Executive Summary

Broadly speaking, there are 2 models of working as a financial advisor: operating independently as a firm owner or with a large affiliate platform such as a wirehouse broker-dealer, independent broker-dealer, or larger corporate RIA. Deciding which model to work under is a key moment in beginning or evolving a career as an advisor.

In the independent model, owners/advisors are generally paid directly by the clients they serve, and they select and pay for the vendors, services, and employees that support them, whereas in the affiliated model, a number of the advisory firm functions are covered by the affiliate platform, with the cost of those services being bundled into the affiliate platform's fee. The key difference from a financial standpoint is that while clients of independent advisors usually pay the entire amount of their fees directly to the advisor, clients of affiliated advisors often pay their fees to the affiliate platform itself, with the platform passing on a percentage of the income to the advisor (and the amount that the platform keeps represents the platform's fee to the advisor for the services they provide).

As a result, many advisors using the affiliate model don't really 'see' the fees that they pay to their affiliate platform, since the only revenue they see is what's left over after the platform has taken their fee. Which in turn makes it more difficult to assess how much the advisor is really paying the affiliate platform, and what they're receiving in exchange for their fee – and ultimately, whether the amount that the advisor is paying the platform is worth what they're getting in return.

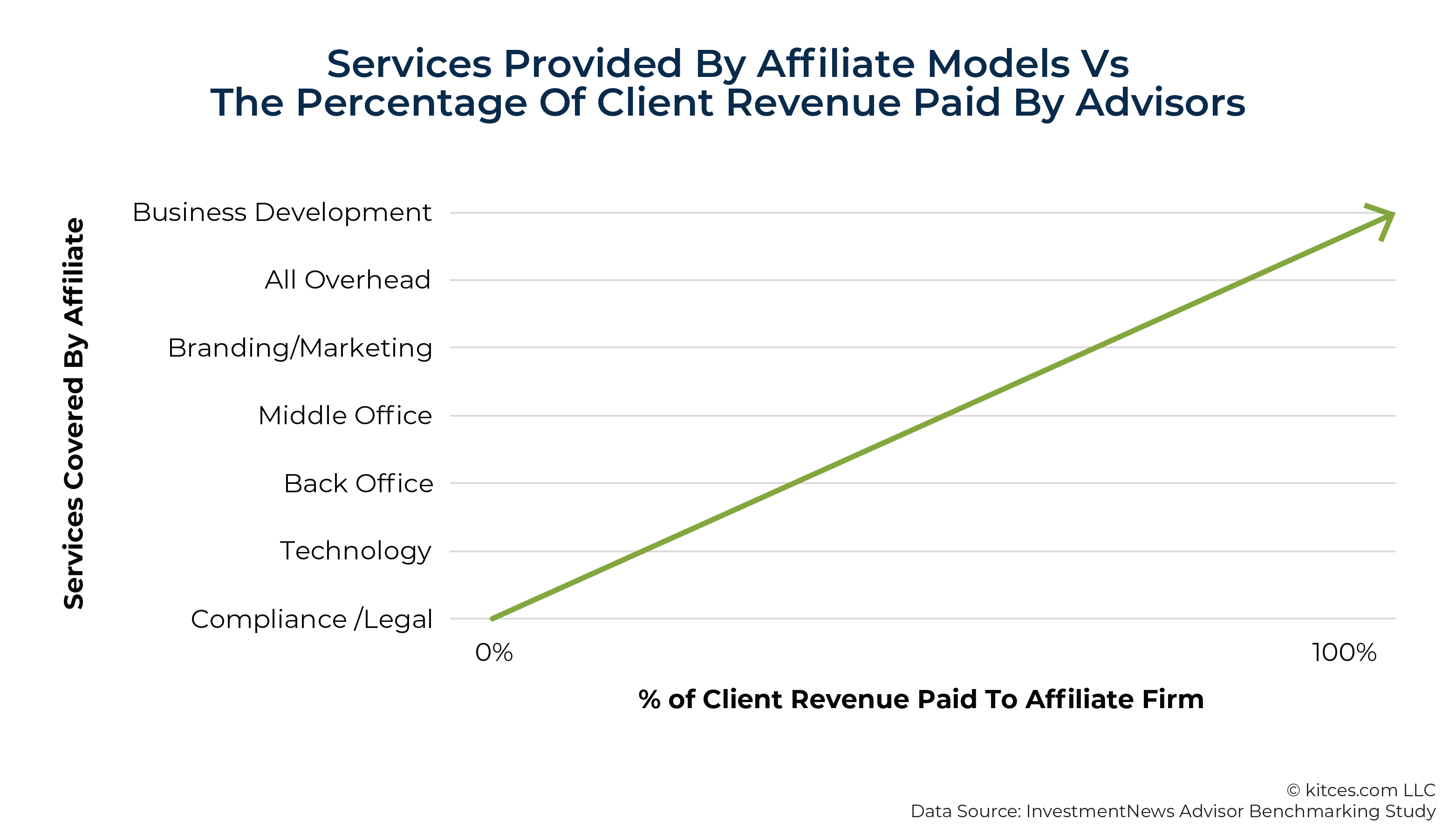

Notably, different affiliate platforms have different payout rates; those that pay out the most (and thus have the lowest fees) tend to cover relatively few functions such as compliance and technology, while those that pay out the least (and therefore have the highest fees) cover a significant amount of the advisor's overhead costs. Which means that using the platform with the highest payout rate won't necessarily result in the most take-home income for the advisor (since they're still responsible for paying all of the overhead costs that aren't covered by the platform); rather, it's more about whether and how the platform's services align with what the advisor needs to succeed in their role – for instance, if an advisor earning primarily fee-based advisory revenue affiliates with a platform that puts a lot of resources towards FINRA compliance for broker-dealer representatives, they'll end up paying significantly for a service that they rarely (if ever) use.

The key point is that regardless of whether advisors use the independent or affiliate model, achieving success as an advisor involves finding the best use of the advisor's resources to leverage support for the functions that they can't perform (or don't want to manage) on their own. Being clear on how an affiliate platform's services align with what the advisor truly needs to outsource can help save advisors from putting resources towards functions that they don't need or use. Ultimately, while some advisors might simply prefer the autonomy of the independent model, it's possible to be successful in whichever model provides the support that the advisor needs to make the best use of their time.

How Advisors Are Paid In Independent Vs Affiliate Firm Models

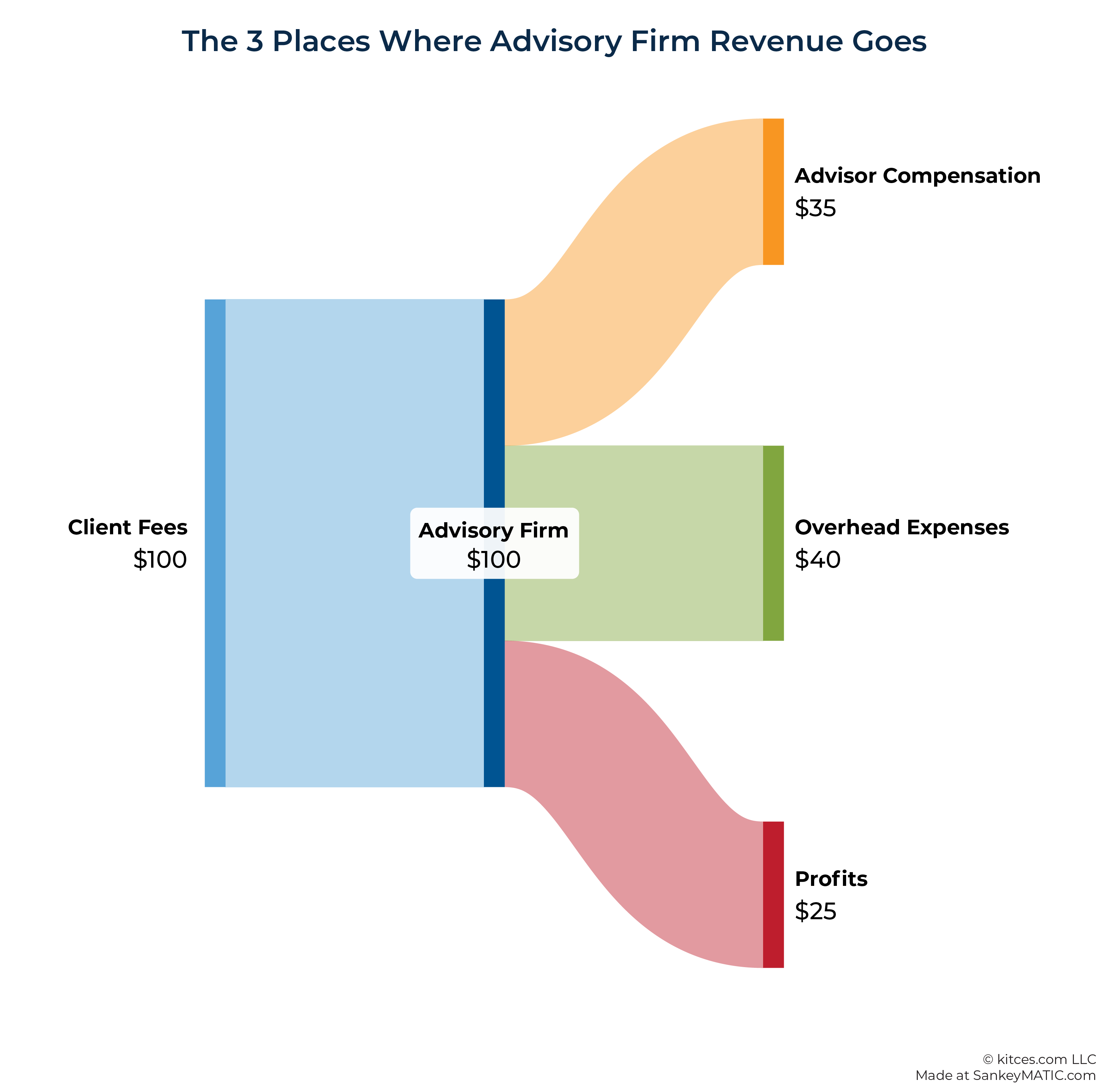

Here's an oversimplified accounting model for a financial advisory firm: When one of the firm's clients pays a fee to work with one of that firm's advisors, some percentage of those dollars goes towards compensating the advisor to do the revenue-generating activity of servicing the client, while some of the rest goes towards paying for overhead costs of being in the advisory business. Anything beyond advisor compensation and business overhead expenses goes to the advisory firm's owner(s) as net profit. For example, if a firm has $100 of revenue, for which it pays the advisor $35 and incurs another $40 of overhead costs, it would have $25 remaining in net profits, as shown below.

The types of expenses involved with providing financial advice are similar for most advisory firms. Advisors need either in-house or outsourced support in compliance, client service, human resources, and other operations and administrative functions. Those who advise on and manage investments need investment research support and a platform to trade on, while those who offer comprehensive financial planning often require associate advisors or paraplanners to help with the process of putting together financial plans. Advisors also incur costs for marketing, insurance, technology, office space, and legal and accounting services.

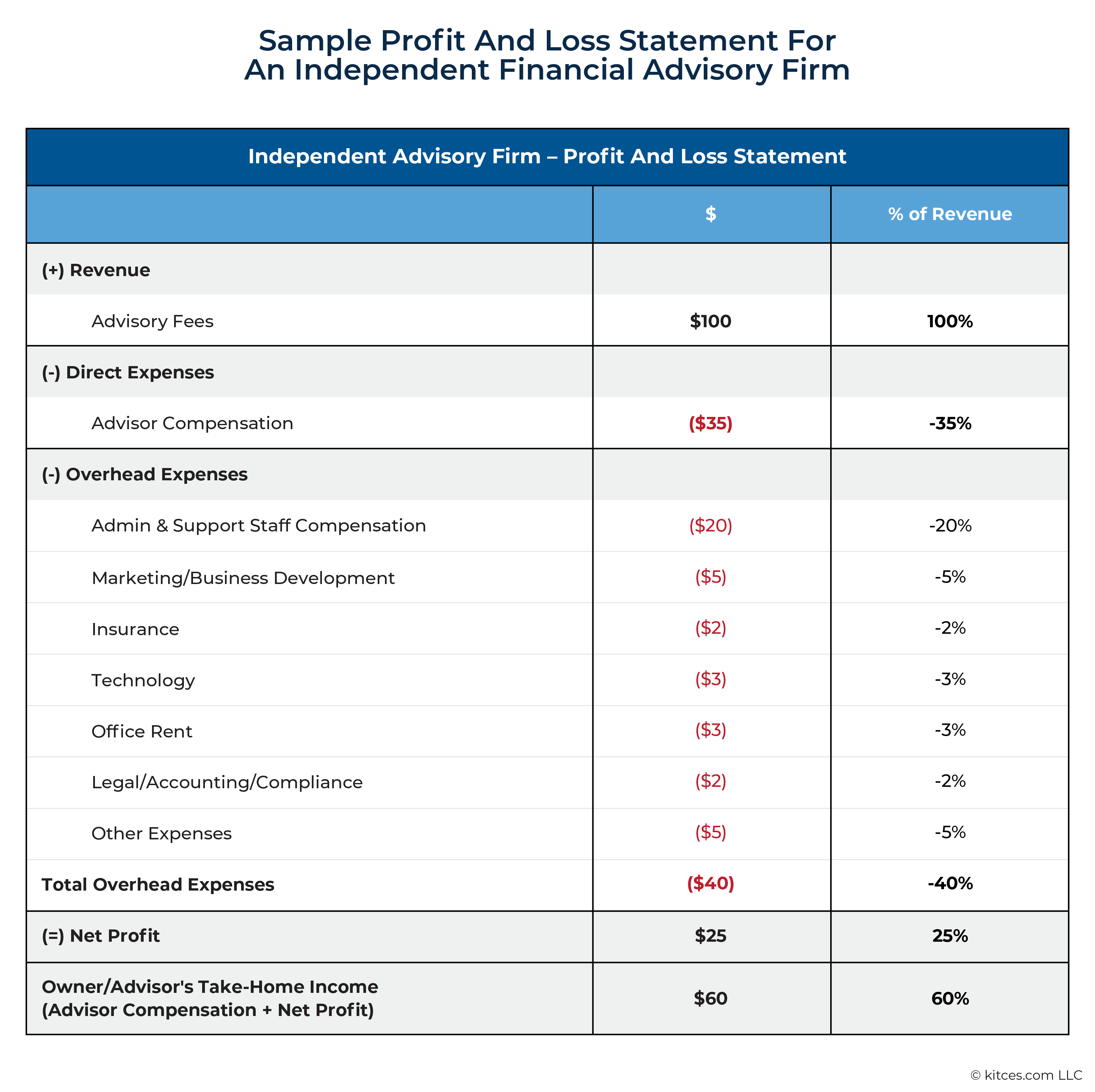

The expense types described above are the ones that are most commonly found on an advisory firm's Profit and Loss (P&L) statement. The standard P&L starts with the firm's revenue (i.e., the fees paid by clients); subtracts the costs of 'direct expenses', which are those expenses directly involved in generating revenue (e.g., advisor compensation); then subtracts the remaining expenses (which are considered 'indirect', or overhead expenses and are related to the firm's overall operating activities) to arrive at the firm's net profits that go to its owners. For firms where the advisor is also the firm owner, the owner/advisor's take-home income is the combination of their compensation as an advisor (i.e., their work for the business) and their net profits as an owner (i.e., their return on investment as an owner of the business).

Here's a sample P&L, with a more detailed categorization of overhead expenses, for the example firm above. The hypothetical firm has $100 of revenue, $35 of advisor compensation, $40 of overhead expenses, and $25 of resulting net profits, with the $35 in advisor compensation and $25 in net profits adding up to $60 in take-home income for the owner/advisor.

Advisors who own their own independent advisory firms are responsible for covering all the costs reflected on the firm's P&L statement. From the fees paid by clients, firm owners pay the salaries of staff and employee advisors, office rent, technology fees, fees for consulting and other services, and so on. After those expenses are paid, however, the firm owner/advisor gets to keep any and all of the revenue that's left over. Such are the risks and rewards of owning an independent advisory firm: The owner/advisor 'owns' 100% of the costs of running the business, as well as 100% of the profits.

Because independent firm owners take in all revenue and pay out all expenses themselves, the P&L statement of an independent advisory firm is a pretty accurate reflection of what the advisor's revenue and expenses actually are. The top-line revenue is what the advisor's clients actually pay in total for advisory services, and farther down on the P&L, the expenses listed represent all of the firm's costs of doing business. And because revenues and expenses are both comprehensively reflected, the bottom-line profits are an accurate representation of the advisor's own profitability. In other words, for owner/advisors of independent firms, the P&L reflects profits and losses accurately both from the standpoint of the firm, and from that of the advisor themselves.

How Affiliate Platform Payouts Can Distort Perceptions Of Advisor Profitability

But being an independent firm owner is only one model of working as an advisor. Many advisors use a different model, where instead of individually contracting with vendors or hiring their own staff to support all of their functions, they affiliate with a larger firm or platform – such as a wirehouse broker-dealer, an independent broker-dealer, or a multi-advisor corporate RIA – that serves to centralize one or more aspects of the advisor's operations. The functions covered by affiliate platforms often include compliance, technology, plan construction, and/or administrative support; but in theory they could cover practically any function performed by an advisory firm, save for actually meeting with and advising clients.

Strictly speaking, an affiliate platform is an overhead expense for the advisors that affiliate with it. The advisor pays the affiliate platform for the services it performs, and that expense replaces or supplements the other expenses on the advisor's P&L, making it similar to any other vendor or service provider.

However, the key difference is that unlike in the independent model, where all client fees are paid directly to the advisor and all overhead expenses are paid directly by the advisor, many (not all, but most) affiliate platforms' fees are taken out of client revenue before it's ever received by the advisor, in the form of a 'payout' rate that represents the percentage of client revenue that's passed on from the affiliate platform to the advisor. Conversely, the affiliate platform's fee is represented by the percentage of revenue that isn't paid out to the advisor.

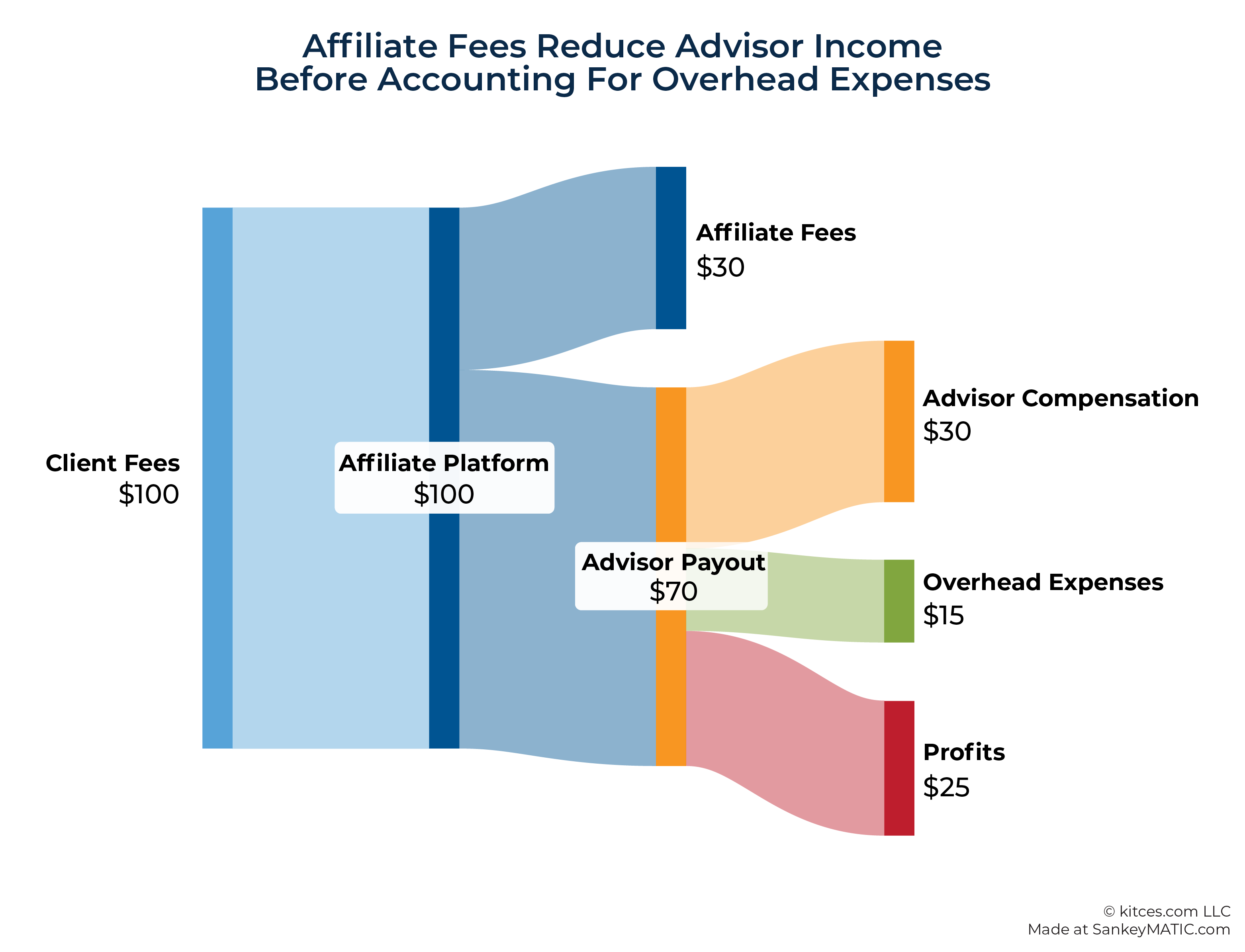

For example, if the affiliate firm pays out 70% of revenue to the advisor, then the affiliate's 'fee' is the 30% that isn't paid out. Even though the advisor doesn't actually 'see' the fee – since they only see the portion of the revenue that's ultimately paid out to them – it's still a real cost in the sense that it represents a portion of the advisor's revenue that they would have 'owned' if they weren't affiliated with the platform (and that the client really actually paid as a part of the services they receive). And if the advisor has additional overhead expenses that aren't covered by the affiliate platform, that further reduces the amount that's left over as profit to the advisor at the end.

So as shown below, if an advisor who earns $100 of client fees has a 70% payout rate from their affiliate platform after its investment platform and grid payouts, they 'pay' $30 as fees to the platform before they receive any revenue for themselves. If, of the $70 that they receive, they pay $30 in advisor compensation and $15 in other overhead expenses, then there's only $25 left over representing the advisor's bottom-line profits.

In addition to splitting client revenues, affiliated advisors and their platforms also split the costs of being in the advisory business. As a result, affiliated advisors typically have a much smaller percentage of their own revenue allocated to overhead. For example, an affiliate firm might cover the advisor's technology and compliance costs, while the advisor is responsible for paying their own support staff and office expenses. Or, on the extreme end, the firm could cover practically all of the advisor's overhead costs, with the advisor only responsible for bringing in new business and serving existing clients (and keeping all their paid-out revenue as advisor compensation and profits).

There's a wide range of other ways in which costs can be split depending on the specific affiliate and the terms they set with their advisors, about which more details will follow below. But the key point is that, in contrast to the independent RIA model where the advisor receives 100% of the revenue and pays 100% of the cost of doing business, in the affiliate model both the revenue and the costs are divided between the advisor and the affiliate firm.

What's notable, then, about the difference between the independent RIA and affiliate models is that, while an independent firm owner can create an accurate P&L statement simply by listing out the revenue they receive and the expenses they pay, an advisor in an affiliate model – who only actually receives a percentage of the total revenue they generate, and whose affiliate platform covers some portion of their overhead expenses – might have a greater challenge in understanding how profitable they actually are. Because in many cases, they only see their portion of the revenue and business costs, and not the cut taken by the affiliate platform.

For example, let's say that, as in the example above, an advisor in an affiliate model keeps 70% of the client revenue that they generate, while the affiliate firm keeps 30% in the form of their investment platform fees and the portion of the grid that they retain. The affiliate firm, in turn, covers the costs of technology, legal/compliance, and business insurance, along with some centralized investment staff support, while the advisor pays the (now-limited) remainder of their costs of doing business out of their 70% cut of the revenue and keeps whatever is left over.

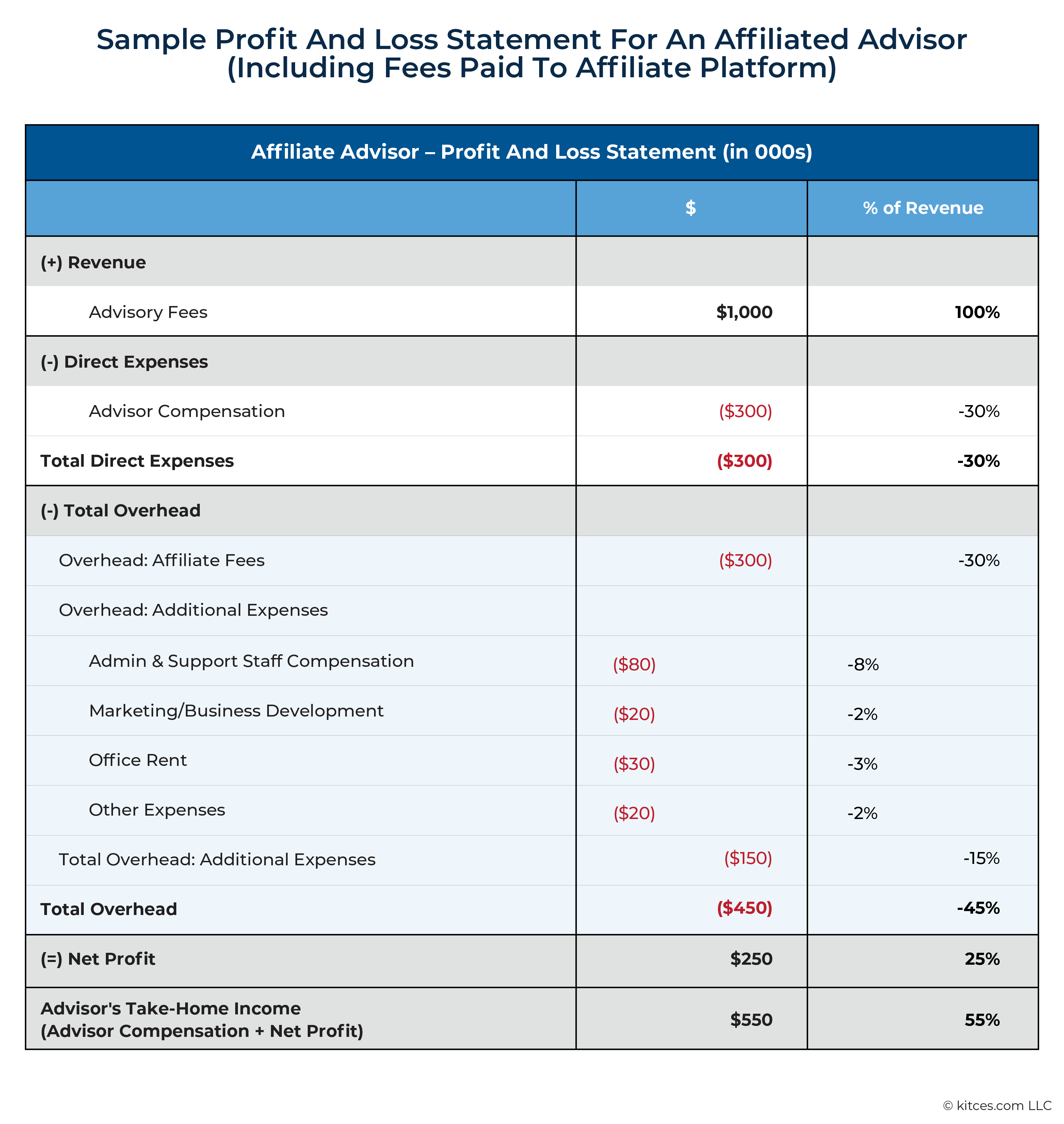

An accurate way of creating a P&L statement for this affiliate advisor would look as follows, assuming a solo advisor who pays themselves advisor compensation for their work in the business and then takes a profit off the bottom line of the business, with the affiliate platform's fee listed as a $300 expense alongside the advisor's other overhead costs:

If the advisor directly paid their affiliate platform fee as they would with any other vendor, it would be obvious to lay out their P&L statement this way, with the affiliate fee listed as a line item along with the advisor's other overhead expenses. However, in practice, affiliate firms usually don't send their advisors an actual 'bill' for their fees; rather, affiliate advisors often only see the payout they receive after the affiliate firm has taken out its cut. Which means that if the advisor were to create their P&L based on only the revenue and expenses that they see, it wouldn't really be a complete picture of their profitability.

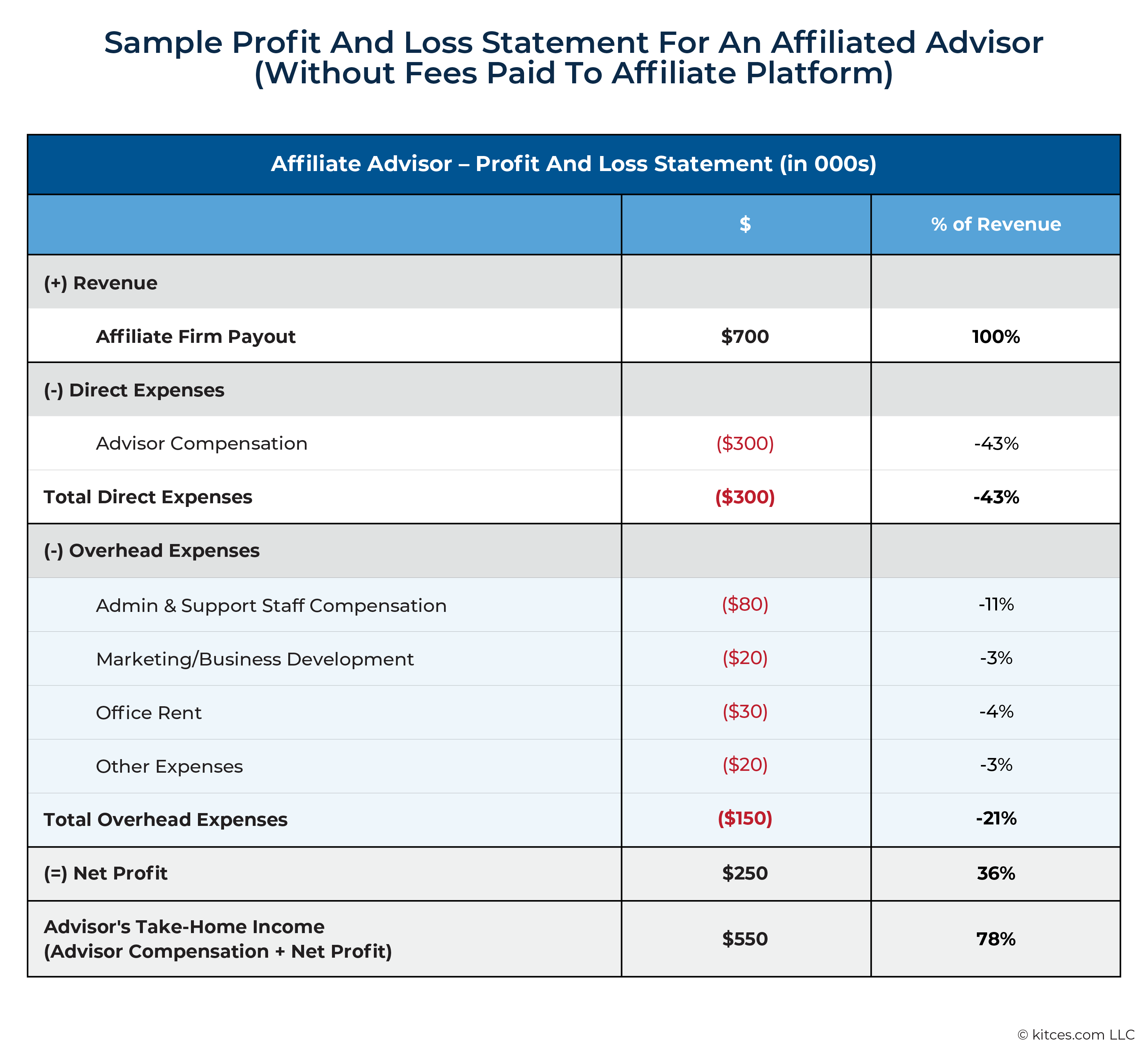

However, if the advisor from the example above created their P&L statement based only on the 70% of client revenue they receive from their affiliate platform, without categorizing the affiliate fee as a separate expense, it would look more like the following:

Note that even though both statements above show the advisor's take-home income as $550,000 in dollar terms, the income as a percentage of top-line revenue is a below-average 55% in the first scenario, and an above-average 78% in the second. Conversely, the second scenario implies a highly efficient firm with only 21% in overhead expenses, but the first reveals the firm actually has an above-average 45% overhead expense ratio (consisting of 30% allocated to affiliate fees, and 15% to other overhead expenses).

On the first statement, the profit margin and overhead expense ratio are calculated after accounting for the entire amount of client revenue generated by the advisor, and subtracting the affiliate's fee as an overhead expense. On the second statement, however, the profit margin is calculated only as a percentage of the payout received by the advisor after the affiliate firm takes its own cut, and the platform's expenses were indirectly excluded. Which ultimately makes the advisor's own profitability – how much take-home income they receive – seem much higher under the second scenario than the first, even though the actual profits are equal in dollar terms.

In other words, advisors who work under the affiliate model may have a distorted view of how profitable they really are if they don't account for the fee charged by the affiliate itself. The advisor's 'true' top-line revenue is the amount of fees paid by their clients, not simply the amount of the advisor's payout from the affiliate firm, because the gap between the clients' fees and the advisor's payout represents a significant expense for the advisor in and of itself!

The reason why it matters for advisors to understand how profitable they truly are when working with a particular affiliate is because it puts that affiliate on a level playing field with other options that the advisor may consider – either different platforms that split revenues and costs with affiliates in different ways, or the independent RIA model where advisors themselves are responsible for all of the costs and keep everything that's left over as their net profit.

If an advisor were reviewing different projected P&Ls to compare the independent advisory model (as in the very first P&L above with 60% of revenue as take-home income) with an affiliate model, their decision might be a lot different if they calculate their take-home income in the affiliate model as 78% instead of 55%. Because the services provided by an affiliate platform might sound like a pretty good deal if they are boosting net take-home income by 18 percentage points (from 60% to 78%), but if it's really a 5% reduction (from 60% to 55%), then it might start to feel like a more significant tradeoff to go with an affiliated model.

Or conversely, the advisor already on the affiliate platform might see their 78% take-home profit and feel that independence is a 'bad' deal, only to find that with a truer reckoning of all their business expenses (including the platform's cut), that they might improve their margins by 5% with an independent model that eliminates some overhead costs of the platfom that they didn't really need.

By viewing costs and profitability as a proportion of the advisor's total revenue (which includes all fees paid by their clients) rather than looking only at the payout received by the advisor after the affiliate fee, advisors can gain a clearer understanding of the benefits they are actually getting for that fee. This approach may also help them decide whether the value they're getting from their affiliate is worth what they're paying.

Why Different Types Of Affiliates Offer Different Payout Ranges

As noted earlier, the different types of expenses involved in running an advisory firm are relatively consistent no matter the model used – all advisors will need things like administrative staff, compliance support, technology, and insurance. In a fully independent RIA model, the advisor chooses whom to hire, which vendors to use, and what services to outsource versus handling them in-house, and subsequently pays those costs themselves. And when using an affiliate, the types of support and services needed are no different from the independent model; the only difference is that instead of the advisor choosing and paying for everything themselves, the affiliate firm covers some part of the range the services used by the advisor (ostensibly in a more scalable and cost-effective manner, if well-aligned to the advisor's needs).

Different affiliate platforms cover different types of functions for the advisor, and as one would expect, the more services and expenses that an affiliate firm covers, the more they tend to charge as an affiliate fee (and the lower the advisor's payout rate will be as a proportion of their revenue generated).

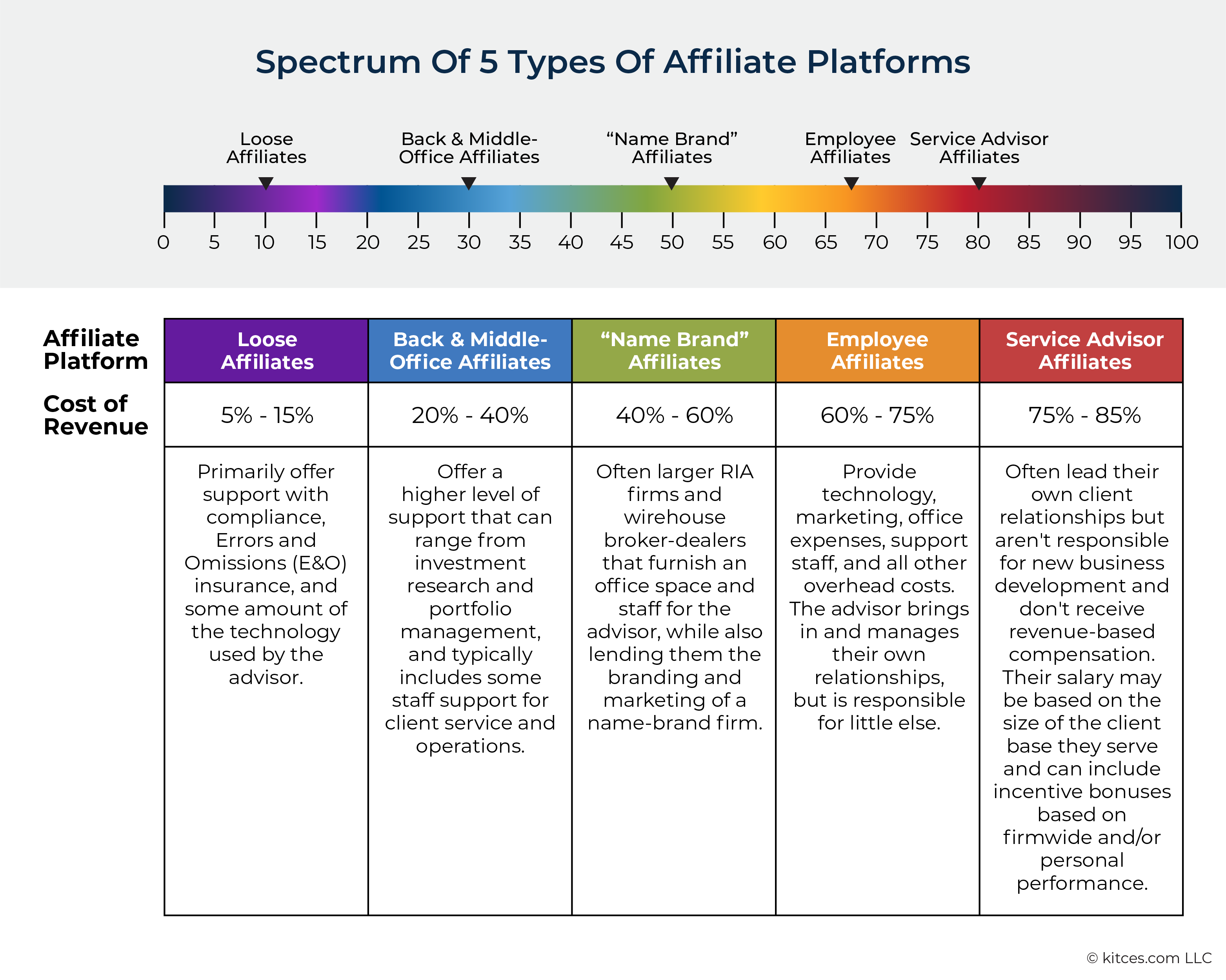

Although there are almost as many revenue and expense split models as there are affiliate platforms to choose from, the different types of platforms can be roughly divided into 5 tiers, based on the services and support they offer as well as the amount that they charge to their affiliates.

- "Loose" affiliates (cost: 5%–15% of revenue). Primarily offer support with compliance, Errors and Omissions (E&O) insurance, and some amount of the technology used by the advisor. Loose affiliates include Independent Broker-Dealer (IBD) firms like Commonwealth, LPL Financial, and Raymond James; and advisor network organizations like Garrett Planning Network, Alliance of Comprehensive Planners, and XY Planning Network (the latter of which aren't really even "affiliates" in the sense that they enter a formal revenue-splitting agreement with the advisor, but do cover a similar range of services for a cost that amounts to a similar portion of the advisor's revenue, making them effectively similar in nature to the IBD affiliates).

- Back- and middle-office affiliates (cost: 20%–40% of revenue). Offer a higher level of support that can range from investment research and portfolio management, and typically includes some staff support for client service and operations. This tier includes many Turnkey Asset Management Platforms (TAMPs), "super-OSJs" that provide back-office support to independent representatives of broker-dealers, and many corporate RIAs (i.e., the RIA arm of broker-dealer firms like Cambridge Investment Research).

- "Name-brand" affiliates (cost: 40%–60% of revenue). Often larger RIA firms and wirehouse broker-dealers that furnish an office space and staff for the advisor, while also lending them the branding and marketing of a name-brand firm. This tier includes names like Edward Jones, Ameriprise Financial, and Merrill Lynch.

- Employee Affiliates (cost: 60%–75% of revenue). There's a vast tier of these firms that provide essentially everything for the advisor – technology, marketing, office expenses, support staff, and all other overhead costs – while the advisor is primarily responsible solely for bringing in and managing their own client relationships. In some cases, the advisor doesn't even need to bring in the clients; those opportunities are created by the firm, and the advisor is simply expected to 'close' the opportunities delivered to them. Most commonly, these firms pay the advisor a base salary plus 20%–40% of the revenue that they bring in (meaning they effectively charge 60%–80% of revenue, minus the base salary and benefits). Examples include many types of bank/trust company advisors, as well as employee advisors at some large national RIAs.

- Service advisor affiliates (cost: 75%–85% of revenue). Some firms hire what would be considered 'service' advisors, who may lead their own client relationships but aren't responsible for any new business development (no requirement to source or sell/close the clients), and who don't get any revenue-based compensation (although their salary might be generally based on the size of the client base they serve, while they may also have incentive bonuses based on firmwide and/or personal performance). In other words, once a firm covers everything up to and including finding new clients for the advisor to serve, that firm essentially 'owns' (nearly) all of the advisor's revenue, and the advisor receives a relatively limited percentage to service the clients. Though notably, with a client base that generates $500k–$1M+ of revenue, this can still be a 6-figure advisor job.

In a broad sense, as shown in the graphic below, choosing an affiliate to work with means the advisor will need to pay the affiliate a portion of revenue that's roughly proportional to the amount of services and support that the affiliate provides. Affiliates that cover the fewest services – most often legal/compliance and technology support – demand the smallest share of client revenue and provide the highest payouts to advisors. However, as the affiliate covers an increasing share of the advisor's overhead expenses – adding on back and middle office expenses, adding branding and marketing costs, and growing to encompass virtually all of the advisor's overhead costs – the affiliate's share of client revenue also increases. To the point that firms that provide everything up to and including bringing in new clients for the advisor to serve may effectively keep 75%–85% of client revenue after paying the advisor's (fixed) salary.

How Affiliate Platforms' Fees Compare With The Costs Of The Services They Cover

How Affiliate Platforms' Fees Compare With The Costs Of The Services They Cover

Conceptually, since advisors pay fees to affiliate firms in order to cover services and costs that they would have been responsible for paying themselves as an independent advisor, aligning with an affiliate platform involves swapping one set of costs (overhead expenses that would have been paid to individual vendors or employees, and/or marketing and business development costs) for another (affiliate fees paid to a single platform for those services). So it would make sense that the fees charged by platforms that cover different levels of advisory overhead expenses would roughly align with the amounts that an advisor would pay if they had to cover those costs themselves (plus an additional margin for the affiliate platforms to maintain their own profitability).

Indeed, data from the 2023 InvestmentNews Advisor Benchmarking Study seem to bear out this conclusion. By looking at the typical overhead expenses incurred by independent advisory firms and grouping them together in ways commonly found in different tiers of affiliate platforms, it's possible to see how the costs of different affiliate platforms align with the services they provide.

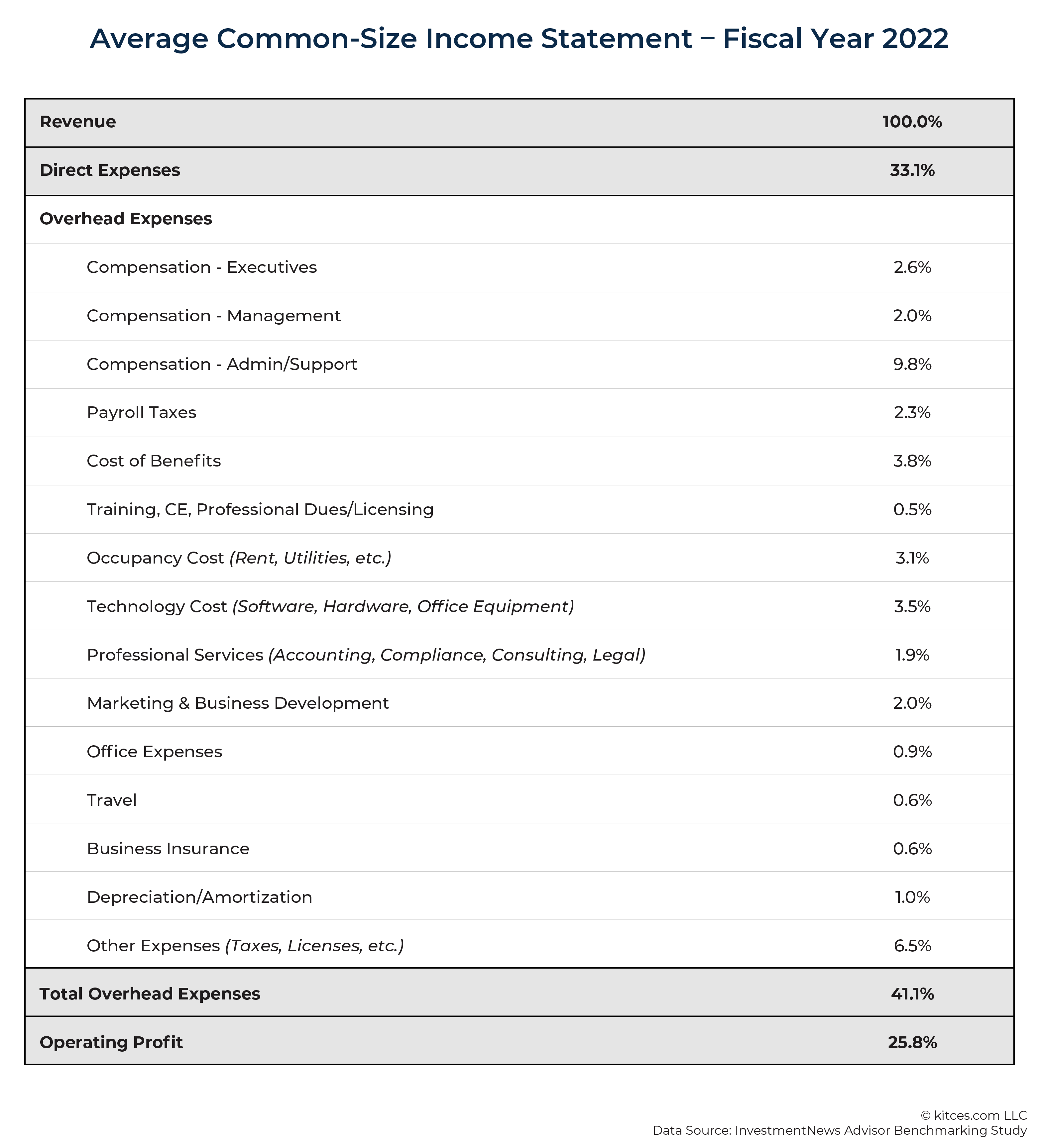

At a high level, according to the InvestmentNews study, the average (independent) advisory firm generally spends 33% of revenue on direct expenses, 41% on overhead expenses, and has a net operating profit of approximately 26%, as illustrated in the following P&L below:

It's possible to group the different expense categories on the P&L by what is covered by different types of affiliate platforms to show how the affiliate fees for different levels of affiliates (as described above) compare with the costs of those expenses as they're paid for individually.

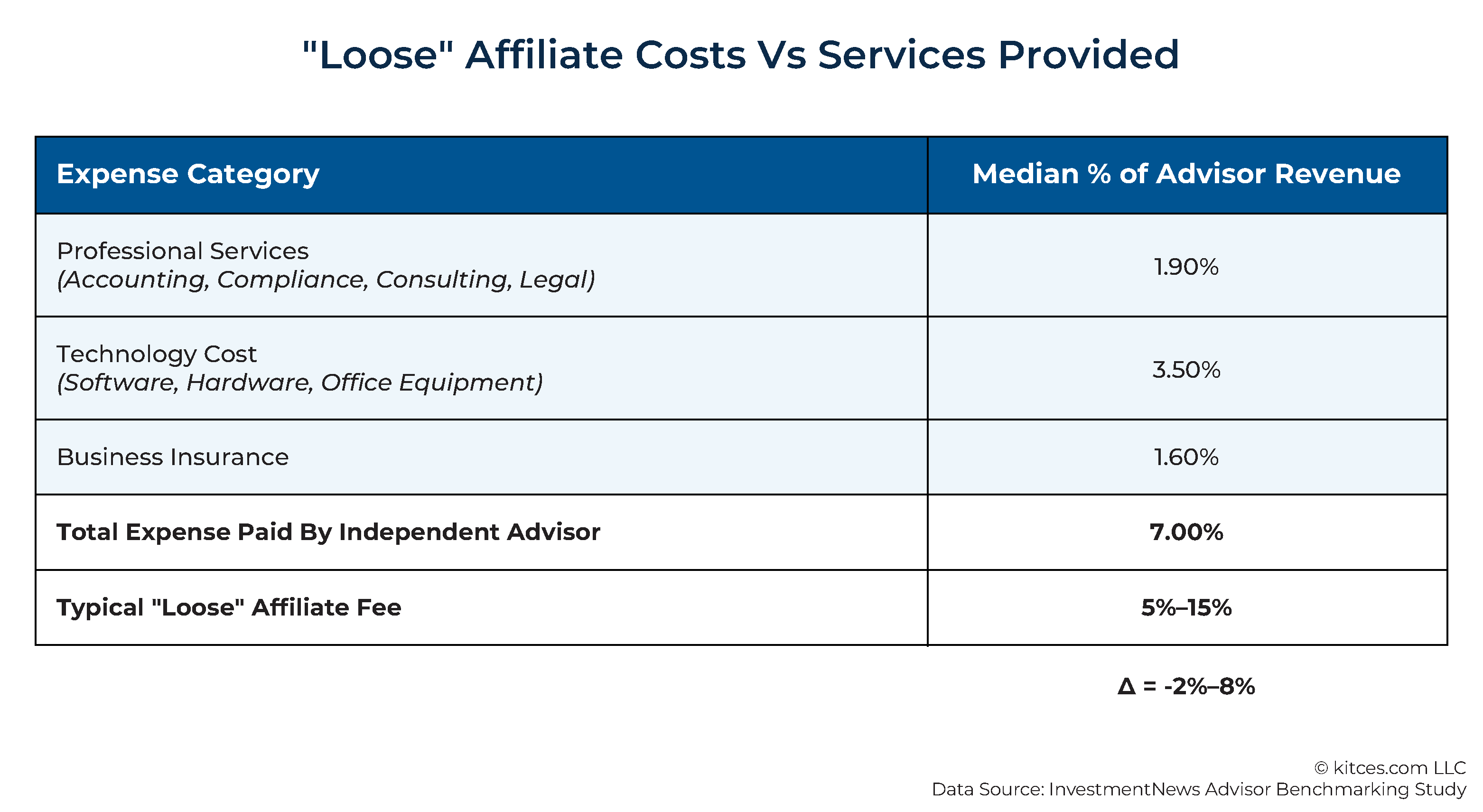

"Loose" affiliates (i.e., those that cover compliance, insurance, and technology costs), which charge the least for their services, tend to charge an average of 5% – 15% of total revenue for their services, in contrast to that same set of services costing about 7% of revenue for an independent advisory firm owner:

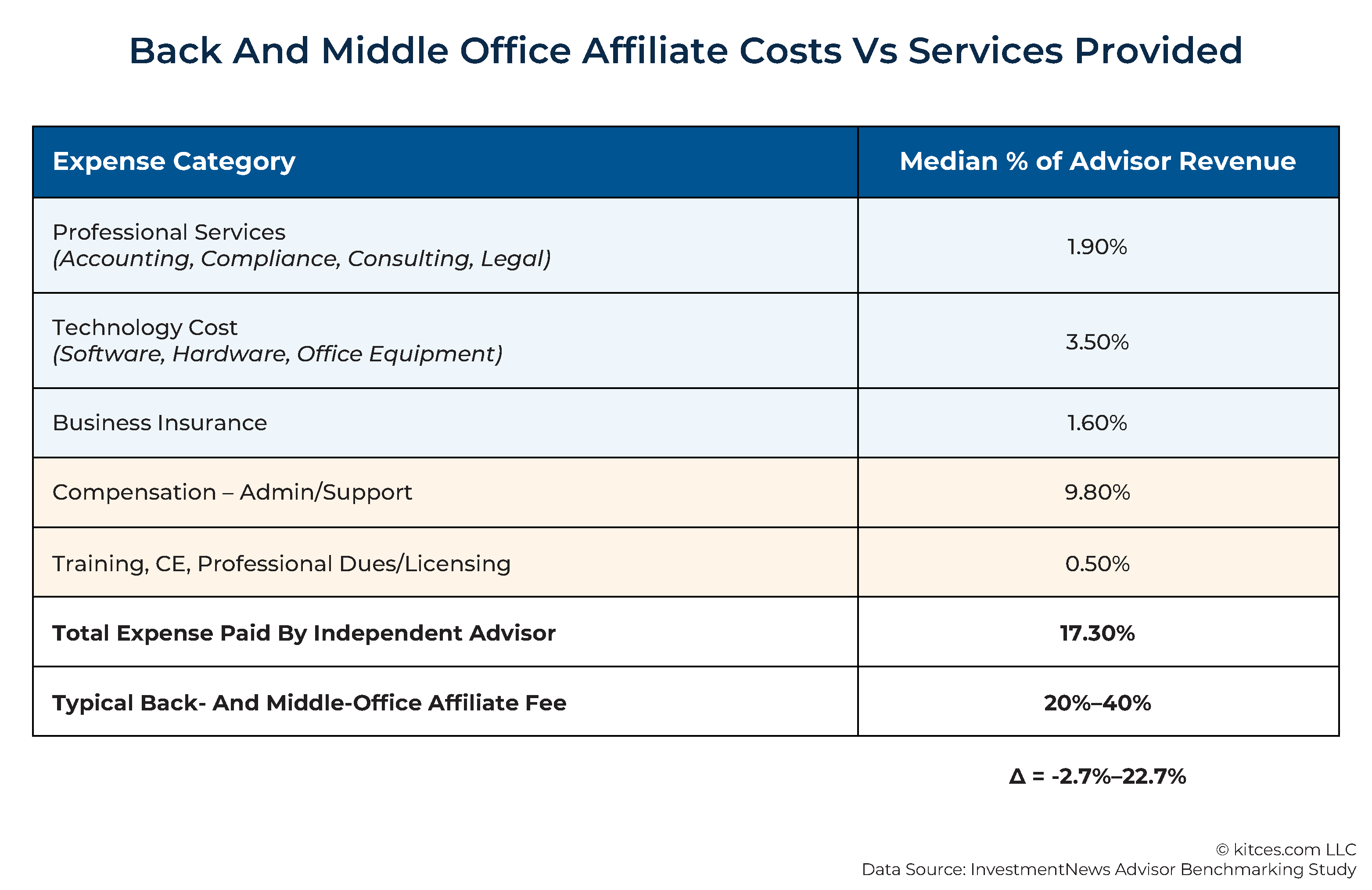

Next, the affiliates that also provide more back and middle office support, including investment research, portfolio management, and client service support (along with the services in the previous tier), charge and estimated 20%–40% for those services, whereas independent firm owners pay an average of 17.3%.

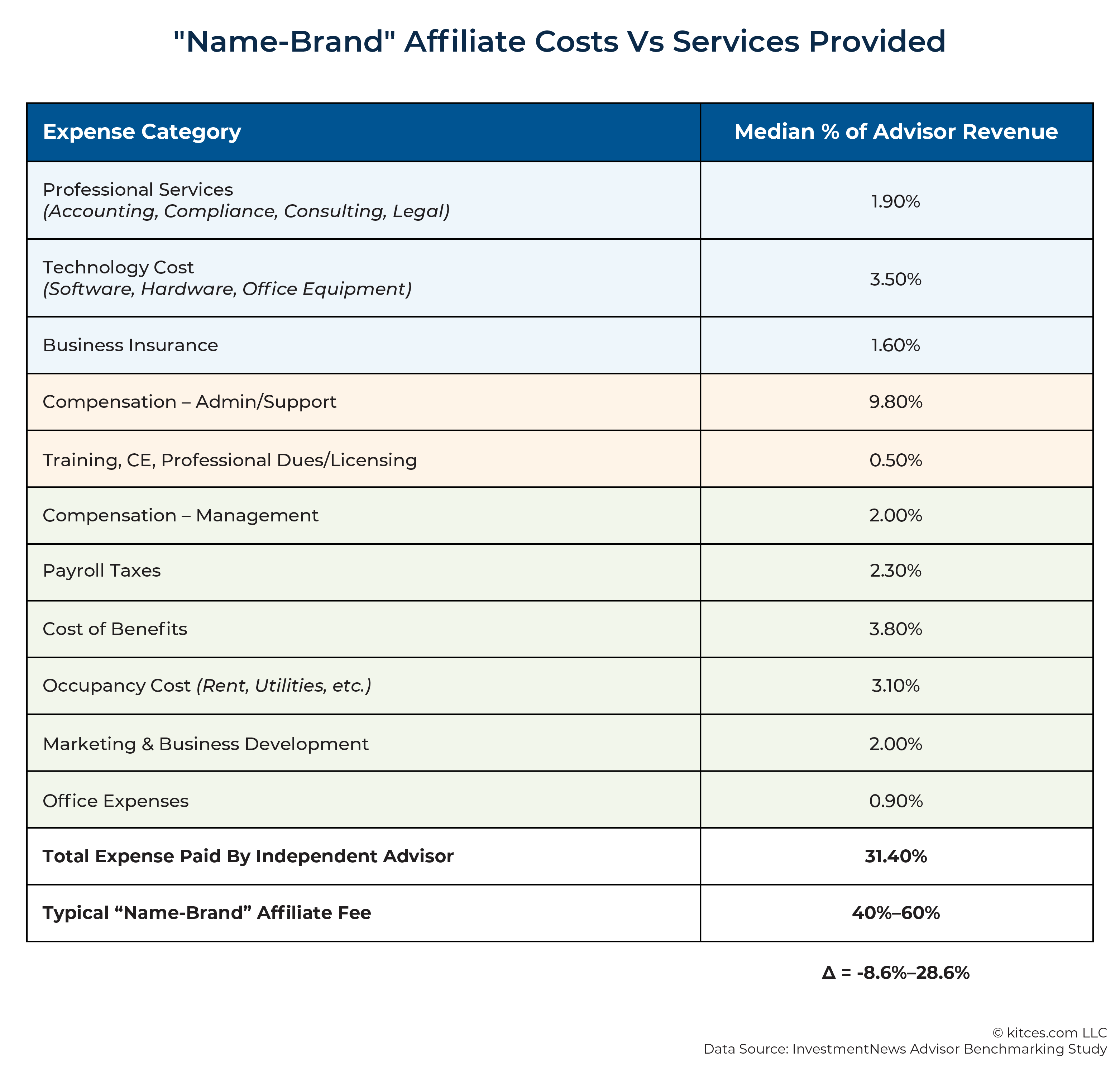

Then, there are the "name-brand" affiliates that also cover management, marketing, and office expenses. While these affiliates charge approximately 40% – 60% of revenue, independent advisory firms spend an average of about 31.4% on the same set of services.

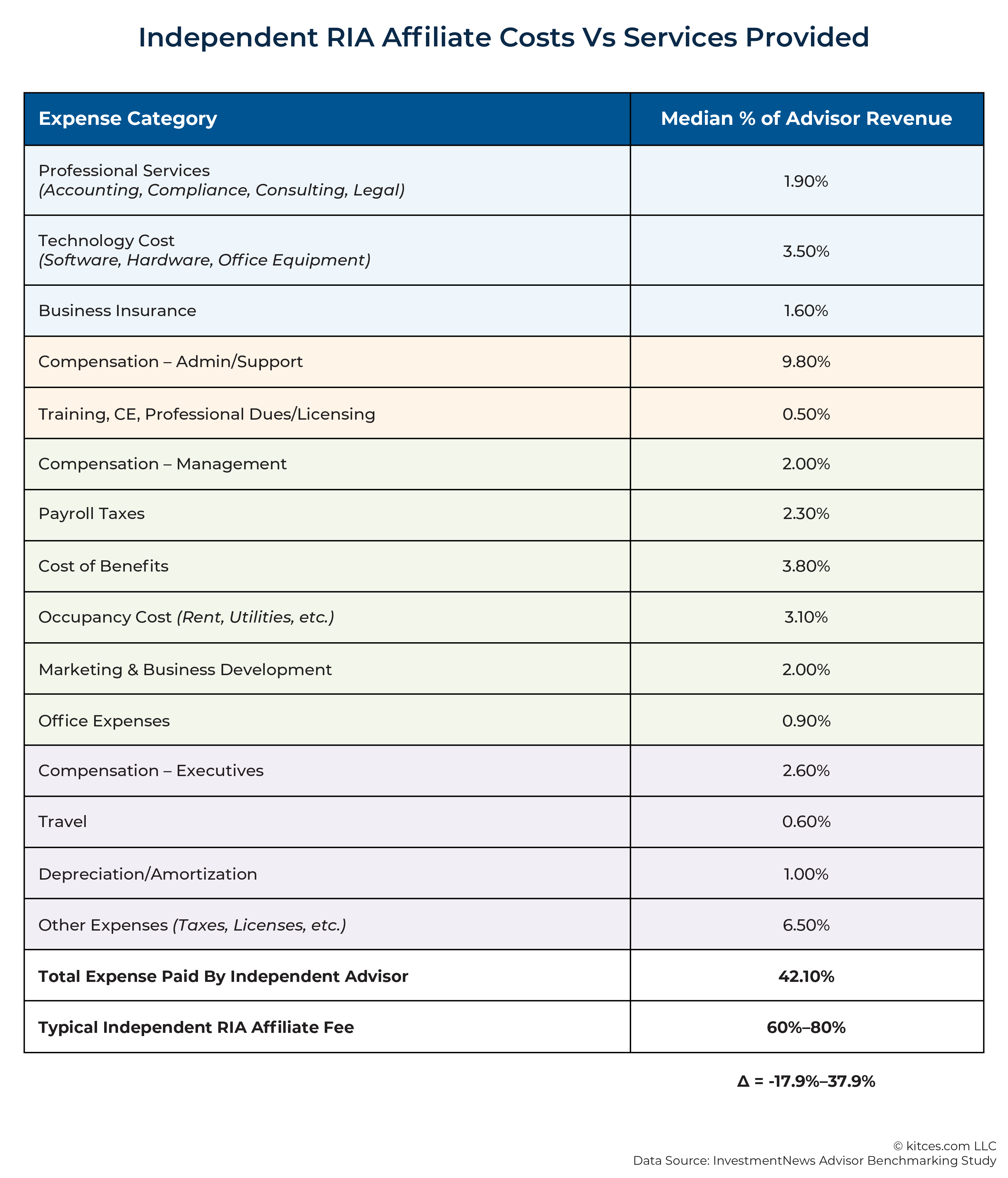

And finally, there are the independent RIA affiliates that cover all of the overhead costs of the firm, with the advisor responsible solely for bringing in new business and advising existing clients. In these situations, affiliate platforms charge an estimated 60%–80% of revenue, while independent firm owners spend around 42.1% on their total overhead costs.

What's clear from looking at the bottom 2 lines in each of the graphics above, which compare the expenses directly paid by independent firms with the cost of affiliate platforms that offer roughly corresponding services, is that as affiliate firms layer on additional types of services and cover a greater segment of the advisor's P&L, there is a widening gap between the affiliate's fee and the amount that the advisor would pay for those services on their own, ranging from only a few percentage points in the "loose affiliate" category to nearly 40% in the independent RIA affiliate model. Which doesn't necessarily mean that affiliates' overcharge' at those levels, since hard-dollar costs are only part of the equation: The time savings represented by not needing to vet and manage different employees and/or service providers also has value to the advisor, since it frees up their time for other revenue-generating tasks like bringing in and serving clients, and the time savings compound as more and more of those services are covered by the affiliate.

In other words, the affiliate firm's actual value to the advisor increasingly grows beyond the sum of the costs of the individual services it provides, with the difference between the 2 representing the value of the advisor's time and focus when they aren't responsible for managing all of those services themselves. (And some opportunity for the service-provider to earn a small profit margin of its own as a service-provider!)

The bottom line, then, is that there isn't really a single channel – independent or any one of the various affiliate models – that is inherently more profitable or lucrative for the advisor than any other. The affiliate firms that cover the most overhead costs leave the advisor with the smallest slice of revenue, but those costs in large part would have needed to have been borne by someone (either the affiliate firm or the advisor themselves) regardless of the channel. And if an advisor is able to focus their time and energy solely on revenue-generating activities (i.e., bringing in new business and serving existing clients), by working with an affiliate that covers everything other than those activities, it could very well end up working out more lucratively for the advisor – in spite of 'costing' them perhaps as much as 60%–80% of their gross client revenue – than if they were responsible for obtaining and managing all of their own support services.

But the caveat, though, is that an affiliate arrangement is only beneficial to the advisor to the extent that the services offered by the affiliate firm align with what the advisor really needs. Given the significant chunk of client revenue eaten up by even the "loose" category of affiliates, it only makes sense for the advisor if they're actually using what they're paying for. And so, for advisors who are exploring whether to partner with an affiliate (or which type of affiliate to work with), the key point is for the advisor to be aware of what they're really paying for as well as what they really need the affiliate to pay for.

The 3 Criteria For Choosing An Advisor Channel Or Affiliate

With many different types of affiliate platforms to choose from, from wirehouses like Merrill Lynch to independent broker-dealers like LPL to super-OSJs like Stratos Wealth Partners and Private Advisor Group to the thousands of independent RIAs throughout the country, having some kind of method for weighing the competing options can be useful for advisors to help them decide which platform will provide them with the best chances of success.

As highlighted above, it's not just about which platform offers the most support, since that may ultimately involve paying for numerous services that the advisor doesn't end up using themselves; rather, it's which offers the best support that the advisor is able to leverage into getting the best return on their investment. Conversely, it isn't just about which platform boasts the highest payout rate, since such platforms typically cover few services and the advisor would still be responsible for efficiently covering the remaining overhead expenses on their own.

Instead, advisors can look at the decision through the lens of 3 different criteria: alignment, profitability, and autonomy.

Alignment

As noted above, an affiliate arrangement that is most likely to work for an advisor is one that aligns the affiliate firm's offerings with what the advisor needs to successfully manage their practice.

One of the biggest areas where this comes into play is compliance, which is a cornerstone of what many affiliate platforms provide for their advisors. Larger broker-dealer firms tend to put a lot of resources towards compliance with FINRA rules, and so while affiliating with this type of firm might make sense for an advisor with a large number of brokerage clients (since FINRA compliance would be a big area of need for them regardless of their affiliation), it might make less sense for an advisor whose main focus is on fee-based advisory clients, where it's primarily RIA regulations at the state and/or SEC level, and not FINRA regulations, that matter most to the advisor.

Even for advisors who are solely registered as RIAs, however, alignment issues can still crop up in other contexts. For example, some TAMPs, such as GeoWealth, provide a lot of services for investment-focused advisors, from outsourced investment research to Unified Managed Account (UMA) capabilities to detailed performance reporting. Which might be a great fit for the advisor if they're focused on providing a lot of value around a unique investing approach, but not so much for other advisors who might be focused on more holistic planning and take a more simplified approach to investing. Or in other cases, it may simply come down to preferences. For example, an affiliate firm might provide office space in a downtown setting to attract lots of local walk-in traffic, which could represent a worthwhile overhead cost for an advisor immersed in the local downtown community, but may not be very valuable for an advisor who prefers to work primarily virtually with clients around the country.

In any case, assessing alignment is primarily about recognizing whether there's a fit between the advisor's needs and the affiliate firm's service offerings. This requires the advisor to have a solid understanding of their own needs and where they could (and would) use the support from an affiliate. Additionally, conducting thorough research into the affiliate firm (looking beyond just the payout rate it offers) is important to understand the nature of the services it offers, the type(s) of advisors it serves, and the level of support it provides for the fee it charges.

Profitability/Efficiency

Given that affiliate firms need to maintain a certain level of profitability for themselves, advisors will generally pay somewhat more for the services provided by an affiliate firm than they would by covering all of those costs themselves. Which, as mentioned earlier, could be made up for by the value added in time savings for the advisor.

However, if the advisor can outsource the service more efficiently and cost-effectively through a different provider (either a different affiliate or a standalone vendor), covering that cost on their own and keeping the savings themselves could make more sense for the advisor rather than outsourcing it more expensively to an affiliate. And for advisors who are comfortable with the additional responsibilities of hiring and managing, it may be even more appealing to 'in-source' the position as an in-house hire who can fully focus on the firm's clientele.

As mentioned earlier, the added cost of partnering with an affiliate becomes quite substantial when the affiliate covers a large portion of the advisor's overhead costs, since the cost of the affiliate outpaces what the advisor would pay to cover those costs on their own. Finding ways to improve efficiency around marketing and client acquisition costs, office costs, and other general overhead expenses that are typically covered by the more comprehensive affiliate firms can help advisors retain much more of their own earning opportunities, since those are the areas that can become the most expensive for advisors to outsource to an affiliate firm. With the caveat, again, that the advisor has to be comfortable and willing to shoulder the responsibility of managing those additional resources.

Autonomy

Not everything comes down to numbers, however. Allowing a platform to handle certain business functions for the advisor also means ceding control over how those functions are performed. And as Kitces Research itself has shown, advisors having autonomy over the parts of the advisory business that matters the most to them is one of the biggest drivers of advisor wellbeing in the first place.

An independent advisor can control basically every aspect of their business, and affiliated advisors whose affiliate firm covers only a handful of services can retain a substantial amount of autonomy. However, the more of the advisor's operations and processes the affiliate firm handles, the less autonomy the advisor will have in how they make decisions about how to operate, with the most-comprehensive platforms having near total control over nearly everything the advisor does. Which might manifest itself in terms of compliance (e.g., the advisor is strictly limited in terms of what they can be approved to post on social media), marketing (the advisor can only use the firm's premade marketing materials, again often for purposes of compliance), and support staff (the firm hires the staff, so the advisor may not have much choice in deciding who might be the best fit for a good working relationship), or any number of other areas.

On the other hand, some advisors don't want the responsibility that comes with autonomy and may be quite happy to not need to hire and manage support staff, or may not be engaged in digital marketing, making the 'loss' of autonomy with a more restrictive platform a moot point. Or stated more simply, the autonomy that an affiliate provides (or not) only matters if it's in a domain that particular advisor actually cares about (or not).

Ultimately, then, setting aside the considerations of which model might be more cost-effective than the other, it can be worth looking at the decision from the perspective of how much the advisor simply wants to be able to do things their way, rather than be beholden to an affiliate firm's policies and procedures – or maybe more accurately, what range of different functions the advisor wants to have the freedom to make their own decisions on, since different affiliates might offer autonomy in different areas.

Deciding whether or not to partner with an affiliate and choosing which type of affiliate to partner with are truly questions where there are no single right or wrong answers. If one model were clearly superior to the others, one would expect a flood of advisors to crowd into it.

And although the increasing popularity of AUM and other fee-for-service models of financial planning has come with a steady stream of advisors leaving wirehouse broker-dealers (since, among other reasons, the resources those firms put towards FINRA compliance don't align with the advisors' own needs for compliance in an advisory model), there's no one channel that all of those ex-wirehouse advisors are predominantly making their way into. Some stay dually registered as broker-dealer representatives and partner with IBDs like LPL, while others become solely independent RIAs, some re-emerge as corporate RIA affiliates with platforms like Sanctuary Wealth or Steward Partners, others choose to tie into networks like Dynasty Financial Partners or XYPN, and a few fold into bigger RIA firms like Creative Planning or Hightower. In each case, the decision comes down to what the advisor's needs are, where they see the best profit opportunities, and/or how much independence they want in the way that they're able to run their practice.

This essentially means that there are plenty of options for advisors with a range of needs and desires, from those who want to control every detail of their advisory practice's operations, to those who are happy to let their firm handle everything except meeting with and bringing in new clients. Because while it's usually the advisor themselves who are responsible for bringing in revenue for their firm, there's a whole host of functions necessary to keep the lights on and continue to create value for their clients. Ultimately, the key lies not in who manages these functions – be it the affiliate firm or the advisor themselves – but in how adeptly the advisor can harness these resources to thrive in their role, continually creating value for both their clients and their practice!

Leave a Reply