Executive Summary

The A-B trust strategy has long been a staple in the world of estate planning to help minimize estate taxes. And even with the increase in the Federal estate tax exemption and the creation of portability of the estate tax exemption, A-B trust planning is still relevant for very high-net-worth clients, and those who may face a lower state estate tax exemption.

However, a significant complication of A-B trust planning occurs when the only (or primary) asset available to fund the trust is a retirement account such as an IRA, given the common desire to obtain “stretch IRA” treatment to minimize taxable distributions from an inherited IRA.

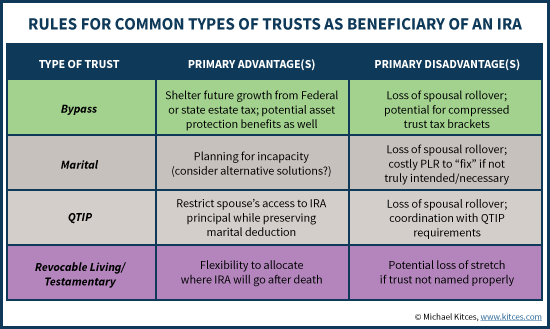

Fortunately, though, the “see-through” trust rules do allow at least some types of A-B trusts to still obtain stretch IRA treatment, particularly in the case of bypass trusts or (properly drafted) QTIP marital trusts, even when created as a testamentary. On the other hand, naming marital trusts or even revocable living trusts outright can result in a total loss of stretch treatment for an inherited IRA.

In addition, it’s notable that even where the see-through trust rules do allow for the stretch of an inherited IRA, the income tax treatment will often be less favorable than naming beneficiaries outright (due to the compressed trust tax brackets). As a result, anytime an A-B trust is being considered as the beneficiary of an IRA or other retirement account, it’s crucial to weigh the non-tax (and potential estate tax) benefits against the likely income tax disadvantages!

Qualifying A “See-Through” Trust As An IRA Beneficiary

Treasury Regulation 1.401(a)(9)-4, Q&A-5 explicitly allows that trusts may be used as the beneficiary of an IRA (or other retirement account), and maintain favorable “stretch IRA” treatment by “seeing through” the trust to the underlying beneficiaries (and using their life expectancies to calculate the stretch).

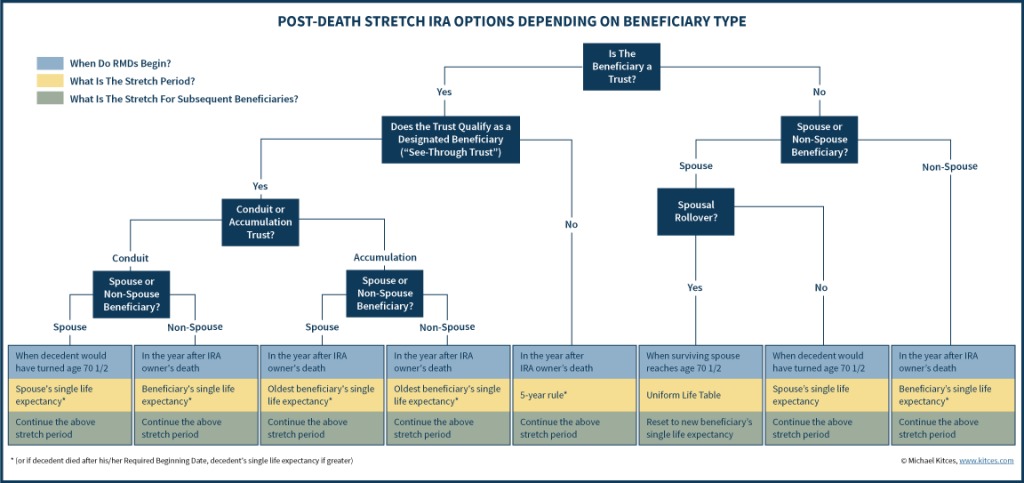

However, not all trusts receive similar treatment. Some trusts are treated as a “conduit” trust, where only the immediate income beneficiary’s life expectancy must be considered when determining the applicable distribution period for the stretch IRA. Other trusts are treated as an “accumulation” trust, where income and remainder beneficiaries must be considered, as the stretch can only be done based on the oldest beneficiary (with the least favorable life expectancy!). And either of these scenarios may be less favorable for stretch purposes than just naming a surviving spouse outright, which is eligible for special treatment (a more favorable stretch period, and the ability to “reset” the stretch for subsequent beneficiaries).

The added complication when using a trust as an IRA beneficiary is that just figuring out whether the trust will be a conduit or accumulation trust can be confusing, as the simple label “trust” is incredibly broad and covers a wide range of trusts that might actually be used as the beneficiary of the retirement account after the death of the original owner.

Yet the distinction is important, as the extent to which the IRA can be stretched by the trust – and which life expectancy is used for the stretch – can vary significantly, depending on whether the trust is treated as a conduit or accumulation trust (or is rendered ineligible as a “see-through” trust altogether). Especially since in the context of popular “A-B trust” planning strategies – either created under a revocable living trust, or a testamentary trust established under the decedent’s Will – the trust could be categorized as any of the above!

Below, we examine the implications and issues to consider whether naming an IRA beneficiary a Bypass trust (the “B trust”), a marital trust (the “A trust”), the difference between using a QTIP vs non-QTIP marital trust, and the adverse consequences that may occur if a revocable living trust or an estate are named directly (for those who perhaps weren’t certain which underlying trust to name).

Bypass Trust (Or “Family Trust”) As An IRA Beneficiary

The use of bypass trusts overall is down since the increase in the estate tax exemption to an inflation-adjusted $5M (made permanent going forward under the Taxpayer Relief Act of 2012, and now up to $5.45M in 2016), and especially now that the unused portion of a deceased spouse’s estate tax exemption is portable to the surviving spouse.

Nonetheless, for higher-net-worth couples, bypass trusts remain relevant to shelter future growth above the couple’s $10M+ combined exemption threshold, and some couples may use bypass trusts at lower net worth levels to minimize state estate taxes (given that most states with a state estate tax do not permit state-level portability of the unused state estate tax exemption amount).

To the extent that a bypass trust is necessary, it is generally still more favorable to fund the trust with other assets besides a retirement account first. After all, an IRA left directly to a spouse can be rolled over, which both allows for far more tax-preferenced accumulation due to the more favorable lifetime RMD tables (and being able to wait until age 70 ½), and ensures that a subsequent beneficiary can “reset” the stretch based on his/her own life expectancy. In addition, in situations where there are multiple types of beneficiaries (e.g., individuals and charities), a (pre-tax) traditional IRA is better served to satisfy charitable bequests first (while other assets can be left to family members and receive a step-up in basis). Nonetheless, sometimes a bypass trust needs to be funded, and the only available asset for some or all of that funding is an IRA.

In the case that an IRA is used to fund the bypass trust – especially with a bypass trust intended to shelter assets for estate tax purposes – it’s important to recognize that the trust will almost certainly be an accumulation trust, retaining the RMDs as they leave the retirement account and not passing them through (as doing so would just push the IRA funds back into the surviving spouse’s estate, compounding the estate tax problem that the bypass trust was intended to minimize in the first place!).

As a result, if a bypass trust is used, it is be critically important to follow the trail of income and remainder beneficiaries until the final distribution is scheduled, to ensure that no beneficiary will result in an (even more) unfavorable applicable distribution period than the life expectancy of the surviving spouse. With a(n accumulation) bypass trust, it is especially important to verify that there are no charities or other non-designated beneficiaries on the list of income and remainder, beyond being in a position as mere potential successors, or the stretch treatment may be lost altogether.

In addition, the retirement account owner may wish to consider, while still alive, doing at least a partial Roth conversion to reduce potential taxation on the inherited IRA down the road, given that most/all of the IRA distributions to the trust will likely be retained in the bypass trust in the future, and therefore be subjected quickly to top 39.6% tax brackets for trusts (which begin at just $12,500 of taxable income in 2016!).

Marital Trust As An IRA Beneficiary

For the typical “AB trust” estate plan, the “B” trust is a bypass trust, and the “A” trust is the marital trust for the outright benefit of the spouse, either to be subsequently held in trust (but freely accessible) for the surviving spouse’s lifetime, or created at the death of the first spouse but then distributed outright immediately to the surviving spouse. (For discussion of marital QTIP trusts, see next section.)

In practice, a marital trust (of the non-QTIP variety) will rarely ever be a favorable beneficiary for a retirement account. The reason is that by naming the trust instead of the surviving spouse directly, that surviving spouse will lose the ability to do a rollover of the IRA into his/her own name to obtain the most favorable spousal treatment (including waiting on required minimum distributions until turning age 70 ½, being subject to RMDs using the Uniform Life Table, and re-naming a new beneficiary for a new stretch after that surviving spouse’s death). Instead, the trust will be subject to RMDs as a non-spouse designated beneficiary; if the spouse is the primary/sole beneficiary, the trust can at least wait to begin RMDs when the original decedent would have turned age 70 ½ (under Treasury Regulation 1.401(a)(9)-5, Q&A-7(c)(3), Example 2), but will still be stuck with a less favorable applicable distribution period (single life instead of the [joint] uniform life table), and no ability to re-set the stretch for subsequent beneficiaries after the death of the surviving spouse.

While such a trade-off – less favorable spousal rollover treatment in exchange for the use of a trust – may be appealing if there is some asset protection, control, or estate tax savings associated with the trust, in the case of a marital trust none of those benefits are available. Thus, the spouse-via-marital-trust beneficiary receives a less favorable outcome for stretch IRA purposes, with no offsetting (tax or non-tax) benefit. (Though notably, since distributions to a marital trust flow through to the surviving spouse, at least all IRA distributions will be taxed at the surviving spouse’s tax rates, and not be subject to compressed trust tax brackets!)

In fact, because the use of a marital trust as the beneficiary of a retirement account often turns out to be a mistake, there are now several instances where a spousal beneficiary has requested a Private Letter Ruling from the IRS where a marital trust was “accidentally” named as the beneficiary and the spouse wanted to roll the IRA funds “through” the marital trust to the surviving spouse. In scenarios where the surviving spouse was the sole beneficiary, and had full dominion and control over trust assets, and the trust allowed non-pro-rata in-kind distributions to its beneficiary, the IRS actually has allowed the surviving spouse beneficiary to “correct” this mistake (see PLRs 200210066, 200236052, 200317032, and 200406048). Nonetheless, obtaining a PLR to “fix” the situation merely results in the same outcome as would have occurred by simply naming the spouse directly, but with a significant amount of added time, hassle, and the non-trivial cost of a filing fee up to $18,000 (plus legal expenses) to obtain a private letter ruling in the first place.

Which means in short, if the ultimate goal is to leave the IRA for the spouse’s sole benefit anyway (and not use a bypass trust in the first place), the best way to do so is by naming the spouse as the outright beneficiary of the IRA, not a (non-QTIP) marital trust for the spouse’s benefit. Alternatively, if a trust is desired for some other reason (e.g., to have a successor trustee in the event of incapacity), consider other means for incapacity planning (such as simply having a Power of Attorney in good order!).

(Marital) QTIP Trust As An IRA Beneficiary

In the case of a marital QTIP trust, the trustee can limit the surviving spouse’s access to the trust principal, which may be important in planning situations like a second marriage (where the decedent wants to ensure that the remaining trust principal be held for children from a first marriage). As a result, when using a marital QTIP trust, there is a reason to leave money in trust “for” a spouse but give up the more favorable tax treatment of a spousal rollover: because of the greater control that the QTIP trust allows, in situations where that control is important to achieve (non-tax) estate planning goals.

Notably, QTIP trusts are required to pay all (accounting) income annually to the surviving spouse as a condition for QTIP treatment under IRC Section 2056(b)(7)(B)(ii). However, this can lead to confusion given that for accounting purposes, RMDs are not necessarily treated as “income” (even though they are all income for tax purposes).

As a result, a QTIP trust that must pay all (accounting) income is not necessarily a conduit trust for trust-as-IRA-beneficiary purposes. In fact, given that the RMD from an IRA under Section 409(c) of the Uniform Principal and Income Act (UPIA) is only 10% income and 90% principal (regardless of the actual underlying investment results), naming a QTIP trust as beneficiary of a retirement account may not only fail to qualify for conduit trust treatment, but naming a QTIP trust that is structured as a conduit trust (passing through all RMDs annually) can actually still fail to meet the requirement for passing through “income” under a QTIP trust in the first place!

To address this potential mismatch in what constitutes “income” for accounting and tax purposes, the IRS has declared under Revenue Ruling 2006-26 that when an IRA is payable to a QTIP trust, in order to ensure that the “income for spouse” requirements are met for QTIP status, the trust should either allow the spouse to demand all “income” from the IRA using a reasonable apportionment of the actual total return of the IRA, use state law to determine a reasonable apportionment between income and principal based on the underlying account (and not looking to the RMDs), or simply pay out at least a 4% unitrust amount to the spouse.

While these provisions will ensure that the QTIP trust meets its obligations for passing through income to qualify as a QTIP, the trust itself still may not be treated as a conduit trust when determining what the RMDs to the trust should be. After all, it is still possible that the RMD (especially in the later years) may be greater than the amount that will be paid out, which in turn means that a portion of the RMDs could be accumulated for subsequent beneficiaries. As a result, a QTIP trust will generally still be an accumulation trust, and thus still have to look to subsequent underlying beneficiaries to determine the applicable distribution period. This also means that the presence of multiple beneficiaries (spouse as income and subsequent beneficiaries as remainder) will prevent the trust from taking advantage of the special rules for surviving spouse beneficiaries (delaying post-death RMDs until the original decedent would have turned age 70 ½) and instead must begin in the year after death based on the oldest trust beneficiary’s single life expectancy.

In order for a QTIP trust to actually be treated as a conduit trust (which may be appealing to obtain the more favorable spouse-as-trust-beneficiary stretch treatment), the trust would need to specify that payouts each year will be the greater of the actual RMD or the amount necessary to satisfy the “income” distribution for QTIP purposes – ensuring that in any particular year, both the QTIP and conduit trust requirements are met. On the other hand, it is again important to note that conduit trust provisions will ultimately push more money through the QTIP trust to the underlying surviving spouse beneficiary (potentially almost all of the IRA if the spouse lives to his/her life expectancy!). So if the goal is to limit the spouse’s access to the trust principal in the first place, it may ultimately be preferable for the trust to not be a conduit trust and instead be an accumulation trust, accepting the less favorable stretch treatment in exchange for the (maximal available) control of the QTIP trust.

Revocable Living Trust Or Testamentary Trust As An IRA Beneficiary

In the case of naming an IRA owner’s revocable living trust, or a testamentary trust created under the decedent’s Will, as the beneficiary of the IRA, the consequences will depend on the terms of the trust itself. To the extent the trust is structured to hold funds in further trust for asset protection or spendthrift purposes, or as a bypass trust, the stretch is generally possible as discussed earlier. In other words, to the extent the trust is otherwise eligible as a designated beneficiary to stretch an IRA, the fact that it was/is created under a revocable living trust or as a testamentary trust under a Will is not necessarily a factor.

However, while naming trusts created under a Will or revocable living trust is not necessarily problematic, how the trust is named in the beneficiary designation can create potential problems if not done correctly.

For instance, in some cases the retirement account owner simply names his/her estate, so that the assets of the estate may be distributed according to the Will – including potentially allocating the IRA to a testamentary trust – and it’s not necessary to determine up front who in particular will receive the IRA (the testamentary trust or some other IRA). Unfortunately, though, because the estate itself is named as the beneficiary, no see-through treatment is possible (as that is only permitted for a trust beneficiary, not an estate as IRA beneficiary), and the retirement account will generally be subject to the 5-year rule (or the decedent’s remaining life expectancy if death occurred after the required beginning date). If there is a desire to stretch through a trust created under the Will, the retirement account’s beneficiary designation form should not name the estate, but instead should explicitly and directly name that testamentary trust created under the Will – e.g., “100% to the Family Trust created under Article 4, Paragraph 1, of my Last Will and Testament dated 1/7/2010”.

Similarly, while it may be appealing to name a decedent’s revocable living trust as the beneficiary, again to leave flexibility about deciding where the IRA will go until after death (where the revocable living trust can determine if it will go to a spouse, a bypass trust, or some other trust beneficiary), doing so may also be problematic.

The reason is that while a revocable living trust will generally become irrevocable at the death of the IRA owner (one of the key requirements for see-through trust treatment), if the revocable living trust is named directly, then all beneficiaries under any provision of the trust must be considered for the stretch. This will potentially result in an unfavorable applicable distribution period (by “accidentally” including an older beneficiary), or the inclusion of a non-designated beneficiary that will ruin the stretch altogether (e.g., a charity named as a beneficiary of any dollar amount anywhere in the revocable living trust could ruin the stretch treatment!). Again, if there’s a desire to see IRA funds flow to a particular subtrust created under the revocable living trust, and qualify for a stretch, it is better to name that subtrust directly (and avoid having any other trust beneficiaries or sub-trusts included). For instance, the beneficiary designation might read “100% to the Family Trust created under Article 5, paragraph 2 of my Revocable Living Trust dated 4/11/2011” which would thereby avoid the inclusion of any beneficiaries named elsewhere in the revocable living trust document.

On the other hand, it’s important to note that naming someone else’s revocable living trust – e.g., a spouse’s revocable living trust, or some other individual’s trust – will not be eligible for a stretch at all, as another person’s revocable living trust remains revocable after the death of the retirement account owner (thereby failing the “trust must be irrevocable at death” requirement under Treasury Regulation 1.401(a)(9)-4, Q&A-5(b)(2)).

Notably, this same problem is often also true of naming a couple’s joint revocable trust, which generally remains revocable after the death of the first spouse. In such situations, the trust will fail to qualify as a designated beneficiary trust eligible for see-through treatment in the first place, because it is not irrevocable (and/or did not become irrevocable at death) as required.

If there is a desire to obtain the stretch for a beneficiary who has their own revocable living trust, such beneficiaries should be named as beneficiaries directly (and not their revocable living trust). Or alternatively, a separate trust should be established for their benefit that is actually irrevocable at the death of the retirement account owner, or earlier, which can be named as the retirement account beneficiary instead.

A-B Trust Planning With Retirement Accounts

Ultimately, the good news is that many of the subtrusts used in A-B trust planning really can be used as the beneficiary of an IRA to accomplish estate planning objectives. However, in most cases, the trust will receive at least slightly less favorable (but still acceptable) income tax and/or stretch treatment (e.g., with a Bypass trust). Sometimes, though, the treatment is significantly less favorable treatment (e.g., in the case of a non-QTIP marital trust, or naming a revocable living trust or estate outright), so much that the tactic should probably be avoided.

To say the least, this means that it’s necessary to carefully weigh the non-tax benefits of the trust against the disadvantages of using the trust to make a final decision. Though notably in some cases, as discussed above, the structure of a trust, or the way it’s named in a beneficiary designation, can at least somewhat improve the tax and stretch treatment!

So what do you think? Do you often use any portions of an A-B trust as the beneficiary of an IRA or other retirement account? How do you weigh the tax vs non-tax advantages and disadvantages of a trust as beneficiary? Please share your thoughts in the comments below!