Executive Summary

Measuring a client's tolerance for risk is an essential (and required!) step when onboarding a new client, as making any sort of recommendation is impossible without first understanding how comfortable clients may be when their portfolios inevitably experience volatility. Over the years, 2 types of measurement tools have emerged as the standards for assessing risk tolerance: 1) psychometric tests, which feature a series of questions (such as, "What amount of risk do you feel you have taken with past financial decisions?") that are designed to measure risk based on past behavior, and 2) econometric tools, which involve questions based on a particular scenario (such as, "Suppose you can invest $100 and this time, there is a 50% chance you could receive $207 and a 50% chance you'd receive nothing. Would you agree to this investment?"). These tools provide critical insight into a client's preferences and attitudes, but as is the case with every subjective assessment, the results may not always reflect a client's true feelings about risk.

As many advicers have experienced, a client who might claim that they can tolerate a high level of risk may, in fact, behave quite differently during periods of higher volatility. The reality is that a client's true relationship with risk can only be partially uncovered through the results of a questionnaire alone. Like any other data point that an advicer may collect, there are stories behind the numbers, and the true power of a risk assessment is in its ability to help an advicer begin a conversation that encourages clients to share their stories. And when advicers take the time to listen to those stories, they begin creating long-lasting bonds with their clients.

And while few (if any!) risk assessment tools include suggestions on how to discuss the results with clients, advicers can use a series of questions to have meaningful conversations with their clients. To start, open-ended questions that use a command-style approach (such as, "Share with me what these results mean to you.”) can avoid setting an expectation that there is a 'right' answer. These questions also set the stage for follow-up questions that help advicers better understand if the client's main concerns around risk are focused on either fear of losing money or anxiety around missing out on growth potential.

From there, an advicer can ask how the client has reacted to prior bouts of market volatility. As while past behaviors can have a strong influence on current and future reactions, the advicer can peel back additional layers of the proverbial onion by exploring what (if anything) the client might wish they had done differently. Lastly (and perhaps most significantly), the advicer can ask (again using the command-style approach), "Tell me how I can best serve you when the market is rising and when the market is falling". Using this approach, the advicer can highlight one of the real values in a true financial planning relationship and start to set expectations around the working relationship as a whole.

Ultimately, the key point is that, while determining a client's risk tolerance is a critical step during the onboarding process and while developing an appropriate portfolio, the true usefulness of risk assessment tools lies in creating stronger bonds with clients. Because the opportunity for advicers to start meaningful conversations not only helps them understand their clients' true concerns, but also demonstrates the value of a real financial planning relationship while clarifying how they can best serve their clients!

Risk Assessments In Financial Planning – What's The Point?

Risk tolerance/behavioral assessment tools, or simply risk assessment technologies, help advisors to better understand their clients from the perspectives of risk tolerance and other behavioral characteristics. There are 2 types of risk measurement tools: psychometric tests, which measure risk based on past behavior and state preferences, and econometric tests, which measure risk based on preference for different probabilistic trade-offs.

Psychometric tools rely on assessing risk tolerance by asking questions like, "How would you describe your attitude when making important financial decisions?" or "What amount of risk do you feel you have taken with past financial decisions? Respondents are generally asked a set of questions and then, at the end of the test, have their answers scored.

Econometric tools, also referred to as "revealed-preference tests", are based on a particular scenario with a set of questions. For example, the advisor might ask the client, "You receive an offer that will require you to invest $100. If you agree to the investment, there is a 50% chance that you would receive $215, and a 50% chance that you would receive nothing. Would you agree to this investment?" And then, after the client considers this, another situational choice can be presented to them. For example, the advisor might follow up with this question: "Now instead, suppose you can invest $100 and this time, there is a 50% chance you could receive $207 and a 50% chance you'd receive nothing. Would you agree to this investment?" Based on the client's answers, additional questions may appear before their risk tolerance is scored.

So, is one of these methods more accurate than the other? Researchers John Grable, Amy Hubble, Michelle Kruger, and Melissa Visbal examined this question by looking at the validity of different risk assessment tools. They compared the risk taken in financially risky activities (e.g., gambling) and measured risk tolerance using different risk assessment styles, including econometric and psychometric. Based on their research, they concluded that the psychometric test provided the best insight into risk-taking behavior – with the caveat that participants may have been willing to take greater risk with money they had found versus money that had belonged to them, and that the amount used in the experiments ($30) may not have been enough for true preferences to show up.

In addition to choosing the right tool to assess a client's risk, discussing the results provided by the chosen tool with the client can also provide great value to the advisor. As while measuring risk is not always a straightforward process and generally involves many considerations for the client and the advisor, advisors can gain important insights from having a conversation about the results regardless of the risk tolerance tool used.

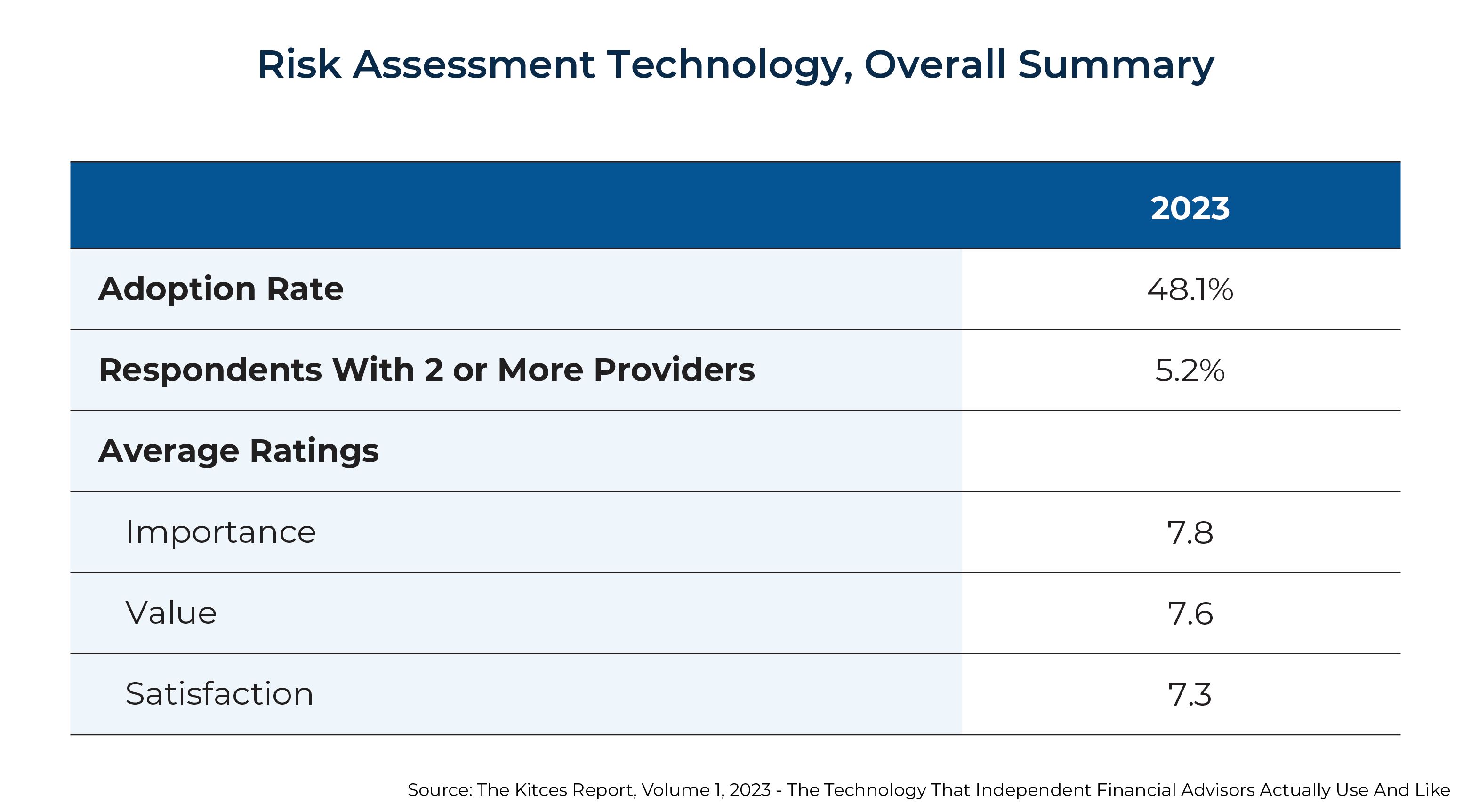

Yet, despite the importance of assessing a client's risk tolerance, the adoption rate for risk assessment technology was only 48.1% based on the most recent Kitces Research on Advisor Technology in 2023, which was below the average relative to other functional technology categories (e.g., financial planning software, tax, portfolio management).

As seen in the chart below, advisors who participated in the study rated the importance of adopting such tools with a relatively low score, which may explain the low adoption rate. On a scale of 1 through 10, advisors rated the importance of risk assessment technology with a score of 7.8., below the overall average for technology across all categories. Moreover, advisors didn't think that risk technology added much value (with an overall rating of 7.6) and did not find the use of such tools very satisfying (overall rating of 7.3).

Despite the low ratings that risk assessment tools received from advisors, it's important to recognize that risk is more than just a number. Risk is a story. Risk is an accumulation of experiences. Like any other number, balance, or fact that an advisor collects – that fact, number, score, or balance has a story behind it. One software tool, DataPoints, takes a unique approach to risk assessment using an approach that relies on stories and conversations around risk assessment – it doesn't just assess a risk score, but also considers the experiences and perspectives of the client. DataPoints– relies on a psychometric test for their Risk Tolerance Questionnaire, as well as a "Market Mindset Quiz" and a "Financial Perspectives Test".

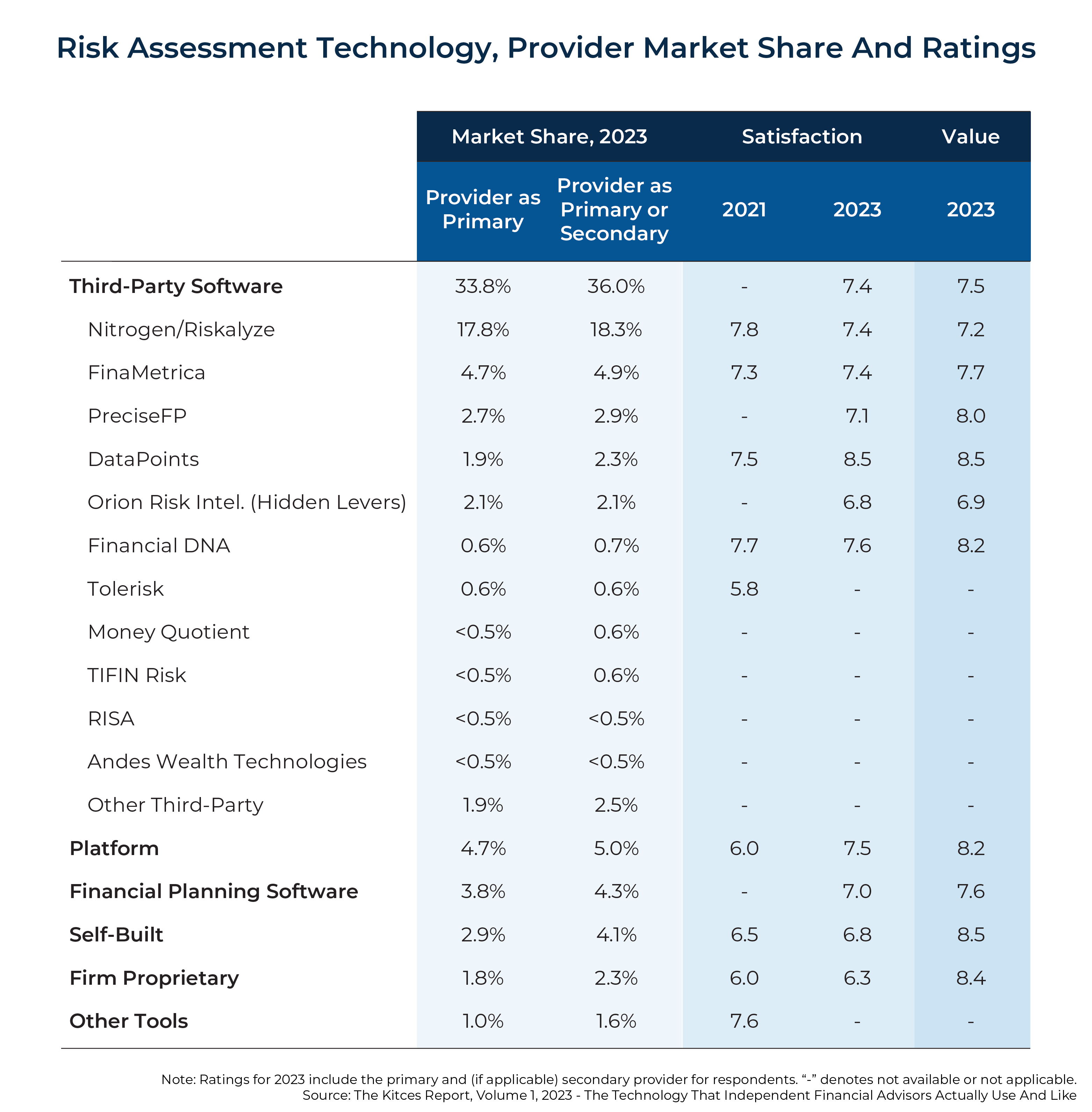

And while DataPoints may currently represent a small market share, it has the highest value and satisfaction ratings, as shown in the chart below.

While risk tolerance is a very important conversation to have with clients, the tool chosen to facilitate the conversation is an important consideration. Because as important as assessing risk tolerance is, what may be even more crucial is the conversation that the tool serves to elicit.

Advisors may rate the DataPoints tool highly because of the additional stories and insights they've gained from using it with their clients, which represents value that is hard to find with other more commonly used risk assessment tools.

Assessments Are Only As Good As The Conversation About Them

No one likes tests. Even if the test is important (e.g., determining how much risk a client is willing to take) or assesses subjective information with no 'right answer' (e.g., a client’s personal risk tolerance), tests, assessments, and questionnaires still feel uncomfortable for many people. This is because, in some way, the answers often reflect something about the test-taker that may be difficult or awkward for them to realize or accept about themselves.

Imagine a client who thinks they need to be more of a risk-taker because they believe that a good investor needs to be comfortable taking on high levels of risk. When this client takes a risk tolerance questionnaire, their views about what it means to be a good investor will likely influence the way they answer, and their responses may not truthfully represent how they really feel. And risk tolerance questionnaires that aren't answered honestly can cause a lot of difficult issues.

For example, if the advisor accepts the risk score at face value without recognizing the client's true opinions about taking on risk, the client and the advisor may both struggle in the next difficult market cycle. The client will have taken on too much risk and be very uncomfortable. The advisor may have to spend a lot of time with this client, talking them through their fear or calming them down; in the end, the advisor may even lose the client.

In the mental health field, many types of tools can be used to assess a person's emotional state. Yet, it is neither the assessment nor the style of therapy that makes the most difference in helping the patient improve their health or situation. Instead, what matters most is the alliance created between the practitioner and the patient. And alliances are created through trust, support, and understanding – all of which arise through having honest discussions. In both mental health and financial planning, no one wants to be judged based on the data from a questionnaire. People want to share their stories and information with those they seek guidance from – whether it be patients working with mental health professionals or clients with their financial advisors. When professionals take the time to hear those stories, they create stronger bonds.

For instance, imagine the client in the situation above, who wants to appear to be a risk-tolerant investor even if their true tolerance is actually much lower. While this person might be afraid to give the 'wrong' answers on their risk-tolerance questionnaire, advisors could probably assess their true feelings through an open conversation about risk tolerance while discussing the questionnaire. This is because people have a natural desire to express themselves. We enjoy sharing our past experiences and future expectations with people we trust.

This does not mean advisors want to toss out the test results entirely and rely only on a risk conversation. Research has shown that the “narrator effect”, the sometimes subtle, authoritative influence that comes through voice (e.g., a commercial using a male voice or a female voice for a particular product), also shows up in financial planning meetings when risk-tolerance tests are administered solely by conversation. Advisors benefit from not just using a test, which is less likely to have issues like narrator effect creep in, but also having a conversation with their client about the test.

Questions To Transform Risk Data Into Risk Conversations

Advisors know their clients are a lot more than just account balances and risk assessment scores. Yet, few risk assessments (if any) come with suggestions about how to discuss the results with clients. The following is a discussion of some questions that advisors can ask to help them have meaningful conversations about risk assessment results while connecting with their clients and understanding how to best support them in times of need.

Starting The Conversation

Tell me what these results mean to you. Share with me how these results reflect what's most important when it comes to your investments and investing goals.

The goal of these initial questions is simply to start the conversation. The questions are open-ended with no 'correct' answer and are intended to be asked using a command-style approach (i.e., saying "tell me" or "share with me" instead of starting with “what” or "how"). This helps prevent sending a signal that the client needs to find a 'right' answer. The question is also easy to follow up with by talking more about what makes this information matter so that the advisor can glean how familiar the client is with the subject matter and what attitudes and emotions may come up when they start thinking about risk.

For instance, a client with a truly high risk tolerance may answer the first question by talking about opportunity. Whereas one with a low risk tolerance might start talking about fear of loss. The follow-up question helps them to expand on the context surrounding their answer, helping the advisor better understand whether their main concerns around risk are more focused on protection or growth.

Describe your investment fears – are they about losing money, missing out on an opportunity, running out of money, leaving too much to kids, or something different?

This question can be used as an alternative or in addition to the previous questions, depending on what advisors feel most comfortable asking. While asking all of these questions together might seem like repeating the same thing, most clients have never had this discussion before, so discussing the same topic from a few different angles might be insightful for both advisor and client.

However, if advisors are concerned that asking similar questions in sequence might suggest they're not listening to the client's responses, they can start the conversation by telling the client that they'll be asking several similar questions and that each question addresses a slightly different aspect of the issue. Talking through different angles of the client's feelings about the assessment results can help the advisor understand what keeps the client up at night and understand any connections the client might make between investing and life fears.

Exploring Past Behaviors

How have you reacted in the past to market fluctuation?

Past behavior often has a significant influence over a person's current and future behavior. Learning more about how a client handled a past event can give insight into how they might react when a similar situation arises in the future. Perhaps even more interesting is that this question might initiate a conversation about what the client would want to do differently.

Imagine a client who pulled a lot of money out of the market during the 2008 financial crisis. They may recognize now that while panic and fear led them to take action, they'd like to take measures to safeguard themselves against making brash decisions based on fear in the future. Which offers an excellent opportunity for the advisor to have a conversation that will help them gain better insight into the client's real feelings about risk and establish their role as the client's trusted guide during difficult conditions that may arise in the future.

Emphasizing The Value Of The Financial Planning Relationship

We are in a partnership – a professional, financial relationship. Tell me how I can best serve you in times of rising financial markets, and in times when financial markets may fall.

This question might take a little bit of time and effort to establish a good discussion because most clients have never had an advisor ask them this question, and they might need time to figure out how to answer. However, being patient with the client and giving them time and space to think and respond can yield valuable insights into how the advisor can best serve the client's needs.

If the advisor had just asked the question about past market fluctuations beforehand, they might frame this question about how best to serve the client by asking, "Think back to the time that we just discussed. Tell me what comes to mind if you were to imagine someone who would have helped you during that time. Share with me what they would have said or done."

The goal of this question is simply to explore more about the expectations the client has of the working relationship. It can be valuable to record this information in a Client Relationship Management record field so that it is easily recalled for advisors to easily and quickly determine how they can best support their clients, especially in times of distress (e.g., volatile market conditions or a personal family crisis). While some clients might prefer phone calls, some may prefer receiving an email or reviewing a Loom video created by their advisor as they provide market commentary.

Let’s assume the market has fallen dramatically. How would you want to talk about the market? How would you want to respond together in that market?

This question is similar to the previous question and also focuses on the value to be derived from the working relationship in a time of need. Yet, this style of question takes a 'pre-mortem' approach, which serves as an exercise for advisors and their clients to proactively think through how they would want to respond to different twists and turns.

Pre-mortems are more than doomsday plans. They uncover attitudes and can help people recognize when something isn’t feeling right before those feelings become too overwhelming. They encourage people to consider new possibilities and stay open to the various ways things can change course.

Imagine again the client who panicked and pulled their money out of the market during the 2008 financial crisis. This individual might indicate that they would want to talk with their advisor more frequently or say that they want to know that it would be okay to call when they are feeling nervous. The client might also say that they want to be able to discuss or even debate various articles that they are reading.

Having this out in the open, the advisor might agree to these debates but ask that the client send over the articles in advance so that they have time to prepare. This helps the advisor identify how they can position themselves to be on the same team as their client – not by debating against each other but instead debating ideas collaboratively as a team, with the desired end goal of having a deeper understanding of the topic in general.

While risk tolerance questionnaires may not be a favorite tool for all advisors, they do give advisors the opportunity to leverage value through conversations about the data they gather. These conversations help advisors understand more precisely how clients are impacted by risk and how they can best be served by their advisors.

By having these discussions, advisors may find that risk tolerance questionnaires can create amazing opportunities for connection that elevate the value of the relationship offered to their clients, going beyond simply identifying the client's risk tolerance. Instead, using these tools and asking meaningful questions can give advisors clarity into what their clients are truly concerned about, how they need to be supported, and what they expect from the relationship!