Executive Summary

In the movie The Godfather, Michael Corleone, the youngest of three sons, is chosen as successor of the New York mafia family throne, after his eldest brother is slain and over his older brother Fredo. While tradition generally designates the eldest child as successor in most family businesses, Fredo Corleone, less intelligent and weaker in character than his younger brother Michael, is superseded by Michael. The incendiary family dynamics that ensue, sparked by Fredo’s anger and resentment toward his own family, end with betrayal and in the tragic demise of Fredo himself.

In real-life family businesses, similar dynamics (though typically not as grave) can arise in which children may get overlooked for leadership positions or roles of successorship because of their lack of experience or skill. And yet, business-owner parents often feel obligated to ’take care of’ their children, and sometimes end up giving them inconsequential roles in the business because they want them to at least still be involved (which can sometimes also include a disparately high level of compensation because they want to provide what they can for their child). Alternatively, children can at other times be given roles that they are outright ill-equipped to handle (i.e., nepotism), which can result in bad decisions that cause harm to the company itself.

Thus, while these business-owner parents may only have the best intentions for their children, the behaviors and family dynamics that result can be counterproductive, arising in circumstances that can ultimately hurt the family business. This situation is called the “Fredo Effect”, and refers to the damage that results from the dysfunctional interactions between parents and children in the context of a family business.

The primary cause of the Fredo Effect often boils down to “role ambiguity”, in which parents have difficulty separating their role as business owner from that of parent. The child, too, can have role ambiguity challenges, as they often have unclear guidance about their role in the business, complicated by (often unfair) overcompensation they might receive, and may thus struggle to understand what specifically is expected of them.

Not only are parents and children affected by the Fredo Effect, but other employees and family members involved in the business are also impacted. Seeing a child-employee get compensated and otherwise rewarded for a job-not-well-done can be demoralizing to workers who are diligent and dedicated to their jobs, but who get none of the recognition or benefits that “Fredo” gets. Over time and left uncorrected, the situation can lead to severe erosion of employee morale and working conditions.

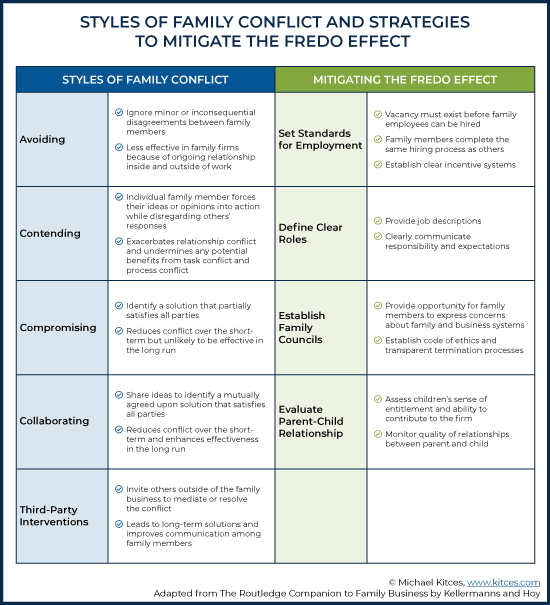

The most effective way to mitigate (and potentially prevent altogether) the Fredo Effect is to ensure that formal, well-written job descriptions are in place, which clearly define the standards and expectations for each role in the company. Establishing a “family council” can also provide a forum to facilitate open communication between family members, which can help them work through role ambiguity challenges by identifying (and delineating between) personal and business concerns, and talking them through with family members.

Financial advisors can help their clients by offering services to assist them implement these solutions. For example, an advisor can assist their family-business-owner clients in reviewing job descriptions to ensure that they clearly define the role, requirements, and expectations for each job; that a sensible reporting structure is in place; and that growth and development opportunities exist for all current employees. Advisors can also participate as an objective expert in family council meetings (and also facilitate the participation of other subject-matter experts as needed). And finally, advisors can help family-business-owner clients establish their own support system with each other, by coordinating introductions and hosting instructional events around issues relating to the Fredo Effect.

Ultimately, the key point is that many family-business owners struggle with role ambiguity issues when it comes to their children. The children, too, face role ambiguity challenges that can lead to dysfunctional behaviors, which can be potentially harmful for the business itself. Financial advisors with family-business-owner clients are in a unique position to serve as an objective third-party expert to help the family mitigate the effects of Fredo, and ideally prevent them from arising at all in the first place.

The Fredo Effect: A Family Businesses’ Poorest Performer (Or Worse)

If you’re thinking Lord of the Rings right now, this is not quite right. That is Frodo. And if you’re now thinking, “Well then, who is Fredo?”, then think of another super-famous multi-part film. Fredo was the middle son in The Godfather saga, based on the novel by Mario Puzo. Frederico “Fredo” Corleone was the older brother of Michael Corleone (played by the very young Al Pacino).

Fredo is infamous because, even though older than Michael, he was overlooked as the successor to the Corleone’s crime syndicate after patriarch Don Vito (played by Marlon Brando, Academy Award winner for Best Actor) stepped down and Santino “Sonny” Corleone, the eldest of the three brothers, had been brutally gunned down and killed. Fredo was not chosen for the position because he was, putting it nicely, a poor performer (and was thus sent to Nevada to learn the casino business, becoming an alcoholic, womanizer, and known for his poor business deals). Ultimately, Fredo betrays the family, sabotaging Michael’s work out of jealousy and anger, and tragically earns the “kiss of death” – the signal leading to his bloody demise – from his own brother.

Accordingly, the “Fredo Effect” is a term coined by researchers Roland Kidwell, Franz Kellermanns, and Kimberly Eddleston in 2012, who surveyed 147 family members of family-run businesses to examine how relationship dynamics potentially bring rise to conflict manifesting in “damaging unethical behaviors.” The term is used to refer to the person in the family business who can be seen as a ‘problem child’ or obstacle to progress. Fredo would be the person that could be or is often described as less skilled or less proficient – this is not the person you trust to get the job done or to come up with good ideas. Looking from the outside in, Fredo would likely be the person one would describe as only having a job because their parents gave them one.

Yet, this is more than just another name for nepotism. The Fredo Effect is actually more about the fallout from trying to undo ‘bad’ nepotism gone wrong (as nepotism or more generally hiring family members into the business can go right, too, and is often what makes a family business so great), which, according to research, is common. Still, though, of the firms that the researchers interviewed, one-third of the firms admitted to having a “Fredo”.

Notably, a key point of the Fredo Effect is that while Fredo generally gets their job because of nepotism, they aren’t usually placed in leadership roles (or given high-level responsibilities) because of their lack of experience and/or competency, which helps to protect the business at least to some extent. Yet the fact that experience and competence often trump nepotism (especially in well-run businesses) can turn out to be the trigger that causes the person benefitting from the nepotism (i.e., Fredo) to backlash against the family firm. Which, in turn, can cause the family firm to retaliate against Fredo.

As such, the Fredo Effect underscores that, while an impediment to the family businesses’ progress can be inconvenient, Fredo’s behavior (and the family’s reaction to Fredo) can quickly escalate into something much more disruptive. Kidwell et al. state that the “Fredo Effect undermines beneficial resources that are critical for the family firms, e.g., entrepreneurial capabilities, implicit knowledge, and social capital”.

More to the point on exactly how Fredo (and family) negatively impact small businesses in particular (as again not all nepotism is bad), is that succession is hard, and family relationships make it harder. For instance, research by Ibrahim, Soufani and Lam in 2001 found that less than a third of family firms successfully pass their business on to the second generation, and only about half of that one-third make it to a third generation, reinforcing the saying “shirtsleeves to shirtsleeves in three generations”.

Types Of Work Conflict That Spawn In Family Businesses

Why are the transition rates of family businesses from one generation to the next so low? The Routledge Companion to Family Business, edited by Franz W Kellermanns and Frank Hoy, compiles some general research on work conflict that identifies three types of problematic conflicts:

- Task conflict: Conflict over content and goals of the work

- Process conflict: Conflict over how work should be accomplished

- Relationship conflict: Conflict with interpersonal relationships

In family-run businesses, relationship conflict can be the toughest, as it is often magnified by what is called the “dual-role dynamic”. This is when a person’s work role and family role begin to mix together. For example, while a business owner can fire Fredo, they will still have to socialize with Fredo at family events. And the challenge of successful transitions is due in large part to the relationship conflict that family businesses struggle with.

Basically, Fredo can potentially make both home and work environments very uncomfortable. And the discomfort is not experienced only by family members; it can also be uncomfortable for co-workers who do not share bloodlines. It is disheartening for any worker to watch another worker move up, get a raise, or join a project simply because they are a family member and despite the fact that everyone (family and non-family) knows the person just is not capable of cutting it. What is more, keeping Fredo around can also send the wrong reinforcement messages. For instance, others may perceive that Fredo receives praise/pay for acting out or for unethical or disruptive behavior, and might assume that they too can be rewarded for similar actions.

The two previous examples were internal (e.g., problems in family meetings and within the firm), but problems with Fredo can also impact situations externally. For instance, if a fight between family members is public, it is not unheard of for the relationship conflict to impact actual market value. One example is Market Basket, a US-based grocery, where the CEO, Arthur T. Demoulas, was forced out by a cousin over questionable business decisions. When the fight became public it impacted the workforce, resulting in a strike that ultimately cost the company $10M per day and likely impacting its customer base.

How Fredos Are Formed And How To Mitigate The Fredo Effect

As one would guess, the process of stopping Fredo can be extremely dangerous for familial bonds, let alone company relationships, and is complicated by the family dynamics involved. As previously discussed, the Fredo Effect forms when family businesses blur the lines between work and family, which is (as it turns out) natural and normal to do – and hence probably why the Fredo Effect is so commonly found.

For instance, in a family setting we would expect that parents take care of their children and may give more or less to a child based on that child’s needs. When one child is sick, we stay home and care for the child, while the other children go to school. Unfortunately though, this same sort of natural, nurturing, and common parent-child behavior – to favor or take care of the weak child – can cause problems in the workplace.

When a child employee isn’t performing well in the family business, the parents/business owners may give their child a raise or a new title and hope that this ‘bump’ in recognition and/or responsibility will spur them into action. This is generally not a good strategy, though, as it often just serves to reward the prior bad behavior.

Moreover, what can make a great parent is often what makes a bad boss, because it is difficult not to ‘boss’ in the same way that you parent when your employees are your kids or family members. In other words, the issue that breeds the Fredo Effect is role ambiguity at all levels of the family – not just for Fredo, whose roles as child and employee may not be well-understood (by Fredo and everyone else), but also for the business owners who may struggle with balancing their actions between running a successful business as a business owner and nurturing/enabling unmotivated family members as a parent.

For instance, when it comes to discipline, parents may find it hard to rebuke their children and instead choose to invoke permissive parenting styles in the workplace (e.g., instead of firing Fredo for a job poorly done, they actually give Fredo a raise or promotion to encourage him to do better). The problem with this behavior is that Fredo coming to expect (undeserved) generosity can foster a sense of unfounded entitlement, where children employees might believe they deserve the next raise as well without doing anything to actually earn that raise either.

Children employees who lack the discipline to do their assigned jobs (yet who are still rewarded anyway) also weaken connections between the family and employees of the family firm. Again, the child’s belief that they are entitled to certain power, respect, and money (without actually having done anything to earn this power, respect, and money) can cause the child to become increasingly dependent on their place in the firm, and the relationship (between family members and firm) to become increasingly unstable. For instance, even though the child may sense that their power, respect, money, and relationship is based on a pretentious pseudo-role in the firm, they still crave feelings of being respected, supported, and appreciated; accordingly, the child’s suspicion that their position may actually be unstable and unnecessary might lead them to demand even more from their parents, or to act out by exerting power on others as a reflection of their own insecurities.

The senior generation may struggle as both parents and bosses with preferential treatment based on family ties instead of on merit. This can be seen in situations where there is a belief that a certain child might be at a disadvantage and ‘needs’ help more than others. For instance, one child employee may need more because they have a baby (a grandchild), so they get a raise over another child employee (or a non-family employee) who might actually have been doing all of the work. The senior generation wants to help as a parent, but in doing so brings about other problems such as resentment and confusion about the company's work ethic.

Role ambiguity also exists for lower generation family members. For instance, some children of the senior generation working in the firm may be privy to private business information (e.g., finances), while others are deliberately kept out of the loop. This can make family gatherings uncomfortable. For example, if the company has had a rough couple of quarters and yet Fredo is spending their profit distributions lavishly (without even realizing the company may be ailing) within their personal lives, it may feel very awkward and may even create animosity between family members who may feel that Fredo (and the firm management, who is rewarding Fredo to begin with) is behaving irresponsibly with respect to the business, while they are tightening their belts and fearing for their jobs.

Children may also be given jobs that they are simply unprepared for. Perhaps this is because the senior generation wanted to kick-start a struggling lower generation family member, or it may just have been the way the cards fell. Whatever the reason, though, being under-qualified for key roles could endanger the firm (e.g., perhaps the employee gives bad advice or implements poorly-designed strategies that hurt the company’s performance), not to mention being stressful for the child, as failing at their job would not only make them a bad employee but also (at least in their mind) a bad son/daughter.

Good Job Descriptions As a Remedy For The Fredo Effect

So what is a family to do? How can they save themselves from themselves (and the Fredo Effect)? Research presented in the Routledge Companion to Family Business says that formally written job descriptions are the key to untangling role ambiguity (and in many instances) avoiding it altogether in the first place.

Of course, formal, written job descriptions are an important best practice for businesses generally. But they are especially important to avoid the Fredo Effect by eliminating role ambiguity. A well-written job description sets the path for who is (and is not) qualified for each role, and advancement in that role.

Along with helping to curb the Fredo Effect, well-written job descriptions can also aid in the employee review process by allowing an impartial reviewer to conduct a fair assessment of the employee based strictly on job responsibilities. For example, a good job description can facilitate a comprehensive 360-degree review, which takes in comments from co-workers and bosses alike, and can be very beneficial for employees.

Family Council Meetings Foster Healthy Communication And Can Help Minimize Role Ambiguity

Helping Clients With A Family-Business Deal With (And Prevent) The Fredo Effect

A big concern with a contentious family dynamic is protecting the senior generation (and the underlying value of the business itself), and financial advisors can absolutely facilitate this without injuring their relationship with lower generation family members by putting together specialized client offerings that cater to business owners of family-owned businesses.

For instance, an advisor with a new client who is a family business owner can offer to review the business’ job descriptions as part of the intake process. For ongoing family-business-owner clients, a “job description review” item can be added to the annual client service calendar, and the job descriptions can be reviewed for missing details as well as potential future gaps as the succession of the business gets underway. If the new or ongoing client has no job descriptions in place, the advisor can offer to help create them.

Some key points during a job-description-focused client meeting could be explored with these following questions:

- Identify the roles and business structure:

- What is the organization (“org”) chart of the business?

- What are the key jobs and accountabilities?

- Who reports to who and how?

- What are the ideal standards (education, experience) for those jobs?

- Identify opportunities for growth and change:

- Does everyone in a current role meet the standard requirements for their job? Do they get it, want it, and have the capacity to do it? If not, how do they need to grow or develop?

- What other roles or new roles might be needed in the future?

- Who and how does one groom current or new employees for positions (whether existing or newly created)?

A good job description will clarify who fits and who does not fit. With a job description in place, the next step involves encouraging Fredo to step up… but not without providing some guardrails around the parents. For example, Fredo can remain in their current role, but also be told that if they complete training, they may receive a new title or be added to a different project. However, if they do not complete the training, they risk being demoted or forfeiting their eligibility for a raise until the training is complete.

In the context of Fredo-fixing, another thing to be mindful of is that both the parent/business owner and Fredo are likely going to have a tough time with any new rules that change the existing dynamic. Fredo might like getting raises, and may resent the structure that now makes it obvious they are not fit for their job. Which in turn means a financial planner can anticipate that while the parents (senior generation) may be on board to create this structure (and feel good about it), they may be challenged to ever actually implement the new plan in fear of offending Fredo. In these instances, it may make sense to help the client identify an incentive program (as noted above) to encourage Fredo to strive to meet the standards required by his role.

The incentive program can essentially serve to create a choice for Fredo, and give them the opportunity to prove their worth, instead of forcing them into a new situation against their will (or continuing to enable their poor performance or bad behavior). Fredo chooses to become better (or not), but the consequences of that choice are clear and need to be strictly enforced. In a well-designed incentive program, the outcome can easily be a win-win.

Another thing financial advisors can do, particularly to help support business owner parents if they do have to create (and enforce) an incentive program, is to take some responsibility for the changes happening within the business. Again, Fredo is not going to love being held to a new standard, and their parents may struggle with saying no to the old way of doing business… but the advisor can easily step in and assert that the new strategy is in the interest of helping the business succeed, effectively giving the parents room to ‘blame’ the financial advisor for the new structure (and reduce the family conflict of feeling that they are imposing it on Fredo directly)!

Having a one-on-one meeting with Fredo also gives the financial advisor the opportunity to give direct recognition to Fredo (which is what Fredo often desires), while sharing their objective perspective of the situation as a financial planner. This can actually help to minimize the risk that Fredo will get angry and resentful by serving as a safe ‘buffer zone’, away from the family, to hold the conversation and address the fear and relationship issues that arise. Fredo (and the family) may also not even realize there can be another way – working for the family doing X job is not the ONLY job out there.

The key, though, is simply that in the same vein as handling a “spender” when parents just can’t say no, advisors can step in as the one to say “no” to Fredo. Financial advisors can suggest that all employee raises must be approved through their office, and can involve outside business professionals in family council meetings to help shoot down poor ideas (or unearned raises or promotions).

A final option for advisors trying to better help clients who own family-run businesses is to use their own small business networks (as many advisors are small business owners themselves) and to make recommendations to third parties when appropriate. Alternatively, some advisors who are crafting a niche in serving small business owners may even seek to cultivate a network of various external experts to support their small business owner clientele.

For instance, advisors can keep a list of recommended professionals that can be presented to clients to choose, a-la-carte style, who they might want to bring in for different situations. The third parties may include:

- Professional mediators or negotiators;

- Interim CEOs, business strategists, or business consultants;

- Family counselors; and

- Industrial Organizational psychologists.

Alternatively, for advisors who are uncomfortable disrupting family dynamics and getting directly involved in the family personally, consider running a lunch-and-learn session to address issues relating to the Fredo Effect. As while the Fredo Effect is probably common among the client base of advisors who often work with small family-run business owners, many clients might appreciate information helping them understand how to deal with it and to prevent Fredo from appearing in the first place. A lunch-and-learn session can also introduce clients to other third parties that specialize in Fredo issues, and can serve as a venue to disseminate information that all small business owners might find beneficial (e.g., creating effective job descriptions).

In some situations, it may also be appealing for advisors to introduce clients to one another, especially if one client has had to navigate the Fredo Effect in the past. This can be done as part of a lunch-and-learn session, or in a more intimate meeting that the advisor simply arranges if both of the clients agree to it.

Ultimately, the Fredo Effect comes about because of issues with role ambiguity and insecurity within a family business, between parents who are also business owners, and children who are also employees, where it’s often difficult to keep those roles separate and distinct.

Advisors who have worked with a family to create a Family Council, develop a family motto, and are armed with the job descriptions and an idea of potential future positions for the business can help Fredo (and his/her parents) by discussing both their financial and personal goals.

Sometimes, this space may be all they need to admit that they might want to do something different altogether. Alternatively, though, the advisor may also create a plan together with Fredo to help get them on track… onto whichever path they end out choosing.

Leave a Reply