Executive Summary

Historically, the active vs passive divide has been primarily a question of how to invest within an asset class. Is it better to utilize an active manager who will try to outperform an index (at the risk of underperforming it), or simply buy the index itself in the form of a fund that at worst should simply “underperform” by the margin of a very small fee. Either way, most investment managers will still implement a remarkably similar asset allocation – regardless of the active vs passive divide – based on the principles of Modern Portfolio Theory.

Yet a deeper look at MPT reveals that in reality, it may have never been intended as a model for strategic asset allocation in the first place. Markowitz himself advocated in his original research that MPT should not be implemented simply by looking at long-term historical averages, but instead by adjusting the statistical analysis of risk and return based on nuances not taken into account by formal computations alone.

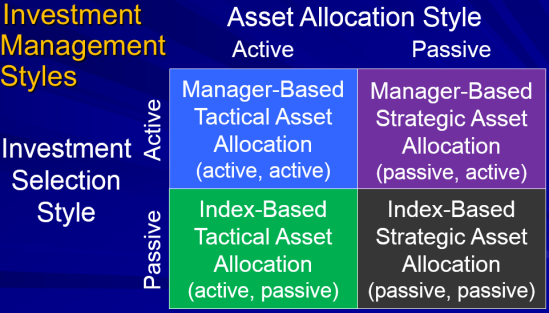

The end point of this dynamic is that the active vs passive divide of investment management is actually split on two different dimensions: to be active or passive within asset classes, and whether to be strategic or tactical amongst them, leading to four quadrants of investment management styles depending on which combination(s) the advisor chooses.

Ultimately, this means that going forward investment managers must be more cognizant to frame their approach based on both dimensions, and recognize clearly where they can – or cannot – add value for clients. So what’s your investment management style? Tactical active, Strategic active, Tactical passive, or Strategic passive?

Classic Portfolio Construction - The Active Vs Passive Divide

The standard approach to portfolio construction starts with determining a client’s goals and risk tolerance, and then finds a diversified asset allocation with an expected return and acceptable risk commensurate with the goals and tolerance. The end point is typically an Investment Policy Statement (IPS) that stipulates how much will be invested in each asset class, and then it’s left up to the advisor to determine how to actually implement each asset class – some may choose to fill in the asset class buckets with index funds, while others may prefer to choose active managers, but clients with similar goals and risk all end out with a similar baseline asset allocation.

So how is the asset allocation itself determined? In practice, most advisors use Modern Portfolio Theory – if not literally with portfolio optimizers, at least conceptually, with a goal of holding various asset classes that have appealing returns, reasonable risk, and low correlations to each other. These three factors – expected return, volatility, and correlations (or a full covariance matrix) are the building blocks of MPT.

Yet while the purpose of MPT is to determine what an optimal “efficient” allocation should be based on the various return/volatility/correlation inputs, as a model it simply shows the investor what to do once the inputs are provided. Coming up with those inputs in the first place is in the hands of the user.

While the typical approach used by advisors today is to rely on long-term historical returns, in his original paper on “Portfolio Selection” where the MPT framework was first published, Harry Markowitz provided his own guidance about how he thought his model (which he called the Expected Return-Volatility Rule or “E-V rule” for short) should be used:

To use the E-V rule in the selection of securities we must have procedures for finding reasonable [estimates of expected return and volatility]. These procedures, I believe, should combine statistical techniques and the judgment of practical men. My feeling is that the statistical computations should be used to arrive at a tentative set of [mean and volatility]. Judgment should then be used in increasing or decreasing some of these [mean and volatility inputs] on the basis of factors or nuances not taken into account by the formal computations…”

“…One suggestion as to tentative [mean and volatility] is to use the observed [mean and volatility] for some period of the past. I believe that better methods, which take into account more information, can be found.”

In other words, in his own paper, Markowitz’s own guidance was that MPT should not be implemented used historical returns and standard deviation (“the observed [mean and volatility] for some period of the past”). Instead, Markowitz envisioned that MPT would be implemented with a combination of statistical techniques and judgment to taken into account nuances of the market not conveyed by statistics alone!

The New Dimension Of Active: Tactical Amongst Asset Classes

The idea of using inputs to MPT beyond just long-term historical averages leads to a more forward-looking approach that takes into account changing market dynamics over time.

For instance, in an environment where intermediate bonds yield 2% instead of 8%, it’s not difficult to see that their expected return will likely differ as well (both due to the difference in yields themselves, and the impact on bond prices if those yields begin to revert towards the long-term average around 5%). Yet using an MPT framework, “optimizing” for low-yield bonds with high downside risk, or higher-return bonds with upside opportunity, will lead to significantly different optimal portfolios.

Similarly, stocks with high P/E ratios (and a low earnings yield) also have very different risk/return characteristics than “cheap” low P/E stocks with strong earnings (at least for the market in the aggregate; individual stocks may vary). This, again, leads to a similar result: favorably valued stocks with a good “margin of safety” will end out with a different allocation on the efficient frontier than buying markets at nosebleed valuations and an elevated risk they will revert to the long-term average.

Which means ultimately, as the risk/return characteristics of all the asset classes change, so too do the inputs to MPT, which impacts the efficient frontier, and leads to a startling conclusion: proper implementation of MPT actually means the optimal asset allocation itself should change over time! Portfolio managers monitoring dynamic markets may actually be compelled to make tactical shifts amongst asset classes just to maintain a constant risk/return exposure in the first place! By contrast, choosing a static, “strategic” asset allocation is akin to saying “perhaps the best estimate of future risk/return/correlations really is the long-term historical averages for those parameters” (Markowitz’ admonition notwithstanding).

Active vs Passive Investment Selection and Strategic vs Tactical Asset Allocation

The impact of dynamic inputs to MPT leads to what are ultimately two different levels at which a portfolio can be managed actively: changes amongst the asset classes, and changes within the asset classes.

Changes within asset classes represents the classic “passive vs active” divide: once there is a set asset allocation, do you want to implement those asset classes using active managers who try to beat the asset class benchmark, or is it preferable to simply own index funds that may not beat the asset class benchmark but at least will do a good job representing its place in the portfolio and “underperform” by no more than a modest indexing fee?

By contrast, changes amongst asset classes represent a new “to be active or not” decision –whether to make active changes to the asset allocation itself based on changing inputs to MPT (a tactical approach), or rely on a static asset allocation (a strategic asset allocation). The difference is whether or not the asset allocation itself it changes over time.

At the intersection of these two dimensions, then, is a combination of four possible “investment management” styles, depending on whether the manager is tactical or strategic in selecting asset classes, and passive or active in implementing those asset classes.

In the “traditional” world of portfolio construction, all investment management decisions remained on the right side of the chart. Asset allocation was presumed to be strategic for all, and the only decision was whether to implement that asset allocation with index funds (the passive approach) or to try to identify stock-pickers/mutual funds capable of outperforming those indices (the active approach).

On the left side of the chart, though, is the new rise of “tactical” asset allocation. In the lower left is the index-based tactical approach. If you took a snapshot of the portfolio, you would see a long list of index funds; but if you took another look at the portfolio in a year, you would different allocations to those index funds. The active implementation is not in the use of active managers in lieu of index funds, but the active management of the index fund allocations themselves! Notably, this form of “active implementation of index funds” may go a long way to explaining the meteoric rise of ETF funds, which may have less to do with financial advisors becoming more passive, than simply shifting to try to provide active management value in the lower left rather than the upper right! (For instance, Morningstar estimates ETF-managed portfolio strategies now have over $100B of AUM and grew 40% in 2013!)

In the upper left are the “double active” portfolio managers – those who actively shift amongst the asset classes, and also seek out active managers within them. Thus, for instance, an actively managed mutual fund might be sold either because the manager themselves is no longer providing value, or because the manager is doing a great job but in an asset class overall that has a poor outlook (e.g., you could have picked a brilliant tech fund manager in 2000, but the real opportunity was not picking the right tech manager but knowing when not to own tech in the first place!).

Where Do You Add Value?

The four quadrant “portfolio manager style” boxes lead to a number of different ways that advisors may choose to add value.

The “anchor” is the lower right: the low-cost passive, strategic portfolio. Arguably, this portfolio is now becoming so “easy” to implement that it is being commoditized altogether; any number of robo-advisors are now available to fill this box at a cost around 25bps.

From there, advisors who choose to add value around the investment portfolio have two choices: go left, or go up translates to either adding value by providing advice about how to allocate tactically amongst the asset classes, or provide value in the selection of active managers who can excel within those asset classes (or do that level of active management hands-on themselves).

Making tactical decisions amongst asset classes may be driven by absolute or relative valuation measures, top-down macroeconomics, or outright forecasting of exogenous events. Making active decisions within asset classes entails a skillset in security analysis and bottom-up analysis, considering costs and fees, liquidity and trading capabilities, etc.

Investment managers may ultimately choose a blend of how they wish to provide blend, and how they wish to do it. They might make tactical decisions internally, but implement with actively managed funds for the security selection. They might be a firm of bottom-up stock-pickers, but draw on outside research for macroeconomic input amongst the asset classes. They might focus on being in the “manager search and selection” business and identify managers capable of making the amongst or within asset class decisions.

Notably, all of this is still separate from the raw benefits of effective implementation, which (in the case of individuals at least) may still include components of tax-loss harvesting, rebalancing, and asset location, which can be applied across any of the four portfolio manager style boxes.

But the bottom line is simply this: as investment management continues to evolve (perhaps back to how Markowitz first envisioned it!), the decision about “active vs passive” is no longer just about index vs actively-managed mutual funds to invest within each asset class, but also about the decisions amongst the asset classes as well. Investment managers would be well served to consider which aspects of active – within and/or amongst – they wish to pursue (or not!), and ensure they know whether/where they intend to add value (and whether they have the resources to do so). This challenge – to clearly show where value is added – will only become increasingly pressured in the future, as the robo-advisors increasingly commoditize the lower right corner of the portfolio manager style boxes, forcing investment managers into one active dimension or the other, or in another direction altogether (such as financial planning and wealth management!) to increase their value-add.