Executive Summary

Financial planning advisory firms have traditionally operated as brick-and-mortar establishments, with clients coming to the office to meet with their advisors in person, and where all employees would generally be available on-site every day during normal business hours. However, with the onset of the COVID-19 pandemic, ‘business as usual’ took a dramatic shift to a more ‘virtual’ reality. Businesses around the world were required to shift gears to comply with social distancing requirements to mitigate the impact of the spreading disease. For financial advisors in particular, this meant quickly developing a strategy to implement processes that would accommodate virtual meetings with clients, as well as work-from-home systems in place for employees to continue servicing clients and to maintain everyday business operations. With no immediate end in sight of the current pandemic condition being resolved, however, business owners are now looking to create more permanent workplace solutions that will accommodate social distancing practices.

Sustaining a successful future advisory firm model will require several changes to leadership strategies, including a shift in focus from a ‘presence-based’ management style, in which the key metric to assessing employee productivity is by the very fact that they show up for work in the office, to more of an ‘output-based’ management style, in which productivity is measured more by attainment of company goals and the deliverables required of employees to achieve those goals. Critical to this shift in management style is a clearly communicated career progression strategy, to convey to employees the importance of their role in the organization and how those roles are designed to meet company goals. Another leadership strategy to adapt a successful future model is the cultivation of ‘Team-Based’ (versus ‘Boss-Based’) accountability systems, in which team members themselves have more freedom and autonomy in conducting work as a means to manage their own accountability, instead of relying on bosses to guide the direction of individual workloads. Finally, allowing employees to choose between working environments (e.g., virtually or onsite with other team members) can enhance employee satisfaction and help them work more effectively.

Also important in cultivating a sustainable future advisory firm is the creation of a cohesive culture that includes all employees – including those team members who work remotely. Open and frequent communication is important in reminding employees about the core values and company goals of their organization. It is also important for management to ensure that employees know that they are valued members of the company, intentionally reminding them of this from time to time, allowing for flexible work hours to accommodate personal priorities, supporting employees in setting up comfortable and functional work environments (whether at home or in the office), and finding team-building activities to engage employees while at the same time emphasizing that the workplace can be considered a source of personal support.

Finally, infrastructure must be thoughtfully designed to support firm growth. Functional technology systems are a crucial infrastructure component and are essential for good communication across the organization, especially when employees are working remotely in different locations. Being able to assess all processes and identify the specific steps that employees are working on through the use of a well-designed workflow task management platform can help all team members to determine whether their workloads are being managed effectively (and to tweak processes as needed), and additional channels of communication (e.g., instant messaging applications) can help minimize email inbox overload. Team structures may need to be reassessed as well, such as limiting the number of a manager’s direct reports so that sufficient resources are available to support employees.

Ultimately, the key point is that as financial advisory firms evolve their organizations to accommodate a more remotely based workforce, there are many decisions for enhancing their success. Critical to this process is for firms to self-assess the needs of their individual employees, to decide how best to reshape the practices followed by leadership and management, and to maintain their culture regardless of where employees may be situated.

The advisory world was tossed into a new working reality when COVID-19 caused stay-at-home orders to be instituted across the country. As weeks turned into months of working from home, many RIAs began asking themselves if the traditional workday would ever look the same. Advisors who historically shunned the idea of allowing employees to work from home have now experienced an awakening, as their teams have generally remained productive and have adapted to the new working environment.

And the good news is that clients have generally been very receptive to their advisors working from home. Which means that while many RIAs have historically felt the need to present themselves in fancy office spaces located in expensive financial districts inside metropolitan areas across the country, it may no longer need to be the case.

The prevailing belief in the wealth management industry has always been that clients would not entrust their life savings to an advisor that wasn’t ‘buttoned up’ and polished. Yet ironically, conducting video calls from home with pets barking in the background and children occasionally 'video bombing’ meetings means polished presentations have given way to genuine human interaction, which has created an even stronger bond between advisor and client. Instead of inviting clients and prospective clients into a cold, mahogany-inspired office, video conferences have invited clients into advisors’ homes – perhaps not by design – but by circumstance.

With clients saying, “I don’t need to come to your office like I used to,” and employees able to maintain their high levels of client service while eliminating their daily commute to and from the office, many RIA owners are beginning to ask, “Why are we spending this much money on office rent?”

For most RIAs, the three largest expense items are employee salaries, office rent, and technology. If owners can reduce the size of their office space and save on rent, and not require employees to live in expensive metropolitan areas and save on staffing costs, advisory firms can reduce two of their three largest expenditures as we come out of this pandemic – all without compromising client service. Not to mention the talent pool that is opened up, as firms will no longer be limited to employment searches solely in their geographic region.

A recent Forbes article, titled “The New Normal Isn’t Remote Work. It’s Better,” stated that, given the option to work from home, “employees are reporting greater productivity and higher job satisfaction, which is translating into enormous profitability for their employers. By permitting offsite work, the businesses then get to access even more overhead savings, like lower real estate, equipment, and supply expenses.”

In the next 6 months, firms that innovate, think creatively, communicate clear expectations to their people, establish a culture of team accountability, and design output-based goals will emerge as industry leaders when the country comes out of lockdown and COVID-19 is finally behind us. In turn, as RIA owners rethink their use of traditional office space and how they can best interact with their teams moving forward, we believe advisory firm physical space will be reduced, office layouts will be adjusted, and shifts of team members coming in and out of the office will be instituted. Which, as outlined in our recently published research paper entitled, “The New RIA Workplace,” will require advisory firms to develop new strategies when it comes to leadership, culture, and infrastructure.

In the sections that follow, we will examine how RIA leaders can adjust their management practices, creatively approach culture in a remote environment, and design impactful technology infrastructure to spur growth in the post-COVID RIA workplace.

Leadership And Management Styles Must Evolve To Sustain A Successful Hybrid Workplace

One main reason that RIA owners have historically been skeptical of remote work is the fact that they can’t see what employees are doing on a day-to-day basis. To be successful in the future model, management will need to shift from a presence-based management style to one that is more output-based, meaning that goals will need to be set regularly and success will be measured on achieving those goals, rather than on the number of hours that employees work.

Implementing An Output-Based Management Style

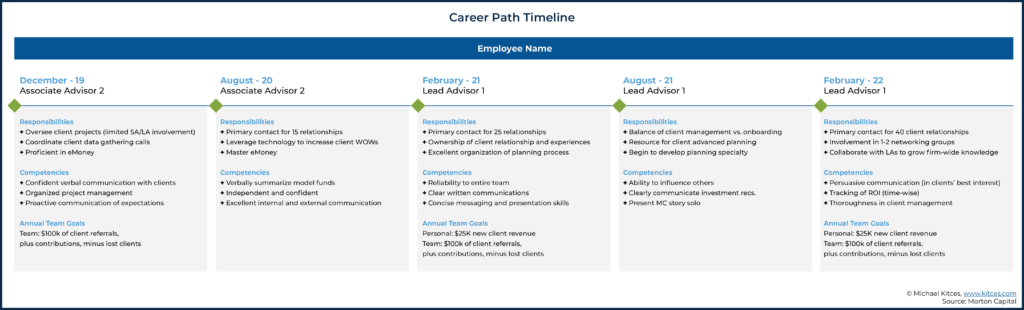

Clear expectations of each employee and the roles they are playing within the organization will need to be (better) defined from the start. This begins with documented, well-defined career paths for each role within your firm (see the sample below that Stacey uses at Morton Capital).

With a more output-based management style, it is even more essential that employees understand how they can progress their careers, and how the firm will define success for each stage of growth. Compensation should be tied to specific personal and firm achievements along the career path, not merely seniority or length of service with the organization.

With employees scattered in various locations, communication must be prioritized. All-hands video calls should be conducted on a weekly basis to ensure employees are hearing directly from firm leadership regularly and have the opportunity to ask questions.

These meetings can be short (15-30 minutes) and should include the following: an inspirational comment from leadership (this could be a shout-out to an employee for a job well done or a client success story), a quick update on the capacity of each department (e.g., what is the current turnaround time on new account applications), and an opportunity to make any firm-wide announcements (e.g., when employees will be able to return to the office). The most important part of a weekly kick-off meeting is to connect with your team and set short-term expectations for the week ahead.

Smaller department/team calls should be held on a weekly or bi-weekly basis where employees are encouraged to share what is working and what is not working, and team goals can be discussed more deeply. For larger organizations, this is a good time to discuss feedback on any challenges between teams as well. The team lead or manager can then give that feedback to the other leaders in the organization and solve issues before they get out of control.

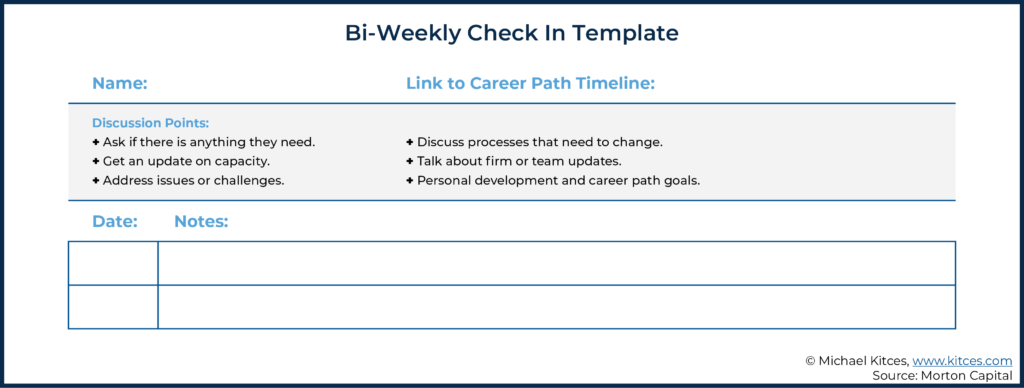

Managers should also hold more casual one-on-one check-ins with each of their employees on a bi-weekly basis simply to ask, “How are you and your family holding up?” Employees may be reluctant to provide negative feedback to their manager for fear of being labeled a 'complainer', so it is crucial that managers listen for clues to ensure team members have what they need to be successful and feel they are on track to meet their personal and career goals, as outlined on the sample template from Morton Capital below (a sample template can be downloaded here). This is also a great opportunity for the manager to provide feedback in a timely manner.

Cultivating Team-Based (Versus Boss-Based) Accountability Systems

It’s important that team members understand that the goal of increased internal communication is not a sign of micro-management, per se, but rather to provide a tool to build the foundation for more autonomy and freedom for each employee.

Michael Kossman, COO of Aspiriant, a $12 billion RIA with 200 employees and 11 offices across the country, suggests, “[In this new environment], we simply don’t have the opportunity for hallway check-ins, so we have to be more intentional about it. Asking very direct questions like, ‘How did you spend your day yesterday?’ will need to be part of the norm. As professionals progress in their careers, that will be less and less necessary, and leaders will have to be satisfied with work being done to high quality within deadlines. Isn’t that what we all really want anyway?”

Feelings of isolation can be very real in a remote working environment – in addition to regularly contacting employees to check on their work progress; it is important that managers simply check in to say, “How are you doing?” Many firms have instituted 'virtual coffee dates' with their team members, where they can check in on non-work-related matters. These check-ins can run 5-15 minutes and are a great replacement for the office drop-ins of the past. Video meetings among team members have also provided an interesting avenue for greater bonding among coworkers – instead of relying on desk photos of family members and pets, video calls have allowed children, spouses, cats, and dogs to meet coworkers and say hello.

Some firms have also created mentor/mentee programs to ensure each employee has an advocate they can voice concerns to. At Morton Capital, we created a committee of people who were passionate about setting up a mentor/mentee program. That committee met for 2-3 months to develop a program where mentors and mentees were paired together for 6-month intervals. The two individuals met bi-monthly and discussed career goals (reviewing their own personal timelines, as referenced above), the role played client communication, or just learned from the experience and wisdom of someone who has been in the industry for many years. These programs also give the firm another touchpoint with employees and let the employee know they have every opportunity to have their voice heard.

After conducting a phone or video check-in with a team member, Michael Kossman suggests sending a follow-up communication summarizing the conversation. “After you have a substantive check-in, send an email saying, ‘Here’s what we talked about being your priorities, and what we mutually committed to. If this is not achievable, please let me know.’” He also suggests circling back at the bi-weekly check-ins on a regular basis to create accountability.

Eric Hehman, CEO of Austin Asset, a $1 billion RIA with 21 employees, instituted Gallup’s Q12 Employee Engagement Survey (an assessment tool that measures employee engagement through a 12-question survey for employees, which identifies potential areas of strength and opportunity that employers can then address) some years ago, but thought it a good idea to leverage the tool as a way of checking in with employees in this work-from-home environment. The firm was able to compare employee responses today to their earlier responses when they were working from the office every day. They also added an open-ended question to the survey, which simply asked, “What’s one thing management can do to make things better for you right now?”

Not only will RIAs need to change the way in which they lead, but they may also need to change the way in which they train. Instead of just focusing on the job at hand, they might have to teach employees how to work effectively as part of a team in their new normal.

At Morton Capital, weekly education sessions have been instituted (every Thursday from 10:00 to 11:00 am), where team members rotate between investment deep-dives, financial planning case studies, presentations from outside professionals, and soft skills training. Recent soft skills training included teaching principles from books such as The 15 Commitments of Conscious Leadership by Jim Dethmer, Diana Chapman, and Kaley Klemp; Brian Solis’ Lifescale; and Gary Keller and Jay Papasan’s The ONE Thing.

Allowing Employees To Have Workplace Preferences

It is important to remember that there is not a one-size-fits-all guide to managing the new RIA workplace. Some team members will thrive at home, and others will desperately want to go back to the good ol’ days.

Personality tests may even be helpful in determining what environment would be best for any particular team member, as people with more extraverted personalities may need other people in the office for their energy source, and those who are naturally more introverted may prefer a private home office and draw energy from their quiet time alone. Some tests that may be helpful for firms to assess their employees’ affinities and preferences include the 16 Personalities test, Kolbe assessment, and Birkman Method program. Note that each of these assessments will result in different types of insights. 16 personalities will give you examples of how people like you typically act/make decisions, but Kolbe and Birkman will be more specific when it comes to your natural tendencies and how those relate to others.

We suggest leaders take this time to evaluate if they are clearly communicating expectations to their employees, following up on those communications in a timely, effective, and personal way, and then training team members to think differently about how to work effectively.

Creating A Cohesive Culture In A Remote Environment Requires Creative Thinking

One of the biggest organizational challenges related to a remote workforce is that of culture – with team members scattered in various locations, how can leaders create a unified way of doing things when employees can’t physically see or touch the firm’s culture from their respective homes?

In the past, firms would display their core values on the wall in common areas throughout the office as a reminder of what the firm believed in and how everyone was expected to act. In a remote working environment, though, how can you ensure the vision of the firm is shared with all employees, regardless of where they physically sit every day?

How Core Values Can Be Communicated In A Remote Work Environment

Many firms host semi-annual or quarterly ‘vision’ meetings to remind the entire staff of where the organization is headed, how the firm’s core values serve a role, and the short- and long-term initiatives of every team and individual employee. These meetings can easily occur over video conference.

It’s important to make the core values personal – tell the team what they mean to you as a leader. This communication surrounding core values should be shared with employees through all communication mediums (written, via email or internal blog post; audio, via phone calls; and video, via video conference or posted to internal communication platforms such as Slack or Microsoft Teams) to ensure employees see and hear the message multiple times, in multiple ways.

Austin Asset conducts weekly firm-wide calls in which they rotate a different employee as the meeting leader; that leader then takes 30 seconds to tell a story about a co-worker who exemplified one of the firm’s values that week. During these calls, they also hand out ‘high-fives’ to people that went above and beyond to help another employee that week. The employee who gets the most high-fives every quarter gets a $250 gift card. Eric Hehman said, “Beyond the money, it’s important that employees continue to live our values, and we are going out of our way to give them affirmation for all the extra work required in a remote environment.”

Brandon McKerney, Director of Operations of Columbia Pacific Wealth Management, a $4.4 billion RIA with 34 employees and 2 offices, reminds us that “morale depends on employees feeling valued and connected to one another. Employers must be much more intentional about demonstrating appreciation and fostering meaningful interactions.

The ‘little’ things can’t be seen as trivial or transactional – just as it is with clients, every meeting or phone call with a colleague is an opportunity to connect and show that you care.” Morton Capital, for example, provided iTunes gift cards to all employees over the 4th of July holiday for weekend movie nights for families.

Re-Imagining Team-Building Activities To Keep Employees Engaged And Structuring The Workplace As A Source Of Personal Support

At the beginning of stay-at-home orders, many firms instituted virtual happy hours or ‘funny hat’ video calls (where everyone wears their favorite funny hat during the call) to encourage employees to join non-work-related conversations and to foster a feeling of togetherness. As the months have worn on, however, these happy hours have run their course, and firms may be feeling the pressure to get creative; some are now trying tactics like virtual exercise sessions, or even in-person socially distanced walks, to encourage more interaction among coworkers.

Some firms have conducted virtual scavenger hunts in employees’ homes, including children and other family members in the fun. Someone’s child can call out a random household item (“potato peeler!” or “musical instrument!”) and everyone on the call needs to run and find the item somewhere in their house – the first person back to their desk/camera wins a point. Another option to stimulate positive morale is to bond over a common cause.

Even though Morton Capital’s employees are working apart, they have tried to invest in the community through initiatives like complimentary financial planning advice: https://vimeo.com/mortoncapital/communitygiveback. This program allowed people in the local community that didn’t meet their minimums to receive a complimentary one-hour consultation with an advisor. The community member filled out a short survey outlining their assets/liabilities/income/expenses and goals, had a call with an advisor, and then was sent a summary action plan with short term activities that would help them achieve their goals.

The level of support leaders have for their team members will also need to extend past the workplace for the foreseeable future. Employers may need to give more to employee’s families to ensure they feel supported as well. For instance, as the new school year approaches and new COVID-19 cases are on the rise, it appears that full-time back-to-school is not going to be an option in many parts of the country; consequently, it is important that employers are prepared for team members continuing to simultaneously juggle work and the responsibility of homeschooling their children. This could include allowing more flexible hours for your employees or offer a stipend to have childcare personnel come to the home and help children navigate remote learning.

It will be critical to allow for flexible working hours so that personal priorities can be attended to along with business priorities. This could mean setting tighter standard hours (for example, 10am to 3pm) and allowing team members to make up the other 3 hours wherever it fits in their schedule.

If a firm truly transitions to goal-based management (i.e., the activities that need to be completed are clear and within a specific timeframe), then the hours for work shouldn’t be arbitrarily-selected; it should be based on accomplishing the specific goal. The U.S. Securities and Exchange Commission recently announced that most employees would be allowed to continue working from home until at least October.

Simply put, though, for a culture to thrive in the current virtual environment, it cannot depend on people being physically present with one another. It will likely depend on the feelings team members have of 'rowing in the boat together' and being supported by their peers and leadership. And figuring out how to inculcate that feeling, even and especially, in a virtual work-from-home world.

Thoughtful Infrastructure Is Paramount For Growth

We all recognize that change is hard, and as leaders, we should proactively make it as seamless as possible by giving our teams the resources they need to be successful. It is important for employers to acknowledge and accept that every employee will not adjust to remote work at the same rate or to the same level of success as others, and that employees will have unique needs to thrive in the workplace. A recent Business Insider article noted that one trait of a good remote worker (among several other traits) is having a good home office environment. Thus, supporting employees with establishing a comfortable and functional workspace can be an effective way to help them do their best work. As an alternative view, a BBC article suggested that those who feed off the energy of others might not be as successful at home; accordingly, strategically coordinating where people will work can help to provide optimal physical environments for each employee.

How Technology Can Support Teams And An Efficient Workplace

Even though leaders may not be able to physically monitor their employees, it is as important as ever to understand what specific activities each person is doing and help them adjust their time to the most productive activities. Specialized workflow software may be worth considering instead of just relying on CRM.

Morton Capital has invested in Workfront, a workflow software, which clearly outlines all the steps in each client-related task. For example, there are 85 steps required to open a new household/account mapped out in the software. All team members can log in remotely at any time and see exactly where in those 85 steps a new household is without having to contact the support team responsible for managing the account-opening process. In addition, managers can easily access reports on team capacity to ensure workload is being appropriately managed.

This workflow software is more powerful than most CRM systems in our industry because it is actually designed for workflow, as opposed to most CRMs that are created to manage client data primarily, and to solve workflow challenges secondarily (and generally in a very simple way). A dedicated workflow tool like Workfront, or an organizational tool (like Asana, Trello, or Monday), can be much more powerful operationally, especially if it ‘takes the thought out of it’ and allows the user to be more productive, accurate, and consistent.

The downsides to some of these tools are the lack of integration to CRM, but at Morton Capital, we have adapted by selecting a primary tool per department. For the teams that work behind the scenes, they primarily use Workfront to manage tasks and projects. The client-facing team members submit requests through Workfront, but use the CRM to track client interactions and more personal reminders/tasks for clients.

Cybersecurity also needs to be a priority for firms in this new environment. Employees should access the internet through password-protected Wi-Fi networks, and employers should be vigilant about account security policies.

Policies should also be instituted around locking computer screens when team members are not at their desks, and employees should ensure monitors, displaying sensitive client data, cannot be viewed from street-level windows.

Providing The Right Equipment To Keep Employees Happy And Productive

Setting up team members for success by providing them with the proper tools to work remotely is critical. Whether using laptops or desktop computers at home, dual monitors with either stands or monitor arms should be sent to every employee’s home. Ergonomic keyboards, wrist pads, and proper office chairs should be prioritized. Remind employees that they should not be hunched over laptop screens that are awkwardly balanced on small end tables for hours at a time. These tools can cost $200-$500 per employee (outside of a laptop) but are well worth it if the team member is able to be more efficient. If an employee already has a setup, consider allowing them to use the stipend to upgrade their router, modem, or other home internet equipment.

PFI Advisors has been a big fan of Vari (formerly Varidesk) products for home office set up. We have also encouraged employees to create multiple ‘stations’ to work from throughout the day (home designs, permitting). Matt, for example, starts his mornings at the dining room table, then shifts to his desk in the bedroom, and oftentimes plugs his laptop into his wife’s desk at certain times of the day to provide mental shifts in perspective in an attempt to keep things fresh. Stacey spends time at her laptop in the backyard for portions of her day for the same reason.

Whether firms are buying new equipment for employees’ homes, or simply repurposing equipment from the office for home use, expense budgets should be re-evaluated in the new environment. Travel costs are way down over the past few months, and entertainment budgets have practically gone to zero with no sporting events, concerts, theater, or even simple lunch or dinner meetings put on hold. With more and more clients embracing virtual meetings with their advisors, travel budgets will probably be a fraction of what they were long after the pandemic is behind us. Printing costs are also way down as in-person meetings aren’t taking place today, and not as many will take place in the future. Employees are printing much less from home than they used to in the office as well. The lack of travel expense budgets and printing costs should leave room to invest in at-home equipment for team members.

Adjusting Firm-Wide Technology Tools To Adapt To A Remote Workforce

With the proper equipment in hand and expense budgets adjusted for a remote workforce, it is also critical that employers institute proper technology practices across the firm – employees must think not only of what tools they have, but how best to use them in the new working environment.

Many employees have struggled with inbox overload, as in-person communication has shifted to the digital world. Policies have been instituted that require email to be solely used for client communication and that internal communication be moved to other modes of communication (e.g., Slack, Microsoft Teams, or other instant messaging applications).

If technology can be used efficiently, there should not be a need to email someone to do a task, but instead, that request can be entered directly via a workflow tool or CRM. By reducing the number of touches on a specific task, work can be accomplished more quickly and can reduce duplicate efforts.

As noted earlier, CRM tools have taken on increased importance as managers can rely on status updates inside the CRM rather than reaching out to team members via email or IM tools. This could include an assurance that advisors are still communicating with clients (which can be seen via a meeting report) or tagging another team member in a CRM update so that they are automatically in the loop on a client call that historically would have occurred with both advisors.

When on video calls, some firms have required employees to shut off their email applications completely to discourage multitasking during team meetings. In addition, some team members set specific ‘email blocks’ 3 times a day for 30 minutes each. This allows them more time to focus without constantly being distracted by incoming emails.

Adjustments To Team Structure To Promote And Maintain A Positive Firm Culture

The structure of your team might adjust as well. This might include centralizing certain functions of the organization or changing your org chart to be more conducive to a remote environment. Investing in individuals takes time, which is not a resource that is easy to come by. To effectively execute business in a hybrid environment, firms may benefit from additional managers/leaders to keep teams on track and work with team members to promote a positive culture and career growth. These leaders should have excellent training (or you may need to implement or update a training program) as it is much more difficult to set goals for the future than it has been to make sure people are in their seats working 8 hours per day.

Each manager should have 5-8 direct reports, and their goals should be focused on ‘working smarter, not harder’ so that RIA owners can continue to grow their practices and focus on the client experience. The more direct reports a manager has, the more time they will spend managing people and the less time they will spend on strategy, processes, and the big picture, which is why limiting the number is very important for long term growth.

If the managers create more efficient practices, ultimately offloading management duties from the owners, and owners grow the practice (instead of managing their staff), the ROI from professional leadership will be well worth the investment. Many books have been written organizational structure and team management, but a few interesting reads include Traction, The Enduring Advisory Firm, and The Culture Code.

As we dive into the possibilities of a new normal, it is important to note that each firm must take time to self-evaluate, seek feedback from their teams, and craft a new workplace unique to their needs and goals.

There is clearly no one-size-fits-all solution when it comes to designing the workplace of the future, and we will all continue to learn and evolve over the coming months. Some of the ideas shared here will stick, and still more will emerge that we haven’t even thought of yet.

COVID-19 will undoubtedly shake up our industry and force firms to re-evaluate priorities in the name of setting themselves up for success in the years to come.