Executive Summary

In recent years, the financial planning profession has seen a growing shift in the services that financial advisors offer to their clients. Whereas in the earliest years of the profession, advisors primarily provided clients with product-based offerings such as insurance, annuity, and investment products, the focus of many advisors today has shifted to service-based offerings around the ‘advice’ itself. Interestingly, though, the shift to service-based advice offerings continues to expand, past the ‘traditional’ realms of financial planning advice, as now more and more financial advisors find themselves playing the role of a financial “life coach” to their clients, focusing more on how their clients can develop their goals and establish the financial capacity to realize their dreams (and not ‘just’ recommending the products they’ll implement to get there), and going along with them on the journey to navigate the inevitable shifts and changes that come along the way.

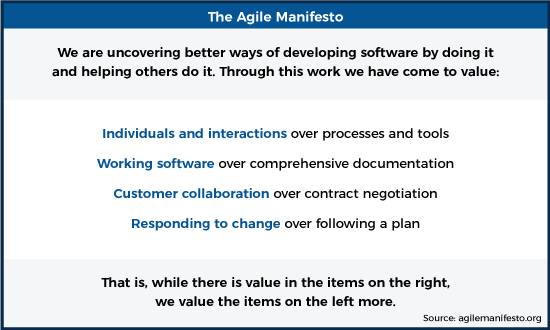

In this guest post, Roger Whitney – Senior Financial Advisor of The Retirement Answer Man, and creator of his “Agile Retirement Management®” process – describes a new financial planning paradigm he calls “Agile Financial Planning” for advisors who want to help clients achieve their financial goals, versus simply creating a one-time financial plan for them. This new model is based on the Agile Manifesto developed in 2001 by a group of software engineers inspired to improve upon the rigid, process-driven “waterfall” style of project management traditionally popular at the time (and that continues to be used effectively today by large corporate businesses). The Agile approach is based on four primary values: 1) individuals and interactions over processes and tools, 2) working software over comprehensive documentation, 3) customer collaboration over contract negotiation, and 4) responding to change over following a plan.

Adapting the tenets of the original Agile Manifesto, Roger developed his own “Agile Financial Planning®” approach, a financial planning process focused on the same objectives of continuous improvement, team input, and a quality (advice) product, with five core principles aimed to help advisors create a high standard for client care: 1) Acceptance that uncertainty is natural and will/should create a need to update strategies for achieving goals; 2) Collaboration between advisors (with financial planning expertise) and clients (with expertise around what makes the most sense for their own lives and situations) in creating a plan will produce more successful results than if the advisor just creates the plan for the client themselves; 3) Flexibility allows for creatively responding to changes in the plan with effective solutions, 4) Prioritizing goals and resources around what’s most important and impactful (versus what might be most attractive but is actually just distracting) will lead to improvement in everyone’s life; and 5) Communication on a continual basis will keep the process moving forward and in alignment with the Agile Financial Plan, providing opportunities to accept and respond to uncertainties as they arise, collaborate, stay flexible, and prioritize.

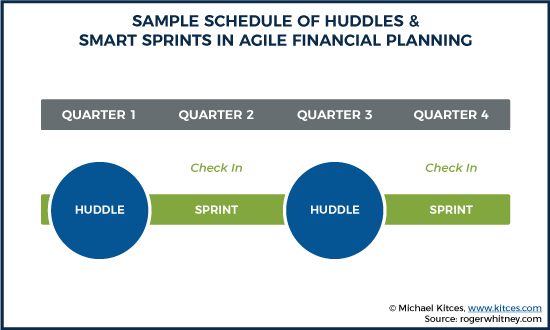

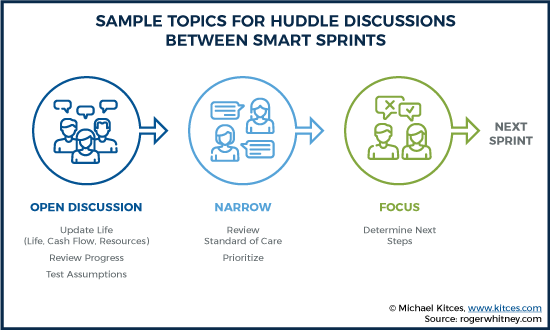

The Agile Financial Planning process consists of four stages: 1) Feasibility (creating a high-level plan to prioritize clients’ most important goals); 2) Sustainability (analyzing resources to develop resiliency in the plan against market forces and life circumstances); 3) Optimization (choosing the strategies to implement to make the best use of resources when executing the plan); and 4) Iteration (staying in touch with clients to ensure they remain engaged in the process, and keep moving forward with goal-setting and implementation). In turn, clients move through these stages with frequent meetings that Roger refers to as “huddles” and “SMART sprints”. In this context, huddles are brief conversations that take place frequently, and serve to keep the advisor and client in touch with each other, in between the goal-setting SMART sprints – the strategy discussions that help the client determine their next SMART (Sustainable, Measurable, Actionable, Realistic, and Time-Bound) goal to prioritize and then “sprint” to implement. Because Agile Financial Planning is a never-ending project that focuses on managing change.

Ultimately, the key point is that an Agile-style financial planning approach offers a process for financial planners who have chosen to go beyond ‘traditional’ financial planning practices that rely on long, comprehensive, data-gathering meetings upfront, to develop a one-time financial plan that is not frequently (if ever) updated. Instead, Agile Financial Planners coach clients on developing multiple SMART goals over time, discussed through frequent huddles designed to keep clients both on track and, more importantly, engaged. Even though the advisor is responsible for managing the process, the process still depends on a dynamic, interactive relationship with participation by both advisor and client, relying on the advisor’s financial planning expertise, and the client’s intimate understanding of their own goals, abilities, and circumstances.

If anybody had told me, 25 years ago when I was collecting my letters (CFP®, CIMA®, CWPA®, RMA, AIF®), that one day I’d be adding a new label of “life coach,” I would have spit out my coffee.

It’s the truth, though. Like many people in our industry, I was attracted to the profession by my love of investing and numbers. Yet today, the best financial planners provide services well beyond investment advice, guiding clients holistically on setting goals, overcoming obstacles and maximizing their enjoyment of life. Gone are the days when great advisors asked clients to complete questionnaires, did a few simple math equations, and eventually pushed a neatly prepared 3-ring financial plan binder across the desk.

Automation can now do all those types of tasks, and much more. Who needs to meet with a financial advisor when Vanguard provides access to a Certified Financial Planner offering basic planning for about a third of a percent of assets under management? Basic math-based planning is a commodity. College graduates and retirees can map out their financial plans in less time than it takes to scroll through Instagram. Heck, anyone can even do sophisticated stochastic modeling with free Monte Carlo simulators.

Financial planners and advisors have had the tailwind of proprietary, exclusive financial tools for decades. Today, however, control of these essential tools has opened up to the world – leaving advisors who aren’t adding true value exposed to the markets. One by one, trading, quotes, research, asset allocation models, rebalancing, financial planning engines, and now access to a Certified Financial Planner have become available to anyone.

The gates are wide open, and if financial advisors are going to thrive (or even just survive) in the twenty-first century, they’ll have to deliver and demonstrate value well beyond investment management. It’s a big risk for many – but also a huge opportunity for the profession because of a new approach.

By tapping into Agile Financial Planning, financial advisors can reclaim prominence as ‘project managers’ who can expertly guide clients through the project of planning out their own financial lives, in a much more holistic and nimble approach. Because true financial planning is no longer a product; it is a fluid, never-ending project focused on managing change.

Conversations take on more of a coaching tone, still focusing on financial capital, but now also focusing on human and social capital. Many of the best financial planners do this but, until now, have not had a unified framework to describe the process.

This primer on the shortcomings of traditional financial planning and the tremendous opportunities of Agile Financial Planning is intended to help advisors shift to a new model that will offer more freedom not only for the clients they serve but also for themselves.

Don’t Go Chasing Waterfalls (And The Rigid, Linear Processes They Model)

From the Greek Pyramids and the Transcontinental Railroad to the early software development of the 1950s and 60s, the great projects of the world have demanded great project management, which is just what they got for many years. Project leaders devised linear, predetermined, and orderly sequences to present tasks and activities on a timeline.

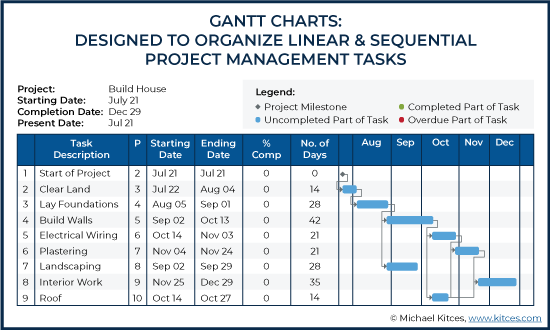

Take a look at the figure below that shows the Gantt chart, named after its inventor, American mechanical engineer Henry Gantt, who designed the graphic schedule in the early 20th century. It’s easy to see why managers with cut-and-dry deadlines, clear employee delineation, and concrete deliverables liked using these types of bar charts to track the plan and progress of their large-scale projects. For a while, they used pen and paper, magnetic blocks, and even Lego pieces to create their Gantt charts.

Enter the computer age – with the arrival of Excel on the scene, it’s easy to see why software designers were also pretty jazzed with Gantt charts, with their clearly organized and logical structure, from their phases of conception and initiation to implementation and maintenance, the linear, sequential design processes succinctly laid out the customer and stakeholder requirements gathered at the beginning of the project. And since progress could be seen as flowing steadily downward, the traditional approach earned the nickname “Waterfall” in the 1970s.

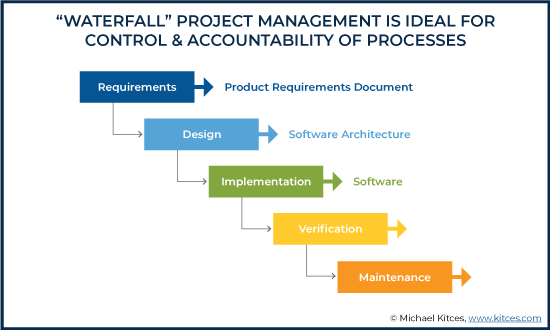

This rigid, top-down schematic fit well into traditional corporate structures that demanded control and accountability in order to direct the organization’s processes. The waterfall approach was also a natural fit for companies in environments that scale, such as Merrill Lynch and IBM, and ones that operate best with a pre-determined, shareable approach that shifts accountability to the practitioner, such as the curriculum at a public school.

Once upon a time, families and their financial planners – especially retirement advisors – easily fit into this model. Life is linear, right? Families have sequential phases, going typically from marriage and childrearing to college funding, career advancement, and, ultimately, retirement with its golden-hued vision of golf, fine wine, and sailing off into the sunset. So it was only natural for financial planning to map out a client’s story using the waterfall approach.

And this is, in fact, what traditional financial planning has done, taking on the waterfall approach in designing the planning process. Planners first ordered clients to complete comprehensive questionnaires. Then they took the questionnaires up the proverbial mountain and eventually came back down with the tablets – burdensome, comprehensive plans, often hundreds of pages long. Clients were then forced to sit for hours upon hours to review these binders with the analysis and recommendations the advisor had developed. It was a clearly articulated multi-step financial planning process.

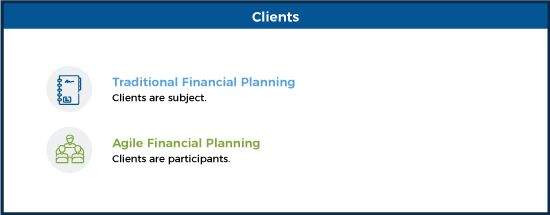

Yet the result was a boring, painful process (dare I say worse than getting a tooth pulled?) for clients. They became the subject of their financial plan, rather than an active participant. Once the meeting was finally over, they’d take the leather-bound tome (eh, I mean ‘plan’), put it on the shelf, check the mental box that they had it, and go back to their lives as usual. It ended up being a dead process, not a living one. When life happened, clients were very reluctant to update the plan – despite the clear need for an update given the change in circumstances – in fear of being forced just to repeat the process!

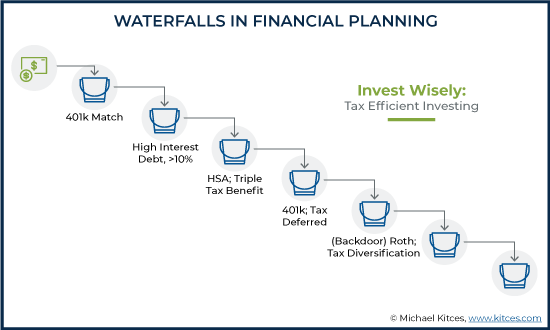

Still, the waterfall method kept flowing into financial planning and other industries everywhere. Without going overboard (so to speak), math nerds were starting to get pretty creative with the water metaphor, sharing diagrams like this one, explaining the basics of pouring money into the right places.

To be fair, this waterfall method has worked well for decades and still does in many areas and industries. Countless project managers, software developers, and financial planners still rely on and swear by the traditional approach to getting a job done, or a retirement plan in place.

But at the same time, there have been some eureka moments in the world of financial planning. Lives aren’t linear! People change! A lot! Tragedies and windfalls happen. Family dynamics and priorities change. The waterfall approach works best in static environments, not in kinetic, fluctuating lives both graced by good fortune and afflicted by existential crises. It focuses solely on assets, saving, and investing – serving as the hub of everything – while creating too much work too quickly. This traditional method also fails to incorporate a wider range of advisor skills, including empathy, adaptability, collective wisdom and intuition – the human characteristics a Mac or PC can’t emulate. Today, financial planners are becoming a mix of investing experts, life coaches, and trusted guides.

The bottom line is that we’re no longer sitting across a mahogany desk from Jim and Sally, who are nodding their heads and smiling politely, as they tune out the jargon and furrow their brows over the meaningless sea of figures. To return to the software comparison, for a moment, I’m old enough to remember buying Microsoft Office and bringing home 20 CDs, which I spent two days loading onto my computer. Once loaded, the bloated software plan slowed my PC down and I used 1/1,000th of its capability. Then I’d have a system that updated very rarely because it was such a pain in the butt. I picture engineers saying: “Let’s just figure out everything. Cram it all in there and we’ll try to get it right the first time.” They don’t want a bloated financial plan that can’t be easily altered when Jim considers buying a beach house, Sally thinks she may leave her job, or their son Joe breaks his leg in an Ultimate Frisbee tournament.

Life is about change management. People want help making lots of smart little decisions as much as they want some direction for the future. We’re naturally short-term oriented. A University of Scranton research study found that while 77 percent of study participants succeeded in maintaining New Year’s resolutions for one week, 81 percent of them failed to stick to their goals over two years. And another study published by the Psychological Bulletin concluded that making specific (and challenging!) goals led to the best outcomes of achieving those goals. So, saving $4 per day by brewing coffee at home instead of driving through Starbucks, for example, is more doable than setting aside $1,460 per year (from wherever the client is supposed to find that $1,460 of available cash).

The good news is that with this new approach to financial planning, advisors don’t have to cram it all in and get it right the first time. They can instead adapt to be more engaging and responsive to life changes – empowering and assuring families, while also delivering profit and fulfilling a purpose. This approach can, in a word, be Agile.

Embracing the Key Values of the “Agile Manifesto”

Like the 4.4 billion Internet users in 2019, I no longer spend hours updating my software, so I can do my job better and faster. Today’s tools launch quickly, identify opportunities to improve and debug problems, and iterate quickly. While the waterfall approach dominated project management (across many industries, including software development) for decades, the idea of an iterative, incremental prototype began percolating. It was similar to the just-in-time production approach pioneered by Toyota in the 60s and 70s – smaller factories, minimal materials, low inventory – aimed at reduced manufacturing time. The timing was just right, with the advent of the World Wide Web, for developers to become more innovative and experimental. And thus, in 2001, a bunch of innovative and experimental developers got together in Snowbird, Utah, to ski, relax, and find fixes for the broken status quo.

The result was the “Agile Manifesto”, which, as we can see, offers four key values that could also fix the inherent financial planning issues with the traditional approach, as discussed above.

Change “software” to “financial plans” and “customer” to “client” and voilà! We have a new foundation for value-added services that fall out of automated capabilities.

The Agile Manifesto also has 12 principles that include satisfying “the customer through early and continuous delivery”; conveying information in a “face-to-face environment”; and “at regular intervals, the team reflects on how to become more effective, then tunes and adjusts its behavior accordingly.”

The 5 Principles of Agile Financial Planning

Continuous improvement, team input, and quality products are at the core of the Agile project management approach – and the Agile Financial Planning approach. Now, I didn’t get to go skiing in Utah, but I was able to muster enough brainpower to draft my own 5 Principles of Agile Financial Planning.

Principle 1: Accept Uncertainty As A Healthy Part Of The Equation

No matter how we slice it, financial planning and investment management are based on predicting the future, whether advisors are trying to determine what asset class is going to do best in the next period of time, or tweaking long-term expectations for market returns, investment, inflation, and other factors. And frankly, that has been the advisor’s value proposition: humans naturally gravitate to someone who knows.

But becoming so focused on what might happen 20 years from today can result in the tail wagging the dog – allowing so-called “precise” estimates of the future to dictate how things should be done in the present. We can sometimes forget that more financial planning precision does not equal more accuracy because the future is unknowable.

So the first fundamental principle of Agile Financial Planning is accepting uncertainty: in markets, taxes, inflation, and our lives. Once we accept this, it’s liberating. We free up our mental space and physical resources to focus much more on a system that filters new information as it becomes available, and life unfolds. We can make lots of little decisions and little adjustments along the way. That’s what the Agile process does.

Rather than try to foresee and plan too much for an unpredictable future, Agile Financial Planning zooms out to create a Strategic Retirement Strategy and then zooms in to the near term and answers the question: “What can we do next to take a solid step forward?” These steps can range from adjusting the allocation of a balance sheet to softer issues, such as creating a strong social network outside of work. In a fluid and unpredictable environment, Agile is a nimble approach that can respond quickly and smartly.

Principle 2: Collaboration Gets Better Results

As I tell my clients (or, as I think of them, my people): “You know your life. You know what you value most, and the personal history that drives you. You worked hard to create the life and wealth that you have. I know how to guide people into and through retirement planning. I’ve walked this journey with others like you. I’m aware of the risks and opportunities, including enlisting the help of subject matter experts when needed. We each have a role and, together, we can create a meaningful strategy that also makes sound financial sense.”

As we’ve discussed, traditional financial planning has been a top-down exercise. The client answers endless questionnaires, and the financial advisor goes off into an ivory tower to create a huge plan trying to accomplish too much. They come back to the client with piles of paper filled with complicated language. The clients may get the gist of it, but they leave with a totally confused feeling, not sure about what it was they actually accomplished. They have no genuine ownership of the plan that was just created for their life and wealth.

Agile Financial Planning, however, embraces collaboration: people sitting at a desk together and working to make good decisions together. This is a central principle because the planner has professional expertise, but the clients are the experts on their own lives – they understand what has gone into where they are today, and where they go from here. Collaborative financial planning reaps the collective wisdom of walking side by side with clients during their journey. It’s always going to get better results because of this combined wisdom.

Principle 3: Flexibility Puts The Best Life Within Reach

Sometimes, we under-appreciate our current fluid and fast-moving environment. Think back to when we were 10 or 15 years old: would we ever have imagined our lives would be organized the way they are today? As the first principle of Agile Financial Planning reminds us, uncertainty can be healthy – but only as long as we are flexible. Instead of chiseling long-term plans in stone, we must sit at the wheel of clay, molding and remolding financial plans to handle the good and the bad things happening.

Financial planners should aim to pivot and make adjustments to their clients’ plans as the clients’ lives unfold. The more constraints on this pivoting, the fewer options will be available. Take debt, for example. Lots of debt means a loss of flexibility for those with loan payments due on a given date every month. When life changes for good or bad, those loan payments stay firmly in place. Agile Financial Planners can add “value optionality” or flexibility to handle changes of any size.

Agile Financial Planning helps advisors and their clients identify the necessary short-term changes in the most efficient, effective, and responsive ways possible while learning to eliminate (or at least reduce) stress and working toward lives people want to lead through continual empowerment. Adjusting quickly to life's financial curveballs helps people stay in the game – and knocks the occasional one out of the park.

Principle 4: Priorities Define The Big Picture

In financial planning, there is so much to do. You have budgeting, you have goal-setting, you have managing careers or prospective careers. Questions for clients can include, “How much should you keep as cash reserves? How much should you be investing, and what tax categories should you be investing in? What kind of disability insurance should you have? What about long-term care insurance?” It goes on and on. Over time, the decisions a client needs to address are overwhelming, and traditional financial planning – where we try to tackle as many problems as possible all at once – bogs down the process.

So prioritization acknowledges a mutual agreement between the planner and the client: “Hey, we can't do everything, but once we build your strategic financial strategy, we can prioritize the most important levers in your life that can make the most difference right now. Here’s what you can do next.”

It’s about focusing on those two or three points and creating a lot of little wins rather than trying to accomplish everything and having a big win at once. Prioritization makes planning much more digestible and easy to do. It keeps people more engaged by setting small victories – you create momentum and a positive feedback loop of, “We are accomplishing things.”

We can envision a dashboard with a bunch of different levers, some big levers, some small. Usually, the smaller levers are the most attractive. They’re the ones that have the bling – they're shiny, they’re bedazzled. These are things that people like to talk about. And sometimes we may get enamored with these levers because we are influenced by some article we read recently about a new strategy or something we are told we should pay attention to.

But while these levers can be very sexy, they actually have little impact on our lives – whereas the big, dull lever right next to us, that we’ve ignored while we've been enamored with the little bedazzled ones, is the one that will make the impact that really matters.

Prioritization is the process of figuring out what levers we should focus on, so we can actually make true improvement in our lives. No more ‘analysis paralysis’ from trying to do everything at once: Agile Financial Planning helps us identify the biggest opportunities for the most impact.

Principle 5: Communication Is Key

I could be the best financial planner in the world if I could read minds, predict the future, and plan accordingly. Since I'm not quite there, scheduling regular check-ins with my people is the next best thing to making sure their lives, their investments, and their goals are in alignment with their best future. These aren’t stiff meetings – as I’ve mentioned, they’re little conversations I call “huddles” that give us the freedom to explore new opportunities, decide on the next actions, and enjoy the fun of celebrating small milestones.

You see this often in a marriage where a husband and wife are walking hand in hand – they have shared priorities and they know where they want to go as a family (or they think they do). As they walk through time together, hand in hand, it's very easy to live separate lives. I’ve been married for 29 years to the same woman, but I always say I've been married to three or four different women because during those 29 years, my wife has changed dramatically. She's a version of herself, but she is not the same lady that she was at 24 when we married.

It’s very easy in a marriage for two people to lose communication, live inside their heads, and create different priorities and values for themselves. Without little conversations to continue collaborating and adjusting together, they'll eventually break hands and start walking farther and farther apart – picture a “V” shape on the sidelines of a football field. All of a sudden, they’ll wake up, have a conversation, and think: “Who is this person that I am married to, and what are we doing? I don't want what they want. They don't want what I want. I don't love them anymore.”

Financial planning works the same way. Everything – taxes, inflation, personal situations, priorities – is so uncertain. As an Agile Financial Planner, however, I can walk hand-in-hand with people so they can continue walking hand-in-hand. Through little conversations we can accept uncertainty, collaborate, stay flexible and prioritize.

By using these five principles, advisors can curate a high standard of care. In each financial planning category and subcategory, there are possible tools to use that can be included in a running checklist. It’s part of every Agile Financial Planner’s duty to review this list of tools in their toolbox. Some tools might seem irrelevant to a client's situation, but they may jog an advisor’s memory and creativity to identify new and novel solutions. It’s Agile to the core.

SMART Sprints

Just like Agile software developers and project managers, Agile Financial Planners can engage clients through early and continuous delivery. For me, these are the little conversations where I can ask questions. I can convey information (my nuggets of wisdom), and we can collaborate to work together.

Even if I can’t sit down physically with my people, I can use Internet video magic to talk from anywhere in the world in real-time. I actually find this more productive, as I can better focus client huddles on the relevant business at hand instead of surrounding distractions, and because it provides the value of non-verbal communication (e.g., screen-sharing technology) and accessibility while eliminating the most logistical hurdles that slow the process down.

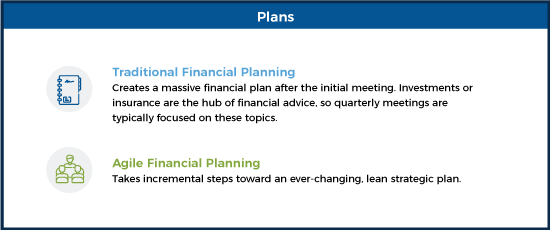

So Agile Financial Planning is less about producing a comprehensive financial plan, and more about creating a minimum viable plan applicable to the client’s present situation. Then, to get to the next short-term goal or objective, we engage in a constant iteration of Agile “SMART” sprints – identifying Sustainable, Measurable, Actionable, Realistic and Time-Bound goals. Instead of asking clients to map out their perfect life in 5, 10 or 15 years, I like 90-day goals, which connect with particular feelings (confident, connected, healthy) and allow us to celebrate more small victories and the clients to indulge in more frequent rewards they’ve outlined. A financial SMART sprint, for example, might be, “In three months, I’ll feel amazing because I’ve added $1,000 to my emergency fund.”

Agile Financial Planning in Practice

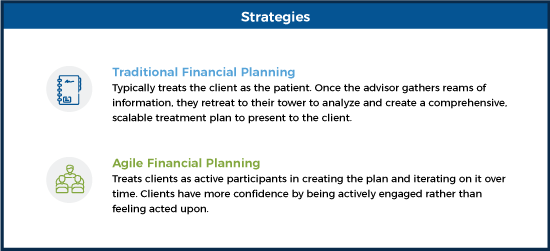

Agile Financial Planning addresses the same issues as traditional financial planning, but the difference lies in how the advisor is positioned, the rhythm of meetings, and how planning and advice are delivered. While traditional financial planning focuses on creating a comprehensive plan in a short period of time, Agile Financial Planning approaches it from a(n ongoing) project management perspective.

Let’s take a look at a recent scenario in my practice: Jeff and Kim are married and are both 52-year-old corporate executives at large companies where they’ve worked for years. They live in Texas and have a 20-year-old daughter.

In our initial ‘discovery’ chat, Jeff and Kim had an idea to retire at age 62, when they’d spend $120,000 per year (on an after-tax basis) on basic life expenses – mortgages, insurance, food, clothing, etc. We also factored in car payments, healthcare, travel, and such extras including a nice wedding for their daughter one day. We discovered two clear priorities: one, that Jeff and Kim really wanted to get out of the rat race and saw retirement as their escape; and two, travel was a big deal to them.

It was time to create our overall strategy – one that uses all five principles of Agile Financial Planning.

During our initial huddle, I explained to Jeff and Kim that they would not be delegating the planning to me – we would be in this together and that I was in no position to make recommendations based on a questionnaire. My role would be project manager and seasoned guide, and I would share my financial planning knowledge and wisdom gained from having walked the path they were on with others like them. I reminded them that they, too, were experts – experts on their own lives. They had a history of experiences and knowledge that I could only begin to understand.

This would be a collaboration. Together, we would come up with better solutions than any of us would individually. We’d work together, each step of the way, and it would be my responsibility to manage the process, lead each huddle, and keep the project on track. Their responsibility would be to stay engaged and participate.

The next step was to define what a “good job” looked like for the first 12 months working together. For Jeff and Kim, I wanted to focus on the sparks that caused them to engage my services in the first place. For many, financial planning falls into the “important, but not urgent” category, though often, there is a spark that causes someone to finally take action. In their case it was a difficult period at work for both of them that inspired them to ask, “What are we doing this for?” By establishing a personal benchmark for their progress, we would fan the spark of their initial intention to gain momentum.

In our first huddle, we talked about these questions from Jeff and Kim:

- We are really tired of the rat race, when can we retire?

- We love travel; can we still travel when we retire?

- If we sell our lake house, what will that do to our retirement date?

- We’re worried about markets; can we take less investment risk?

- Will we be okay?

With our initial 12-month benchmark established, I showed the couple how we would manage the project together.

The Huddle Rhythm

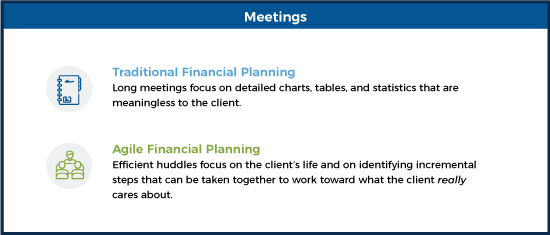

Unlike traditional planning meetings, Jeff, Kim, and I established a rhythm of huddles, or little conversations, to make incremental progress together. In my 25-plus years as an advisor, I’ve participated and witnessed client meetings span one, two, and three-plus hours where the client was subjected to a painstaking review of detailed charts and tables full of statistical jargon that meant nothing to them. The keys to an Agile process, on the other hand, are engagement and momentum.

Key elements of a successful huddle include:

- Rarely last more than one hour;

- Are agenda driven;

- Review progress on open action items;

- Discuss where progress has been made and any roadblocks;

- Brainstorm on current stage of project based on personal benchmarks;

- Establish next action (SMART Sprint); and

- Document with written summary.

On the surface, this meeting cycle looks exactly like the quarterly review meetings of traditional financial planning. The difference is what is discussed and accomplished in each meeting.

In traditional financial planning, the initial planning meetings are spent on in-depth analyses of nearly everything, with the goal of memorializing it all in one massive financial plan. Traditional financial planning often has investments or insurance as the hub of financial advice, and as a result, these traditional plans focus on investment and/or insurance solutions. Once done, quarterly meetings typically focus on investment strategy, relative performance, and a light review of whether the client is “still on track.”

In my Agile approach, we don’t try to figure everything out at once and, most importantly, we don’t have financial products as the hub. Instead, we always focus on the client’s life and taking little incremental steps to move forward together. With the client’s life as the hub, financial products and strategies are relegated to potential tools to be utilized as needed. Just like a client's life, the plan is ever-changing based on how life unfolds for the client.

In each huddle, we look to identify the opportunities and risks to their strategic plan and which ones we should focus on first. Then, step-by-step, we take action.

Four Stages of The Agile Financial Plan (AFP)

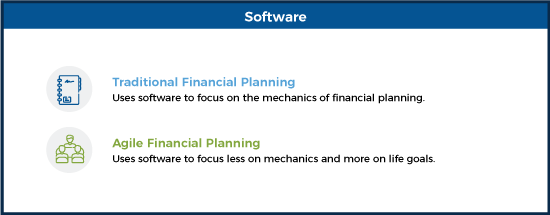

The Agile Financial Plan (AFP) focuses less on the mechanics of financial planning and more on the feasibility of the client achieving life goals. For this approach, AFPs use two primary forms of software:

- Goal-based financial planning software to establish a life vision for the client and organize financial resources (e.g., MoneyGuidePro); and

- Cash flow-based software to refine tactics (e.g., NaviPlan)

Creating the AFP has four stages:

- Stage 1: Feasibility

- Stage 2: Sustainability

- Stage 3: Optimization

- Stage 4: Iteration

The process is much like manufacturing a car: first, we’ll find out if we have a feasible design that’s actually going to work.

Next, we create a solid frame so that it’s reliable, enjoyable to drive, and won’t make us fear that it may fall apart a few miles down the road.

Then, at the optimization center, we choose the colors and the little luxuries to improve the ride that’s already viable.

Finally, with a plan established, we begin a series of meetings, typically three, lasting about an hour each to create a feasible roadmap. These are focused on what the client cares about most.

Stage 1: Feasibility – Create A High-Level Plan To Prioritize The Most Important Goals

Let’s return to Jeff and Kim. Unlike a traditional planning meeting, which would typically begin with a massive amount of data gathering, our first meeting began by framing Jeff and Kim’s goals and current financial resources on a very high level using a three-step process. By not going too deep too soon, we were free to play with alternate scenarios to focus on what Jeff and Kim cared about most.

It typically takes three to four quick huddles during the course of a month or so at the beginning of the relationship to complete this stage and come up with an initial strategic plan. Once the roadmap is established, a more regular huddle/SMART sprint meeting schedule kicks in (which generally means two SMART sprints and two structured huddles per year).

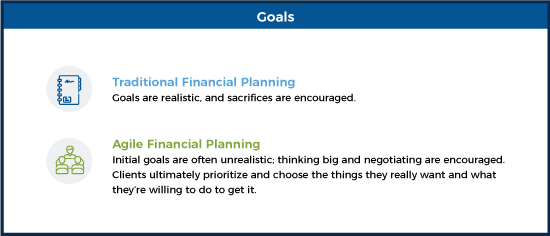

Feasibility Step 1: Dream Big (And Then Negotiate What’s Most Important)

For this step, I use MoneyGuidePro’s online client discovery tool to help clients take an initial stab at defining their long-term goals and organizing their financial resources on a high level. I’ve found MoneyGuidePro’s interface easy to use and fun. The clients are interacting online to create the initial plan goals, and so begin to own the process.

My initial instructions for Jeff and Kim included:

- Dream big about what you’d like your life to be.

- Don’t be realistic about your goals. If you want it, put it on there.

- For goals, give a SWAG (Sophisticated Wild Awesome Guess).

- When listing your financial resources, don’t share details; just list the account type and approximate value.

Notice that I told the couple not to be realistic about their goals. I don’t want the initial goals to be feasible, I want the initial plan to fail, and I tell clients this. All too often in traditional financial planning, clients are told how and where they should sacrifice. The solutions they’re offered range from saving more and taking more investment risk, to working longer and settling for less in retirement.

That’s not very inspiring. Often, traditional planning has a one-dimensional focus on money and investing. As longevity continues to increase, the financial math gets more difficult, resulting in an increased call by advisors recommending that their clients sacrifice more. No wonder such a small percentage of people have a written financial retirement plan: only 21 percent of boomers, 19 percent of generation X, and 13 percent of Millennials, according to a study conducted by Fidelity in April 2019.

In Agile Financial Planning, we want clients to think big about their life. Really big. They need to explore all the possibilities first. They can’t do that unless they really dream and get everything out in the open. People get this. They know they can’t have everything, and they’re more than willing to make tradeoffs if it helps them work towards what they care about most. By getting them to think big, we can help them negotiate between the countless competing interests for their time and money.

Notice also that I didn’t ask Jeff and Kim for account statements or their current asset allocation. This often surprises clients, especially if they have worked with an advisor previously. I explained to the couple that my goal was to help them look at their life with fresh eyes. Instead of going too deep and too early, getting bogged down in current numbers (the “what is”) we shifted toward creating “what should be.” Once we created “what should be,” we would reconcile “what is” to develop a path to altering course.

Feasibility Step 2: Color in the Picture

Once clients have created their initial vision of life goals via MoneyGuidePro’s client discovery portal, we huddle to review the results together. I share my screen and we talk through each goal and financial resource they’ve entered. This huddle is interview-based – I ask lots of questions and listen, letting them add color to the black and white outline they created in the software. I dive deeper in certain areas to discover things they may have missed.

My goal for this second huddle is for them to have more ownership of the process and a better understanding of the interaction among their needs, wants, and wishes, and the resources they have to achieve them.

It’s important to note that almost all of my meetings with clients are video conferences. I use Zoom, because I’ve found it to be much more stable and easier to use than the many alternatives I’ve tried. A traditional advisor may think this would be difficult for a client – perhaps impersonal and not as effective as in-person meetings – but I’ve found the opposite to be true.

In fact, I’ve found video meetings to be superior to in-person meetings in some important ways.

First, they allow me to meet with clients more frequently. Jeff, Kim, and I can meet even if the three of us are traveling in three different places. This is essential to an Agile process.

Second, it makes our meetings much more productive. Absent the pleasantries of receptionist greetings, refreshments, and small talk, we can be agenda-driven.

Third, in some ways video makes the meeting more personal. It’s not unusual for children or pets (like Sherlock, my Great Dane) to visit.

Fourth, I can easily share my screen and walk through scenarios.

And last, I’m more tuned in to each client. When Jeff talks about ‘their’ goals, I can look at Kim for nonverbal cues of agreement, confusion, etc. If I see a disparity, I can dive a bit deeper with her. This would be difficult in a conference room.

Feasibility Step 3: Getting to Possible

In this huddle (which I call the “messy meeting”) we briefly review client goals and resources and then dive into the results of the initial MoneyGuidePro Monte Carlo analysis. Our goal with this huddle is to identify the biggest levers that will influence the results, test alternate scenarios, and negotiate between various tradeoffs to a feasible plan.

We continue to use MoneyGuidePro’s engine to test multiple what-if scenarios. Rarely are clients’ goals clear-cut, and rarely do clients understand the options available to work toward their goals.

For example, clients tend to think of retirement as a binary decision – they’re either working or they’re not. Often times, it’s not the absence of work they desire, it’s more time away from it. This freedom could be attained through part-time work early in retirement (we call this “pretirement”).

In addition, most clients have competing interests they need to reconcile – they might face a tradeoff between investment risk and retirement lifestyle or a tradeoff between how much they save now and their expected retirement date. My role during this huddle is not to advocate for a choice; it’s to show them the tradeoffs, guide them through the negotiation process, and share my wisdom from having done it with others like them.

This messy meeting can easily spill over into multiple negotiation sessions (though they are never more than one hour). Because the clients are not the subjects of the Agile Financial Plan, but are instead participants in creating the AFP, I’ve found that multiple negotiations give them the mental space to think more freely and discuss together. Plus, staying at a high level better engages clients or spouses who are less financially attuned. It’s a huge win.

By the end of the feasibility stage, the clients will have created a meaningful vision for the future, developed a greater appreciation for the fluidity of planning, and attained a better understanding of the tradeoffs required to work toward it.

Yes, they will have created the vision. Not me. I simply used my financial acumen and wisdom to help guide them. This is very unlike traditional planning where the final financial plan, once completed, is presented to them and memorialized in a leather-bound binder that holds little meaning to the client.

Stage 2: Sustainability – Analyze Resources To Ensure Resilience Through Market Forces And Life Circumstances

Once we get to a feasible plan in MoneyGuidePro, we switch to a cash flow-based planning platform. The cash-flow perspective allows us to get more granular and detailed to make the plan more sustainable and resilient through market forces and life circumstances.

Our goal during this stage is to minimize the ability of outside forces (such as markets and life events) to push us off course. For example, when I work with clients who are very near retirement, we focus on building income floors to fund retirement lifestyle, investment risk management, and life and long-term-care planning.

Okay, now I’ll address that bomb I just threw out there regarding multiple planning platforms. We run planning scenarios concurrently in MoneyGuidePro and the cash flow-based platform NaviPlan. This involves my team reentering all data and results from each, which are rarely in sync. And, yes, we show them both to clients. Different forecasting tools have different strengths. MoneyGuidePro’s goal-based interface is amazing for creating a feasible client roadmap through an interactive process, but it lacks the cash-flow modeling details needed to make a feasible roadmap resilient. NaviPlan has less flexible goal-setting features, but is better at modeling tax strategy and creating income floors to fund retirement consumption.

But what about those different results? Don’t these confuse clients? Yeah, it’s not comfortable. But guess what? The results aren’t “right” anyway given the uncertainty of life itself, and they’re going to change a million times as life unfolds. Rather than pretend any of the analyses are right, we use the opportunity to reinforce the value of our Agile process.

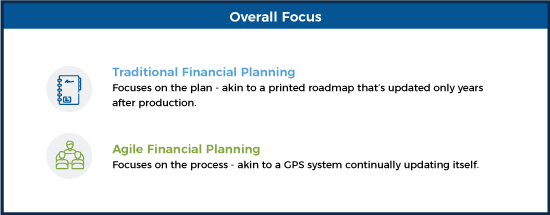

And this may be the key difference between Agile Financial Planning and traditional planning. Traditional planning focuses on The Plan – the one roadmap to follow until it’s updated years later. Agile Financial Planning focuses on the process. It focuses on the process of accounting for new information, challenging assumptions, and making lots of little smart decisions as life unfolds. People get this. In fact, they appreciate it and value our collaborative process all the more.

Stage 3: Optimization – Choose The Best Strategies To Make The Best Use Of Resources

Once we’ve created a sustainable Agile Financial Plan (or, shall I say, “process”), we focus on how to optimize it. I call this the ‘bling’ of planning. It includes investment strategy, investment vehicle selection, tax-strategy, Roth conversions, and other tactical decisions designed to enhance the overall plan.

Traditionally, this is where many advisors are most comfortable, and where many clients lose focus. Many advisor-client engagements start because of a necessary tactical decision: “How do I invest my rollover?” “Do I need life insurance?” “I read this article about Roth conversions, how much should I convert?” As a result, it’s easy for most planning conversations to stay here. That’s a mistake. Starting with tactics is like a doctor treating a symptom before understanding the cause. Don’t let the tail wag the dog.

Agile Financial Planning is process-driven. If you follow a good iterative process, you can develop a sound strategy, which will lead to better tactical decision making.

Stage 4: Iteration – Stay In Touch With Clients To Ensure They Remain Engaged And Keep Moving Forward

While stages 1 through 3 of the Agile Financial Planning process nurture an ember (started by the spark that moved the client to seek guidance) into a small flame, stage 4 continually fans the flame of intentional action, keeping the client engaged in making the most of the only life they have.

For Jeff and Kim, this meant choosing the opportunities and risks to focus on first, setting a SMART sprint to address them, and then iterating the process over and over, while all along the way, constantly rechecking our assumptions, thinking creatively, prioritizing what to do next, and then taking action.

Wrapping Up

Using all of these tools allowed Jeff, Kim, and me to move forward with a robust plan that focused on minimizing investment risk and their time in the corporate world while maximizing their ability to simplify their life and to travel.

Our communication led to “Aha!” moments of selling the lake house, shifting to more pleasurable “pretirement” work that would still provide income and allow them to leave their full-time careers two years earlier, and also included plenty of little conversations and adjustments planned along the way to make the transition even smoother.

And we could only have done it through Agile Financial Planning using its principles of accepting uncertainty, collaborating, defining priorities, communicating, and always remaining flexible.

Jeff and Kim’s story is just one of many that illustrate Agile Financial Planning at work. Each of the stages I’ve described takes place during a series of huddles. While the timeline of huddles will vary based on each client and each specific need, I always close client meetings with clear next steps, focusing only on the things we can control.

The benefit for clients? They own the process – which empowers them instead of pushing them away. And even if they don’t have a lick of financial interest, they feel a part of Agile Financial Planning, because it’s a human process.

The benefit for advisors? They’re basing their value not on what they can promise, but on what they can actually deliver – managing the process.

A few years ago, my family and I went to Costa Rica and spent some time exploring a national park. We could have easily walked through it on our own, but we hired a guide who knew the park inside and out. He was able to stop at exactly the right moment to pull out his binoculars or set up his telescope for us to see sloths in the trees, active monkeys, and egg-filled spider webs stretching across streams… sights we totally would have missed otherwise.

This is the role of an Agile Financial Planner – to serve as guides who have walked this journey hundreds if not thousands of times before. The Agile Financial Planner has built up a bank of wisdom about things others don’t immediately see: where the blind spots are, where the opportunities might be. They can hold the client's hand and walk them through this journey safely – occasionally pulling out a pair of binoculars or telescope to reveal some surprisingly good things.

But they’re not going to tie their clients’ shoes, smear on their sunscreen, or adjust their hats. They make it very clear that the Agile process is not a delegation to planners to come up with solutions. This is a collaboration.

Being Agile means looking at the process as a project management exercise, not a financial planning exercise. Traditional financial planning typically generates an end product presented to the client. An Agile project creates an ongoing, living document that requires continual action.

And Agile Financial Planning focuses heavily on living: the lives that clients have led, and what vision they have for the life ahead. Gone are the endless questionnaires; in their place are productive, interactive conversations not just about assets, risk, potential financial returns, and cash flow, but also about goals, priorities, skillsets, opportunities, and, ultimately, purpose.