Executive Summary

Despite the reality that change is inevitable, it’s remarkably difficult to identify in real-time which new innovations will stick around and change the world, and which will never manage to gain traction (or turn into a fad that is quickly adopted but just as quickly forgotten). In some cases, the reality is that the idea was good but its execution was poor, and couldn’t stand up to reality. In other cases, the idea was ‘right’ but was before its time. In the end, it takes the right execution of the right idea, and the right environment that fosters the demand, to make innovation happen.

The past year witnessed an immense amount of change in the AdvisorTech landscape, driven by a combination of new innovations that came to market, and some ‘old’ ideas whose time has seemingly come. All of which is driven by broader structural trends that are slowly but steadily reshaping the financial advisor landscape… and formulating the conditions that allow new technology to take hold.

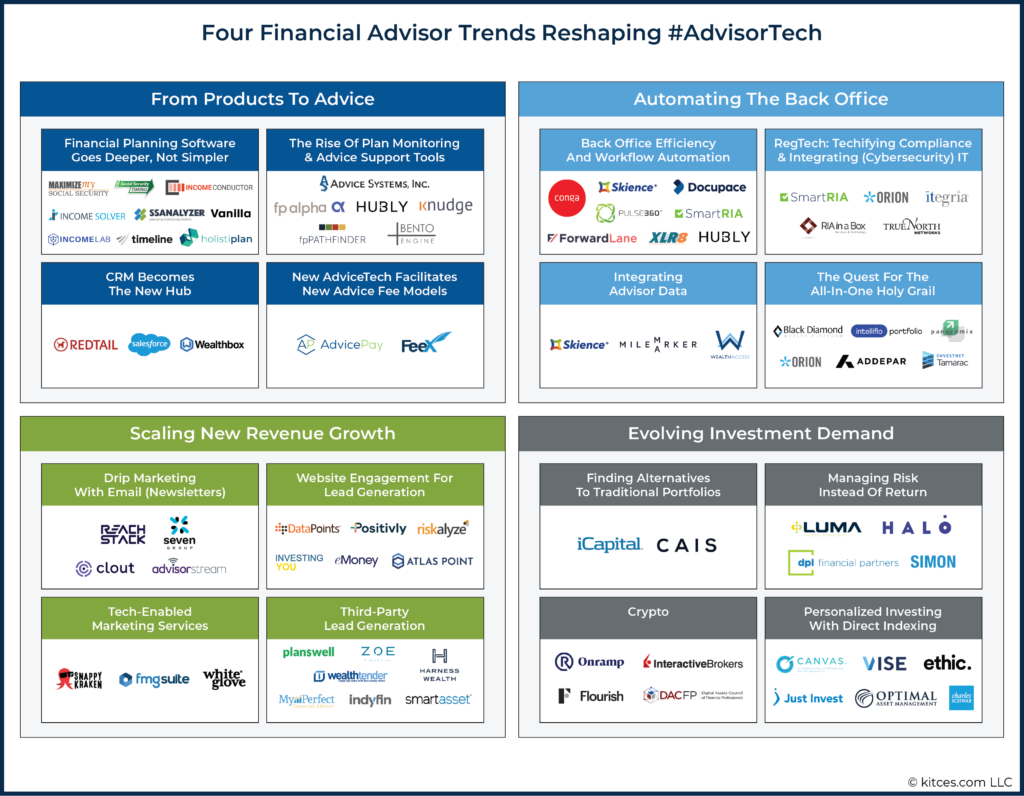

In the current environment, the four trends reshaping #AdvisorTech include: 1) an ongoing transition From Products To Advice as advisors increasingly sell advice (not products); 2) a growing hunger to Automate The Back Office, as the shift to recurring revenue business models is driving a push to better scale the back office (to service that recurring revenue more efficiently); 3) Scaling New Revenue Growth, as advisory firms increasingly separate the advisors who service clients, and the (non-advisor-driven) marketing systems that bring them in; and 4) Evolving Investment Demand, as anticipated low returns for both stocks and bonds lead to a growing desire to invest in… almost anything else (from alternatives to structured notes and annuities to cryptoassets).

In last week’s discussion, we explored the first two trends – the shift from products to advice, and the growing demand for solutions to automate the advisor’s back office – while this week, we delve further into the #AdvisorTech trends that are driving some of the biggest investments: scaling new revenue growth, and platforms to meet the evolving investment demands of advisors (and their clients). As the reality is that advisors pay substantially more for #AdvisorTech solutions that power revenue growth – either directly in the form of marketing solutions, or indirectly by powering the portfolios of advisors still primarily operating on an Assets Under Management (AUM) model. Which means trends that impact the ways advisors generate (new) revenue are especially lucrative (as reflected in some eye-popping capital raises in 2021!).

In the end, though, it’s important to recognize that trends persist (which is what makes them trends, and not fads!), which means the trends that drove AdvisorTech innovation in 2021 are likely to continue well into 2022 and beyond. So hopefully this discussion provides some helpful perspective in not only looking back at where AdvisorTech has come over the past year… but where it will continue to go in the year to come!?

The Four Trends Reshaping AdvisorTech

While it’s often said that technology innovation can lead to “sudden” disruption, in practice, fast change is often preceded by extended periods that slowly but steadily change the underlying conditions to make the fast change possible.

For instance, while Netflix “disrupted” the video rental store business of Blockbuster, the disruption of streaming services only happened in the context of a decade-long rise of the internet and build-out of substantial internet capacity that made streaming possible. Similarly, digital cameras disrupted traditional film-based cameras only after decades of exponential improvements in (ever-faster) computer chips and (ever-smaller) hard drives made it possible.

Accordingly, by looking to the underlying trends that are reshaping the advisor landscape – often not even ‘new’ trends, but steadily persistent and compounding trends that can cumulatively build substantial demand for change, and rapid adoption of a new innovation that solves for a new need – we can understand the potential trends that may drive new AdvisorTech innovation.

In the current landscape, those four driving trends are:

1) From Products To Advice. The ongoing shift of the advisor value proposition from having the best (array of) financial services products to sell, to selling financial advice itself, which changes the software and advice support systems that advisors use.

2) Automating the Back Office. While robo-advisors were once predicted to replace the human financial advisor, instead the technology appears to have spawned a reinvestment into the advisor’s back office that is now driving a newfound focus on everything from business process automation to building the next generation of integrations (and the advisor-owned data warehouses to drive it).

3) Scaling New Revenue Growth. As advisory firms shift to recurring revenue business models, a separation is occurring between the advisors who service clients, and the (non-advisor-driven) marketing systems that bring them in, spawning a new wave of marketing and lead generation tools.

4) Evolving Investment Demand. The ubiquity of mutual funds and ETFs, coupled with a potential low-return environment for both stocks and bonds, is spawning newfound pressure for investment-centric advisors to bring something new and different to the table, from alternatives, to structured notes and annuities, to cryptoassets, to more personalized portfolios (built on a new Direct Indexing chassis) that reduce the focus on investment returns altogether.

3) Scaling New Revenue Growth

One of the most underappreciated ramifications of the ongoing shift from commission-based business to AUM and other fee-for-service (e.g., monthly subscriptions or annual retainer fees) business models is what happens when an advisory firm shifts its revenue from one-time transactional to ongoing-recurring revenue instead.

As the reality is that in a transactional commission-based model, when the financial advisor wakes up every January 1st with a revenue of $0 until they once again go out and get (more) new clients, the advisor rarely invests very heavily into staff infrastructure; after all, the only thing that’s worse than feeling like you’re starting over every year is having significant overhead and needing to get a high volume of clients just to get from negative cash flow to breakeven and start earning a profit!

By contrast, in a recurring revenue advisory model, at some point the financial advisor begins the year with an existing base of clients, who may in the aggregate be paying hundreds of thousands (or even millions) in revenue, and “all the firm needs to do” is give them good advice and good service to keep them. Which leads to a growing number of admin staff and employee advisor hires to provide that service, and the emergence of a true “profit margin” for the firm – where the revenue of the clients is split between the direct cost of advisors to serve them, the administrative and overhead cost to run the firm, and an ongoing profit margin for the founder for the enterprise they’ve built.

The caveat, though, is that as the firm grows, it becomes increasingly difficult to sustain the growth rate. In part, this is simply because of the “tyranny of the denominator” – the fact that as the size of the firm grows, the sheer number of clients it takes to sustain the growth rate becomes challenging. A $20M AUM firm needs one new $250k client each month to sustain a 15% organic growth rate; a $200M AUM firm needs a $600k client every week to sustain the same growth rate; and a $2B firm needs a $1.2M AUM client every business day to maintain 15% organic growth rates. But the problem is even more daunting when historically, the advisor-owner was often the primary or sole person responsible for business development, and at some point, there’s simply “too much” required volume for one person to possibly maintain the growth.

While historically the solution to this was simply to hire more financial advisors who would help bring in clients and grow the business, though, in recent years advisory firms have shown an increased desire and willingness to scale more centralized marketing systems where “the firm” generates the new client opportunities and hands them to the advisors (which can reduce the client acquisition cost for the firm through centralized efficiencies, while also reducing the risk of advisors who break away if the advisors are reliant on the firm to get new clients).

This trend is now spawning a growing number of advisor technology solutions specifically around systematizing and scaling an advisory firm’s marketing and lead generation capabilities to go beyond a reliance on individual advisors bringing in their own new clients.

a) Drip Marketing With Email (Newsletters)

One of the longest-standing advisor marketing strategies has been the newsletter. Historically produced as a quarterly 4-8 printed deliverable that would be physically sent to prospects, advisors would go to networking meetings with the goal of gathering business cards (with mailing addresses) to which their quarterly newsletter could be delivered in the future.

After all, most prospects don’t wake up one night in a cold sweat thinking, “I need to get myself a comprehensive financial plan!” Instead, financial planning usually remains on the back burner for months or even years, until “something happens” that creates a need for them to take action, at which point they’re likely to reach out to whoever is top of mind. Which meant the advisor who regularly delivered a (high-quality) newsletter to their prospects had a good chance to be top-of-mind at the exact moment their prospect decided “now is the time”.

With the rise of the internet and then the smartphone, consumer reading habits have shifted from print newsletters to digital, but the essence of “drip marketing” remains as valid as it ever was. Which in turn has spawned the rise of a growing number of email marketing platforms, from MailChimp to HubSpot… and in recent years, a growing number of AdvisorTech solutions attempting to build a more industry-specific version of “MailChimp for Financial Advisors”. Where their unique value proposition is providing out-of-the-box content that advisors can use to fill their email marketing newsletters (as most advisors aren’t naturally inclined towards writing or other content creation).

In 2021, the email marketing category heated up quite a bit, with new entrants like Seven Group to accompany other recent newcomers like Reach Stack and TIFIN Group’s Clout, and Broadridge acquiring the faster-growing AdvisorStream, not long after FMG Suite acquired Twenty Over Ten and its Lead Pilot email marketing solution.

The irony of the recent acceleration in the growth of email marketing is that, for many, email was the marketing strategy of the 2000s, while social media was supposed to be the digital marketing channel of the 2010s. Instead, though, recent Kitces Research has shown that most advisors have struggled greatly to turn social media marketing into real business results, while it’s been email marketing that has proven remarkably resilient and able to hold the attention of prospects (or at least, more than social media holds their attention!).

b) Website Engagement For Lead Generation

While drip marketing via newsletters (and now email newsletters) has long been a staple of advisor marketing, the reality is that the strategy only “works” if advisors can get people onto their newsletter list in the first place. Or stated more simply, it doesn’t help to have an email marketing funnel if the advisor can’t pour a steady stream of prospects into the top of the funnel to become leads in the first place. Which means that along with the growth in email marketing solutions is a rise in tools that advisors can embed onto their websites to engage their prospects to join their mailing list as well.

In the past, the “Call To Action” (CTA) on a website was typically for a piece of content – e.g., click here to get our white paper – but in a world where it’s difficult for most advisors to create such (differentiated) content, it is instead increasingly common to use other embeddable tools that can engage prospects and draw them through to the next step.

Thus far, most of these “lead generation” tools are extensions of other advisor technology tools. For instance, Riskalyze makes it possible for advisors to embed a version of the Riskalyze risk evaluation process directly into the advisor’s website. Similarly, eMoney in 2021 rebranded their Advisor-Branded Marketing solution as “Bamboo” to amp up their lead generation support. Not as a way to do ‘digital onboarding’ for new clients, but specifically as a way to engage prospects to become clients (or at least, provide their contact information to be added to the advisor’s email list).

A more recent emerging trend in on-site lead generation is to provide questionnaires or “assessments” that entice prospects to engage with an opportunity to learn more about themselves (and ideally, to better understand their own gaps or needs where the advisor might be able to help). Accordingly, a number of new “behavioral assessment” tools were added to the Kitces AdvisorTech Map in 2021, including Atlas Point, Positivly, Investing You, and DataPoints. Notably, these tools do not necessarily focus on anything specific to financial planning or investing in particular, but tend to focus more broadly on various “financial behaviors” that clients engage in (that they may want to explore and learn more about, and that their advisor may be able to help with).

Ultimately, the key point is simply to recognize that email marketing alone doesn’t “work” unless advisors can get clients to join their mailing list in the first place. Which means as email marketing continues to grow in popularity, so too will the solutions that help advisors grow their mailing lists as well.

c) Tech-Enabled Marketing Services

“Business Development” has long been viewed as an essential skill for financial advisors, where the key to being a “successful” advisor was the ability to do whatever was necessary to build one’s own book of clients. As a result, the sheer self-selection process of who ‘survives’ as a financial advisor in the first place means the average advisor has at least a ‘reasonable’ skillset when it comes to marketing and sales.

In practice, though, the financial services industry has focused far more on the “sales” than the “marketing” side of business development. Which means that most advisors are much better at convincing a prospect to become a client than they are at finding prospects to get in front of in the first place. Thus why so many advisors had to rely on cold-calling in their early days, and “prospecting” is still a dreaded activity for many financial advisors – for which growing the existing client base enough to be able to rely on referrals instead is a welcome relief.

Consequently, one of the ironic challenges of the rise of email marketing and on-site engagement tools to execute a digital marketing funnel is that few advisors actually skilled or experienced at how to actually execute a systematized marketing process, as prospecting in the past was primarily a “Game Of Numbers” executed with brute force and perseverance, not a scalable marketing system.

In response to this challenge, one of the emerging trends of 2021 was the rise of “tech-enabled marketing systems” – companies that nominally offer marketing technology solutions, but in practice are primarily service providers that are paid to actually execute the technology for their advisors. For instance, White Glove (which provides outsourced advisor marketing services) acquired Gainfully’s email marketing automation solution in 2021, so that it can wrap its outsourced marketing services more directly around Gainfully’s technology solution. Similarly, FMG Suite completed the integration of their Twenty Over Ten acquisition and its Lead Pilot email marketing automation solution to build into their Services solution. And even Snappy Kraken – which raised a $6M Series A round in 2021 for its marketing automation email solution for advisors – is now upselling a pipeline-building outsourcing solution on top of its technology… at double the cost of the software itself!

In other words, not only is there an emerging hunger for service providers who can actually help implement marketing technology for financial advisors, but “tech-enabled services” are actually commanding a far higher price point in the advisor marketplace than the technology itself!

d) Third-Party Lead Generation

In the early days of the financial advisory business, the client process was broken into four key roles: Finders, Binders, Grinders, and Minders. The finders did the prospecting to generate the leads; the binders sold the prospect and got them to sign (bind themselves) as a client; the grinders did the planning and support work; and the minders serviced the client on an ongoing basis. Each role would receive 25% of the client's revenue.

In the modern era, the idea that the Finder – whoever generated the lead – should get 25% of the client revenue is still a common viewpoint. As advisors who pay third-party solicitors to refer prospects (e.g., affiliated COIs like accountants) still often share as much as 15% to 25% of the revenue for the referral. And the popular RIA custodial referral programs are known for requiring a 25%-of-ongoing-revenue, revenue-sharing arrangement for their referral leads.

Given the incredibly high retention rates of advisory firms, though, a lifetime revenue-sharing agreement for a client referral can add up to very significant dollars, especially when financial advisors typically work with clients who have hundreds of thousands or even millions of dollars of assets to manage. Which means a single $1M client that pays a 1%-of-AUM fee would provide $2,500 of revenue-sharing referral payments at a 25%-of-revenue arrangement. Which at 95%+ retention rates and 20-30+ average client tenures can reach $50,000+ of cumulative lifetime value in referral payments for a single client!

As a result, one of the biggest trends of the past year was a veritable explosion of capital in scaling up third-party lead generation services for financial advisors, that are all looking to capitalize on the potential for a single referral of an affluent individual to add up to tens of thousands of dollars. Accordingly, in 2021 Wealthtender launched a lead generation solution, Planswell expanded from Canada into the US with a lead generation offering, MyPerfectFinancialAdvisor launched its own advisor lead generation site, IndyFin raised $2M to power the growth of its lead generation service, Zoe Financial raised $10M of capital to scale up its lead generation service for advisors, Harness Wealth raised $15M of capital for its lead generation, and SmartAsset reached “unicorn” status with a $1B+ valuation on the back of its accelerating pivot into the advisor lead generation business.

In the long run, though, the real question is whether the growing number of lead generation services will be able to scalably generate enough financial advisor leads themselves, as the reality is that client acquisition for financial advisors is very expensive, and highly competitive (which means cost-efficient strategies to generate leads are often quickly arbitraged away as others bid up the same marketing channel), and most financial advisors only want to pay for pre-screened, high-quality leads (which are even harder to source). Which means, as a third-party lead generation solution for advisors, their success or failure will not be determined by the technology, per se, but simply their ability to do financial advisor marketing themselves at scale at a lower cost than what advisors can execute on their own (earning the difference as a profit for their efforts).

4) Evolving Investment Demand

Over the past 20 years, the financial advisor business model has increasingly shifted from its roots in product-based commissions, and towards the Assets Under Management (AUM) model. This trend has been driven by a confluence of factors, including the rise of the internet (that allowed consumers to buy stocks, bonds, mutual funds, and other financial products directly online, forcing financial advisors to add more value in the form of designing diversified asset-allocated portfolios), a regulatory impetus towards fee-based accounts (starting with the so-called “Merrill Lynch rule” in 1999 that opened the door to fee-based accounts, accelerated by the Department of Labor’s fiduciary rule in 2016, as regulators increasingly recognized that ongoing levelized fees reduce incentives to churn products), and the simple reality that the AUM model and its recurring revenue is more scalable (creating bigger and more successful advisory businesses that have attracted other advisors to follow a similar path).

The challenge of the AUM model, though, is that when advisors charge ongoing fees, there is an ongoing pressure on advisors to show the client “what have you done [for me] lately?” Which in practice is usually translated into a focus on investment performance (and rapid growth of platforms like Orion, Black Diamond, and Tamarac, to help advisors track and report on their performance), as advisors try to show how clients are getting better investment results with the advisor than they would have been able to achieve on their own (e.g., by ‘just’ buying the benchmark, or having been left to their own devices, and the potential behavioral investment mistakes they may have made along the way).

In absolute terms, though, a decade of ultra-low interest rates since the financial crisis dragging down bond returns, coupled with increasingly elevated P/E ratios for the stock market in the aggregate (which portends lower stock returns), is putting more and more pressure on advisors trying to justify their ongoing value. As a 1% AUM fee takes a non-trivial bite out of bond returns that have historically been 5%+, but can take literally the majority of the bond return when yields sit under 2%. Similarly, the ‘bite’ of the AUM fee on stock returns that might only be 6% to 8% in the coming years is far greater on a relative basis than when stocks achieve their historical 10% average returns.

For some advisors, the response to these challenges has been to shift their value proposition increasingly towards financial advice itself, making their AUM fee a more holistic “wealth management” fee, for which managing the portfolio is not the sole (or sometimes not even the primary) service that clients receive for the (AUM) fee that they pay.

For others that are still staying focused on investment management, though, the end result of this low-return environment, and the pressures it creates on the traditional AUM fee, is a growing focus on new ways that advisors can either bring clients new and different investment products (that hopefully have greater return potential), shift the focus of their investment value proposition (e.g., from managing returns to managing risk), or reconfigure their investment proposition altogether.

a) Finding Alternatives To Traditional Portfolios

With reduced returns on both stocks and bonds, one of the most straightforward options is to find alternatives to these traditional asset classes – literally, by finding viable investment products in the broad domain of “alternatives”.

Historically, “alternatives” were, almost by definition, investments that were not available in a traditional packaged investment product. In general, that meant alternatives tended to be private investments – e.g., hedge funds and private equity, real estate and other limited partnerships, private credit, etc. – which both weren’t available on traditional platforms (thus making them more unique and exclusive), and were generally more illiquid (with the attendant risks and, in theory, additional return available from capturing an ‘illiquidity premium’).

As demand for alternatives has risen, the investment marketplace has responded, with a near-explosive proliferation of new alternative investment offerings across an ever-widening range of ‘non-traditional’ strategies, with more and more investment managers rolling out new products to capture a piece of the opportunity. To the point that for the average financial advisor, it’s hard to even navigate the voluminous choices… especially given the greater burden of due diligence on what are still, in the end, less liquid and more opaque solutions (which means if clients get placed into the ‘wrong’ one, it will be even more costly to extricate them from the bad investment).

Accordingly, 2021 saw a rapid rise in the growth of various alternative investment platforms that are attempting to formulate marketplaces where advisors can seek out and find the ‘right’ alternative investment for their clients (for which the marketplace receives a small slice for facilitating the transaction). Which included iCapital raising a stunning $440M of capital (at a $4B valuation!) to power the next stage of its alts marketplace growth (including serving as the backbone to Envestnet’s move into alts), while CAIS spent much of 2021 deploying its late-2020 $50M Series B.

Notably, because in the end alternatives marketplaces aren’t necessarily about doing business with advisors, per se, but capturing the economic opportunity of the trillions of end dollars that advisors manage for their clients, the sheer size of the market opportunity in the B2B2C business of alternatives investments has driven far more capital towards alts platforms than for nearly all other AdvisorTech solutions for advisors themselves, combined!

Nonetheless, the fact remains that as long as stock and/or bond returns are projected to be well below average, there will be an ever-present pressure on financial advisors to find alternatives that have a greater return potential – both to justify their fee by finding ‘better’ returns than traditional investments, and because the advisory fee itself doesn’t produce such a drag when it’s applied against a higher-return portfolio!

b) Managing Risk Instead Of Return

When Harry Markowitz first proposed his Expected return – Volatility (E-V) rule, now simply known as “Modern Portfolio Theory”, it was a novel consideration to design portfolios based on their aggregate volatility, and that total risk of a portfolio could actually be reduced by adding in more volatile investments as long as they had low (or ideally, negative) correlations to the rest of the portfolio. Which in turn spawned a number of new ways to model portfolio risk and measure investment outcomes, from the Sharpe ratio to Jensen’s Alpha, all built around recognizing not just whether the portfolio produced a “good” return, but a good “risk-adjusted” return.

From the performance reporting perspective, the significance of a growing awareness of risk-adjusted returns was that the “best” portfolio result was not necessarily the one with the highest return, but the highest return relative to the amount of risk that was taken. The caveat, though, is that because risk and return go so hand-in-hand, in practice, lower-risk investments are almost by definition going to be lower return, and lower-return investments are virtually always lower risk. Which means it’s difficult to actually “manage” risk, per se, as opposed to simply choosing whether to own more or less of it in the first place (i.e., helping a client choose between a 30/70 or a 70/30 portfolio).

In recent years, the growth of options and other derivatives markets have created a new way to carve up the risk-return spectrum – not by simply choosing to own more high-risk-high-return or low-risk-low-return, but specifically to buy higher-risk-higher-return investments and then use options strategies to carve out the extremes. For instance, an investor can create a substantially-lower-risk version of the S&P 500 by owning the index, and pairing it with a put option that limits any downside beyond -15%... paid for by selling a call option that also gives up any return above +15%.

However, such options strategies are not practical for most financial advisors to implement directly, due to a wide range of challenges, from advisor trading systems that weren’t built for options, to the limitations on directly owning derivatives inside of retirement accounts, to the difficulties in trading (and needing to continuously maintain and roll) one-off retail options for a wide range of client accounts. Which in turn has led to a rise in various products that package those options strategies together, from indexed annuities to structured notes.

In 2021, this trend rapidly accelerated, with a heavy push of new and growing platforms aiming to capture advisor interest in new ‘risk-managed’ investment products. As a result, SIMON Markets raised a $100M Series B round to accelerate its marketplace of risk-managed annuities (particularly into the RIA channel, which historically didn’t have access to many fee-based products), Halo Investing also raised a $100M Series C round to accelerate its growth in buffered ETFs and structured notes (and expand further into annuities), Luma Financial is reportedly raising a fresh $75M round for its growth into annuities, and DPL Financial Partners raised $26M to drive growth in its focused annuity offering into the RIA channel.

Notably, the reality is that structured notes have been around for nearly 15 years, while annuities have existed for many decades. However, the reality is that the former were primarily sold by transactional brokers as a ‘product’, while annuities were historically sold by insurance agents (also as a product). In 2021, the shift is towards packaging structured notes, annuities, and other risk-managed products into solutions that non-commissioned fee-based RIAs can use instead. Which entails different kinds of marketplaces, different kinds of systems integrations, different kinds of advisor support… and another huge B2B2C market opportunity given the trillions of dollars of AUM in play.

c) Crypto

While Bitcoin and other cryptocurrencies have been around for more than a decade and began to hit consumer awareness in 2017 when the price of Bitcoin first spiked, 2021 was arguably the year that cryptoassets truly went ‘mainstream’ – from an explosion in media coverage of Bitcoin and other crypto, to the rise of Non-Fungible Tokens (NFTs), and the simple reality that Bitcoin achieved a market capitalization of more than $1 trillion (and cryptoassets in the aggregate peaked at more than $2.5 trillion). A recent Pew study found that 16% of Americans have now invested in cryptocurrencies. (To put that in context, ‘only’ 45.7% of households even own a mutual fund!)

The explosion of consumer adoption of (and even broader interest in) cryptocurrencies finally appears to have impacted financial advisors as well, who historically have polled at <1% in usage of cryptocurrencies, but in the latest FPA Trends In Investing study was reported at 14% of advisors currently using or recommending crypto to their clients (and 26% stating that they anticipated increasing their use of crypto in the coming year).

The caveat, though, is that in practice, financial advisors don’t have a good way to implement cryptocurrencies with their clients. As portfolio management systems are built to integrate to ‘traditional’ brokerage platforms and RIA custodians, not decentralized finance systems. Implementing individual blockchain wallets for each client is not scalable, nor is it clear that the ‘average’ client can even effectively maintain their own cybersecurity behaviors at the level necessary to keep their own cryptoassets secure.

In 2021, the gap between the demand for cryptoassets from consumers (and a desire to adopt by a growing number of advisors) and the feasibility of doing so on traditional advisor platforms led to a number of new innovations, from the launch of the first Bitcoin (futures-based) ETF, and Interactive Brokers launching cryptoasset trading on its RIA custodial platform, to Flourish launching a Crypto solution giving advisors a way to buy Bitcoin for their clients integrated to ‘traditional’ RIA portfolio management systems, to OnRamp Investing raising $6M in capital to integrate a wider range of cryptoassets into advisor portfolios (from reporting integrations to building new trading systems to accommodate), while Ric Edelman’s Digital Assets Council of Financial Professionals (DACFP) launched an effort to expand advisor education in crypto.

Even with systems to make cryptoasset investing more administratively feasible, though, in the long run, the question remains as to how many (fiduciary) advisors will really want to invest clients into cryptoassets that can decline 50% to 75% in a few months (when most advisors struggle to keep their clients on board with stocks that drop ‘just’ 20% to 40% in a bear market decline), or whether the sheer volatility of cryptoassets will prove too great to gain broad advisor adoption. In addition to the number of advisors who are still skeptical about whether cryptoassets are ‘just’ another fad or a bubble, more akin to 1600s tulips or 1990s tech stocks than the next great asset class. Nonetheless, from an advisor technology perspective, to the extent that technology systems were a material limiting factor in cryptoasset adoption, 2021 was the year that platforms started to tackle that issue… a trend that will certainly carry into 2022 as new cryptoasset investing systems are deployed.

d) Personalized Investing With Direct Indexing

For advisors who manage client portfolios on an ongoing basis, and have to perennially respond to the client question “what have you done for me lately?”, the answer typically relates to how the advisor has (or has not) beaten a specified benchmark index. As especially in the modern era of ultra-low-cost index ETFs, the client in theory really could have just “owned the index” passively, and achieved those index returns (minus just a couple of basis points of index ETF cost). So the advisor is under pressure to demonstrate how their investment process delivered something better than what “the market” alone could have provided.

However, the default benchmark of “owning the market” only works for clients who want to own the market. Historically, the market was the default simply because, by definition, it captures everything the client could have owned (without making any active investment decisions to own anything else). But it was also the default because there was no real way for clients to structure their own benchmark to be anything different.

In the past decade, though – and especially in the past couple of years – an alternative approach has begun to emerge: using technology to manage the ownership of each of the component stocks of the index, instead of an index fund, which not only allows the client to engage in tax-loss harvesting of the individual stocks in the index (for a small bit of ongoing tax alpha), but also allows the client to specify what they want their “market” to be.

Known now as “Direct Indexing”, the key distinction of the approach is that clients have the opportunity to express their own preferences in deciding what is on the list to be owned in the first place. Want to own “the market”… but not tobacco stocks or gambling stocks because those aren’t industries you want to support? You can do that. Want to own “the market”… but only with energy companies that are built from renewable energy sources? You can do that, too. The end result: a form of passive indexing (in that the client isn’t necessarily making any ongoing active management decisions), but one that is personalized to the individual preferences of the client. And one that could completely replace the existing multi-trillion-dollar mutual fund and ETF complex.

Accordingly, in 2021 there was a veritable explosion of acquisitions of Direct Indexing providers, primarily by traditional asset managers that appear to be trying to head off the competitive threat by owning it themselves. Which included Vanguard acquiring JustInvest, JPMorgan acquiring OpenInvest, Franklin Templeton acquiring Canvas, Pershing acquiring Optimal Asset Management, and Fidelity participating in a $29M Series B round into Ethic Investing. In the meantime, startups also got into the mix – most notably, with storied Venture Capital firms Sequoia and Ribbit investing $65M into Vise. And Schwab revealed that it is building its own “Personalized Indexing” solution… which it predicts is “coming like a freight train” for traditional mutual funds and ETFs.

Thus far, it’s not clear which particular Direct Indexing approach will gain the most traction – from those looking to leverage it as a tax loss harvesting strategy, to those using it for ESG or similar values-based investment customization, advisors who want to use the technology to manage their own proprietary strategies (at the individual stock level), or those advisors who want to engage in even more client-specific portfolio construction for unique circumstances (e.g., building a stock-level completion portfolio around an executive client’s existing holdings of company stock). But given the disruptive potential and the dollars at stake – and the fact that traditional asset managers are moving into the space already, if only in the hopes that if mutual funds and ETFs are going to be disrupted, they may as well participate in what comes next – expect that all the acquisitions of 2021 are more fully rolled out to advisors in 2022, and the industry will see which direct indexing approach gains the most traction!

As Bill Gates famously quipped, “We always overestimate the change that will occur in the next two years, and underestimate the change that will occur in the next ten”. Hopefully, by considering the financial advisor trends that are underway – which are likely to persist for many years to come – this will help you consider how to shape your own AdvisorTech decisions as you look to how different the world may be 10 years from now (and the advisor technology that will be necessary to support it!).