Executive Summary

While pre-tax distributions from retirement accounts are generally taxed at ordinary income rates, an exception to this rule applies to appreciated employer securities distributed from an employer plan that are a part of a Net Unrealized Appreciation (NUA) transaction. In such instances, the NUA (i.e., the appreciation on the employer securities that occurred within the employer’s retirement plan) is taxed at the more favorable long-term capital gains rates (when sold in a taxable account).

Given the disparity between the two rates, the ability to swap ordinary income tax rates for long-term capital gains tax rates on a portion of a worker’s retirement savings may sound highly appealing. However, doing so is not always a great move. While the NUA itself gets the benefit of long-term capital gains treatment, the portion of the shares distributed that is attributable to their cost when purchased within the employer plan (what would be their basis had they been purchased with taxable dollars) is subject to ordinary income tax rates right away. Additionally, completing an NUA transaction removes the assets (for which NUA is used) from the ‘protective’ tax-deferred wrapper provided by a retirement account.

Nevertheless, there are clearly times when an NUA transaction can be used to help reduce an individual’s tax liability. But to do so, three key NUA rules must be followed:

- NUA transactions can only be made after a ‘Triggering Event’;

- The employer-sponsored retirement plan must be emptied within one calendar year (i.e., as a lump-sum distribution); and

- The shares of stock on which NUA is desired must be moved, in-kind, to a taxable account.

Since the favorable long-term capital gains treatment in an NUA transaction is only applicable to the growth of the employer securities (while the purchase price of the shares is subject to ordinary income tax), the strategy is generally viewed as one that is best reserved for employer securities that have experienced substantial growth. Indeed, the greater the appreciation, the more attractive NUA becomes. Even so, that doesn’t mean that NUA can’t be useful in other situations.

One situation in which NUA with more modestly appreciated employer securities can make sense is when the NUA transaction is used to fund near-term cash flow needs. If a plan participant needs to take a distribution from their plan to satisfy immediate cash flow needs, then absent the use of NUA, the entire distribution will be taxed at ordinary income rates. By contrast, as long as there is at least some level of appreciation in the employer stock in the plan (i.e., some amount of NUA), then using an NUA transaction to fund short-term cash needs will result in a tax savings, as the proportion of the distribution attributable to growth (versus the purchase price) will be taxed at long-term capital gains rates.

Just how ‘short-term’ the cash flow need should be for NUA with modestly appreciated securities to make sense depends on the situation, which should be evaluated based on a taxpayer’s unique set of facts and circumstances. If a taxpayer can fund multiple years of cash flow needs using NUA, without pushing themselves into a higher tax bracket, then such a move is likely to make sense. By contrast, where (a significant portion of) the added ordinary income created by an NUA transaction is taxed at a higher marginal rate than would otherwise be the case if ‘regular’ distributions were spread of those years, the benefit of the long-term capital gains tax treatment on the NUA is often more than offset by the higher ordinary rates that apply to the cost of the shares.

Ultimately, Net Unrealized Appreciation (NUA) can provide certain plan participants with valuable tax-saving opportunities. And while using NUA with modestly appreciated employer securities to fund short-term cash flow needs isn’t likely to be the ‘move’ that makes or breaks one’s retirement success, it’s a relatively easy way for many plan participants to reduce their tax bill. And when it comes to taxes, less is always more!

The benefit of tax deferral offered by retirement accounts is a powerful tool that can allow individuals to accumulate substantially larger nest eggs to fund retirement spending than the savings they could otherwise accumulate through the use of ‘regular’ taxable accounts. But that tax deferral isn’t a free ride. Rather, it comes at a cost.

Specifically, while qualified dividends and long-term capital gains typically receive favorable tax treatment (as they are taxed at lower rates than ordinary income), when that income is earned within a retirement account, that favorable tax treatment doesn’t apply.

Instead, almost all distributions from retirement accounts are considered ordinary income and are subject to ordinary income tax rates, regardless of the nature of that income (e.g., ordinary income, qualified dividends, capital gains) when it was earned within the account.

The wiggle room provided by the “almost” in “almost all distributions” is needed to account for distributions of stock of the company where the account owner is (or was) employed, that are made from employer-sponsored retirement plans and classified as Net Unrealized Appreciation (NUA).

What Is Net Unrealized Appreciation (NUA)?

When available, Net Unrealized Appreciation (NUA) presents an opportunity to reverse the typical trade-off of the tax deferral that can be taken now, that typically comes with losing out on the favorable tax treatment on qualified dividends and long-term capital gains in the future, for contributions made to a 401(k), IRA, or similar (non-Roth) retirement account.

In effect, NUA allows an individual to trade back the ordinary income tax rates (that would normally apply to plan assets when distributed) for long-term capital gains on a portion of their retirement savings that consist of the appreciation of employer securities within a plan, in exchange for giving up the tax-deferred ‘wrapper’ provided by the retirement account and paying ordinary income tax on the employer securities purchased, at the time of purchase (as explained further, below).

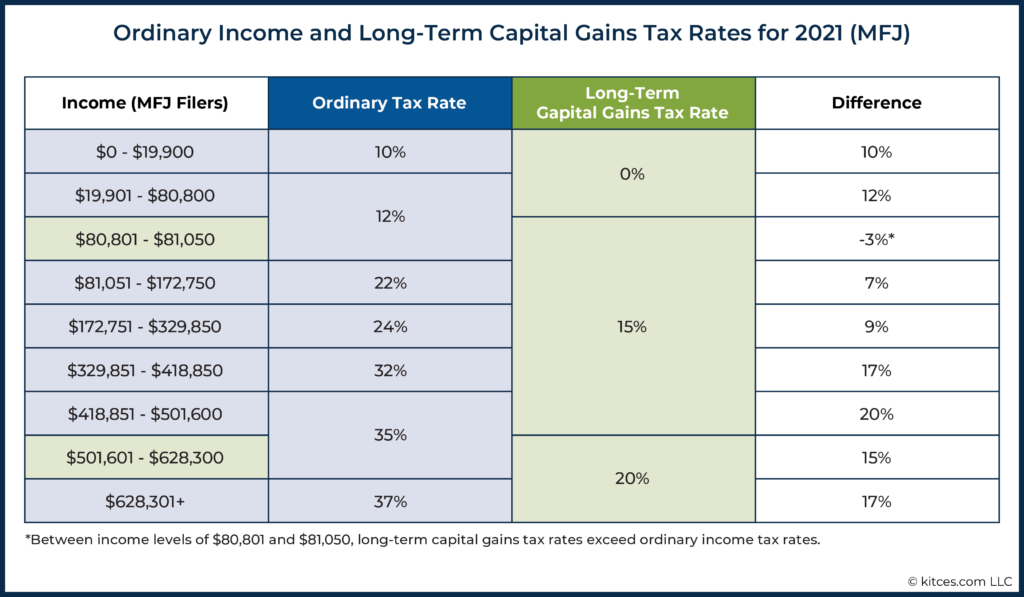

Given the disparity between ordinary income tax rates and long-term capital gains rates which, as shown in the chart below, currently ranges from as low as 7% to as high as 20% (save for an extremely narrow income range in which, in a quirk in the law, the long-term capital gains rate is actually 3% higher than the ordinary income tax rate) NUA would seem like an appealing tax planning move at first glance.

Thus, the obvious question… “What, exactly, is NUA?”

Simply put, NUA is the appreciation of an employer’s stock that occurs while those shares are held inside of a retirement plan that is sponsored by that employer.

Example 1: Shaggy is an employee with Mystery, Inc., and a participant in Mystery, Inc.’s 401(k) plan, which includes shares of Mystery as part of its lineup of investment options.

From time to time, throughout the course of his employment, Shaggy has purchased shares of Mystery within his Mystery 401(k) plan.

The cumulative purchase price of those shares (what would, effectively, be Shaggy’s cost basis if the shares were purchased in a taxable account) is $300,000. Meanwhile, thanks to the growth of Mystery over time, though, shares have appreciated to $1 million in total value.

The $1 million – $300,000 = $700,000 of growth of the Mystery stock that occurred within the Mystery 401(k) plan is NUA.

Obviously, the growth of employer shares in a retirement account can lead to significant NUA over the course of an employee’s work history. Accordingly, advisors with clients who have NUA are in a prime position to provide valuable tax planning services!

Taxation Of An NUA Transaction

Although the ability to trade ordinary income tax rates for long-term capital gains rates on NUA is an enticing proposition, it’s not always the slam dunk that it would appear to be on the surface. That’s because, in addition to giving up the tax-deferred ‘wrapper’ provided by the retirement account, when an individual engages in an NUA transaction (i.e., when a complete distribution of plan funds is made, in which the employer stock is moved in-kind to a taxable account), they must pay ordinary income tax on the cost of the employer’s company shares (what would be the cost basis of the shares if they had been purchased in a taxable account) for which NUA is used.

Example 2: Recall Shaggy from Example #1, who purchased $300,000 of Mystery, Inc. stock within his Mystery 401(k) plan, which, over time, grew to $1 million. As a result, Shaggy had $700,000 of NUA on the Mystery shares.

If Shaggy completes an NUA transaction on the full value of the Mystery shares he holds within his Mystery 401(k), he will owe ordinary income tax on the cumulative $300,000 purchase price of those shares for the year in which the NUA transaction took place.

Meanwhile, the $700,000 of NUA would be taxable at long-term capital gains rates, which Shaggy would owe in the year that the Mystery shares are ultimately sold. This could be in the same year as the NUA transaction (if Shaggy sells the shares in the taxable account during the same calendar year), or in a future tax year.

The NUA (i.e., the growth on the shares of employer stock), unlike the cost of the employer company’s shares themselves, is not taxable until the shares are sold in a taxable account (as discussed further below). Only at that time, when the shares are sold, does the NUA become taxable at long-term capital gains rates.

3 Key NUA Transaction Rules

Individuals who wish to engage in an NUA transaction (by completely distributing retirement plan funds and moving any employer stock in-kind to a taxable account) may only do so at certain times, and they must follow certain rules precisely, as even a ‘simple’ slip up can turn a potentially tax-saving NUA transaction into a tax-accelerating (and tax-increasing) nightmare instead.

Specifically, there are three key NUA rules which must be followed in order to properly execute an NUA transaction. They are as follows:

- NUA transactions can only be made after a ‘Triggering Event’ (described below);

- The employer-sponsored retirement plan must be emptied within one calendar year (i.e., as a lump-sum distribution); and

- The shares of stock on which NUA is desired must be moved, in-kind, to a taxable account (not all company stock must be moved to a taxable account; NUA transactions do not have to be an all-or-nothing decision).

Rule #1: NUA Transactions Can Only Be Made After A ‘Triggering Event’

The first critical NUA rule is that an NUA transaction can only take place after a plan participant has experienced what is known as a "Triggering Event”.

There are three different “Triggering Events” after which an NUA transaction may take place. They are:

- Attainment of age 59 ½;

- Separation of service; or

- The participant’s death (in which case, NUA could be used by the participant’s beneficiary).

Rule #2: The Employer-Sponsored Retirement Plan Must Be Emptied Within One Calendar Year (Lump-Sum Distribution)

The second critical NUA rule is that a participant’s entire plan balance (along with all like plans of the same employer), which may include both NUA-eligible shares and other investments, such as mutual funds, must be distributed from the plan within one calendar year in what is known as a “Lump-Distribution.” Plan balances attributable to investments other than company stock, as well as amounts attributable to company stock for which NUA treatment is not desired, can be rolled over to another retirement account, such as an IRA, to preserve tax deferral.

Notably, the calendar year does not have to be the same calendar year as the triggering event. Rather, at any time after a triggering event has occurred, a participant may distribute the full balance of their account (as long as all distributions from the account that take place after the triggering event are made within one single year).

Example 3: Recall Shaggy from Examples #1 and #2, who had $700,000 of NUA on $1 million of 123, Inc. stock within his Mystery, Inc. 401(k) plan.

Now, suppose that Shaggy separates from service in 2021 at the age of 60, and immediately falls into a deep sleep for 10 years. As a result, there are no distributions made from Shaggy’s Mystery 401(k) plan during this time.

In 2031, after 10 years of slumber, Shaggy wakes up to find that his Mystery shares are worth $2 million inside his 401(k) plan. Given the potential to shift the tax rate on that tremendous appreciation from ordinary income tax rates to long-term capital gains rates, Shaggy decides it would be a great time to make an NUA transaction.

Even though it has been 10 years since his separation-of-service “Triggering Event”, since no distributions were made during the interim period between Shaggy’s separation from Mystery (the triggering event) and when he made his NUA transaction (the time at which, following the 3 key NUA transaction rules, Shaggy’s Mystery shares were distributed, in-kind, from the Mystery plan), Shaggy can still make a Lump-Distribution by distributing his entire Mystery 401(k) balance in 2031.

In the example above, even though Shaggy’s decision to make an NUA transaction was made 10 years after he separated from service, he can still qualify for long-term capital gains tax rates on the NUA in his account as long as he makes a qualifying Lump-Sum Distribution. This means that no previous distributions were made in the prior years, after his last triggering event (his separation from service in 2021), and that the entire account balance is distributed within one year.

Rule #3: The Shares Of Stock On Which NUA Is Desired Must Be Moved, In-Kind, To A Taxable Account

The third and final key NUA rule is that the shares of employer stock for which a plan participant wishes to make use of the special NUA tax treatment must be moved directly, in-kind, to a taxable account.

They cannot be sold inside the 401(k) with the corresponding cash proceeds sent to the taxable account, and they cannot first be moved in-kind to an IRA, and then later distributed from the IRA, in-kind, to a taxable account.

Common examples of taxable accounts into which NUA-eligible shares can be transferred include individual, joint, and revocable trust brokerage accounts. Roth IRAs, on the other hand, cannot be used for this purpose.

NUA Is Generally Viewed As A Viable Strategy For Highly Appreciated Assets

In general, NUA is viewed as a strategy that makes sense only for highly appreciated employer securities. That makes sense. After all, the greater the appreciation of the employer securities relative to the initial purchase price of those shares, the greater the percentage of the NUA transaction that will (ultimately) be taxable at long-term capital gains rates instead of ordinary income tax rates.

Suppose, for instance, that plan participant purchased $240,000 of their employer’s stock within the 401(k) plan offered by that employer, and that the value of those shares is now worth $250,000 (they’ve gone up in value by $10,000, which is NUA). Using an NUA transaction, the participant could turn $10,000 of future ordinary income (the tax on the growth when distributed in the future, if not via an NUA transaction) into long-term capital gains. In a vacuum, perhaps, that would be a ‘win’.

The reality, though, is that in order to swap ordinary income tax rates for long-term capital gains rates on the $10,000 of growth, the participant would have to add a giant chunk of income to their tax return now (the $240,000 purchase price of the shares). And they’d be giving up future tax deferral. All in all, probably not a very good trade.

Now, suppose the opposite scenario presented itself, and that the participant had invested ‘only’ $10,000 of their 401(k) money into employer stock, but that, over time, the value of those shares appreciated to the same $250,000. Here, using NUA would be a veritable ‘no-brainer.’ Even though such a transaction would remove the tax-deferred ‘wrapper’ of the retirement account, paying ordinary income tax on only $10,000 to shift $240,000 from ordinary rates to long-term capital gains rates would make that a very good trade in almost any circumstance.

At a high level, these reversed scenarios illustrate why, in general, planners and plan participants look for highly appreciated employer stock before engaging in an NUA transaction. In fact, it often takes a surprisingly high ratio of appreciation (NUA)-to-cost in order to make an NUA transaction ‘worth it’ over the long run.

Nevertheless, there are certain, albeit more limited, scenarios in which using NUA on only modestly appreciated employer securities can make for good planning and produce tax savings.

Using NUA On Modestly Appreciated Stock To Fund Short-Term Income Needs

One situation in which planners can help clients by exploring NUA, even when the appreciation (NUA)-to-cost ratio of employer stock within the same employer’s retirement plan is fairly modest (or even rather low), is when the participant has near-term cash flow needs that will be met through the use of retirement funds.

Notably, if retirement distributions are needed to satisfy near-term living (or other) expenses, then using NUA can result in tax savings, regardless of how much (or little) appreciation there has been on the employer stock in the 401(k) plan. If a plan participant needs to take a distribution from their plan to satisfy cash flow needs, distributions will be all ordinary income if NUA is not used. By contrast, as long as there is at least some level of appreciation in the employer stock in the plan (i.e., some amount of NUA), then using an NUA transaction to fund short-term cash needs will result in a tax savings.

Simply put, if a participant is going to be taking a distribution anyway, getting some of the distribution out at long-term capital gains rates is better than paying tax on the entire distribution at ordinary income tax rates.

Example #4: Velma is a 62-year-old recent retiree, and plan participant in the Mystery, Inc. 401(k) plan. She is currently in the 12% tax bracket (and 0% capital gains tax bracket).

During her employment, Velma purchased a total of $400,000 of Mystery stock. Since she is older than the triggering-event age of 59 ½, she is eligible to make an NUA transaction. Unfortunately, the stock never performed up to her expectations, and today, it’s worth ‘just’ $500,000.

Given this set of facts, NUA would (and perhaps, should) be avoided in this case. After all, 80% of the current $500,000 price of Velma’s Mystery stock is attributable to the original $400,000 cost of the shares.

While the $400,000 would be taxable at ordinary income tax rates, even when distributed as part of an NUA transaction, only 20% is attributable to the growth of those shares and would be taxable at long-term capital gains rates if NUA were to be used!

But what if, in the above example, Velma needed $50,000 from her Mystery 401(k) over the coming year to cover her living expenses?

In short, that would completely change the calculus of whether Velma should consider NUA. It would go from a situation in which NUA should likely be avoided, to a scenario where NUA almost certainly makes sense!

Notably, NUA does not have to be an all-or-nothing decision. Rather, a plan participant can choose to use NUA on only a portion of their NUA-eligible shares. This can allow a participant to match their NUA distribution to their immediate cash flow needs, reaping at least some long-term capital gains benefit.

Example #5: Recall Velma, from Example 4, who has $500,000 of Mystery, Inc. stock inside her Mystery 401(k) plan that was purchased for $400,000, and who now has an immediate need for $50,000 cash to cover her current living expenses as she adjusts to her first year of retirement.

Instead of taking a normal distribution from her 401(k) to cover her expenses, Velma takes her financial advisor’s advice and decides to use NUA on $50,000 worth of her Mystery shares.

if Velma were to take $50,000 out of her 401(k) without making an NUA transaction to fund her living expenses, the distribution would be entirely taxable at ordinary income tax rates.

By contrast, suppose Velma uses an NUA transaction for $50,000 worth of Mystery shares (and rolls the rest of the account value, including the value of her other Mystery shares, to an IRA as a lump-sum distribution).

While 80% (the proportion of the distribution attributable to the purchase price of the shares) × $50,000 = $40,000 would be subject to ordinary income tax right away, the remaining 20% (the proportion of shares attributable to NUA) × $50,000 = $10,000 of the distribution would be subject to long-term capital gains rates (when the shares are sold in the taxable account which, presumably, would be right away).

Since Velma is in the 12% ordinary income tax bracket, using NUA to fund the immediate living expenses would shift $10,000 from being taxable at 12% (Velma’s ordinary income tax rate), to being taxable at 0% (the long-term capital gains rate for individuals in the 12% ordinary income tax bracket).

Accordingly, despite the relatively high cost of Velma’s Mystery shares, using NUA will result in a 12% (difference between 12% ordinary and 0% long-term capital gains rates) x $10,000 = $1,200 tax savings for Velma!

Based on the facts outlined in Examples #4 and #5, above, it’s pretty apparent that Velma would benefit from using NUA to fund her living expenses for her first year of retirement. After all, by doing so, she would be able to get $10,000 out at her long-term capital gains rate of 0% that otherwise would have been subject to her ordinary tax rate of 12%.

But what about year two? And year three? And so on?

In other words, while it’s clear that using NUA with modestly appreciated shares to cover short-term cash flow needs can result in a lower tax bill, just how “short” does “short-term” have to be for such a move to make sense? For the trade-off of NUA to make sense?

The answer, not surprisingly (as usual), is “It depends.”

Let’s go back to basics for a moment. At the highest level, the benefit of using NUA is that it allows the appreciation on employer stock (earned inside the employer-sponsored retirement plan of the same employer) to be taxed at long-term capital gains rates instead of ordinary income tax rates (when the shares are sold in a taxable account). So, naturally, the greater the difference between a taxpayer’s ordinary income tax rate and long-term capital gains rate, the greater the potential savings using NUA.

On the flip side, there are two primary downsides to NUA: the immediate taxation of the cost of the shares at ordinary income tax rates (which is generally the larger issue), and the loss of future tax deferral. Let’s unpack each of those a little bit further.

Calculating How Long NUA Should Be Used To Fund Short-Term Expenses

Recall that in order to use NUA, shares must go in-kind, from an employer-sponsored retirement plan to a taxable account. Additionally, the entire plan has to be distributed in one calendar year. Accordingly, ordinary income tax will be due on the total cost of the shares for all years of expenses you want to fund using NUA in one calendar year. The more years that are funded, the greater the likelihood that the marginal rate on the ordinary income tax will increase, more than offsetting any benefit provided by the NUA tax break.

In Examples #4 and #5, above, it clearly made sense for Velma to fund her first-year retirement expenses of $50,000 using NUA.

But what about year two? Could it make sense to take a larger NUA distribution and sock away another years’ worth of expenses in a taxable account in order to get the NUA tax break on an even larger distribution?

It might. But it might not. This is one of those situations where you just have to hunker down and run the numbers.

Example #6: Recall Velma, from Examples #5 and #6 above, who had $500,000 of Mystery, Inc. stock inside her Mystery 401(k) plan with a cumulative purchase price of $400,000 and appreciation (NUA) of $100,000.

Let’s compare two scenarios to see if funding more than one year with NUA would make sense.

Scenario A: Use NUA To Fund Year 1 Of Retirement

In this scenario, Velma chooses to only fund the first year of her retirement via a $50,000 NUA Transaction from her Mystery 401(k) plan as detailed in Example #5, with the remainder of her 401(k) rolled into an IRA. In her second year of retirement, Velma takes a ‘regular’ distribution from her IRA to cover her living expenses.

In year one, Velma would use the 12% ordinary income tax rate and 0% long-term capital gains rate from Example #5. Accordingly, we can calculate that she would have to take an NUA distribution of $55,310 that year to ‘net’ $50,000 after factoring in estimated taxes of $5,454.55 (which equals 80% of the $55,310 distribution taxed at Velma’s ordinary rate of 12%, and the remaining 20% of the distribution being tax-free, thanks to Velma’s 0% long-term capital gains rate).

In year two, Velma’s entire distribution would be taxable at ordinary income tax rates, so it would take $56,818.18 to net the same $50,000 after-tax amount.

Thus, over the course of the two years in which only year 1 was funded with NUA, Velma has paid a total of $5,454.55 (year 1) + $6,818.18 (year 2) = $12,272.73 in income taxes.

Scenario B: Use NUA To Fund Years 1 And 2 Of Retirement

In this scenario, Velma decides to use NUA to fund two years’ worth of retirement expenses. Here, Velma needs to take enough out of her 401(k) plan to net $100,000 after taxes (which would be moved to a taxable account, with the remainder rolled into an IRA). That, however, means it would be necessary to take a larger distribution than she took in either year 1 or 2 in the first scenario.

Given the progressive nature of our tax system, though, this approach could easily backfire. For instance, let’s suppose that, as a result of the larger distribution, half of the ordinary income generated via the cost of Mystery stock (upon distribution as NUA) was taxed at Velma’s ordinary income tax rate of 12%, while the remainder was bumped into the 22% ordinary income tax bracket. Accordingly, the blended tax rate on that income would be (12% + 22%) ÷ 2 = 17%.

Of course, Velma would have to liquidate some shares of Mystery stock, post-NUA, in the taxable account to cover her living costs for year one. Those would be taxable at the 15% capital gains tax rate (since Velma was bumped out of the 0% capital gains tax bracket at the same time that she was bumped out of the 12% ordinary income tax bracket).

In year two, absent a large taxable distribution from her retirement account, the remainder of her NUA shares could be sold in year two, when Velma was back in the 0% long-term capital gains bracket. Accordingly, we can assume a blended tax rate of (15% [year 1]) + (0% [year 2]) ÷ 2 = 7.5% on the NUA portion of the distribution.

Doing some ‘quick’ math, we find that it would take a distribution of roughly $117,785 of Mystery stock to net Velma the $100,000 she needs to support her living expenses in years 1 and 2. $17,785 of the distribution will be used to cover Velma’s cumulative income tax bill, leaving her with $100,000 of after-tax money to use for her living expenses in her first two years of retirement.

Nerd Note:

Where does the $117,785 amount come from?

Recall that the total account value of $500,000 had a cost basis of $400,000. Thus, 80% of the account value would be subject to ordinary income tax rates, while only 20% of the account value consists of NUA and would be subject to capital gains tax rates.

In short, 80% of the $117,785 is attributable to the purchase price of the Mystery, Inc. stock and is taxable at ordinary income tax rates. At the blended ordinary income tax rate described above of 17%, there would be 80% x $117,785 × (1 – 17%) = $78,209 left after tax.

Additionally, 20% of the $117,785 is attributable to the purchase price of the Mystery stock; thus, it will be taxable at long-term capital gains rates when sold in the taxable account. At a blended long-term capital gains bracket of 7.5%, there would be 20% x $117,785 × (1 – 7.5%) = $21,790 left after tax.

Added together, the net after tax amounts of $78,209 (ordinary income) + $21,790 (capital gains income) = $99,999, just about equal to the $100,000 of cumulative expenses Velma will have in years 1 and 2.

Comparing the two scenarios in the example above, we can easily see that while using NUA to cover Velma’s first year of retirement expenses was a ‘win’, using it to cover two years of retirement expenses was decidedly not. While some can be good, more is not always better.

But, as noted above, each situation has to be evaluated on its own merits. In some cases, a taxpayer may be able to cover several years’ worth of expenses with NUA without bumping themselves into a higher ordinary income tax bracket. In other situations, they won’t. It all depends on the amount of ‘available space’ in the taxpayer’s current bracket, the size of the NUA distribution needed to cover each year of living expenses, and how much of the distribution will be taxed at ordinary income tax rates versus how much will be taxed at long-term capital gains rates!

In other situations, the taxpayer’s ordinary income tax bracket may bump to a higher rate, but by a more modest amount (e.g., going from the 22% bracket to the 24% bracket). And in some cases, the ordinary income tax rate may change while the long-term capital gains rate stays the same (which is even more likely since NUA is not subject to the 3.8% Net Investment Income Tax (NIIT), effectively ‘eliminating’ the 18.8% capital gains bracket).

And, of course, even when the tax bills are relatively similar, there can be an edge to erring on the side of less NUA, thanks to the loss of tax deferral. That said, while the loss of tax deferral is worth considering, it isn’t always the deciding factor, especially today.

Specifically, when evaluating the use of high-cost NUA for purposes of short-term cash flow, there’s likely a minimal benefit to any ongoing deferral provided by a retirement account. Notably, the power of tax deferral is compounded over time, and if you’re talking about short-term cash flow, the one thing you don’t have is time!

Additionally, short-term cash needs are generally set aside in very safe investments. The safety of such investments comes at a price, of course, which is a lower expected return. At today’s low interest rates, that might mean the funds earmarked to cover short-term expenses earn little to no interest, further reducing the value and importance of tax deferral (for that portion of an individual’s assets).

Ultimately, Net Unrealized Appreciation (NUA) can provide certain plan participants with valuable tax-saving opportunities. Perhaps somewhat ironically, the value of low-cost NUA shares is often overvalued, while the value of high-cost NUA shares is often undervalued. This is because high-cost NUA shares can be used to lower the tax bill on plan distributions needed to generate cash flow necessary to meet a plan participant’s short-term income needs.

In certain situations, this strategy may make sense to fund only a year’s worth of expenses, while in other circumstances, multiple (generally two to three) years’ worth of expenses may be best funded using this approach.

Is this strategy likely to be the thing that makes or breaks an individual’s retirement success? Probably not. But it is an approach that can reduce an individual’s tax burden simply by taking distributions in the ‘right’ way. When it comes to tax planning, that’s about as easy of a lay-up as you’ll find… so don’t pass it up!