Executive Summary

Welcome to the August 2019 issue of the Latest News in Financial Advisor #FinTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors and wealth management!

This month's edition kicks off with the announcement that Orion Advisor Services is acquiring newcomer financial planning software maker Advizr for a whopping $50M (on a revenue base of only $3M), and will almost immediately begin offering it for free to Orion users as a way to make the Orion client experience more financial planning centric… but in the process, creating potential client experience and workflow conflicts for actually-planning-centric advisory firms already using other third-party financial planning software tools.

From there, the latest highlights also include a number of other interesting advisor technology announcements, including:

- Independent software goes wirehouse as Morgan Stanley selects Box to power its new Client Vault and Merrill Lynch cuts a deal with Envestnet Tamarac to replace its own proprietary portfolio performance reporting solution.

- AdvicePay launches a new Fee Calculator tool for advisory firms to show and explain their pricing to clients, as Schwab’s Intelligent Portfolio Premium service quickly garners $1B in 3 months with its own financial-planning-for-a-monthly-subscription-fee offering.

- Northern Trust Asset Management acquires robo-advisor-for-advisors Emotomy as standalone digital onboarding tools continue to struggle to find traction.

- Salesforce rolls out a new “downmarket” version of Financial Services Cloud in an attempt to compete in the small-to-mid-sized RIA market

Read the analysis about these announcements in this month's column and a discussion of more trends in advisor technology, including Betterment rolling out an “Everyday” high-yield cash savings option for its investors but finding that it’s the Betterment For Advisors RIAs quickly becoming its biggest cash referrers, Ritholtz Wealth re-launches its LiftOff “robo” service for small clients and chooses to pay Betterment For Advisors 0.25%/year just to not use existing RIA custodians’ digital onboarding tools, “Techno-TAMPs” are on the rise as Ethic Investing raises a $13M Series A to provide advisor-customized centrally-managed SRI strategies, Plaid rolls out new student loan account aggregation capabilities that may finally bring more student loan planning tools to advisors, and Envestnet MoneyGuide partners with Jackson National to leverage its wholesalers to provide training on MoneyGuideElite’s new “Secure Income Modeling” tool designed to make it easier for RIAs to begin using annuities with their clients.

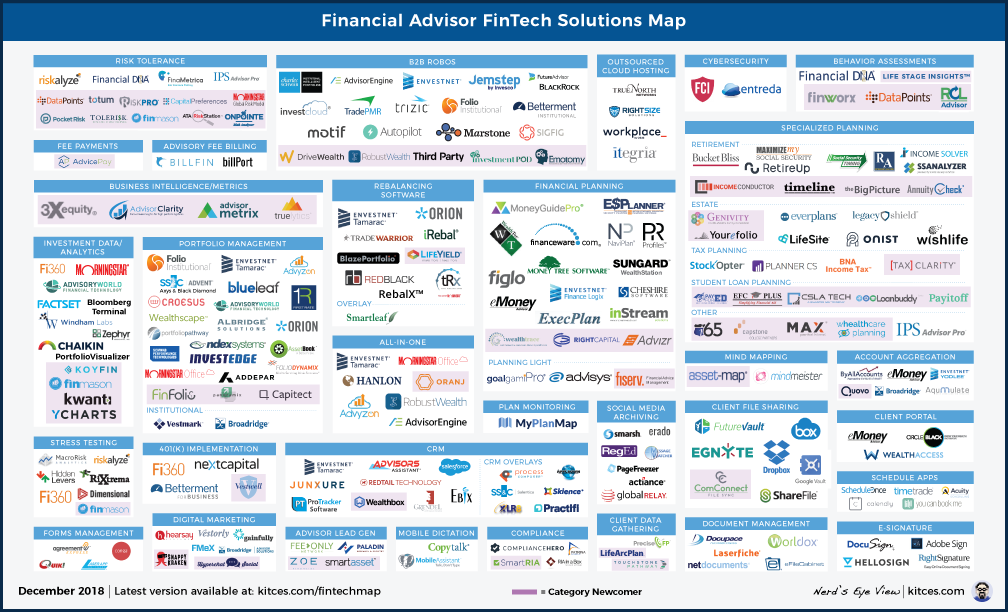

And be certain to read to the end, where we have provided an update to our popular new “Financial Advisor FinTech Solutions Map” as well!

I hope you're continuing to find this new column on financial advisor technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Orion Acquires Advizr For $50M In Shift To More Planning-Centric Client Experience. As technology increasingly commoditizes the core advisor function of crafting and implementing a diversified asset-allocated portfolio, advisory firms are increasingly pressured to either go deeper into their investment process to add value (or at least justify their existing fees), or shift towards providing comprehensive financial planning advice and other wealth management services to add value instead. And notably, this emerging divide between investment-centric and planning-centric firms is relevant not only with respect to their value proposition to clients but, ultimately, the staffing decisions the firm makes, and where and how the firm chooses to allocate its technology budget (as when financial planning becomes a more central part of the advisor value proposition and a revenue driver, advisory firms become more willing to pay for financial planning solutions). Which in turn has led in recent years to a wave of investment-centric platforms acquiring financial planning software in order to bolster their offering for historically-investment-oriented firms that want a more planning-centric client experience, from Fidelity buying eMoney Advisor to Envestnet acquiring FinaniceLogix and then also acquiring MoneyGuidePro. Now continuing the trend, portfolio management and reporting software Orion announced this month it was acquiring financial planning software Advizr. Surprisingly, though, the deal reportedly closed at an eye-popping price tag of $50M in cash despite Advizr having only about $3M in revenue, and lagging in both adoption and User Ratings relative to its more established competitors… raising the question of why, exactly, Orion was so anxious to get its hands on Advizr, and whether the company will be able to effectively gain adoption from its existing user base. As Orion CEO Eric Clarke notes, though, while 70% of its firms have a financial planning integration, only 30% of the households in those firms have a financial plan connected to their Orion account, suggesting a financial planning implementation gap amongst Orion firms that Orion itself ostensibly hopes to solve and close with Advizr. However, given Advizr’s difficulty in creating a strong enough financial planning offering to gain market share in the first place, it’s not clear that Orion users will be interested in switching to newcomer Advizr from more established competitors, except perhaps the minority of firms that had no financial planning software relationship to begin with (but again, those are more likely to be investment-centric firms that don’t have interest in financial planning in the first place!). Nor is it even clear whether Orion will be able to successfully roll out and gain adoption with Advizr’s more financial-planning-centric portal, as planning-centric firms using competitors like eMoney Advisor or RightCapital already have their own financial planning portals for clients (and MoneyGuidePro is expected to add one soon, given their acquisition by Envestnet, which also owns Yodlee), making the new Advizr portal redundant to many firms. Which, ironically, means the Advizr acquisition may make Orion a better fit for its investment-centric firms that want to shift towards financial planning, but alienate its existing planning-centric firms that find an Orion-Advizr portal in conflict with the planning tools they already use with clients. Nonetheless, Orion seems to be positioning Advizr as a core part of its future offering, announcing from the start that its $50M Advizr acquisition will be available for free to existing Orion firms. Though unless Orion ultimately plans to try to consolidate all of its advisors into using Advizr’s financial planning software tools instead of the existing alternatives (becoming less open-architecture and more of an all-in-one solution), it remains to be seen whether or how planning-centric firms will actually adopt Orion’s new financial planning capabilities at all?

Betterment Rolls Out “Everyday” Option For High-Yield Cash Savings And Finds Early Traction With Advisors. In recent months, a growing number of “robo” advisor platforms have begun to launch high-yield savings accounts as a way to entice new users to their platforms, starting with Robinhood trying to tempt savers with a 3%-yield checking account late last year, to Wealthfront launching its own 2.59% high-yield cash solution earlier this year (and quickly gathering $1B of additional assets), Personal Capital offering its own high-yield cash solution last month… and now Betterment coming out with its own version dubbed “Betterment Everyday.” Notably, though, Betterment was actually an early pioneer in providing a higher-yielding cash solution to clients, having several years ago launched a “Smart Deposit” option that used Quovo account aggregation to detect high idle cash balances in client bank accounts and then automatically transfer them to a higher-yielding short-term bond allocation (80% short-term U.S. Treasuries and 20% short-term corporates). However, the new Betterment Everyday is a bona fide bank account cash sweep option, that will route dollars directly into an FDIC-insured bank account (not “just” a series of short-term bond funds), and Betterment has indicated that it plans to offer a new Checking Account option later this year as well. And in a world where competition for cash is increasingly fierce, Betterment controversially tried to edge its promising savings account yield even higher with a 2.69% “teaser” rate (contingent on also signing up for its Betterment Everyday Checking waiting list), beating out Wealthfront’s recently increased 2.57% rate. In other words, robo-advisors appear to be increasingly subsidizing their cash yields above market rates as a “marketing expense” to attract new investors they hope to cross-sell (although all the players reduced their rates by 0.25% in the past week as the Fed itself lowered the Fed funds rate). What’s notable from an industry perspective, though, is that traditional broker-dealers and RIA custodians still make the bulk of their revenue from cash by offering low yields on the idle dollars and earning a healthy scrape – as it was recently announced that with Schwab’s recent acquisition of USAA, the company plans to sweep $7B of cash in USAA brokerage accounts into Schwab’s own related bank, generating an additional $130M of revenue for Schwab in the process. Which means robo-advisor platforms are increasingly giving away “for free” (by offering full-market or even above-market yields) what their traditional competitors use to drive profits, potentially putting newfound pressure on the “traditional” model of incumbents. In fact, Betterment has already noted that its biggest referrers to the Betterment Everyday platform are actually the advisors on its Betterment For Advisors platform… suggesting that, notwithstanding the success of robo-advisors enticing clients with high-yielding cash, there may be an even bigger hunger for advisory firms to use high-yield cash as a way to compete for new and existing client business!

AdvicePay Rolls Out Fee Calculator To Help Advisors Validate Their Fee-For-Service Pricing. Historically, few financial advisors have even actually been responsible for setting their own pricing. In the early days of commission-based compensation, the product manufacturer set the commission rate, and the only question for the advisor was whether he/she would get the sale, and how much money the client would put in at that commission rate. With the shift to the AUM model, advisors suddenly had more flexibility to set their own fees… except the “going rate” of a 1% levelized commission meant advisory firms quickly homogenized around a fairly standard 1% AUM fee, such that financial advisors today generally only need to explain their fees if they’re materially different than 1% of AUM. However, with the rise of various fee-for-service models, from standalone planning project fees to ongoing annual retainer or monthly subscription fees, advisors are for the first time entirely on their own to set – and justify – what their fees will be. In other words, when an advisor quotes the financial planning fee, and the client says “can you explain how you arrived at that price to work with you as my advisor?”, advisors today are hard-pressed to come up with an explanation short of “that’s just what we charge!” In this context, it’s notable that AdvicePay, a payment processor that facilitates clients paying one-time and ongoing financial planning fees directly from a bank account or credit card, has rolled out a new “Fee Calculator” tool. Which will not only allow advisors to better automate the process of creating invoices and then collecting fees (akin to AUM fee billing solutions for advisors charging AUM fees), but will facilitate advisors creating their own fee structures – from complexity-based fees, to charging a percentage of income and/or net worth – and actually show the calculation to the client (on the screen, or on the invoice) to help justify why their fees are what they are in the first place.

Schwab Validates Consumer Interest In Subscription Fee Pricing With $1B Of New AUM For SIP Premium In 3 Months. For years, the financial planning world has struggled with how to serve “next-generation” clients, especially Millennials, who are often outright rejected by established firms for failing to be able to meet the investment minimums those firms require to serve the clients profitably under the assets-under-management (AUM) model. For some advisors, the solution has been to set a minimum fee – rather than an investment account minimum – and leave the choice to clients about whether to engage or not based on that fee (rather than summarily rejecting them on the basis of assets alone). The caveat, of course, is that if all the firm does is investment management, a minimum fee quickly becomes the equivalent of a prohibitively expensive AUM fee (unless the client’s account size is already very close to the established minimum), leading firms to increasingly bundle some level of financial planning services into the minimum fee as well to justify the cost. Except financial planning itself can be time-consuming and service-intensive, which just necessitates an even-higher minimum fee instead, making it potentially even-more-expensive-looking on an AUM-equivalent basis. Accordingly, firms have increasingly been looking to the monthly subscription fee approach as a means to break down a (minimum) fee into more bite-sized chunks (especially important if those fees will be paid directly from cash flow and not an investment account), an approach pioneered by XY Planning Network and its nearly 1,000 advisors doing financial planning on a subscription fee basis for non-AUM clients. But now, the monthly subscription fee appears to be going mainstream, not only as a way to charge cash-flow-affordable financial planning fees for non-AUM clients, but as an alternative to the AUM minimum fee, with Schwab Intelligent Portfolios launching a new $30/month subscription service (dubbed Schwab Intelligent Portfolios Premium) earlier this year that bundled together investment management (with a low $25,000 investment minimum) and access to a CFP professional for ongoing financial planning advice. And now, just 3 months later, Schwab announced that it has already collected a whopping $1B of new assets under management into its SIP Premium solution, demonstrating substantial consumer interest in the financial-planning-for-a-monthly-subscription-fee approach. Raising rumors that Merrill Edge may also be considering a subscription fee model, questions about whether Vanguard’s popular Personal Advisor Services will soon match with its own monthly subscription fee model (priced at $28/month just to undercut Schwab?), and increased interest in advisory firms adopting their own subscription fee model to profitably serve more complex, non-AUM client needs as well.

Ritholtz Wealth Repudiates RIA Custodian Onboarding Automation Capabilities By Relaunching Liftoff With Betterment For Advisors. When robo-advisors first really hit the scene in 2012, their vision was to disrupt human financial advisors by offering asset-allocated portfolios directly to consumers for a much lower cost. Within 2 years, though, similar versions of “robo-advisor” technology were being built for human advisors, to automate and expedite their own onboarding process with clients. The caveat, however, was that most human advisory firms didn’t have the marketing reach and distribution to get the word out to Millennial investors (and robo-advice isn’t simply an “if you build it, they will come” offering). The exception, though, was Ritholtz Wealth Management, led by highly popular advisor bloggers Barry Ritholtz and Josh Brown, who in 2014, launched “LiftOff”, their own “robo” tool allowing smaller investors who read their blogs to automate the process of investing directly with the firm. Unfortunately, though, the following year, Envestnet acquired the Upside Advisor platform that Ritholtz was using to power LiftOff, and since then, LiftOff appears to have languished. Now, however, Ritholtz Wealth has announced that it is re-launched LiftOff, and will be using the Betterment For Advisors platform to power it. The significance of this news isn’t merely that Betterment has landed a high-profile advisory firm, but that Ritholtz Wealth is a very established firm, that already has traditional RIA custodial relationships, and the technology infrastructure in place to largely automate the process of trading and rebalancing… and still chose to work with Betterment For Advisors, at a 0.25% platform fee, instead of the “free” traditional RIA custodian. In other words, while RIA custodians have insisted that their onboarding processes are increasingly easy and automated, Ritholtz Wealth is effectively willing to pay 0.25% out of its own pocket just for the privilege of not use a traditional RIA’s (apparently still lackluster compared to Betterment) onboarding capabilities. Which on the one hand, is a strong statement that a firm well-positioned to actually succeed in the realm of “robo” advice – given the Ritholtz team's ever-widening digital marketing reach – still doesn’t think that traditional RIA custodians are up to snuff. And also raises interesting questions about whether RIA custodians could use technology improvements to justify their own transition to charging an ongoing custody fee (instead of making their money piecemeal from cash, trading fees, sub-TA fees, etc.), as the Betterment For Advisors deal with Ritholtz suggests there is some real willingness in the advisor marketplace to pay for better, truly-automated onboarding and investment management tools.

Techno-TAMPs Building Custom SMAs On The Rise As Ethic Investing Raises $13M Series A. The Turnkey Asset Management Platform (TAMP) first gained momentum in the 1990s, not coincidentally as leading advisory firms first began the shift from being stock- or mutual-fund-pickers, to creating diversified, asset allocated portfolios instead. After all, once advisors get into the business of creating standardized model portfolios that all clients will use, it becomes increasingly easy to just outsource the investment management function to a third party that can do the same investment research, model creation, and trading implementation, for all the advisors and their clients on a centralized basis with economies of scale. Ironically, though, the success of TAMPs and their centralized technology efficiencies are now increasingly experiencing their own existential crisis, as rebalancing and model management software becomes so ubiquitous that advisors can access investment models directly from model marketplaces and implement them almost entirely for free (albeit with the model marketplace subsidized by the underlying expense ratios of the funds themselves). Which in turn is either driving TAMPs to become more service-oriented – replacing the client servicing and communication tasks on top of the increasingly commoditized models – or pushing TAMPs even deeper down the technology path. For which the latest emerging trend is the rise of the “Techno-TAMP” – a third-party asset management firm that uses technology tools to allow advisors and their clients to hyper-customize portfolios for individual clients (effectively managed in a Separately Managed Account [SMA] format), but leaving the TAMP the responsibility to actually do the trading and implementing (as opposed to just the technology of portfolio design alone). Of course, if advisors are going to customize portfolios, the question quickly emerges of “what, exactly, would clients want to have customized?” For which the answer is often some form of SRI (Socially Responsible Investing or Sustainable, Responsible, Impact), where otherwise standard index-based portfolios can be customized to client-specific weightings around environmental, social, governance, and other similar factors. For which Ethic Investments has quickly become an early standout, having just closed on a $13M Series A round (on the tail of another $6.8M round just 10 months ago), with its own version of pre-built or technology-customized SRI portfolios for advisors. Notably, relative to traditional industry metrics, Ethic is still a very small TAMP, reported at “just” $200M of AUM. Still, though, the Ethic Investments round represents a broader trend of the new Techno-TAMP that is emerging – with competitors like OpenInvest and Just Invest – that are attempting to execute the TAMP outsourced model but using technology to allow for a deep level of advisor-client customization (often by leveraging the potential to disaggregating mutual funds and ETFs altogether and constructing Direct Indexing 2.0 portfolios from the underlying stock components instead).

Northern Trust Acquires Emotomy As Robo-Advisor-For-Advisors Platform Woes Continue. When robo-advisors first arrived in 2012 with the promise to disrupt human financial advisors, most human financial advisors quickly recognized that what robo-advisors were doing – providing basic asset-allocated portfolio implementation – was only a small part of a comprehensive financial advice relationship, and not necessarily a threat. However, robo-advisor technology was clearly superior to what traditional advisors had access to through their broker-dealers and custodians, leading to a rising demand for “robo-advisor-for-advisors” technology that would allow human financial advisors similar technology efficiencies to onboard new clients and implement their portfolios, leading to a wave of robo-advisor pivots and acquisitions, from Blackrock acquiring FutureAdvisor to Invesco acquiring Jemstep, Envestnet acquiring Upside Advisor and Legg Mason acquiring Financial Guard, and a wave of standalone upstarts trying to compete in the space, including Marstone, Riskalyze’s Autopilot, RobustWealth, and Emotomy. The challenge, however, is that several years later, adoption and growth of most of the “B2B” robo category has been muted at best. In part, the challenge is simply that onboarding capabilities are something most advisors expect from their broker-dealers and RIA custodians directly and appear loathe to pay separately for such middleware technology. In other cases, the challenge was that the B2B robo-advisors had some valuable unique features, but in an attempt to broaden their services, built so many different components that they created substantial overlap to existing advisor systems, effectively becoming a misshapen jigsaw puzzle piece that didn’t actually fit for most advisors. And so appears to be the demise of Emotomy – which was variously an onboarding tool, a proposal generation tool, a performance reporting engine, rebalancing software, and a client portal – which this month announced it was being acquired by Northern Trust’s Asset Management platform (via Emotomy’s parent company Belvedere Advisors), ostensibly in the hopes of using the technology as a value-add and eventually a distribution channel for its own asset management strategies. Notably, though, Emotomy had actually already begun to make shifts towards supporting asset managers, with its Emotomy Turbo offering that gave asset managers a white-labeled digital portal to manage more of their own investment back-office and integrations to partners and even a built-in RIA database of advisors. Which means ultimately, Emotomy’s technology may still get put to good use as an internal tool for Northern Trust itself. But is a powerful reminder that even with useful technology, it’s still crucial to have an effective pricing model and distribution strategy that actually fits into the realities of the advisor’s current technology ecosystem.

Will Plaid’s Student Loan Data Feeds Finally Enable Student Loan Planning Software? The financial planning software that advisors use is largely a reflection of the ways that advisors get paid, with in-depth modules on investments and retirement planning (so advisors can manage the retirement portfolios), life insurance (to demonstrate the need for advisors who sell the product), estate planning (to support the sale of life insurance for estate planning purposes), and college planning (to support the sale of 529 plans), but relatively little for cash flow planning and budgeting, or the liability side of the balance sheet (from mortgages to student loans), neither of which are areas where advisors have historically had products to sell. However, as advisory firms place relatively less emphasis on the asset management side of the business, and more on holistic financial planning advice (including cash flow and debt management), there is a growing interest in financial planning software that can support a holistic advice process. Of which one of the stickiest areas is student loan planning, which has a complex maze of unique rules of its own, with key differences between Federal versus private student loans, and specialized programs that only apply to certain types of student loan debt and not others… and what is largely a manual process to gather all of the relevant data necessary to do such analyses in the first place. Which makes it all the more notable that Plaid, the account aggregation data aggregator (that recently acquired Quovo) announced this month a new “Liabilities” module for its account aggregation data flows, that will provide data feeds for student loan debt (and eventually mortgages, auto loans, and credit cards as well). And while the early adopters of Plaid’s new Liabilities data flows so far are student loan consolidation platforms, the availability of student loan data feeds from Plaid may finally power the rise of better student loan planning tools within financial planning software for advisors, especially as the shift to financial planning for next-generation clients demands better tools (with over $1.5 trillion of student loan debt, concentrated in the hands of next-generation clients as one of their primary financial planning concerns). Unfortunately, though, it appears that at least initially, Plaid’s data feeds will draw primarily from the student loan servicing platforms themselves, which can provide current loan balances and interest rates, but doesn’t necessarily include the additional key information regarding loan history, disbursement dates, type of Federal repayment plan, etc., that is vital to effective student loan planning and is currently only available from the government’s own National Student Loan Data System (NSLDS). Which means Plaid’s current Liabilities module alone probably won’t be enough to entirely crack the marketplace for student loan planning software for advisors. Nonetheless, with more account aggregation opening up around student loans, it seems only a matter of time before additional data feeds with the missing key data points begin to emerge and fully enable the next generation of student loan planning software?

Envestnet MoneyGuide Partners With Jackson National To Roll Out “Secure Income Modeling” Annuity Illustration Tool. Earlier this year, MoneyGuidePro announced the coming launch of a new more advanced version of the software, dubbed “MoneyGuideElite”, that would specifically delve deeper on modeling retirement liquidation and retirement income strategies. Included in the new offering was a tool called “Secure Income Modeling”, that would project a client’s Essential Expenses against their available sources of “secure” income (e.g., Social Security, annuities, etc.), including the ability to model specific annuity guaranteed income features as a part of the Monte Carlo projections. And now, Envestnet MoneyGuide has announced a new partnership with Jackson National Life, which will provide a group of “Advisory Integration Consultants” – i.e., Jackson National annuity wholesalers – who will help to train advisors how to use the annuity modeling tool and incorporate annuity solutions into their practices (though the trainings are reported to be “carrier agnostic”). The news comes as Envestnet increasingly repositions itself to be a distribution platform not only for TAMP and SMA solutions as it has in the past, but a widening range of annuity, insurance, and even credit, as a part of its new Insurance and Credit Exchanges, where MoneyGuidePro’s financial planning software becomes both the illustration tool to validate the product need, and the pathway by which advisors will be able to implement the solutions (with direct integrations to Envestnet’s various exchanges). In other words, Envestnet is positioning MoneyGuidePro as a distribution channel for investment, insurance, and credit solutions, where Envestnet participates by being compensated for distribution from the products that are made available on the platform (to the point that someday, it could conceivably even make MoneyGuidePro free, akin to how Uber, Airbnb, and Amazon platforms are free, just to participate in the economics of advisors helping to implement client purchases via their platform). The big question mark, though, is whether advisors will actually begin to implement insurance and annuity solutions through MoneyGuidePro and Envestnet’s Insurance Exchange in the first place… though with the rollout of “Advisory Integration Consultants”, Envestnet is clearly committed to the strategy and a desire to drive adoption of its new wide-reaching platform model.

Salesforce Attempts To Move “Downmarket” To Small-To-Mid Advisory Firms With New “Lite” Offering. When it comes to CRM software for advisory firms, the landscape is dominated by a series of "niche" players (largely “homegrown” solutions built by advisors, for advisors) that have developed solutions specific to the needs of advisory firms, including Redtail, Junxure, and Wealthbox… and Salesforce, the mega-CRM platform that spans virtually all industries and has been increasingly active as a competitor in financial services (including and especially with the launch of its own Financial Services Cloud). From a pure capabilities perspective, the flexibility and robustness of the Salesforce platform has quickly made it the most common CRM of choice for the largest advisory firms and enterprises… but with very little adoption amongst small-to-mid-sized firms that cannot afford the level of customization necessary to make Salesforce effective in their firms (or outright just don’t want to pay what is a substantially higher per-user fee than the available alternatives). But now Salesforce appears to be making a move to come “downmarket” and compete more directly with the other advisor CRM platforms, with a new “lite” version of its Salesforce Financial Services Cloud, dubbed “Grow Client Relationship Fast Start,” which will package together a custom offering from Skience, which supports data aggregation and a custodial integration feed from (just) one of the four major custodians, along with third-party service and implementation support. In addition, the new Salesforce offering will include financial planning software integrations with MoneyGuidePro and eMoneyAdvisor, with additional data feeds, integrations, and construction of dashboards available for a separate (additional) cost. Pricing for the new Salesforce offering has not yet been provided but is expected to be “competitive” as Salesforce tries to expand its reach. Ultimately, though, Salesforce maintains that, in the long run, its value-add will be what it can accomplish beyond just “CRM” alone, including leveraging artificial intelligence for better data analytics… though it remains to be seen whether small-to-mid-sized advisory firms even have enough “big data” to be effectively analyzed for Salesforce’s AI tools to be a relevant value-add in the first place?

Morgan Stanley Partners With Box To Power Secure Client File Vault. With the ongoing shift of paper to the digital cloud, advisory firms must simultaneously be able to handle “paperwork” with clients in a digital format (e.g., electronic onboarding and e-signature tools), and convert their own paperwork to digital with cloud-based document management systems (e.g., DocuPace, LaserFiche, or WorldDox). Yet there’s also a challenge of helping clients handle their own conversion of historically-paper files to digital (especially for key documents like wills, trusts, and tax returns), and having a secure way to transfer such files and work with them collaboratively… which in recent years has led to the rise of various “secure client vault” solutions. The challenge with client vaults, though, is the delicate balance between absolute data security of key files with important information, secure (i.e., encrypted) file transfers… and not making the process so cumbersome and difficult (in an effort to make it so secure) that no client actually wants to go through the trouble of using the solution. And so it’s notable that wirehouse Morgan Stanley recently announced that it was launching a partnership with Box.com to offer a new Client Vault, and explicitly cited for its balance between “a rich client experience and meet[ing] the strict security standards for cloud-based solutions” against more consumer-familiar solutions like Dropbox or more industry-specific offerings like Citrix Sharefile or Egnyte. Of course, for many advisory firms, a standalone Client Vault solution is unnecessary, because it’s already offered as part of some other client portal system (e.g., tied to the clients’ portfolio performance reporting portal, or their financial planning portal). Nonetheless, for advisory firms that are still exploring options for a standalone solution, and remain particularly concerned about the security implications of offering a secure Client Vault, it’s hard to beat the implied endorsement of Box surviving the incredibly intense vetting process of a major wirehouse like Morgan Stanley.

Envestnet Tamarac Grows Beyond Independent RIAs With Merrill Lynch Mega-Deal. 20 years ago, the best technology in wealth management lived in wirehouses, which had the economies of scale and base of 10,000+ advisors over which they could amortize the costs to develop the best (proprietary) portfolio performance reporting tools, while independent RIAs operated on the then-fledging Schwab Advisor Services platform and could only choose from a small handful of independent providers, including then-startup Tamarac. Now, however, the rise of the internet has made it possible for independent software providers to centrally develop and manage a single base of code, deployed for hundreds or even thousands of firms, and rely on APIs to integrate to whatever other tools their advisory firm customers use… such that it’s now the independent software companies that have the largest economies of scale, with as many as 10s of thousands of users, while wirehouses struggle to iterate their own proprietary tools rapidly enough to keep pace. Consequently, one of the major advisor FinTech shifts in recent years has been the decision of even the largest wirehouses to begin moving away from their own proprietary tools, and instead to license and white-label independent software into the wirehouse environment. And in this vein, Envestnet this month announced a blockbuster deal to become the portfolio management and performance reporting software that will power Merrill Lynch Private Wealth Management, and in the process replacing Merrill’s own proprietary My Financial Picture solution. Notably, Merrill will only be rolling out Tamarac to about 200 advisory teams in its PWM division – and not the entire firm – but the decision to roll out to PWM first (Merrill’s "crème de la crème" advisors) is a huge vote of confidence for Tamarac, and with $2.4T under management at Merrill in total, the deal is an absolutely massive win and further growth opportunity for Tamarac (that today “only” serves 1,000 RIAs that manage “just” $1.2T, instantly making Merrill into Tamarac’s biggest customer). From a capabilities perspective, the driver appears to be not just Tamarac’s performance reporting in general, but specifically, its ability to easily account-aggregate in positions from other firms, including alternatives positions via PCR, which is both a benefit to the client (to be able to see holdings consolidated in one place), and obviously an opportunity for Merrill Lynch advisors as well (to see where held-away assets are located, and even how they’re performing). And given what was likely a competitive situation to other performance reporting tools, it’s equally notable that Merrill Lynch chose Tamarac, and not high-net-worth performance reporter Addepar (that Morgan Stanley selected as its own new system 2 years ago), a decision that appears to be driven at least in part by the fact that Merrill is already a customer of Envestnet-owned Yodlee and FinanceLogix (and the aforementioned PCR integration for non-traditional alternatives that are held away). Ultimately, though, Tamarac maintains that it is not moving away from its RIA core with the wirehouse deal, and instead simply that the wirehouse’s needs and demands will drive and support new Tamarac enhancements that will ultimately be valuable for the RIA community, too. Nonetheless, the key takeaway is that the growth of RIA software is now reaching the size and scale that it’s no longer “just” for independent RIAs anymore!

In the meantime, we’ve updated the latest version of our Financial Advisor FinTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Will Orion be able to leverage Advizr to expand financial planning capabilities, or will Advizr conflict with Orion’s existing planning-centric firms? Will Salesforce be able to gain traction in the small-to-mid-sized RIA market? Will MoneyGuide’s Secure Income Modeling tool actually be able to drive annuity adoption in the RIA community? Please share your thoughts in the comments below!

(Disclosure: Michael Kitces is a co-founder and owner of XY Planning Network, and AdvicePay, both of which were mentioned in this article.)

Any advice on where to go to find a TAMP that will host my model portfolios so that other advisors can access them? The TAMPS I have spoken to thus far won’t work with startups. Thanks.

Randy,

Most TAMPs run their own models, rather than work with third parties and their models.

You might try some of the more ‘platform’ style TAMPs like Envestnet, Adhesion, and SMArtX, which actually function more like TAMP-marketplace-platforms than just being their own packaged-and-delivered TAMPs. Along with some of the Model Marketplaces like TD Ameritrade’s via iRebal.

Hope that helps a little!

– Michael

Outstanding column. Thank you!