Executive Summary

Qualifying for Federal financial aid requires filling out and submitting the Free Application for Federal Student Aid (FAFSA), based on your income from the preceding year. Except historically, this FAFSA process has been challenging, because schools are already issuing acceptance letters about attendance before most families have even finished filing their tax return to know what income to report on the FAFSA!

To make the process easier, this week President Obama signed an executive order that will change the FAFSA rules beginning with the 2017-2018 school year, allowing students to complete the FAFSA based on the “prior-prior year” (PPY) income, and shifting the entire application process back to October of the preceding year (a full 11 months before the student will matriculate!).

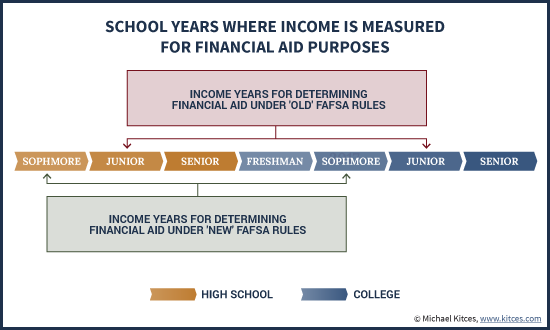

The new rules should make it much easier for students to file the FAFSA to determine eligibility for financial aid (especially since it will now be feasible to use the IRS’ automated Data Retrieval Tool). But notably, it means that the current 2015 tax year will now count twice for financial aid purposes (2016-2017 under the current prior-year rules, and again in 2017-2018 under the new PPY rules!). And in the future, the new prior-prior year rules mean the “key” years of income for college financial aid now start as early as the student’s rising sophomore year of high school… but notable end mid-way through the student’s sophomore year of college!

Rules And Deadlines For Filing The FAFSA

In order to obtain Federal financial aid for college, students are required to go through a determination process that gathers information about available income and assets (from both the student and his/her parents) to determine the “Expected Family Contribution” (EFC). To the extent that the actual Cost Of Attendance (COA) is higher than the EFC (i.e., the college costs more than the family can reasonably be expected to contribute!), the difference is what may potentially be made up as “need-based aid” through various Federal financial aid programs. These may include Pell Grants (which don’t have to be repaid), Perkins Loans (offered directly from the Federal government at a favorable interest rate), Stafford Loans (backed by the Federal government to ensure more favorable interest rates, and possibly eligible for payments to be deferred until after graduation), and income-earning opportunities through work-study jobs.

The data-gathering process to actually determine what a family’s expected contribution will be based on its income and assets is accomplished by completing the Free Application for Federal Student Aid (FAFSA). Able to be completed by hand or through a Department of Education website, the FAFSA gathers financial details about the family situation based on current assets and the most recent year’s tax return, to calculate what the Expected Family Contribution will be for the upcoming school year.

With the typical school year beginning in the fall, determining the family’s EFC based on its most recent year of income means the calculations are based on the family’s tax return filed earlier that year for the prior year. Thus for instance, a student who just matriculated this September would have had financial aid determined for the current 2015-2016 school year based on the family’s income in 2014, as reported on its 2014 tax return filed in the first few months of this year.

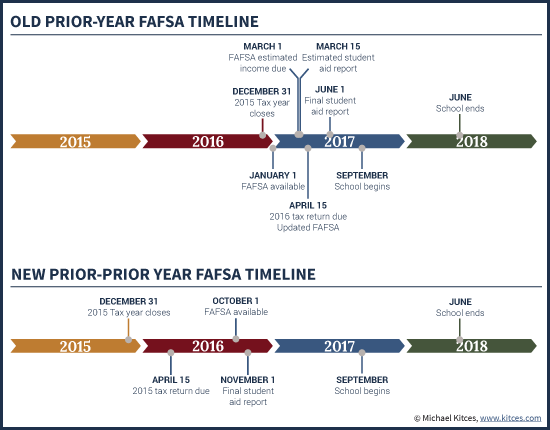

Accordingly, the FAFSA first becomes available on January 1st every year, such that the student can begin the process the moment the prior year has ended and income can be determined. Of course, in reality few families are actually ready to file their tax return on January 1st, especially given that various tax reporting forms to determine income don’t come until weeks or even a few months later, from an employer’s W-2 to various investment Form 1099s and the pass-through K-1s from those who have a stake in a partnership, LLC, S corporation, or a trust.

Though because schools are also anxious to complete the process of acceptance and determining at least an estimate of financial aid, in practice many students will file the FAFSA based on an estimate of income by mid-February or early March. Later, the student is expected to update the final FAFSA once the family’s tax return is filed, and the school then provides a final Student Aid Report (SAR) (which may or may not match the earlier expected financial aid estimate, depending on how accurate the student’s income estimates were in the first place!).

New Rules Will Allow Prior-Prior Year (PPY) Income Data For 2017-2018 FAFSA

To help address the incredibly compressed timeline between when a prior year tax return is filed (as late as April) and when students must make a college decision in order to matriculate that fall, earlier this week President Obama announced a new executive action to alter the income determination under the FAFSA.

Specifically, the new rules stipulate that instead of using the prior year’s income to calculate the Expected Family Contribution (EFC), beginning with the 2017-2018 school year the FAFSA will gather information based upon the prior-prior year tax return instead. As a result, those who apply for college to matriculate in the fall of 2017 will not use the 2016 (prior year) income data; instead, they will use the 2015 (prior-prior year) reported income instead.

Given that the FAFSA will now rely on trailing income data from an entire year earlier – which means waiting for the most recent year’s tax return to be filed will no longer be a constraint – the updated rules also stipulate that the FAFSA will become available earlier, in October of the preceding year, rather than on January 1st.

Thus, for the 2017-2018 school year, instead of using 2016 income with a FAFSA that becomes available on January 1st (before prior year income data is usually even available!), under the new rules the FAFSA will become available in October of 2016, and should be able to be completed immediately because it will be based on 2015 income data that would have already been reported to the IRS (unless perhaps a tax extension was filed, but even then the prior year income will be finalized just a few weeks later under the October 15th deadline for extended individual returns).

Accordingly, the image below shows a comparison of the old and new timelines for submitting the FAFSA. As reflected in the changes, what was previously a highly compressed processes with a series of “preliminary/estimated” and “final” reporting (for submitting income for FAFSA purposes, and getting a Student Aid Report to show the amount of aid that will be provided) now becomes a straightforward linear process.

Planning Issues And Opportunities Of New PPY Income Rule For FAFSA

The rollout of the new prior-prior year income rules for filing the FAFSA has several significant planning implications and opportunities to consider.

Easier Filing And The IRS Data Retrieval Tool (DRT)

While the ability to use prior-prior year income data improves the timeline for filing the FAFSA, it also makes it feasible to use the IRS Data Retrieval Tool to automate pulling income/tax data directly from the IRS into the FAFSA.

Historically, using the IRS Data Retrieval Tool (DRT) was problematic, because the data wasn’t even available until 1-2 weeks after the Federal income tax return was filed (and that was for electronic filing; if the return was filed by paper, it could be 6-8 weeks before the data would be available!). Consequently, unless the family’s tax return was filed very early on in tax season, the FAFSA deadline had usually come and gone before the DRT system could be used, and it’s most common use was to pull final data to update previous income estimates already reported on the FAFSA!

With the new rules and timeline though, virtually all families (unless on extended return and waiting until the last minute to file!) will have access to the IRS data directly through the DRT system as soon as the FAFSA becomes available in 2016. Which should both drastically cut down the time it takes to finish the initial FAFSA (currently estimated to be an hour although recent refinements have been reducing that time), and just outright make it easier to complete the process.

Given that by some estimates, as many as 2 million college students fail to complete the FAFSA process (and nearly 40% of them may have been eligible to claim Federal Pell Grants!), making the process easier has significant implications for helping more students in need get the aid they’re eligible for.

Aligning Financial Aid With The College Application Process

Another notable aspect of the new prior-prior year income rules is that it more effectively aligns the financial aid process with the college application process.

In the past, making a decision about which college(s) to apply to and accept has been challenging because crucial information about the availability and amount of financial aid didn’t come until very late in the process. After all, early application deadlines are often in November (or January at the latest) and regular college applications are often due in the January-February time frame. But a family might not even finalize its reported income until April and not get a final Student Aid Report until June. As a result, students were often left in ‘limbo’, receiving college decisions with tentative or unknown amounts of financial aid, and then waiting weeks or months more to find out what would be affordable or not.

With the flexibility of the PPY income rules, and a FAFSA process that can begin as early as October, students looking to matriculate for the 2017-2018 school year will be able to going through the financial aid process at the same time as the rest of the college application process, which should make it feasible to get a Student Aid Report in quick succession after finding out whether the student has been accepted to the college in the first place.

In fact, the National Association of Student Financial Aid Administrators (NASFAA) estimates that colleges will soon be able to free up significant staff resources that are currently spent in the challenging back-and-forth process of reviewing estimated-and-updated FAFSA filings, and instead use those financial aid administrators to provide quicker financial aid responses to students as they’re being accepted to college!

Coordinating New PPY FAFSA Federal Rules And Institutional Financial Aid

Notably, in addition to receiving needs-based financial aid from Federal (and some state) programs, some private colleges use their own alternative methods to determine institutional aid, such as the Institutional Methodology from the College Board.

At this point, the prior-prior year rules apply only to the FAFSA Federal system, and not the financial aid process for individual institutions. While it’s possible (and likely) that schools using their own institutional methodology will fall in line – and NASFAA has already begun to ask schools to pledge shifting to the PPY method to align with the new Federal rules – students aiming/expecting to receive significant institutional aid by the 2017-2018 school year should monitor for whether their schools have actually updated their process by then. Similarly, many private scholarships currently base their process on prior-year income, although Scholarship America is encouraging scholarship programs to adapt to the new PPY method as well (but it remains to be seen whether all will adjust in time for the 2017-2018 school year).

On the other hand, it’s worth noting that since some institutional aid is handed out on first-come-first-served basis, if a school does update to the new PPY rules, students will want to be certain to begin the process as early as possible and not wait for the “traditional” timeline after the prior tax year has ended!

Income Timing And Financial Aid Under The New PPY Rules

One side effect of the planned transition to the new PPY rules is that the current 2015 tax year will now actually be used twice in determining Federal (and possibly institutional) financial aid. For the 2016-2017 school year, the current 2015 tax year is what was already being used under the normal prior-year rules (with the FAFSA becoming available on January 1st of 2016 and the family tax return being filed in the months that follow). But now, the 2015 tax return will be used again as the prior-prior year rule for the FAFSA that becomes available in October 2016 to apply towards the 2017-2018 school year as well!

Accordingly, families who anticipate or are counting on financial aid may want to be especially careful about any significant income events for the remainder of the 2015 tax year. Normally, the “good” news of having a big income year is that at least in subsequent years, when the FAFSA process is repeated as the student progresses through school, the calculation is done again and as income decreases the eligibility for aid can increase. But with the coming transition from prior-year to prior-prior-year, the 2015 tax year will be counted twice in a row!

Of course, in situations where there is an extraordinary income change and current year income is known to be lower (e.g., because a family member just got laid off from work in the first few months of the year), the standard rules will still apply that allow for students to request a Professional Judgment Review (also known as the Financial Aid Appeal process for special circumstances). And in fact, Professional Judgment reviews may even become more common, as in the past there wasn’t much time for circumstances to change between the end of the prior tax year and the financial aid application process; now, there will be a 12+ month lag, which creates more possibilities for a significant change in family circumstances. At this point, though, the US Department of Education already doesn’t provide a great deal of guidance to financial aid administrators about how to evaluate Professional Judgment situations, and it’s possible that further guidance may have to be issued about how to handle what will likely be a higher volume of review scenarios.

On the other hand, it’s notable that once the new prior-prior year rules are adopted, they will be the law of the land and part of the standard process for all who complete the FAFSA. In other words, the transition to the new PPY rules is not optional, allowing you to choose (and cherry-pick) the prior year or the prior-prior year. Instead, the 2015 tax year will be used for the 2016-2017 school year (under the existing prior-year rules), the 2015 tax year will be used again for the 2017-2018 school year (under the new prior-prior year rules), and going forward thereafter every FAFSA will be completed using prior-prior year income.

Which means ultimately, aside from being especially cognizant about how 2015 income will ripple out for not just one year of financial aid but two, it doesn’t appear that much can be done to “game” the FAFSA system with the transition to the PPY rules. An earlier study from NASFAA (funded through the Bill and Melinda Gates Foundation) already found that the transition to PPY wouldn’t likely have much impact on most Pell Grants (aside from making students more likely to apply for them!) because those whose income is low enough to qualify for financial aid tend to continue to be eligible each subsequent year as well.

On the other hand, for those whose students are currently sophomores (rising juniors in 2016 and seniors in the 2017-2018 school year), the “good” news at least is that any income deferred past 2015 will vanish forever from the financial aid process. While it “would have” been income for financial aid for the student’s senior year under the prior-year rules, it won’t be under the new prior-prior year rules! (Though if the student has younger siblings who will be attending college, beware the impact of 2016 on his/her financial aid!)

In fact, perhaps the most significant impact of the new PPY rules is simply to recognize the “time shift” that applies, and which years actually do matter now when qualifying for financial aid. In the past, the (tax) years that mattered were the year the student rose from being a junior to senior in high school, and the freshman, sophomore, and junior years of college (as by the time the student was in his/her senior year, aid was already determined). Now, financial aid will be based on the student’s rising-junior and rising-senior years of high school, along with the freshman and sophomore years of college; by the junior year of college, the prior-prior year for the last year of college will already be locked in. In other words, "late stage" college planning now has to occur earlier than ever to have an impact!

The bottom line, though, is that beyond the time shift of which income years apply for financial aid, the biggest opportunity of the new prior-prior year income rules is not to game the income system, but simply to recognize that it’s easier than ever to go through the process of applying for financial aid, and without the stress of students getting acceptance letters while waiting months to find out if they can ever afford to attend!

So what do you think? Does this impact any of the college and financial aid planning you do with your clients? Will you be considering any new/different strategies in light of the new PPY rules?

Hello,

I harmonize with your conclusions .Most of your college admissions application deadlines are in January and February, which makes it a very hectic time in the guidance offices across the country. You as the student need to be aware of this because you will have to get your applications to your guidance counselor/college adviser at least 2 weeks prior to the date that you want your applications out in order to meet the college admissions’ deadline. It is crucial to meet all of your deadlines because these institutions of higher education are dealing with thousands of applications every year. Keep in mind that most college admissions decisions are based on the numbers, the depth of the application pool and what they need that year.Moreover, we should use the college application management tool to manage the application thus to avoid rejections. You can visit https://apply101.com/ to get more details about it. I really like your blog. Your blog is very informational.I will tag it to my favourites internet site list and will be checking back soon.

This is going to hurt my family greatly. We are earning FAR less in 2016 than in 2015 with no way to show that now. Our only recourse will be with each school’s FAO and their decision is final. This is terrible. There should be an option to use either. We are screwed.

Suzanne,

Remember that your lower 2016 income WILL still provide a lower EFC and higher financial aid. It will just come for the 2018-2019 school year, instead of the 2017-2018 year.

So unless your child was/is going to be a senior in the 2017-2018 school year, all this does is change WHICH year you get financial aid for your lower income in 2016. It doesn’t eliminate the benefit.

– Michael

It eliminates it insomuch as there is no way to actually ever make up that year’s loss. The only way that would happen is if both of my kids were to have their final year of college during a year where we did very well but the year before that we didn’t. That’s not very likely. This will also put us at the mercy of each respective university’s Financial Aid Office. This was very poorly planned out. The fix for this would have been to offer the option of using the returns for 2016 instead of 2015.

We are in the same boat and it is VERY unfair! Our income, because of a job loss and my husband’s new job is much less than what he made in 2015, we will never be able to gain the financial aid my daughter needs when she starts college for the 2017-2018 year, even though our income is so low this year and for the first year she starts. This makes no sense at all! It is so bad, we are having to take money out of our savings just to pay bills from month to month.

This is a terrible summary of Suzanne’s situation. She specifically stated that she is concerned about her income for 2016 vs 2015. This means that she has a student currently filing FAFSA. This means that she essentially “loses” FAFSA for 2 of 4 years. You get to choose “which” year you get to make up the benefit because the loss doesnt get reported for 2 whole FAFSA cycles.

If you have a loss of infome in the beginning of 2016, and had good income for 2015, then when you filed 2016-2017 and you already are operating on a loss for 2016-2017, then you have to find a way to pay the difference for 2016-2017 with either a loan or more work (which some like in my position can’t do if its due to disability). Then you have no income of low income for 2016 which would normally show and be reported in 2017 for the 2017-2018 cycle, but guess what, your still on that 2015 filing when you have good income, not what should have been the one revealing the loss in 2016. So your in the same boat for 2017-2018.

Now, if your in the same situation for 2018 and 2019 (as in my situation being 100% disabled now) and you just happened to start your 4-year in 2016, then you get 2 years of FAFSA. If you only had 2 years left in 2016, those two years are a total loss. If you had 3 years then you get 1 with the grant eligibility. That is a much greater impact than just the 1 year “choose which one you want to earn it in”.

And yes, I know you can appeal to have your income adjusted but like Suzanne said, it is up to the FAO at the school and if you miss their arbitrary deadlines or they just dont want to play ball, your totally screwed. I tried to appeal mine in October last year when the new FAFSA app was supposed to come out, and my FAO told me I was not even allowed to fill out the app to have my income adjusted until after my taxes for 2017 were paid out and transcripts were available. Because of the new EIC rules this year, I didnt recieve my return until March 7th. Guess when the deadline to fill out the income adjustment for was… Feb 1, 2017… Before your taxes can even be considered, much less recieve completed transcripts for. Long-story short.. the FAO told me, by their arbitrary standard, that I could not request reconsideration until after taxes were filed, which was after their arbitary deadline… Yeah… that worked out in my favor.. NOT. Now I am waiting for the same thing to happen this coming year, where I will get the same run around I’m sure.. and lose another year of Pell eligibility. Thats 2 of my 4 years for those keeping score at home. And since the last year I get to file will be Oct 2018 for the 2019-2020 year, I will get only 1 year of Pell eligibility. (My first year I was at a very inexpensive community college so I didn’t have an EFC that would warrent a Pell anyway and my wife and I just struggled through with only my disability for living expenses and a Pell would have helped out immensely but that wasn’t a result of the rules changing so it doesn’t really apply to this discussion).

So yes, the rules changing does affect quite a few people tossed into low income for 2 years, not just 1, if their income changed in 2016 for the worse. No ifs.. ands.. or buts… The ONLY way this rule changed should have happened was for the FAO’s to be REQUIRED to allow the new income information to be considered based on EITHER 2015 OR 2016, whichever is more advantageous, and deal with those cheating the system in arrears. Since the supposed reason for the rule change that Obama touted was to better allow students and parents to utilize grant money that wasn’t being used.. to benefit the student and the parents more.. then why would they NOT let us choose which tax return will benefit us in the FAFSA system the most, unless they really did do it this way so that people brought down to the lower class have a much harder time climbing out. And if there really was soooooo much grant money going unused, why try to narrow down the pool of those who can use it by disallowing the more advantagous tax situation to determine eligibility.

Wow, as a self employed family, we are in the same position as Suzanne. Finding this out now, and with two children in college, we are in a world of hurt. Our income change from last year to this year is significantly lower.