Executive Summary

By definition, “advice” is a recommendation to someone about a prudent course of action to improve their situation or achieve their goals, which by its very nature is delivered by the advice-giver in the interests of the person receiving the advice. As a result, professionals from law to medicine to accounting to investment advisers have long imposed a “fiduciary” duty of professional advice-givers to provide advice in the best interests of the person receiving that advice.

Since 2008, CFP® professionals have similarly been required to provide fiduciary advice in the best interests of their clients… but only to the extent they were actually doing Financial Planning (or material elements of Financial Planning), as simply being a CFP® professional did not necessarily trigger a fiduciary obligation (to the extent that the CFP® professional was implementing or selling a product without providing broader financial planning advice).

Under CFP Board’s new Code of Ethics and Standards of Conduct (“Code and Standards”) that took effect in October of 2019, and which were first enforced after June 30th of 2020, CFP Board has for the first time imposed a “fiduciary at all times” obligation on CFP® professionals – whether providing comprehensive Financial Planning, or non-Financial-Planning Financial Advice.

In turn, CFP Board’s new Code and Standards require that CFP® professionals meet both a Duty of Loyalty (to put the client’s interests ahead of their own) and a Duty of Care (to act with the care, skill, prudence, and diligence of a professional), while still following their fundamental Duty to Follow Client Instructions (even in situations where clients choose and ask the CFP® professional to implement a course of action that the advisor did not recommend). And to the extent that Material Conflicts of Interest are present, they must be disclosed by the CFP® professional (even if the CFP® professional’s Firm does not impose such requirements).

Ultimately, CFP® professionals that fail to adhere to CFP Board’s fiduciary and other Duties to Clients (and the associated Financial Planning Practice Standards when delivering financial planning) may be subject to disciplinary action, including a Private Censure, Public Censure, suspension, or even permanent revocation of the CFP® marks. Which, notably, may apply even to CFP® professionals who otherwise adhere to other regulators’ lesser standards!

New CFP Board Code Of Ethics And Standards Of Conduct

On March 28th of 2018, CFP Board’s Board of Directors announced a new Code of Ethics and Standards of Conduct that would apply in the future to CFP® professionals. The new rules, a consolidation of CFP Board’s prior series of 4 guiding documents for CFP® certificants – the Code of Ethics and Professional Responsibility, Rules of Conduct, the Financial Planning Practice Standards, and related Terminology – represented the culmination of a more-than-two-year project, guided by CFP Board’s 12-person Commission On Standards, which hosted 17 public forums and 2 public comment periods, and the first major update to the standards since the last round of changes were adopted in the middle of 2007 (and took effect in the middle of 2008).

At its core, the purpose of the new Code of Ethics and Standards of Conduct is stated directly within the Preamble to the new Standards, which states:

CFP Board’s Code of Ethics and Standards of Conduct reflects the commitment that all CFP® professionals make to high standards of competency and ethics. CFP Board’s Code and Standards benefits and protects the public, provides standards for delivering financial planning, and advances financial planning as a distinct and valuable profession. Compliance with the Code and Standards is a requirement of CFP® certification that is critical to the integrity of the CFP® marks. Violations of the Code and Standards may subject a CFP® professional to discipline.

New Code Of Ethics For CFP® Professionals

The fundamental purpose of a Code of (Professional) Ethics is that it is intended to set forth a core set of principles that professionals can use to determine the right course of action to take when faced with a potentially difficult decision. They are not intended to be specific rules to follow and comply with, but instead are broader statements of ethical values that the organization holds dear and continuously aspires towards.

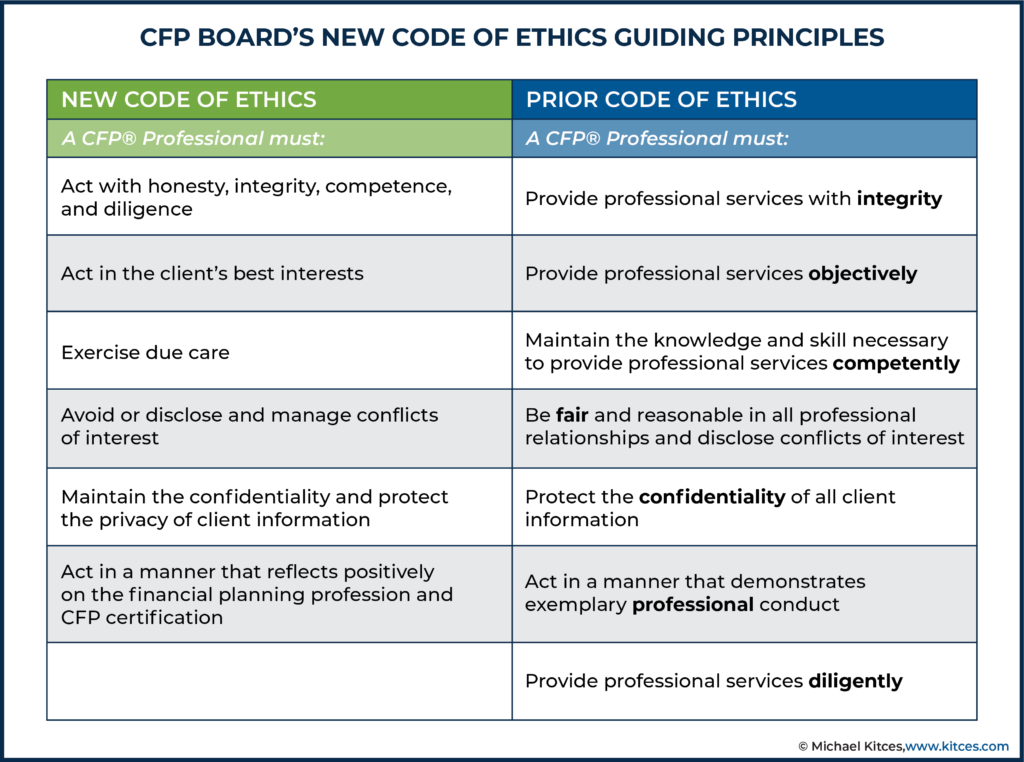

In the past, CFP Board’s Code of Ethics was literally a series of 7 guiding principles: Integrity, Objectivity, Competence, Fairness, Confidentiality, Professionalism, and Diligence. However, the new Code of Ethics sets forth an even higher level of guiding principles that CFP® professionals should aspire to.

Notably, the new Code of Ethics is principles-based and substantively similar to the prior Principles, still embodying the goals of integrity, competency, diligence, confidentiality, professionalism, and the essence of objectivity and fairness (in a combination of acting in the client's best interests, and avoiding or disclosing-and-managing conflicts of interest where appropriate), and is meant to apply at all times – again, as a universal set of principles that all CFP® professionals should aspire towards.

However, the new Code of Ethics reframes these obligations in a broader (and by definition of a Code of Ethics, more aspirational) way, rather than specifically prescribing that the CFP® professional provide their professional services with integrity, objectivity, etc. As actionable prescriptions of what CFP® professionals should actually do speaks more directly to the CFP® professional’s Standards of Conduct – i.e., the specific practices that CFP® professionals are expected to engage in with clients (and will be judged against if a complaint occurs and enforcement action must be taken).

(Reorganization Of) New Standards Of Conduct For CFP® Professionals

CFP Board’s new Standards of Conduct, which are meant to provide more actionable guidance of what CFP® professionals are expected to do with clients, reorganizes and expands upon the prior rules, effectively combining together what was previously the Rules of Conduct and Financial Planning Practice Standards, along with certain parts of the Code of Ethics Principles (that were more prescriptive in action than Principles-based), and the prior Terminology section, into a new set of six core sections:

Duties Owed to Clients. The 15 “duties” that CFP® professionals owe to clients (including and especially the new Fiduciary Duty).

Duties Owed to Firms and Subordinates. The specific obligations for supervising persons acting under the CFP® professional’s direction, and/or obligation to follow firm procedures, as well as obligations for notifying the CFP® professional’s Firm about CFP Board discipline.

Duties Owed to CFP Board. Further guidance about the updated obligation in the Code of Ethics that CFP® professionals should not take actions that “reflect adversely on a CFP® professional’s fitness as a CFP® certificant, upon the CFP® marks, or upon the profession”, and details regarding a CFP® professional’s reporting obligation to CFP Board.

Financial Planning and Application of the Practice Standards for the Financial Planning Process. Provision of a core definition of “Financial Planning” and the standard for determining when Financial Planning is required.

Practice Standards for the Financial Planning Process. Guidance on what it means to do financial planning in practice once an Engagement is established (and turning what was previously a 6-step financial planning process into 7 steps instead).

Prohibition on Circumvention. An express prohibition against CFP® professionals trying to circumvent the rules by doing indirectly, or through or by another person, any act or thing that the Code and Standards prohibits the CFP® professional from doing directly in the first place.

At a high level, though, the most significant change in the new CFP Board Code of Ethics and Standards of Conduct is the introduction of a new “fiduciary at all times” obligation for CFP® professionals. Notably, a fiduciary duty for CFP® professionals is not new – it was first added to CFP Board’s Code of Ethics and Professional Responsibility back in 2007 – but the original fiduciary obligation applied only when CFP® certificants were doing financial planning or material elements of financial planning. Which had created what was often criticized as a ‘loophole’ that CFP® professionals could hold out as such (to convey the professionalism and credibility of the CFP® marks) but then only engage in product sales and evade the fiduciary obligation despite being a CFP® professional by claiming they were not doing financial planning to trigger the rule.

The New Fiduciary-At-All-Times Obligation Of CFP® Professionals When Providing Financial Advice To A Client

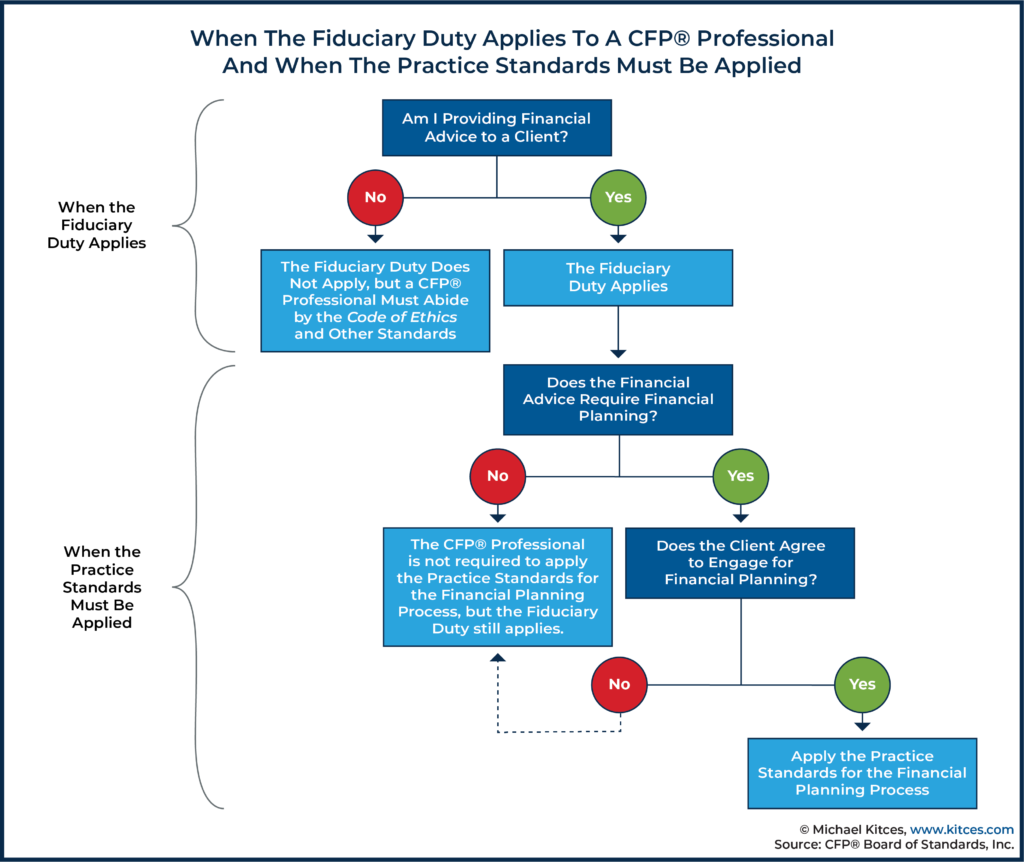

While the prior rules for CFP® professionals only required adherence to a fiduciary duty when actually doing Financial Planning, the new rules do not rely on a CFP® professional to be “doing” Financial Planning or material elements of Financial Planning to trigger a fiduciary obligation.

Instead, merely being a CFP® professional and being engaged to provide advice to clients will trigger the fiduciary obligation, as the CFP Code and Standards now states that:

At all times when providing Financial Advice to a Client, a CFP® professional must act as a fiduciary, and therefore, act in the best interests of the Client.

In turn, “Financial Advice” is defined very broadly (as a part of the Glossary section of the new Standards), as:

[Financial Advice Is] a communication that, based on its content, context, and presentation, would reasonably be viewed as a recommendation that the Client take or refrain from taking a particular course of action with respect to:

- The development or implementation of a financial plan;

- The value of or the advisability of investing in, purchasing, holding, gifting, or selling Financial Assets;

- Investment policies or strategies, portfolio composition, the management of Financial Assets, or other financial matters; or

- The selection and retention of other persons to provide financial or Professional Services to the Client.

In addition, exercising discretionary authority over a client’s financial assets will automatically be deemed as “Financial Advice” as well.

The end result of this new fiduciary framework, given the breadth of what might be considered “a recommendation that the client take or refrain from taking a particular course of action” with respect to a client’s finances, is that CFP® professionals will effectively face a ‘fiduciary at all times’ obligation with respect to their financial advice to clients (including product-sales solicitations that constitute a recommendation, even if only occurring on a one-time and not ongoing basis).

Which, in practice, will have significant implications for CFP® professionals within product-based organizations (e.g., insurance companies, asset managers, and broker-dealers), given the non-fiduciary nature of the product sales environment (as discussed further in later sections of this article); though the new standards will impose some additional duties and obligations even on CFP® professionals operating under Registered Investment Advisers (RIAs) that already have a parallel fiduciary obligation imposed upon them by the Investment Advisers Act of 1940.

However, in practice, the substantive changes of the new CFP Board Code and Standards go far beyond ‘just’ the imposition of a new comprehensive fiduciary duty regarding the Financial Advice and Financial Planning that CFP® professionals provide.

In addition, the new Code and Standards provide significant updates to the duties that CFP® professionals owe to their clients, redefine Financial Planning, the Practice Standards that are expected when providing Financial Planning, and how to determine when those Practice Standards apply, along with a new process for reporting bankruptcies of CFP® professionals, and enhanced reporting requirements of what CFP® professionals must disclose to CFP Board (and by when).

Notably, though, for the CFP® professional’s fiduciary obligation to Clients to apply, the Client must actually engage the CFP® professional for services. Accordingly, the “passing statement of ‘advice’ to someone at a cocktail party” will not give rise to the CFP® professional’s fiduciary (or other) obligations, because the financial advisor has not been engaged by the individual as a Client in the first place.

The 3 Duties Of CFP Board’s Fiduciary Standard

It’s one thing to ‘say’ that a professional will give advice in the best interests of their clients as a fiduciary; it’s another to actually have a clear standard against which advice can be judged as having been delivered in a fiduciary manner (or not).

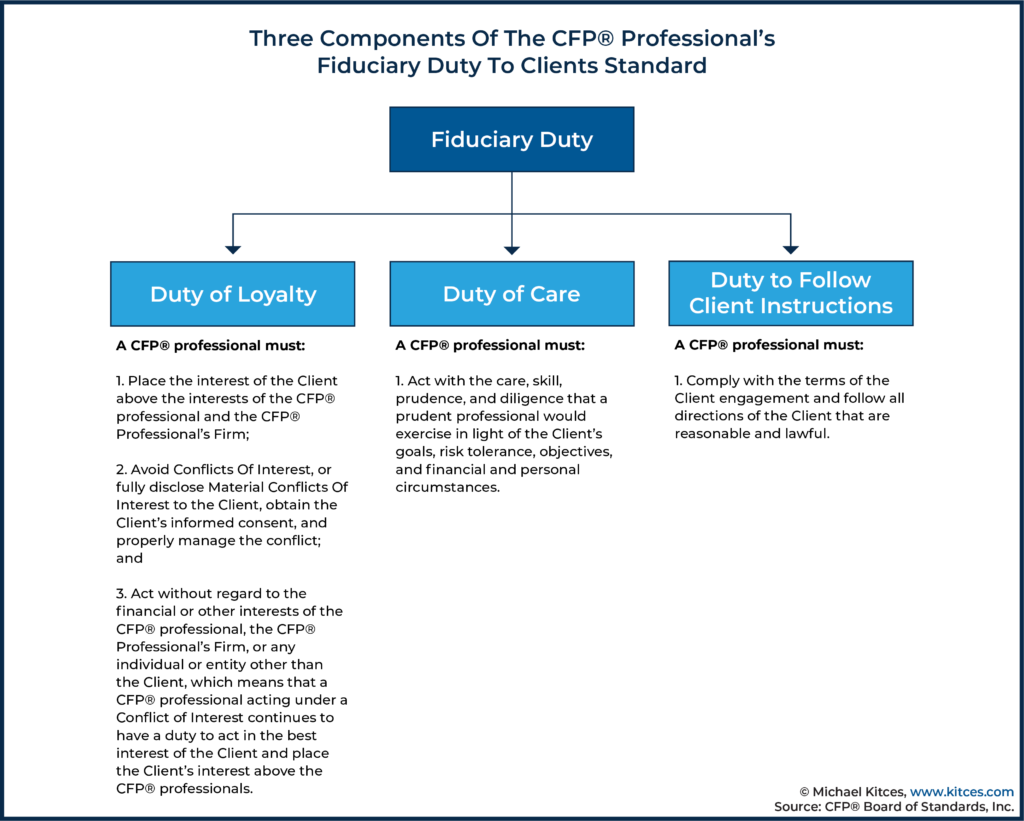

Accordingly, CFP Board’s new Standards of Conduct prescribes three core duties that CFP® professionals will be expected to fulfill in order to actually meet their fiduciary obligation:

- Duty of Loyalty;

- Duty of Care; and

- Duty to Follow Client Instructions.

Fiduciary Duty Of Loyalty For CFP® Professionals

The duty of loyalty is a common anchor for any and all fiduciary duties. At its core, it is about being loyal to the client and therefore acting in the best interests of the client. In the context of CFP Board’s new Code and Standards, the Duty of Loyalty specifically requires that the CFP® professional:

- Place the interests of the Client above the interests of the CFP® professional and the CFP® professional’s Firm;

- Avoid Conflicts of Interest, or fully disclose Material Conflicts of Interest to the Client, obtain the Client’s informed consent, and properly manage the conflict; and

- Act without regard to the financial or other interests of the CFP® professional, the CFP® professional’s Firm, or any individual or entity other than the Client, which means that a CFP® professional acting under a Conflict of Interest continues to have a duty to act in the best interests of the Client and place the Client’s interests above the CFP® professional’s.

A key aspect of CFP Board’s new Code and Standards and its fiduciary Duty of Loyalty is that the CFP® professional is expected to put the client’s interests not only ahead of their own, but also ahead of the CFP® professional’s Firm.

Accordingly, in situations where the firm pressures the CFP® professional to place the financial, product, sales, or other interests of the firm ahead of the client, the CFP® professional is expected to honor CFP Board’s fiduciary Duty of Loyalty, and in its “Duties Owed To Firms” section (as discussed below), is explicitly granted ‘amnesty’ (i.e., will not be subject to discipline for violating their own firm’s policies and procedures that conflict with CFP Board’s fiduciary obligation.

Of course, in situations where a CFP® professional defies their firms, they may still be subject to discipline from (or even termination from) their firm… which means, in the long run, CFP® professionals are expected to select or align themselves with firms and platforms that will allow them to fulfill their fiduciary obligation to clients.

On the other hand, it’s crucial to note that CFP Board’s new fiduciary duty does not require that CFP® professionals avoid organizations that manufacture or distribute financial services products for sale. Instead, akin to the SEC’s own approach to the fiduciary duty, the Code and Standards require that CFP® professionals either avoid Conflicts of Interest (where feasible) or, if unable to avoid them, must fully disclose and subsequently manage any Material Conflicts of Interest (while still aiming to fulfill their overall fiduciary duty to clients).

In other words, the mere presence of a (not-already-avoided) Conflict of Interest does not itself violate the fiduciary obligation of the CFP® professional; instead, failing to disclose such a Conflict, and not taking steps to manage the Conflict of Interest, is deemed a failure to meet the Standards. (As would be succumbing to the Conflict of Interest and actually giving an inappropriate recommendation.)

However, CFP® professionals should also recognize that, in situations where a Conflict of Interest is retained, disclosed, and managed (rather than avoided entirely), the CFP® professional must not merely disclose the Conflict, but obtain the client’s informed consent. Although whether a Client has provided informed consent depends on the facts and circumstances and may even be inferred when not explicit. For example, silence after disclosure may constitute informed consent, if the disclosure contains sufficiently specific facts that are understandable to a reasonable Client (or may not constitute informed consent if that is not the case). As a best practice, though, a CFP® professional should consider not just providing disclosures, but actually documenting (e.g., obtaining a signed receipt by the client, and even taking contemporaneous client meeting notes) that the disclosures were received, discussed, and that the client ‘understood and appreciated’ the ramifications of the disclosure and how it may (potentially adversely) affect the CFP® professional’s advice.

Fiduciary Duty Of Care For CFP® Professionals

The second typical duty under a fiduciary obligation is the Duty of Care. In general, the Duty of Care requires that professionals provide professional advice, and (only) help in areas in which they have the competency to provide appropriate advice.

In the context of CFP Board’s Duty of Care in particular:

A CFP® professional must act with the care, skill, prudence, and diligence that a prudent professional would exercise in light of the Client’s goals, risk tolerance, objectives, and financial and personal circumstances.

Notably, in practice, CFP Board’s Duty of Care requires both that CFP® professionals have obtained all of the relevant information necessary to make a recommendation (i.e., provide advice “in light of the client’s goals, risk tolerance, objectives, and financial and personal circumstances”), but also that they must do so with professionalism (with the “care, skill, prudence, and diligence that a prudent professional would exercise”).

CFP Board’s Duty of Care is similar in practice to the “Prudent Person” standard under ERISA, which requires that a fiduciary act “with the care, skill, prudence, and diligence under the circumstances then prevailing that a prudent [person] acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims”.

Fiduciary Duty To Follow Client Instructions

One of the common concerns that arises in the context of a fiduciary duty is “what happens when the client refuses to follow or adhere to the fiduciary advice provided?” and even more directly, “what if the client directs the fiduciary to implement an action the fiduciary themselves didn’t recommend?”

To clear the air of the concern, the new Code and Standards set forth a third duty – the “Duty to Follow Client Instructions” – that unequivocally states:

A CFP® professional must comply with all objectives, policies, restrictions, and other terms of the Engagement and all reasonable and lawful directions of the Client.

In other words, in situations where the Client themselves disregards the CFP® professional’s advice, and then asks the CFP® professional to implement an action contrary to their own advice, the CFP® professional still is expected and has an obligation to follow the Client’s instructions (presuming they are otherwise reasonable and legal in the first place).

Fiduciary Obligation To Disclose And Manage Conflicts Of Interest

CFP Board’s new Standards include a fiduciary Duty of Loyalty to place the client’s interests ahead of their own, and to avoid or, if unavoidable, to disclose and manage any conflicts of interest. In this context, CFP Board defines a Conflict of Interest as when a CFP® professional’s “interests (including the interest of the CFP® professional’s firm) are adverse to the CFP® professional’s duties to a Client… or [when] a CFP® professional has duties to one Client that are adverse to another Client.”

Beyond this general obligation, though, the new Standards also have a separate and explicit Duty to Clients to disclose and manage conflicts of interest.

Specifically, as it pertains to disclosure, the new rules require that:

When providing Financial Advice, a CFP® professional must make full disclosure of all Material Conflicts of Interest with the CFP® professional’s Client that could affect the professional relationship. This obligation requires the CFP® professional to provide the Client with sufficiently specific facts so that a reasonable Client would be able to understand the CFP® professional’s Material Conflicts of Interest and the business practices that give rise to the conflicts, and give informed consent to such conflicts or reject them.

In turn, the determination of whether the client received sufficient disclosure in order to give informed consent will hinge on CFP Board evaluating:

…whether a reasonable Client receiving the disclosure would have understood the conflict and how it could affect the advice the Client will receive from the CFP® professional. The greater the potential harm the conflict presents to the Client, and the more significantly a business practice that gives rise to the conflict departs from commonly accepted practices among CFP® professionals, the less likely it is that CFP Board will infer informed consent absent clear evidence of informed consent. Ambiguity in the disclosure provided to the Client will be interpreted in favor of the Client.

For the purpose of these rules, CFP Board defines a conflict of interest as being Material “when a reasonable Client or prospective Client would consider the Conflict of Interest important in making a decision”.

However, it is notable that CFP Board’s disclosure does not require written disclosure of Material Conflicts of Interest. Instead, the rules explicitly state that written consent is not required and that oral disclosure is permitted (as long as it is still given before providing financial advice), though “evidence of oral disclosure of a Conflict will be given such weight as CFP Board in its judgment deems appropriate”. Which means that written disclosure may not be required but will likely still be deemed a best (and more defensible) practice. And notably, “a sincere belief by a CFP® professional with a Material Conflict of Interest that he or she is acting in the best interests of the Client is insufficient to excuse failure to make full disclosure.”

In addition, to the extent the CFP® professional does retain a Material (and now disclosed) Conflict of Interest, they are expected to try to manage that Conflict:

A CFP® professional must adopt and follow business practices reasonably designed to prevent Material Conflicts of Interest from compromising the CFP® professional’s ability to act in the Client’s best interests.

Fortunately, to the extent that financial advice is already a highly regulated profession, at least some of the disclosure obligations may be redundant to existing rules already applicable to CFP® professionals, particularly those who work at RIAs that already have similar disclosure obligations via their Form ADV Part 2A.

On the other hand, broker-dealers may need to develop new disclosures for their Material Conflicts of Interest, and (re-)evaluate whether their disclosure delivery processes meet the obligation of not just disclosure delivery itself but obtaining informed consent as well.

(Potentially Conflicting) Duties Of CFP® Professionals To Their Firms And Subordinates

In addition to the fiduciary duties that a CFP® professional owes to their clients, CFP Board’s Standards of Conduct also stipulate Duties that CFP® professionals owe to the firms they work for, and to the subordinates they supervise.

Specifically, the Code and Standards require that:

A CFP® professional must exercise reasonable care when supervising persons acting under the CFP® professional’s direction, including employees and other persons over whom the CFP® professional has responsibility, with a view toward preventing violations of applicable laws, rules, regulations, and these Standards.

While a relatively straightforward expectation of anyone in a management or supervisory position, CFP Board’s Code and Standards require that CFP® professionals manage their subordinates with a view towards preventing violations of applicable laws, rules, and regulations. Which means CFP® professionals who fail to adhere to their management duties and/or are otherwise disciplined for failures of oversight may be disciplined by CFP Board for failing to adhere to their duties, in addition to whatever sanctions their firm or regulators may impose.

Notably, though, the Code and Standards also create an expectation that the CFP® professional manage their subordinates “with a view toward” preventing violations of CFP Board’s own Standards of Conduct. Which is important, because CFP Board’s fiduciary Standard of Conduct may be different/higher than the otherwise applicable standards in the business (e.g., in the case of CFP® professionals in broker-dealers not subject to a fiduciary standard), elevating the expectations for not just the CFP® professional but also for their entire team. Consequently, CFP® professionals responsible for managing teams and overseeing others (i.e., advisors) in a non-fiduciary environment will still be expected to try to manage their teams towards CFP Board’s Fiduciary Standard … with the caveat that the obligation is only “with a view toward”, recognizing that in practice pursuing such fiduciary management approaches may simply not be fully feasible in certain non-fiduciary firms.

In turn, CFP Board’s Code and Standards also require that CFP® professionals comply with their firms’ (lawful) policies and procedures, but again with an exception, stipulating that a CFP® professional:

- Will be subject to discipline by CFP Board for violating policies and procedures of the CFP® professional’s Firm that do not conflict with these Standards.

- Will not be subject to discipline by CFP Board for violating policies and procedures of the CFP® professional’s Firm that conflict with these Standards.

Similar to the obligations of CFP® professionals managing subordinates, CFP Board’s Code and Standards require that CFP® professionals adhere to their firms’ policies and procedures. Failing to do so may not only entail consequences from the advisor’s firm, but also from CFP Board (which retains the latitude to discipline CFP® professionals for failing to follow their firms’ policies and procedures, in addition to disciplining advisors for the underlying behavior that the firm itself was punishing in the first place, such as an inappropriate sale/recommendation to the client).

However, again recognizing that CFP Board’s Code and Standards may not align with the internal standards of non-fiduciary firms (e.g., broker-dealers and insurance agencies), the CFP® professional will not be held accountable in situations where they choose to violate the firm’s policies and procedures in a manner that otherwise adheres to CFP Board’s Code and Standards (i.e., in situations where the firm’s standards conflict with CFP Board’s, such as in the case of an advisor who refuses to implement the company’s suggested product that is inferior and instead recommends a superior alternative to the client that wasn’t recommended/permitted by the firm itself).

Of course, in situations where CFP® professionals fail to adhere to their firm’s policies and procedures and follow CFP Board’s Code and Standards instead, CFP Board will not pursue disciplinary action for failing to follow the firm’s rules, but the advisor’s own Firm may still choose to do so based on its own policies and procedures that were violated in the first place.

On the other hand, in situations where a CFP® professional is disciplined by CFP Board:

A CFP® professional must promptly advise the CFP® professional’s Firm, in writing, of any public discipline imposed by CFP Board.

Notably, in a highly regulated environment like financial services, the requirement to notify a firm of CFP Board discipline may ultimately result in a U-4, ADV, or new Form CRS disclosure about the advisor’s (CFP-Board-based) disciplinary history (where the firm feels it is necessary to disclose such disciplinary actions)... which is the point (i.e., to help ensure that consumers receive proper disclosure of the CFP® professional’s disciplinary history, including and especially in situations where the CFP® marks are revoked or the CFP® professional otherwise relinquishes the marks, such that the CFP® professional would no longer otherwise be subject to CFP Board’s own disciplinary disclosure obligations).

Nerd Note:

Because of the complexities and nuances that arise particularly in the context of conflicts of interest not only between CFP® professionals and their clients, but also between their firms and their clients, CFP Board provides a number of Case Studies on common scenarios that CFP® professionals may face, including with respect to share class recommendations and where clients instruct the CFP® professional to execute trades in a certain manner.

In the end, the reality is that the obligation of CFP® professionals to act as fiduciaries in the best interests of their clients isn’t entirely new – it was an obligation that existed under the prior Code of Ethics and Professional Responsibility as well.

However, the prior rules only applied a fiduciary duty to CFP® professionals actually doing Financial Planning (or material elements of Financial Planning), while CFP Board’s new Standards of Conduct will apply more broadly to any type of Financial Advice that a CFP® professional provides… which in practice will span the full breadth of virtually any financially-related recommendation that a CFP® professional provides in a Client Engagement.

For RIAs that are already subject to a fiduciary duty under the Investment Advisers Act of 1940, the new CFP Board rules are substantively similar to the fiduciary obligation they may already face, albeit subject to all Financial Advice that the CFP® professional provides (and not just the advice they deliver while ‘wearing’ their RIA hat).

On the other hand, for registered representatives of broker-dealers, and insurance agents, CFP Board’s new duties impose a new higher standard for their advice… such that even if the CFP® professional meets all the requirements of their firm and the regulations of FINRA and/or state insurance regulators, they may still fail to adhere to CFP Board’s higher standard, and instead are expected to comport themselves accordingly or else face potential discipline, from Private Censure to a Public Censure or even suspension or revocation of the marks.

Of course, being a CFP® professional is not a legal license, and financial advisors can always choose to continue to practice without the CFP® marks after failing to adhere to CFP Board’s fiduciary obligation. Nonetheless, as the CFP® marks are increasingly viewed as a minimum benchmark of trust and competency by consumers themselves, the stakes of relinquishing the CFP® marks (or having them suspended or revoked) are higher than ever. On the other hand, though, arguably, CFP Board’s fiduciary obligation is simply requiring CFP® professionals to do what is good business with clients anyway?