Executive Summary

This month, the FPA’s “Research and Practice Institute” (RPI) released its study on “Trends in Client Communication”, a part of its ongoing follow-up to last year’s “Future of Practice Management Study” that identified client communication as a key driver of advisory firms (and a self-identified challenge area for many advisors).

Not surprisingly, then, the results of the RPI study show a wide range of practices in how advisors handle their client communication, segment their clients, and conduct their client review meetings. Nonetheless, the results do provide an interesting glimpse into common practices today; for instance, 71% of advisors report that they segment their clients to at least some degree, 85% conduct client meetings in their offices (rather than the client’s home/business), and 88% have a website for providing at least basic information to clients.

Notwithstanding these consistencies, though, the conclusions of the study suggest there is still significant room for advisors to continue to standardize the way they conduct review meetings and deliver communication to clients as well. For instance, while 80% of advisors say they use a CRM only 41% actually enter client notes into their CRM, only 1-in-3 advisors even occasionally set a formal agenda for client meetings, and only about a quarter of advisors have defined standards of service for their clients and have a means of tracking effectiveness!

While the study is ultimately more descriptive than prescriptive, it will be interesting to see how these statistics trend in the coming years!

Foundation Of Effective Client Communication

As defined in the FPA's Research and Practice Institute (RPI) study on Trends in Client Communication, there are four key components that drive an effective communication strategy: the communication must be meaningful to clients, profitable to the firm, defined in a manner that can be standardized/automated, and the standards must be communicated to clients to set proper expectations in the first place.

As defined in the FPA's Research and Practice Institute (RPI) study on Trends in Client Communication, there are four key components that drive an effective communication strategy: the communication must be meaningful to clients, profitable to the firm, defined in a manner that can be standardized/automated, and the standards must be communicated to clients to set proper expectations in the first place.

Notwithstanding the fundamental importance of ensuring that there are clear standards for client communication that clients are aware of, and that can be implemented and tracked and measured, the RPI study would that only 56% of firms formally define their service standards for clients (e.g., frequency of contact/meetings, response times to clients, etc.), and of those only 46% formally track whether they’re meeting the standards they’ve set.

Similarly, there is little consistency in communicating to clients what the standards will be; 44% of advisors communicate some expectations once up front with clients, but only 30% review/reinforce this on an ongoing basis (and 27% don’t communicate service standards at all). To the extent standards are communicated, 81% simply do so informally/verbally, while only 15% have a written service agreement. Similarly, in gathering feedback from clients about effectiveness, 83% just informally ask how things are going, while only 41% use a written or online survey (along with 11% who do a phone survey and 10% who use a client advisory board).

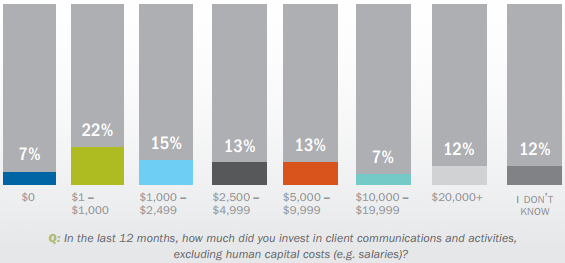

Given this range in activity and consistency, it is perhaps no surprise that the amount of money firms spend on client communications and activities (excluding staff costs) varies tremendously by firm, with 29% of firms spending under $1,000 and 19% spending more than $10,000/year. (Notably, it appears that client social/appreciation/educational events would be included in this cost, such that the wide range of expenses is probably reflective of those types of events in particular.)

Client Segmentation Strategies And Service Tiers

After all the years of industry articles and consultants advocating for advisors to segment their clients, the RPI study affirms that the majority of advisors really do at least some segmentation of clients; 71% reported that they currently segment their clientele, with 44% of that client reviewing and updating the segmentation on a regular schedule. Segmentation standards varied, using a wide range of metrics including assets, revenue, influence, referral activity, and time required to service.

Amongst those advisors who segment their clients, 82% also tier the service levels they provide to their clients based on those segments. When comparing the firms that segment their clients to the firms that don’t, the following differences in services became evident in the firms that segment clients:

- Unsegmented firms average 2 face-to-face meetings and 3 “other” (telephone/web) meetings with clients. By contrast, segmented firms do significantly more review meetings with their top clients (almost 3 face-to-face and 5 “other” meetings per year), and significantly fewer with lower priority clients (averaging only 0.7 face-to-face and 1.6 other meetings).

- Unsegmented firms average 1 social event and 1 educational event per while, while segmented firms average more than 2 social events and also 3 educational events for their top clients each year.

- Segmented firms share more articles of interest with their top clients.

- Segmented firms do less “other” communication with low priority clients (i.e., it appears they tend to stick to “just” the committed minimum communication standards for their lowest segmented clientele)

These differences suggest that “segmentation” for advisors means a combination of both greater frequency/depth of services for top clients in some areas, and reduced frequency/depth of communication for lower priority clients in other areas.

Conducting Review Meetings With Clients

Another aspect of advisor communication that the RPI study evaluated was how advisors conduct their review meetings.

The results showed that 85% advisors “most commonly” conduct their client meetings at their firms; of those, a little more than half do the meetings in their own personal office, and the rest use a meeting room at their office. Only about 15% of advisors typically meet with clients at their home or office (and of those that do, 80% meet at the client’s home, not the client’s place of business!).

In structuring meetings, advisors currently favor somewhat informal meeting structures. Only 36% of advisors send an agenda in advance of client meetings (and of those, only 1/4th of them do it “always”), although 69% send a follow-up to the clients after the meeting (about 1/3rd always send the follow-up and the other 2/3rds do so sometimes).

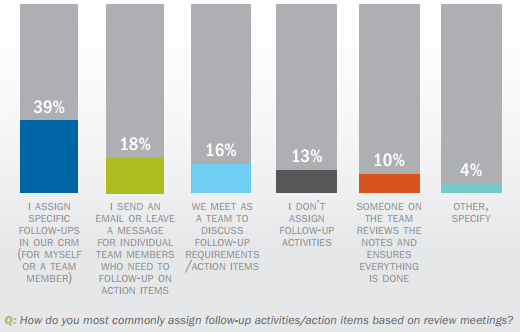

In terms of capturing what happened in the meeting itself, there’s even more variability. About 33% of advisors still put written notes in a physical client file after a meeting; only 41% enter their notes directly into a CRM, which is striking as 80% of the advisors indicated they use a CRM (and means that a significant number of advisors who have a CRM still aren’t using it to record client notes!). This inconsistency in CRM also leads to a wide range of approaches for handling the follow-up activities/action items after a client meeting, as indicated below.

Other Notable Results Of The Research & Practice Institute Communication Study

Some other notable results of the RPI study included:

- 88% of advisors have a personal/firm website; of those, about half simply use it to provide information about the advisor/firm, while the other half also have some “client only” tools/resources on the site.

- 82% of advisors have a LinkedIn profile for professional use (by far the dominant social media platform for advisors); the next most popular platforms for professional use were Facebook (26%), Twitter (24%), and Google+ (22%).

- The most popular use of social media for advisors is to find insights on improving their businesses and their technical skills; going forward, advisors indicate they plan to use social media less for gathering insights and more for pushing out their own ideas.

- Notwithstanding all the discussion about pursuing the adult children of current clients, only 34% of advisors are proactively trying to build relationships them. By contrast, 42% of advisors are proactively trying to obtain younger prospective clients not necessarily tied to the family of their current clients (though this result is distorted by the fact that younger advisors are often building business in this demographic as their primary client).

- Advisors are most focused (87%) at proactively building relationships with the spouses of current clients and engaging both members of the couple (which is arguably a better near-term retention strategy anyway!), as for almost half of advisors, only half their married clients attend meetings together.

Overall, the FPA’s RPI study isn’t ultimately very prescriptive about what advisors should be doing, nor are the results/outcomes directly tied back to key performance indicators or business metrics. Nonetheless, as with some other recent studies on best practices in advisor communication with clients, this one provides an interesting perspective on the current landscape of what advisors are doing, and will set an interesting baseline as the study is (hopefully!) updated over time to document trends in advisor communication approaches in the coming years!

In the meantime, for those who are interested, you can see a full copy of the RPI study on client communication here.