Executive Summary

As we enter the holiday season and 2018 winds to a close, I am once again so thankful to all of you, the ever-growing number of readers who continue to regularly visit this Nerd’s Eye View blog (and share the content with your friends and colleagues, which we greatly appreciate!). Over the past year, our readership has grown yet another 16%, with more than 220,000 unique readers visiting Kitces.com in the past month. But the journey for us is never done… as this year, we’ve added a number of new team members both writing for the blog and supporting us behind the scenes, as we gear up for an even bigger and better 2019 with back-end enhancements to the platform, new industry research studies, and new types of content that we hope you will continue to find valuable.

Yet we realize that the sheer volume of content that’s released from the Nerd’s Eye View can be overwhelming at times, and that, even though so many of you have made this blog a weekly habit, it’s not always possible to keep up with it all. Which means an article, once missed, is often never seen again, “overwritten” by the next day’s, week’s, and month’s worth of content that comes along.

Accordingly, just as I did last year and in 2016, 2015, and 2014, I've compiled for you this Highlights list of our top 20 articles of 2018 that you might have missed, including some of our most popular episodes of the Financial Advisor Success podcast. So whether you're new to the blog and #FASuccess podcast and haven't searched through the Archives yet, or simply haven't had the time to keep up with everything, I hope that some of these will (still) be useful for you! And as always, I hope you'll take a moment to share podcast episodes and articles of interest with your friends and colleagues as well!

In the meantime, I hope you're having a safe and happy holiday season. Thanks again for another successful year in 2018, and I hope you enjoy all the new features and content we'll be rolling out in 2019, too!

Don't miss our Annual Guides as well - including our list of the "16 Best Conferences for Financial Advisors in 2019," our "2018 Reading List Of Best Books For Financial Advisors," and also our recent new advisor tech guides, “Student Loan Planning Software Solutions: Comparing The 8 Leading Tools For Financial Advisors” and “Comparing The Best Digital Advice ‘Robo-Advisor’ Platforms For RIAs,” as well as our ever-popular "Advisor's Guide To The Best Financial Planning Software (For You)"!

2018 Best-Of Highlights Categories: Retirement Planning | Advisor Regulation | Industry Trends | Practice Management | Career Development | Tax Planning | Insurance Planning | Investments | Behavioral Finance | Financial Advisor Success Podcasts

Retirement Planning

Getting Real About (Annual) Health Care Costs In Retirement – Every year, Fidelity issues a report estimating the total health care costs that a retired couple will face in retirement, which most recently was pegged at $280,000 for the combination of Medicare Part B and Part D premiums and additional out-of-pocket costs… a daunting sum for most prospective retirees. Yet the reality is that while $280,000 may be the present value of annual health care costs in retirement for a married couple, in practice those costs amount to little more than about $10,000/year (albeit over 20-30 years for a married couple), or $5,000/person, or about $400/month/person… which, while not trivial, is both remarkably manageable and remarkably stable for most retirees (as by the time Medicare Part B and Part D are purchased, along with a Medigap supplemental policy, there is actually almost no further uncertainty in retiree health care costs outside of long-term care needs). Which means that health care costs in retirement may still cumulatively add up over a period of decades, they are actually a very “plannable” expense. And a recent joint study between Vanguard and Mercer Health and Benefits found that the ongoing monthly cost of health care in retirement can be further refined by considering his/her current health, as the average cost is actually only $3,400/year for those who are low-risk with few chronic health conditions, but $7,600/year for those who are higher risk with many pre-existing chronic conditions. In turn, the relative stability of retiree health care costs, when combined with the decrease in discretionary spending as retirees age, also helps to explain why overall retiree spending tends to decrease significantly in the later years of retirement (even as retirees fear explosively rising health care costs… that don’t actually rise very much). The key point, though, is simply to understand what real retiree health care spending looks like in retirement, and that thanks to the existence of Medicare Part B and Part D and Medigap supplemental policies, is actually a very stable expense for most retirees that is quite straightforward to plan for as part of a retiree’s budget. (Though for higher-income individuals, be certain to adjust for the non-trivial addition of income-related Medicare adjustment amounts, or the so-called “Medicare surtax,” for which even higher surcharges will be taking effect in 2019!)

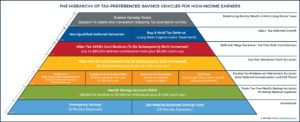

The Hierarchy Of Tax-Preferenced Savings Vehicles For High-Income Earners – To encourage various types of savings behaviors, Congress over the years has created a number of different types of tax-preferenced accounts, for everything from traditional and Roth IRAs (and 401(k) plans) for retirement savings, to 529 plans for college savings, and HSAs for medical savings. Yet not all types of tax-preferenced accounts are equally tax preferenced, with HSAs enjoying “triple” tax preferences (tax-deductible contributions, tax-deferred growth, and tax-free distributions), others only enjoying two-out-of-three, and some (like non-qualified deferred annuities) only enjoying one tax preference. In turn, the various types of tax-preferenced accounts also have their own limitations on how much can be contributed, and when. The end result, then, is a form of “hierarchy” of tax-preferenced savings to determine which account(s) are best to contribute to first, which follow next, etc., starting with Health Savings Accounts (especially appealing because HSAs can also be used as a supplemental retirement savings account for retiree health care expenses to boot), and then followed by various double-tax-preferenced accounts (traditional or Roth IRAs, deferred compensation, 529 plans), and then the various “backdoor” Roth contribution strategies (or even the “mega-backdoor Roth” through a 401(k) plan), followed by more “basic” tax-deferred growth strategies like using low-cost investment-only non-qualified annuities (or simply buying and holding taxable investments for long-term capital gains rates). Although from a long-term wealth-building perspective, sometimes the best way to save is simply to first establish an effective emergency fund (to avoid needing to unfavorably liquidate all the other tax-preferenced accounts with potential penalties), and a personal job mobility/business startup fund to allow room to invest in your own human capital (which for younger workers with a long career time horizon, is still more valuable than even the most tax-preferenced retirement savings accounts anyway!).

– To encourage various types of savings behaviors, Congress over the years has created a number of different types of tax-preferenced accounts, for everything from traditional and Roth IRAs (and 401(k) plans) for retirement savings, to 529 plans for college savings, and HSAs for medical savings. Yet not all types of tax-preferenced accounts are equally tax preferenced, with HSAs enjoying “triple” tax preferences (tax-deductible contributions, tax-deferred growth, and tax-free distributions), others only enjoying two-out-of-three, and some (like non-qualified deferred annuities) only enjoying one tax preference. In turn, the various types of tax-preferenced accounts also have their own limitations on how much can be contributed, and when. The end result, then, is a form of “hierarchy” of tax-preferenced savings to determine which account(s) are best to contribute to first, which follow next, etc., starting with Health Savings Accounts (especially appealing because HSAs can also be used as a supplemental retirement savings account for retiree health care expenses to boot), and then followed by various double-tax-preferenced accounts (traditional or Roth IRAs, deferred compensation, 529 plans), and then the various “backdoor” Roth contribution strategies (or even the “mega-backdoor Roth” through a 401(k) plan), followed by more “basic” tax-deferred growth strategies like using low-cost investment-only non-qualified annuities (or simply buying and holding taxable investments for long-term capital gains rates). Although from a long-term wealth-building perspective, sometimes the best way to save is simply to first establish an effective emergency fund (to avoid needing to unfavorably liquidate all the other tax-preferenced accounts with potential penalties), and a personal job mobility/business startup fund to allow room to invest in your own human capital (which for younger workers with a long career time horizon, is still more valuable than even the most tax-preferenced retirement savings accounts anyway!).

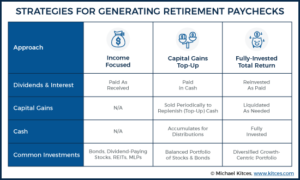

How Do You Actually Create A Steady Retirement Paycheck From A Volatile Retirement Portfolio? – For the better part of 40 years, most prospective retirees have received ongoing income deposited to their checking accounts once or twice every month in the form of a paycheck. Which means that as retirement approaches, one of the most crucial questions that prospective retirees face is: how will I continue to create income that goes to my checking account every month to pay my ongoing bills in retirement? Historically, the process of generating retirement income was simply buying bonds and spending the bond interest, which evolved after the inflationary 1970s to include also buying some stocks and spending the (more-inflation-adjusting) stock dividends. But with increasingly diversified portfolios comes the additional of long-term capital gains as well, and a growing number of investment vehicles is providing new retirement income “alternatives” from non-traded REITs to Master Limited Partnerships (MLPs) as well, not to mention the introduction of Required Minimum Distributions from pre-tax retirement accounts after age 70 ½… all of which makes it remarkably complex to figure out how to simply generate ongoing cash flows that show up in the checking account every month. In practice, advisors typically follow one of three strategies to generate retirement cash flows for retirees while taking into account all of these factors: 1) the “income-focused” approach of buying a wide range of income-producing assets (e.g., bonds, dividend-paying stocks, REITs, MLPs) and simply spending the income as it’s received; 2) the “capital gains top-up” approach of buying a more diversified portfolio, accumulating the interest and dividends, and periodically selling appreciated investments to “top up” the available cash with capital gains; and 3) the “fully-invested total return” approach where cash is always fully invested, and assets are simply liquidated as needed (particularly appealing as transaction costs move inexorably towards $0). Ultimately, there are risks and benefits to all the strategies, but having some clear strategy – which can even then be commemorated in a “Withdrawal Policy Statement” – makes it feasible to both systematize the process across an advisory firm and also to get retiree buy-in to the income generation process.

– For the better part of 40 years, most prospective retirees have received ongoing income deposited to their checking accounts once or twice every month in the form of a paycheck. Which means that as retirement approaches, one of the most crucial questions that prospective retirees face is: how will I continue to create income that goes to my checking account every month to pay my ongoing bills in retirement? Historically, the process of generating retirement income was simply buying bonds and spending the bond interest, which evolved after the inflationary 1970s to include also buying some stocks and spending the (more-inflation-adjusting) stock dividends. But with increasingly diversified portfolios comes the additional of long-term capital gains as well, and a growing number of investment vehicles is providing new retirement income “alternatives” from non-traded REITs to Master Limited Partnerships (MLPs) as well, not to mention the introduction of Required Minimum Distributions from pre-tax retirement accounts after age 70 ½… all of which makes it remarkably complex to figure out how to simply generate ongoing cash flows that show up in the checking account every month. In practice, advisors typically follow one of three strategies to generate retirement cash flows for retirees while taking into account all of these factors: 1) the “income-focused” approach of buying a wide range of income-producing assets (e.g., bonds, dividend-paying stocks, REITs, MLPs) and simply spending the income as it’s received; 2) the “capital gains top-up” approach of buying a more diversified portfolio, accumulating the interest and dividends, and periodically selling appreciated investments to “top up” the available cash with capital gains; and 3) the “fully-invested total return” approach where cash is always fully invested, and assets are simply liquidated as needed (particularly appealing as transaction costs move inexorably towards $0). Ultimately, there are risks and benefits to all the strategies, but having some clear strategy – which can even then be commemorated in a “Withdrawal Policy Statement” – makes it feasible to both systematize the process across an advisory firm and also to get retiree buy-in to the income generation process.

Advisor Regulation

How The Product Distribution Industry Beat DoL Fiduciary By Proving Their “Advisors” Aren’t Real Advisors – The biggest regulatory news of 2018 was the decision of the Fifth Circuit Court of Appeals to vacate the Department of Labor’s fiduciary rule, ending a more-than-7-year rulemaking fight about whether the brokerage industry should be held to a higher (fiduciary) standard with respect to the advice they provide retirees. The brokerage industry contended throughout that the rule would create undue costs and burdens on their product distribution model, eliminating their ability to service “small” investors, thereby reducing access to financial advice for consumers. Yet surprisingly, in its actual court briefings and statement, the primary case that broker-dealers and product manufacturers successfully made was simply that their brokers and insurance agents shouldn’t be regulated as fiduciary advisors because they’re not actually advisors in the first place; instead, they’re simply salespeople in the business of selling investment and annuity products to consumers in a non-advisor capacity, explicitly emphasizing that “brokers—also known as “registered representatives”—offer investment products to their customers… [while] Investment Advisers, by contrast, primarily offer investment advice to clients,” and that while, “Brokers may provide some financial advice when assisting investors with a sale…this by itself does not convert them into an adviser.” The industry’s main lobbying organizations, SIFMA (representing wirehouses) and FSI (representing independent broker-dealers) then went on to state that “a person acting as a broker ordinary is not a fiduciary,” and “an agent who receives a commission on the sale of a product is not paid for rendering advice… she is paid for effective the sale,” and are “relationships that [lack] that special degree of ‘trust and confidence’… long-recognized as non-fiduciary.” Similarly, the Indexed Annuity Leadership Council also maintained that the Department of Labor “failed to identify substantive evidence that sales of these [annuity] products actually takes place in such [trusted advice] relationships.” To which the court ultimately agreed, affirming that “stockbrokers and insurance agents are compensated only for completed sales… Investment Advisers, on the other hand, are paid fees because they render advice” and criticized the Department of Labor for applying a fiduciary rule to the brokerage industry because “it is ordinarily inconceivable that financial salespeople or insurance agents will have an intimate relationship of trust and confidence with prospective purchasers [i.e., clients].” Or stated more simply, the brokerage industry and product manufacturing firms successfully defeated the Department of Labor’s fiduciary rule not on the basis that the fiduciary duty would be unduly burdensome, but simply by maintaining that their brokers and agents aren’t actually advisors in the first place. All those companies’ consumer marketing and advertising campaigns notwithstanding.

Industry Trends

How “Robo” Technology Tools Are Causing Fee Deflation But Not Fee Compression – Despite years of forecasts that “robo-advisors” would cause fee compression for human advisory firms, the revenue yield of advisory firms (total revenue divided by total assets under management) has remained stubbornly fixed at right around 77 basis points… until the most recent Investment News Pricing and Profitability Study, which found that the average revenue yield of advisory firms has “suddenly” fallen nearly 10% to 69bps instead. Which is concerning, as advisory firms typically have substantial fixed cost overhead (particularly on staff), which means a revenue yield decrease of nearly 10% could quickly collapse the profitability of running an advisory firm at all. Yet a deeper dive reveals that while advisory firm fees may be starting to shift lower, advisory firm profit margins are not; in fact, advisory firm profit margins have actually increased over the past 6 years since robo-advisors first emerged, even as revenue yield is declining. Which implies that, to the extent advisory firms are starting to decrease their fees, it may have less to do with “fee compression” and more to do with “fee deflation” instead… in other words, that competition from robo-advisors isn’t forcing advisors to cut their fees, but that the implementation of better “robo” technology tools and rising productivity in advisory firms (with revenue/staff up nearly 18% in the past 4 years alone) is making it possible for firms to voluntarily cut their fees while maintaining their profit margins instead. Though notably, while staff productivity metrics are on the rise (implying that robo-advisor technology really is beginning to replace back-office staff), advisor productivity metrics (as measured by revenue/advisor and clients/advisor) is actually declining, as the ongoing automation of key advisor functions is also compelling advisors to do more on top of the technology to justify their own value proposition to clients. Or stated more simply, the benchmarking reveals that advisory firms are starting to charge less for their services despite actually doing more for their clients with deeper advisor relationships, while maintaining their profit margins on top, by increasingly adopting technology to replace back-office overhead jobs and enhance the firm’s overall productivity.

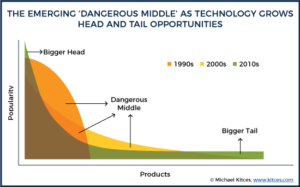

The Long Tail, The Big Head, And The Dangerous Middle Of Financial Advisory Firms – For nearly 20 years, industry pundits have been predicting a wave of industry consolidation that would eventually squeeze out solo and small independent advisors and compel them to join (or be acquired by) larger firms that use their economies of scale to deliver superior financial planning to clients at a lower cost. Yet despite the ongoing drumbeat of negative forecasts, industry benchmarking studies continue to show record profits for the most successful solo advisory firms, that are still generating as much net take-home income as the per-partner take-home pay of billion-dollar-AUM firms! Not to say that large advisory firms aren’t also thriving, with almost 700 RIAs now holding at least $1B of AUM (out of nearly 18,000 SEC-registered investment advisers), and 3.8% of RIAs now have a whopping 60% of all RIA assets, scaling up their marketing to capture more market share and attracting the most affluent clients who seem to gravitate to the largest firms. In fact, the only firms that appear to be struggling are the ones in the middle, that are too large to be hyper-efficient solo advisory firms, but still far too small to enjoy the economies of scale of large firms… a phenomenon that is playing out in multiple industries simultaneously as the internet both enables the largest companies to “go viral” and get bigger while smaller more niche companies can thrive in a world where Google makes even the most specialized solutions findable. In other words, there’s room to both “Go Big” or to “Go Niche,” and it’s possible to be successful as a behemoth or a boutique… but beware the Dangerous Middle, where the growing complexity of the business combined with still-limited resources creates some of the unhappiest advisory firm owners.

– For nearly 20 years, industry pundits have been predicting a wave of industry consolidation that would eventually squeeze out solo and small independent advisors and compel them to join (or be acquired by) larger firms that use their economies of scale to deliver superior financial planning to clients at a lower cost. Yet despite the ongoing drumbeat of negative forecasts, industry benchmarking studies continue to show record profits for the most successful solo advisory firms, that are still generating as much net take-home income as the per-partner take-home pay of billion-dollar-AUM firms! Not to say that large advisory firms aren’t also thriving, with almost 700 RIAs now holding at least $1B of AUM (out of nearly 18,000 SEC-registered investment advisers), and 3.8% of RIAs now have a whopping 60% of all RIA assets, scaling up their marketing to capture more market share and attracting the most affluent clients who seem to gravitate to the largest firms. In fact, the only firms that appear to be struggling are the ones in the middle, that are too large to be hyper-efficient solo advisory firms, but still far too small to enjoy the economies of scale of large firms… a phenomenon that is playing out in multiple industries simultaneously as the internet both enables the largest companies to “go viral” and get bigger while smaller more niche companies can thrive in a world where Google makes even the most specialized solutions findable. In other words, there’s room to both “Go Big” or to “Go Niche,” and it’s possible to be successful as a behemoth or a boutique… but beware the Dangerous Middle, where the growing complexity of the business combined with still-limited resources creates some of the unhappiest advisory firm owners.

Broker-Dealers Can’t Compete Until They Treat Advice As A Value-Add Not A Liability – A renaissance is underway in the broker-dealer community as the industry shifts increasingly towards advice, with the latest Financial Planning magazine survey of the top 50 independent broker-dealers showing that, in the aggregate, they’re now generating more revenue from advisory fees than from commissions. Yet the regulatory structure of a broker-dealer is still to serve as an intermediary for the distribution of investment products, for which they take a scrape of the commissions paid in the process of overseeing the brokers who sell products via their platform. In fact, technically broker-dealers cannot give anything more than “solely incidental” advice without registering as an investment adviser in the first place, and as a result, have developed compliance mechanisms over the years designed to limit the scope of the advice their advisors give. Which now is creating substantial cultural impediments in the broker-dealer transition from products to advice, where the very process of “advice” itself is still treated not as a core value proposition of the broker-dealer, but a “liability” exposure to be managed. Especially since the hiring standards for many broker-dealers are still quite low, and as a result, compliance oversight rules must be written for the “lowest common denominator,” limiting whatever bad advice the worst ill-trained broker in the organization might give… even as broker-dealers also try to more centralize their advice, and/or use technology to “standardize” what clients receive as a means of reducing the risk that an advisor gives their own (hopefully good but potentially wrong) advice. Yet in the process of the push towards commoditized standardized advice, centralization that limits the value proposition of advisors, and (unduly burdensome) compliance rules to limit advice liability… broker-dealers may struggle more than they anticipate in the transition to the advice model, as the mentality of treating advice as a liability instead of a value-add will tend to drive away good advisors while retaining the product-based brokers that the firms didn’t actually want to keep in the future! Whereas if broker-dealers actually want to attract and retain good advisors who give advice, to key to success in the future is allow (and even help) them to deepen their training and education (e.g., CFP certification as a minimum and then post-CFP designations on top) and form specializations that further enhance their expertise… which, in the process, also reduces liability exposure by simply reducing the risk that they give the “wrong” advice in the first place!

Why RIA Custodians Should Start Charging A Basis Point Custody Fee – Most RIA custodians make their money in three ways – by earning money on cash (either via the expense ratio of a proprietary money market or by sweeping the cash to a related bank subsidiary), through servicing fees for mutual funds and ETFs (e.g., 12b-1 and sub-TA fees or outright platform fees), and ticket charges on trades – and the good news is that, at scale, those revenue streams are so effective that most financial advisors are able to access RIA custodial platforms entirely for “free.” Except in truth, they’re not free… they’re borne by the advisor’s client, who in turn receives below-average yields on their cash, higher expense ratios on their mutual funds and ETFs, and must pay ongoing ticket charges for trades. Which many advisors then try to reduce, by deliberating minimizing trades and turnover, choosing the lower-cost funds available (including, in particular, Vanguard and DFA, which do not pay the same back-end platform fees as other asset managers), and minimizing client cash positions (or transferring them away to third-party platforms offering higher yields). Which means, in essence, that RIAs are seeking to systematically dismantle the revenue lines of their RIA custodians to reduce costs for their clients, even as they rely on those RIA custodians for “free” custodial services! In recent years, though, the conflict is becoming increasingly problematic, from RIA custodians charging higher ticket charges for Vanguard and DFA funds, to the recent blow-up where TD Ameritrade removed Vanguard funds entirely from its NTF ETF platform to be replaced by new State Street “Core” ETFs that would pay a better revenue-share to the company. Which raises the question of whether, eventually, RIAs will be so successful in reducing the revenues of their RIA custodians to better their clients that eventually custodians themselves will have to shift to charging an RIA custody fee instead… and in the process, actually create platforms with superior products that have lower costs and higher yields, precisely because the platforms would no longer need to mark up fund costs and mark down investor yields if they’re getting paid on a fee-only basis by their RIAs in the first place?

What Do You Say When You Witness Sexual Harassment At A Financial Advisor Conference? – For nearly 15 years, the number of female CFP professionals has remained stubbornly pegged at 23% despite ongoing efforts of the industry to attract more women. Because unfortunately, even as the profession seeks to build awareness and draw more women into financial planning, the positive impact may be limited due to the amount of sexual harassment and demeaning and belittling comments still directed at women by “fellow” advisors at the typical advisory industry conference. In some cases, the problem is overt, with unwanted sexual advances or even inappropriate touching of women at conferences. In other cases, the problem is more subtle, such as calling a group of female advisors talking to a male advisor a “harem” and implying their concubines rather than recognized and bona fide professionals. And most commonly, conference sexual harassment takes the form of simply assuming that a woman at a conference couldn’t possibly be a financial advisor, with questions like “whose assistant are you” used as a greeting or introduction at a conference social activity (even if that attendee’s name badge has “CFP” and their own name in the firm’s name, suggesting the woman is the founder/owner advisor and not an assistant!). Yet for many, both women and men, the unwanted behavior and inappropriate sayings are often so common that it’s difficult to know what to say in order to address it… leaving even those who want to support “dumbfounded” and at a loss for words. But ultimately, if the industry is going to change, and truly be more welcoming and supportive of women… it’s time for everyone to speak up about and call out inappropriate sexual behavior (or sexually demeaning statements) at conferences.

Practice Management

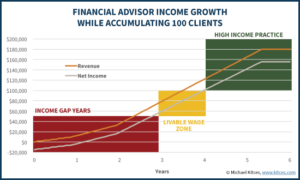

Financial Advisor Success Requires Just 50 Great Clients – As more and more financial advisors try to focus into niches and specializations, or at least to more clearly define their ideal target clientele, there’s a great deal of fear about whether the “right” target clientele is being chosen. After all, if a business chooses a target market that is too narrow, there just isn’t enough of a business opportunity to be successful in the first place. Yet the reality is that most financial advisors will struggle to ever handle more than about 100 “real” client relationships, and the most successful solo advisory firms are often able to take home as much as 80 cents on the dollar… which means it takes as little as $1,800/client (which is just $150/month in planning fees, or an average account size of just about $150,000 at a typical 1.25% AUM fee for “small” accounts), to gross $180,000/year of revenue and net nearly $150,000 in take-home income. In turn, as the average revenue per client rises – for advisors who are able to more deeply specialize and serve an even slightly-more-affluent clientele – it becomes feasible to make $200,000+ of net income by simply serving 50 great clients who pay $5,000+ per year (which is still “just” a 1% AUM fee working with mass affluent clients who average $500,000 in retirement assets). Of course, the caveat is that it still takes a long time to get to 50 great clients – often 5+ years adding 1-2 clients per month with a little bit of client turnover – which means it’s crucial to have a plan on how to deal with the “income gap” that occurs during the early lean years. Nonetheless, the key point is that when it takes no more than 50 great “A-level” clients for most financial advisor to be wildly successful, almost any conceivable niche, specialization, or target market is viable, as it only takes 50 people anywhere on the planet who have that problem the advisor can solve. At least, as long as the advisor does target 50 great clients who have the financial wherewithal to afford the advisor’s services in the first place!

– As more and more financial advisors try to focus into niches and specializations, or at least to more clearly define their ideal target clientele, there’s a great deal of fear about whether the “right” target clientele is being chosen. After all, if a business chooses a target market that is too narrow, there just isn’t enough of a business opportunity to be successful in the first place. Yet the reality is that most financial advisors will struggle to ever handle more than about 100 “real” client relationships, and the most successful solo advisory firms are often able to take home as much as 80 cents on the dollar… which means it takes as little as $1,800/client (which is just $150/month in planning fees, or an average account size of just about $150,000 at a typical 1.25% AUM fee for “small” accounts), to gross $180,000/year of revenue and net nearly $150,000 in take-home income. In turn, as the average revenue per client rises – for advisors who are able to more deeply specialize and serve an even slightly-more-affluent clientele – it becomes feasible to make $200,000+ of net income by simply serving 50 great clients who pay $5,000+ per year (which is still “just” a 1% AUM fee working with mass affluent clients who average $500,000 in retirement assets). Of course, the caveat is that it still takes a long time to get to 50 great clients – often 5+ years adding 1-2 clients per month with a little bit of client turnover – which means it’s crucial to have a plan on how to deal with the “income gap” that occurs during the early lean years. Nonetheless, the key point is that when it takes no more than 50 great “A-level” clients for most financial advisor to be wildly successful, almost any conceivable niche, specialization, or target market is viable, as it only takes 50 people anywhere on the planet who have that problem the advisor can solve. At least, as long as the advisor does target 50 great clients who have the financial wherewithal to afford the advisor’s services in the first place!

Billing On Outside Held-Away Assets Under Advisement – As advisory firms shift more and more towards holistic financial planning, it becomes increasingly limiting to provide a full range of holistic services on all of the household’s assets for “just” the fee applicable to the managed account(s) the advisor handles directly. Accordingly, while some advisory firms are shifting wholesale away from AUM fees and into retainer fees to serve a wider range of clientele, many are simply starting to assess a (usually lower) advisory fee on those held-away assets where the advisor may not be directly managing the money, but investment advice is still being provided. However, there are a number of caveats to consider in charging an Assets Under Advisement (AUA) fee. First and foremost, advisors need to be certain that they’re adding enough value in outside-account advice to be worth the fee, and even then often charge a lower fee than managing the assets directly… which in turn may create an incentive for clients to not roll over (and increase their fees for “similar” investment advice on the account) when it is available to manage! In turn, some advisory firms will try to manage a client’s held-away assets more directly, even taking log-in credentials to effect trades on their behalf, but that can trigger SEC custody issues and add a requirement for an annual custody audit! And there’s still a matter of figuring out how to bill an AUA fee, given that advisors generally cannot debit the fee directly from outside accounts, which means either billing the accounts that are managed (which can actually reduce the advisor’s reported returns on accounts they do manage for the fees of accounts they don’t!), or integrate technology to bill clients directly for their separate AUA fees!

Career Development

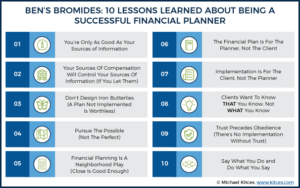

10 Wise Lessons Learned About Being A (Better) Financial Planner – While new financial planners are increasingly building their careers by starting out early on CFP certification, the reality is that learning to be a “good” financial planner takes a lifetime of building on a successive series of skill domains. Which on the one hand means that the learning process is long (and arguably never ends)… but on the other hand, also means there is much to be learned by seeking wisdom from experienced advisors who have already tread the path. In this post, Ben Coombs, who practiced as a financial advisor for nearly 40 years and was part of the very first graduating class of CFP certificants in 1973, shares his own perspective on what it takes to be a better financial planner, including the key points: you’re only as good as your sources of information (and that your sources of compensation will often control your sources of information, which is concerning as they may have their own conflicts of interest!); be certain not to make financial plans that are “Iron Butterflies” (which look pretty but won’t fly) and instead stay focused on just the three core issues of where the client wants to go, where he/she is today, and most importantly what the client is willing to do to get from here to there; financial planning is a neighborhood play (i.e., the goal of the analysis should be to get recommendations in the right neighborhood, because there’s little value about trying to be overly precise about a distant unknown future anyway); the financial plan is really for the planner (it’s the framework for us to evaluate a client’s situation), but implementation is what really matters to the client (and therefore should be client-driven); clients want to know that you know but not necessarily what you know (so be certain to know when you’ve made the point and don’t need to keep hammering the details); and trust precedes obedience (which means if your clients aren’t implementing the plan, it may be because they don’t really trust your recommendations in the first place, so be certain to say what you do and do what you say to build that trust over time).

– While new financial planners are increasingly building their careers by starting out early on CFP certification, the reality is that learning to be a “good” financial planner takes a lifetime of building on a successive series of skill domains. Which on the one hand means that the learning process is long (and arguably never ends)… but on the other hand, also means there is much to be learned by seeking wisdom from experienced advisors who have already tread the path. In this post, Ben Coombs, who practiced as a financial advisor for nearly 40 years and was part of the very first graduating class of CFP certificants in 1973, shares his own perspective on what it takes to be a better financial planner, including the key points: you’re only as good as your sources of information (and that your sources of compensation will often control your sources of information, which is concerning as they may have their own conflicts of interest!); be certain not to make financial plans that are “Iron Butterflies” (which look pretty but won’t fly) and instead stay focused on just the three core issues of where the client wants to go, where he/she is today, and most importantly what the client is willing to do to get from here to there; financial planning is a neighborhood play (i.e., the goal of the analysis should be to get recommendations in the right neighborhood, because there’s little value about trying to be overly precise about a distant unknown future anyway); the financial plan is really for the planner (it’s the framework for us to evaluate a client’s situation), but implementation is what really matters to the client (and therefore should be client-driven); clients want to know that you know but not necessarily what you know (so be certain to know when you’ve made the point and don’t need to keep hammering the details); and trust precedes obedience (which means if your clients aren’t implementing the plan, it may be because they don’t really trust your recommendations in the first place, so be certain to say what you do and do what you say to build that trust over time).

The Handbook For Next Generation Partners Of Independent Advisory Firms – One of the most interesting phenomena of the industry’s ongoing shift from commissions to fees is not just that potential conflicts of interest and standards of care may change in going from the broker-dealer to RIA channels, but simply that the AUM model – as a recurring revenue model – is capable of building far larger advisory firms than the commission-based model ever could. Because under the commission-based model, every January 1st the advisor/owner wakes up with income at $0 and must go out and find new clients to generate new revenue (adjusted perhaps for a small amount of trails for ongoing servicing of prior transactions)… and it’s difficult to hire a deep team that would cause the business to start in a hole every year! By contrast, the recurring revenue of AUM fees makes it possible over time to hire and develop a financial planning team that services a healthy (and economically viable) amount of ongoing client revenue, creating a newfound size and scale in the RIA model over the past 20 years that simply didn’t exist for financial advisors in the decades prior. Which in turn raises the new question for young advisors: not “what’s the best way to get clients to build your advisory practice?,” but instead “what’s the best way to climb the “corporate” ladder to make partner at a large advisory firm?” To answer that question, industry consultant Philip Palaveev authored “G2: Building The Next Generation,” which effectively is a handbook on what second/next generation “G2” advisors in larger independent advisory firms should be doing to successfully manage their career track to partnership (including what kinds of expectations are realistic, and why/how to develop the requisite skills necessary to move up the ladder). Though notably, the key is that while it’s crucial to learn good technical and relationship management skills to become a successful financial advisor in the first place, long-term success in moving to the top of an advisory firm is ultimately about more than “just” being a great advisor, but also learning to be a great manager and leader of the business as well… even when that includes “managing up” to the firm’s existing founders and senior leadership to help the advisor carve his/her own career path if/when/as necessary!

The Handbook For Next Generation Partners Of Independent Advisory Firms – One of the most interesting phenomena of the industry’s ongoing shift from commissions to fees is not just that potential conflicts of interest and standards of care may change in going from the broker-dealer to RIA channels, but simply that the AUM model – as a recurring revenue model – is capable of building far larger advisory firms than the commission-based model ever could. Because under the commission-based model, every January 1st the advisor/owner wakes up with income at $0 and must go out and find new clients to generate new revenue (adjusted perhaps for a small amount of trails for ongoing servicing of prior transactions)… and it’s difficult to hire a deep team that would cause the business to start in a hole every year! By contrast, the recurring revenue of AUM fees makes it possible over time to hire and develop a financial planning team that services a healthy (and economically viable) amount of ongoing client revenue, creating a newfound size and scale in the RIA model over the past 20 years that simply didn’t exist for financial advisors in the decades prior. Which in turn raises the new question for young advisors: not “what’s the best way to get clients to build your advisory practice?,” but instead “what’s the best way to climb the “corporate” ladder to make partner at a large advisory firm?” To answer that question, industry consultant Philip Palaveev authored “G2: Building The Next Generation,” which effectively is a handbook on what second/next generation “G2” advisors in larger independent advisory firms should be doing to successfully manage their career track to partnership (including what kinds of expectations are realistic, and why/how to develop the requisite skills necessary to move up the ladder). Though notably, the key is that while it’s crucial to learn good technical and relationship management skills to become a successful financial advisor in the first place, long-term success in moving to the top of an advisory firm is ultimately about more than “just” being a great advisor, but also learning to be a great manager and leader of the business as well… even when that includes “managing up” to the firm’s existing founders and senior leadership to help the advisor carve his/her own career path if/when/as necessary!

The Defining Personality Traits Of (Successful) Financial Planners  – The conventional view in the financial services industry is that being extraverted is the key to success as a financial advisor, as those who aren’t very extraverted may struggle with the outbound marketing and networking necessary to find and develop a steady stream of new clients to work with. Yet in a recent study of more than 1,000 financial advisors, it turns out that extraversion is not actually the biggest predictor of success and staying power amongst financial advisors. Instead, while the majority of financial advisors are more extraverted, the driving traits that defined the longest-standing and highest-income financial advisors were being highly conscientious and very agreeable (but not necessarily extraverted). In addition, the research suggests that the biggest “deal-breaker” trait for financial advisors is not being introverted, but being very neurotic (i.e., lacking emotional calm during stressful situations). Because the reality is that if one of the key value propositions of a financial advisor is helping clients stay the course difficult times of market volatility… the starting point is that the advisor themselves can maintain their own composure in the midst of challenging times. In turn, traits like being introverted vs. extraverted, or relative openness to experience (also a key trait on the “Big Five” of personality measurements) are less determinants of success, and more of simply being “style factors” that determine how any particular advisor will tend to handle their client relationships.

– The conventional view in the financial services industry is that being extraverted is the key to success as a financial advisor, as those who aren’t very extraverted may struggle with the outbound marketing and networking necessary to find and develop a steady stream of new clients to work with. Yet in a recent study of more than 1,000 financial advisors, it turns out that extraversion is not actually the biggest predictor of success and staying power amongst financial advisors. Instead, while the majority of financial advisors are more extraverted, the driving traits that defined the longest-standing and highest-income financial advisors were being highly conscientious and very agreeable (but not necessarily extraverted). In addition, the research suggests that the biggest “deal-breaker” trait for financial advisors is not being introverted, but being very neurotic (i.e., lacking emotional calm during stressful situations). Because the reality is that if one of the key value propositions of a financial advisor is helping clients stay the course difficult times of market volatility… the starting point is that the advisor themselves can maintain their own composure in the midst of challenging times. In turn, traits like being introverted vs. extraverted, or relative openness to experience (also a key trait on the “Big Five” of personality measurements) are less determinants of success, and more of simply being “style factors” that determine how any particular advisor will tend to handle their client relationships.

Tax Planning

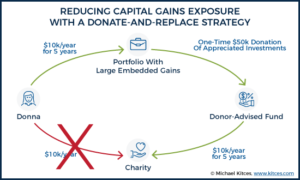

Capital Gains Strategies For Highly Appreciated Investments After A Big Bull Market Run – After a more-than-9-year run in the markets that have driven up some investments 100%, 200%, or even 300%+ from the bottom, most long-term investors now face substantial embedded capital gains in their portfolios. Which, as market volatility rises in 2018 while the bull market is arguably at least “long in the tooth,” creates substantial concerns about how to transition portfolios to be more defensive with such sizable capital gains looming, or even just to engage in periodic rebalancing. And can even make it more difficult for advisors to get new clients, who may not want to transition their investments from a prior advisor or investment strategy given their capital gains exposure. So what can advisory firms do to address such situations? Some advisory firms create a “capital gains budget” – a target for the total amount of capital gains that the client agrees are “OK” to take in the current year, setting the stage for (but also implicitly committing to) a multi-tax-year transition of the capital gains over time. Other firms may set upside or downside targets to engage in staged selling over time (e.g., to cut a 8% position in half by selling 1% of the shares for every 5% increase or decrease in price, until 4 increase or decrease thresholds have been reached), and simply allowing the market movements themselves to dictate when to sell. For those who are more charitably inclined, though, often the best strategy is a “donate-and-replace” strategy, contributing appreciated investments to charity to obtain a full-value tax deduction and make the capital gains bill vanish altogether… and then take the cash that would have been used to make the donation, and instead use it to re-purchase shares to replace the original ones that were donated (but at a new current-value cost basis!).

– After a more-than-9-year run in the markets that have driven up some investments 100%, 200%, or even 300%+ from the bottom, most long-term investors now face substantial embedded capital gains in their portfolios. Which, as market volatility rises in 2018 while the bull market is arguably at least “long in the tooth,” creates substantial concerns about how to transition portfolios to be more defensive with such sizable capital gains looming, or even just to engage in periodic rebalancing. And can even make it more difficult for advisors to get new clients, who may not want to transition their investments from a prior advisor or investment strategy given their capital gains exposure. So what can advisory firms do to address such situations? Some advisory firms create a “capital gains budget” – a target for the total amount of capital gains that the client agrees are “OK” to take in the current year, setting the stage for (but also implicitly committing to) a multi-tax-year transition of the capital gains over time. Other firms may set upside or downside targets to engage in staged selling over time (e.g., to cut a 8% position in half by selling 1% of the shares for every 5% increase or decrease in price, until 4 increase or decrease thresholds have been reached), and simply allowing the market movements themselves to dictate when to sell. For those who are more charitably inclined, though, often the best strategy is a “donate-and-replace” strategy, contributing appreciated investments to charity to obtain a full-value tax deduction and make the capital gains bill vanish altogether… and then take the cash that would have been used to make the donation, and instead use it to re-purchase shares to replace the original ones that were donated (but at a new current-value cost basis!).

Proposed Section 199A Regulations Refine Definitions Of Specified Service Businesses Eligible For QBI Deduction – With the passage of the Tax Cuts and Jobs Act in the final weeks of 2017, most financial advisors were left with little time to interpret and figure out how to start planning for the new tax rules as 2018 took effect. And as it turned out, the IRS was caught off guard as well, spending much of 2018 issuing guidance and proposed regulations about how the new rules would work. And arguably there was no area that set off both more interest, and more confusion, than the new 20% Qualified Business Income (QBI) deduction for “pass-through” businesses… especially since it turns out that the QBI deduction is actually available to any business that is not a C corporation (even including sole proprietors who don’t actually have a pass-through business entity). However, the fact that there are income limits on the QBI deduction for those who are operating “specified” service businesses, in turn led to a series of strategies that began to emerge about how to “crack and pack” groups of businesses together or apart in order to maximize the deduction and work around the limitations. Which in turn led the IRS to issue a series of Proposed Regulations in the summer to explain exactly how the QBI deduction would work, and more importantly when certain businesses would have to be grouped together (or not) when claiming the deduction (and effectively shutting down the aforementioned crack-and-pack strategies). Which did at least partially limit some of the potential QBI deduction planning strategies, although small business owners (including advisors themselves) still have to consider what is the “best” choice of business entity in their particular situation to maximize the QBI deduction.

Insurance Planning

How Healthcare Sharing Programs Compare To Traditional Health Insurance – The ongoing rise in health insurance premiums, especially for those who don’t have access to (paid-for or at least subsidized) health insurance through an employer, is leading some people to look for alternatives to buying traditional coverage on health insurance exchanges. For which an increasingly popular solution is so-called “healthcare sharing programs,” typically organized under ministries or other religious organizations like Christian Healthcare Ministries (CHM), Liberty HealthShare, Medi-Share, and Samaritan Ministries, and offering health coverage at a substantially lower cost than traditional insurance. In part, though, healthcare sharing programs are less costly simply because their benefits are often more restrictive, often including limitations for pre-existing conditions, and excluding various hazardous activities. In addition, some (though not all) healthcare sharing programs require a religious affiliation to the organization itself, they generally do not coordinate with Health Savings Accounts, and may have limitations on benefits for expensive ongoing prescription drugs (as opposed to shorter-term limited-time needs). Which means, in essence, that healthcare sharing premiums are lower in part because they limit who can participate (and therefore their risks) in the first place, and in the process may be outright unavailable to some. And while the core structure of a healthcare sharing program is to take in “premiums” (monthly share amounts) from participants that are pooled together in order to pay out for “claims” (eligible events) after a certain “deductible” (the personal responsibility or annual unshared amount), healthcare sharing programs are still not legally insurance and do not necessarily have the same legal obligations (or capital reserves) as traditional insurers. Nonetheless, with more than 1,000,000 people now being covered by healthcare sharing programs, they are becoming an increasingly recognized lower-cost alternative to traditional health insurance… at least for some (healthy) families.

Investments

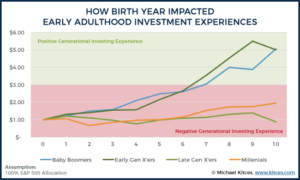

How Birth Year Shapes A Generational Experience In Stock Market Investing – While in the long-term, market volatility tends to average out, for any particular investor it rarely does. The reason is the investor’s ongoing cash flows in and out of the portfolio results in a “sequence of returns” phenomenon, where savers with bad returns early on don’t suffer much (because they haven’t yet saved much) and benefit from the market recovery that follows (on their now-much-larger-with-more-savings portfolio), while retirees with bad returns early on can have a catastrophic failure even if returns average out in the long run (because ongoing withdrawals plus poor early returns may completely deplete the portfolio before the good returns finally show up!). The challenge from an individual perspective is that the market returns themselves are beyond the investor’s control, though… which means, in the aggregate, investors who happen to enter young adulthood as savers when market returns are poor (and then subsequently recover) may benefit as an entire generation from the favorable sequence timing (as late Baby Boomers and early Gen X’ers did), while those who happen to retire in the face of poor returns may struggle (as early Baby Boomers did retiring on the eve of the financial crisis). Which means, ironically, that a significant portion of a saver’s (or retiree’s) long-term success is dictated entirely by the year in which they happened to be born, and the particular journey of returns that they (along with everyone else in their generation) happens to experience! And notably, the phenomenon may be similar for financial advisors themselves, as today’s experienced advisors in their 50s and 60s may be fundamentally more bullish on investing (because markets were perpetually “up” throughout the early years of their careers with clients), while younger advisors in their 30s and 40s have predominantly seen sideways and bear markets for the bulk of their careers (and may well carry the scars of adverse sequence of return risk with them for the rest of their years in working with clients, and shape their generational views on industry debates about the value of investment management and the active vs passive divide!).

– While in the long-term, market volatility tends to average out, for any particular investor it rarely does. The reason is the investor’s ongoing cash flows in and out of the portfolio results in a “sequence of returns” phenomenon, where savers with bad returns early on don’t suffer much (because they haven’t yet saved much) and benefit from the market recovery that follows (on their now-much-larger-with-more-savings portfolio), while retirees with bad returns early on can have a catastrophic failure even if returns average out in the long run (because ongoing withdrawals plus poor early returns may completely deplete the portfolio before the good returns finally show up!). The challenge from an individual perspective is that the market returns themselves are beyond the investor’s control, though… which means, in the aggregate, investors who happen to enter young adulthood as savers when market returns are poor (and then subsequently recover) may benefit as an entire generation from the favorable sequence timing (as late Baby Boomers and early Gen X’ers did), while those who happen to retire in the face of poor returns may struggle (as early Baby Boomers did retiring on the eve of the financial crisis). Which means, ironically, that a significant portion of a saver’s (or retiree’s) long-term success is dictated entirely by the year in which they happened to be born, and the particular journey of returns that they (along with everyone else in their generation) happens to experience! And notably, the phenomenon may be similar for financial advisors themselves, as today’s experienced advisors in their 50s and 60s may be fundamentally more bullish on investing (because markets were perpetually “up” throughout the early years of their careers with clients), while younger advisors in their 30s and 40s have predominantly seen sideways and bear markets for the bulk of their careers (and may well carry the scars of adverse sequence of return risk with them for the rest of their years in working with clients, and shape their generational views on industry debates about the value of investment management and the active vs passive divide!).

Behavioral Finance

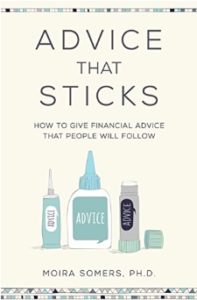

How To Give Better Financial Advice That (Actually) Sticks – The “ideal” client for a financial advisor is one with a clear fact pattern to analyze, for which there is a single straightforward recommendation, which the client immediately follows through to implement. In the real world, though, client situations are more complex… and even when the advice and best path to follow is clear, not all clients implement the recommendations in a timely manner (or at all). Notably, though, such “non-compliance” (or at least “non-adherence”) of a professional’s advice isn’t a new phenomenon and has actually been studied for decades in the medical world. The key insight: the burden for following through on implementation isn’t only on the shoulders of the patient or client, because how the advice is delivered also matters, which means the advice-giver themselves has a key role to play (beyond just coming up with the “right” recommendation in the first place). In her recent book “Advice That Sticks,” Dr. Moira Somers explores how the research on client adherence (or non-adherence) to a professional’s advice can be applied in the context of financial advisors. Starting with the recognition that clients themselves come to advisors for a wide range of different reasons beyond just seeking out answers to their financial questions, and it’s almost impossible to know how to deliver advice properly until the context and purpose of the advice-seeker’s behavior is understood. In addition, a client’s receptivity to advice is impacted by numerous factors, from their own personal financial history and circumstances (and the “money scripts” they’ve learned from their prior financial and life experiences), to their social and environmental factors, to the nature of the advice itself (long-term preventative advice is the hardest to implement!), and how the advisor’s own advice-delivery process can impact the outcomes. The key point, though, is simply to understand that clients who don’t implement the advice they’re given aren’t necessarily “bad clients” for failing to do so; instead, advisors should consider whether or how they can adjust the way their advice is delivered to try to make it more implementable, too. On the plus side, that means there is also tremendous additional value to be created for clients by not just giving the most accurate good advice, but actually being the best at giving advice that sticks, too!

– The “ideal” client for a financial advisor is one with a clear fact pattern to analyze, for which there is a single straightforward recommendation, which the client immediately follows through to implement. In the real world, though, client situations are more complex… and even when the advice and best path to follow is clear, not all clients implement the recommendations in a timely manner (or at all). Notably, though, such “non-compliance” (or at least “non-adherence”) of a professional’s advice isn’t a new phenomenon and has actually been studied for decades in the medical world. The key insight: the burden for following through on implementation isn’t only on the shoulders of the patient or client, because how the advice is delivered also matters, which means the advice-giver themselves has a key role to play (beyond just coming up with the “right” recommendation in the first place). In her recent book “Advice That Sticks,” Dr. Moira Somers explores how the research on client adherence (or non-adherence) to a professional’s advice can be applied in the context of financial advisors. Starting with the recognition that clients themselves come to advisors for a wide range of different reasons beyond just seeking out answers to their financial questions, and it’s almost impossible to know how to deliver advice properly until the context and purpose of the advice-seeker’s behavior is understood. In addition, a client’s receptivity to advice is impacted by numerous factors, from their own personal financial history and circumstances (and the “money scripts” they’ve learned from their prior financial and life experiences), to their social and environmental factors, to the nature of the advice itself (long-term preventative advice is the hardest to implement!), and how the advisor’s own advice-delivery process can impact the outcomes. The key point, though, is simply to understand that clients who don’t implement the advice they’re given aren’t necessarily “bad clients” for failing to do so; instead, advisors should consider whether or how they can adjust the way their advice is delivered to try to make it more implementable, too. On the plus side, that means there is also tremendous additional value to be created for clients by not just giving the most accurate good advice, but actually being the best at giving advice that sticks, too!

Why (Prudent) Spending Rates Matter More Than Savings Rates – There is no shortage of both research and conventional wisdom about how much households should save, from rules of thumb like “save 10% to 15% of your annual income” to more detailed studies (and projections of financial planners) that provide “precise” savings recommendations. Yet in practice, the biggest challenge for most households is not in knowing how much to save, per se, but in freeing up the flexible discretionary dollars in their ongoing household budget to be able to save in the first place. Because if the household’s spending rate is too high, there isn’t enough money left at the end of the month to save, recommending how much “should” be saved is a moot point. Which means effective savings recommendations really need to start with helping households figure out what is prudent to spend in the first place, particularly because once major purchases like automobiles and homes occur, there may not be much flexibility left. Of course, there are a number of guidelines available on how much a household can afford to spend on housing and automobiles… with the caveat that most such guidelines are created by lenders, who technically are “recommending” not a prudent amount to spend, but the maximum amount that a household can afford while still being reasonably likely to repay the lender (even if it makes them miserable in the process). And while government organizations like the Bureau of Labor Statistics do track what households actually spend in various categories as a part of their Consumer Expenditure Survey, when households already have a dismally low 3.2% national savings rate, it only reinforces the point that a lack of clear prudent spending guidelines have already dug many households into a deep hole for which “just save more” is an ineffective recommendation because most of their household cash is already committed elsewhere! All of which raises the question: what is a prudent spending rate for typical household expenses (particularly major purchases like cars and homes), and how should households figure out what is or is not an appropriate amount to spend in the first place to “live within their means”?

Bonus: Financial Advisor Success Podcasts

#FA Success Episode 91: Mitch Anthony On Increasing The Value Of Advice By Focusing On Life-Centered Planning For Transitions Not Goals – The very foundation of financial planning is that we help clients plan for and achieve their goals. Yet industry guru Mitch Anthony points out that, in the end, goals themselves are often ephemeral, changing both in response to our own changing preferences, and the transitions that life sometimes unexpectedly throws at us. Which suggests that in practice, the value of a financial advisor may be less about helping clients to achieve their goals, and more about simply helping them navigate the journey itself, with a financial planning value proposition built around 6 key principles: Organization (helping clients get their financial house in order); Accountability (helping clients follow through on whatever their financial commitments may be); Objectivity (outside perspective on otherwise-emotionally-driven decisions); Proactivity (helping clients to anticipate life transitions and plan for them); Education (on what clients need to know to address their situations); and Partnership (working jointly with clients on their journey). Accordingly, the key way to then measure the effectiveness of a financial advisor and their positive impact is not to look at the Returns On Investment (ROI) generated in the portfolio, but the Return On Life (ROL) that the client generates as they work with their financial advisor in a “life-centered” planning relationship.

#FA Success Episode 100: Scaling A Financial Life Management Firm By Starting With Client Intentions Instead Of Goals With Joe Duran – Despite having built what objectivity is one of the largest independent RIA wealth management firms in the U.S., now with more than $25B of AUM, Joe Duran doesn’t view his firm United Capital as being in the “wealth management” business at all, but in the “Financial Life Management” business instead… where it’s all about helping clients to live richly, instead of just dying richly. Accordingly, the focus at United Capital is not on planning for goals, per se, but instead, it's on the client’s underlying values and intentions – with unique tools that United Capital developed specifically to facilitate those conversations – and helping them align their finances and decisions with those values and intentions. In addition, Joe Duran also explores why the firm does not require every client to start out going through the comprehensive financial planning process (even though the goal is to get every client there eventually), the key steps to consider when trying to scale an advisory business, and how the evolution of the emerging crop of national independent advisory firms is less and less about just delivering quality financial planning itself but becoming the technology platform that powers the business as well… although, in the end, the “secret” to success is still about focusing not on the results, but the inputs and the process of always trying to serve clients better than you do today.

#FA Success Episode 94: James Osborne On Crafting Your Optimal Solo Practice By Simply Charging What You’re Worth – In recent years, there has been a growing debate about the long-term viability of the AUM model, and whether the future of financial advice instead is all about retainers and other fee-for-service models instead. Yet James Osborne runs a unique advisory business model of simply charging a flat $4,800/year for every single client, not necessarily to make a statement about the future business model of the industry, but simply because he’s figured out that’s exactly what it takes for him to charge what he’s worth to serve his clients the way he wants to serve them… with the end result of building an ultra-high-margin solo advisory firm with “just” 80 clients generating nearly $400,000 of retainer fee revenue (which he’s accomplished despite being only 35 years old!). Accordingly, Osborne talks about his founding vision for the advisory firm, how the firm and his clientele have evolved as he’s built into his one-flat-fee-for-all model, how he’s adjusting his process with clients as he approaches capacity, and what he plans to do when he reaches his personal capacity as an individual advisor, where he no longer has room to grow… but may already generate more income at that point from his stable lifestyle practice than most advisors will ever earn in a year anyway?

Leave a Reply