Executive Summary

The business of financial advising is a client service business, and as such the client should always come first. This is certainly true in the advice and recommendations provided to the client, and most advisors extend it even to allowing clients to schedule meetings at the times they wish.

Except as an advisory firm grows, providing clients “too much” flexibility in scheduling meetings leaves the financial advisor stuck in a purely reactive mode, with declining productivity and the inability to focus due to the disruptive switching from client meeting to financial planning work to emails to staff meetings and more. And when you’re unable to control your business, then your business will control you!

So what’s the alternative? Create a more rigorous and structured schedule for yourself and your client meetings - a "model week" - and then plan around the consistent calendar it creates. For instance, only accept client meetings on Tuesdays, Wednesdays, and Thursdays, saving Mondays to prepare for the week’s meetings and Fridays to wrap up all the necessary follow-up. And while it might feel scary to ask clients to focus meetings only on certain days, the reality is that in most cases, it would take little more than a nudge for most clients to follow along.

Ultimately by restructuring meetings, though, the advisor (and the supporting team!) can not only regain control of the business, but enhance their productivity and efficiency by reducing the constant distraction of switching from one types of task to the next. It even allows for time to schedule meetings to work on the business – a key task that is crucial for strategic business growth, but is almost impossible to do when the advisor isn’t in control of the business in the first place!

Take Control Of Scheduling Client Meetings To Be Proactive Versus Reactive

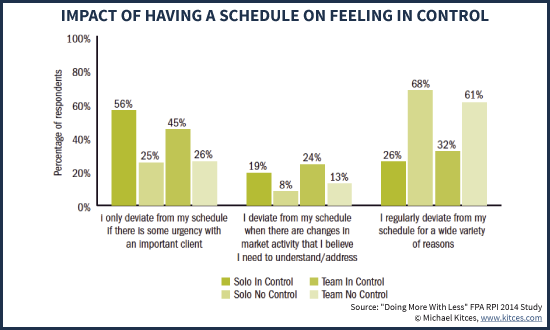

One of the key results of last year’s FPA study on Time Management and Productivity for financial advisors is that when it comes to the advisory world, it’s “control your business, or your business will control you.” In other words, advisors who maintained structure within their advisory business reported feeling more in control of their overall lives; those who were more reactive in their businesses felt less in control altogether.

Of course, the idea that it’s necessary to manage and control your schedule is not new. A growing range of research has found that being engaged with too much at once and multi-tasking is actually a severe impairment to our productivity and focus. We might think we’re getting a lot done, but in reality we’re getting far less done because switching from one task to another and back again is a major disruption, as each switch creates lost time for our brains to refocus on the new task. One study estimated that switching tasks can temporarily reduce your IQ by 10 points and your productivity by 40%.

And notably, the nature of avoiding multi-tasking by focusing on one thing at a time isn’t unique to just what you do from minute to minute, bouncing (or hopefully, not!) from writing one email and then another to writing a plan or reviewing a portfolio analysis while checking the news and your social media channels. The challenge of frequent task-switching, and its productivity-damaging impact, is equally relevant throughout the day, as you shift from checking emails to staff meetings to writing financial plans and conducting client meetings.

The difference, however, is that while being distracted from minute to minute is an outright challenge of creating focus for yourself and learning to “single-task” instead, the speed at which you switch amongst a broader range of single tasks throughout the day (and week) can still have a productivity impact… but is almost entirely a function of how you choose to schedule your time – or allow your time to be scheduled – in the first place!

A Hectic Week In The Life Of A Typical Financial Advisor

For most financial advisors, the scheduling of meetings from week to week is highly reactive. Client meetings are typically the first priority, and clients are given wide latitude about when to come in to meet throughout the week; if the advisor goes to the client’s location to meet, there may at least be some effort to schedule the meeting near other client meetings in the same geographical area. But still, clients typically have full reign over the advisor’s calendar, and their availability dictates the flow of meetings.

Once client meetings are scheduled, “the rest” of the advisor’s obligations for the week are fitted around those client commitments. A day or two before each client meeting usually entails a staff meeting to check in regarding whether everything is prepared for that client meeting. A broader “staff meeting” happens erratically (if at all) based on the advisor’s post-client-meeting availability, with perhaps a “typical” staff meeting time at the beginning of the week but still subject to be moved if a client wants to meet at that time. Other work, from writing emails to keeping up on industry news to doing financial plans and portfolio analyses, fills in around the remaining time between client meetings.

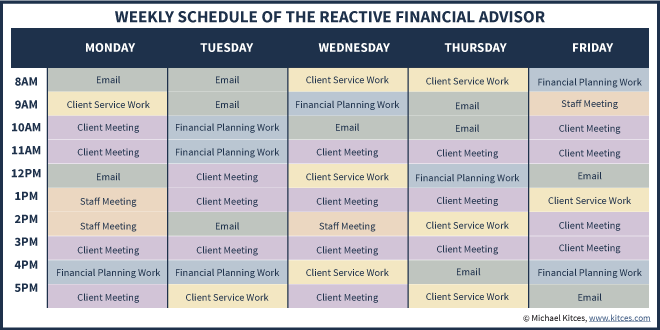

In other words, the hectic week of the typical financial advisor probably looks something like this, with a scattered cacophony of client service work, financial planning work, staff meetings, client meetings, and email squeezed in wherever possible!

Scheduling A "Model Week" Rhythm Of Staff And Client Meetings

So what’s the alternative? Simply put, to proactively structure the week with a fixed schedule, rather than reactively scheduling around whatever is already placed on the calendar (by clients). In other words, trying to create an ideal "model week", and then conforming client meetings and other obligations around the targeted structure.

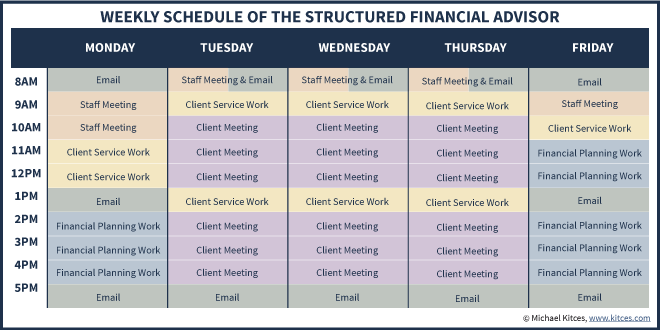

For instance, the first goal might be to reserve Mondays and Fridays for beginning-of-week and end-of-week major staff meetings, each followed immediately by preparing some of the necessary client service work (pre-meeting preparation and post-meeting follow-up). Monday and Friday afternoons would be reserved for focused financial planning work and projects. Email would be checked only at rigorously scheduled intervals: first thing in the morning, mid-day after lunch, and at the end of the day before wrapping up.

In turn, all client meetings would be moved mid-week to Tuesdays, Wednesdays, and Thursdays. Kicking off every morning would be time for a brief daily staff meeting, preparing client service work for the day, and a quick email check. From that point forward for the rest of the day, clients would schedule into open time slots all morning and afternoon, where they can be scheduled one right after the other, with a mid-day break to catch up on client service work coming out of the meetings (record to-do’s and follow-up items) and a final preparation for the rest of the day’s meetings.

With this structure, clients would receive communication that meetings are available specifically on Tuesdays, Wednesdays, and Thursdays of every week, with flexibility about when to schedule on just those days. Similarly, clients could be informed that you only check email at the beginning and end of each day, with a quick email check-in mid-day on Mondays and Fridays, so any urgent issues should be directed to your support staff to handle, or elevate to you in the unusual situation that you truly must be involved yourself.

Ultimately, the final weekly schedule with this approach would actually still have the same amount of time being spent in each of the various categories, including email, client service work, financial planning work, staff meetings, and client meetings. The only difference is the structure of the calendar… and the fact that while the reactive calendar changes every week throughout the year, the structured calendar would give the advisor a regular and steady productivity-enhancing meeting rhythm all year long!

Enhancing Productivity By Regaining Control Of Your Schedule

Perhaps the biggest caveat to trying to regain control of your schedule by taking a proactive approach to structuring your meetings is the change necessary to do so. Particularly when the “clients-first” mentality conflicts with the goal of limiting client meetings to particular days of the week.

Nonetheless, having talked to many advisors who have implemented this exact approach, the reality is that in the overwhelming majority of situations, it’s a non-issue for most clients. The next time you (or your staff) reach out to schedule with them, simply give them meeting options on Tuesdays, Wednesdays, and Thursdays, and not the other two days of the week. If the client suggests that Monday or Friday of a particular week works better, suggest a Tuesday/Wednesday/Thursday of the following week as an alternative.

In the extreme, you might explain to them that as a means to enhance client service, you’re creating a more structured meeting environment to allow for better coordination between you (the advisor) and the work that’s being done for the client. In most cases, though, this conversation is probably unnecessary, as clients will simply choose from the meeting choices presented to them. And newer clients who only ever experience your usual mid-week scheduling routine will never know the difference.

Of course, in a truly exceptional client scenario, you might still schedule a client meeting for a Monday or Friday afternoon, supplanting a time for your other (internal) financial planning work if necessary – while bearing in mind that many situations that clients ask for ‘urgent’ meetings aren’t really urgent enough to require disrupting your productive ability to serve all your clients!

Notably, a key point of the structured meeting schedule is that it not only facilitates your own personal productivity, but can greatly enhance the productivity of your staff/support team as well. A quick daily check-in (“the daily huddle”) every morning helps to ensure everyone is on the same page, reducing the number of mistakes that get made across the team. The regular rhythm of the client meeting schedule, and the work time built around it, provides a structure that everyone on the team can build around as well. Which means regaining control of your schedule to enhance your productivity is actually a boost to the productivity of the entire team and business!

As last year’s FPA study on financial advisor time management and productivity showed, the advisors who rarely deviate from their set schedule feel most in control of their business (and their time), while those who regularly deviate from the schedule end out suffering for the lack of control!

Setting A Meeting Rhythm For Working On Your Business

Another benefit of regaining control of your schedule is that it gives you the opportunity to identify times/days you will aim to work on your business, rather than just working in the business. These are the times to take a pause, think about the business and what’s next, and strategize with partners and staff, are far easier to put on the calendar when you have control of the schedule in the first place.

For most of us as financial advisors, finding the time to plan and strategize for the business is difficult, because the “habit” is that scheduling is always reactive to client meetings – which means, with enough clients, that the time for strategy rarely actually makes it onto the calendar. If you never know what days are “safe” to schedule for business meetings, you never know how to schedule around client meeting requests.

In fact, Verne Harnish makes the case in the popular business management book “Scaling Up” that in the best businesses the leadership has a “Meeting Rhythm” for ensure regular meetings are conducted to work on the business. Business legends from John D. Rockefeller to Steve Jobs to T. Boone Pickens were known to meet daily to break bread with their key directors and business leaders, to ensure they had a pulse on the business and were able to react and adapt quickly to the needs and challenges that arose. Daily communications formulated into weekly strategies, which fed up into monthly goals, and the process repeated itself.

In fact, Verne Harnish makes the case in the popular business management book “Scaling Up” that in the best businesses the leadership has a “Meeting Rhythm” for ensure regular meetings are conducted to work on the business. Business legends from John D. Rockefeller to Steve Jobs to T. Boone Pickens were known to meet daily to break bread with their key directors and business leaders, to ensure they had a pulse on the business and were able to react and adapt quickly to the needs and challenges that arose. Daily communications formulated into weekly strategies, which fed up into monthly goals, and the process repeated itself.

Notably, Harnish suggests that the pace and “pulse” of the meeting rhythm depends on the growth pace of the business. For rapid-growth firms, the pulse accelerates – those growing 50% - 100% annually might need to treat each quarter like a full year for strategic planning purposes. In the context of advisory firms that tend to have slower growth, where 5%-15%/year of organic growth is more common (even for a “fast”-growing firm), the meeting pace may stretch out a bit as well. But Harnish still makes the case that such businesses should at the least have monthly meetings with key staff members to discuss tactics for the business, quarterly strategic themes to focus on, and an annual strategic planning process to set the agenda for the coming year.

And to ensure those planning meetings happen, schedule them far in advance, on the structured calendar, on days that would have otherwise contained client meetings – just to ensure that you are committed not to take client meetings on those days, and have time to spend working on the business. For instance, you might commit to spending 1 hour of staff meeting time every Friday thinking about how to improve the business, one half-day every month with your key staff members, and one full day every quarter to consider strategic planning issues.

Of course, some of you reading this article may be wondering how you could possibly find the time to schedule such strategic planning meetings to work on the business, given all the work to be done for clients in the first place. But again, that’s the point. Taking proactive control of your calendar allows you and your team to be more productive in getting everything done, by reducing the negative drag of multitasking, which frees up time to work on the business! And if there isn’t enough time to take away a day of client meetings to do a day of strategic planning meetings every quarter, even after taking control of your schedule, that’s the hint you may just be flat out overscheduled in the first place, and that it’s time to hire more staff support and better focus your time on what you do best!

So what do you think? Do you have a regular weekly rhythm of meetings with clients and your team? Are you now considering whether to create a more structured meeting process in the future? Have you already made the transition? Please share your own experience in the comments below!

I just started this two weeks ago and already feel better about control over my time.

Michael

What you’re describing really works. So many other industries use an Activity Schedulers in their daily work and office and learn the importance of sticking to it. (I do, too).

There are many parts of the day that often are get left out of schedulers — but I think really need to be show: breakfast, lunch, dinner down time, talk a walk time, networking, conducting seminars time, team time, reenergize time.

And one that is often forgotten — how an FA would handle clients in different time zones, based on where an firm/FA is registered. (example: I work REAL early Monday/Tues to accommodate clients on one coast and close up real early on those days, too.)

How much time do you want to leave between client meetings is important to consider, too. Especially us introverts need more time between client meetings to energize again.

It’s amazing what happens (customer service wise) in an office (with a physical address or with a online receptionist service) when a client calls and the advisor’s assistant says “___ is busy at the moment, but ___ can call you back between ___ and ___ or ___ and ___ today. Which is best for you.

The same can be said when a team knows what time slots are still open during the week for “today” meetings (keep 2 spaces open each week and if they don’t get full — I’m sure that an advisor can figure other things to do with that “extra” time).

I’ve been getting clients to use my MS Excel Scheduler nearly 11 years now. A schedule shows an advisor who really can go into a day (and often their need to hire help because they can’t fit everything into 1 normal day!)

What I’ve seen works really well is the “chunking up of time” — setting aside at least 3 hours, 4 hours is best — at a time — to do one particular task. A Scheduler should include 16 hours + 8 sleep hours to create their ideal workday, weeknight, and weekend, too.

Other ways of scheduling is to:

a) Schedule full days of client time with only emergency email/phone time or onboarding/review chores done on those days .

b) Schedule all paperwork to be completed or updating of data be done on “x” day (then everyone in the office does it the same day and knows when the data is being updated, which helps with customer service, too)

c) Schedule a catch up day (Integrity Days) once a month to just work on whatever needs working on but not talking with clients.

d) Schedule to not talk to any clients who can come to the office the forth week of a month (unless absolutely necessary of course). Instead get caught up that week and meet with clients unable to get to your office, networking or strategic partners at that time.

e) Schedule networking time and time with your strategic partners.

f) Have your assistant look at your mail every morning and afternoon and put important things in a folder called “right away” — that’s the folder you (or your service advisor, associate) look in every am and pm.

g) Schedule one week a month to not work with clients at all. Instead make this a planning day and update things like your SWOT, value prop, strategic business plan, marketing calendar, etc.

h) Schedule daily reading time in the am for the reading the newspapers (local and online) as well as your favorite blogs and newsletters :).

Having a schedule for an office also allows a firm to use an online scheduler where clients can actually schedule themselves! Some will want to use it.. others will stay away, but it’s another tech tool for advisors , their clients and there teams to use, too.

Another thing that I’ve found helpful is helpful is to move advisors to a place where they NEVER answer on email or the phone first thing in the AM unless someone has told them that it’s an emergency.

IMO starting a day with email/phone calls starts the day off wrong and it’s so easy to get bogged down in that stuff — for sure. (When I traded, we’d start the day talking as a team about the days event(s) and work, have coffee, read the newspapers — and that system really set the day off on the right foot — or I should say left and right feet.).

Personally I have found, against my own best beliefs, that the world does not end if don’t look at my email until at 11am!

What to do first thing? That’s office time. Meet daily with your team virtually or in person — even if everyone says nothing much gong on and you end the meeting quickly. Use it to have a 5 minute meetings (phone or in person) with your assistant about the day’ s work. And if/when meeting in person, add some healthy food to the mix or you’ll have a sleepy team the rest of the day 🙂

Michael,

One of the things that we added a bit over a year ago was a regularly scheduled time and day every week for training for everyone in the office. It is a huge incremental productivity booster. It also allows for a lot of cross training for when someone is out of the office.

Another link you and your readers might like is http://calnewport.com/blog/2015/11/03/spend-more-time-managing-your-time/

One issue we face in India is that most of our clients are also working. Which means a lot of them prefer to meet on weekends! How do clients in the USA (or other markets) find time on a workday to come into an advisor’s office??

In the US, we treat going to see our financial planner like going to the doctors office and take a 2 hour break from work. Most clients are in positions, either self-employed or in their careers, where they can afford to do this.