Executive Summary

Allowing employees to enjoy the success of a company can be a helpful motivator and reward. Employer-sponsored retirement plans that allow employees to purchase company stock enable employees to gain a stake in the company, which can also present them with Net Unrealized Appreciation (NUA) opportunities. In most cases, distributions made from tax-preferenced retirement accounts are taxed at ordinary income rates. However, when stock held in an employer plan is eligible for NUA treatment, participants pay ordinary income tax only on the cumulative purchase price of the shares upon distribution, and can enjoy long-term capital gains taxes on the growth of those shares (assuming certain NUA requirements are met).

Advisors with clients who can benefit from NUA opportunities must ensure that three rules are met. First, the distribution must be completed after the participant experiences a “Triggering Event”, which are attainment of age 59 1/2, separation from service (whether voluntary or not), or death. Second, the distribution must be made as a “Lump-Sum Distribution”, which means that assets must be completely distributed within one calendar year. Lastly, the employer stock shares must be distributed from the employer-sponsored retirement plan “in-kind” (i.e., maintained as employer stock shares and not liquidated) into a taxable account. These three rules are non-negotiable, and violating any of them removes any possibility of using the NUA tax break.

Additionally, unlike employees in publicly traded companies, those who work for privately traded companies can be faced with limitations on how their employer stock shares must be distributed (particularly from an ESOP). Because there is no law that requires employers to make this option available to plan participants, some employers may incorporate ESOP prohibitions that make true “in-kind” distributions impossible (in order to limit outside investors from owning the closely held stock). In other cases, the privately held stock may be transferrable, but there are restrictions on holding the stock outside the ESOP which may make NUA transactions complicated to fully realize – or at least not worthwhile.

Which means that advisors can help clients who are employees of private companies determine whether they can take advantage of NUA in the first place. For example, employees who work for S corporations may have distribution contingencies in their plan that result in an immediate long-term capital gain tax on distributions that need to be immediately sold, on top of the ordinary income tax due on the original purchase price.

Ultimately, for participants in these instances, knowledge is power – both pertaining to navigating the requirements to take advantage of NUA tax benefits when they are available, and selecting the best alternative options (such as rollovers into other retirement accounts) if the NUA strategy ends out to be tax-inefficient!

For most individuals, saving enough money during their working years to successfully fund an enjoyable retirement is a common primary objective. Due to this fact, many employers include various retirement-savings benefits as part of their overall compensation packages. For instance, many employers sponsor a retirement plan, such as a 401(k) plan, into which employees can make tax-preferenced contributions (i.e., deferrals). In addition, many employers will often further assist employees in achieving their retirement savings goals by making cash contributions to such plans (e.g., matching contributions, non-discretionary contributions, profit-sharing contributions).

Sometimes employers will allow employees to participate in the company’s success (or lack thereof) in the form of company stock itself, held via an employer-sponsored plan. If the company performs well, employees can reap the benefits of that growth via their ownership of the company shares within either a 401(k) plan (in which the participant elects to use some of their funds to purchase the employer’s stock) or an Employee Stock Ownership Plan (ESOP). And while the growth of the company is valuable in its own right, an additional benefit is that the growth that occurs within the plan is eligible for a special tax break, known as Net Unrealized Appreciation (NUA).

Net Unrealized Appreciation (NUA) Basics

When an individual owns stock (or a stock fund) of the company they work for, and when the stock is held inside a retirement plan sponsored by the same company, any growth on those securities that occurs while they are held within the plan is known as Net Unrealized Appreciation (NUA). If a participant follows a series of rules, then that NUA will be eligible for a special tax break.

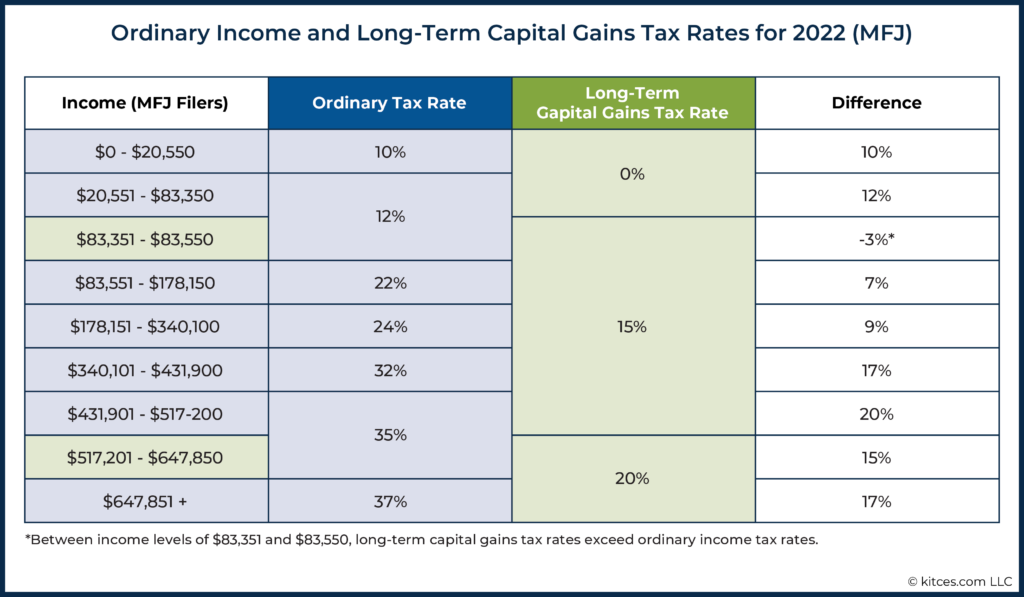

More specifically, while distributions from retirement accounts are generally subject to ordinary income tax rates, when a ‘proper’ NUA transaction is completed (i.e., when a lump-sum distribution of plan funds is made after a qualifying Triggering Event, in which the employer stock is moved in-kind to a taxable account), the NUA (the growth on employer stock that occurred within the plan) is taxable at long-term capital gains rates instead. Given the current differences between long-term capital gains rates and ordinary income tax rates, an individual’s long-term capital gains rate can be anywhere from 7% to 20% lower than their ordinary income tax bracket (as illustrated via the graphic below)!

Notably, if the only tax consequence of using NUA was getting to swap out the ordinary income tax rate for the long-term capital gain rate, it would be a no-brainer. Unfortunately, however, that’s not the case.

However, the trade-off of NUA is that in order to get the long-term capital gains treatment on the appreciation of employer securities (when they are sold), a plan participant must pay ordinary income tax on the cumulative purchase price of the shares for which NUA is used when they distribute the shares from the employer plan. As a result, taking advantage of favorable NUA treatment incurs an immediate tax event on part of the value – ordinary income on the cost basis of the shares – in exchange for more favorable future treatment on the rest (long-term capital gains on the NUA gains themselves), which depending on the time horizon may or may not be as favorable as simply holding the shares in a retirement account, for years or potentially decades of tax-deferred compounding growth, and just paying ordinary income on that future growth.

Example 1: Maria is a participant in a 401(k) plan and has purchased shares of her employer’s stock with a portion of her plan assets. The total cost of the employer shares purchased by Maria within the plan is $100,000, but the shares have grown in value, and are now worth $1 million.

When Maria turns 60 (thus meeting the Triggering Event of reaching age 59 ½), she decides to use NUA on her shares of employer stock. She will owe ordinary income tax on the $100,000 cost of the shares in the year that she makes the transaction of transferring her shares as an in-kind Lump-Sum Distribution into a taxable brokerage account.

The $900,000 of growth, however, will be taxable at long-term capital gains rates, whenever Maria (or her heirs) decide to sell the stock.

To properly complete an NUA transaction, a plan participant must follow three key rules:

- The distribution must be completed after the participant experiences a “Triggering Event”, which are death, separation from service, or reaching age 59 ½ (discussed further below);

- The distribution must be made as a “Lump-Sum Distribution”; and

- The shares of employer stock must be distributed from the employer-sponsored retirement plan “in-kind” (i.e., as employer stock).

Net Unrealized Appreciation (NUA) Triggering Events

The first rule of NUA is you don’t talk about NUA. Wait, that’s not it… that’s Fight Club (it’s just so easy to confuse the two). The first rule of NUA is that, as mentioned earlier, a participant can only use the NUA tax break after they’ve had a Triggering Event. There are three such Triggering Events outlined by the Internal Revenue Code that apply for employees who may be eligible for NUA. They are:

- Attainment of age 59 ½. To use this Triggering Event, a plan participant must actually be 59 ½ or older (not ‘just’ in the year in which they turn 59 ½)

- Death. Once a plan participant dies, the balance of the funds in their account belongs to their beneficiary. Accordingly, “death” (of an account owner) should be viewed as more of a Triggering Event for a beneficiary.

- Separation From Service. This Triggering Event applies regardless of whether the plan participant’s separation was voluntary or not.

The Net Unrealized Appreciation (NUA) Tax Break Requires A Lump-Sum Distribution

The second key rule that must be followed in order for a distribution to be eligible for the special tax break on NUA is that the distribution must be a “Lump-Sum Distribution”. A Lump-Sum Distribution is defined as the total distribution of assets from a qualified plan in one calendar year, after a Triggering Event.

To be clear, this requirement means that everything (both the employer stock, as well as any other assets, such as mutual funds and ETFs) are distributed from the employer plan in a single calendar year, after any of the above Triggering Events (though portions of the distribution can be rolled over, as explained below).

One important aspect of this rule that tends to create confusion, amongst plan participants and advisors alike, is that the Lump-Sum Distribution and the Triggering Event do not have to take place within the same calendar year. Rather, the Lump-Sum Distribution need only be made after a Triggering Event, which can be in the same calendar year as the Triggering Event, or in any future year.

Example 2: Tyler is a participant in his employer’s ESOP plan. The shares of his employer stock, within the plan, have experienced substantial growth during his employment and, accordingly, Tyler’s financial advisor recommends that he take advantage of the NUA tax break available to him.

Due to the success of the company and his personal savings, Tyler’s advisor recommends Tyler consider retiring in December of 2021 at the age of 60. Although Tyler’s retirement (and the fact that he has already attained age 59 ½) is a Triggering Event for NUA purposes, he need not make his Lump-Sum Distribution in 2021, and instead chooses to leave his employer stock in his ESOP plan account.

Tyler diligently lives off of his other savings during his first decade of retirement, leaving his NUA-eligible employer stock (within his ESOP) alone.

At age 70, however, Tyler’s financial plan calls for him to tap some of his ESOP funds, and to use the NUA tax break. Even though it’s been 10 years since his Triggering Event, he can still empty the plan in one calendar year and have the distributions qualify as a Lump-Sum Distribution, provided that Tyler has not taken any distributions from the plan in the interim.

It’s worth noting that while the Lump-Sum Distribution requirement of NUA is ‘absolute,’ there is no requirement that NUA be used for all the shares of employer stock within a plan.

Rather, a plan participant can elect to use NUA for just a portion of the stock, and roll over the balance of the employer securities (or an equivalent cash amount) to another retirement account. Non-employer securities can also be rolled over to another retirement account to preserve the tax deferral on those assets.

Ultimately, at the end of the year (in which the Lump-Sum Distribution takes place), the balance of the employer-sponsored plan must be $0. But the plan participant has a choice of how much to withdraw as in-kind stock and transfer to a brokerage account as a NUA distribution, and how much employer stock (or other holdings in the retirement plan) will simply be rolled over to an IRA instead.

The Net Unrealized Appreciation (NUA) Stock Must Be Distributed In-Kind To A Taxable Account

The third and final NUA rule is that the appreciated employer securities (for which the NUA tax treatment is desired) must be distributed to a taxable account (e.g., individual account, joint account, revocable trust account) in-kind in order to receive the favorable NUA treatment. They cannot be rolled over to another retirement account and remain eligible for NUA; instead, any shares rolled over to an IRA will, in the future, simply be treated as an IRA distribution (taxable as ordinary income like any other IRA distribution, even if the asset was previously NUA-eligible stock).

NUA Considerations For Private Companies: Tax Rules Versus Plan Rules

If a plan participant wants to use the NUA tax break, they need ‘only’ follow the three rules of making a Lump-Sum Distribution of the entire account after a Triggering Event with the shares of NUA stock being transferred in-kind, as described above.

That said, those three rules are ironclad and non-negotiable, regardless of a company’s or a plan participant’s unique circumstances. If a participant fails to satisfy just one of those rules, the NUA tax break is off the table.

Sometimes, one or more of the NUA rules is broken by accident (often because of a lack of understanding of the rules). Other times, however, an employer retirement plan’s own rules may limit how (or whether) in-kind distributions can be made, preventing even the most knowledgeable of participants from complying with the various NUA requirements, and effectively preventing plan participants from enjoying the NUA treatment.

Generally speaking, participants in plans sponsored by publicly traded companies don’t have much to worry about in this regard. Simply put, the public nature of those companies – in which essentially anyone can become an owner – means that it is not necessary to limit where shares of employer stock go when they leave the plan.

The same, however, is not true for employees of privately held companies. Rather, when it comes to privately held companies that incorporate the use of company stock into an employer-sponsored retirement plan, plan participants will generally find themselves in one of the following three situations:

- The plan places no major restrictions on in-kind distributions of employer stock;

- The plan prohibits in-kind distributions of employer stock; or

- The plan allows in-kind distributions of employer stock with one or more contingencies/restrictions.

No Distribution Restrictions On Employer Stock Means NUA “Business As Usual”

In some situations, a privately held company will allow shares of its stock to be distributed from its employer-sponsored retirement plan(s) in-kind, with no restrictions. In such situations, the participant is generally either issued the shares electronically or mailed paper stock certificates. Then, when the plan participant chooses to do so, they can sell the shares back to the company at fair value (or potentially sell via a private transaction to another individual/entity, if allowed).

For such (lucky) plan participants who meet the requirements to qualify for NUA treatment, the NUA thought process is largely the same as for similar persons with appreciated shares of publicly traded companies.

NUA Limitations When In-Kind Distributions From ESOPs Are Not Allowed

For some ESOP participants, the ‘dream’ of using NUA to mitigate the tax bite on highly appreciated securities of a private company is destined to remain just that… a dream. Simply put, some ESOPs will impose plan rules that make it impossible to use NUA, even on highly appreciated securities.

Notably, while the Internal Revenue Code allows distributions from an employer plan to be made in-kind (regardless of whether that employer is publicly traded or privately owned), there is nothing in the law that requires employers to make that option available to participants.

Accordingly, some privately held companies will construct their plans in a manner that prohibits in-kind distributions. They simply don’t want their stock to be held by ‘outside’ investors or otherwise leave the ESOP plan, resulting in the requirement that all ESOP plan distributions be made in cash.

Nerd Note:

There are a variety of reasons that a company might not want ESOP participants to be able to take a distribution of their employer securities, in-kind. For instance, many ESOPs restrict a participant’s voting rights to corporate matters, such as mergers, reorganizations, and sales, while preserving the right of the ESOP trustee to vote on other matters, such as electing members of the company’s Board (which can allow ‘direct’ [non-ESOP] shareholders to retain more control over the company).

And when a plan distribution is made in cash, the transaction violates the third key NUA Rule, which requires that shares of employer securities (for which NUA tax treatment is desired) are distributed in-kind. Accordingly, for ESOP plans that require such cash distributions, NUA is effectively off the table, and the best that a plan participant may be able to do from a tax perspective is to rollover plan distributions to another retirement account in order to preserve tax deferral, unless they can persuade the employer to alter the plan rules to at least permit an in-kind distribution with contingencies that still allow the employer to retain the stock in the long run.

Nerd Note:

Although ‘rank and file’ employees will generally have little to no say as to how a plan is operated, a participant who is an owner or influential employee may be able to convince management to amend a plan that does not currently allow for in-kind distributions to one that does. Notably, if the company has done well, the executives and other highly compensated employees are the ones likely to have the most plan-held appreciated stock and, thus, who are in the position to benefit the most from the ability to use NUA.

NUA Considerations For Privately Held Companies Offering In-Kind Distributions Of Employer Stock With One Or More Contingencies/Restrictions

In somewhat of a middle-ground between “no in-kind distributions” and “no restrictions on in-kind distributions” lives the potential for plans to allow in-kind distributions of employer stock, subject to certain contingencies, restrictions, or other limitations.

While such constraints can manifest themselves in a variety of different ways, one of the most common contingencies attached to an in-kind distribution of employer stock is the requirement that distributed stock be instantly sold back to the company.

Indeed, this type of restriction is particularly common for ESOPs that are sponsored by S corporations (where ownership needs to be restricted to certain individuals or qualifying trusts in order to maintain qualified S corporation status), or corporations that are substantially employee-owned and whose by-laws restrict stock ownership (e.g., to the ESOP, employees, or former employees).

For individuals with appreciated stock participating in plans with this type of restriction, the good news is that NUA again becomes feasible. However, the double-edged sword that is NUA – in general, the benefit of long-term capital gains on appreciation, at the expense of ordinary income tax on the total cost of those shares when distributed – is sharpened further.

Because instead of just worrying about the ordinary income tax hit of the cost of the shares upon distribution, the participant must also factor in the long-term capital gains tax on the appreciation as well, which is forced to occur when the shares are sold immediately after distribution!

Example 3: Edward is a participant in a privately held employer’s ESOP that allows in-kind distributions from the plan, but that also requires such shares to be immediately sold back to the company at fair market value.

The total cost of Edward’s shares, when they were purchased within the ESOP, is $250,000. The fair market value of the shares is currently worth $1.25 million.

If Edward chooses to use NUA for all of his shares, as a result of the distribution, he will owe ordinary income tax on the $250,000 purchase price of the shares inside the plan.

However, since his plan requires that any stock distributed in-kind be sold immediately back to the company at fair market value, he will also have to consider the income from the growth of his stock of $1.25 million (fair market value of the shares) – $250,000 (cost of the shares, for which ordinary income tax is owed) = $1 million, on which he must pay long-term capital gains tax!

Clearly, plan participants in a position like Edward, from the example above, are in a much more challenging situation – at least with respect to NUA – than would be the case for a participant with similar gains within a plan sponsored by a publicly traded company.

On the surface, the ability to swap ordinary income tax rates for long-term capital gains rates still sounds great, but when all the stock must be sold at one time, and when the gain from that sale must be added to the ordinary income already created by the NUA transaction itself, the value of NUA is quickly diminished.

Consider, for instance, a scenario in which Edward, from Example 3, expects to be in the 22% bracket during retirement. Without considering any other ordinary income he may earn during the year, the $250,000 of ordinary income (Edward the cost of the shares distributed from the ESOP) is already likely to be pushing Edward out of the 22% bracket and into the 24% bracket. That alone might not be a death knell for using NUA if it allows a huge chunk of gains to be taxed at much lower rates than would otherwise be the case.

But by virtue of the fact that Edward would have to sell all of the stock distributed to him in-kind at one time, and that such a gain would have to be added to income generated from the NUA transaction itself, the tax savings of long-term capital gains treatment is greatly reduced.

Notably, rather than the 15% long-term capital gains rate that would ‘normally’ apply to Edward whilst in the 22% ordinary income tax bracket, the overwhelming majority of the gain would be taxed at the highest long-term capital gains bracket of 20% (because the capital gain is so large, the gain drives itself into the top capital gains bracket)!

And with such a small difference between the 20% long-term capital gains rate and the 22% ordinary income tax rate that Edward would otherwise expect to pay in the future, the luster of the NUA strategy is dulled to a point where it is almost assuredly the wrong move. Because while, in a vacuum, a 20% rate is better than a 22% rate on the same income, if the proceeds from the NUA stock sold back to the company were invested back into a taxable account, then the impact of the future tax drag resulting from those investments – the annual taxes that would be owed on interest, dividends, and capital gains, which would otherwise be deferred if the same income were earned within a retirement account – would come with a ‘price’ that makes the NUA choice obviously untenable, despite the 2% ‘discount’ it may offer upfront.

A rollover to another retirement account, such as an IRA, where tax-deferred growth can continue to be generated, and where the tax bill can be put off until distributions are taken in the future, becomes the better play.

Confirming NUA Feasibility By Reviewing ESOP Plan Documents

Clearly, plan-specific rules and provisions can have a huge impact on planning for employer securities held within a qualified plan sponsored by a privately held company, given the common transferability limitations on privately held stock that can run afoul of the NUA requirements. Accordingly, participants and advisors should familiarize themselves with the specific rules of a plan at their earliest opportunity to do so.

In many situations, the best source of such information is a plan’s Summary Plan Description. Oftentimes, the Summary Plan Description is available to participants online. If not, and a participant does not have a current hard copy of the document, they can (and should) request one from their Human Resources department or another employee benefits representative.

Typically, a Summary Plan Description will have a section on “Distributions,” in which information about in-kind distributions can often be found. Language such as, “Distributions of your account from the Plan will be in cash” will tell you that NUA is effectively off the table.

By contrast, language such as, “If you choose an in-kind distribution, a stock certificate will be issued for the shares held in your Plan account and mailed to your address on file”, would indicate that it’s game-on for NUA, and that the same wisdom that would apply to appreciated securities held in the plan of a publicly traded company could likely be applied to the current situation as well.

And language such as, “Distributions of Company stock are subject to a mandatory requirement that you immediately sell such Company stock back to the Company or ESOP Trust” will let you know that, while NUA may be possible, the additional requirements associated with an in-kind distribution may reduce the benefit of such a transaction to a point where it may no longer be the best option for even highly appreciated stock.

While in many situations, the Summary Plan Description will yield all the information needed to make an informed decision, some plans are created with flexibility designed to allow companies to adjust their distribution rules from time to time, which can further complicate matters for participants.

For instance, a Summary Plan Description might contain language such as, “Distributions of your account from the Plan will be in cash and/or shares of Company stock, the combination of which shall be decided by the Plan Administrator,” or “Distributions of Company stock may be subject to a mandatory requirement that you immediately sell such stock back to the Company.” In such situations, the ambiguity surrounding the current treatment of distributions is generally best resolved with a call to the plan administrator.

In general, plans will not release information to an advisor without a plan participant on the line, even if that information does not contain any personal information about the participant (i.e., ‘just’ discussing the plan’s rules). Accordingly, advisors should find a time to reach out to the plan during a meeting with a client, or via a three-way call. To the extent possible, advisors should try to make sure that such conversations are archived on a recorded line, so that any future discrepancies between information received and the plan’s actions can be addressed. In the absence of an archived call, advisors and participants should be encouraged to ask for information from the plan in writing.

Nerd Note:

While plans can be drafted to allow certain flexibility (e.g., sometimes allowing for in-kind distributions, while at other times, limited distributions to only cash), the plan cannot discriminate on behalf of certain employees. Current rules must be applied ‘evenly’ to all plan participants.

Saving for retirement is a central goal for most workers, which is often supported by employers through the adoption of one or more qualified retirement plans. Such plans offer employees the ability to save on a tax-preferenced basis, and in many cases, the employer makes contributions to the plan on behalf of the employee.

Sometimes an employer-sponsored retirement plan will allow a participant to participate in the success of the company by owning the stock via the plan. In such situations, the appreciation earned on such stock over time is eligible for a special tax break, known as NUA.

For publicly traded companies, NUA opportunities are largely a matter of simply deciding whether doing so would be worthwhile, and then just following the NUA rules.

But when individuals own the stock of privately held companies within their employer plan, the situation can be decidedly more complicated. In some situations, the plan’s own rules may make using NUA an impossibility altogether (such as by requiring all plan distributions be made in cash), while in other situations, restrictions imposed by the plan may greatly reduce the benefit of using an NUA strategy to the point where it no longer makes practical sense.

The key point is that just because a company is not publicly traded doesn’t mean that NUA can’t be done. It is often possible to complete an NUA transaction using privately held stock as well. Still, though, the level of due diligence and research required before using the NUA strategy is increased with private company stock held in an ESOP or similar structure. Fortunately, where NUA either can’t or shouldn’t be used, a direct rollover to another retirement account always remains a viable option.