Executive Summary

Welcome to the March 2019 issue of the Latest News in Financial Advisor #FinTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors and wealth management!

This month's edition kicks off with the mega-news that Envestnet has acquired PortfolioCenter from Schwab, and in the process, has stirred up a feeding frenzy of what may be once-in-a-lifetime deals as all the major portfolio performance reporting solutions compete for the nearly 2,000 legacy PortfolioCenter users that are now in transition.

From there, the latest highlights also include a number of interesting advisor technology announcements, including:

- Commonwealth spins off its proprietary broker-dealer operating system and advisor tools into a standalone entity, Advisor360, and then promptly licenses it out to MassMutual’s 9,000 brokers

- Cetera stakes a new direction in the post-product future of the broker-dealer model with a “fee-for-service” advice initiative using AdvicePay

- OnPointe Risk Analyzer launches a new Riskalyze alternative that aims to compete not just on risk tolerance assessment but marketing capabilities as well

- FA Match raises a $500k seed round and builds a broker-dealer recruiting matchmaking platform for independent brokers looking to make a switch

Read the analysis about these announcements in this month's column and a discussion of more trends in advisor technology, including the latest new “Multiple Opinions” and “Timeline” features announcements from Riskalyze, Chalice Financial Network’s acquisition of SuccessionLink as a channel to recruit new advisors, PreciseFP launches a standalone “digital onboarding” solution with SSG that does not require advisors to change client portals and portfolio performance reporting solutions, and Yourefolio launches a new drag-and-drop estate plan flowcharting tool (at least for the subset of advisors still doing estate planning flowcharts!).

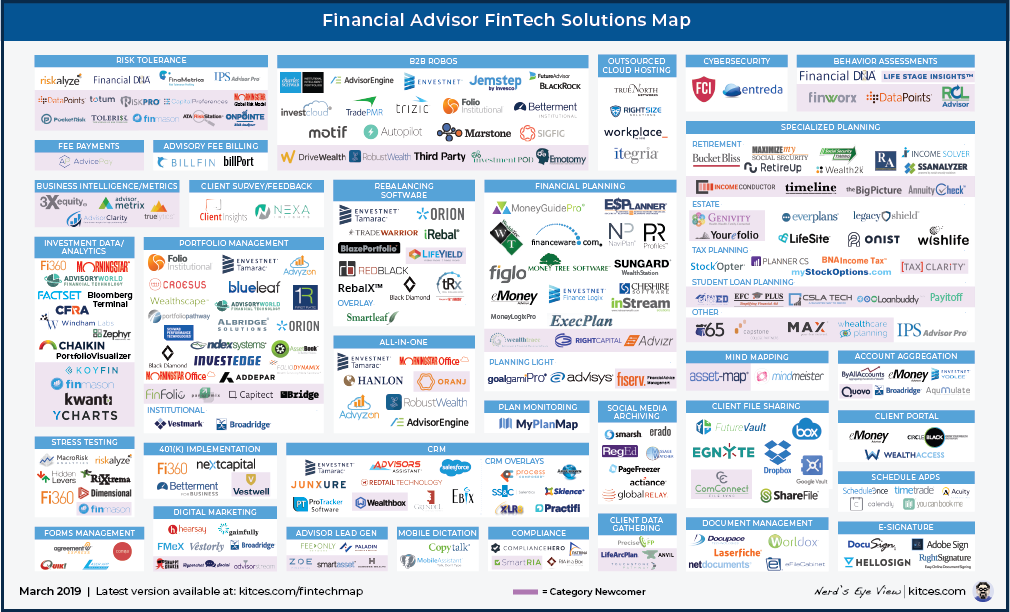

And be certain to read to the end, where we have provided an update to our popular new “Financial Advisor FinTech Solutions Map” as well!

I hope you're continuing to find this new column on financial advisor technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Envestnet Triggers Portfolio Reporting Software Feeding Frenzy With Acquisition Of PortfolioCenter. Portfolio performance reporting software has long been one of the “hot” categories of advisor technology, driven in no small part by its sheer pricetag… where advisory firms may pay as much as $5,000 to $10,000 or more, per advisor, for what is deemed as “essential” software in the AUM model. Accordingly, the past decade has witnessed a slew of high-profile deals for such portfolio accounting tools – from Envestnet purchasing Tamarac, Advent buying Black Diamond, and TA Associates acquiring Orion Advisor Services – along with a seemingly never-ending stream of upstarts (trying to break into the same lucrative software market). But for most of the past decade, they’ve all been gunning for PortfolioCenter, the server- and desktop-based portfolio reporting system that became the stalwart of the first generation of RIAs in the 1990s and 2000s, that through last year, was still polling as the #1 portfolio reporting solution for RIAs… an apparent combination of advisor inertia, an incredibly painful and costly migration process to make a change (especially for firms that have been manually downloading and reconciling their own data for 20+ years), and the hope that eventually Schwab would release its own updated cloud version (with a migration path to get there). But when Schwab announced last fall that it was not going to be releasing a new cloud-based version of PortfolioCenter after all, and instead would focus on its own free-but-solely-for-Schwab-RIAs alternative, PortfolioConnect, questions began to arise about whether or when PortfolioCenter would eventually be sold off or wound down (despite Schwab’s insistence it didn’t plan to sunset the software anytime soon). And now, the question is answered: PortfolioCenter has been sold to Envestnet, reportedly for a “negligible” amount. The deal appears to have been triggered at least in part because Envestnet’s Tamarac itself, which is built on top of PortfolioCenter, comprises upwards of 1,000 of PortfolioCenter’s remaining 3,000+ advisory firms. Which meant Tamarac had a unique interest in seeing PortfolioCenter continue (or at least to buy and control its code base), while Schwab wanted to find a "graceful" exit from its obligation to continue servicing PortfolioCenter’s run-off business. Yet arguably the real prize of PortfolioCenter is not the nearly 1,000 users who were already Tamarac clients, but the other 2,000 advisory firms that are suddenly in play… firms that weren’t marketed to aggressively when they were under the Schwab umbrella – ostensibly out of competitors’ fears of not angering the parent-company giant – but are now fair game in the hands of Envestnet. Thus, Orion promptly announced a whopping “9 months free” deal for any PortfolioCenter users who want to try making the switch, Black Diamond offered 12 months free plus free conversions and free training, Envestnet responded by offering PortfolioCenter users who stay with PortfolioCenter/Tamarac can have premium upgrades for free for 2 years (albeit with a hefty 7-year lock-in), and Morningstar took its own swing at Envestnet by raising the question of whether Envestnet would sell or otherwise take advantage of advisor and client data in PortfolioCenter or offer other “pay-to-play” opportunities to asset managers that want to get in front of PortfolioCenter users. Notably, for advisors, the fact that Tamarac itself remains built on PortfolioCenter likely means Envestnet will continue to support it for many years to come (a likely factor to why Schwab decided to sell to Envestnet in particular). Yet it seems only a matter of time before Envestnet will at least try to shift PortfolioCenter users over to Tamarac. Which for some or many advisors may be a fine outcome. But if advisors really aren’t certain whether they want to be with Envestnet’s Tamarac for the long run, arguably now is the time to evaluate alternatives – if only because the feeding frenzy is underway, and the incentives from competitors to make a change will likely never be better than they are right now.

Commonwealth Spins Out Its Advisor360 Technology Platform Into Standalone FinTech With MassMutual As A Launch Partner. Commonwealth Financial has long had a strong reputation as one of the leading independent broker-dealers; by advisor headcount (nearly 2,000), it is the 12th largest IBD, but with an industry-leading average production, Commonwealth ranks 4th largest by revenue. And the company is unique for having largely built its own proprietary technology platform – Advisor360 – so popular that, in a world where most broker-dealers struggle with their technology, Commonwealth consistently ranks #1 in advisor satisfaction. The challenge, however, is that technology development can be an incredibly expensive investment, even for a privately-owned long-term-oriented broker-dealer like Commonwealth, and costs can only be amortized only “so far” across its existing base of advisors and revenue. And so in this context, it’s significant that Commonwealth announced it is spinning out Advisor360 into its own standalone technology company, making Commonwealth its first customer… and MassMutual’s insurance broker-dealer its second, which will add a massive 9,000 brokers to the Advisor360 user base (plus an estimated 9,000 more in MassMutual support staff). Notably, though, Advisor360 isn’t just software for advisors, it’s effectively an entire broker-dealer operating system in a single unified platform (akin to what United Capital built and now licenses to other RIAs as FinLife Partners), in a world where virtually every other broker-dealer has only been able to cobble together an array of independent solutions and try to integrate them to the extent possible. In fact, arguably the demand for better and more efficient broker-dealer software means that Advisor360 as an independent company could quickly grow to reach many multiples of the advisors it currently serves at Commonwealth itself… which on the one hand represents a tremendous market opportunity for the Advisor360 technology, and on the other, risks making other broker-dealers so much more efficient with the technology that they, in turn, become more competitive against Commonwealth itself! Though ultimately, the real question may simply be whether or how easily Commonwealth’s “proprietary” software that they built for themselves really generalizes to other broker-dealers. Though without a doubt, being able to amortize development costs across 30,000+ advisor, support staff, and home office users (instead of “just” Commonwealth’s own) will give the platform far more resources to invest into development in the first place… and suddenly turns Commonwealth’s formerly-proprietary Advisor360 into a head-to-head competitor against the likes of Envestnet, Morningstar, Pershing, and Fidelity in the broker-dealer community!

Cetera Launches Fee-For-Service Advisor Platform And Debuts As First AdvicePay Enterprise. One of the indirect consequences of the Department of Labor’s fiduciary rule is that it highlighted the tenuous role of the broker-dealer in the future of financial advice platforms. After all, a broker-dealer exists as an intermediary for product distribution, and in a future world where advisors are paid primarily for advice itself (and not product distribution), there’s literally no need for a broker-dealer in the first place. To some extent, this trend is already reflected in the virtually one-directional flow of advisors from broker-dealers to the RIA model… but, in turn, is leading some broker-dealers trying to reinvent themselves as forward-looking advice platforms. Last November, it was Commonwealth Financial announcing that it would be launching a standalone RIA unit for brokers who want to completely drop their FINRA licenses but remain with the Commonwealth platform. And now, Cetera is announcing its own “Advice-Centric Experience” platform, specifically to support its brokers that want to transition to or expand on their fee-for-service advice model (where the advisor is primarily compensated for the advice itself, and not for products or investment management). Of course, the challenge is that most broker-dealers are not built to deal with standalone fee payments (particularly in high volume), and accordingly, Cetera also announced that it is becoming the first major hybrid broker-dealer enterprise to adopt AdvicePay to facilitate those fee-for-service payments (since the company recently finished advisor-crowding its own $2M capital round to build its enterprise solution). From Cetera’s perspective, the challenge now will simply be getting its hybrid advisors to expand their business models in the fee-for-service direction to reach new and different clientele (e.g., next-generation clients that prefer to pay for advice via standalone or ongoing monthly subscription fees, rather than via a product or investment account). From the broader industry perspective, the question is whether the rest of the hybrid broker-dealer community will similarly begin the pivot away from their product and 1%-of-assets investment management roots and towards 1%-of-income fee-for-service advice as the next-generation advisor business model.

Riskalyze Continues Expanding Its Reach With Multiple Opinions And Timeline By Focusing On Real Advisor Conversations. Until Riskalyze showed up, “risk tolerance questionnaires” were just an obligatory compliance process, used to validate the suitability of an investment as a part of FINRA’s KYC (Know Your Customer) obligation. Most advisors simply used whatever basic questionnaire their compliance department provided them, while some independent advisors at least sought out a “more rigorous” questionnaire from third-party providers like FinaMetrica. What made Riskalyze unique was not merely that it shifted risk tolerance from the standard “what is your time horizon” and “what would you do in a down market” questionnaire into one tied more directly to client willingness to accept certain upside-vs-downside trade-offs, but that it also shifted those discussions from a due diligence obligation after the client agreed to come on board, into a meaningful conversation with a prospect beforehand instead (allowing Riskalyze to price itself as a "marketing" solution, substantially higher than a back-office "compliance" solution). In this context, it’s notable that at the recent T3 Advisor Technology conference, Riskalyze announced two new “conversations” (i.e., features). The first is Multiple Opinions (originally announced at their own annual conference last fall), which makes it easier for multiple people to each go through Riskalyze’s risk tolerance questionnaire process and then see and discuss any differences in their answers to find a common consensus (e.g., in situations where husbands and wives disagree about risk tolerance or multiple members of an investment committee). The second is “Timeline,” an extension of Riskalyze’s Retirement Maps (that show basic projections of how wealth is anticipated to grow over time, to understand the client’s risk capacity) that allows clients to attach specific events to that projected retirement accumulation and decumulation timeline (e.g., lump sum transactions to send a child to college or buy a new home in retirement), which again is relevant not just from a technical perspective (such financial events impact risk capacity), but also because it facilitates a conversation around how those events may impact the “right” portfolio. The key point, though, is that while Riskalyze has spawned numerous competitors who continue to try to compete with them by developing a “more rigorous” methodology to assess the client’s risk tolerance itself, or a wide range of features and integrations, the real reason Riskalyze continues to dominate its category is their ability to not merely build relevant advisor features, but to facilitate an ever-widening range of relevant client conversations.

OnPointe Launches New Risk Tolerance Platform Built From The Ground Up To Support The Advisor Marketing Process. As Riskalyze has quickly come to dominate the marketplace for risk tolerance software, most competitors have tried to win market share away by coming up with alternative “better” ways to assess risk tolerance, effectively trying to compete on the merits of the risk tolerance process itself. Yet the reality is that Riskalyze’s success is not merely about the particular way that it assesses risk tolerance, but the way that it effectively facilitates conversations, with both clients and especially prospects, that has truly made it so successful. Thus while most risk tolerance questionnaires were simply used to ensure that a portfolio being recommended to a client was suitable, Riskalyze was the first to use risk tolerance effectively for marketing purposes, by allowing prospects to assess their risk tolerance, compare it to their actual current portfolio, “inevitably” scare themselves with a misaligned portfolio (as very few self-directed investors ever perfectly diversify consistent with their risk tolerance), and then serve up the advisor’s recommended portfolio as a (more-consistent-with-their-risk-tolerance) alternative solution. And so, it’s notable that the latest competitor to throw its hat into the ring in the risk tolerance category – OnPointe Risk Analyzer – is promoting not just its particular two-dimensional risk profiling process (assessing both risk tolerance and risk capacity), but directly building the assessment tool into marketing workflows as well. In fact, OnPointe is not only developing its risk tolerance assessment tools, but its own version of “OnPointe Email” (a MailChimp or Constant Contact competitor) to integrate risk tolerance into drip marketing strategies, along with its own version of OnPointe Landing Pages (an industry-specific competitor to popular LeadPages). In other words, OnPointe is not only trying to out-Riskalyze Riskalyze when it comes to the rigor of how risk tolerance itself is assessed – an opportunity given that many advisors like Riskalyze from a marketing perspective but aren’t always confident that clients can answer the complex trade-off questions correctly – but it is the first to try to roll out a series of full-scale marketing capabilities to go along with it. Though with such a head start in market share, it remains to be seen if OnPointe can actually attract Riskalyze customers away… although its more aggressive pricing (with OnPointe starting at “just” $99/month, compared to Riskalyze’s $165/month) may at least be appealing to more price-sensitive firms that are looking for a marketing-savvy Riskalyze alternative.

Yourefolio Launches Drag-And-Drop Estate Planning Flowcharts For Interactive Estate Planning. Historically, estate planning was a key component of financial planning because financial advisors were paid for the life insurance policies implemented to provide estate tax liquidity. Which, over time, evolved into not just selling life insurance for estate planning purposes, but simply helping clients to understand their estate plan in the first place and “translate legalese into English” in a world where clients often don’t remember, or in many cases never actually understood, exactly where and how their assets will flow. As while simple “I Love You” Wills are straightforward (“Honey, I love you, I leave you everything”), once ILITs and testamentary A/B trusts are added in, plus more complex estate planning vehicles like GRATs and IDGTs, and the fact that revocable living trusts along with retirement accounts and annuities pass outside the Will anyway (along with Joint-Tenants-With-Rights-Of-Survivorship that passes directly by operation of law), it’s often remarkably difficult just to keep track of where everything will go. The classic way this was conveyed to clients was with an estate planning flowchart, often shown via financial planning software as a way to calculate estate tax exposure, or perhaps with a separate graphic created in Powerpoint. Yet standard financial planning software often couldn’t handle flowcharting more complex estate planning scenarios, and building “custom” flowcharts for every client with Powerpoint or similar tools could be very time-consuming. And so in this context, it’s notable that Yourefolio has actually created a more modern estate plan flowcharting tool, that makes it both far easier to build such flowcharts (than it would be in Powerpoint!), and with drag-and-drop capabilities that make it feasible to actually illustrate and dynamically explore estate planning options and alternatives with clients on the spot. Of course, the irony is that flowcharting, and estate planning in general, is less relevant in a world where estate tax exemptions have risen so high that very few even have a Federal estate tax problem to plan for. Yet with nearly a dozen states that still have their own (much lower) estate tax exemptions, and the fact that trusts are often still relevant for non-tax (e.g., asset protection or spendthrift) purposes, not to mention second marriage scenarios, estate planning flowcharts are arguably still relevant for many advisors… especially if Yourefolio makes them really easy to construct. Although in the end, Yourefolio may have to figure out how to more easily integrate their flowcharts – or at least the output – into standard financial planning software, to avoid the need for advisors to log into multiple different platforms just to complete a single comprehensive financial plan?

FA Match Raises $500k Seed And Launches Broker Recruiting Marketplace. With the growing volume of RIA mergers and acquisitions, a cottage industry of RIA investment bankers has emerged, along with numerous “M&A” marketplace platforms that aim to introduce buyers and sellers. Yet the reality is that the original “marketplace” for advisor matchmaking was not RIA buyers and sellers, but brokers looking to change platforms and the broker-dealers aiming to recruit them. In fact, the total number of brokers at independent broker-dealers far exceeds the number of advisors at independent RIAs, and there are already many more broker recruiters than there are RIA M&A matchmakers. The recruiting marketplace is further supported by the fact that there is already an “industry standard” price to be paid for recruiting – typically 6% of trailing 12-month GDC – and unlike investment bankers matchmaking an M&A transaction (where the fee comes directly from the proceeds), broker-dealer recruiting payments are typically paid from a broker-dealer’s marketing budget separate from the economics of the transaction for the broker itself. Accordingly, given the financial health and vitality of the broker recruiting marketplace, it is perhaps no surprise that this month marks the launch of the first digital marketplace platform solely focused on broker recruiting: FA Match, led by experienced broker recruiter Ryan Shanks (of Finetooth Consulting), with seed funding led by MassMutual. Similar to other advisor matchmaking platforms like RIA Match, FA Match serves up introductions when brokers and broker-dealers mutually show an interested “match” in each other, and will even facilitate initial communication and conversations. The solution will be free for advisors – given that broker-dealers already pay a recruiting fee for placements – but in a world where there’s no lack of broker-dealers or recruiters who will take a phone call from a broker interested in making a switch, the primary question is not whether broker-dealers will pay for placements (they will), but simply whether and how FA Match can attract brokers looking to make a change to the FA Match platform in particular, given that there are already so many other recruiting pathways available.

Chalice Financial Network Acquires Succession Link As Path For Prospecting Members. The ongoing advisor shift away from products (and thus away from the broker-dealer model that facilitates product distribution) has in recent years not only led to the rise of breakaway brokers transitioning to RIAs, but also the rise of various RIA support platforms, for the subset of advisors that find the RIA model appealing but want the rest of the “support” infrastructure that comes with a traditional broker-dealer, from platforms like Dynasty Financial to more independent models like the Garrett Planning Network or XY Planning Network. The challenge, however, is that those platforms still have to find advisors who are leaving the broker-dealer channel, to have an opportunity to attract them. (As it’s often difficult to attract existing RIAs once they’re settled into their current infrastructure.) In this context, it’s notable that upstart advisor network Chalice Financial announced this month that it was acquiring Succession Link, one of a handful of advisor mergers-and-acquisitions marketplaces that have emerged in recent years in an attempt to capitalize on the marketplace platform model by matchmaking advisory firm buyers and sellers. From Chalice’s perspective, the appeal of tying to an advisor M&A marketplace is that, by definition, advisors who are merging are in transition, which gives solutions like Chalice an opportunity to be a provider for the newly minted firm. And Chalice advisors who want to grow through acquisition get more direct access to a marketplace to find prospective sellers (and in fact, Chalice announced a new partnership with Oak Street Funding to facilitate acquisition loans for its members). The caveat, however, is that there are now a growing number of platforms all trying to become advisor M&A and recruiting marketplaces, from old stalwarts like FP Transitions to the more recent RIA Match, along with newer entrants like FAMatch and AdvisorBid, and it’s not entirely clear that there are that many advisors looking to be sold or recruited. In fact, the decision of SuccessionLink itself to sell to another startup that itself “only” raised a $4.6M Series A last year (which suggests the SuccessionLink sale price wasn’t substantial) raises concerns that the Advisor M&A Marketplace business model might itself be struggled from a lack of adoption by sellers. Though at a minimum, Chalice also gets access to and contact information for SuccessionLink’s 43,000 members, who are being offered half off their membership to join by the end of the month… a powerful reminder that when it’s difficult to get advisors’ attention and on their radar screens in the first place, there’s still a remarkable amount of value in a good old-fashioned (e-)mailing list.

SSG Deepens RIA Custodial Partnerships On Performance Reporting And Digital Onboarding with Portfolio Pathway And PreciseFP. Because of the competitiveness of portfolio performance reporting solutions, platforms like Tamarac, Orion, and Black Diamond have been dominant in the mid-to-large-sized RIA marketplace (that can afford those platforms’ higher prices for a broader feature set), leaving upstart competitors to try to compete with smaller more-price-sensitive RIAs in the hopes of eventually moving upmarket. Yet while there are thousands upon thousands of smaller state-registered investment advisers who need such solutions, the highly fractured marketplace makes it incredibly difficult for new companies to find and reach them in the first place. Which makes it notable that Portfolio Pathway announced a partnership this month with startup-RIA-friendly custodian Shareholder Service Group (SSG), giving the portfolio performance reporting (and trading and rebalancing) solution access to SSG’s 1,600 advisory firms to grow more rapidly in the small-RIA environment. And coupled with the Portfolio Pathway announcement, SSG also announced a partnership this month with PreciseFP, the forms-management solution that started out developing digital financial planning data gathering forms, and is now evolving into a full-scale “digital onboarding” solution, where advisors and their clients can enter data into PreciseFP’s SSG-specific form templates and automatically populate key SSG paperwork, validate fields to ensure proper data entry (which should substantially reduce NIGOs), and facilitate e-signature on the spot. From SSG’s perspective, the partnership with PreciseFP gives it a more streamlined digital onboarding experience for clients. But the real significance from the industry perspective is PreciseFP itself, which has solely built a digital onboarding and forms management solution for advisors, effectively disaggregating the onboarding process from the rest of the client portal and performance reporting capabilities, which allows them to partner alongside (rather than be a competitor to) performance reporting solutions like Portfolio Pathway, whereas most other “digital advice” solutions for advisors (e.g., AdvisorEngine) have built more all-in-one solutions of onboarding and client portals (and may struggle for adoption precisely because they require advisors to switch everything even if firms just want better digital onboarding capabilities alone).

Wealthfront Expands Deeper Into The Traditional Brokerage Model With Cash Sweep Account. When the robo-advisor movement first emerged in 2012, the upstarts declared that they were going to disrupt the traditional financial advisor and the conflicted brokerage industry, charging a simple, clean, and low-cost advisory fee for an all-in solution. In fact, during the Department of Labor’s fiduciary rulemaking process in 2015, then-Labor Secretary Perez touted Wealthfront as a fiduciary paragon. But within a year, growth rates at B2C robo-advisors were slowing dangerously (and in the case of Wealthfront, its average account size and average revenue/client began to outright decline despite the ongoing bull market), leading to a series of shifts and pivots away from its founding fiduciary model. First came the launch of a proprietary Risk Parity fund, that Wealthfront controversially began to automatically default and transition its clients into, indirectly increasing its fees by inserting its own proprietary product into the mix (in a manner that, ironically, wouldn’t have even been allowed in Wealthfront retirement accounts had the DoL fiduciary rule remained in place). And now, the company has announced that it’s entering into the latest lucrative Wall Street conflict – sweeping client cash to an affiliated cash management solution, in which the firm can financially participate (typically either via the expense ratio of a proprietary money market fund, or via the net interest margin from an affiliated bank sweep). At this point, Wealthfront is offering investors the option to choose either a money market fund or an FDIC-insured bank sweep, with an initial (and reasonably competitive) rate of 2.24%, though Wealthfront reserves the option at its own discretion to negotiate a fee as much as 2% (200bps) on cash balances with its participating banks, raising concerns about whether the initial 2.24% rate is effectively just a “teaser” rate that won’t stay competitive if/when/as Wealthfront raises its portion of cash fees in the future. Of course, as noted earlier, Wealthfront’s arrangement is not unique, as the approach of sweeping cash to a related money-making entity is common across the brokerage industry (including at most RIA custodians). And with rising interest rates suddenly making investors care about what yield they’re receiving on their cash, offering a 2.24% yield may well help Wealthfront attract more investment dollars and open more accounts (just as competitor Robinhood recently did). Nonetheless, the decision to add yet another solution for Wealthfront clients, in which Wealthfront has financial participation on the back end, is a striking pivot for a company that was launched with a mission to disrupt Wall Street… and has ended out fighting for its survival and revenue growth by increasingly copying Wall Street’s conflicted playbook instead.

ETFs Become The Loss Leader As Schwab And Fidelity Expand Commission-Free ETF Platforms And SoFi Launches Two No-Fee ETFs. For the past decade, ETFs have been in an all-out price war, driven by Vanguard, in particular, using its economies of scale to drag the expense ratio of ETFs ever lower and forcing competitors to cut their own fees to similar or even lower levels in an attempt to win back market share. Yet as ETF fees approach the zero bound, a shift is beginning to emerge – whereby ETF fees are so low, that investors aren’t necessarily as sensitive to price anymore. As a result, last year, Fidelity made waves by launching the first zero-fee ETFs… only to find that, through the end of the year, its zero-fee funds didn’t actually draw in all that much in asset flows after all. Nonetheless, Fidelity has continued to expand its line-up of zero-fee ETFs, in the hopes that it can make enough on securities-lending business, and/or by getting investors to also buy other non-zero-fee Fidelity ETFs once they’re in the door, to eventually profit. In other words, ETFs are beginning to shift from merely being a game of low-cost razor-thin margins built on giant scale, and into a world where they’re simply the “free” loss-leader to get other more lucrative business instead. In this context, it is perhaps not surprising that now SoFi, the student loan lending platform that is increasingly expanding into broader wealth management, announced the launch of several new SoFi ETFs, two of which – the SoFi 500 ETF and the SoFi Next 500 ETF – will be zero-fee (technically, a 0.19% expense ratio that is being fully fee-waived). Which, like Fidelity, will give SoFi the chance to reach new investors, who may then use its other (non-zero-fee) ETFs, and/or expand into using a wider range of (more lucrative) SoFi services as well. Similarly, Schwab and Fidelity this month also announced an expansion to their own no-transaction-fee (NTF) platforms for ETFs as well, which the brokerage platforms are similarly using as their own means of offering ETF trades “for free” as a loss-leader to get other business opportunities (though notably, it is rumored that asset managers themselves are paying the platforms on the back-end to have shelf space in the NTF ETF platforms, which helps to explain why notoriously-not-pay-to-play providers like Vanguard and DFA are not included in the offerings). Nonetheless, the key point is simply that ETF fees – both the expense ratios of ETFs themselves, and the trading fees to execute them – appear to have now dropped so low, that, rather than compete for the last basis point or two of revenue, it’s easier for investment technology platforms to just give them away for free in the hopes of adding investors (or advisors) and making money in other ways instead. Which on the plus side will further drive down ETF and trading costs in the coming year or few, as more and more of the marketplace likely capitulates. But on the minus side, simply introduces new conflicts as advisors who get more and more ETFs “for free” through their investment platforms have to ask hard questions about how exactly the platform is making money off the advisor or the client (to ensure the “free” platform doesn’t actually end out costing them even more in the long run!).

In the meantime, we’ve updated the latest version of our Financial Advisor FinTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Was it a big win for Envestnet to acquire PortfolioCenter, and will they really manage to retain the bulk of today’s PortfolioCenter users? Will Commonwealth be able to sell Advisor360 and become the operating system for even more broker-dealers? Will OnPointe really be able to win advisors away from Riskalyze? Is Cetera starting a new broker-dealer trend in its shift to fee-for-service advice?

Disclosure: Michael Kitces is a co-founder of AdvicePay and XY Planning Network, which were mentioned in this article.

Leave a Reply