Executive Summary

Prior to the passage of the Tax Cuts and Jobs Act in 2017, W-2 employees had the ability to deduct unreimbursed job-related expenses paid with personal funds as miscellaneous itemized deductions on their personal income tax returns. But the TCJA suspended most miscellaneous itemized deductions (including unreimbursed employee business expenses) through 2026, eliminating the opportunity for employees (including S corporation owners who also serve as employees of those companies) to deduct business expenses on their individual returns.

But the good news for S corporation owner-employees is that, by implementing an “Accountable Plan” a (a reimbursement program which meets certain IRS regulations), S Corporation owner-employees can continue to deduct business expenses that they pay for personally by “passing” them along to the business. Essentially, an Accountable Plan is an IRS-approved reimbursement program that allows a business to reimburse employees for business expenses they incur as part of their work. The business is then able to deduct those reimbursed amounts as if the business had incurred the initial expense, itself.

When using an Accountable Plan, reimbursements for business expenses are not considered compensation to employees thus, don’t increase payroll taxes due on wages or an employee’s income tax liability. However, it’s important to note that the deductibility of an expense incurred by an employee isn’t changed when submitted for reimbursement to an employer. Thus, any limitations or restrictions inherently associated with a deductible expense remain in place (e.g., the 50% deductibility of meal expenses).

There are three simple guidelines an Accountable Plan must follow to be considered valid: 1) all expenses to be reimbursed through the plan must have a business connection, 2) expenses must be “timely substantiated,” and 3) any excess advances provided to the employee must be “timely repaid.” While the actual definition of “timely” (with respect to substantiation and repayments of advances) is somewhat ambiguous, the IRS has provided several “safe harbor” options.

Since Accountable Plans are so simple to establish, and since they offer such flexible rules around to whom they can apply, and to which expenses they will cover, there is generally no reason for most S Corporations not to implement them. For example, the Accountable Plan can be designed so that only certain expenses can be reimbursed, and/or so that only specific employees can participate.

Despite their simplicity, though, business owners should understand that if the IRS does not deem their plan in compliance with the Accountable Plan rules, their plan will be treated instead as a “Non-Accountable Plan”. In such instances, any reimbursements will be added the employee’s wages. Even though employee wages reduce gross business revenue, that reduction is offset by the increase in wages. And to top it off, the impact of higher FICA taxes as a result of those wages means that the total tax liability will be higher than if the expense hadn’t been reimbursed in the first place!

Ultimately, the key point is that an Accountable Plan is a simple way for S Corporation owner/employees to shift deductibility of business expenses from the employee to the employer and offers the ability to mitigate tax liability by allowing business owners to choose which expenses are reimbursable and which employees will be eligible to submit reimbursements. Thus, in light of TCJA and the suspension of miscellaneous itemized deductions, for S Corporation owner-employees, in particular, Accountable Plans are an especially effective tax planning tool.

When it comes to tax planning, there is really one goal… to pay as little tax as possible over the long run. But to achieve that one goal, it takes both proactive planning to mitigate future taxes (which are somewhat unknown), and a sound understanding of the exemptions, deductions, credits, and other tools available today that can help individuals wring Uncle Sam’s “tax sponge” as dry as possible.

S corporation owners, in particular, start off at a disadvantage relative to other business owners as far as deducting business-related expenses. Sole proprietors, for instance, don’t have unreimbursed expenses because they literally are the business! When they spend money on a business expense, it automatically is a business expense (and claimed as a deduction accordingly on their Schedule C)!

General partners in partnerships, on the other hand, can incur business expenses that go unreimbursed by the partnership, but unlike unreimbursed employee expenses, those unreimbursed partner expenses can be deducted on a personal return. More specifically, general partners can deduct Unreimbursed Partner Expenses (UPE), on Schedule E, a “strategy” that remains viable even after the Tax Cuts and Jobs Act.

Of course, it’s also important for S corporation owner-employees (individuals who both own an interest in an S corporation and perform services for that company), to take advantage of any business-related tax deductions. This often means adding (or maintaining) an Accountable Plan for reimbursements of otherwise nondeductible expenses. And while such plans have long been a part of the business owner’s tax planning arsenal, changes made by the Tax Cuts and Jobs Act have made them more valuable to S corporation owner-employees than ever before.

The Unique Ways That S Corporation Owners Are Required To Report Income and Claim Expenses

S corporations are, by definition, “small businesses” (the form used by corporations to elect S corporation status, IRS Form 2553 is literally called “Election by a Small Business Corporation”). But there are small companies, and then there are small companies.

(Note: Limited Liability Companies (LLCs) may file Form 2553 to make an S corporation election. While the underlying entity is still organized as an LLC under state law, for Federal tax purposes, the entity is treated as an S corporation. Thus, the following discussion applies to both “true” S corporations, as well as LLCs which have properly elected to be taxed as S corporations.)

To that end, most S corporation owners are not only owners of those businesses, but they are also employees of the business. In fact, a 2016 Treasury Department study found that owner-employee wages reported between 2001 and 2013 were included on roughly 80% of S corporation returns which paid any wages. And while such persons don’t necessarily distinguish for themselves when they are performing the functions of each - “Ok, now I’m acting as the owner”… “Oh wait, now I’m being an employee again” and just focus on the net cash flow they take out of the business – the roles, and types of cash flow they receive, are very much separate for tax purposes.

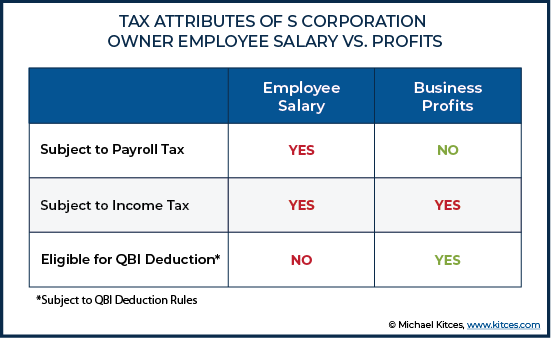

For instance, an S corporation is required to pay owners “reasonable compensation” (a reasonable salary) for services provided to the corporation. Any amounts that are paid/received as salary are subject to payroll taxes (i.e., FICA taxes for Social Security and Medicare), on both the employer side (paid by the S corporation) and the employee side (deducted from the owner-employee’s paycheck). Conversely, profits (dividends) of an S corporation (whether distributed or not) are subject to ordinary income tax, but are not subject to employment taxes. Furthermore, only the profits of an S corporation are potentially eligible for the Tax Cuts and Jobs Act (TCJA)-created 20% Qualified Business Income (QBI) deduction for pass-through entities, whereas the salary paid to an S corporation owner-employee is not eligible for the deduction. Thus, while an individual may not make a clear distinction between income received as an owner of an S corporation versus their income due to employment by the S corporation, the IRS most certainly does.

The same distinction must also be made for expenses, which can be incurred by the S corporation itself, or by the owner-employee in their capacity as an employee (as an unreimbursed business expense). Categorizing an expense one way or another has always been necessary, but in years prior to 2018 (before the Tax Cuts and Jobs Act), the determination was less important in terms of its impact on many S corporation owner-employees’ total tax liability.

How TCJA Changed The Relative Benefit Of Claiming S Corporation Expenses Inside Or Outside The Business

Before the Tax Cuts and Jobs Act was passed at the end of 2017, if an S corporation owner-employee incurred a “business” expense in their capacity as an employee (which is how some deductible expenses, such as those for the home office deduction, must be incurred), they were able to claim the expense as an unreimbursed-employee-expense miscellaneous itemized deduction on Schedule A of their personal income tax return. While the deduction was subject to the 2% floor (and was also potentially eliminated by the alternative minimum tax (AMT)), many owner-employees were able to receive at least some benefit from the deduction. Alternatively, if the expense was incurred by the S corporation, itself, the business was able to claim a deduction, and reduce the profit that would ultimately flow through to the S corporation owner’s personal income tax return (and thus, the owner’s ultimate tax liability).

Notably though, as part of the Tax Cuts and Jobs Act, all miscellaneous itemized deductions subject to the 2% floor have been suspended through 2026. Thus, while any expenses incurred by an S corporation (or any business) are still deductible by the business, any unreimbursed employee expenses incurred by an S corporation owner-employee in their capacity as an employee (or any employee, for that matter) are no longer deductible on their personal return (through 2026)!

Accountable Plans Shift S Corporation Business Deductions From (Owner-)Employees To Employers

Given the changes made by the TCJA (that made business expenses tax deductible ONLY if they’re claimed by the business, and not by the business owner as an unreimbursed employee business expense), ideally, there would be some “magic way” of transforming now-nondeductible unreimbursed employee expenses to deductible expenses of the business…

(Cue the Accountable Plan)

An Accountable Plan is an IRS-approved, simple and elegant way to shift business-deductible expenses from an employee to their employer. In short, an Accountable Plan is simply a reimbursement program, established by an employer, that allows employees to be reimbursed for business expenses they incur as part of their work. Accordingly, the employer is then able to deduct amounts reimbursed to the employees as if the business had incurred the initial expense, itself.

For instance, while a business can deduct an expense for supplies that it pays for directly, an employee who purchases supplies out of pocket is no longer allowed to deduct the expense (as an unreimbursed business expense miscellaneous itemized deduction). With an Accountable Plan, though, the employee can be reimbursed for supplies purchased on behalf of the company, and then the company would be entitled to take a deduction for the full amount.

Example #1: Val is the owner-employee of an S corporation, and purchases $100 of supplies with his personal credit card for use by the company. While Val is no longer able to deduct the expense as a miscellaneous itemized deduction on Schedule A of his 1040, he can be reimbursed $100 under the company’s Accountable Plan, and the company can then deduct the full $100.

But how would an Accountable Plan treat expenses that have restrictions or limitations on the amount that can be deducted?

Example #2: Val has a dinner meeting with his client Sarah and submits a $100 receipt to his company for reimbursement under its Accountable Plan. In this case, the business would only be able to take a deduction for $50, since meal-related expenses are only 50% deductible by a business to begin with.

Thus, an Accountable Plan does not change the nature of a potential deduction – that is to say, whether something is fully deductible, partially deductible, or nondeductible – but rather, from the employer’s side, it’s as if the employer had incurred and paid the expense directly, which is what makes it a deductible expense that the business can claim to begin with!

Furthermore, reimbursements to an employee under an Accountable Plan are merely giving back an employee the money they laid out on behalf of their employer. Therefore, even though the employer will be able to deduct such amounts (subject to “normal” deduction rules), those reimbursements are not considered “compensation” to the employee, and thus, are not subject to income tax or employment taxes either (i.e., those reimbursements are tax-free to the employee).

Example #3: Marcy is the owner of Marcy’s Toy Shoppe, Inc., an S corporation. Marcy primarily uses her cell phone for work, but pays for the plan personally as part of a “family plan”. Prior to 2018, Marcy had claimed $1,000 of cell phone expenses per year as an unreimbursed employee expense when reporting itemized deductions on Schedule A of her personal income tax return.

Given the changes made by TCJA, though, Marcy is no longer able to deduct those expenses, so she creates an Accountable Plan for Marcy’s Toy Shoppe instead. After doing so, Marcy can submit her $1,000 of business-related cell phone expenses to her employer (which is essentially Marcy, since it’s her own company), and can reimburse herself for that amount. Marcy’s income as an employee will not be increased, but her profit as an owner will be reduced by $1,000. Which effectively means the Accountable Plan allows Marcy to cover the entire $1,000 expense on pre-tax basis!

Rules For S Corporation Accountable Plans To Deduct Reimbursed Business Expenses

The use of the word “plan” in connection to anything employer-related often conjures up thoughts of complex rules, burdensome requirements, and potential added costs. But an “Accountable Plan” for an S corporation is none of those things. Rather, an Accountable Plan can be established almost instantaneously, and typically at little to no cost to the employer (other than having to reimburse employees for covered expenses).

That being said, Treasury Regulation Section 1.62-2 does outline a number of requirements that must be met in order for a reimbursement arrangement to be considered an Accountable Plan, including that the expenses must have a business connection, be timely substantiated, and any excess advances must be timely paid.

Accountable Plan Expenses Must Have A Business Connection

Under Treasury Regulation Section 1.62-2(d), in order for expenses to be reimbursed under an Accountable Plan arrangement, they must have a business connection. In other words, the expenses must be incurred by the employee in the course of performing services for the employer.

Said differently, an accountable plan can’t turn a non-deductible business expense into a deductible business expense simply because an employer decides to reimburse an employee for an expenditure. Rather, the expense must still be a business expense.

Example #4: Rori is the owner of an RIA structured as an S corporation. She occasionally visits the local office supply store to pick up supplies for the business. Recently, Rori’s son went back to school and needed various supplies from the same store. During her trip to pick up the school supplies, Rori picked up several reams of paper for her office.

While the reams of paper would able to be submitted to her business for reimbursement under an Accountable Plan, the school supplies would not eligible for the same treatment. Further, since the trip to the store was not a business trip, the miles-driven would be considered personal miles. Thus, travel costs associated with the trip to the store would also not be eligible for reimbursement under an Accountable Plan.

Accountable Plan Expenses Must Be Timely Substantiated

Treasury Regulation Section 1.62-2(e) dictates that under an Accountable Plan, an employer must require that any expenses to be reimbursed be substantiated to the employer within a reasonable period of time.

Accordingly, it’s generally good practice to require employees to submit receipts for all reimbursable expenses in a timely manner. Receipts are only required, though, if an expense exceeds $75 (unless the expense is related to lodging, in which case a receipt is always required).

Furthermore, substantiation of business gifts, business travel away from the home (including meals and lodging), and the use of certain “listed property” (e.g., a passenger automobile) as defined in IRC Section 280F(d)(4), are generally required to be substantiated with specific information, including:

- The amount of the expense

- The time and place of the travel, or a description of the gift

- The business purpose of the expense

- The business relationship to the person receiving the benefit

Thus, while a receipt may provide some of this information (e.g., the amount of an expense, as well as the time and place), supplemental information not found on the receipt (e.g., the business relationship of the person receiving a benefit) must generally be supplied by the employee and received by the employer as well.

For other expenses, the information submitted by an employee to an employer must be “sufficient to enable the payor to identify the specific nature of each expense and to conclude that the expense is attributable to the payor's business activities” (though there is an exception to this rule for certain per diem amounts.) Because as noted earlier, expenses to be reimbursed must have a valid (and now, substantiated) business connection in the first place.

Of course, that still leaves one question up in the air… Just how long is the “reasonable period of time” an employee has to submit the substantiation of expenses described above?

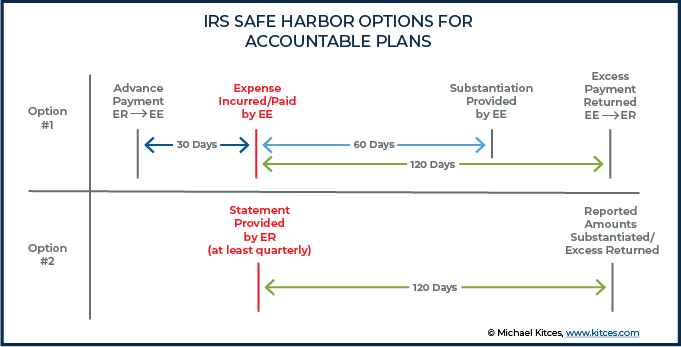

For those owner-employees who wish to “guarantee” that their substantiation window will be considered “reasonable” by the IRS, Treasury Regulation Section 1.62-2(g)(2)(i) provides a 60-day safe harbor. Thus, any expense substantiated to an employer within 60 days of when it is incurred or paid by the employee will be considered substantiated within a timely manner. Alternatively, Treasury Regulation Section 1.62-2(g)(2)(ii) provides another safe harbor option that requires employers to provide employees with a statement no less than quarterly that shows advance payments not yet substantiated, and employees are then required to either substantiate the yet-to-be-substantiated amounts, or repay them, within 120 days of the notice.

Unfortunately, for employers who chose not to use the safe harbor described above, there is no one-size-fits-all definition of a “reasonable” timeframe. Rather, the reasonableness of the timeframe employees are given to provide the employer with substantiation related to their requested reimbursements depends on the particular facts and circumstances. In general, though employers should be encouraged to require such expenses be substantiated no less than quarterly.

Any Excess Advances To Employees Under An Accountable Plan Must Be Timely Repaid

The final key requirement for an Accountable Plan, as outlined in Treasury Regulation Section 1.62-2(f), is that any amounts initially paid to an employee in excess of what the employee ultimately substantiates to the employer generally must be repaid within a reasonable amount of time (there is an exception to this rule for certain per diem amounts). This may happen if, for instance, an employee is going on a business trip and the employer “fronts” the employee an estimated amount (i.e., to prevent the employee from having to first “come out of pocket” to meet those expenses), and then trues up after the fact that the dollars were in fact spent for business purposes.

Once again, whether the timing is “reasonable” is a “facts and circumstances” argument. However, for those business owner’s looking for maximum assurances, Treasury Regulation Section 1.62-2(g)(2)(i) once again provides a safe harbor: so long as the advance is made within 30 days of when the actual expense is paid or incurred, and an excess is returned within 120 days after that date (on which the expense is paid or incurred), the timing is considered reasonable.

Not Required But Best Practice: Formalize The Adoption Of A Written Accountable Plan

Interestingly, there is no requirement in Treasury Regulation Section 1.62-2, the Internal Revenue Code, or elsewhere, that a company maintain (or create) an Accountable Plan in writing. However, as a matter of good practice, and to provide the best defense to a potential IRS inquiry, businesses should take appropriate steps to formalize the adoption of an Accountable Plan, including establishing a written “plan”.

Though there are no specific requirements for what to include in a written Accountable Plan (since there isn’t even a requirement to have one in writing in the first place!), it’s still a good idea to create a business document (e.g., as part of an Employee Handbook) that includes information such as:

- The requirement for employees to provide substantiation for expenses

- Information related to the timing of the above requirements

- Information regarding reimbursable and non-reimbursable expenses

- The requirement for employees to return excess payments

To further “cement” the validity of the Accountable Plan, S corporations should note the adoption of the Accountable Plan in their corporate minutes. Other entities should record evidence of the plan’s formal adoption in the manner that they record other significant business decisions.

S Corporation Owners Can Design Accountable Plans Selectively For Certain Employees and Expenses

An Accountable Plan isn’t an ERISA-qualified 401(k) or similar retirement plan that has non-discrimination rules that would otherwise require all employees to be treated exactly the same. Thus, an employer is generally free to selectively choose which employees it will reimburse for which expenses, and in what manner (though employers should always check to make sure there are no state or local laws which conflict with this information).

For instance, an employer can choose to reimburse only owner-employees for home office expenses, and not reimburse other employees for the same expenses. Alternatively, it could use an Accountable Plan for some employees, and a Non-Accountable Plan for other employees. An employer could even use an Accountable Plan for all expenses, but use a Non-Accountable Plan for only some expenses of certain employees! Of course, the employer should have justifiable reasons to implement different reimbursement policies for different non-owner-employees, not simply because he might like one employee more than another (which could regrettably lead to employee-filed grievances!).

An Accountable Plan Can Reimburse Employees For A Variety Of Expenses

One of the biggest benefits for S corporation owner-employees who adopt an Accountable Plan is that it allows them to deduct expenses related to a home office (provided they meet the “normal” rules to be able to claim a deduction for home office expenses, such as passing the “regular” and “exclusive” use tests). In fact, in the post-TCJA world, it’s effectively the only way for an S corporation owner-employee to receive a deduction for all expenses related to a home office.

The reason is that, as noted earlier, such individuals can no longer claim a deduction for home office expenses as an employee because it would have been claimed as a miscellaneous itemized deduction for unreimbursed employee expenses… which under TCJA has now been suspended through 2026 (along with all other miscellaneous itemized deductions subject to the “2% floor”). Renting one’s home office to their S corporation is similarly unsatisfying, thanks to rules found in IRC Section 280A, (which given its title - “Disallowance of certain expenses in connection with business use of home, rental of vacation homes, etc.” – really isn’t that surprising!).

But with an Accountable Plan, an employee can submit for reimbursement all expenses related to the maintenance of a home office – even though it’s being submitted by the owner (as an employee) to the S corporation he/she owns. Notably, when calculating home office expenses for reimbursement, the “Actual Expense Method” (also referred to as the “Regular Method”) must be used (as Revenue Procedure 2013-13, which created the alternate safe harbor “Simplified Option” reporting method, prevents its Simplified Option to be used for employee reimbursements).

Using the Actual Expense Method, owner-employees can submit for reimbursement to their S corporation a ratable (percentage of business use) portion of otherwise nondeductible home-related expenses, such as home utility bills, maintenance, and repair costs, and insurance. An allocable amount of depreciation can also be submitted as an expense (and should, since whether it is actually used as an expense or not, there will be depreciation recapture upon the sale of the home). Finally, ratable amounts of mortgage interest and property taxes can be submitted for reimbursement. And while both of these expenses are potentially deductible as itemized deductions on Schedule A absent the use of an Accountable Plan, the TCJA’s higher standard deduction (meaning fewer people actually itemized), coupled with TCJA’s new specific limits for each deduction ($10,000 cap on state and local taxes and $750,000 maximum mortgage amount for which interest paid may be claimed as an itemized deduction), make this ability more valuable than ever before.

Another potentially large deduction that can be created/preserved for S corporation owner-employees through the use of an Accountable Plan is a deduction for auto-related expenses. Such expenses can be calculated by using a ratable portion of the actual expenses the owner-employee incurred and substantiated to the employer by using receipts, etc. Alternatively, the standard mileage rate can be used (58 cents per mile for 2019), in which case it is not necessary to maintain receipts or other evidence of actual expenses (though proof of business miles driven must still be retained).

Accountable Plans can also be used to reimburse owner-employees for other mixed-use expenses, such as internet costs and cell phone costs. Unlike a home office (where the percentage of square feet of the total home used for the office can be easily calculated) or an automobile (where the percentage of miles driven for business can be easily calculated), the business use of these items is generally less clear. For example, should you track the amount of time you use your home internet for business, or for pleasure to determine the business amount? Should you somehow keep track of the bandwidth used for each instead? Thankfully, for expenses like home internet (and cell phone), the IRS allows the business-related (and hence, deductible) amount to be calculated using any “reasonable” method.

Finally, it’s worth noting that an Accountable Plan can also be used to reimburse owner-employees for expenses that are truly 100% allocable to the business, but were paid for by the employee. For instance, what if an owner-employee takes a key supplier out for a business dinner but uses his “personal card” instead of his “business card” by mistake? Or what if the same individual is going to make a large purchase at a retailer for which they have a “personal card” that will give them 5% back?

With an Accountable Plan in place, it’s no problem! The personally-paid expenses can be submitted for reimbursement to the employer, preserving the ultimate deduction.

Not Having An Accountable Plan Results In A Non-Accountable Plan (Triggering Taxable Wages To Employees) By Default

The rules for Accountable Plans are hardly onerous. That said, the relative ease of creating and maintaining such a plan (relative to what it takes to reap other tax benefits) does not mean that following its rules is any less important. Rather, failure to abide by the “simple” rules of an Accountable Plan can have serious tax ramifications.

More specifically, in the absence of an Accountable Plan, the IRS default is to treat a reimbursement arrangement as a “Non-Accountable Plan”. And a Non-Accountable Plan is not a tax-efficient way of reimbursing owner-employees for expenses, because, with a Non-Accountable Plan, any amounts paid as reimbursements may still be deductible by the business itself, but must be added to the payee’s wages.

In the context of an S corporation owner-employee in particular, this means that the failure to have an Accountable Plan results in not actually getting a real deduction (since the deduction for the business is income to the owner as wages, which just transfers the income from business to business owner instead of making it a deductible expense). In fact, the end result is actually an increase in the S corporation owner-employee’s tax liability, as the increase in their wages increases their employment taxes, too! Which, ironically, is even worse than just not having the business reimburse the owner at all when there was a failure to create an Accountable Plan in the first place.

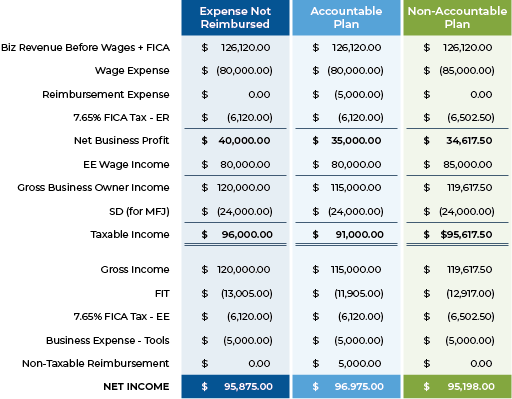

Example #5: Ralph is the sole owner of Best Plumbers, Inc., an S corporation. For 2019, Ralph is paying himself $80,000 in salary, and is expected to have net S corporation profit of $40,000 on top of his wages.

Throughout 2019, Ralph purchases $5,000 of plumbing tools using his personal credit card. If Ralph does nothing, he will have wages for 2019 of $80,000, on which both he and the S corporation will each pay 7.65% FICA taxes. In addition, Ralph will have gross income of $120,000 = $80,000 salary + $40,000 profit attributable to his business.

If, however, Ralph were to reimburse himself from the S corporation via an Accountable Plan, his wages would remain unchanged at $80,000, but his profit would be reduced from $40,000 to only $35,000 by the $5,000 of additional (now-) business expenses. Thus, it is clearly a tax-saving move by Ralph.

Suppose, however, that Ralph fails to meet one of the requirements of an Accountable Plan and as such, the IRS deems he is using a Non-Accountable Plan. Now the situation would be very different!

Ralph’s wages for 2019 must be increased by the reimbursement amount of $5,000, bring his total taxable wages for the year to $85,000. This increase in wages causes Ralph to personally pay $382.50 = $5,000 x 7.65% more in FICA taxes (which are nondeductible), and his S corporation’s FICA tax bill is increased by an equivalent amount!

And although the S corporation can deduct both the $5,000 of reimbursements paid to Ralph and its portion of FICA tax paid, reducing total profit to $40,000 - $5,000 - $382.50 = $34,617.50, it means Ralphs total business-related income is still $34,617.50 profit + $85,000 salary = $119,617.50. That’s $382.50 lower than the initial “do nothing” business-related income amount of $120,000… on top of Ralph having paid an addition $382.50 x 2 = $765 in employment taxes!

Notably, as the above example highlights, an S corporation owner-employee who reimburses themselves from the business without an Accountable Plan can actually fare worse than just not reimbursing themselves at all!

When the Tax Cuts and Jobs Act suspended miscellaneous itemized deductions subject to the 2% floor through 2026, it eliminated the opportunity for employees – including S corporation owner-employees – to deduct unreimbursed employee expenses as Schedule A itemized deductions on their current income tax returns. For employees who have little to no input over company policies, the sad fact is that no tax benefit will be available for any continued unreimbursed employee expenses.

S corporation owner-employees, however, often have a significant amount of control over their company’s policies and procedures. In fact, it’s not uncommon for a single individual or family to have total control over the entity, and when that’s the case, it almost always makes sense to implement an Accountable Plan to make sure that any and all business-related expenses remain deductible.

Adopting an Accountable Reimbursement Plan is also generally a good approach for S corporations with multiple unrelated owners, but some additional consideration may be required for an effectively designed plan. For example, if one S corporation owner-employee submits reimbursements for home-office expenses of $5,000, but another owner who designated a larger portion of his/her house as a home office and lives in a more expensive neighborhood submits $20,000 of expenses of a similar nature for reimbursement, the potential for conflict exists. But with proper planning – such as increasing one or more owner salaries to “compensate” for the differences, or simply setting a cap on the reimbursable amount as part of the Accountable Plan, such issues can easily be overcome.

The bottom line though, is simply that given the current tax landscape, nearly all S corporations should formally adopt Accountable Plans to reimburse employee-incurred expenses, essentially shifting the business deduction from the employee to the employer. The rules to set up a plan are relatively simple to follow and there are only a few timelines to keep in mind, involving how far in advance the employer can pay the employee for anticipated expenses (as well as when the employee needs to repay any excess advance amounts), and how much time the employee has to substantiate expenses. And because Accountable Plans allow the employer to selectively decide which expenses are reimbursable, and which employees will be eligible for reimbursement, they can be a potentially effective tool to help wring the tax sponge dry!