Executive Summary

For many businesses and industries, it’s crucial to do a proper analysis up front to estimate the size of the “target market” – how many total potential customers are there and how much would they spend on your products or services, so the company can figure out if there’s a big enough market opportunity amongst those tens or hundreds of thousands of consumers (or more) to make it worthwhile to launch that new product or service for them.

In the context of a financial advisor, though, the reality is that the sheer intensiveness of the time it takes to serve financial planning clients in an ongoing advice relationship means most advisors will struggle to ever handle more than about 50-100 "real" client relationships on an ongoing basis. And even if the advisor gets highly efficient – e.g., through technology – there’s some evidence to suggest that our brains themselves simply may not be able to keep track of materially more than 100 client relationships (on top of all the other family/friends relationships in our lives).

The good news, though, is that the limitation of “just” 100 clients still leaves ample room for the typical advisor to serve the nearly 30 million mass affluent (or wealthier) households and earn a very successful living. After all, an advisor spending "just" 12 hours per year on each client (which across 100 clients is 1,200 hours/year), and charging $150/hour for their services (whether via an hourly fee, annual or monthly retainer, or AUM fees) can generate $180,000/year of revenue, and the most efficient advisors would be able to take home nearly 80 cents on the dollar (or almost $150,000 of it) after business expenses.

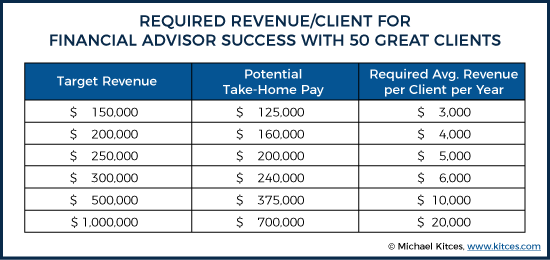

And for advisors who can move “upmarket” and serve even more affluent clientele, the requisite number of clients just drops further – and/or the advisor has even more earning potential. After all, 50 retiree clients paying “just” $5,000 per year (as an annual retainer, or perhaps in AUM fees from their $500,000 retirement rollovers?) gives an advisor a potential of $250,000 of gross revenue and take-home pay of more than $200,000 annually! And the higher the average revenue per client from there, the more the earning potential, even with "just" 50 great clients!

Of course, the caveat is that it can still take a long time to get to that 50-100 clients. Adding 1 client every month would still take 8 years to reach a 100 client capacity; even if the pace of new clients accelerates after the first few years, it may still take 5-6 years to build that client base. And trying to reach 50 more affluent clientele may still take just as long, as there are fewer clients needed, but they may be harder to reach (or it takes longer to establish the credibility to attract and retain them).

On the other hand, the fact that it “only” takes 50 great "A-level" clients for financial advisor success means that advisors have the luxury to pick almost any conceivable niche specialization… because it takes no more than 50 people on the planet, who are willing to pay to have that particular problem solved, to be financially successful as an advisor! And the more those niche clients can afford to pay, further increasing revenue/client, the more the upside income potential of the 50-great-client practice!

So who will you find to be your 50 great clients?

Customers Vs. Clients: How Many Real Clients Can A Financial Advisor Handle?

In looking at the landscape of financial advisors, there’s a remarkable variability in the number of clients any particular financial advisor may have. Some have a few dozen, some have several hundred. Newer advisors tend to have fewer clients, while veteran advisors typically have more, if only because the latter have had more years to accumulate those clients.

The situation is complicated in part by the wide range of definitions for what constitutes a “client” in the first place. For experienced advisors, that list of “clients” often includes a number of consumers who may have once, years ago, done a piece of transactional business with the advisor, and never been in touch since.

In fact, given the transactional roots of financial advisors – where the primary role was to sell financial services investment or insurance products, and legally any financial advice was just “solely incidental” to selling brokerage services – arguably many of the people that financial advisors call “clients” are at best "dormant clients" (not actively engaged by or being serviced much by the advisor), and in reality, would more appropriately be called “customers” instead. The difference: customers transact business (after which the transaction engagement ends, until there's perhaps a new transaction), while clients are people served in an ongoing advice relationship.

In turn, though, this raises the question of how many actual active clients the typical financial advisor really has. And how many does a financial advisor need to have in order to be financially successful? Especially given some of the research suggesting that no human being can mentally manage more than about 150 interpersonal relationships in total. And since most of us consume a few dozen of those "relationship mental slots" for our personal friends and family, realistically it’s not clear if any professional even can manage an ongoing client relationship with more than about 100 clients.

Fortunately, though, it turns out that 100 real clients may be all most advisors need. At the most.

Getting Paid To Serve 100 Real Clients

Serving 100 real clients in an ongoing financial planning relationship takes time. Different advisors serve clients in different ways – some may focus heavily on interacting via email and conduct video chats, while others may follow a regular routine of meeting in person with clients 2-4 times per year.

A reasonable starting estimate might be that the advisor spends 12 hours per year working directly with clients to provide ongoing advice (assuming the time-intensive initial plan is done separately). That ongoing advice could be delivered as four 2-hour meetings throughout the year, and an hour per quarter of intra-meeting work behind the scenes. It could be 1 hour per month of ongoing email communication and check-in meetings, for a more-frequent higher-touch service model. Ultimately, firms might even craft a client service calendar that includes a combination of client meetings, calls, and educational events to specify the scope of advice services throughout the year.

Across the span of 100 clients, working 12 hours per year with each would add up to 1,200 hours per year, which is certainly manageable. Someone who works 40 hours per week all year, and takes off 2 weeks for vacations, ends out working about 2,000 hours per year. Which means at 1,200 hours of client-facing time is still only 60% of the advisor’s time for the year, leaving 800 hours per year (or almost 3 hours per working day, or about 2 days per week) for all the other activities involved in running the advisory business, from compliance obligations to marketing to perhaps some other behind-the-scenes support work for clients.

And notably, at a “professional” rate of $150/hour, the 1,200 hours of client-facing time in an advisory firm would add up to $180,000 of gross revenue for the advisor. Even though the advisor is only nominally paid for 60% of his/her working hours in the year!

Of course, gross revenue is not necessarily a net amount that the advisor takes home, but prior industry benchmarking studies have noted that the most successful (and technology-leveraged) solo advisors are taking home as much as $0.87 for every $1.00 of gross revenue, which is increasingly feasible given the availability of technology tools and flexible virtual assistants for administrative support to financial advisors. At least under an independent RIA model that can be run in a relatively lean manner as a solo advisor (as contrasted with advisors on an independent broker-dealer platform, where many only receive 80% - 90% payouts on their gross revenue, with some wirehouse or employee-broker-dealer platforms as low as 40% to 50%).

On $180,000 of gross revenue, being able to net upwards of 80% of gross revenue as take-home pay would result in final advisor compensation of more than $150,000/year, or about 3x the U.S. median household income!

Financial Advisor Business Models For Serving 100 Clients

Notably, while it make take “just” 12 hours per client at $150/hour to potentially generate a net take-home pay of $150,000/year as an advisor, that doesn’t necessarily mean that literally charging $150/hour is the most effective business model to generate revenue (due to how salient the hourly model makes the ongoing cost).

One popular business model option would simply be the AUM model. At a 'typical' 1% AUM fee, this would necessitate 'just' average investment assets of $180,000 (in a world where there are nearly 30 million households that are “mass affluent” with a liquid net worth between $100,000 and $1M), for which the advisor provides ongoing financial planning services along with investment management (though ostensibly the investment management function may be outsourced to a TAMP, given a solo advisor’s limited capacity to do hands-on investment management). And in point of fact, industry benchmarking data shows solo financial advisor firms are already predominantly focused on serving these kinds of mass affluent clientele with an AUM-centric business model (and can do so very successfully).

Another option would be charging the client an ongoing retainer fee, either for an outright amount of $1,800/year, or broken down further as a monthly retainer model for $150/month (which over 12 months is $1,800/year). The virtue of the (monthly) retainer model is that it further opens up a range of prospective clientele, who might not have the available assets to pay an ongoing 1% AUM fee, but have enough income to pay the advisor directly from their personal cash flow (e.g., for prospective clients who are younger professionals with a healthy income but also significant debt and/or limited savings so far, a common clientele we see within XY Planning Network).

Of course, an ongoing financial planning relationship with clients also means they will need assistance implementing various financial services products over time – not on a purely transactional basis, but done on an as-needed basis as their lives change and evolve. Accordingly, many advisors adopt a hybrid model of doing AUM or retainer fees while also generating some level of commissions from the implementation of either select investment products, or appropriate insurance products (e.g., [term] life insurance, disability insurance, and long-term care insurance). Helping clients implement product solutions – presuming it’s done in a manner that still meets the advisor’s fiduciary obligation to act in their clients’ best interests – can further support an advisor’s revenue to generate the targeted $150/hour (or $1,800/year/client) to be compensated for what the advisor's time is worth. On the other hand, it’s important to bear in mind, as noted earlier, that the advisor’s revenue for product implementation may be substantially reduced by a broker-dealer (or general agent’s) slice of the underlying commissions.

The Challenge Of Getting To 100 Clients

In the end, perhaps the biggest caveat of needing “just” 100 clients for a successful advisory firm is how to get 100 clients in the first place.

At best, the reality is that it’s likely to be a relatively slow ramp-up period. For new advisors who get to 1 new client every month, it still takes 8 years to get to 100 (and that's with no client turnover!). If the advisor builds momentum over time, perhaps getting 2 new clients per month after the first 2 years, it still takes “just” 5 years to get there. If the first year or two is slower as the advisor is still getting established into a niche before the pace ramps up, it could take 6-7 years.

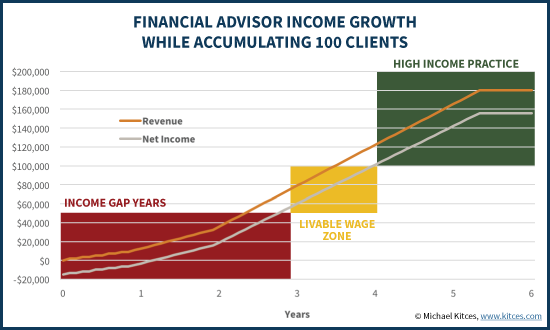

Fortunately, the reality is that the advisor doesn’t have to reach a “full” client base to at least make a livable wage. As noted earlier, a target of serving 100 clients with 12 hours/year of service at $150/hour leads to a cumulative revenue of $180,000 and a net take-home pay that could be as high as $150,000. For someone who has “just” half the clients - i.e., has grown to 50 client relationships - that’s still potentially $90,000 of revenue and perhaps $60,000 to $75,000 of take-home pay (depending on the extent that expenses have begun to scale, as some advisory firm costs are still fixed overhead). That’s enough to be “livable” in most parts of the country, and is actually a very healthy income in many areas. Still, though, it means a new advisor could face an “income gap” of 3-4 years from starting at $0 until reaching those compensation levels (and then growing further from there), which means it’s important to have a plan to fill that income gap in the interim ramp-up (start-up) years.

Raising Revenue/Client - All It Really Takes Is 50 "Great" Clients

Notably, the more dollars that clients actually pay for services, the fewer it takes to reach any given target level of income. Or viewed another way, for advisors who can get more affluent clients that pay more in revenue per client, it may not even be necessary to try to reach as many as 100 clients.

For instance, if clients are paying twice as much as the earlier examples - $3,600/year, or $300/month, in some combination of AUM and retainer fees and implementation commissions - it only takes 50 clients to reach the same revenue. An advisor who works with retirees that are rolling over $500,000+ portfolios for retirement only needs 36 clients (at a 1% AUM fee) to reach the same level of revenue. If the advisor can get millionaire clients, it only takes 18.

Or alternatively, still growing to 50 great clients now has an upside of $300,000 of gross revenue, or $500,000, or more. Of course, getting “bigger” clients can be more difficult, as there’s greater competition, more complexity, and it may require the advisor to spend even longer establishing trust and credibility in the first place. In addition, clients paying significantly more often expect more service to substantiate what they’re paying, which means the advisory firm may need at least some additional staff support to deliver on their expectations. Nonetheless, at higher revenue/client levels, there’s still ample room to hire staff and still have more take-home pay as the advisor. In fact, the upside profitability potential of working with fewer more affluent clients is one of the primary reasons that advisors who start out with a broader base of clients early on end raising their minimums to focus on (fewer) higher income/net worth clientele over time.

In other words, the essence of the pathway to building an advisory business around 50 great clients is to set a target for the value of the advisor's time and the amount of revenue per client necessary to compensate the advisor for his/her time... and then focus on lifting that revenue/client over time by adding new clients that increase the average (finding clients where the value of the advisor is worthwhile to them at that price), and then "graduating" the smallest clients who rotate off the bottom of the list because they're no longer the best fit for where the advisor's firm has grown. Or stated more simply - if the advisor is focused on building a practice around 50 great clients, it's necessary to actively manage which 50 clients get those available 50 slots.

In some cases, advisors may try to “jump start” the process by buying an existing advisory firm or at least a book of clients, though this requires significantly more start-up capital (or the willingness to take on significant debt to finance the transaction), and may ultimately require more pruning to winnow back down to 50 great clients anyway. And of course, if you have that much capital available, it may be more desirable to simply use it as a way to cover personal living expenses while growing the client base directly, given that for most advisory firms it’s rather inexpensive to actually start the business to begin with. (It’s maintaining a personal lifestyle while getting clients that sinks most new financial advisors, not the cost of establishing the business itself. Which is also why most advisors can’t get start-up capital to launch an advisory firm.)

On the plus side, the fact that you “just” need 50 great clients is actually incredibly freeing, when deciding who to work with as a target clientele to begin with. Because having such a small target for the total number of clients means there’s virtually no financial advisor niche that is “too narrow.” Which in turn makes it possible to be incredibly focused in designing a business model to serve them, a service model to deliver value to them, and even build a narrowcasting platform to market and reach them. Of course, the more affluent those niche clientele are, and the higher the financial planning fees they can afford, the more upside potential there is to work with them (delivering a service that is commensurate with the price).

The bottom line, though, is simply to recognize that the process of building a successful advisory practice is simply the process of accumulating your 100 clients, or better yet your 50 great clients (give or take a few, depending on your personal capacity, your service model, and the typical revenue you generate from each client based on their own income/assets and needs). And the path to reaching 50 great clients is not necessarily capital intensive – because advisory firm start-up costs aren’t very significant – but it is a very slow build to gather the requisite number of clients, and generate the associated income. And while working with even more affluent clients that generate higher revenue/client can drive even higher levels of income and financial success (and reducing the number of clients needed), building the requisite credibility takes time as well. Which means that, while in the long-run an advisory firm can be very financially rewarding, reaching that point of success is still a marathon, not a sprint!

Who will you pursue for your 50 great clients?

So what do you think? How many 'real' financial planning clients do you need? How many can one advisor realistically serve? Does 100 ongoing clients being served seem just right, too low, or too high? Could you build a business around 50 great clients?

Disclosure: Michael Kitces is a co-founder of XY Planning Network, which was mentioned in this article.