typically begins three months prior to the month a person reaches their 65th birthday and ends three months after the month of their 65th birthday.

Without other creditable drug coverage, signing up for Part D coverage during the Initial Enrollment Period is critical. For most, it’s appealing simply because it helps to ensure that a participant has at least some reasonable cap(ish) on potential drug expenses. Once a Medicare Part D participant has reached their annual out-of-pocket maximum for drugs, they qualify for “catastrophic coverage,” after which they are only responsible for “small” coinsurance or copayments. For 2019, the out-of-pocket maximum is $5,100 (which, thanks to the “small” coinsurance or copayments that are still owed, isn’t really a true “maximum").

Late Enrollment Penalties For Delayed Medicare Part D

Beyond just getting a Medicare Part D prescription drug plan for the sake of the coverage itself, signing up for Part D drug coverage during the initial enrollment period is also important to prevent an individual from incurring a late enrollment penalty (LEP), should they decide to enroll at a later date. Typically, the penalty is assessed to Medicare Part D participants with gaps in creditable coverage for 63 days or longer after the end of their Initial Enrollment Period, and is equal to the national base beneficiary premium x 1% x the number of full uncovered months after the end of the Initial Enrollment Period (rounded to the nearest $0.10). This penalty generally applies for life, unless the Medicare participant decides to drop prescription drug coverage altogether, and must be paid in addition to the actual Medicare Part D plan premium, and any income-related monthly adjustment amount (IRMAA). Thus, the decision not to sign up for Medicare Part D “on time” (but to do so later) can have long-term consequences, even for those who are mostly healthy and don’t require prescription drugs.

Example #1: Blanche, whose Part D Initial Enrollment Period ended June 30, 2008, is 75 years old. A veritable model of physical fitness and unburdened by the need for any ongoing medications, Blanche has never enrolled in any sort of Medicare prescription coverage, nor has she had any other prescription drug coverage (i.e., she has had no creditable drug coverage). However, after recently watching her equally fit friend, Rose, unexpectedly fall ill and incur substantial medical bills, Rose has decided to utilize the 2018 Medicare Open Enrollment Period to enroll in Part D coverage.

Due to her lack of creditable coverage prior to enrollment, Blanch will owe a Part D penalty for life. For 2019, the base beneficiary premium is $33.19/month (which is actually down from $35.02/month in 2018!). Thus Blanche’s monthly Part D penalty will be equal to $41.80/month, which is equivalent to 126 (the number of months from July 2008 – December 2018) x 1% x the $33.19/month base premium for 2019 (rounded, in this case down, to the nearest $0.10). Which means Blanche’s total Part D prescription drug plan will be approximately $33.19/month (or whatever her actual prescription drug plan costs) + $41.80/month = $74.99/month, as the late enrollment penalty must be paid in addition to the actual premium of Blanche’s selected Medicare Part D drug plan.

Notably, Blanche will continue to owe the penalty in all future years she remains enrolled in a Part D drug plan. The penalty amount, however, will change each year, as the base beneficiary premium changes.

Planning For Clients Who Lack Medicare Part D Coverage

Clearly, neither the prospect of lifelong penalties or high, unexpected drug costs are particularly attractive. Therefore, advisors should analyze their book of business and determine which clients 65 or older currently have creditable drug coverage (other than via Medicare), and which clients currently have no such coverage.

Fortunately, those clients who do have creditable coverage should be made aware that, upon termination of their current creditable coverage, they will have the ability to sign up for Medicare Part D without a penalty via a Special Enrollment Period.

However, and of even greater importance and urgency, advisors should contact those clients without any sort of creditable coverage and discuss the potential benefits of enrolling in Part D coverage now. Which is important not only for the fundamental benefit of securing coverage itself – in case there are future health events that require prescription drugs – but also to “stop the bleeding” of the Late Enrollment Penalty. Remember, there is no cap to the Late Enrollment Penalty. Each month without creditable coverage just makes the penalty worse when/if Medicare Part D drug coverage is later secured. And assuming coverage was not secured during the Initial Enrollment Period, absent some sort of circumstance that would trigger a Special Enrollment Period, Medicare Part D drug coverage can generally only be added during the annual Open Enrollment Period… period!

To review and compare available plans, advisors and their clients can visit the Medicare Plan Finder page. Fair warning though… it’s not exactly the most user-friendly site/experience, so advisors may need to help some of their non-tech-savvy clients through the process, or at least make sure that they have someone else available to do the same.

Switching From Original Medicare To A Medicare Advantage Plan

When it comes to Medicare planning for clients, inertia is often a powerful force. Once clients adopt a particular plan – be it a Medicare Advantage plan or original Medicare – they tend to stick with it unless there is some sort of event that triggers them to look for alternative coverage, such as a preferred doctor no longer accepting their current coverage. But there are some important differences between traditional Medicare versus Advantage plans that means at least some clients should proactively consider a switch, most commonly to help manage their Medicare premiums if they want to reduce the combined cost of their Part B, Part D, and Medigap supplemental policy.

What Is Medicare Advantage (Medicare Part C)?

As an alternative to traditional Medicare, nearly all Medicare participants (more than 99%) have the option of enrolling in some sort of Medicare Advantage Plan, sometimes referred to as Medicare Part C.

Medicare Advantage is a type of Medicare coverage, but instead of being provided by the Federal Government’s Center for Medicare and Medicaid Services, it is offered through private companies. Medicare Advantage plans include their own version of Part A coverage, Part B coverage, and typically Part D coverage as well (there are some Medicare Advantage Plans that do not cover prescription drugs, but they are much more the exception than the rule).

The precise way in which money flows from taxpayer, to government, to private insurance company, to healthcare provider under the Medicare Advantage system is rather complicated. However, the basic premise is that once a private insurance company has been approved by Medicare to offer an Advantage plan, the private carrier receives a flat rate from Medicare for each enrollee, and then becomes responsible for paying enrollees’ medical expense claims. Medicare Advantage insurers then use their bargaining power to negotiate discounts or other pricing concessions with doctors, hospitals, etc. That savings can then be used to provide enrollees additional benefits, to reduce costs, to bolster profits, or some combination thereof.

Of course, not all doctors and hospitals are willing to negotiate their rates to the same degree, and as you might imagine, insurers will naturally want covered persons to visit those healthcare providers with whom they have negotiated discounts. And thus… the creation of “a network,” a nearly universal component of most Medicare Advantage plans. To that end, roughly two-thirds of all Medicare Advantage plan participants are enrolled in HMO-style plans, under which care must generally be provided by an in-network provider, with the majority of the remaining participants enrolled in PPO-style plans, under which participants can receive care from an out-of-network provider but will pay more if they don’t stay within the network.

In addition to their required coverage of Part A and Part B expenses, and their typical integration of Part D prescription drug benefits, many Medicare Advantage plans offer additional benefits, such as coverage for hearing aids, dental, and vision expenses. These expenses are generally not covered by traditional Medicare, nor are they covered by Medigap policies (though some Medigap providers may offer participants the opportunity to purchase additional coverage to mitigate the risk of such expenses).

Like all insurance policies, Medicare Advantage plans can vary dramatically in terms of both cost, and coverage. Interestingly, the overwhelming majority of Medicare participants have access to at least one Medicare Advantage plan that is a $0 premium plan. Of course, such plans are not “free,” and enrollees are still responsible for making their regular Part B premium payments (which are then redirected from the Federal Government to the plan), plus any deductibles, copayments, etc. associated with the plan. But “just” paying Medicare Part B and getting the full benefits of Part B, and Part D, some, most, or even all Medigap supplemental benefits, and perhaps even some additional benefits (i.e., dental or vision coverage) as well, can be a very cost-effective decision. At least for those who have a reasonable network of doctors in their local Part C Medicare Advantage plan based on their geographic location.

Geography Is The Most Predictive Factor In Medicare Advantage Plan Adoption

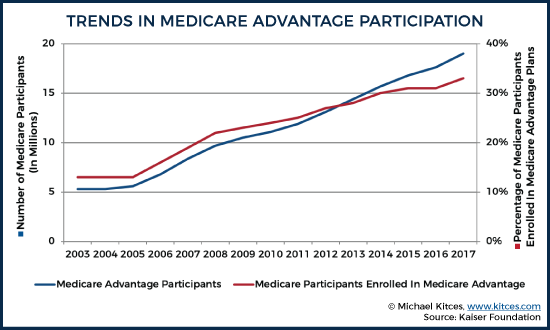

While the majority of Medicare participants are still enrolled in traditional Medicare, participation in Medicare Advantage Plans has risen dramatically over the past 15 years, in terms of both the sheer number of enrollees, as well as the percentage of overall Medicare participants enrolled in the program.

Furthermore, while the prevailing view is that low-income and minority beneficiaries rely on Medicare Advantage plans to a significantly greater degree than the Medicare population as a whole (trading off the limitations of a network for lower “more affordable” premiums), this appears to be significantly over-exaggerated. Indeed, according to a 2015 American Health Insurance Plans’ Center for Policy and Research report, as of 2012, roughly 26.1% of Medicare Beneficiaries had income of less than $10,000, but only 20.3% – a lower percentage – of all Medicare Advantage Plan enrollees were comprised of the same population. Similarly, at the “upper” end of the spectrum, roughly 10.3% of Medicare participants had incomes in excess of $50,000, and they represented roughly 7.4% of all Medicare Advantage enrollees… meaning that while those with higher incomes tend to skew somewhat towards traditional Medicare, there are still plenty of such individuals opting for Medicare Advantage Plans!

In fact, geography – and more specifically, the state in which a Medicare beneficiary lives – tends to play a much greater role in whether they are likely to opt for Medicare Advantage or traditional Medicare. For instance, in 2017, Alaska had the lowest percentage of Medicare beneficiaries enrolled in Medicare Advantage plans (at just 1%!), followed by Colorado (3%) and Vermont (8%). Meanwhile, some 6 states had Medicare Advantage plan adoption rates of more than 40%, led by Minnesota at 56%... meaning, in Minnesota, it’s actually more likely that a Medicare participant is enrolled in a Medicare Advantage plan than traditional Medicare (ostensibly an acknowledgment of the success of Minnesota Medicare Advantage plans successfully building a robust network of medical providers for a compelling cost)! And given recent trends in Medicare Advantage adoption, it may not be long until the same is true of several other states as well!

Similarly, while age, sex, and race all seem to play some role in determining how likely an individual is to enroll in a Medicare Advantage plan, as evidenced by the same 2015 American Health Insurance Plans’ Center for Policy and Research report noted above, none of them seem to have near the predictive impact as the state in which a Medicare participant resides, and the relative success of Medicare Part C plans having grown a significant network for a reasonable premium.

Who Should Consider Switching To A Medicare Advantage Plan During Open Enrollment?

With open enrollment upon us, advisors need to consider which of their clients on traditional Medicare should consider joining the growing ranks of Medicare Advantage plan participants. While every situation must be evaluated separately – a lot of it will depend on the type and quality of Medicare Advantage Plan available in a client’s locale (and whether his/her doctors are in the plan’s existing network) – there are some common scenarios which tend to at least trigger a conversation around the question, “Does it make sense to switch to a Medicare Advantage plan?” Such clients/scenarios include:

Clients incurring or expected to incur higher dental, vision or hearing expenses – Has it become increasingly likely that your client will have higher costs for dental-, vision-, or hearing-related expenses? If so, now might be an opportune time to switch from original Medicare (and potentially Medigap), which does not cover such costs, to a Medicare Advantage plan, which may cover such services (and, obviously, if this were the case, you’d want to look for a plan that does cover those items!). You could also try to secure an additional medical insurance policy, on top of traditional Medicare (and potentially Medigap), to cover such dental, vision, or hearing needs, but not everyone can or wants to spend additional money on that sort of coverage. Furthermore, it’s possible such policies could require underwriting, further increasing the policy cost, or making coverage impossible altogether.

Get A Cheap Out-Of-Pocket Maximum – Medicare Advantage plans also have the added benefit of coming with a built-in out-of-pocket maximum (which can be as high as $6,700 in 2019, but is lower for some plans), whereas original Medicare has no out-of-pocket limit (though the purchase of a Medigap policy can provide one). So for those clients who prefer to minimize the impact of a “worst-case scenario,” switching to a Medicare Advantage plan may prove helpful. Clients who don’t have a Medigap policy limiting their out-of-pocket maximum expenses for the year – perhaps because they are generally healthy and don’t anticipate needing (much) care, and thus, don’t want to spend the extra money – should give strong consideration to an inexpensive, perhaps even $0-premium, Medicare Advantage plan. If they don’t plan on visiting doctors much anyway, who cares if their network of providers is limited? And this way, if the unexpected should occur, there’s a limit to the potential damage.

Clients Moving To A New Location – As noted above, the most predictive factor of whether a Medicare participant opts to choose a Medicare Advantage plan is geography. Thus, anytime a client moves, it’s worth checking to see what sort of Medicare Advantage plans are available in their new locale. Notably, such a move will often result in a Special Enrollment Period, during which a client can make the switch from original Medicare to Medicare Advantage without waiting for an Open Enrollment Period. But during the chaos of a move, that opportunity may be missed... especially if the client is currently on original Medicare, which is fairly universally accepted, and they don’t “have” to secure new coverage. Which means the annual OEP provides a second opportunity to make a switch to a Medicare Advantage plan that may make sense after the move.

Additional Flexibility Added For 2019 – Thanks to a new change for 2019, this open enrollment season might be the ideal time for clients who have long been on the fence about making the switch from original Medicare to a Medicare Advantage plan to take the plunge and make the switch. Why?

Beginning in 2019, there will be a new Medicare Advantage Open Enrollment Period, from January 1st through March 31st. During this time, participants will be able to switch between Medicare Advantage plans, and even drop their Medicare Advantage plan and return to original Medicare (including, if desired, Part D prescription drug coverage). Thus, if clients make the leap to a Medicare Advantage plan today (or at least by the normal December 7th Open Enrollment deadline), but later find they have a case of “buyer’s remorse,” they can unwind their decision at any point during the first quarter of 2019.

It’s also worth noting that there is a reasonable amount of flexibility built in to the system for those individuals with a Medigap policy who are worried about not being able to qualify for the same coverage if they later change their mind and wish to leave the Medicare Advantage Plan program and return to traditional Medicare (as outside of certain situations in which individuals have “guaranteed issue rights,” insurers offering Medigap policies after their initial enrollment period can require individuals to go through medical underwriting, charge more for certain conditions, and/or exclude certain pre-existing conditions from coverage). Specifically, the Medigap/Medicare Advantage plan rules include something called trial rights. Under this rule, if a Medigap participant drops Medigap coverage to enroll in a Medicare Advantage plan for the first time, they can change their mind at any time during the first year and can go back to original Medicare and enroll in any Medigap policy offered within their locale without any underwriting. After the first year, it’s still possible to switch back to original Medicare and a Medigap policy, but underwriting could be required.

Switching Between Medicare Advantage Plans

Like Medicare Part D drug plans, Medicare Advantage plans may change their drug formularies from one year to the next. In addition, Medicare Advantage plans may also make other changes throughout the year, such as altering their network by changing the list of covered providers and services, which could make it beneficial for those covered by a Medicare Advantage plan to switch to another Part C plan instead.

Thus, similar to the annual “check-up” for Medicare Part D participants, during the Open Enrollment Period (or before if the information is available), advisors should perform a Medicare Advantage plan review each and every year. In addition to checking the drug coverage to make sure critical medications will continue to be covered in a cost-effective manner, advisors should encourage clients participating in a Medicare Advantage plan to make sure any “I-have-to-be-able-to-see-that-Doctor doctors” are still covered by the plan.

Switching From Medicare Advantage To Original Medicare

In addition to using the Medicare Open Enrollment period to switch from traditional Medicare to a Medicare Advantage Part C plan, you can also use the Medicare Open Enrollment period to leave the Medicare Advantage program and return to original Medicare. Original Medicare offers a number of advantages over most Medicare Advantage plans, including and especially what is typically a much wider group of covered healthcare providers (i.e., a bigger network).

Who Should Consider Switching To Original Medicare During Open Enrollment?

When creating a list of clients to contact regarding possible benefits of making the switch (potentially back) to original Medicare, there are a number of situations to prioritize, including:

Individuals complaining about the network/referral process – Nobody really likes having to get referrals to see a specialist, but for some people, it’s far more of a burden than others. In general, Medicare Advantage plans will require enrollees to get a referral from their primary care doctor, or other eligible provider, prior to covering payments to any specialist (as most Part C plans are HMO-style plans). In contrast, original Medicare participants can generally visit any specialist accepting Medicare without first getting a referral. So for clients doing a lot of complaining about how annoying it is to have to get referrals all the time, consider using this year’s open enrollment period to make the switch away from Medicare Advantage.

Desire to see more out-of-network healthcare providers – As noted earlier, Medicare Advantage plans are typically structured as HMOs or PPOs. That may not present a problem for a Medicare participant so long as their insurer covers their doctor, but what if that changes? Or what if they develop a new condition and wish to visit a specialist who is not covered under their Medicare Advantage plan? In such cases, switching from the Medicare Advantage plan to original Medicare may provide a benefit, as original Medicare has no “network” limitations. And, although doctors are not required to accept Medicare, there are generally more covered provider options with original Medicare than there are with any individual Medicare Advantage plan.

Clients Moving To A New Location – As noted earlier, any time a client moves, it’s worth checking to see if wholesale changes in the Medicare coverage is necessary. Perhaps, for instance, they are moving from an area with an excellent array of Medicare Advantage plan and covered providers, to an area with a minimal number of plans with much fewer covered provider options. In such circumstances, the switch away from Medicare Advantage and to original Medicare may be optimal. Again, while such a move will typically result in a Special Enrollment Period, during which a client can make the switch, that opportunity may have already been missed, which makes the annual Open Enrollment Period to the time to make the adjustment.

The end of the year is often a busy time for advisors and clients alike. While traditional year-end planning items, such as tax-loss harvesting, year-end Roth conversions, and deduction-bunching often have significant impacts, in many instances, a year-end Medicare check-up – prior to the end of the Medicare Open Enrollment Period (during which changes can be made) – may prove to be the most valuable year-end planning older clients engage in from one year to the next. Such planning not only has the ability to save clients hundreds (or potentially even thousands) of dollars in unnecessary medical expenses from one year to the next but can continue to allow individuals to see their preferred healthcare providers, which for some, is even more important.