Executive Summary

Niels Bohr famously observed that "Prediction is very difficult, especially if it's about the future!" The sentiment is especially poignant when it comes to economic forecasting, as it's nearly impossible to get an accurate picture of the current state of the economy at any given moment. As a result, uncertainty about how the economy may unfold, even along the shortest time frames, is the default. However, given the ongoing debate around the various 'hard', 'soft', or 'no-landing' scenarios that have dominated the headlines due to the Federal Reserve's campaign to tame inflation, it's safe to say that economic uncertainty is especially elevated at the moment. The good news is that by gaining a better understanding of some of the economy's key drivers, financial advisors have the opportunity to deliver more value to their clients by helping them better identify the opportunities and risks present in this highly uncertain environment!

As has been the case for several quarters, the prevailing characteristic remains a "tale of 2 economies". While the manufacturing sector (which makes up 'only' 8% of the U.S. economy) contracted for the 12th consecutive month, the services sector (constituting about 78% of GDP) expanded for the 11th consecutive month, serving as a primary driver behind continued wage inflation as well as tightness in the labor market.

While there's certainly a chance that the Fed will achieve its 2% inflation target without a commensurate spike in unemployment, there are still plenty of threats on the horizon. Notably, banks face pressure on several fronts, including declining values of longer-term debt holdings impacting balance sheets, savers shifting out of savings accounts as they seek higher-yielding money market funds, and record-level office vacancy rates that hinder the refinancing of low-rate real-estate loans into higher-rate loans.

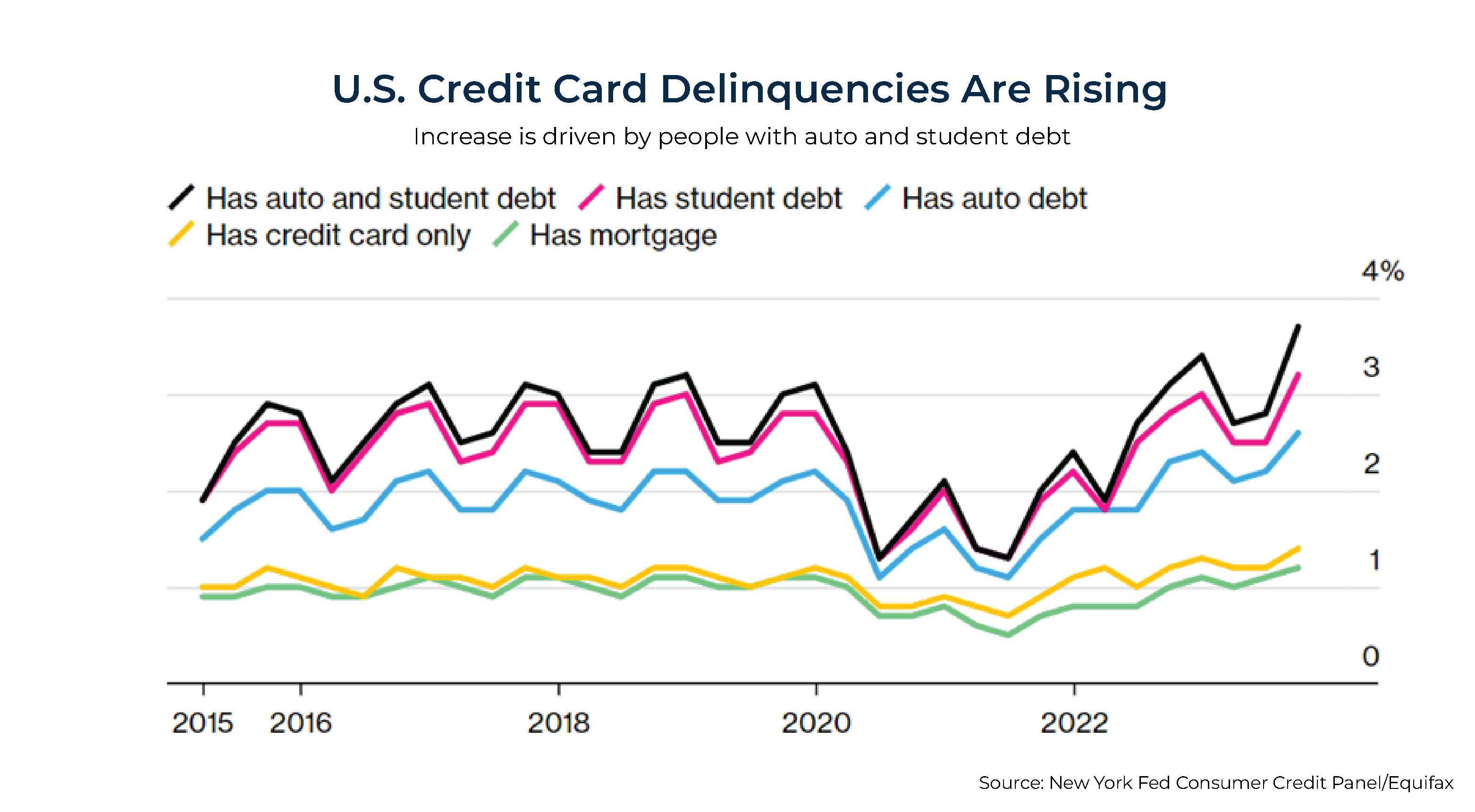

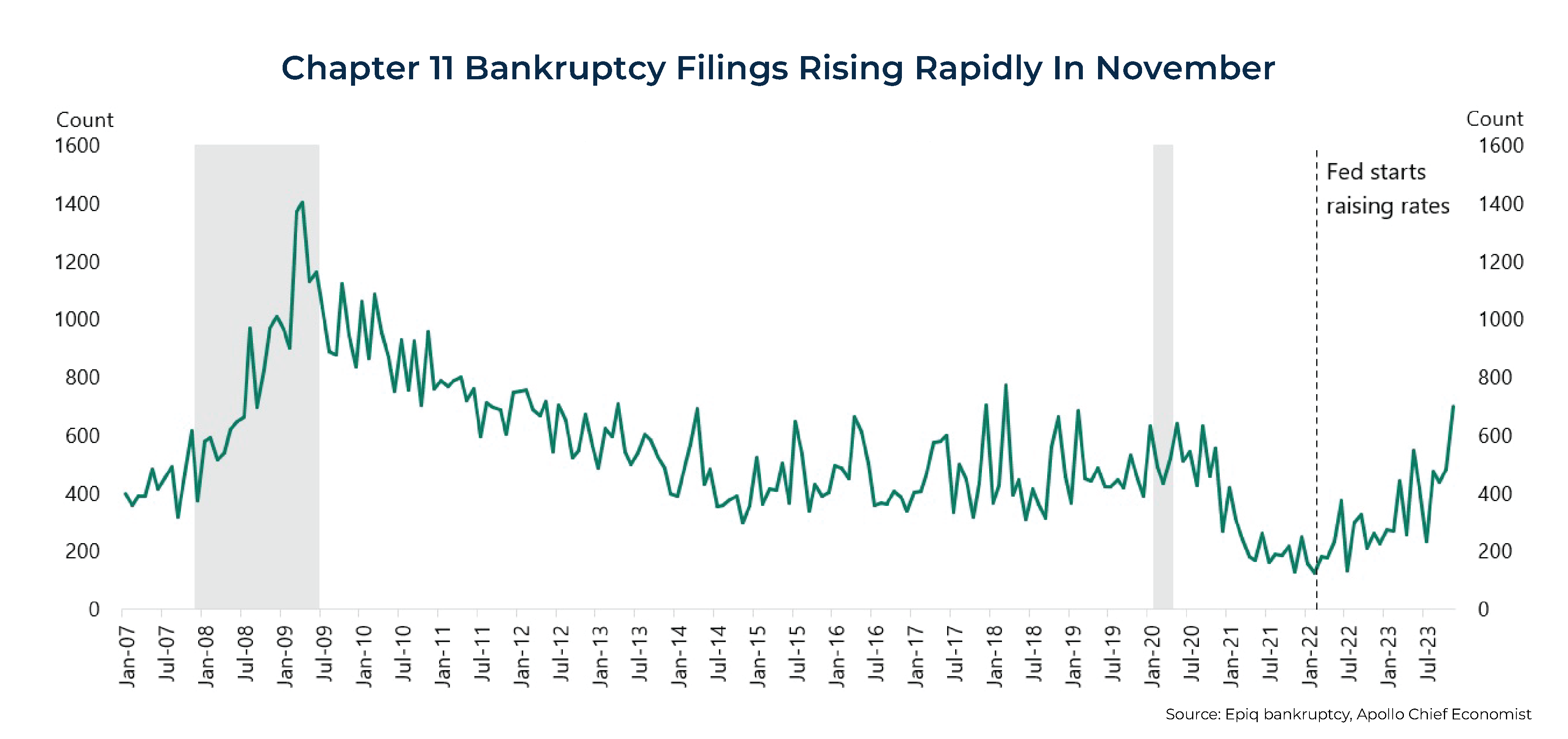

Consumers, meanwhile, have just about burned their way through their post-COVID savings, which was the main driver for GDP growth in 2023. With credit card balances and delinquencies spiking and student loan payments resuming, it's unlikely that consumers will be able to sustain their spending levels and ride to the rescue once again in 2024. Businesses are also feeling the pinch from higher interest rates, as November saw a rapid increase in the number of Chapter 11 commercial bankruptcies.

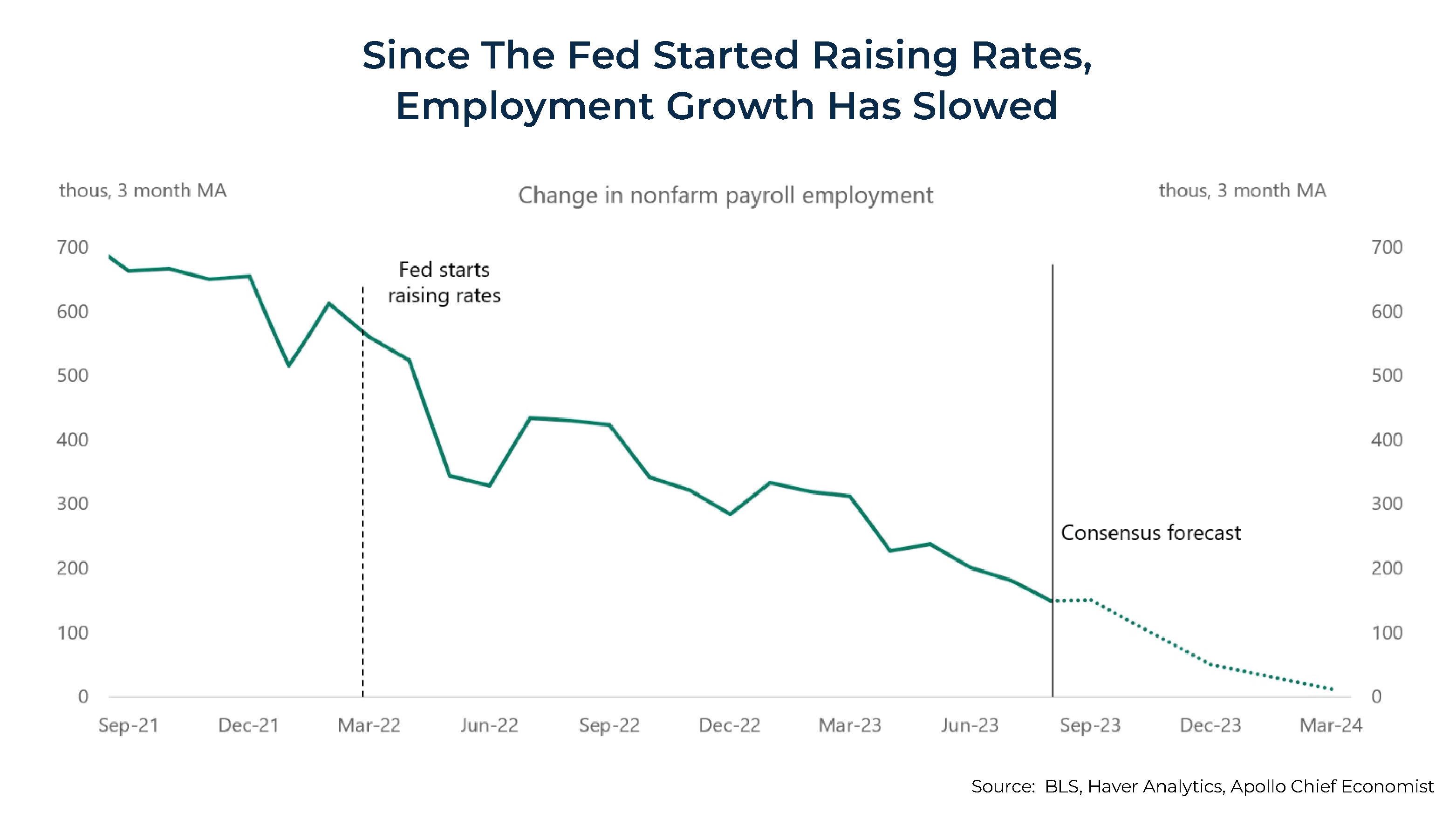

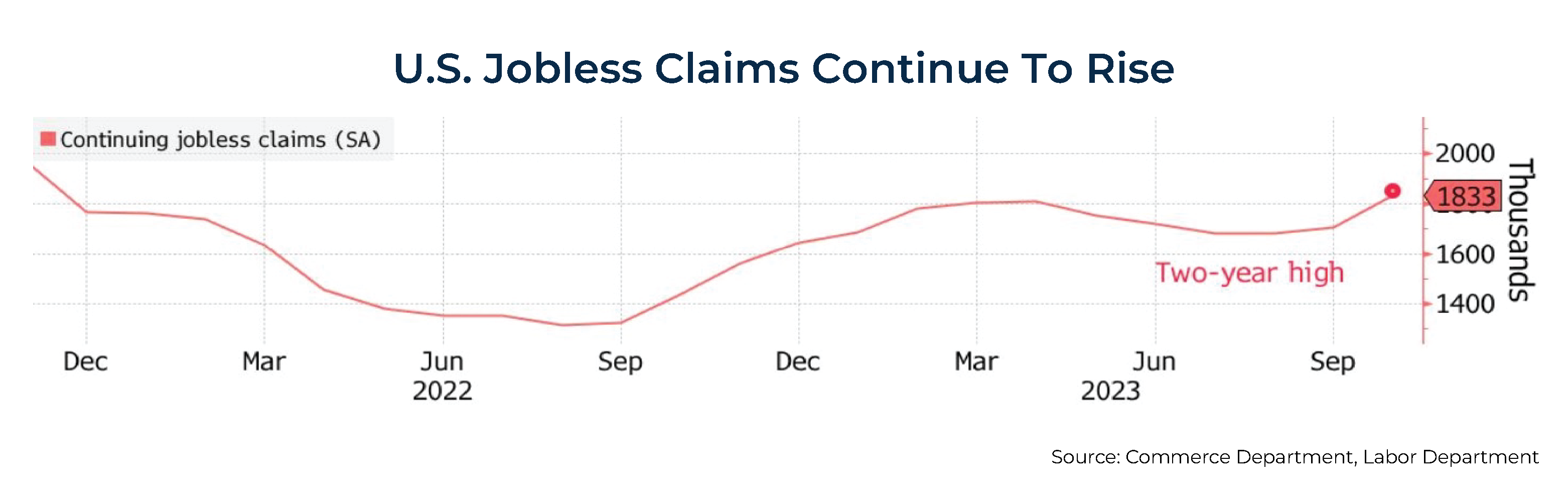

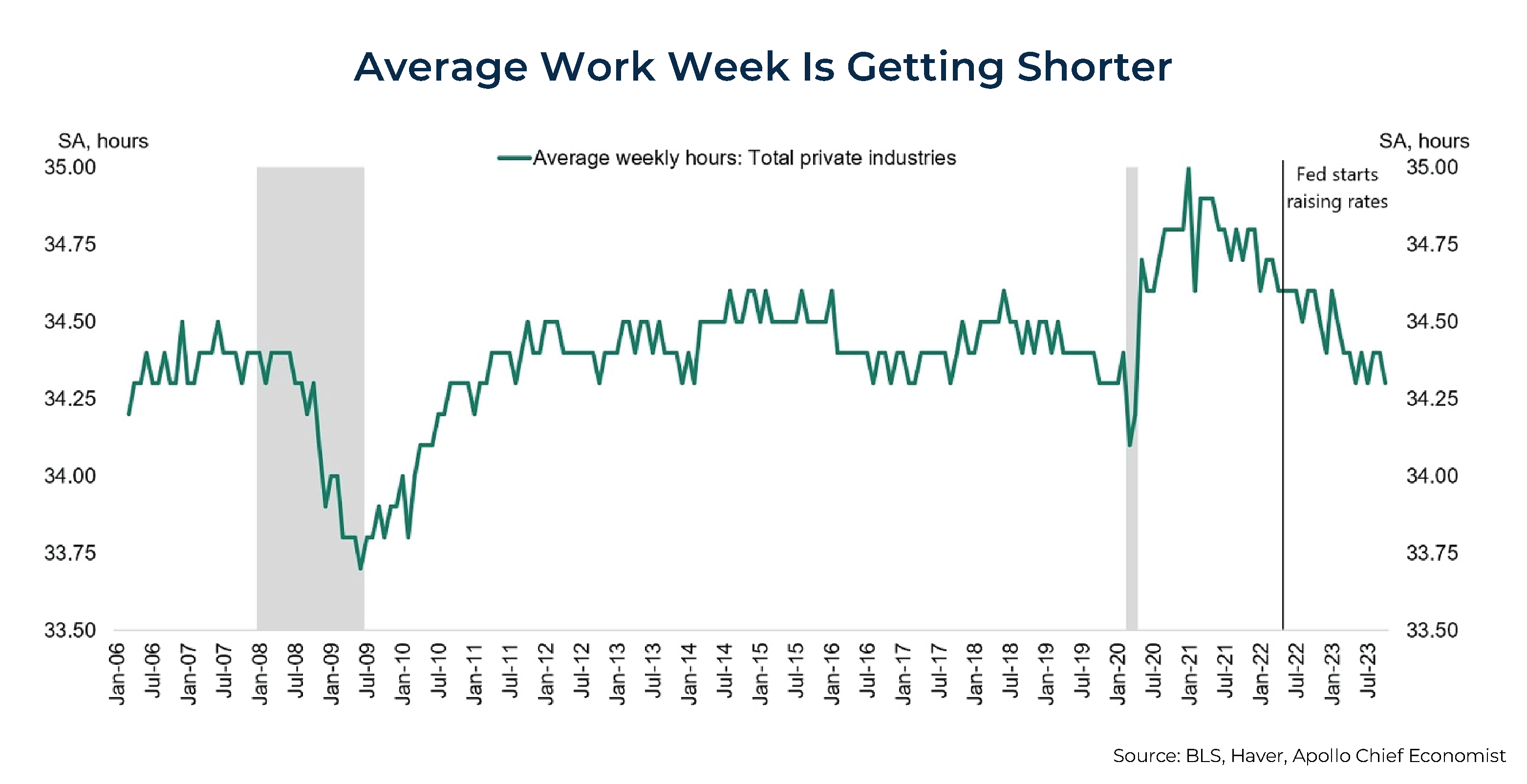

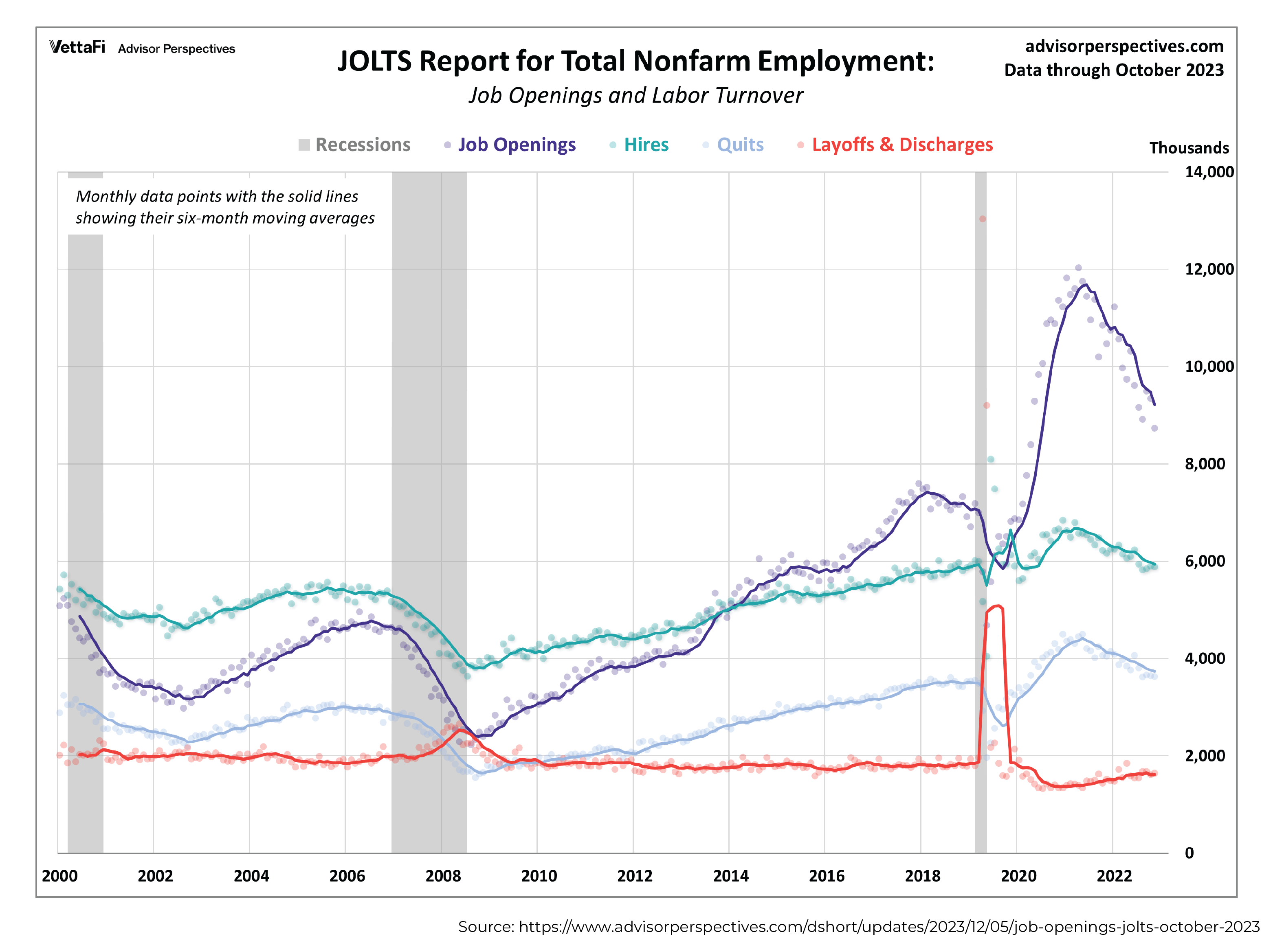

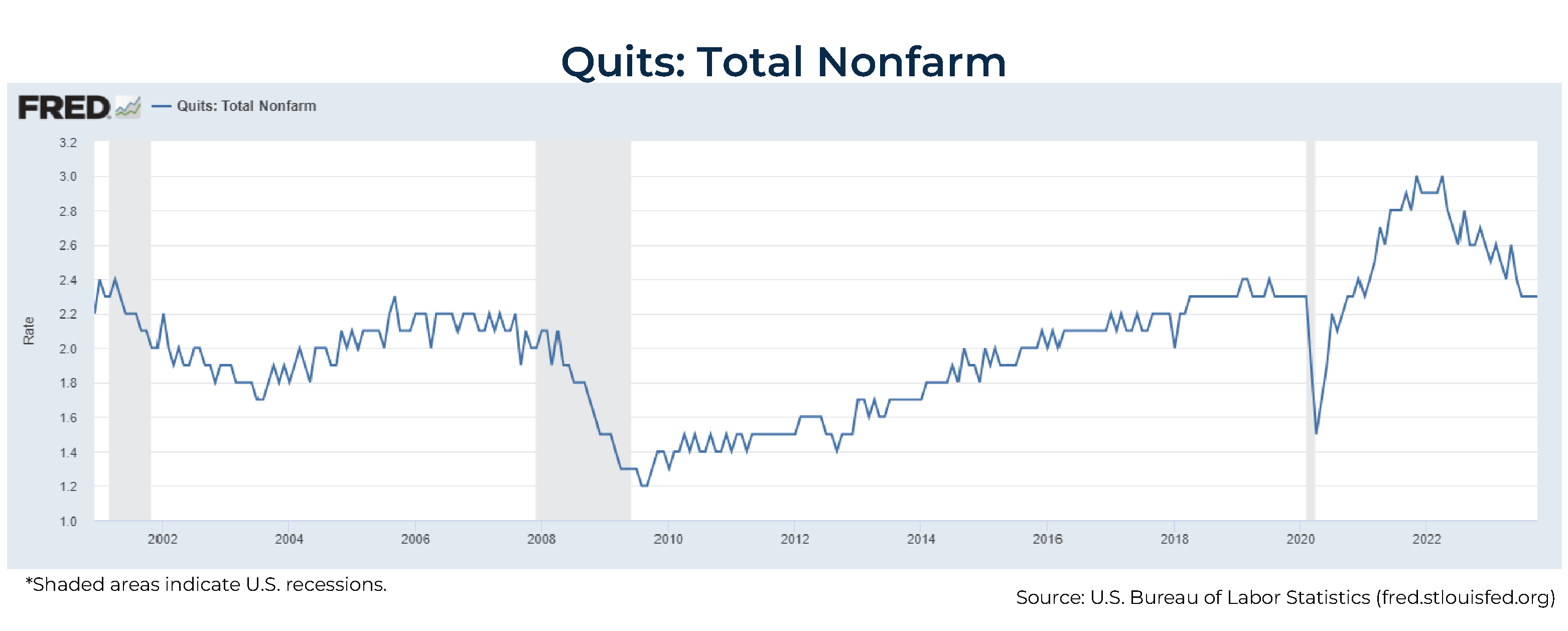

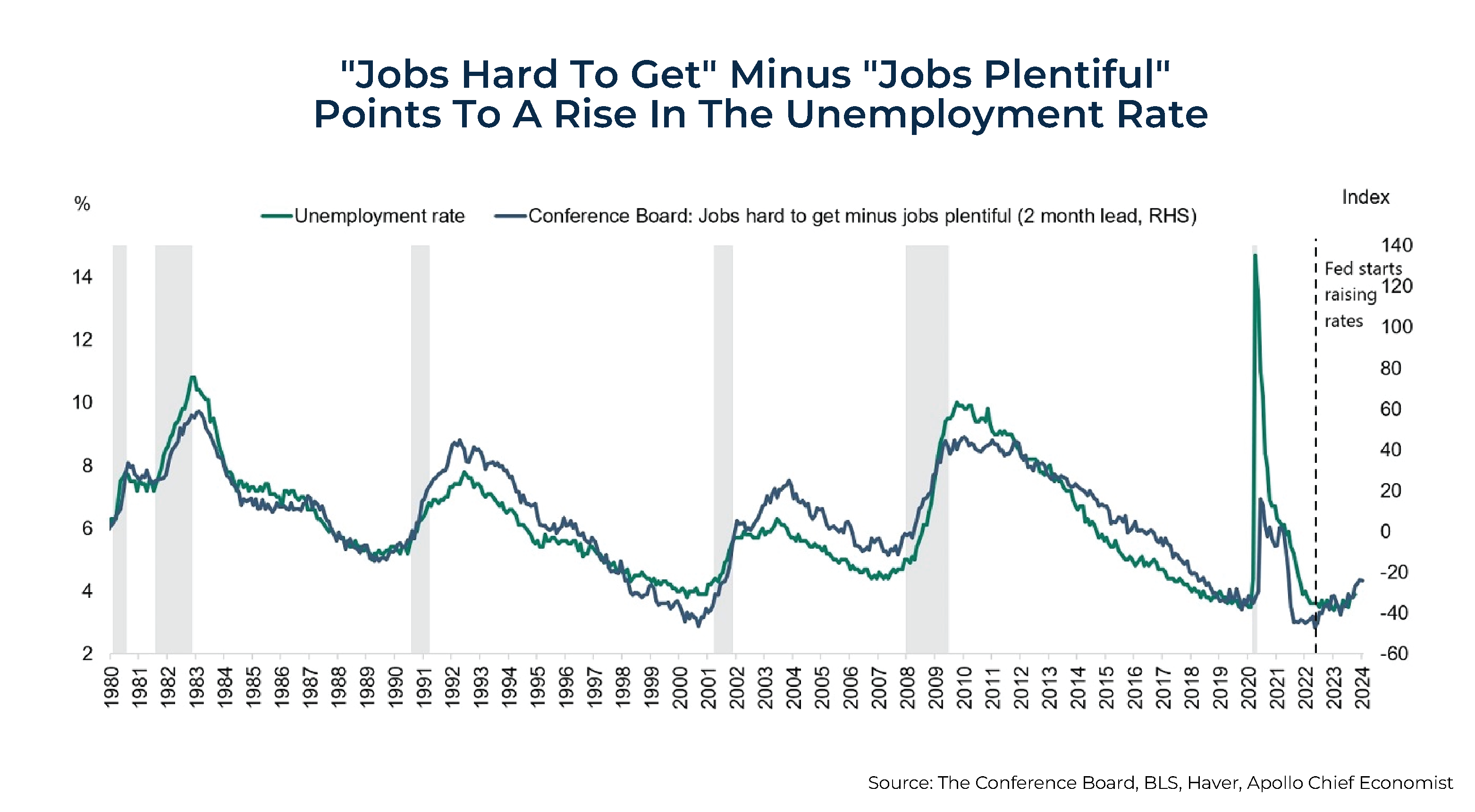

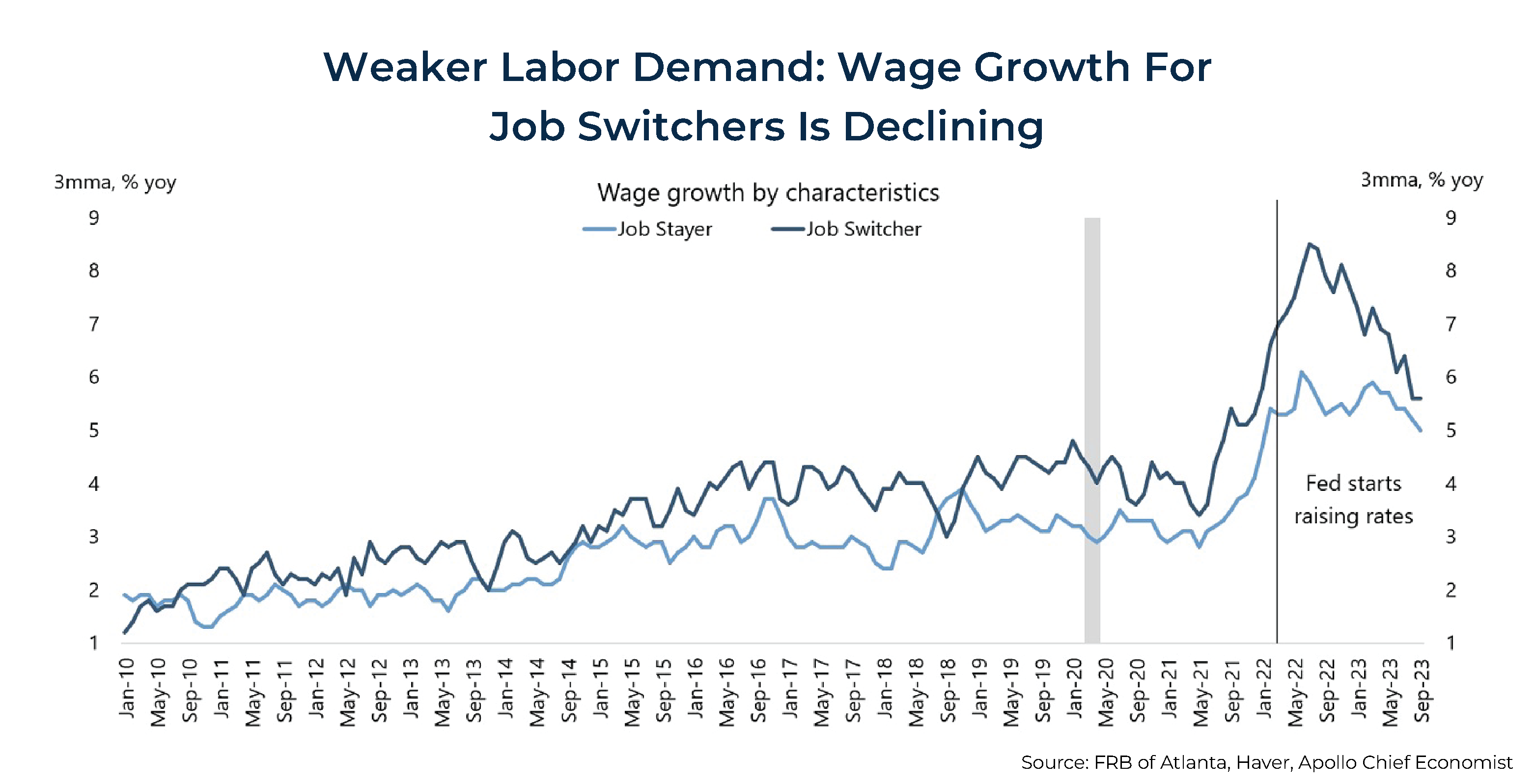

The labor market, while still remarkably resilient, has also started to show signs of stress. Since the Fed started raising rates in March 2022, job growth has steadily slowed; continuing claims for unemployment hit a 2-year high; the average work week is getting shorter; and job openings, 'quit rates', and wage growth for job switchers have all been falling.

The good news is that while there's little doubt that the economy is indeed slowing, there don't seem to be any "black swans" lurking around the corner, as was the case for 2008's severe recession. As a result, professional forecasters generally agree that there's less than a 50% chance of negative growth throughout 2024 and that unemployment could rise to a manageable 4.1%.

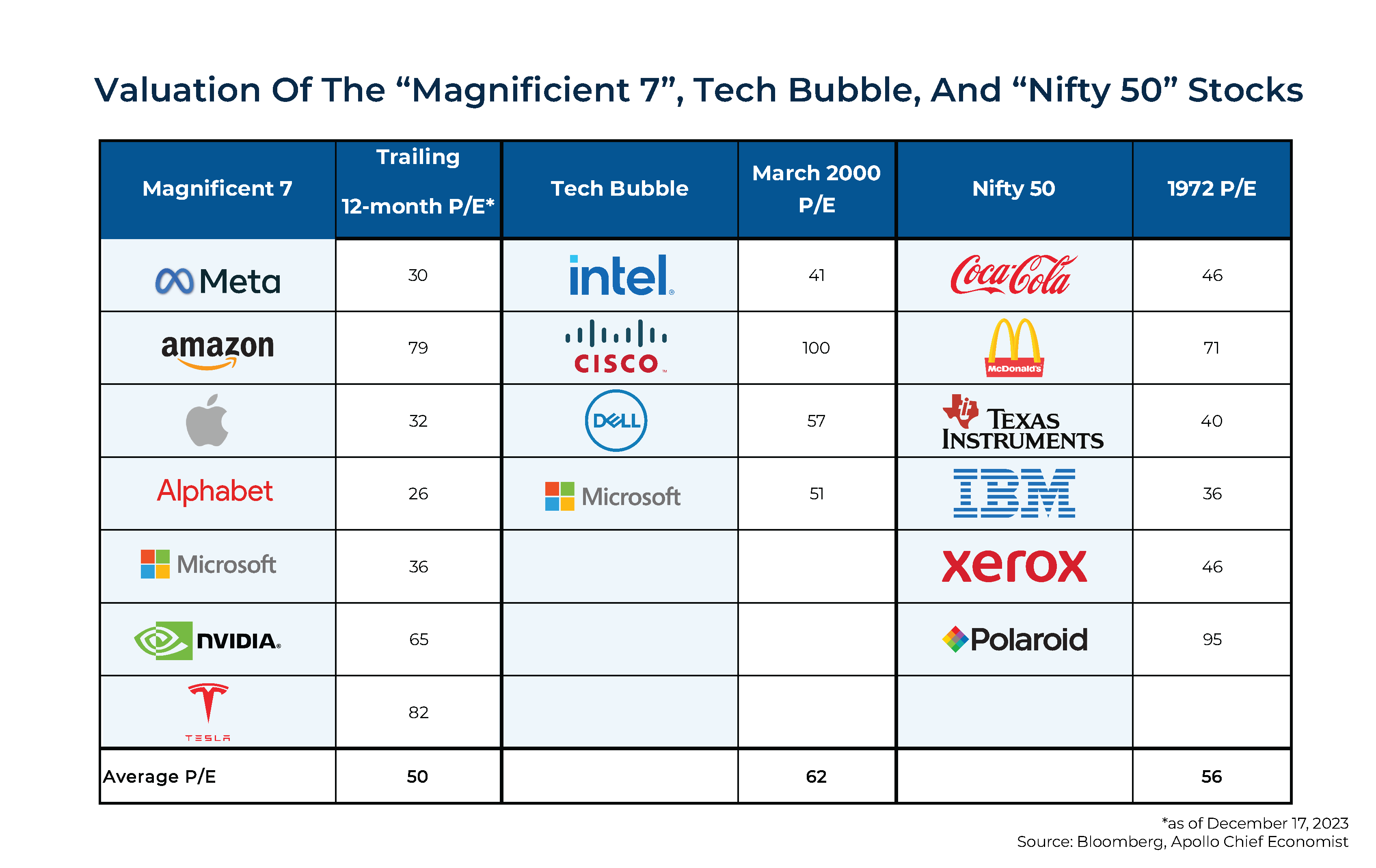

That said, plenty of factors can still impact the economy and markets, including the conflicts in Israel and Ukraine, increased tensions with China, a spiking debt-to-GDP ratio, and chances for a government shutdown. Moreover, historically extreme valuations in a small handful of mega-cap stocks that account for about 30% of the market weight in the S&P 500 (i.e., the Magnificent Seven) means that any sort of correction in those names could reverberate through the broader market.

The key point is that, given the current economic uncertainty, there are several ways that advisors can help clients prepare for potential downturns. This can involve reducing exposure to high-risk equities and longer-term bonds while moving towards shorter-term, lower-risk debt. Additionally, diversifying towards assets that still carry a risk premium but have a low correlation to stock market cycles or traditional bond inflation risks (e.g., reinsurance, private lending, consumer credit, long/short factor funds, commodities, and trend-following) can be beneficial. Ultimately, while no one has a (clear) crystal ball or control over any of the myriad factors influencing the markets, advisors play a crucial role in helping their clients understand and navigate these risks, keeping them focused on their long-term goals!

The cumulative impact of the Federal Reserve's actions has resulted in it achieving its objective to slow demand in order to reduce inflation toward its target of 2%. Raising interest rates has led to not only tightening credit conditions (credit is harder to obtain and has been accompanied by a drop in the money supply) but also a loosening of the labor market (a rise in unemployment, a drop in the number of job openings, and a fall in the quits rate), a decline of the manufacturing sector, slowing demand for services, and a fall in inflation.

This quarter's review will cover the economy; the loosening of the labor market; the tightening credit conditions along with rising delinquencies; the resumption of student loan repayments; the outlook for inflation; the concerns over funding the huge Federal deficits; the outlook for interest rates; equity valuations and the outlook for markets; and an in-depth look at the world's 2nd largest economy, China.

The Economy

The U.S. continues to be a tale of 2 economies. The manufacturing sector, which accounts for only about 8% of employment, has been in recession since November 2022 as the Fed's aggressive rate hikes cooled the interest-sensitive sectors of the economy (such as housing, autos, commercial real estate, manufacturing, and durable goods).

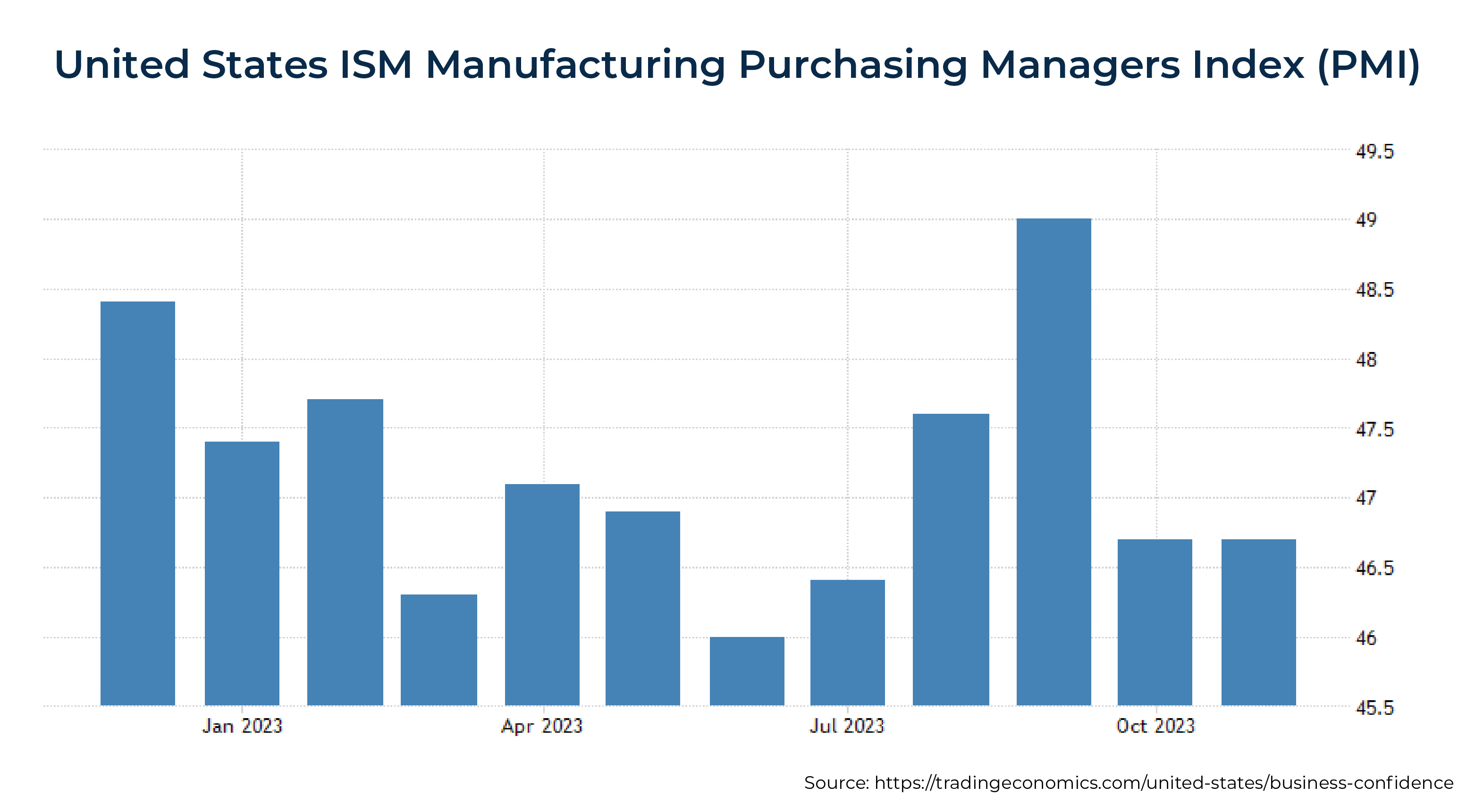

The November 2023 U.S. ISM Manufacturing PMI, which assesses the level of demand for products manufactured in the U.S., was 46.7, indicating contraction (below 50) for the 12th consecutive month.

On the other hand, services-sector spending, which is less sensitive to interest rates and constitutes about 78% of GDP, continues to be strong even as economic growth has slowed. Economic activity in the services sector, as indicated by the ISM Services PMI, expanded for the 11th straight month in November (52.7). Note that readings above 50 indicate expansion (see chart below).

The sharp rise in longer-term rates poses 8 major risks to the economy, as listed below, including the burden of debt service. Interest on the Federal debt will become the 2nd largest category of government spending over the next year.

- Increasing interest service. The average interest rate on Federal debt is 2.8%. Obviously, it is set to rise substantially. Total debt service is $620 billion. Let me explain the math.

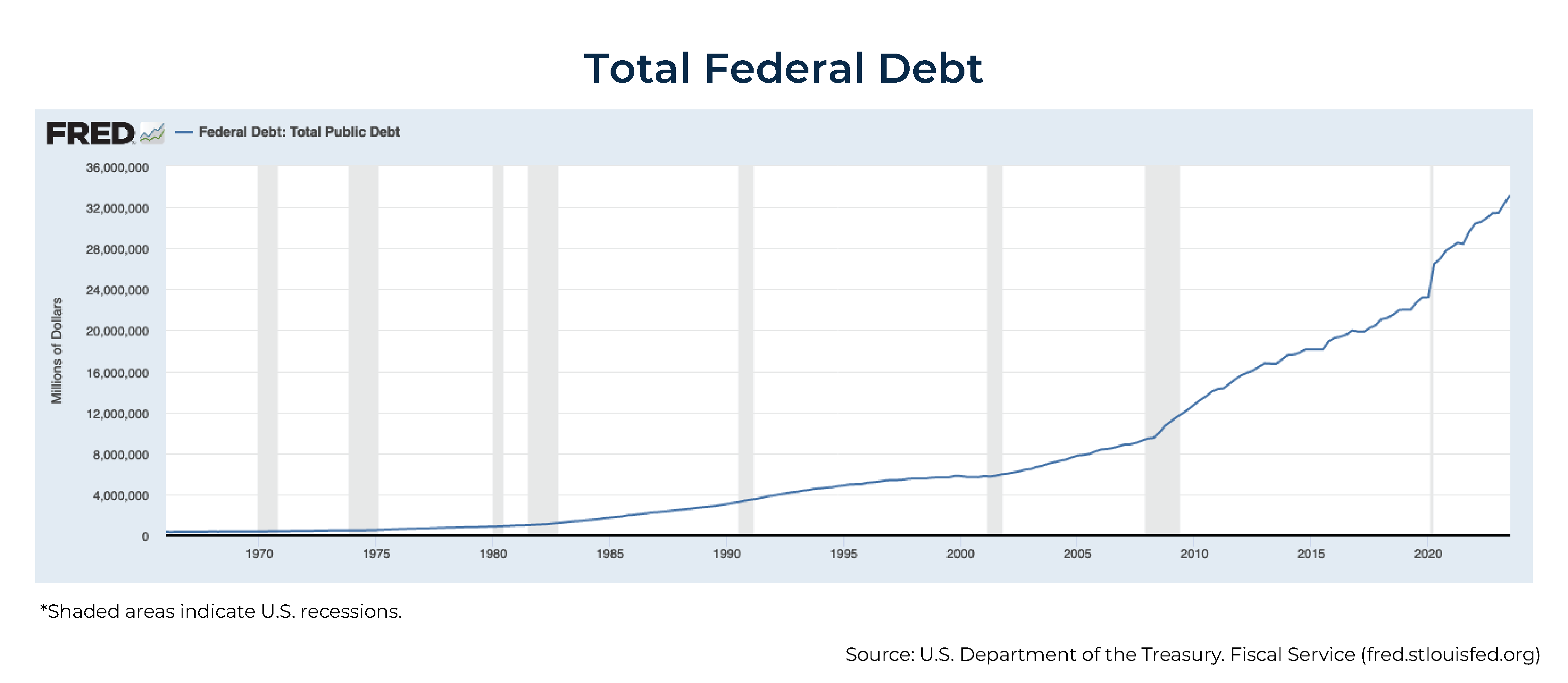

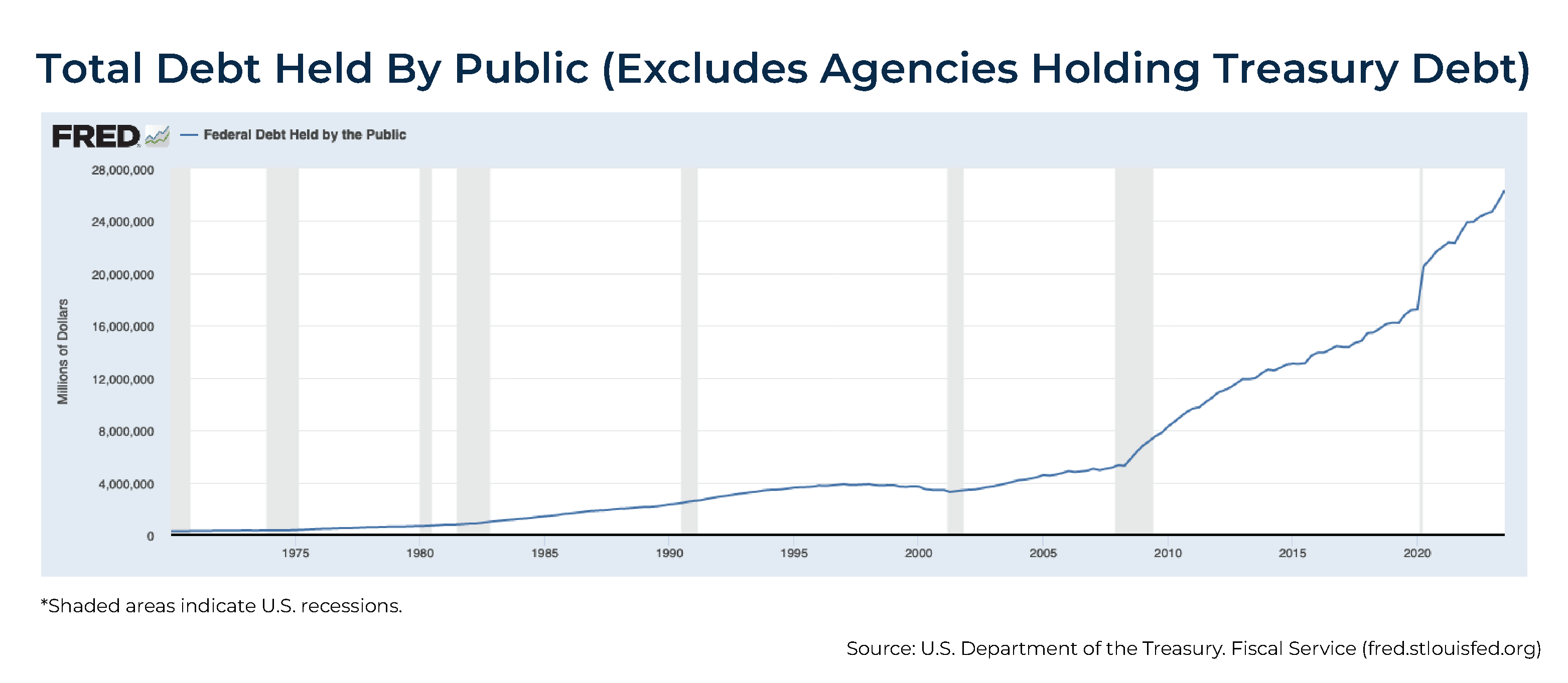

Total debt is $33.1 trillion, as shown in the graphic below. It is important to strip out agency debt (i.e., agencies holding Treasury debt). Since the Federal Reserve is considered the public, we also need to remove Fed holdings (the Fed rebates interest to the Treasury). So the debt held by the "public" is $26.3 trillion.

It is important to strip out agency debt (i.e., agencies holding Treasury debt). Since the Federal Reserve is considered the public, we also need to remove Fed holdings (the Fed rebates interest to the Treasury). So the debt held by the "public" is $26.3 trillion. Interest is 22% of tax receipts. It is reasonable to expect that over the next year, interest service will become the 2nd largest expenditure category (exceeding health, national defense, etc.). Historically, it is a very bad idea to borrow to pay the interest on debt. Further, the $33.1 trillion of debt does not include the many unfunded government obligations.

Interest is 22% of tax receipts. It is reasonable to expect that over the next year, interest service will become the 2nd largest expenditure category (exceeding health, national defense, etc.). Historically, it is a very bad idea to borrow to pay the interest on debt. Further, the $33.1 trillion of debt does not include the many unfunded government obligations. - Financial sector instability. Increasing long rates hit bank balance sheets. Most banks are locked into holdings of longer-term loans and Treasuries. Both collapse in value when long rates rise. For example, consider banks' holdings of mortgages. From July 2020, 30-year mortgages averaged less than 3% for over a year. The current rate, about 6.125% as of late December 2023, is more than double that. This type of duration risk is exactly what took down Silicon Valley Bank (in SVB's case, it was holdings of longer-duration Treasury bonds).

- Credit squeeze. The combination of an inverted yield curve (which hurts banks' profitability) and higher long rates (which hit banks' balance sheets) have led to the strange situation where banks can only afford to pay a few basis points on their savings deposits. This leads to capital flight to Money Market Funds (MMFs). The MMFs invest in Treasuries and other safe securities. The capital flight slowly squeezes credit out of the system. This leads to slower growth.

- Lack of investment. Higher rates increase the cost of capital. The increased cost of capital makes fewer investment projects viable. Investment is a major driver of GDP, and it also drives innovation.

- Stress on the consumer. The post-COVID savings glut will be exhausted by year's end. These savings have been the main driver of GDP growth in 2023. Some consumers' savings are already depleted, credit card debt is increasing ($48 billion in the second quarter of 2023 to last quarter's $1.08 trillion), and credit card delinquencies are rising. We cannot count on the consumer to bail out the economy in 2024.

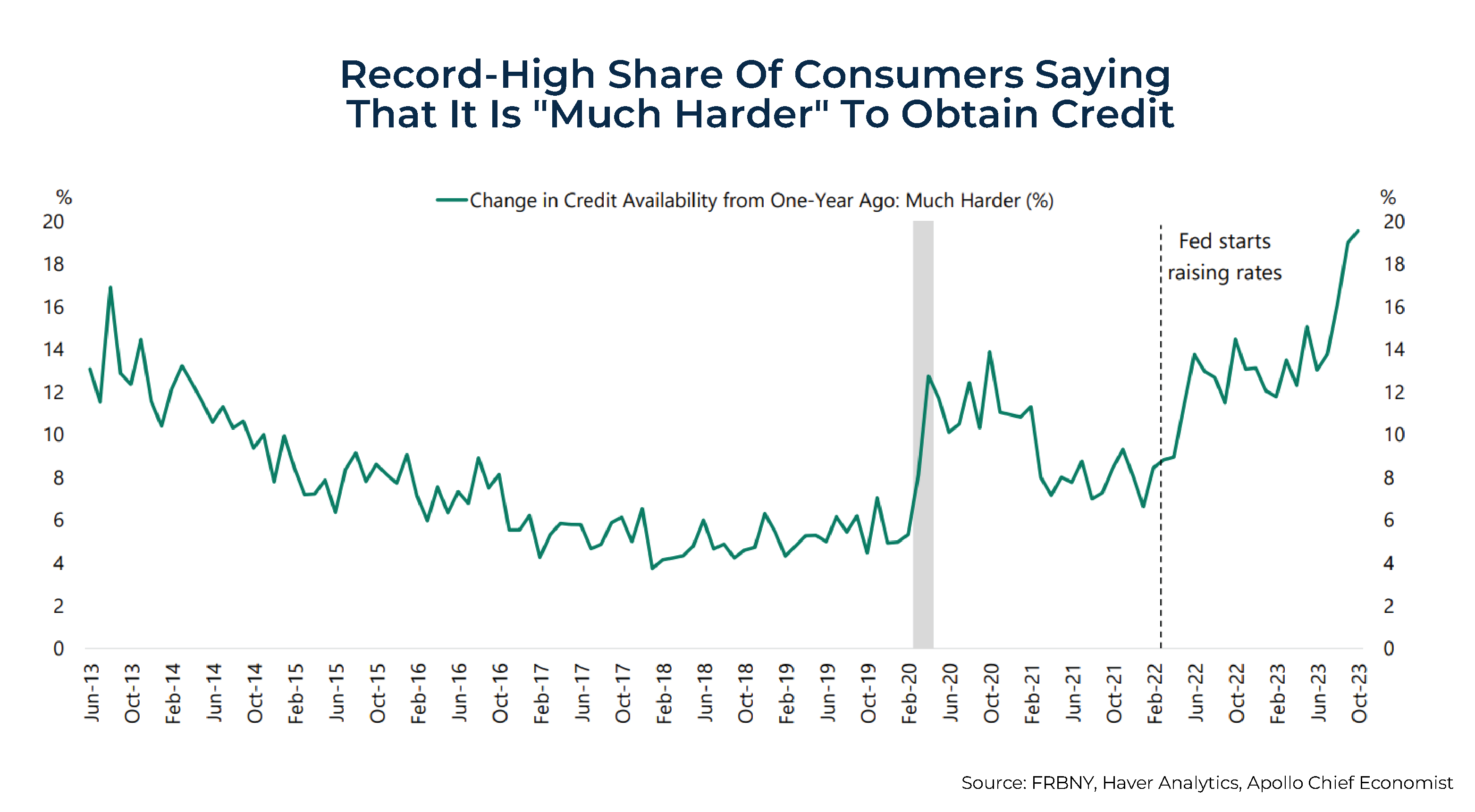

And credit is getting harder to obtain.

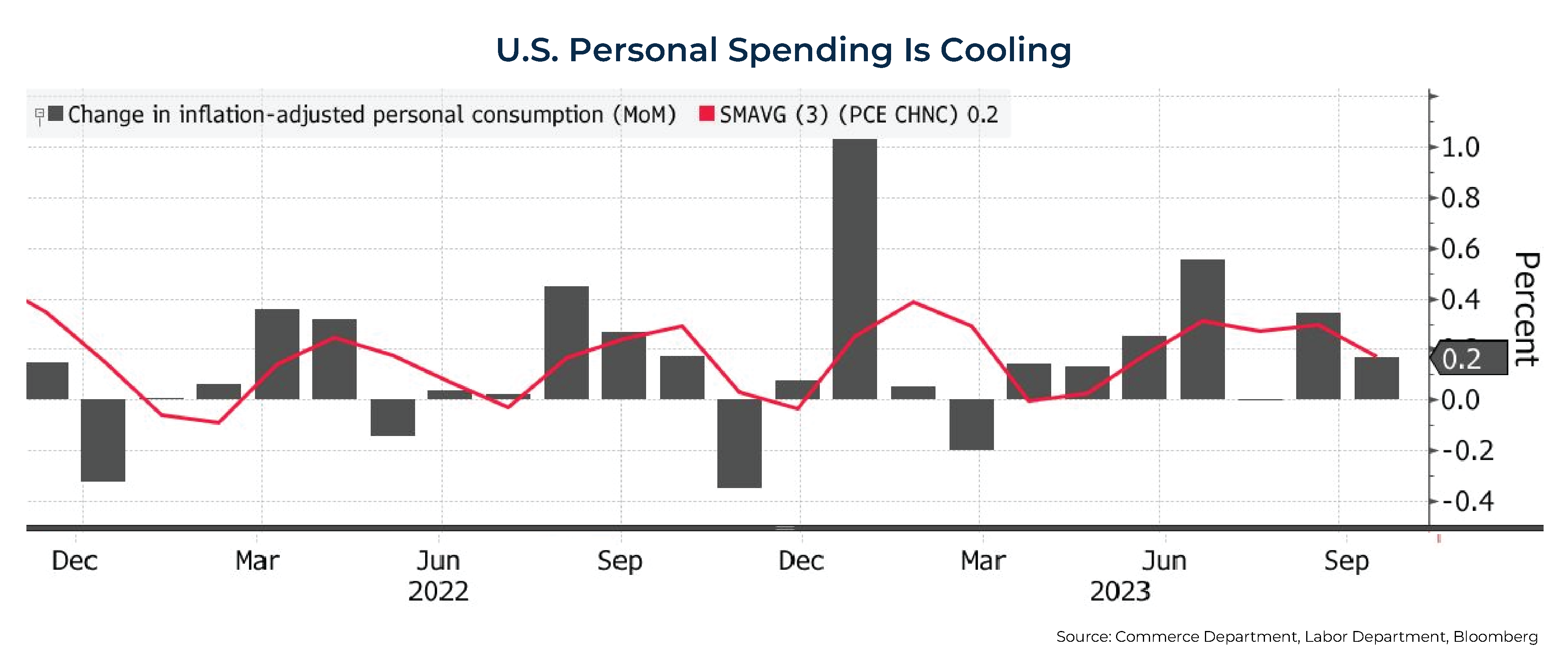

And credit is getting harder to obtain. The result is that consumer spending, which represents about 2/3 of GDP, has been slowing.

The result is that consumer spending, which represents about 2/3 of GDP, has been slowing.

- Commercial real estate. The office vacancy rate in San Francisco hit an all-time high of 35% in November (versus 3%–4% pre-pandemic). Other cities, like Chicago, are also setting records for vacancies in office space. Banks hold a substantial amount of real estate debt. While banks would like to roll over into much higher-rate loans, they may be unable to do so.

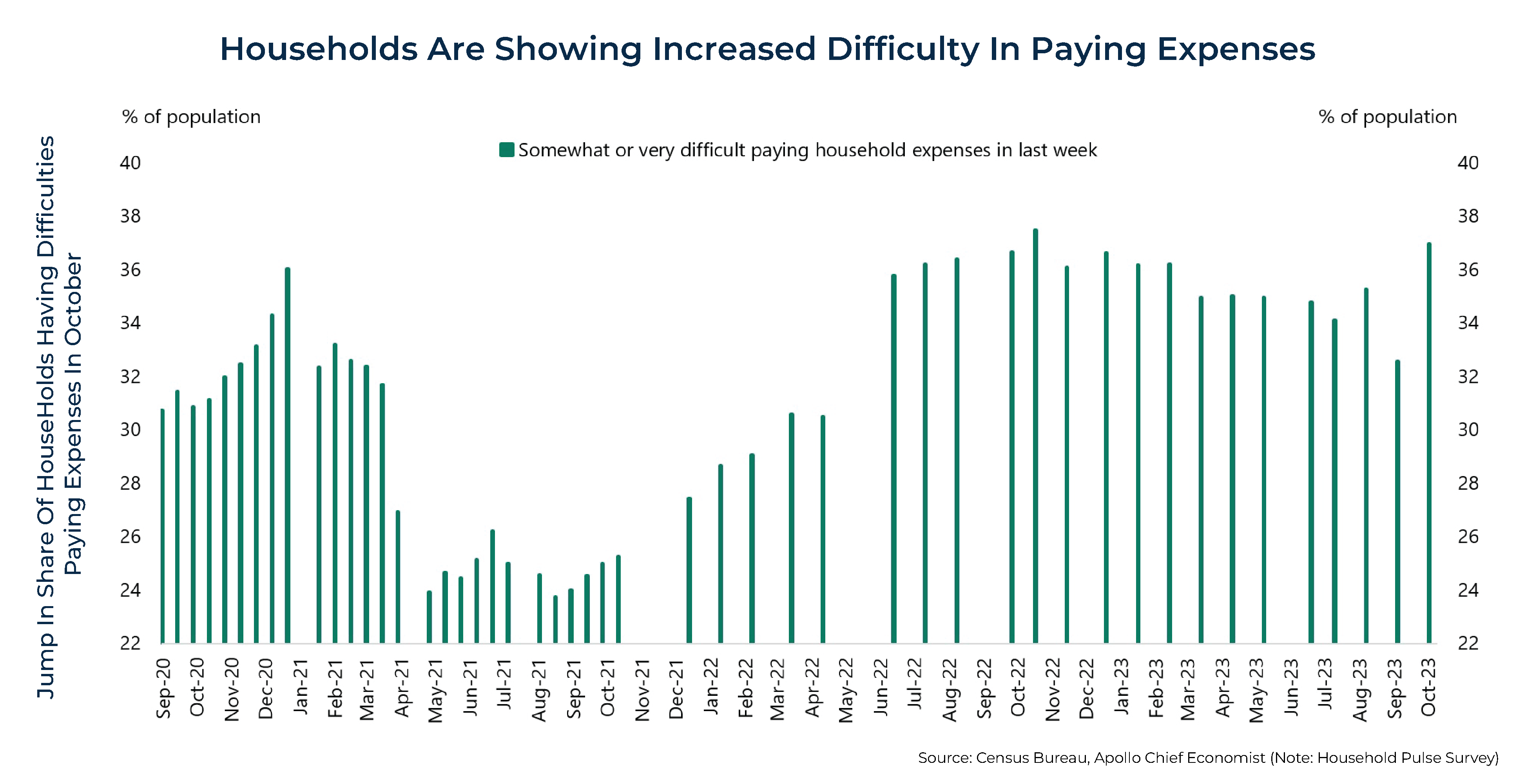

- Resumption of student loan payments. 40 million people have student loans. Federal student loan payments, which had been paused during COVID, resumed at the end of September. It is increasingly difficult to get replacement credit due to a credit squeeze at banks, and higher rates make loans less affordable. According to the Apollo Academy, the Census Household Pulse Survey for October "showed a jump in the share of consumers saying they are having difficulty paying their household expenses. Looking at the Household Pulse Survey in detail shows that the difficulties …were concentrated among households with a college degree, making between $50,000 and $150,000, suggesting that restarting student loan payments is the source of increased financial stress for consumers."

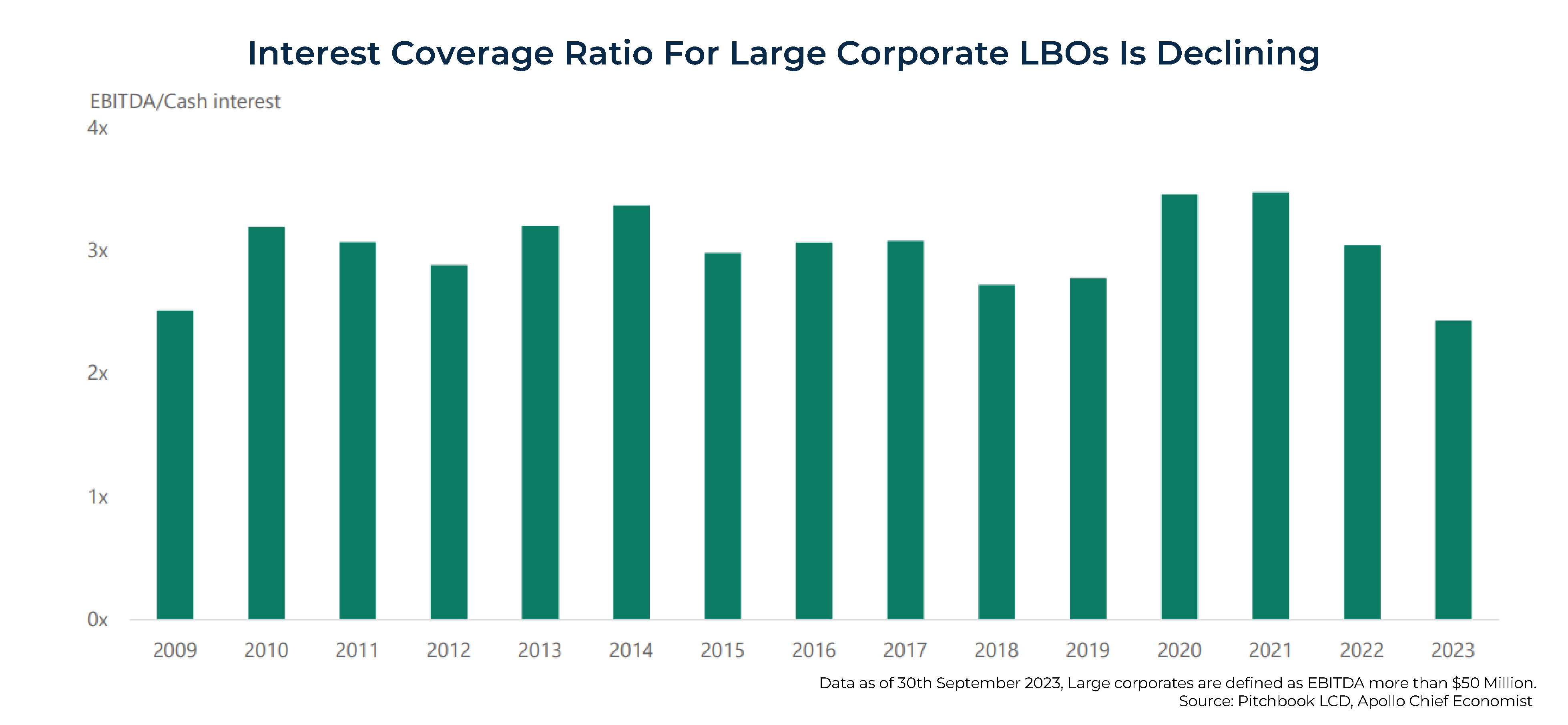

- Corporate balance sheets are showing signs of distress. LBOs are acquisitions of a company by a private equity firm using a significant amount of debt as the main source of funding. The interest coverage ratio measures a company's ability to service its interest payments. It is calculated by dividing the company's earnings before interest and taxes (EBIT) by its annual interest expense with a higher ratio indicating lower risk. As you can see in the chart below, the declining interest coverage ratio indicates that corporate balance sheets are showing signs of distress.

That is leading to an increase in default risk, with Chapter 11 commercial bankruptcies rising rapidly in November.

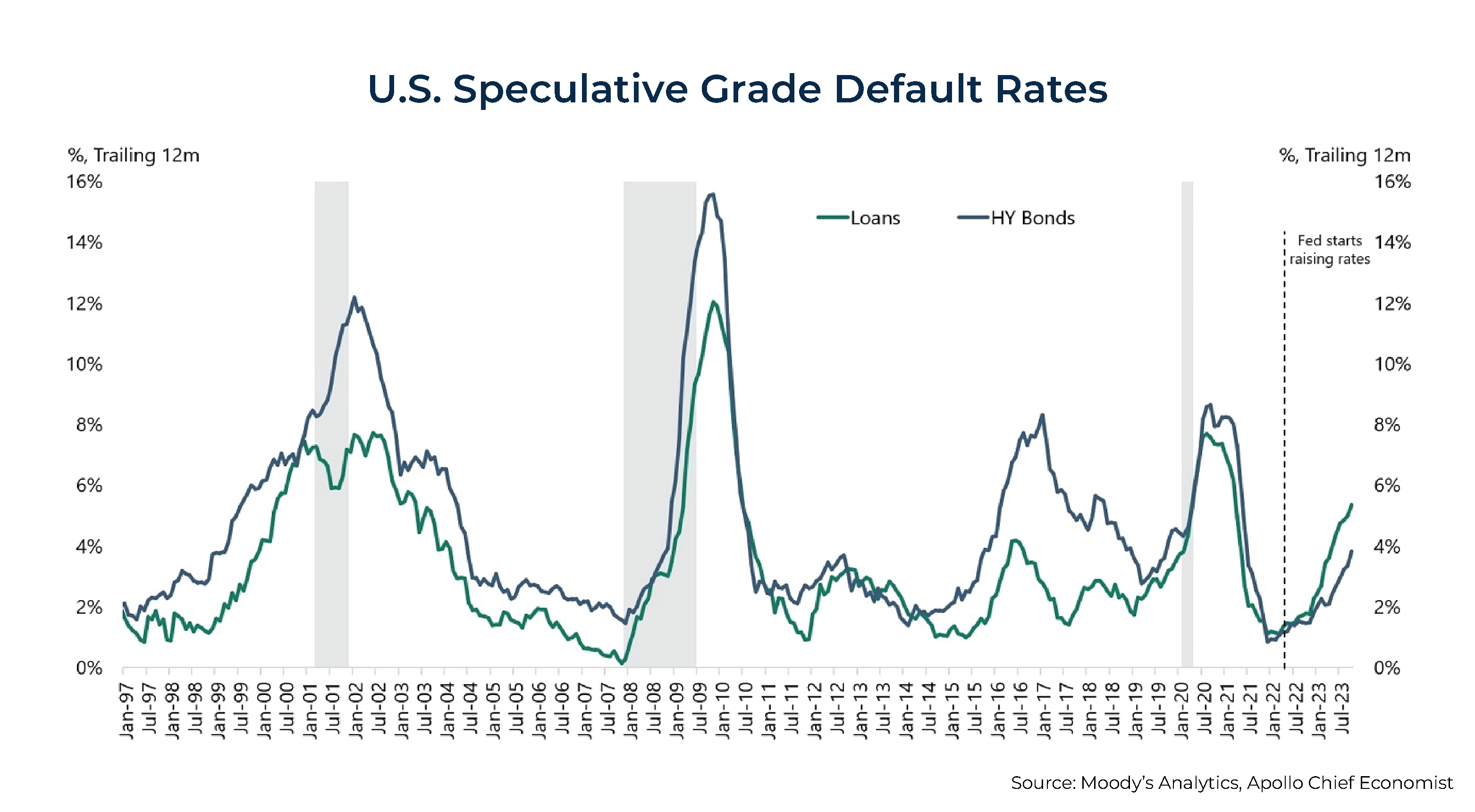

That is leading to an increase in default risk, with Chapter 11 commercial bankruptcies rising rapidly in November. The sharp rise in defaults in high-yield debt (see chart below) could lead to higher unemployment. According to Apollo Chief Economist Torsten Sløk, the "total employment of companies in the high-yield index is 11 million, and total employment of companies in the leveraged loans index is 8 million."

The sharp rise in defaults in high-yield debt (see chart below) could lead to higher unemployment. According to Apollo Chief Economist Torsten Sløk, the "total employment of companies in the high-yield index is 11 million, and total employment of companies in the leveraged loans index is 8 million."

We turn now to examining credit market conditions.

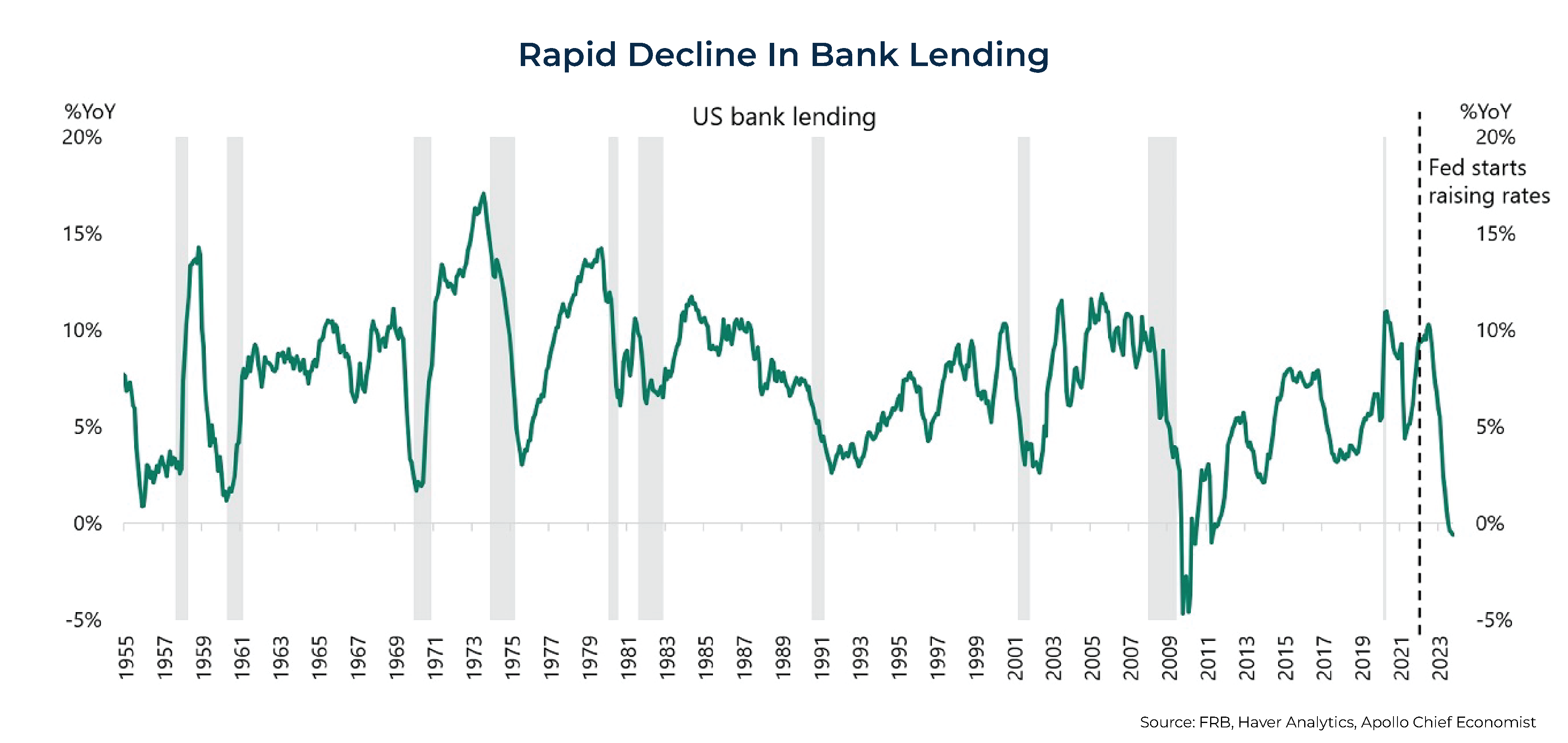

Bank Lending

Since the Federal Reserve started raising rates, lending growth has slowed (see chart below).

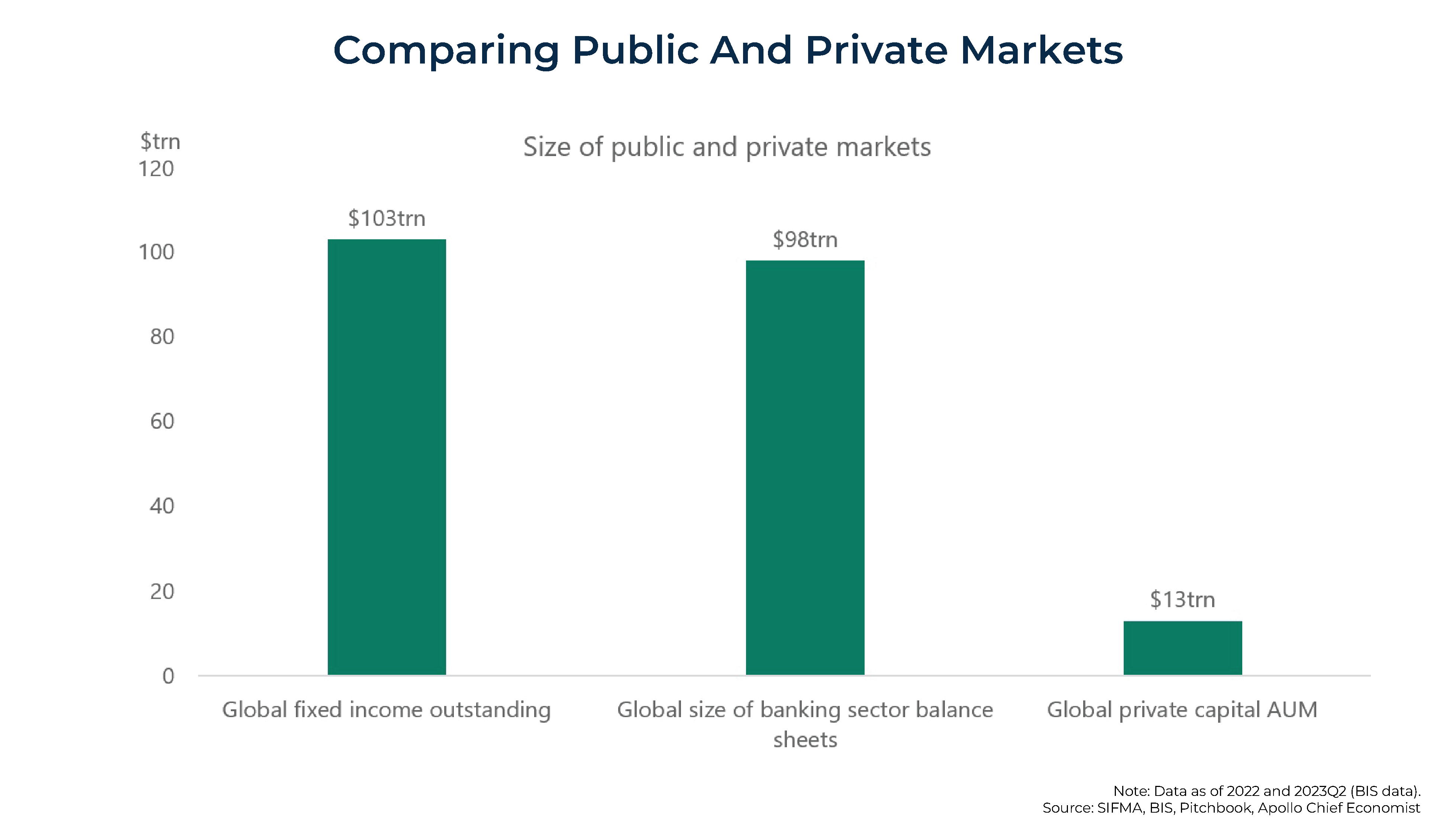

Private Markets

While private market lending activity is growing rapidly, it is not growing fast enough to replace bank credit and public credit markets, as it is growing much slower than global financing needs. While total global fixed-income assets are well over $100 trillion, private capital is only about $13 trillion. Since 2010, banks have increased lending by more than $5 trillion, as have investment grade markets, and high-yield markets have grown by about $500 billion; private credit assets grew by 'only' $1 trillion, and borrowing costs in private markets are much higher.

We turn now to discussing the loosening of the labor market.

Labor Market Conditions Are Loosening

A strong labor market has been supporting economic growth, though it is losing steam (at least it was until the strong job report released by the U.S. Department of Labor in November), as companies are now adding jobs at a slower pace, new and long-term unemployment claims are rising, wage growth has decelerated, there has been a decline in weekly hours worked, and the quits rate has fallen – all of which are leading to some pullback in consumer spending and likely slower economic growth.

However, there are several factors, as listed below, indicating that the upward pressure on wages has been reduced, which should lead to slower growth in wages and, thus, inflation.

- Since the Fed started raising rates in March 2022, job growth has steadily slowed, as shown in the chart below. In addition, the unemployment rate crept up from a low of 3.4% in January to 3.9% in October before dropping to 3.7% in November.

- Continuing claims for unemployment have been rising and have reached a 2-year high.

- The average work week is getting shorter.

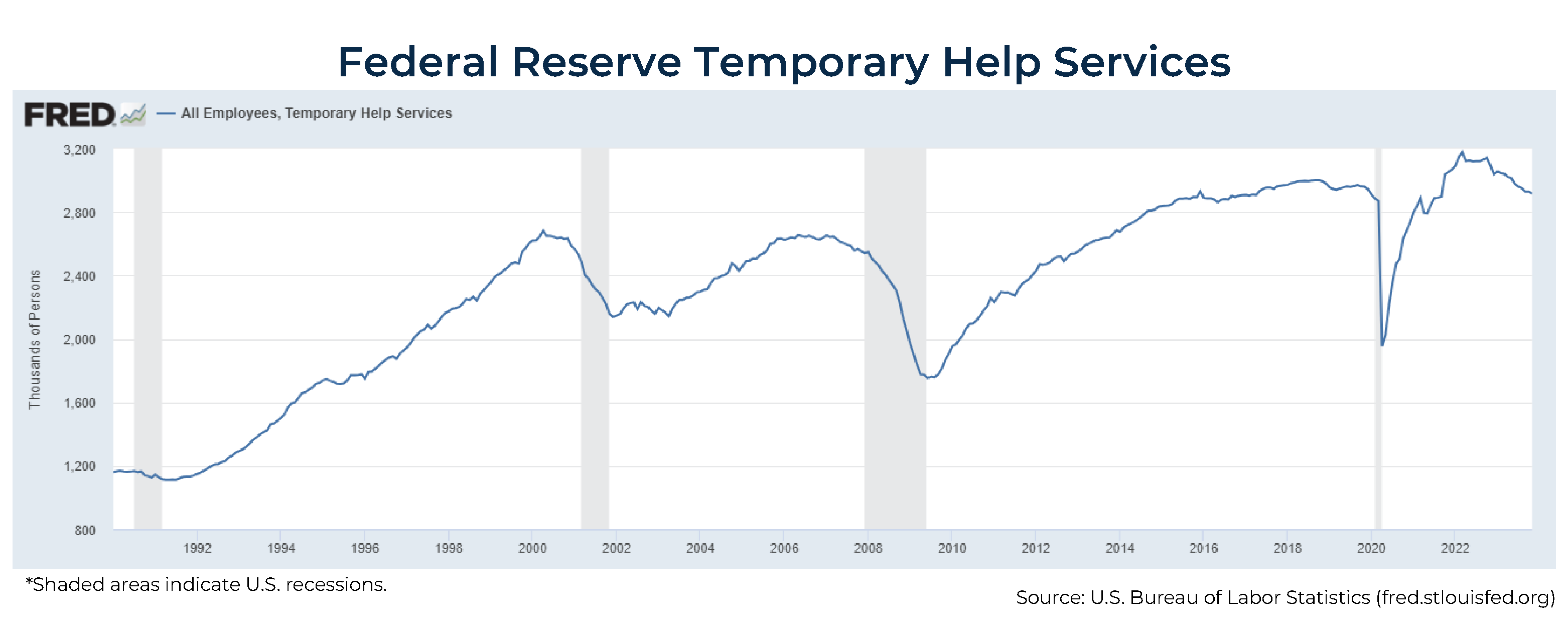

- As a forward-looking indicator (as the chart below indicates), the Federal Reserve's temporary help services turned down decisively before the 2001 and 2007 recessions. It began to turn down significantly in October 2022, about a year ago.

- There has been a drop in the number of job openings. Vacancies dropped to 8.7 million on the last day of October. Additionally, the quits rate has fallen, as workers are less confident about being able to find a new job.

- Jobs are getting harder to find, which is correlated with a rise in unemployment. The Conference Board's consumer confidence survey on jobs availability asks consumers whether they think jobs are plentiful or hard to get.

- Wage growth for job switchers is declining. This is a sign that overall demand for labor is slowing; with fewer open positions and more applicants, employers feel less pressure to offer significant pay increases to attract talent.

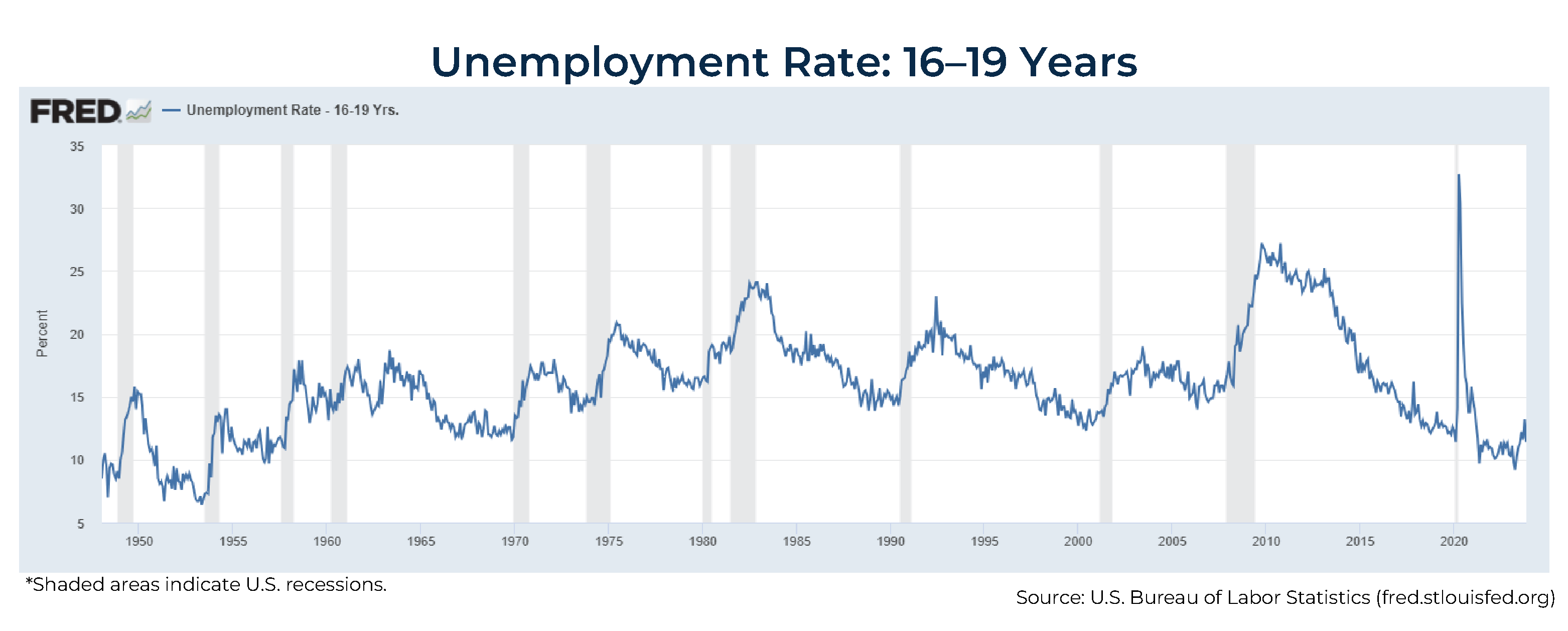

- Youth unemployment is rising rapidly. The unemployment rate for 16- to 19-year-olds increased from 9.2% in April to 13.2% in October before falling to 11.4% in November, a possible indicator of a weakening labor market.

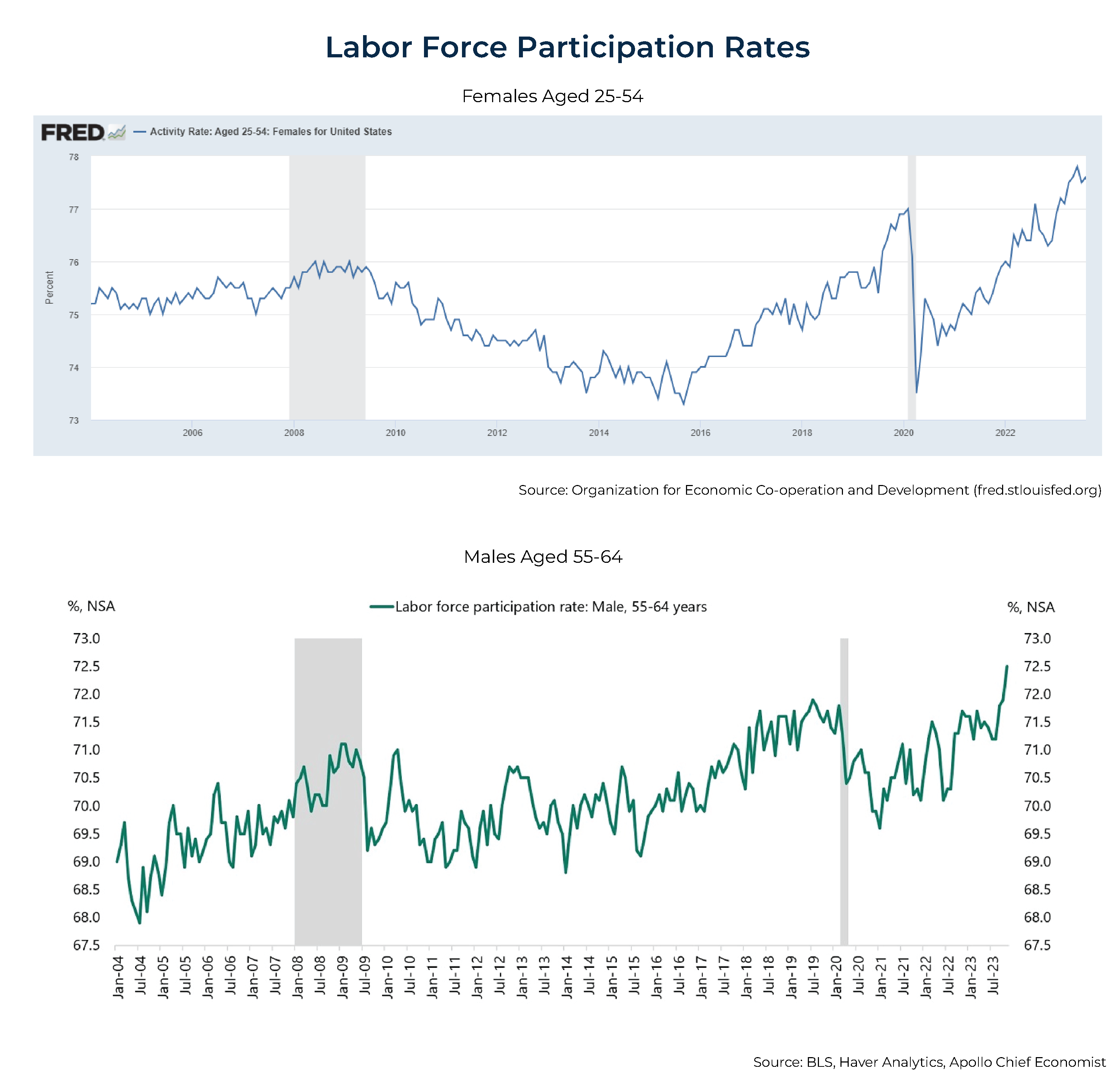

Another factor contributing to a less tight labor market is that the labor force participation rates have been increasing significantly since 2020, shown below for women ages 25-54 (to a record 77.6% in October) and men ages 55-64 (the highest level in at least 20 years). Rising wages and technology improvements allowing more people to work from home likely explain the higher participation rates, which increase the supply of labor.

However, despite the increase in labor participation rates, employment costs unexpectedly accelerated in the 3rd quarter, heightening concerns that a still-strong labor market risks keeping inflation above the Federal Reserve's target.

The Employment Cost Index (ECI), a broad gauge of wages and benefits, increased 1.1% in the July-to-September period after rising 1% in the 2nd quarter. When compared with the previous year, there was a 4.3% increase in the ECI, representing the most modest year-over-year growth since 2021. However, this growth rate is considerably higher than the average observed in the pre-pandemic years. Moreover, the jobs report for November indicated a 0.4% rise in wages for the month.

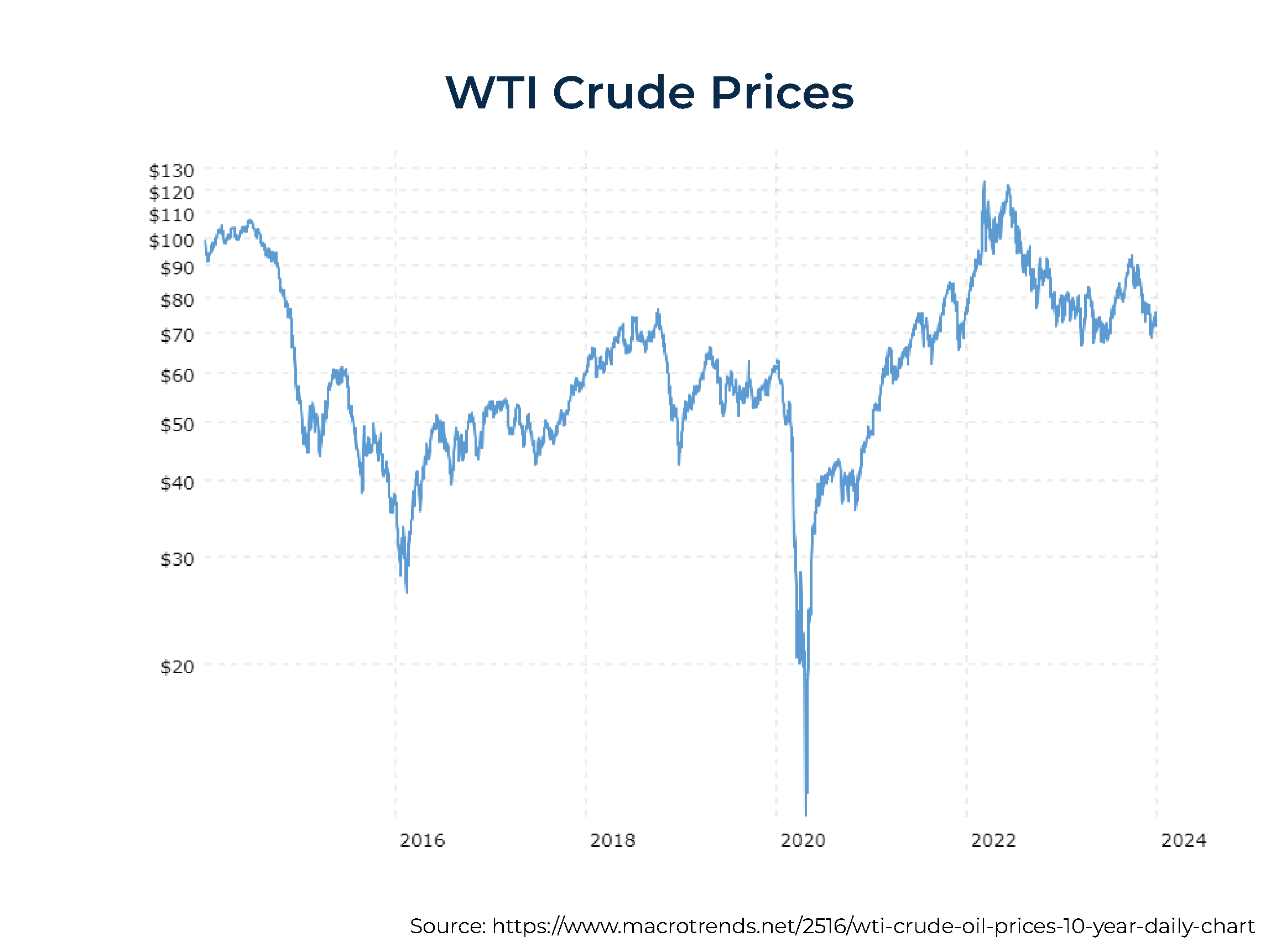

A positive sign in the outlook for inflation is the sharp decline in oil prices.

The Price Of Oil

The price of a barrel of West Texas Intermediate (WTI or NYMEX) crude oil had soared from its pandemic lows to just over $120 between March and June of 2022. However, by December 28, 2023, it had fallen to just about $73 – contributing to the sharp decline in inflation over that period. With that said, the Fed knows that energy prices are highly volatile. Thus, its focus is on the core CPI, which excludes both the volatile energy and food price components (more on that later).

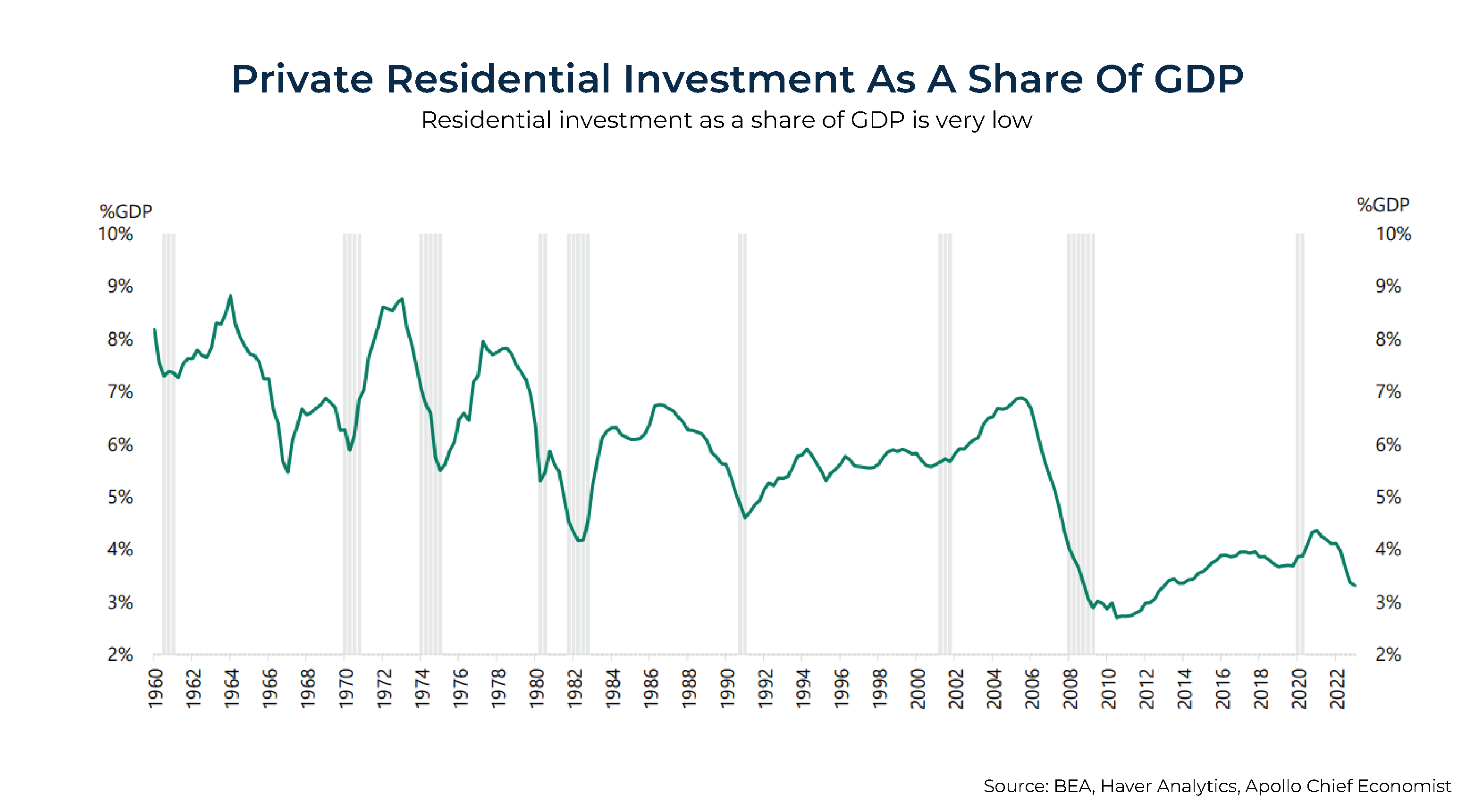

We turn now to the housing sector, an important though much smaller part of the economy than it was historically.

Housing

Housing construction's contribution to the GDP is currently at its historical low, having dwindled to roughly one-third of its level 60 years ago. At the same time, mortgage rates are at very high levels. This surge in rates has significantly impacted the housing market, with existing home sales in October dropping to their lowest level in 13 years, suggesting that this year could mark the weakest performance since 1992. The downward trend persisted into November, with a further 7.7% decline, the 10th straight month of decreasing sales. Despite these challenges, the inventory of homes for sale remains low, indicating that the housing sector poses limited downside risks to the overall economy.

Economic Outlook – Summary

While economic growth is likely to slow, there are no excesses of the type that led to the 2008 financial crisis nor any excesses in inventories. Thus, it doesn't seem likely that we will see a severe recession (a 'hard' landing), though a mild one (a 'soft' landing) is certainly possible. And it is even possible there will not be a recession at all (no landing).

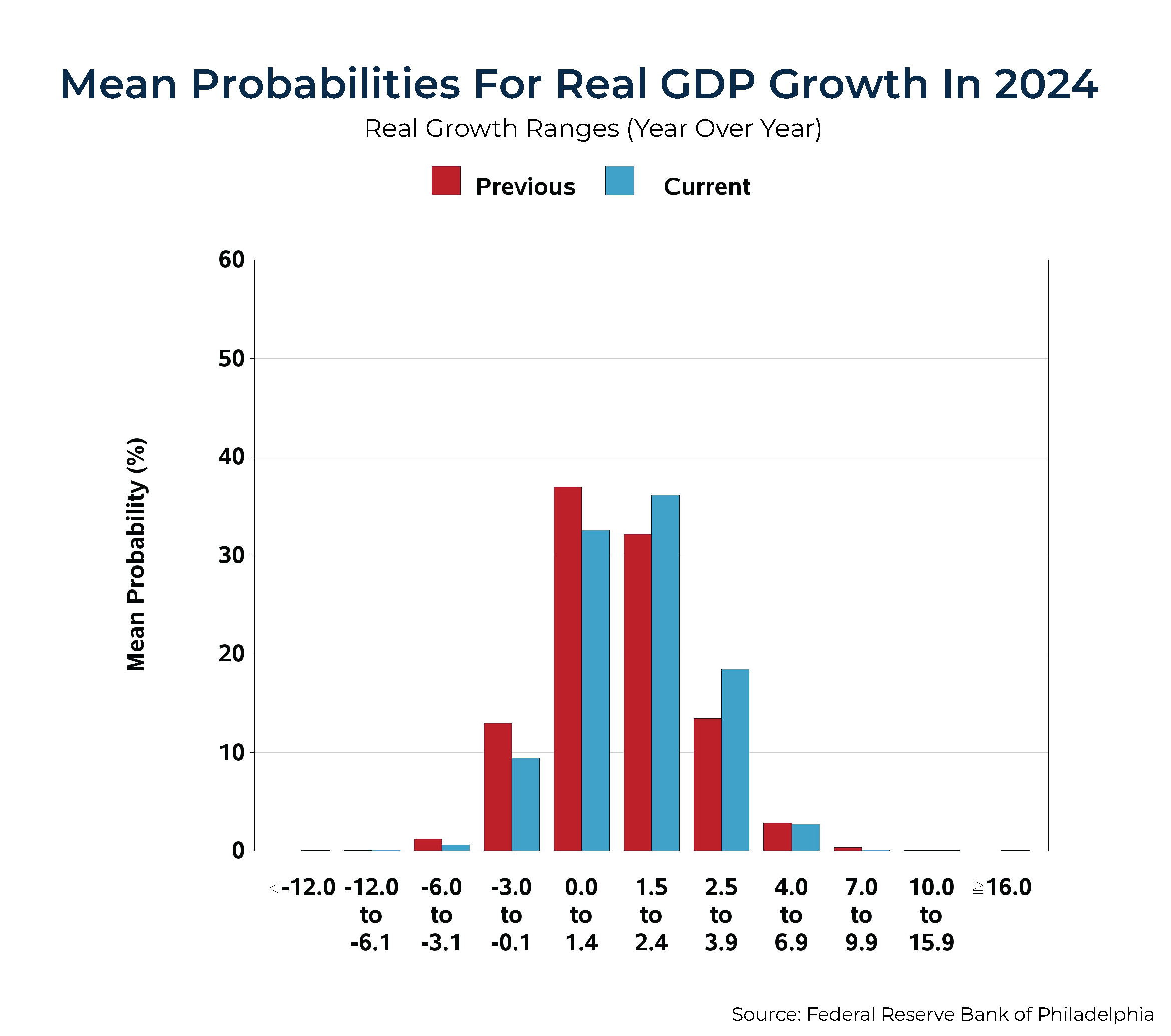

Having reviewed the positives and the concerns, and keeping in mind that everything we reviewed is well known by the markets (and thus incorporated into prices), what do professional economists forecast for the economy? The consensus forecast, from a survey of professional forecasters done by the Philadelphia Federal Reserve, should be considered 'the wisdom of crowds'.

Philly Fed's 4th Quarter 2023 Survey Of Professional Forecasters

The Federal Reserve Bank of Philadelphia released its 4th quarter 2023 Survey of Professional Forecasters on November 13, projecting that real GDP will grow 1.3% in 2024, down from its full-year 2023 forecast of 2.1%. The forecast does not include a single quarter of negative economic growth, let alone a recession, just a soft landing.

The following chart shows the mean probabilities of real GDP growth in 2024. It emphasizes the importance of thinking about forecasts not in terms of point estimates but as probabilities of a wide dispersion of possible outcomes (there are no clear crystal balls). With that in mind, the forecasters put the odds of a recession in 2024 as follows:

- 1st quarter: 40.9%

- 2nd quarter: 40.2%

- 3rd quarter: 36.8%

- 4th quarter: 34.7%

The forecast for unemployment is that it will rise from its current rate of 3.7% to 4.1% and will thus have no hard landing. But if unemployment doesn't rise, that would give the Fed more freedom to keep rates higher for longer, especially if inflation remains above its 2% target. And the forecast is for inflation to rise to 2.5% in 2024, remaining above target in 2025 at 2.3%.

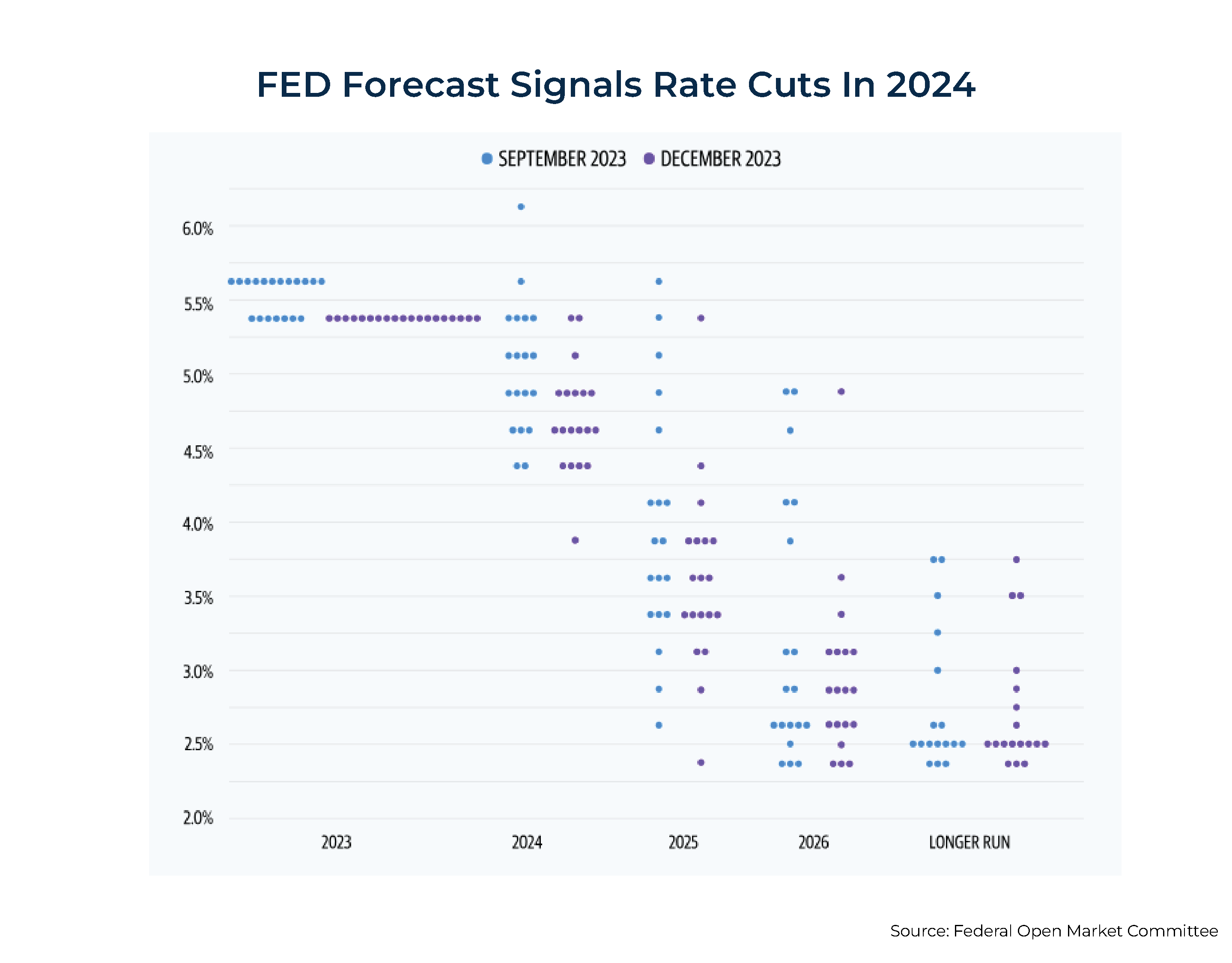

The Federal Reserve released its Summary of Economic Projections in its December 2023 meeting, which included the 'dot plot' graphic indicating each Fed official's expectations for future interest rates. It displayed a wide range of estimates on how much the Fed should cut rates next year. The median forecast called for cuts of 75 basis points; 8 anticipated fewer reductions, while 5 expected deeper cuts.

My own view is that Jerome Powell, the current chair of the Fed, wants to be remembered like former Fed chair Paul Volcker (who slew the inflation dragon in the 1980s) and not former Fed chair Arthur Burns (who allowed inflation to spiral in the 1970s). Thus, the Fed would like to keep rates at current levels until there's overwhelming evidence that inflation is beaten back or the economy is turning.

Having discussed the economic outlook, we turn now to discussing the problems of unsustainable budget deficits and the implications of the rising debt-to-GDP ratio.

U.S. Budget Deficits And Funding The Debt

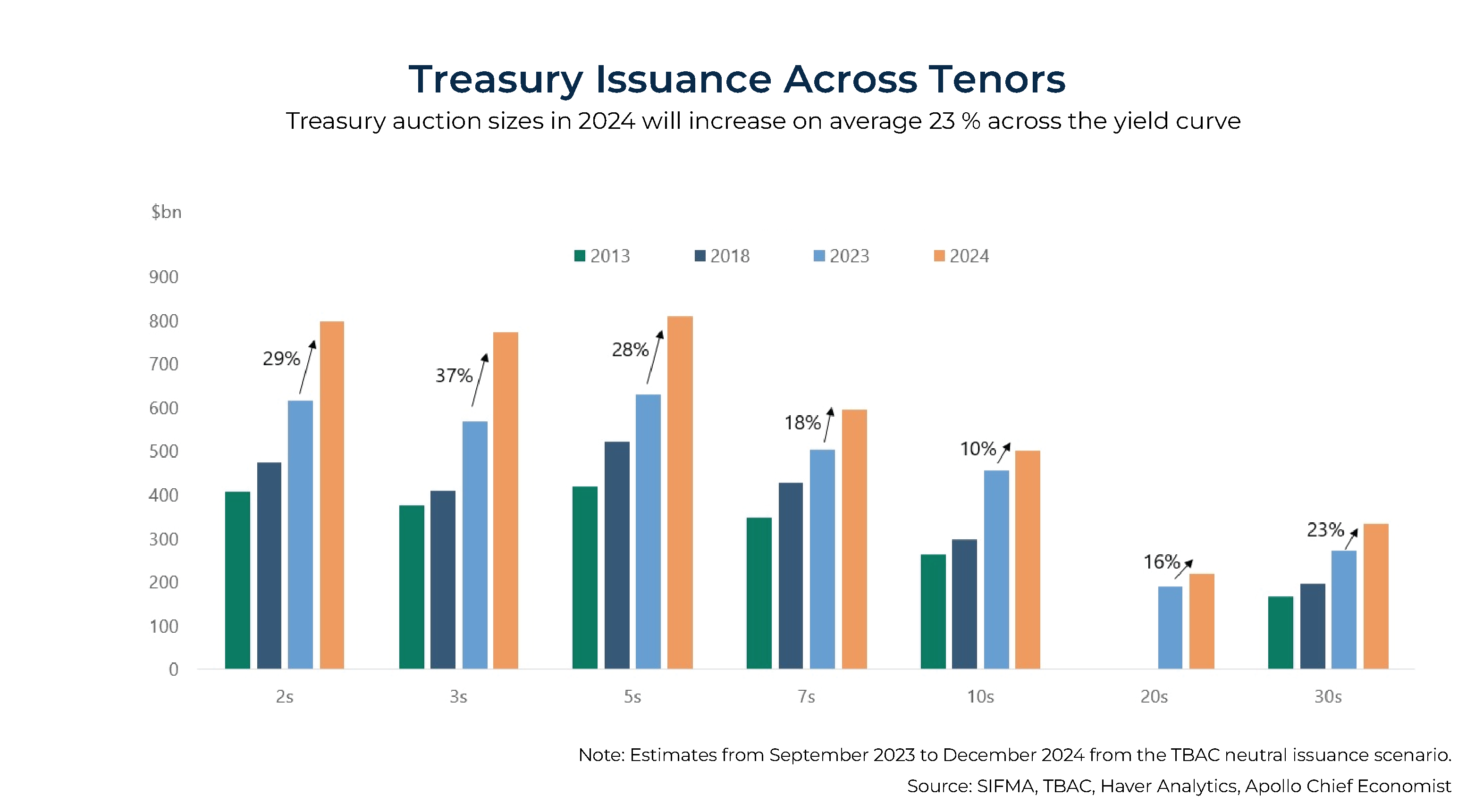

The huge fiscal deficits incurred by the Biden administration are leading to a dramatic increase in the size of the Treasury auctions. The Treasury Borrowing Advisory Committee forecasts that auctions will increase in 2024 on average by 23% across the yield curve. This dramatic growth in the supply of risk-free assets will pull dollars away from other fixed-income assets, including mortgages and corporate credit, as investors turn away from spread products toward Treasuries.

While the size of the auctions is increasing (the supply of bonds is rising), there have been 3 persistent sellers of Treasury securities (helping to explain the rise in interest rates until the November rally drove the yield on the 10-year note from a high of about 5% on October 19 to about 3.9% on December 15).

There are several additional reasons that may have contributed to the rise in rates from their lows (the 10-year yield was just 1.63% at the start of 2022). More importantly, they are reasons to be concerned about the future level of interest rates.

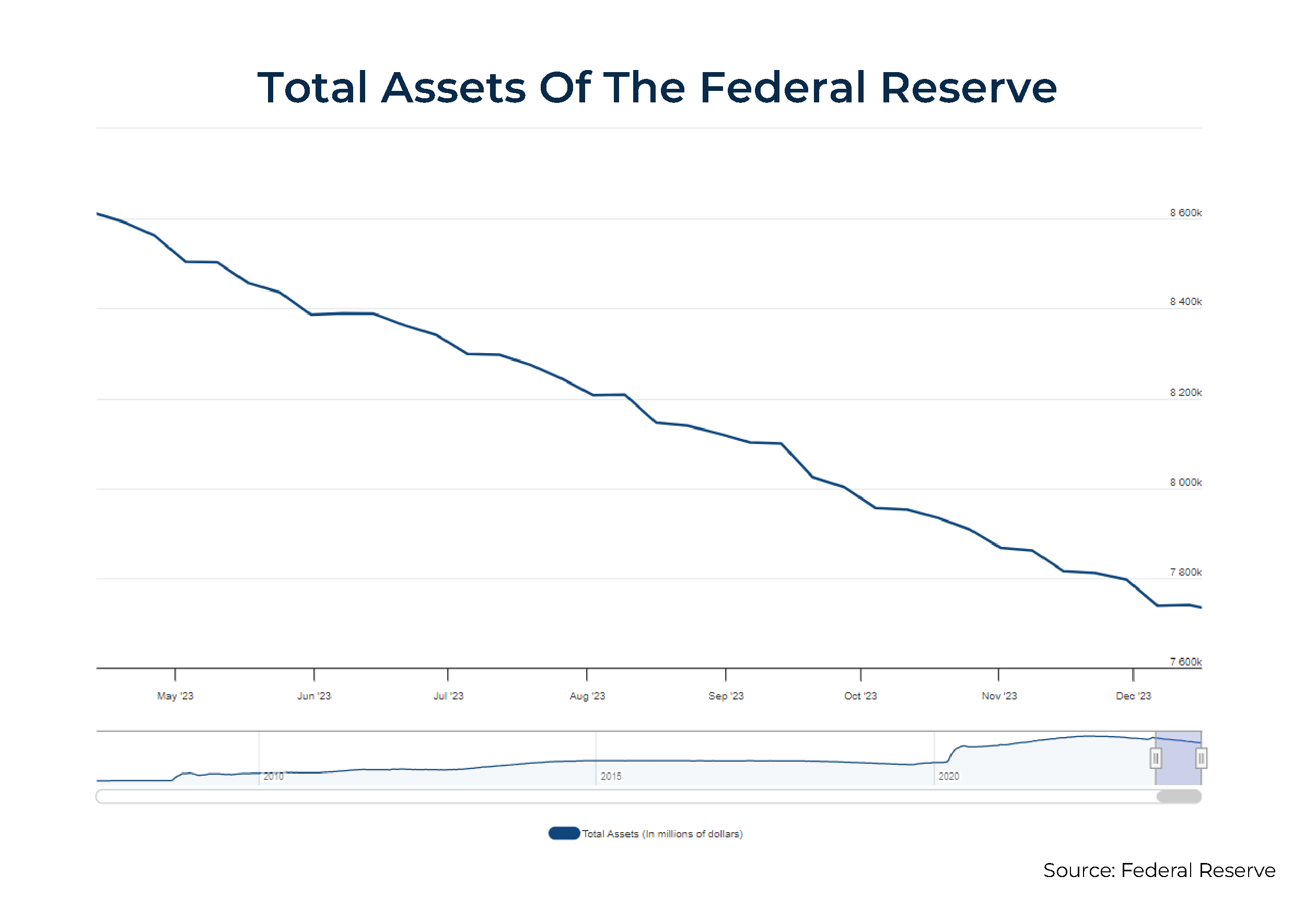

- In addition to raising interest rates, the Fed has been engaged in quantitative tightening (QT), shrinking its balance sheet by almost $100 billion every month since April 2023.

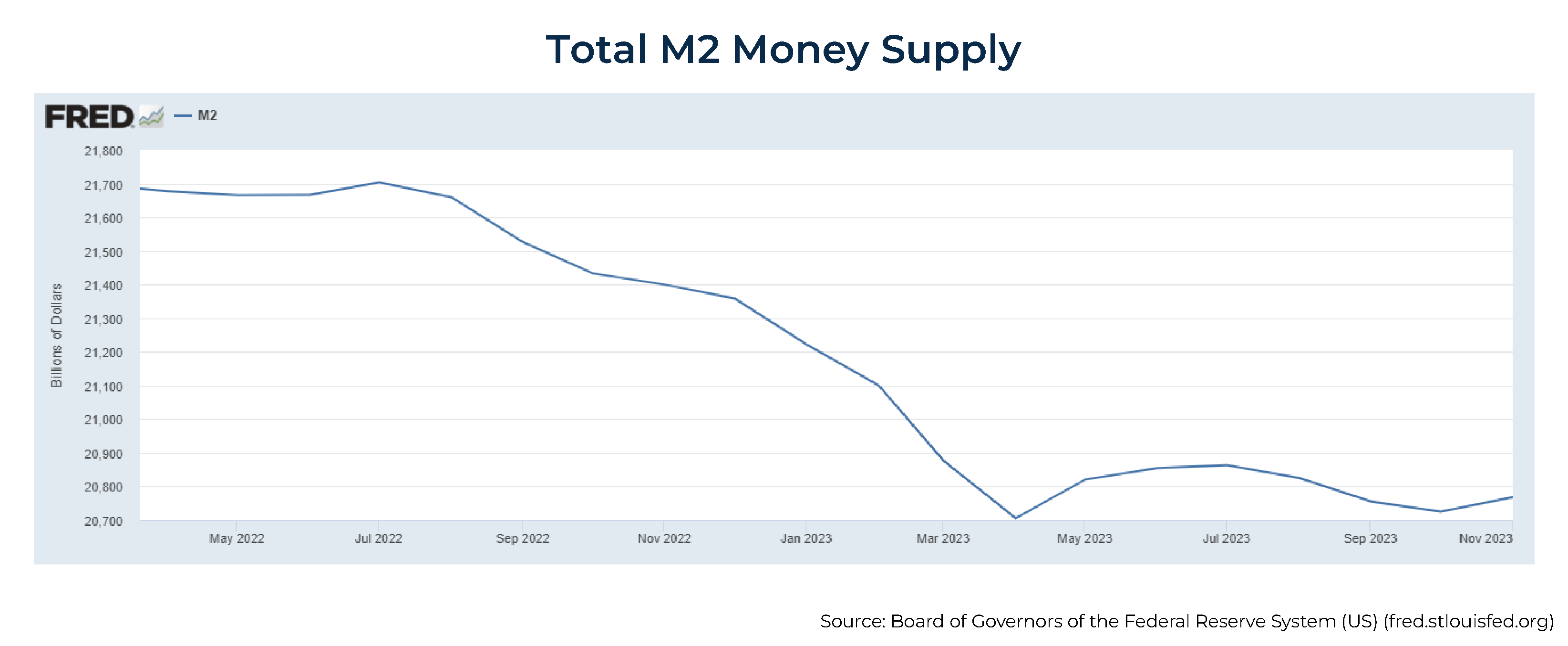

One result has been a drop in the money supply, which has been draining liquidity and pushing rates higher than they otherwise would be.

One result has been a drop in the money supply, which has been draining liquidity and pushing rates higher than they otherwise would be.

- Brazil, Russia, India, China, and South Africa (BRICS) are actively engaged in reducing their holdings of U.S. dollars as a reserve currency. Other countries are joining them, including Argentina, Iran, Saudi Arabia, Turkey, Venezuela, and other Gulf States countries. These countries have all taken steps to reduce their reliance on the U.S. dollar in international trade and finance. The result is that the share of U.S. dollar assets in central bank reserves dropped by 12 percentage points – from 71% when the euro was launched in 1999 to 59% by 2021. The sale of U.S. Treasuries by the central banks of these countries puts upward pressure on rates. And the total U.S. government debt owned by overseas private investors and central banks has fallen to about 30%, down from roughly 43% a decade ago.

- Among the largest holders of Treasury securities are U.S. banks. The commercial real estate crisis has created a capital problem for banks, especially regional banks. To raise liquidity, they could be forced to sell Treasury securities, the most liquid asset they hold. And Congress is considering raising the requirements for bank capital and implementing the final components of the international Basel III agreement, intended to enhance the oversight, regulation, and risk management within internationally active banks.

- While the Fed has been tightening monetary policy by raising rates and engaging in quantitative tightening, the Federal government has been engaging in massive fiscal stimulus, running a budget deficit of about $1.7, or about 6.3% of GDP at a time of full employment (when we should be running surpluses to slow economic demand). Excluding the impact of the aborted student loan cancellation program, the deficit would have been closer to $2 trillion (or about 7% of GDP), twice as much as it was the year before. The economy received a boost from the enactment of the 2022 CHIPS and Science Act and Inflation Reduction Act. The CHIPS and Science Act allocated about $280 billion to enhance U.S. domestic research and semiconductor manufacturing. This included $39 billion in manufacturing subsidies, 25% investment tax credits for equipment costs, and $13 billion dedicated to research and workforce training in the semiconductor field. Meanwhile, the Inflation Reduction Act provided $663 billion toward climate-related initiatives in the Federal tax code. These legislative measures have significantly stimulated the economy, spurring increased infrastructure spending during a period of full employment.

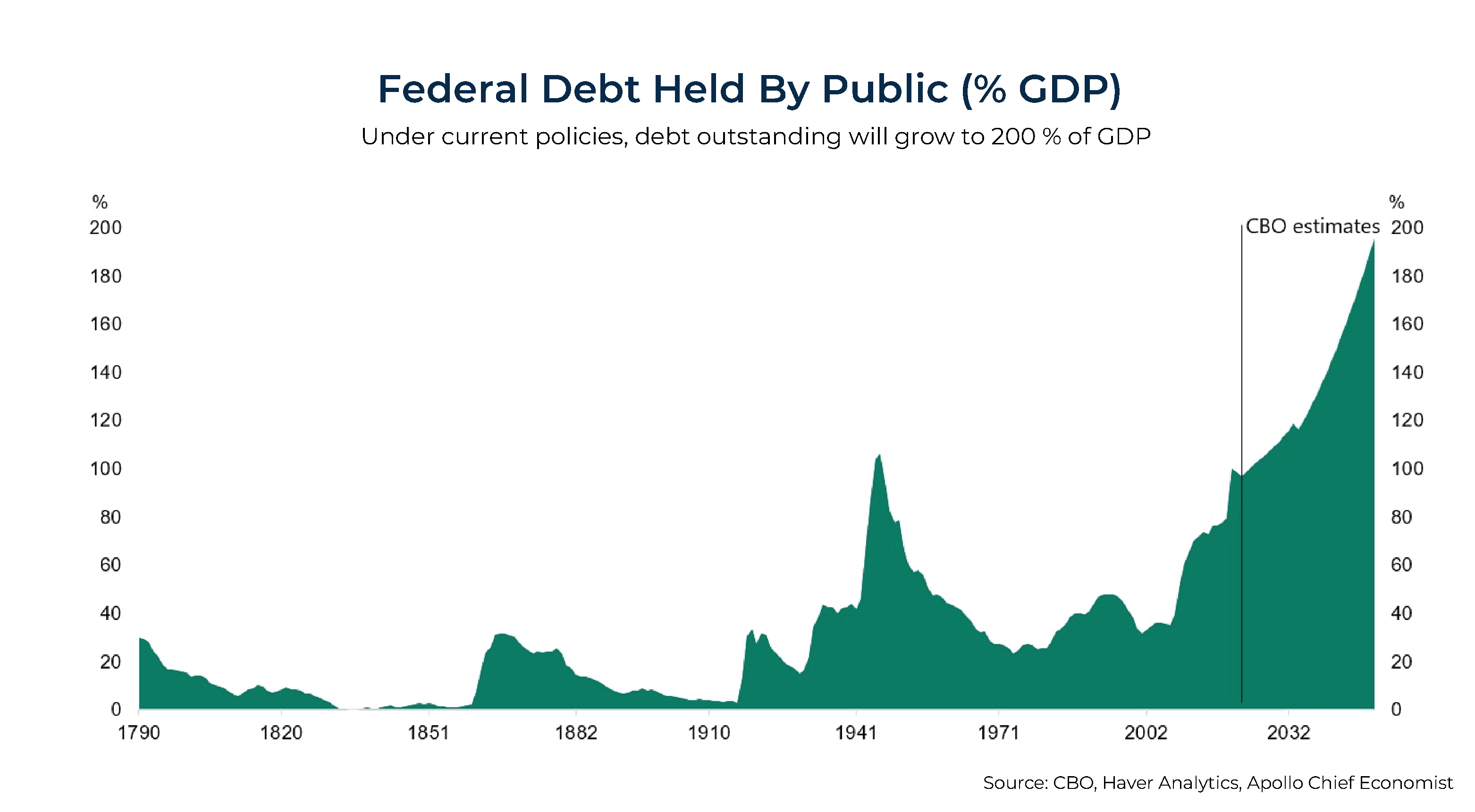

- The fiscal deficit, with U.S. debt-to-GDP now exceeding 100% and forecasted to continue rising, has led to the downgrading of our debt rating. That could lead foreign investors to demand a greater risk premium to hold Treasury securities, pushing rates higher. In addition, the deficit has led to the increasing supply of Treasury bonds that must be issued to fund it, putting upward pressure on rates. On November 10, Moody's lowered its U.S. credit rating outlook from "stable" to "negative", pointing to substantial fiscal deficits and reduced debt affordability. This adjustment comes in the wake of Fitch's August downgrade, a decision influenced by prolonged political disputes over the U.S. debt ceiling.

- The U.S. economy has been stronger than expected. As discussed earlier, the manufacturing sector, which accounts for only about 8% of employment, has been in recession since November 2022, but the services sector, which constitutes about 78% of GDP, has been persistently expanding. The continuing robust demand for consumer services is why inflation in the non-housing services sector continues to be so high, increasing the risk that rates will have to remain higher for longer. Consumer prices for durable goods have fallen on a year-over-year basis, helping to bring the November CPI level down to 3.1% year-over-year because the cost of services, particularly housing and auto insurance, have been rising at a faster pace; the year-over-year core CPI (which excludes the volatile food and energy sectors) increase was 4.0%. For instance, while shelter prices, accounting for approximately 1/3 of the CPI's composition, rose by 6.5% over a 12-month period, this annual rate has been consistently decreasing since reaching its peak in early 2023, with a 0.4% increase recorded in November.

- Japanese Yield-Curve Control (YCC) is ending. The Bank of Japan (BOJ) began the gradual phase-out of its 7-year YCC program in July, marking a significant move toward its eventual termination. YCC suppressed Japanese bond yields, increasing demand for higher-yielding assets such as U.S. Treasury bonds. The phasing out of YCC could be contributing to higher U.S. yields due to reduced demand from Japanese investors.

Having reviewed the issues, we turn now to what the future holds for interest rates.

What Does The Future Hold For Interest Rates?

As always, my crystal ball as to the future of U.S. interest rates remains cloudy. Many forecasters have called for a U.S. bond rally, believing that the Fed's tight monetary policy, with tightening credit standards in the banking system, will lead to a slowing economy, allowing inflation to fall toward the Fed's target of 2%. Providing further hope is that after growing rapidly in the post-COVID period, money supply growth (the fuel for inflation) has sharply declined and even turned negative.

However, there are risks that could lead to rates staying higher for longer or rising further. What can history tell us about future interest rates after episodes of rising inflation?

Rob Arnott and Omid Shakernia, authors of the study History Lessons: How 'Transitory' Is Inflation?, analyzed the behavior of inflation across 14 developed economies once a country's inflation rate surged past various thresholds and studied how long a burst of inflation typically lingered. Following is a summary of their findings:

- When inflation reached a 4% level, the lowest quintile of outcomes took less than 3 years to revert back to 2%. The reversion to 2% took at least 18 years at the highest quintile of outcomes. The median reversion to 2% took 8 years.

- When inflation reached the 4% threshold but did not exceed 6%, the 2nd threshold, the median reversion took 2 years to fall back to 2%. If the 2nd threshold was reached, then a protracted period of high inflation was observed to follow; the reversion back to a 2% target took an average of 15 years. If the level of inflation proceeded to the 3rd threshold of 8% and continued to accelerate, the average reversion to 2% was 16 years. If inflation failed to accelerate (cresting inflation), the reversion dropped to 3.5 years on average.

- For the highest thresholds from 18% to 20%, inflation tended to resolve much faster, possibly due to central bank intervention. However, the number of observations was insufficient to provide much confidence in the result. The worst quintiles observed at every level of inflation exhibited a reversion to 2% between 18 and 22 years.

Their findings led Arnott and Shakernia to conclude: "If history is a guide, inflation can take far longer to return to normal levels than most people realize."

While it is possible that the current phase of high inflation will be temporary (the CPI peaked at 9.1% in June 2022 and fell to 3.1% in November 2023, though the core year-over-year CPI increase was still 4.0%), it should not be taken as certainty, especially in light of the outlook for fiscal deficits.

What can historical yields and yield curves tell us about the future? 1-month Treasury bills have averaged a real yield of about 0.3%. To that, a forecast of long-term economic growth should be added, which, for the U.S., is about 1.8% (well below the longer-term average of about 2.5%). That puts the real yield for longer-term debt at about 2%.

However, an estimate for inflation must also be added. If you're an optimist, the floor should be 2% (the Fed's target), which would put the nominal longer-term yield at about 4%. If you are not as optimistic, and particularly if you are concerned about our inability to address the growing fiscal deficits and debt-to-GDP levels, you would forecast a higher figure, perhaps 3% or even higher. That would put the yield on longer-term debt above 5%. Another negative for rates could be an increasing risk premium demanded by foreign holders of dollar reserves. The risk that rates rise or fall is at least balanced at this point.

Those investors concerned about the future direction of interest rates and inflation should consider increasing their allocation to Treasury Inflation-Protected Securities (TIPS); it is now a particularly attractive time, as real yields are well above 2%. As of December 17, the yields on 5-, 10-, and 20-year TIPS were 1.74%, 1.69%, and 1.76%, respectively. Another option for those willing to accept some economic cycle (credit) risk and their illiquidity is to invest in private credit funds (such as Cliffwater's Corporate Lending Fund, CCLFX), which invest in floating-rate loans that are senior, secured, and sponsored by private equity firms. CCLFX has a duration of only about 1 month, a yield to maturity of about 12%, and a distribution rate of 11%.

Potential Headwinds

We turn now to additional risks investors should be aware of that could have significant negative impacts on the economy and markets.

- In addition to the geopolitical risks created by the ongoing wars in Ukraine and Israel and the increasing tension with China, increased nationalism (sometimes in the name of national security) is creating the risk of a 'tit for tat' trade war. That would not only slow global growth but increase inflation (via tariffs and other impediments to trade) and lead to increasing fiscal deficits (through tax incentives granted), increasing the risk of recession. The inappropriately named Inflation Reduction Act is a good example, with incentives to favor domestic purchases to which other nations will surely respond. This is a risk investors should not ignore.

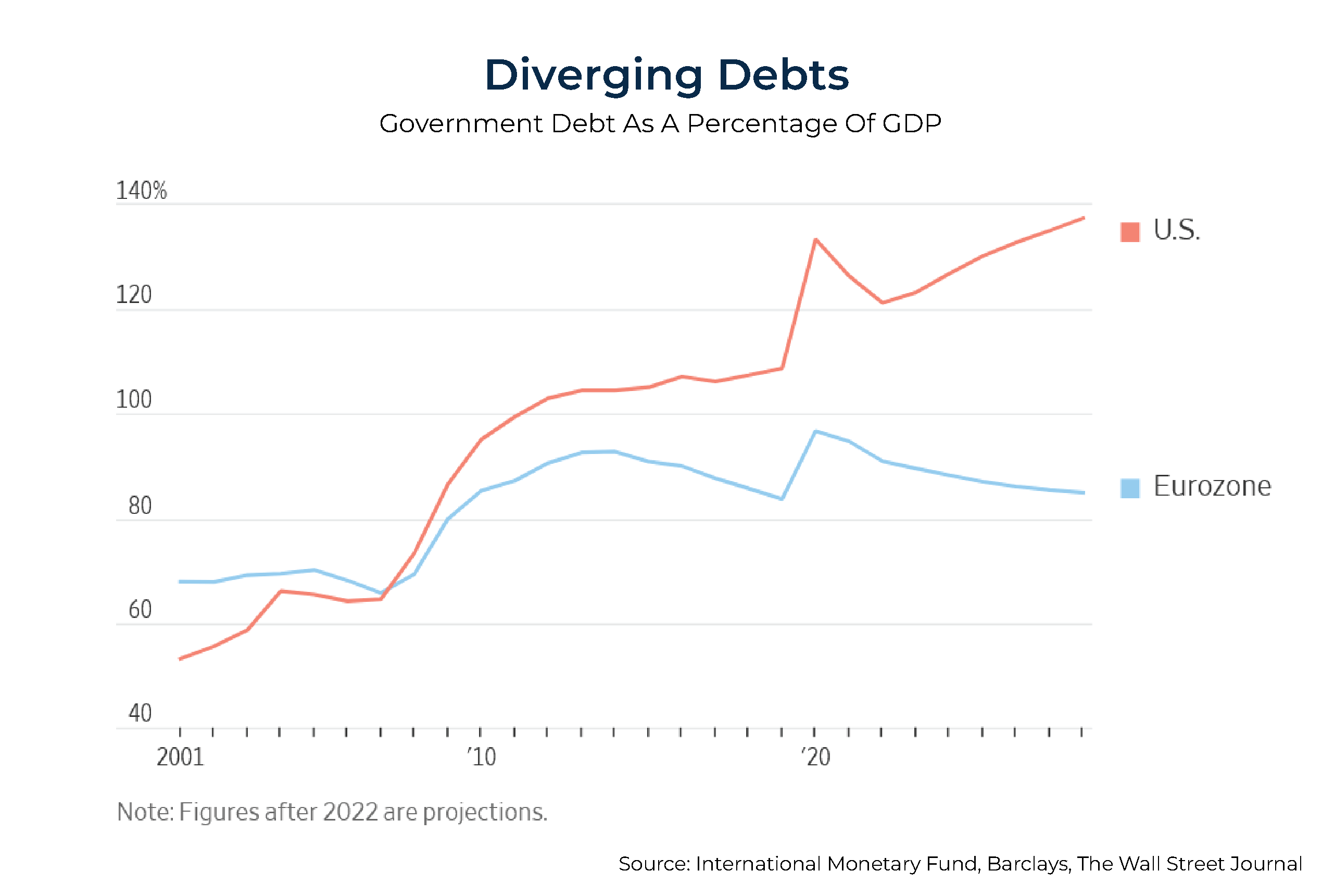

- The U.S. debt-to-GDP ratio is set to rise dramatically over the next few years. In projections released in October, the International Monetary Fund projects U.S. deficits will reach 6.8% of GDP in 2024, 7.1% in 2025, and remain above 6.6% through 2028. And under current policies, the Congressional Budget Office expects the debt to grow to 200% of GDP.

However, in Europe, it is a different picture. The IMF expects the combined deficits of eurozone governments to fall to 3.4% of GDP this year from 3.6% in 2022 and to 2.7% in 2024.

However, in Europe, it is a different picture. The IMF expects the combined deficits of eurozone governments to fall to 3.4% of GDP this year from 3.6% in 2022 and to 2.7% in 2024. Those countries that were in crisis a decade ago are expected to have much smaller budget gaps. In Greece, the deficit is forecast to fall to 1.6% of GDP from 2.3% last year, while Portugal's is expected to fall to 0.2% of GDP from 0.4%. Ireland is forecast to have a budget surplus for the 2nd straight year. Italy and France, among others, continue to have deficits of roughly 5% of GDP.

Those countries that were in crisis a decade ago are expected to have much smaller budget gaps. In Greece, the deficit is forecast to fall to 1.6% of GDP from 2.3% last year, while Portugal's is expected to fall to 0.2% of GDP from 0.4%. Ireland is forecast to have a budget surplus for the 2nd straight year. Italy and France, among others, continue to have deficits of roughly 5% of GDP.

Rising government debt levels can curb our ability to spend on technological innovation and even defense and, thus, national security, hurting our leadership position in the world.

Unfortunately, politicians seem unwilling to address the deficit problem, which will require significant increases in taxes and reductions in benefits. Thus, the conclusion investors should draw is that they will likely have to depend more on their own abilities to fund a secure retirement. - There is a risk of a government shutdown. The first expiration date of the Continuing Resolution (CR) passed in November to avoid a government shutdown is January 19. It would apply to the programs covered by the Agriculture, Energy-Water, Military Construction-VA, and Transportation-HUD bills. A 2nd expiration date follows shortly thereafter (February 2) and would apply to the programs covered by the Commerce-Justice-Science, Defense, Financial Services-General Government, Homeland Security, Interior-Environment, Labor-HHS-Education, Legislative Branch, and State-Foreign Operations bills. Besides extending appropriations, the measure also includes several policy extensions through January 19 for certain healthcare programs and a farm bill extension through fiscal year 2024.

In the coming years, a number of expected fiscal policy deadlines will require legislative responses from Congress. Many of the deadlines could bring additional costs if Congress acts irresponsibly, or they could present an opportunity for Congress to reduce deficits. Each of these presents risks to markets if Congress fails to pass budget agreements. And if they are not fiscally responsible agreements, it seems likely that the credit rating of the U.S. would be negatively impacted, further raising our debt servicing costs as investors demand a larger risk premium.

Each of these headwinds creates risks to the economy. Should any of them, let alone all of them, appear, the risk of recession would increase, with significantly negative implications for the already huge budget deficit.

We now turn to another potential headwind: economic, social, and geopolitical problems for the world's 2nd-largest economy.

China

China is by far the largest exporter and is the top trading partner for 120 countries. Thus, it is critical to the global economy. 8 areas of concern are discussed below.

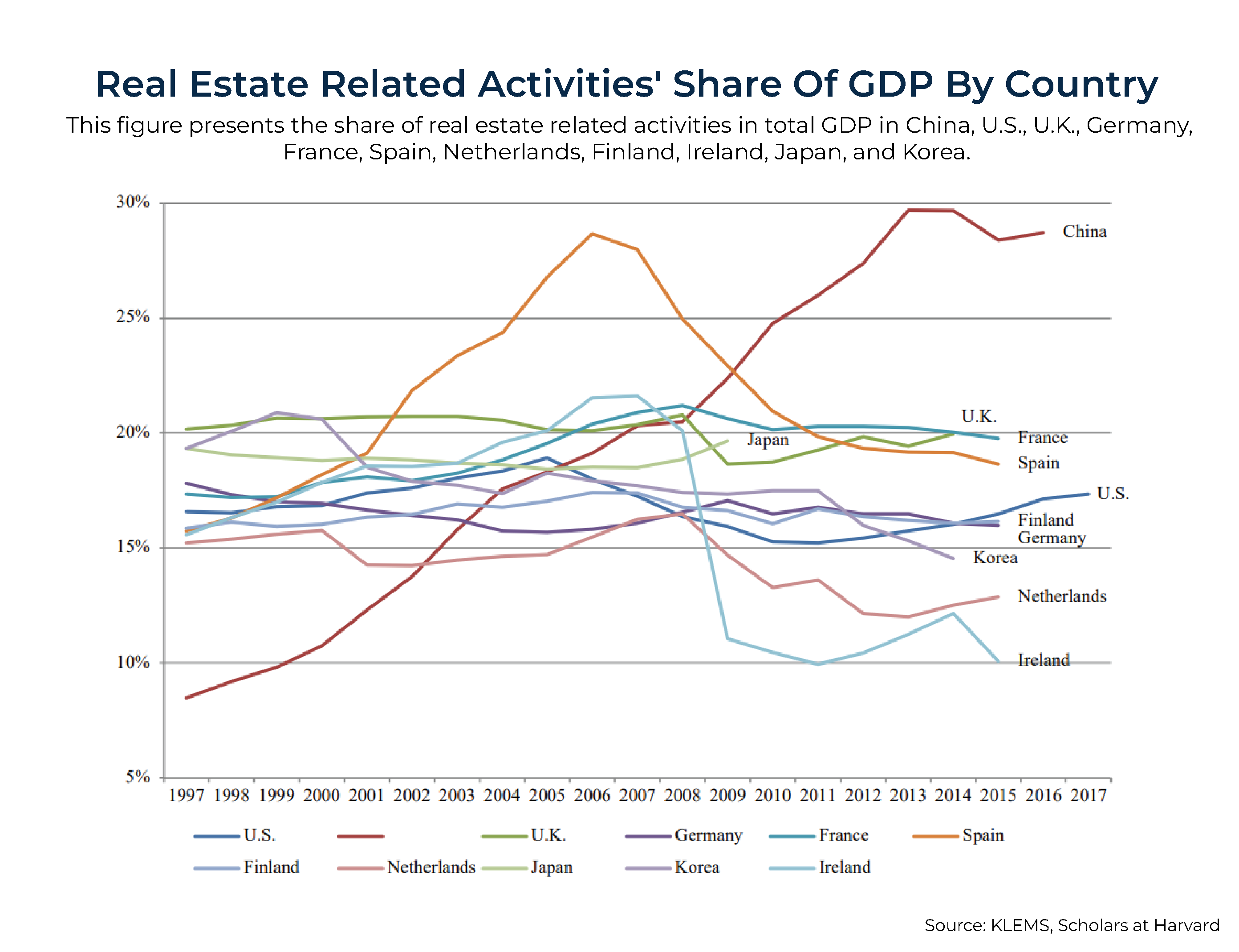

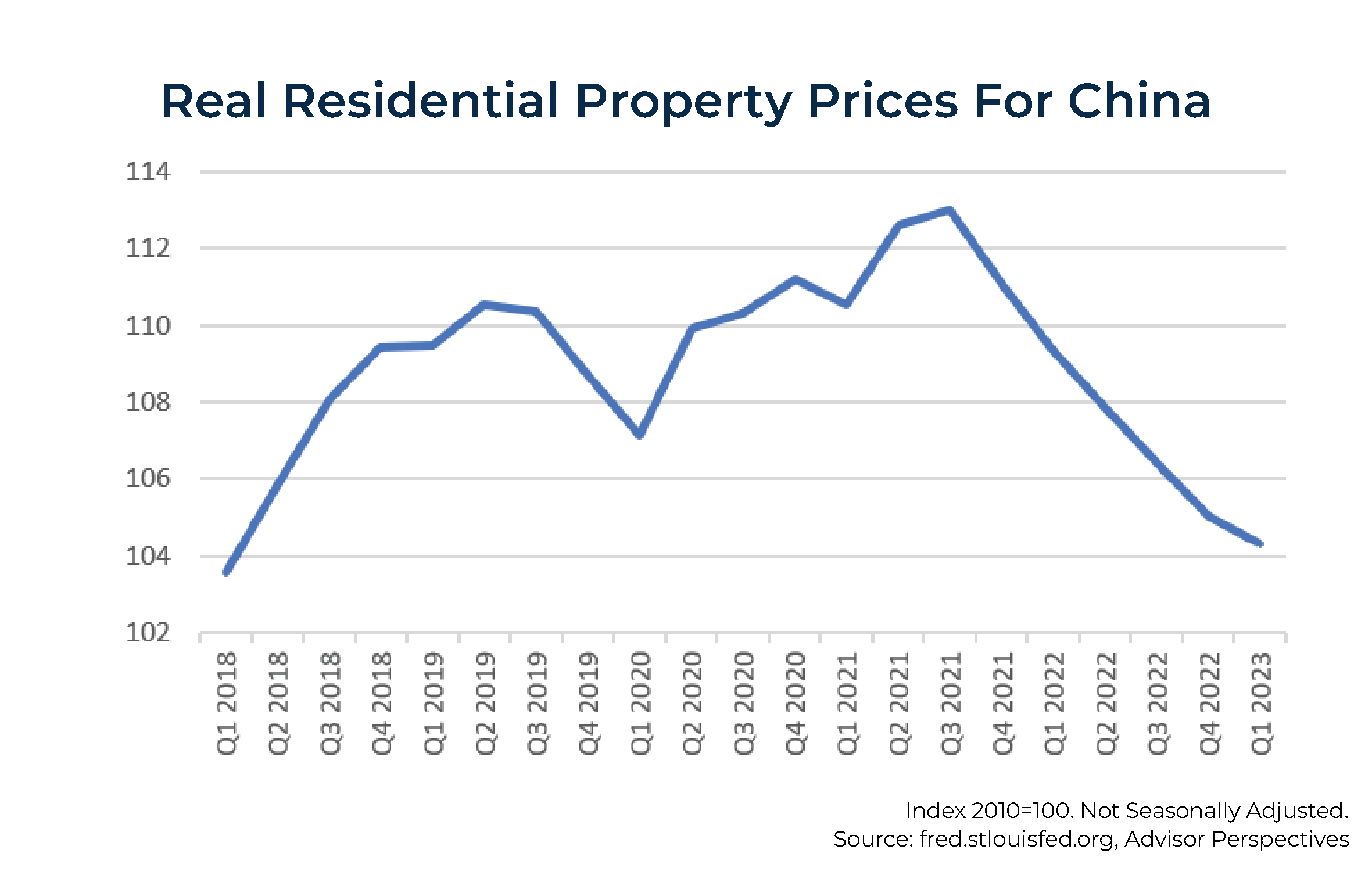

- Real estate. Real estate is more important in China than in the rest of the developed world because the Chinese have a much higher percentage of their net worth invested in real estate versus stocks and bonds.

And the property market is suffering.

And the property market is suffering.

- Hidden debt problem. China's cities and provinces have accumulated a massive amount of hidden debt. The International Monetary Fund and Wall Street banks estimate that the total outstanding off-balance-sheet government debt is around $7 trillion to $11 trillion, a significant amount of which is at high risk of default. With economic growth slowing, it will become harder for local governments to meet their obligations. In reaction, Moody's Investors Service lowered its outlook in December on China's credit rating (A1, 4 notches below AAA) to negative from stable, citing China's economic growth.

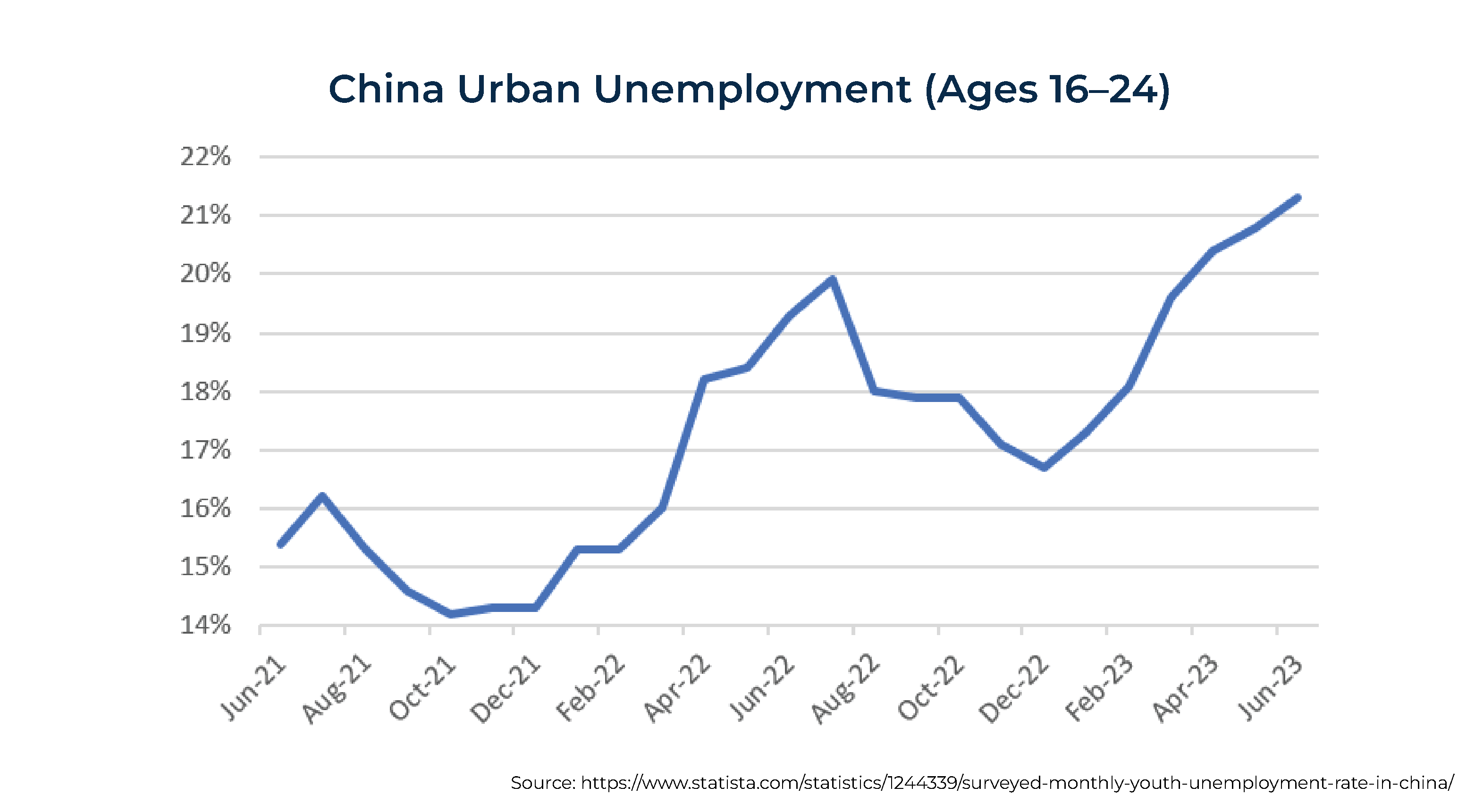

- Soaring youth unemployment.

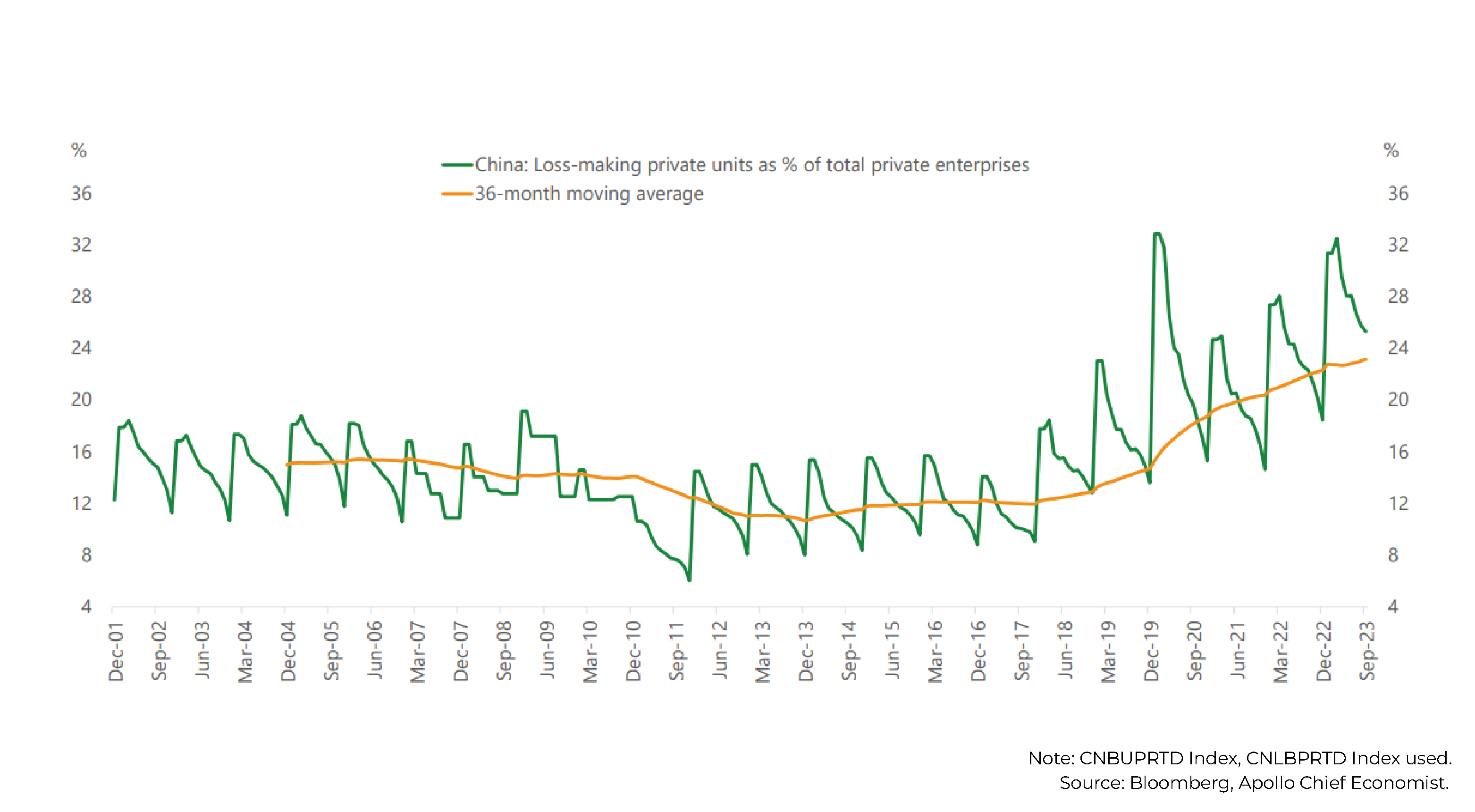

- An increase in Chinese private firms losing money.

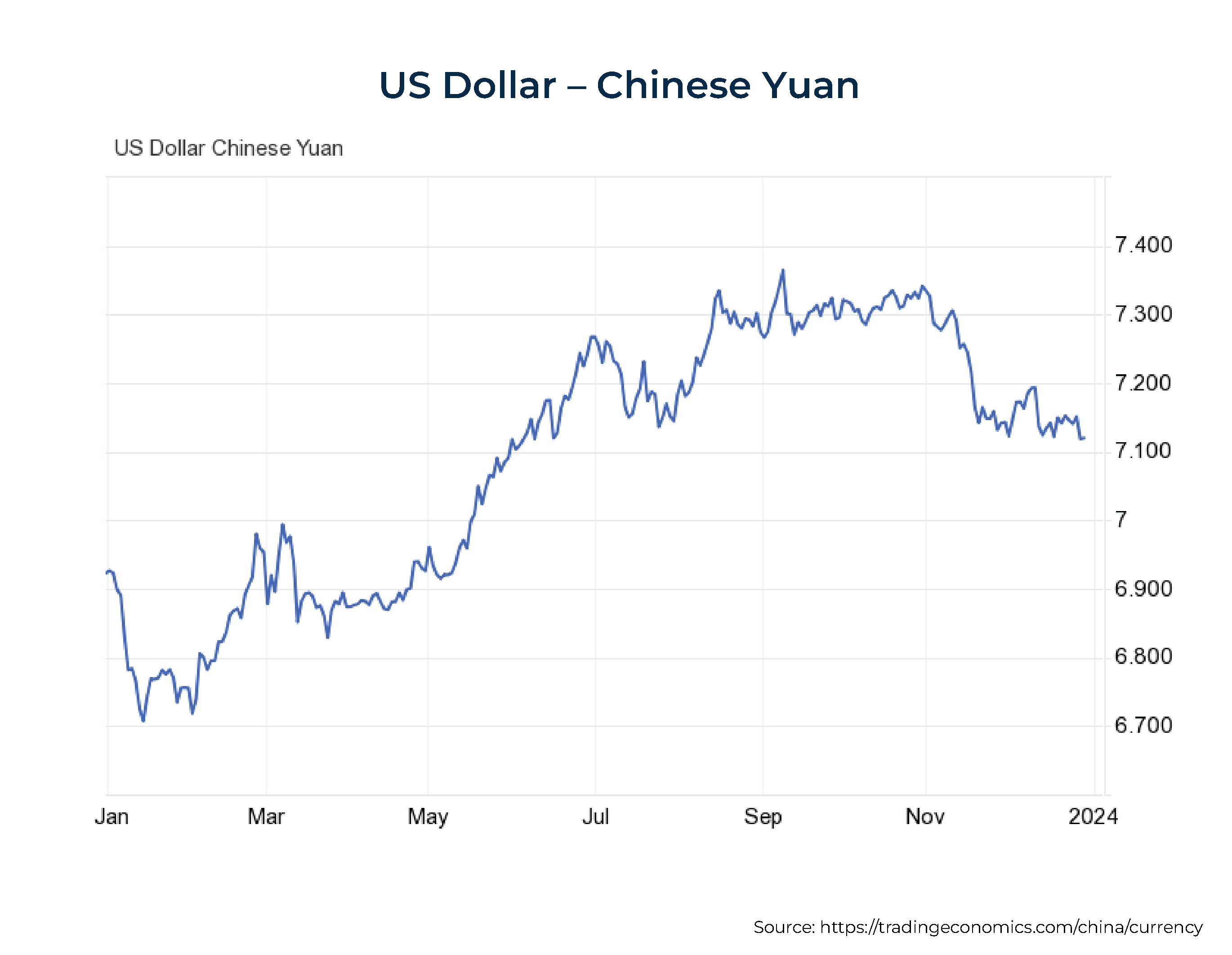

- Foreign companies are withdrawing earnings. International companies withdrew over $160 billion in total earnings from China across 6 successive quarters through the end of September. This surge in profit repatriation resulted in negative foreign direct investment in China for the first time in 25 years during the 3rd quarter. These outflows have added pressure on the Chinese yuan, which has weakened by approximately 3% against the U.S. dollar as of December 28 (standing at 7.1163), reaching its weakest point in over 10 years at about 7.36 in September.

Foreign institutions have cut their holdings of yuan-denominated Chinese bonds by the equivalent of more than $110 billion since the start of 2022 after accumulating the securities for years. Global investors have also become net sellers of stocks listed in mainland China. From August to October, they pulled more than $23 billion from yuan-denominated shares.

Foreign institutions have cut their holdings of yuan-denominated Chinese bonds by the equivalent of more than $110 billion since the start of 2022 after accumulating the securities for years. Global investors have also become net sellers of stocks listed in mainland China. From August to October, they pulled more than $23 billion from yuan-denominated shares. - Depressed stock prices.

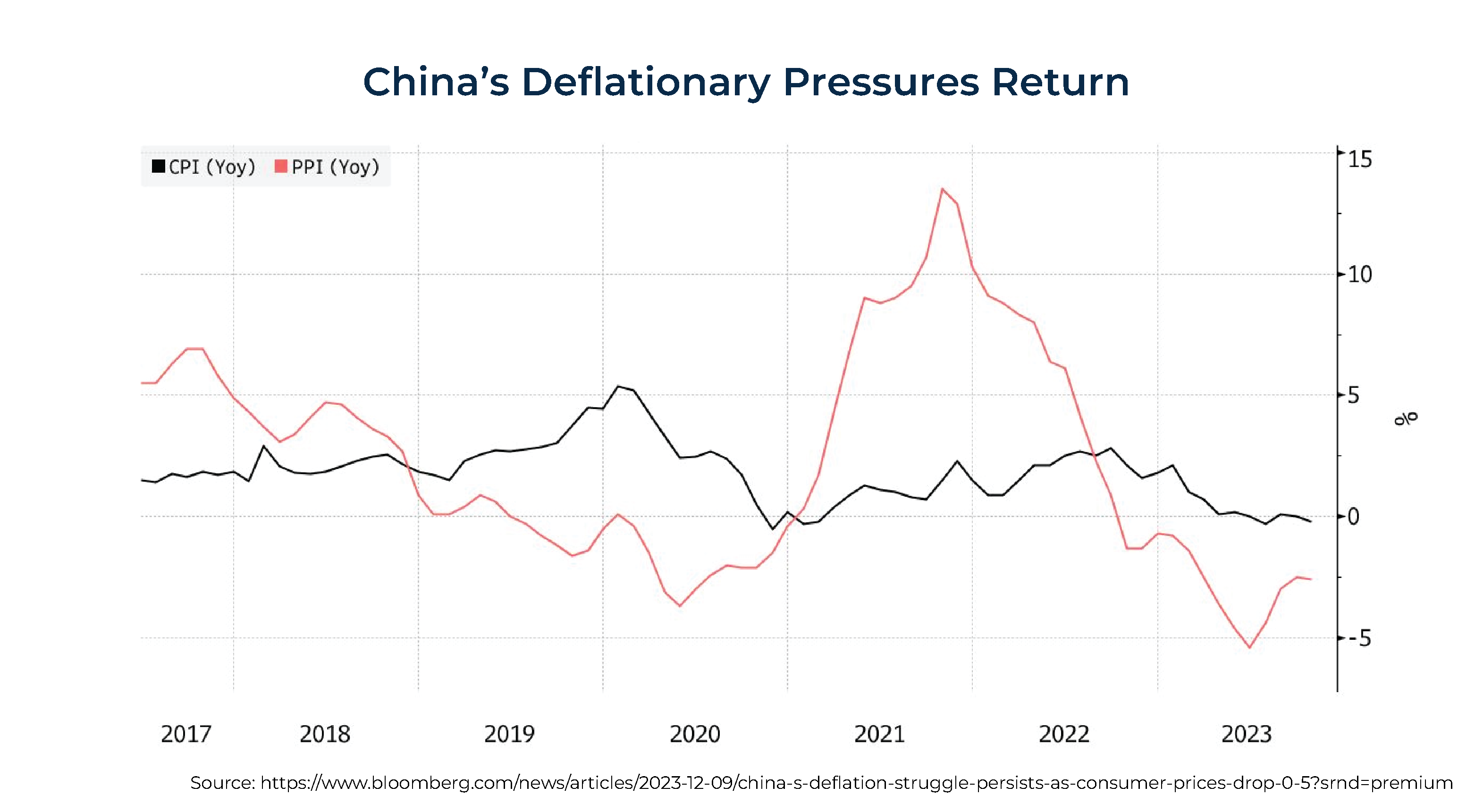

- Weak demand leading to deflation. Consumer prices fell 0.5% in November, and producer prices fell for a 14th straight month, dropping 3.0%. Note that as the world's largest exporter, China is thus exporting deflation to the rest of the world, helping to bring inflation rates down.

- Consumer confidence has collapsed.

In summary, given the problems facing China, it doesn't seem likely that its economy will provide a boost to world economic growth. And while the economic outlook is troublesome, depressed equity prices already reflect that. The trailing 12-month P/E of the iShares MSCI China ETF (MCHI) is under 10 (9.6 on December 17).

We turn now to the outlook for equities.

Equity Markets Outlook

While the S&P 500's return through December 17 was about 24%, the performance of the Magnificent 7 was responsible for the vast majority of the returns. That performance has been greatly impacted by investors' fascination with the AI' story'. However, history provides cautionary warnings about sky-high valuations driven by 'stories'.

As the table below demonstrates, with an average P/E of 50, the valuations of the Magnificent 7 are now reminiscent of the high valuations of the Nifty 50 and the dotcom stocks just prior to their crashing. While not a forecast of a crash, it is a warning that, at the very least, these stocks, which currently make up about 30% of the total market cap of the S&P 500, are at historically extreme valuations. Fortunately, the rest of the market has valuations that are much closer to their historical averages.

While investors have many reasons to be less than optimistic as most central banks around the globe continue to engage in more restrictive monetary policy to fight inflation, valuations generally already reflect that concern. As of December 17, Yahoo Finance showed that Vanguard's U.S. Total Stock Market ETF (VTI) had a trailing 12-month price-to-earnings (P/E) ratio of 22.1 (about its average over the last 40 years). Excluding the Magnificent 7 would lower that figure significantly. In contrast, Vanguard's Total International ETF (VXUS) had a P/E of 12.5, well below its historical average (for example, from 1996-2023, the MSCI EAFE Index had an average P/E of about 21). Similarly, its Emerging Markets Stock Index ETF (VWO) had a P/E of just 11.2.

Value stocks are trading as if we are already in a serious recession. As examples, Avantis' U.S. Small-Cap Value ETF (AVUV) was trading at just 7.6 times earnings; its International Small-Cap Value ETF (AVDV) was also trading at a multiple of 7.3; and its Emerging Markets Value ETF (AVES) was trading at a multiple of just 7.6. On the other hand, the large growth stocks are trading at historically very high valuations. For example, the Vanguard Growth ETF (VUG) was trading at a P/E of 37.1. And note that over the last quarter, the P/Es of the 3 value ETFs have gotten cheaper, while the P/E of VUG rose almost 25%!

Don't let recency bias keep you from investing in asset classes that have performed relatively poorly, such as international stocks (relative to U.S. stocks) and U.S. small and value stocks (relative to U.S. large and growth stocks). Their valuations are now trading at historically large discounts, increasing the odds that they will outperform going forward.

Another favorable development for international equities is that in the eurozone and Japanese equity markets, earnings growth and dividends accounted for more than 60% of returns this year compared with only 40% in the U.S – returns in the U.S. have been driven primarily by multiple expansions (enthusiasm for the AI story), leading to a large increase in valuations of tech names, while the impact on earnings has yet to show up to the same extent.

Remember that for stocks, it doesn't matter to markets whether the future news is good or bad, only whether it is better or worse than expected. The markets appear to be anticipating the worst possible outcomes, at least for value stocks, as valuations are near levels reached at the depth of the Great Recession.

We turn now to the outlook for corporate profits. What will happen to them, given what seems likely to be a slowdown in economic activity while labor markets remain tight (which could put pressure on wages and hurt profit margins)?

Corporate Profits

In 2022, the earnings of the S&P 500 companies were $219.49. The December 15, 2023, forecast from FactSet called for an increase of just 0.6% to about $221. With the S&P 500 at about 4,700, that's a P/E of about 21. According to FactSet, analysts are expecting earnings growth in 2024 of 11.5%. That would put calendar 2024 earnings at about $246 – a forward-looking P/E of about 19. Keeping in mind that corporate earnings have historically grown in line with the growth in GDP, that creates an enigma – either the stock market is right, or the bond market is right.

The bond market's inverted yield curve, with 1-month Treasuries yielding about 5.5% and the 10-year Treasury yielding about 3.9% (as of December 17), indicates that the bond market is expecting the Federal Reserve to cut rates several times due to slowing inflation and/or a weakening economy. In 2024, the Philly Fed Survey of Professional Forecasters expects the economy to grow by just 1.3% and inflation to increase by 2.5%. That's a total increase in GDP of just 3.8%, which is inconsistent with a forecast of 11.5% in earnings growth – unless there is a dramatic increase in productivity, perhaps from AI.

On the other hand, it's also possible that corporate profits get squeezed because of wage pressures and a slower economy. Should that occur, equities, at least the high-priced growth stocks, could come under significant pressure as earnings fall short of forecast. While my crystal ball remains cloudy, historically, the bond market has been a superior predictor to the stock market – one logical explanation being that the bond market is dominated by sophisticated institutional investors, while the stock market can be more influenced by naive retail investors who tend to trade more on 'noise' and emotions and are subject to recency bias.

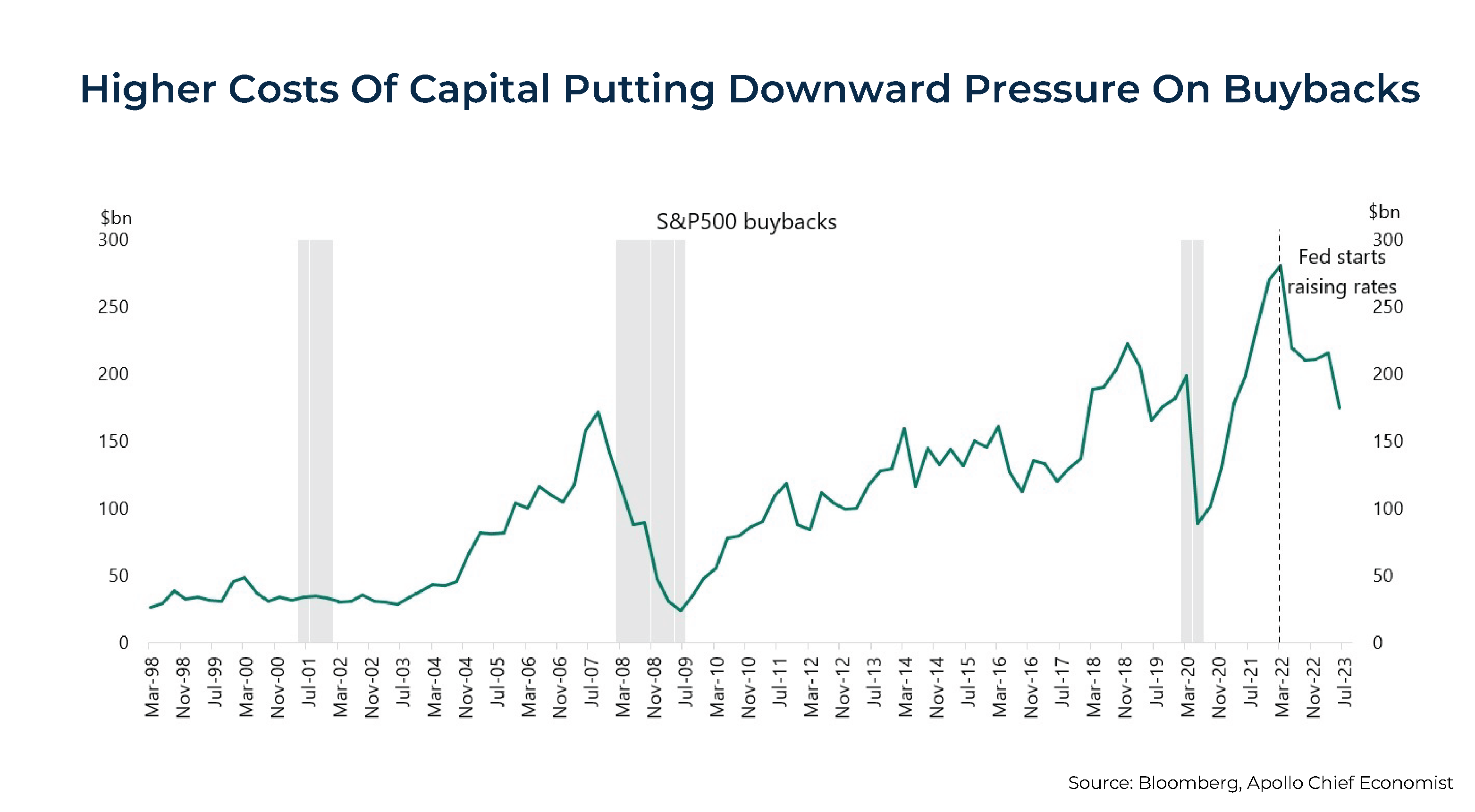

It's important to recognize a possible challenge for stocks: the likelihood of reduced buyback activity due to concerns about a recession, the newly imposed tax on buybacks, and increased capital costs. These 3 factors collectively enhance the importance of free cash flow for companies.

What Should Investors Do?

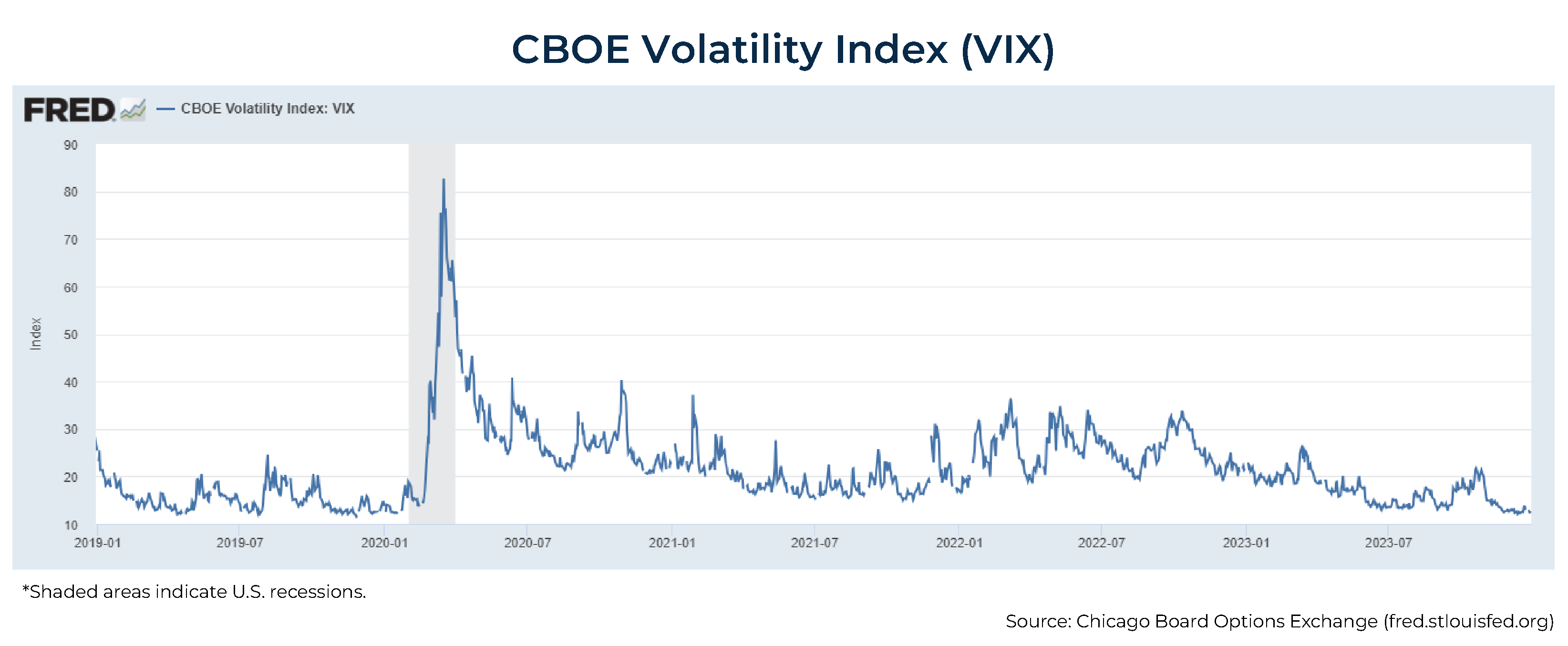

First, be prepared for volatility, especially if Congress is unable to avoid a shutdown of the government, trade tensions increase, or geopolitical risks increase. The surge in deficit spending amid economic growth is poised to ignite intense discussions on Capitol Hill regarding the country's fiscal strategies. This comes as legislators confront the possibility of a government shutdown early next year and decisions concerning the expiration of tax cuts worth trillions of dollars.

As of December 28, the VIX (a measure of the market's volatility) was trading at about 12.5, well below its historical average.

Given all the uncertainty investors are facing, it is surprising to me that it is trading at such a low level. Perhaps investors are overconfident of a soft landing?

For those investors concerned about volatility and downside risk, there are 2 ways to address those issues. The first is to reduce exposure to stocks and longer-term bonds and bonds with significant credit risks while increasing their exposure to shorter-term, relatively safe credit risks. By raising interest rates dramatically, the Fed has made that alternative more attractive than it has been in years. For example, for those concerned about inflation, the yield on 5-year TIPS has increased from about –1.6% at the start of 2021 to about 1.7% on December 17, 2023.

Another way to address the risks is to diversify exposure to risk assets to include other unique sources of risk that have historically shown minimal or no correlation with the cyclical risks associated with stocks or the inflation risks tied to traditional bonds, even though they have still offered risk premiums. The following are alternative assets that may provide diversification benefits. Alternative funds carry their own risks; therefore, investors should consult with their financial advisors about their own circumstances prior to making any adjustments to their portfolio.

- Reinsurance: The asset class looks attractive, as losses in recent years have led to dramatic increases in premiums, and terms (such as increasing deductibles and tougher underwriting standards) have become more favorable. Those changes led to returns being well above historical averages in 2023.

- Private middle market lending (specifically senior, secured, sponsored, corporate debt): This asset class also looks attractive, as base lending rates have risen sharply, credit spreads have widened, lender terms have been enhanced (upfront fees have gone up), and credit standards have tightened (stronger covenants).

- Consumer credit: While credit risks have increased, lending rates have risen sharply, credit spreads have widened, and credit standards have tightened.

- Long-short factor funds

- Commodities

- Trend following (time-series momentum): It tends to perform best when needed most – during extended bear markets.

Larry Swedroe is head of financial and economic research for Buckingham Wealth Partners, collectively Buckingham Strategic Wealth, LLC and Buckingham Strategic Partners, LLC.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third-party data and may become outdated or otherwise superseded without notice. Third-party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. LSR-23-603