Executive Summary

One of the fundamental challenges that professionals face when providing recommendations to consumers is that the recipient may struggle to fully understand the ramifications of their decision about whether or not to accept and follow the recommendation in the first place. After all, professionals tend to be engaged with respect to matters that are especially complex or challenging – such that the average person cannot make the decision quickly or effectively on their own, and must rely on the services of a professional. Yet, in a world where consumers still must give their consent to pursue recommendations that may have adverse outcomes, it’s hard to be certain that the consumer really understands enough to give their “informed” consent in complex matters in the first place. Accordingly, various professions have evolved over time the framework of what it takes to ensure a consumer is giving “informed consent” – to act on a recommendation made by the professional with full awareness of the potential risks that it may entail.

And in its latest update to its Code of Ethics and Standards of Conduct (“Code and Standards”), CFP Board will now require that CFP® professionals obtain informed consent with respect to any recommendations they make to clients that may entail a Material Conflict of Interest, to be certain that the Client truly understands the prospective conflict before deciding whether to engage the CFP® professional. In practice, this will entail not only providing upfront information about the CFP® professional’s services and compensation (which may be delivered orally for Financial Advice engagements but must be written for Financial Planning engagements) but also disclosures of the CFP® professional’s Material Conflicts of Interest (which may be oral or written), and obtaining the Client’s informed consent (by any means desired, though clearly for professional liability protection, CFP® professionals will likely want to document this in writing!).

Fortunately, the reality is that for most CFP® professionals individually, such disclosure documents will have already been created by their RIA as their Form ADV Part 2 (for an investment adviser representative), or by their broker-dealer (as a registered representative), along with their respective Form CRSs, such that few will have to create new and separate documents themselves. Nonetheless, being aware of the obligation to provide such information and disclosures, and, in particular, the burden to obtain informed consent (and a likely desire to document it, either with contemporaneous notes in the advisor’s CRM or perhaps with a delivery-and-acknowledgment receipt), means CFP® professionals will still need to be cognizant of what it takes to comply with the new rules.

In turn, CFP Board’s new Code and Standards also expand the obligations of CFP® professionals to report external disciplinary matters to CFP Board, comply with CFP Board investigations, and adhere to CFP Board’s Terms and Conditions. Recognizing that, in the end, the CFP® marks are not a formal license (and CFP Board is not a government-sanctioned regulator), but CFP® professionals who pay CFP Board to use the CFP® marks still, in the process, agree to adhere to CFP Board’s rules… providing CFP Board with the means to ensure that CFP® professionals uphold rules of professionalism, or risk having their CFP® marks suspended or permanently revoked!

As a part of its new Code and Standards first approved on March 28th of 2018, which became effective on October 1st of 2019, and were enforced beginning on June 30th of 2020, CFP Board will impose new obligations on CFP® professionals with respect to how they manage and disclose Conflicts of Interest to clients, provide Engagement information to clients, and report disciplinary matters to CFP Board itself (and cooperate with its Terms and Conditions and its investigations).

The crux of these obligations is to ensure both that prospective clients of CFP® professionals have a clear understanding of the Scope of Engagement, the nature of Engagement, and any relevant factors that may impact the advice received pursuant to that Engagement… and that CFP Board remain apprised of situations where CFP® professionals should be disciplined for failing to adhere to CFP Board’s Standards and for giving inappropriate advice.

Providing Requisite Information About Services And Compensation To Clients (And Prospects)

One of the core requirements of the previously-6-step-now-7-step financial planning process is to clearly establish the scope of the relationship with the Client, which includes both making the Client aware of the services the CFP® professional provides (and what they cost), and any other pertinent information that the Client would need to make an informed decision about engaging the CFP® professional’s services.

However, CFP Board’s Code and Standards provide differing requirements about the depth and breadth of the CFP® professional’s description of services and supporting information, depending on whether the CFP® professional is providing (comprehensive) financial planning advice (to which the full Financial Planning Practice Standards would apply), or instead is simply providing “Financial Advice” instead, which is broadly defined as covering:

“Financial Advice” is…

- a communication that, based on its content, context, and presentation, would reasonably be viewed as a recommendation that the Client take or refrain from taking a particular course of action with respect to:

- The development or implementation of a financial plan;

- The value of or the advisability of investing in, purchasing, holding, gifting, or selling Financial Assets;

- Investment policies or strategies, portfolio composition, the management of Financial Assets, or other financial matters; or

- The selection and retention of other persons to provide financial or Professional Services to the Client; or

- The exercise of discretionary authority over the Financial Assets of a Client.

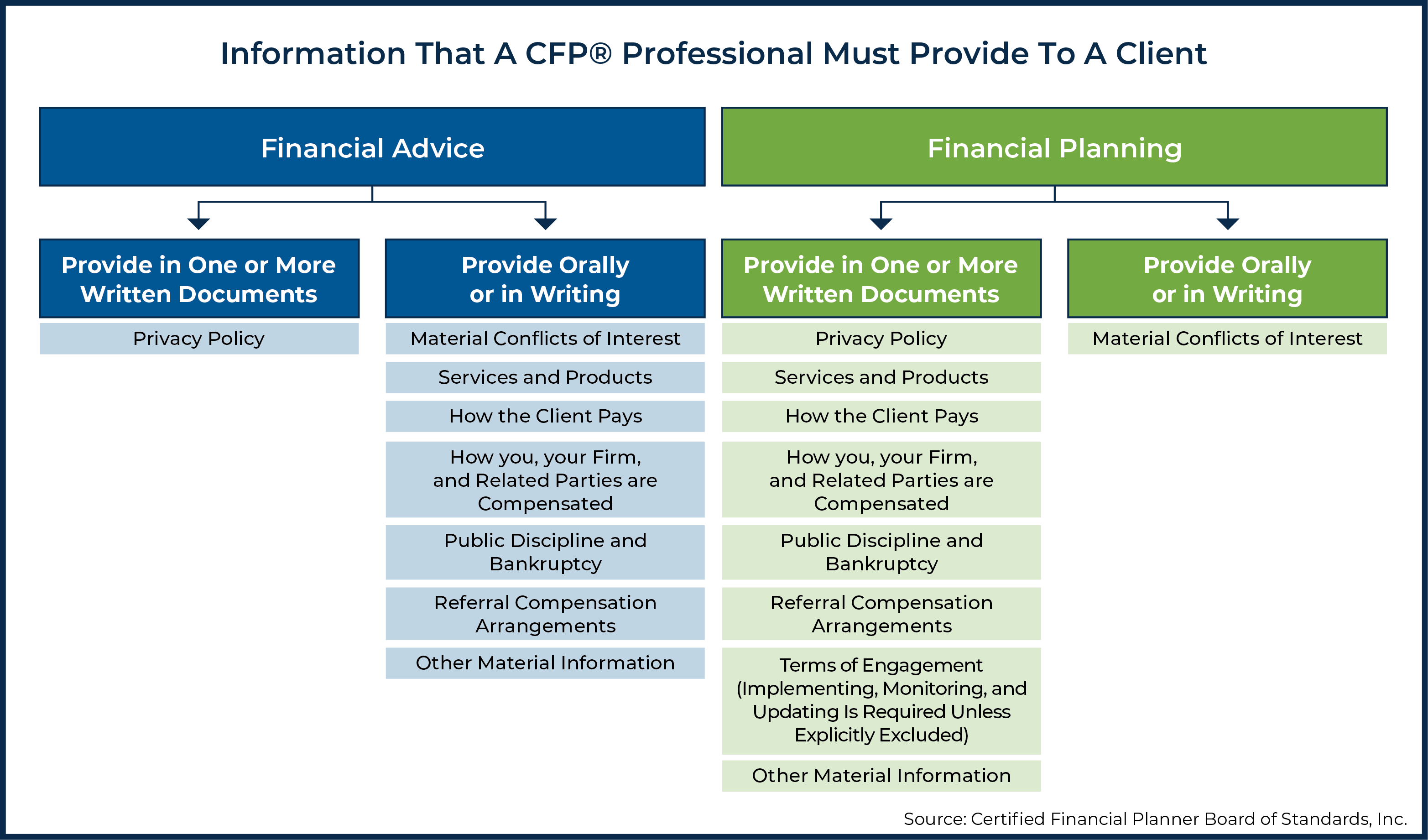

In the case of such broad-based “Financial Advice” (that does not require the full Financial Planning Practice Standards), the CFP® professional must provide the following information to the Client, either prior to or at the time of Engagement:

1) Services and Products. Description of services and/or products to be provided;

2) How the Client Pays. How the Client will pay for the products and services received, and a description of the additional types of costs that the Client may incur, including product management fees, surrender charges, and sales loads (though notably, a description of how the CFP® professional will be compensated is sufficient, without exact detail of the precise percentages or amounts, which may vary depending on the exact solution implemented);

3) How the CFP® professional (and Related Parties) are compensated. How the CFP® professional, the CFP® professional’s Firm, and any Related Party, are compensated for providing the products and services;

4) Public Discipline or Bankruptcy. The existence of any public discipline or bankruptcy, and the location(s), if any, of the webpages of all relevant public websites of any governmental authority, self-regulatory organization, or professional organization that sets forth the CFP® professional’s public disciplinary history, or any personal bankruptcy or business bankruptcy where the CFP® professional was a Control Person;

5) Material Conflicts of Interest. The information required under the obligation to disclose Material Conflicts of Interest (as discussed earlier);

6) Written Privacy Policy. The information required regarding “Written Notice Regarding Non-Public Personal Information” (i.e., maintaining privacy and confidentiality of client information, as discussed separately as part of a CFP® professional’s 15 Duties to Clients);

7) Referral Compensation Arrangements. Disclosure of Economic Benefit for Referral or Engagement of Additional Persons (i.e., revenue-sharing and other referral compensation agreements, as discussed separately as part of a CFP® professional’s 15 Duties to Clients); and

8) Any Other Material Information. Any other information about the CFP® professional or the CFP® professional’s Firm that is Material to a Client’s decision to engage or continue to engage the CFP® professional or the CFP® professional’s Firm.

Notably, this required information and related disclosures must be delivered before or at the time of a Financial Advice Engagement but does not have to be delivered in a written format. Oral disclosure of this information is permitted, though the CFP® professional is still required to document that the information was, in fact, provided in a timely manner. On the other hand, CFP® professionals who prefer to deliver the information in writing may still do so, including via email (or with directions to the client on where to obtain that information via the advisor’s website) if the client has otherwise consented to email communications.

On the other hand, when a full-fledged Financial Planning Engagement occurs (i.e., where the Financial Planning Practice Standards apply because the CFP® professional is providing Financial Planning, providing sufficiently broad Financial Advice that incorporates multiple integration factors, or causes the Client to have a reasonable basis to believe he/she will receive Financial Planning), the CFP® professional must not only provide the aforementioned information, but is also expected to formalize the “terms of the Engagement” between the Client and the CFP® professional (or his/her firm), including the Scope of Engagement and any limitations, the period(s) during which the services will be provided, and the Client’s responsibilities.

Formal documentation of the scope of the engagement is especially important in the context of a Financial Planning Engagement, as by default, a CFP® professional is presumed to be responsible for implementing, monitoring, and updating the Financial Planning recommendation(s) as well unless those duties are specifically excluded from the Scope of Engagement.

In addition, when the CFP® professional is engaged for Financial Planning, all of the information above (except the disclosure of Material Conflicts of Interest) must be provided in writing and not just orally. However, per the separate oral-or-written obligation for disclosure of Material Conflicts of Interest, the CFP® professional will still have the option to provide oral (as opposed to written) disclosure of those Material Conflicts of Interest.

Notably, the above information is required to be provided to clients, though because it must be at the time of an Engagement itself or before, in practice it may be delivered while a future client is still ‘just’ a prospect.

Beyond providing upfront information to future/new clients, though, the Duty to Provide Information to a Client also includes an ongoing obligation to provide updated information to clients. Specifically, a CFP® professional has an ongoing obligation (the Code and Standards does not specify a precise number of days) to provide to the Client any information that is a Material change or update to the information required to be provided to the Client. Material changes to the advisor’s public disciplinary history or bankruptcy information must be disclosed to the Client within 90 days of when such an event occurs.

Nerd Note:

To help facilitate compliance for CFP® professionals in their (differing) obligations when providing Financial Advice and Financial Planning, CFP Board has created both a Financial Advice Engagements Compliance Checklist and a Financial Planning Engagements Compliance Checklist for CFP® professionals to use.

Obtaining Informed Consent Of Disclosed Conflicts Of Interest For CFP® Professionals

CFP Board’s new Code and Standards includes a ‘fiduciary-at-all-times’ obligation to act in the Best Interests of the Client, including a Duty of Care to “act with the care, skill, prudence, and diligence, that a prudent professional would exercise in light of the Client’s goals, risk tolerance, objectives, and financial and personal circumstances”, and a Duty of Loyalty to “Place the interests of the Client above the interests of the CFP® professional (and the CFP® professional’s Firm)”, and in situations where a conflict of interest is present, to either avoid the conflict or to properly manage the conflict of interest while disclosing it to the Client.

Specifically, as it pertains to disclosure, the new rules require that:

When providing Financial Advice, a CFP® professional must make full disclosure of all Material Conflicts of Interest with the CFP® professional’s Client that could affect the professional relationship. This obligation requires the CFP® professional to provide the Client with sufficiently specific facts so that a reasonable Client would be able to understand the CFP® professional’s Material Conflicts of Interest and the business practices that give rise to the conflicts, and give informed consent to such conflicts or reject them. (Emphasis added.)

Notably, a key element of the CFP® professional’s disclosure obligation is that it is not enough to merely provide paperwork with disclosure 'fine print'. Instead, the CFP® professional is expected to give “sufficiently specific facts” so that a reasonable Client would be able to understand the conflict and how it could affect the advice the Client will receive from the CFP® professional, and, thus, give informed consent to those Conflicts of Interest.

As a best practice, a CFP® professional should consider not just providing disclosures, but actually documenting (e.g., through a signed receipt by the Client, and even contemporaneous client meeting notes) that the disclosures were received, discussed, and that the Client ‘understood and appreciated’ the ramifications of the disclosure and how it may (potentially adversely) affect the CFP® professional’s advice.

The determination of whether the Client received sufficient disclosure in order to give informed consent will hinge on CFP Board evaluating:

“…whether a reasonable Client receiving the disclosure would have understood the conflict and how it could affect the advice the Client will receive from the CFP® professional. The greater the potential harm the conflict presents to the Client, and the more significantly a business practice that gives rise to the conflict departs from commonly accepted practices among CFP® professionals, the less likely it is that CFP Board will infer informed consent absent clear evidence of informed consent. Ambiguity in the disclosure provided to the Client will be interpreted in favor of the Client.”

In practice, the obligations on CFP® professionals to obtain informed consent for Material Conflicts of Interest will likely lead to additional documentation of such disclosures, including the depth of disclosure documents themselves (i.e., what is provided to clients to explain such conflicts in a manner that leaves the Client fully informed), confirmation of whether the disclosures were received (i.e., disclosure delivery receipts), and contemporaneous client notes of any meetings where conflicts were discussed.

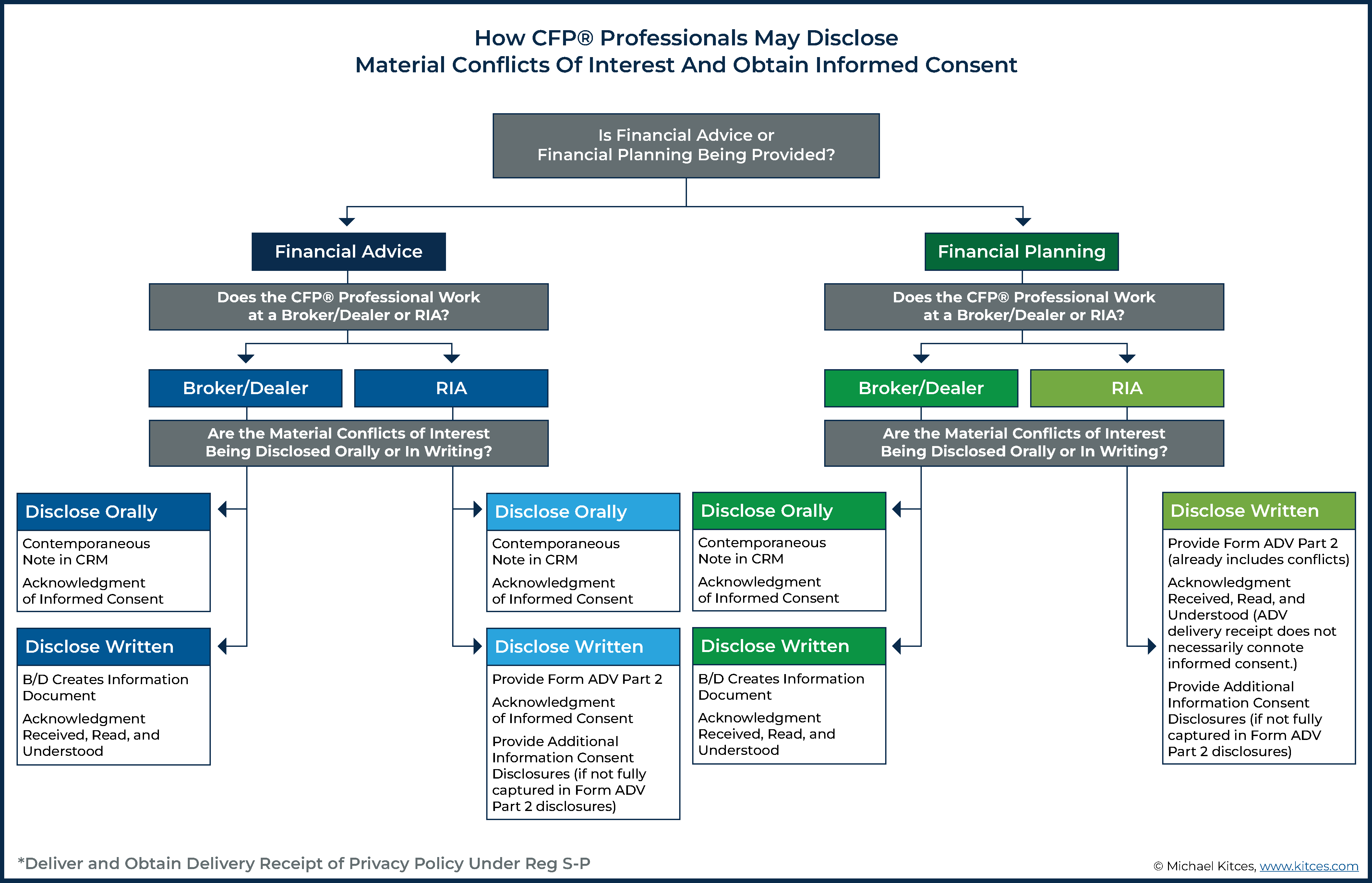

However, it is notable that CFP Board’s disclosure requirements do not require written disclosures of even Material Conflicts of Interest. Instead, the rules explicitly state that written consent is not required and that oral disclosure is permitted (which CFP Board attributes to the view that “in some circumstances, there are logistical challenges to providing written disclosure of Material Conflicts of Interest”, though “evidence of oral disclosure of a Conflict will be given such weight as CFP Board in its judgment deems appropriate”. Which means that written disclosure may not be required but will likely still be deemed a best (and more defensible) practice.

Still, though, the new Code and Standards are clear that disclosure is required for any conflict that is “Material” (defined in the Glossary as any information that “a reasonable Client or prospective Client would consider… important in making a decision”), and that “a sincere belief by a CFP® professional with a Material Conflict of Interest that he or she is acting in the best interests of the Client is insufficient to excuse failure to make full disclosure.” Furthermore, disclosure of a Material Conflict of Interest must be provided before providing Financial Advice.

In addition, to the extent the CFP® professional does retain a Material (and now disclosed) Conflict of Interest, they are expected to manage the impact of that conflict:

A CFP® professional must adopt and follow business practices reasonably designed to prevent Material Conflicts of Interest from compromising the CFP® professional’s ability to act in the Client’s best interests.

In the months and years to come, it is likely that CFP Board will further promulgate best practices and recommendations in how to manage common Material Conflicts of Interest, similar to how the SEC (for RIAs under the Investment Advisers Act of 1940) and the Department of Labor (under ERISA) have, from time to time, issued guidance on how fiduciaries should act to best fulfill their fiduciary obligations to clients.

In the meantime, though, CFP® professionals are still expected to engage in their own internal evaluation of prospective Material Conflicts of Interest, and determine strategies to help manage those conflicts of interest, even and including conflicts of interest presented to the CFP® professional by his/her firm (e.g., opting out of participating in aggressive sales contests).

Best Practices In Providing Requisite Information And Disclosures For CFP® Professionals

In order for CFP® professionals to fulfill their duties to provide the requisite information for prospective clients, and to disclose and obtain informed consent with respect to Material Conflicts of Interest, written materials may not always need to be provided, but written documentation of the information and disclosures is necessary in all situations.

In other words, in cases where the CFP® professional is providing non-Financial-Planning Financial Advice (where oral disclosures are sufficient, aside from the delivery of a written Privacy Policy), or when providing oral disclosures of Material Conflicts of Interest and how they will be managed in a Financial Planning Engagement, CFP® professionals must document the information that was discussed (e.g., in their CRM system), even if a written document itself was not provided.

In addition, because CFP® professionals are required to obtain informed consent in the case of Material Conflicts of Interest, it is also advisable to obtain either a delivery receipt from clients (i.e., that they received the written materials) or an acknowledgment that they understand the Conflicts of Interest (i.e., in the event that they were discussed orally); more importantly, it is advisable to acknowledge from the Client that they have read (for a written document) or understand (for an oral discussion) the CFP® professional’s Conflicts of Interest and are providing their informed consent to proceed in light of them. As CFP Board’s Code and Standards do not require that all conflicts of interest be eliminated… but again, do require not just disclosure and not just consent, but specifically informed consent.

In fact, some major financial services firms have already developed a full written document providing both the requisite written information for clients (for Financial Planning Engagements) and also regarding their Material Conflicts of Interest.

From a practical perspective, though, while all CFP® professionals are obligated to provide the requisite information, the process of fulfilling the obligation to create and deliver such documentation will depend on the firm they work for, and the manner in which they’re currently regulated.

As in general, CFP® professionals working for broker-dealers may be able to provide oral disclosures for Financial Advice (for everyone except the written Privacy Policy that is mandated under Reg S-P anyway) but will still want to have contemporaneous notes in their CRM and may wish to obtain a signed acknowledgment for informed consent, and any written disclosures would need to be created by the broker-dealer itself (either for Financial Advice where the broker-dealer chooses to provide written information and disclosures or in the case of Financial Planning where written information is required).

In the case of CFP® professionals at RIAs, on the other hand, Form ADV Part 2 should generally suffice for providing written information regarding services, and also written disclosure of Material Conflicts of Interest. Though ultimately, CFP® professionals should still verify that Form ADV Part 2A covers the full breadth of necessary details and the mere delivery of Form ADV alone does not automatically satisfy the requirement – and may be particularly insufficient in the case of dual-registrants who may be providing other services outside the scope of their RIA that would therefore not be covered in Form ADV Part 2A.

A CFP® professional should consider, as a best practice, a more substantive Informed Consent acknowledgment than the Form ADV Part 2A delivery receipt.

In essence, then, CFP® professionals will need to focus on 5 core areas with respect to their oral and/or written information and disclosures:

- Material Conflicts Information (whether a B/D-created document, or the RIA’s Form ADV Part 2A if it contains all of the information that CFP Board requires, or oral disclosure) that provides sufficiently specific facts concerning all Material Conflicts of Interest;

- Other (e.g., Non-Conflicts) Information (which again may be a B/D provided document, or the RIA’s Form ADV Part 2A; may be delivered orally in the case of non-Financial-Planning Financial Advice);

- Delivery of the information and informed consent (determine how to deliver the information; a CFP® professional who uses email delivery must have a reason to believe that the information was successfully delivered to the Client; a best practice is to verify that clients actually read and understand the information);

- Contemporaneous documentation (e.g., in the advisor’s CRM) if the information was delivered orally; and

- Written Privacy policy (already satisfied by Reg S-P for registered representatives under a broker-dealer or RIA).

Reporting And Other Duties Of CFP® Professionals To CFP Board

Unlike being a broker or an investment adviser (or a doctor or a CPA), earning the CFP® certification to “be a CFP® professional” is not a legal license.

Instead, technically the CFP® marks are registered trademarks, and CFP Board grants CFP® certificants the right to use those marks (e.g., to put the CFP® mark on the advisor’s business card) if they meet CFP Board’s “Four E’s” (Education, Experience, Examination, and Ethics) requirements… and agree to adhere to CFP Board’s “Terms and Conditions”. Accordingly, while CFP Board does not have direct legal or regulatory oversight of CFP® certificants, it can (and does) nonetheless require CFP® certificants to adhere to the applicable Code and Standards (as part of the Ethics requirement of the Four E’s).

As a result of the required adherence to CFP Board’s Terms and Conditions, in order to legally be permitted to use the CFP® marks, CFP Board can compel certain duties of CFP® Certificants to CFP Board itself, in order for it to effectively conduct its oversight regarding the proper use of the CFP® marks it licenses out to CFP® certificants.

Accordingly, as part of its Code and Standards, CFP Board requires CFP® certificants to:

- Refrain from Adverse Conduct that would reflect poorly on the CFP® marks;

- Report Disciplinary And Similar Events to CFP Board;

- Cooperate with CFP Board in its Investigations; and

- Comply with the Terms and Conditions Themselves.

Refrain From Conduct That Reflects Poorly On CFP® Marks

In the long run, the CFP® marks are only beneficial to CFP® certificants if they are viewed as a credible and trustworthy marker of professionalism by consumers… a viewpoint that is enhanced by both how CFP® certificants individually behave when serving their clients and CFP Board’s broad-based Public Awareness efforts to convey the credibility of the CFP® marks, but that is also impaired by the misdeeds of individual CFP® certificants that may reflect poorly on that credibility.

Accordingly, not representing the CFP® marks in a professional and credible manner is itself a deemed violation of CFP Board’s Code and Standards and the duties that CFP® professionals have to the organization that licenses them the right to use those marks, as CFP Board requires that:

A CFP® professional may not engage in conduct that reflects adversely on his or her integrity or fitness as a CFP® professional, upon the CFP® marks, or upon the profession.

A key aspect of the duty to refrain from conduct that reflects poorly on the CFP® marks is that it not only requires adherence to the CFP® professional’s fiduciary obligation to clients but also pertains more broadly to the “fitness” of an individual to be a credible CFP® professional in the first place.

Accordingly, ‘conduct unbecoming’ of a CFP® professional that has emerged from CFP Board’s own Disciplinary and Ethics Committee actions over the years includes (but is not limited to) conduct that results in:

- A Felony or Relevant Misdemeanor conviction (i.e., for conduct involving fraud, theft, misrepresentation, other dishonest conduct, crimes of moral turpitude, violence, or a second (or more) alcohol and/or drug-related offense), or admission into a program that defers or with holds the entry of a judgment of conviction for a Felony or Relevant Misdemeanor;

- A Finding in a Regulatory Action (initiated by governmental agency, self-regulatory organization, or other regulatory authority) or a Civil Action (i.e., lawsuit or arbitration) that the CFP® professional engaged in fraud, theft, misrepresentation, or other dishonest conduct;

- A personal bankruptcy or business bankruptcy filing or adjudication where the CFP® professional was a Control Person of the business, unless the CFP® professional can rebut the presumption that the bankruptcy demonstrates an inability to manage responsibly the CFP® professional’s or the business’s financial affairs;

- A federal tax lien on property owned by the CFP® professional, unless the CFP® professional can rebut the presumption that the federal tax lien demonstrates an inability to manage responsibly the CFP® professional’s financial affairs; or

- A non-federal tax lien, judgment lien, or civil judgment that has not been satisfied within a reasonable amount of time unless the CFP® professional can rebut the presumption that the non-federal tax lien, judgment lien, or civil judgment demonstrates an inability to manage responsibly the CFP® professional’s financial affairs.

Notably, this conduct clause pertains not only to ‘relevant’ misdemeanors or regulatory actions (e.g., pertaining to fraud, theft, misrepresentation, and other dishonest conduct) but also to Civil actions where the individual is found guilty of such behavior (even if not found guilty in a criminal court or by a regulator) and applies broadly to any type of Felony.

Furthermore, as CFP® professionals responsible for providing financial advice – which suggests the individual should be ‘expert enough’ to manage their own financial affairs as well – bankruptcies and tax liens, as well as liens for civil judgments (e.g., where the CFP® professional was sued in a Civil Action and required to pay damages), also carry an implicit failure to reflect well on CFP® professionals.

However, financially related ‘conduct unbecoming’ can be rebutted by showing mitigating circumstances that demonstrate that the matter was not a result of the CFP® professional’s inability to responsibly manage their own financial affairs. (Whereas Felonies, Relevant Misdemeanors, and applicable Regulatory or Civil Actions automatically ‘fail’ the test.)

Notably, though, this approach – where the Disciplinary and Ethics Commission will review bankruptcy matters on a case-by-case basis, thereby giving a CFP® professional an opportunity to rebut the presumption that the bankruptcy demonstrates the CFP® professional’s inability to manage his or her financial affairs – is itself a change in approach. Since July of 2012 (and until the revised Code and Standards and Procedural Rules took effect), when a CFP® professional notified CFP Board of a (first) bankruptcy (or CFP Board otherwise discovered it in public records or a background check), CFP Board automatically disclosed the bankruptcy on its website and via a press release (which, while not technically a disciplinary action, was akin to a Public Censure for the conduct). The current rules revert the treatment to a case-by-case basis similar to the prior (pre-July-2012) rules. However, a second bankruptcy is a presumptive bar to certification under the Fitness Standards.

On the other hand, it’s notable that general conduct and behavior that other CFP® professionals may dislike – e.g., an abrasive communication style or a generally ‘unlikeable’ personality – generally do not constitute grounds for enforcement action or possible suspension or revocation of the CFP® marks. In the end, the behavior must reflect adversely on the individual’s “integrity or fitness as a CFP® professional, upon the CFP® marks, or upon the profession”, beyond just a strong personal dislike of a fellow CFP® certificant’s personality or behavior. (Though notably, the list of applicable Felonies, Relevant Misdemeanors, Regulatory and Civil Actions, and various financial matters, are not an exclusive list of unbecoming conduct, and CFP Board does reserve the right to pursue action in other circumstances that arise to a similar level of demonstrated lack of integrity or lack of fitness.)

On the other hand, when it comes to conduct that is deemed unacceptable, the Code and Standards also have a broad requirement that:

A CFP® professional may not do indirectly, or through or by another person or entity, any act or thing that the Code and Standards prohibit the CFP® professional from doing directly.

Report Disciplinary And Similar Events To CFP Board And Cooperate With Investigations

One of the fundamental challenges in CFP Board enforcing its Code and Standards for CFP® professionals is that virtually all of the inappropriate conduct that may violate those standards will be determined by some other organization or entity – e.g., a regulator, or a government agency, or a court of law. As a result, there is a risk that CFP Board simply may not know that a CFP® professional has engaged in conduct that would constitute a violation of the CFP® professional’s duties to CFP Board.

For new CFP® professionals, the application process to obtain the marks – and affirm that they have met the Four E’s of Education, Exam, Experience, and Ethics – includes making a certifying statement that the candidate for CFP® certification has met the requisite Fitness Standards, where admitting unbecoming conduct or failing to sign the certification may result in a bar from receiving the marks. (And lying about prior conduct would itself become grounds for a subsequent revocation of the marks if/when later discovered.) A Petition for Fitness Determination process exists for those who face a presumptive bar, for instance, in the case of a prior bankruptcy, to explain the situation and why they should still be deemed fit to use the marks.

In addition, CFP Board does seek out information from other regulators (e.g., FINRA and the SEC) and/or public records (e.g., regarding bankruptcies) to determine if there are any public regulatory or disciplinary actions that may represent unbecoming conduct of the CFP® professional that occurred after the initial certification of Fitness.

However, in addition to the upfront determination of Fitness, and ongoing scans for potential disciplinary actions from a regulator, CFP Board also requires CFP® professionals themselves to provide written notice (and a supportive “Narrative Statement”) to CFP Board within 30 days (via CFP Board’s self-reporting form) of when the CFP® professional has:

- Been charged with, convicted of, or admitted into a program that defers or withholds the entry of a judgment or conviction for, a Felony or Relevant Misdemeanor;

- Been named as a subject of, or whose conduct is mentioned adversely in, a Regulatory Investigation or Regulatory Action alleging failure to comply with the laws, rules, or regulations governing Professional Services;

- Had conduct mentioned adversely in a Finding in a Regulatory Action involving failure to comply with the laws, rules, or regulations governing Professional Services (except a Regulatory Action involving a Minor Rule Violation in a Regulatory Action brought by a self-regulatory organization);

- Had conduct mentioned adversely in a Civil Action alleging failure to comply with the laws, rules, or regulations governing Professional Services;

- Become aware of an adverse arbitration award or civil judgment, or a settlement agreement, in a Civil Action alleging failure to comply with the laws, rules, or regulations governing Professional Services, where the conduct of the CFP® professional, or an entity over which the CFP® professional was a Control Person, was mentioned adversely, other than a settlement for an amount less than $15,000;

- Had conduct mentioned adversely in a Civil Action alleging fraud, theft, misrepresentation, or other dishonest conduct;

- Been the subject of a Finding of fraud, theft, misrepresentation, or other dishonest conduct in a Regulatory Action or Civil Action;

- Become aware of an adverse arbitration award or civil judgment, or a settlement agreement in a Civil Action alleging fraud, theft, misrepresentation, or other dishonest conduct, where the conduct of the CFP® professional, or an entity over which the CFP® professional was a Control Person, was mentioned adversely;

- Had a professional license, certification, or membership suspended, revoked, or materially restricted because of a violation of rules or standards of conduct;

- Been terminated for cause from employment or permitted to resign in lieu of termination when the cause of the termination or resignation involved allegations of dishonesty, unethical conduct, or compliance failures;

- Been named as the subject of, or been identified as the broker/adviser of record in, any written, customer-initiated complaint that alleged the CFP® professional was involved in:

- Forgery, theft, misappropriation, or conversion of Financial Assets;

- Sales practice violations and contained a claim for compensation of $5,000 or more; or

- Sales practice violations and settled for an amount of $15,000 or more.

- Filed for or been the subject of a personal bankruptcy or business bankruptcy where the CFP® professional was a Control Person;

- Received notice of a federal tax lien on property owned by the CFP® professional; or

- Failed to satisfy a non-federal tax lien, judgment lien, or civil judgment within one year of its date of entry, unless payment arrangements have been agreed upon by all parties.

Ultimately, the conduct for which CFP® professionals are required to provide notification is effectively the conduct that would or at least potentially may result in a failure to meet the Fitness Standards, including criminal charges, the initiation of regulatory investigations and actions, the filing of civil actions, customer complaints, findings of a violation of a rule or standard of a professional license, membership, or certification, a termination from employment or permission to resign in lieu of termination, bankruptcies, tax liens, judgment liens, or unpaid civil judgments. For which the CFP® professional must not only provide written Notice to CFP Board, but also a Narrative Statement that “accurately and completely describes the Material facts and the outcome or status of the reportable matter” so that CFP Board may make a determination of whether the individual facts and circumstances merit disciplinary action from CFP Board itself.

Notably, the requirements for giving written Notice apply not only to the conduct of the CFP® professional themselves, but also in situations where he/she is a Control Person of an entity that triggered the rules (e.g., in the case of an entity that declared business bankruptcy, or that was named in an arbitration award or civil judgment). As where the CFP® professional is a Control Person of the entity, unbecoming conduct of the entity reflects on the conduct of the CFP® professional themselves.

Of course, CFP® professionals who do not self-report their inappropriate conduct, therefore, cannot be directly disciplined for it, at least at the time. However, in the end, unbecoming conduct is not necessarily automatically grounds for revocation of the CFP® marks, and may simply result in a suspension, Public Censure, or Private Censure. Which is important, as when CFP Board is increasingly scanning other regulators, and public information for notices of conduct unbecoming of a CFP® professional, the later discovery of such behaviors that were not self-reported becomes itself an additional offense (the conduct itself, and the failure to self-report such conduct), which can ultimately be deemed an aggravating factor that increases the subsequent penalty (e.g., turning a Private Censure or Public Censure into a suspension or revocation).

Accordingly, CFP® professionals are better served by submitting written Notice and trying to justify their situation with the associated Written Narrative, than not reporting the conduct and risking harsher consequences later.

Similarly, CFP Board also requires that CFP® professionals cooperate with CFP Board’s own investigations into such matters, stating:

A CFP® professional may not make false or misleading representations to CFP Board or obstruct CFP Board in the performance of its duties. A CFP® professional must satisfy the cooperation requirements set forth in CFP Board’s Procedural Rules, including by cooperating fully with CFP Board’s requests, investigations, disciplinary proceedings, and disciplinary decisions.

Similar to the requirements for written Notice, failure to cooperate with CFP Board can in and of itself constitute a violation of the Code and Standards and be deemed an aggravating factor that further increases the gravity of a subsequent disciplinary action against the CFP® professional.

Comply With CFP Board’s Terms And Conditions For CFP® Certification

As noted earlier, the CFP® marks are technically not a license granted by a government agency, but a trademark owned by CFP Board that a CFP® certificant licenses in exchange for a certification licensing fee.

However, CFP Board limits the use of the CFP® marks to those who not only meet their Four E’s requirement of Education, Examination, Experience, and Ethics, but also those who agree to CFP Board’s Terms and Conditions themselves.

The Terms and Conditions stipulate everything from how the CFP® marks themselves can be used, authorization for CFP Board to conduct background checks (to affirm Fitness), upfront consent to adhere to CFP Board’s enforcement actions, and agreement to CFP Board’s Mandatory Arbitration clause with respect to disputes with CFP Board itself.

Ultimately, failure to adhere to CFP Board’s Terms and Conditions can itself be grounds for CFP Board to rescind the license for the CFP® certificant to use the marks. But the Code and Standards themselves also explicitly require that CFP® professionals comply with the Terms and Conditions. As a result, failure to do so is not only a violation of the certification agreement itself, but grounds for a disciplinary action against the CFP® professional as well.

In the end, the core obligation of CFP® professionals is that they adhere to CFP Board requirements, its Code and Standards, and its Terms and Conditions, which itself is required as a condition of paying the licensing fee to use the CFP® marks in the first place.

As a result, while CFP Board may not be a government-sanctioned regulatory entity, it can still obligate CFP® professionals to provide required disclosure and other information to clients, and for CFP® professionals to report disciplinary matters to (and cooperate with disciplinary investigations by) CFP Board, or else they face the potential of Private Censure, a Public Censure, suspension of the CFP® marks, or even permanent revocation of the CFP® marks.

Or stated more simply, CFP® professionals who wish to obtain the benefits of holding out as such and show that they have earned the CFP® marks as a hallmark of being a financial planning professional must actually comply with CFP Board’s Code and Standards conduct with respect to what it means to really be a CFP® professional!