Executive Summary

Financial advisors often assist their clients with deciding when to file for Social Security benefits, helping them choose between filing prior to their Full Retirement Age (FRA) for a reduced benefit, filing at FRA for the ‘full’ benefit, or delaying benefits after FRA until (at the latest) age 70 to increase the monthly benefit by 8% per year. Often, advisors encourage their clients to delay their filing to increase their future monthly benefit (since the ‘return’ on delaying benefits can be higher than what the client would expect to achieve on their invested assets), unless there are clear reasons (such as health issues) that the client would not expect to live long enough to make delayed filing worth the wait.

But for some people, the decision of when to file for Social Security is not strictly about numbers. Individuals can experience feelings of anxiety and doubt about the decision to delay filing – even if the available information supports the case for delaying – if they fear they will not live long enough to enjoy the higher monthly benefit. These feelings can be magnified when the decision to file or delay is framed as a one-time choice, increasing the pressure on the individual to make the ‘right’ decision in spite of uncertain information (such as future health and life expectancy) on which to base it. Consequently, a person might feel compelled to file for Social Security benefits rather than delaying them, even when doing so might increase their risk of outliving their retirement savings.

Fortunately, the Social Security rules allow advisors to reframe the filing decision to make it easier for their clients to decide more confidently whether to file or delay. Because, in reality, delaying Social Security benefits isn’t a one-time decision at all: An eligible individual can change their mind and file for benefits at any time. Furthermore, once they have reached FRA, that person can apply for up to six months of retroactive benefits, allowing them to receive a lump sum of accumulated payments while also activating their monthly benefits going forward. Meaning that, if the individual initially decides to delay filing, they effectively have a six-month window to change their mind without giving up any of the benefits they would have received had they chosen to file in the first place.

Therefore, rather than asking clients to make a single, irrevocable decision for the entire 3- to 4-year period between FRA and age 70, advisors can, instead, reframe the choice as a series of reversible decisions for six months at a time. If the client changes their mind within that six-month timeframe and wants to file, they can file a retroactive application and claim their benefits as if they had done so at the beginning of the period. Otherwise, they can continue to delay filing for another six months, further repeating the cycle until the client either decides to file or reaches age 70 (at which point they would file anyway, having reached the maximum age for delayed benefit credits). Not only does this framing provide the client with a more reasonable timeframe to foresee future health issues or other factors that could cause them to change their mind, but because the six-month intervals align with the period in which individuals can apply for retroactive benefits, each six-month decision is entirely reversible.

As with any Social Security filing strategy, it’s important to be aware of the risks and tradeoffs of recommending this strategy to clients – for example, applying for retroactive benefits and receiving a six-month lump sum could result in a temporary spike in taxable income, with potential cascading effects on tax deductions, credits, and Medicare premiums. Ultimately, however, by nudging clients with the option to consider when to claim benefits through six-month ‘reversible’ decisions, advisors can potentially help them make better choices and to act with confidence!

Social Security benefits are a critical part of many retirement income plans. In such situations, making the best claiming decision (or decisions) can have a big impact on the success of that plan. And even in other situations, where individuals have been able to accumulate enough other income and/or assets to make Social Security benefits a less critical element of the overall retirement plan, making the best claiming decision to try and reap the greatest amount of total benefits is still a priority for most individuals.

Unfortunately, when it comes to Social Security claiming decisions (like many things in life), knowing the right thing to do, and actually doing that right thing, are not always one and the same. More specifically, while the decision to delay receiving benefits (in order to increase the monthly amount of future benefits) is often the clearly advisable path, concerns such as, “What if I get sick and die earlier than expected?” or “What if Social Security goes broke?” can lead individuals to claim benefits much sooner than would otherwise be advisable.

Ultimately, the decision as to when to claim Social Security benefits is a decision that is made by the individual who will receive those benefits. But by combining elements of behavioral finance, along with a deep understanding of the Social Security rules, advisors can play a beneficial role by nudging clients to delay claiming benefits longer, increasing future guaranteed monthly income for the rest of their lifetime (and potentially for the rest of a spouse’s lifetime, as well!).

The Basics Of Social Security Retirement Benefits

To be entitled to a Social Security Retirement Benefit, an individual must generally earn 40 or more Social Security work history “credits”. These credits are earned quarterly, and thus, it takes 10 or more years of total work for most individuals to earn their 40 quarterly credits to qualify to receive a Retirement Benefit. (While the work does not have to be consecutive, it does need to meet a minimum earnings level; one quarter is earned for each $1,470 of earnings in 2021, up to a maximum of four quarters.)

But while qualifying for Social Security Retirement Benefits is an important step in creating future retirement income, the bigger question for most soon-to-be and actual retirees (who know they’ve worked more than long enough to receive benefits) is, “How much will I receive in Social Security Retirement Benefits?” Ultimately, the answer to that question hinges on two factors: 1) the individual’s earnings history, and 2) when the individual decides to begin receiving their Retirement Benefit.

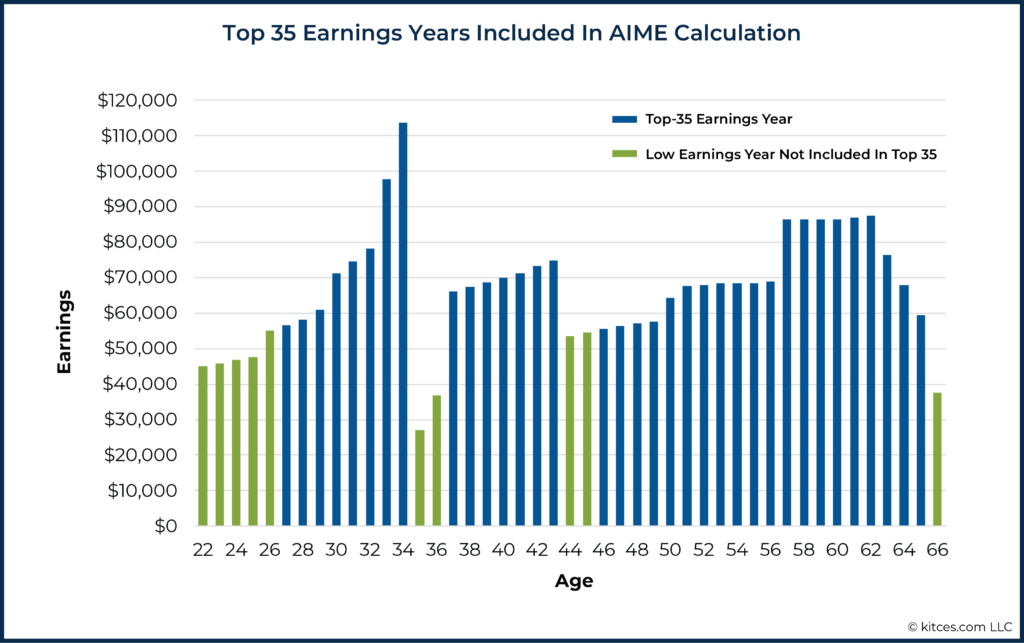

With regard to the first factor, earnings history, an individual’s highest 35 years of wage-inflation-adjusted earnings are used to calculate their Average Indexed Monthly Earnings (AIME).

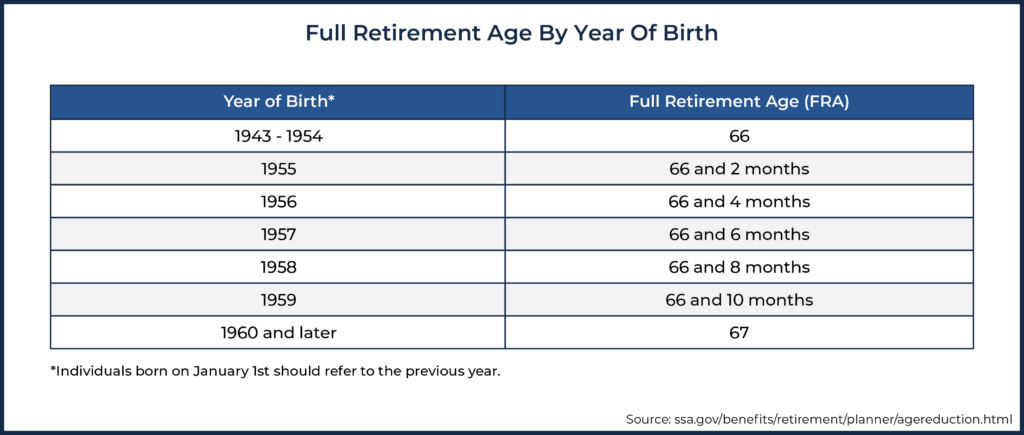

At that point, how much an individual will receive from Social Security as a monthly Retirement Benefit hinges on the second factor, which is when they decide to begin receiving their benefit. Notably, if an individual begins to receive Retirement Benefits at their Full Retirement Age (FRA), their monthly benefit will precisely equal their Primary Insurance Amount. As illustrated on the chart below, the FRA for new and soon-to-be retirees varies from 66 to 67, depending on the year of birth.

But individuals don’t have to wait until their FRA to begin receiving their Social Security Retirement Benefit. Rather, individuals can generally begin receiving a reduced Social Security Retirement Benefit as early as age 62.

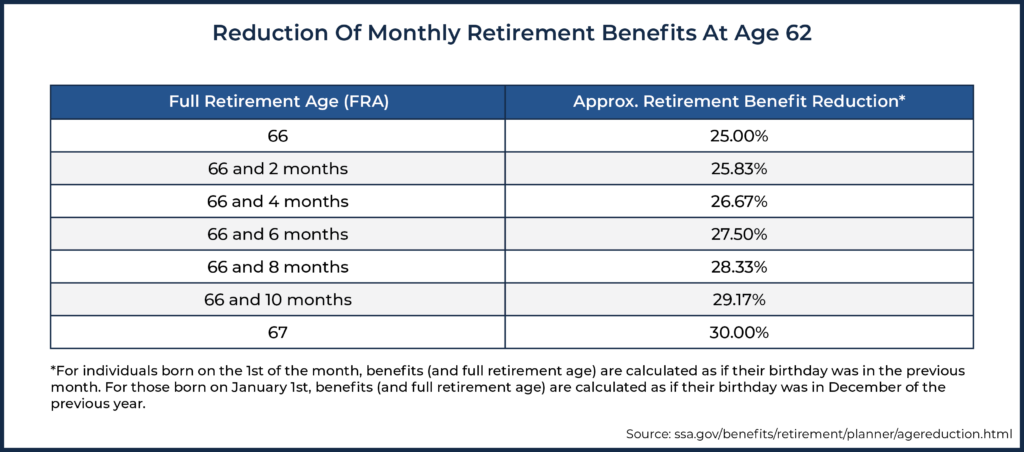

The trade-off for receiving benefits early (prior to an individual’s FRA), though, is that monthly benefits are reduced (by as much as 25% for individuals with an FRA of 66, and as much as 30% for individuals with an FRA of 67) for life, compared to what would have been received if benefits were claimed at FRA.

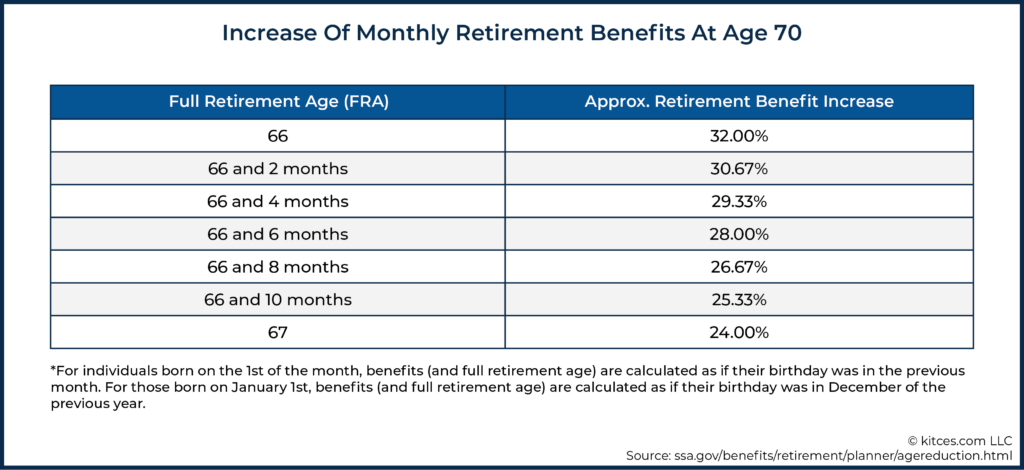

Furthermore, while a full Retirement Benefit can be received at Full Retirement Age (FRA), individuals can increase their monthly benefit for life by delaying the receipt of benefits until age 70. For each month an individual delays receiving their Retirement Benefit beyond their FRA, their monthly benefit will be increased by 8% per year (or 8% ÷ 12 months = 0.67% per month, since calculations are determined on a monthly basis). Thus, individuals with a Full Retirement Age of 66 can increase their monthly benefit if they retire 4 years (48 months) later at age 70 by as much as 48 months x (8%/12 months) = 32%, while those with a Full Retirement Age of 67 can increase it if they retire 3 years (36 months later at age 70 by as much as 36 months x (8%/12 months) = 24%.

For some married individuals, the ability to increase a monthly retirement benefit by delaying benefits beyond Full Retirement Age takes on greater significance. Notably, if the first-to-die spouse’s monthly benefit was higher than the survivor’s own benefit, the survivor can ‘swap’ their own benefit for their deceased spouse’s monthly benefit (known as a survivor benefit).

The Rules For Retroactively Claiming Benefits Change At Full Retirement Age

When most people think about “Full Retirement Age,” the first thing that typically comes to mind is the age at which a full Social Security benefit can be received. While that is certainly true, an individual’s FRA is also meaningful because it marks the time when many of the rules surrounding Social Security benefits change.

One such shift in the rules when an individual reaches FRA involves the ability to file for retroactive benefits. Simply put, the decision not to claim an early Retirement Benefit prior to FRA is an irrevocable decision. If a month's worth of benefits has been ‘missed’ (because no application to begin receiving benefits for that month was submitted), no benefits can be received for that month.

Example #1: Ida is a 63-year-old retiree who was born in 1958. Her FRA is 66 years and 8 months. Thus far, she has not claimed her Social Security Retirement Benefit. Recently, though, due to her failing health, Ida has begun to regret the fact that she did not claim her Retirement Benefit sooner.

Unfortunately, since Ida has not yet reached her FRA, the best that she can do is to submit an application now for benefits to begin immediately (though it will likely take the Social Security Administration some time before benefits are actually received).

She is not entitled to any early benefits retroactively for months prior to her initial application.

In contrast, once an individual reaches their FRA, they become eligible to file a retroactive application to receive benefits for earlier months. It’s not an open-ended invitation to change one’s mind, though. Rather, individuals can only file a retroactive application for the months after reaching their FRA, not to exceed six months.

Example #2: May was born in May 1955, and is 66 and 6 months old. She reached her FRA (66 and 2 months) 4 months ago. Thus far, she has not claimed her Social Security Retirement Benefit. Recently, though, due to her failing health, May has begun to regret the fact that she did not claim her Retirement Benefit sooner.

Since May has already reached her Full Retirement Age, she can file a retroactive application to receive benefits that could have been received in previous months. Here, since May is only four months past her FRA, she can receive retroactive benefits for the four months since reaching her FRA.

If an individual decides to file a retroactive application for their Retirement Benefits beyond 6 months past their FRA, they may only be granted a maximum of 6 months of retroactive benefits.

Example #3: Fulton was born in 1953 and is a 68-year-old retiree. He reached his FRA (66 years) two years ago. Thus far, he has not claimed his Social Security Retirement Benefit. Recently, though, due to his failing health, Fulton has begun to regret the fact that he did not claim his Retirement Benefit sooner.

Since Fulton has already reached his Full Retirement Age, he can file a retroactive application to receive benefits that could have been received in previous months. However, Fulton’s retroactive application for benefits may be for a maximum of only six months, even though his FRA was 24 months ago.

As illustrated by the examples above, while the ability to retroactively claim benefits (after Full Retirement Age) is not unlimited, it can still provide a modicum of solace for those who delay receiving benefits, only to later rue that decision.

Effects Of A Retroactive Application

Naturally, retroactive benefits aren’t a ‘free ride.’ In other words, you don’t just get (up to) six months for nothing. Rather, the effect of a retroactive application is to treat the applicant as though they had originally filed for benefits as of the (retroactive) application date.

Thus, while the individual will receive benefits for the months covered by the retroactive application, they will ‘give up’ the delayed credits of 8/12% per month they had been earning during the same period.

Example #4: Recall Fulton, from Example #3 above, who, at age 68, had grown to regret delaying his Social Security Retirement Benefit past his FRA of 66.

Based on Fulton’s work history and Average Indexed Monthly Earnings (AIME), his Primary Insurance Amount (PIA) is $2,000. Accordingly, had Fulton begun receiving his Retirement Benefit at age 66, he would have received a monthly benefit of $2,000.

On the other hand, if Fulton were to claim benefits at his current age of 68, 24 months past his FRA, his monthly benefit (ignoring any cost-of-living adjustments) would be $2,000 (his PIA) + (24 months × 8/12% × $2,000) = $2,320.

If, however, Fulton files a retroactive application for Retirement Benefits for the maximum allowable six months, he would lose six months of delayed credits in the calculation of his monthly benefit. Thus, while he would be entitled to the six months of benefits he ‘missed’ already, which he would receive as a lump sum amount upfront, his monthly benefit going forward (ignoring any cost-of-living adjustments) would be only $2,000 + (18 months × 8/12% × $2,000) = $2,240

While the Social Security Administration pays retroactive benefits as a single lump-sum amount, in many instances, the lump-sum amounts are small enough that they don’t significantly impact tax planning. On occasion, though, such lump-sum distributions can lead to the so-called “Tax Torpedo,” phasing out of deductions and/or credits, and even higher Medicare Part B/D premiums.

Using A Retroactive Application Of Retirement Benefits To Create Six-Month ‘Delay Nudges’

While part of successfully guiding clients through the financial planning process requires technical knowledge and a deep understanding of relevant rules and strategies to spot opportunities for improvement when they exist, what’s equally important for advisors to help guide their clients is getting them to act on appropriate strategies.

That’s not to say that advisors can or should dictate to clients what they will do, but rather, a recognition that encouraging clients to take the ‘right’ actions is an essential part of being a high-performing advisor. Ultimately, the best financial plan in the world isn’t worth much, if anything, if it’s not used.

The ability to file a retroactive application for Social Security Retirement Benefits provides advisors with an excellent opportunity to blend technical knowledge and behavioral finance techniques to get clients to make ‘better’ Social Security claiming decisions. Notably, it’s not uncommon for individuals to feel compelled to claim Social Security benefits sooner than when they should.

Nerd Note:

Ultimately, the best time to claim Social Security benefits isn’t known until a client dies, or they reach the break-even point for delaying benefits until age 70 (as any death after that time would have made waiting until age 70 the ‘right’ Social Security ‘play’). Nevertheless, given an individual’s or couple’s health, family history, and overall financial situation, it is possible to make an informed ‘guesstimate’ as to the best time to claim benefits.

A common reason for individuals to claim benefits before the ‘optimal’ age is that they are concerned that they will die too soon to make the decision to delay worth it. For such individuals who are hesitant to delay, but who are likely to benefit from doing so, reframing the decision to delay benefits beyond Full Retirement Age from a single, longer timeframe to many smaller, reversible decisions can pay dividends.

Simply put, to some individuals, three or four years of delaying Social Security Retirement Benefits can seem like an eternity. And while the ability to claim benefits at some interim date is always ‘on the table’, when clients are told, “You should strongly consider delaying benefits until 70”, for example, they will often mentally approach it as an all-or-nothing choice.

To help combat this issue, instead of having clients focus on delaying Retirement Benefits from Full Retirement Age to as late as age 70 as a single choice, advisors can implement a ‘nudge’ strategy, to reduce the cognitive strain that a seemingly all-or-nothing choice might elicit, by encouraging such persons to instead look at the situation as opportunities that consist of eight separate, independent, and reversible decisions that each delay benefits for six months.

Nerd Note:

Technically, delaying benefits from a Full Retirement Age of 66 to 70 is really 48 separate decisions to delay receiving benefits at one-month intervals. Practically, however, few individuals, if any, will want to review such a decision so frequently.

Framing the bigger decision as six-month, ‘bite-sized’ decisions to delay benefits can, itself, be enough to help empower some individuals to get comfortable with the idea of delaying the receipt of Social Security benefits. But for those who are still on the fence or uneasy about the decision, advisors can emphasize the ability to file a retroactive application, effectively ‘Ctrl+Z’-ing any single decision to delay benefits for (up to) six months.

Consider, for instance, the following sample dialogue:

Mr. Smith, I understand that you’re concerned that you might not live long enough to make delaying the receipt of your Social Security benefit worthwhile. But while I would hate for you to have ‘left money on the table’, if that indeed happens, as your advisor, my larger concern is what happens if you live ‘too long.’

Here’s what I’d like to propose…

Instead of claiming benefits now, would you consider waiting six months to make that decision? In retrospect, many of the people that I’ve worked with who are in similar situations have been glad they waited a little longer.

But if in six months, when we meet again to discuss this, you still feel like claiming benefits today is the right decision for you, we can always file a retroactive application with the Social Security Administration to claim benefits as if you started today.

They’d send you one check to ‘catch you up’ on the payments that you missed, and after that, you’d receive monthly checks for life as if you claimed your benefits today from the beginning.

Would that work for you?

Not everyone will say yes, but by reframing the decision about when to claim Social Security benefits from a long-term, irrevocable decision to a short-term, reversible one, advisors can help more individuals who would benefit from a delayed start date to do so.

The Six-Month Social Security Claiming Decision Review ‘Meeting’

If an individual agrees to an initial six-month post-FRA delay, at the time that decision is reviewed (roughly six months later), there are only a limited number of possibilities. One possibility, of course, is that the individual still thinks that they should have started to claim benefits at their Full Retirement Age. In such an instance, advisors should assist the client to file the retroactive application, as promised in the initial discussion.

Other times, the six months without receiving a Social Security benefit may have given an individual enough time to get so comfortable with the idea of living without the receipt of a monthly Social Security Retirement Benefit that they may now enthusiastically support delaying benefits even further on their own. Provided such a delay is still in the individual’s best interest, advisors need only set expectations for when the client would like to review the decision again.

A third scenario, however, is that the individual is okay with having forgone benefits for the initial six-month period, but wishes to begin receiving benefits at that time (after the first six-month delay). In such situations, advisors should consider ‘recycling’ the approach they took six months earlier. Once again, they can encourage the individual to delay benefits for six months. If, in another six months, they still feel as though they should have claimed benefits after the first six-month delay, a retroactive application can be filed to do so.

Of course, there’s always the possibility that in another six months’ time, the individual will have, once again, a change in heart about their start date.

Downsides, Drawbacks, And Challenges To Six-Month Nudges Using Retroactive Applications

Six-month nudges can be a powerful tool to help encourage clients to delay the receipt of Social Security Retirement Benefits, but like just about everything in financial planning – and, indeed, life – there are important trade-offs to consider.

Death Is A Death Knell For Retroactive Social Security Retirement Benefit Applications

Social Security Retirement Benefits are, well… for retirement. And simply stated, deceased persons need not worry about retirement income. Accordingly, retroactive applications for Retirement Benefits cannot be filed on behalf of an individual who has died.

Thus, one risk of using six-month nudges is that an individual could unexpectedly die during one of the wait-and-see-if-you-still-feel-the-same-way-in-six-months periods, eliminating the ability to retroactively claim benefits for those months. That said, the risk of losing benefits in such a manner is relatively small, as roughly 95% of all individuals alive at their Full Retirement Age are likely to reach age 70. Furthermore, of the deaths occurring within the delayed-credit window, only a fraction are likely to be sudden in nature.

Yet, it is those sudden deaths that represent the true risk to this strategy, as naturally, those who ‘know’ that they have a limited life expectancy would have made their decision to delay or file (retroactively) with that information already in hand.

Nerd Note:

Single individuals with a high chance of near-term death should almost always claim their Social Security Retirement Benefit as soon as possible. For married individuals with a higher Primary Insurance Amount than their spouse, the decision is more nuanced due to the fact that the deceased individual’s benefit can ‘live on’ after they die as a Survivor’s Benefit (for the surviving spouse).

Retroactive Applications Reduce Retirement Benefits For Life

While an unexpected death can potentially spell trouble for the six-month nudge strategy (because, as noted earlier, a retroactive application cannot be filed on behalf of a deceased person), an unexpectedly long life expectancy can also be problematic for those who ultimately do decide to claim benefits retroactively. Critically, as noted above, any delayed credits ‘earned’ for months for which retroactive benefits are received will be ‘reversed.’

As delayed credits are equal to 8/12% per month, an individual who files a retroactive application for the maximum allowed six-month period (which is often the case) will have their monthly benefits reduced by 8/12% × 6 = 4% compared to claiming benefits beginning at the time when the retroactive application was filed.

That 4% reduction is a permanent reduction, and one that is only magnified over time, as cost-of-living adjustments widen the gap between the actual benefit received (after filing for retroactive benefits) and the amount that could have been received, had a retroactive application not been filed.

For individuals who end up living into their upper-80s and beyond, the decision to file a retroactive application decades earlier can result in a significant reduction in the cumulative Social Security benefits they receive during their lifetime.

Receipt Of Prior Year’s Benefit Via Retroactive Applications Can ‘Artificially’ Increase Income

As noted above, the Social Security Administration pays retroactive benefits in a single, lump-sum amount. That lump-sum amount has the potential to create a spike in income for some retroactive filers that could result in an increase in the marginal tax rate of that income.

However, since the maximum number of months for which a retroactive application can be submitted is limited to six, issues related to increased income (as a result of the receipt of lump-sum Social Security benefits paid pursuant to such an application) are experienced by those who receive retroactive benefits for a previous tax year (as these benefits would have been paid the previous year had they begun with the filing of a ‘normal’ application at that time).

Consider, for instance, a retroactive application that is submitted in December by an individual to begin benefits retroactively going back to July of that year. Early in the following calendar year, not only would they begin receiving their ‘regular’ monthly benefits, but they would also receive a lump-sum check for benefits from the previous year that had been ‘missed.’ In total, that could lead to the equivalent of 18 months of Social Security Retirement Benefits being taxable in a single calendar year!

By contrast, while a retroactive application that results in a lump-sum payment for benefits that would have otherwise been received earlier during the same calendar year may impact personal cash flow, it would not impact an individual’s tax bill.

For example, if an individual files a retroactive application in June to begin receiving retroactive benefits going back to January of the same year, they would receive a lump-sum payment for benefits that would have otherwise been paid out during the first half of the year, followed by the ‘regular’ monthly benefits for the remainder of the year. In such an instance, where the lump-sum check for retroactive benefits is received in the same year that those benefits would otherwise have been received if they hadn’t been delayed, there would be no change to the recipient’s tax bill.

Nerd Note:

In limited circumstances, savvy advisors may suggest the use of a retroactive application for clients who want to claim benefits ‘now’, but who can benefit from shifting Social Security income to a later year. If, for instance, an individual wants to claim benefits in August of a particular year, but expects to have a significant drop in income during the following year, it could make sense to use a retroactive application to ‘shift’ the income of benefits from August through December to the following tax year.

The amount of a Social Security Retirement Benefit that an individual receives is determined, in part, by the individual’s earnings history and, in part, by when the individual decides to claim their Retirement Benefit. While such benefits can generally be claimed as early as age 62, by delaying their receipt until as late as age 70, the monthly amount received is increased for life (and potentially for the life of a surviving spouse, as well).

Of course, while higher monthly benefits sound great, the trade-off is that by delaying benefits, the number of months in which benefits will be received during the individual’s lifetime is reduced.

While not all workers will benefit from delaying the receipt of Social Security Retirement Benefits (until as late as age 70), many individuals who probably should delay are hesitant to do so, often for fear of a premature death. In such situations, where an individual has already reached their Full Retirement Age, advisors can reframe long-term delay decisions into reversible six-month nudges.

Specifically, advisors can encourage clients who have reached their Full Retirement Age to consider their option of filing applications for retroactive benefits for up to six months (or back to Full Retirement Age, if shorter) to confirm whether they really want/need to begin benefits prior to age 70. If, at the end of the six-month period on which retroactive benefits would be paid, an individual still feels as though claiming is the best decision, they can file the retroactive application and ‘pretend’ as though they had filed six months earlier than the current ‘day one’.

Ultimately, breaking down what could be a four-year decision to delay benefits into many shorter decisions, coupled with the comfort of knowing that any one of those shorter decisions can be reversed, can empower more individuals to delay the receipt of Social Security benefits with confidence.

If you are interested in learning more about how to navigate and optimize Social Security claiming decisions with clients (especially couples), check out the Kitces Course on Social Security Optimization for Couples.