Executive Summary

While the shift to digital tools and platforms has been underway for more than a decade, from the growth of blogging and social media to the rise of the robo-advisor, the coronavirus pandemic of 2020 will likely forever mark a turning point that rapidly accelerated the digital shift for financial advisors. Yet while the forced digitization of the financial advice business has been most noticeable of the realm of digital paperwork (i.e., eSignature adoption) and meetings themselves (e.g., Zoom and the like), it is the marketing and growth of financial advisory firms where the digital shift has been most disruptive to the advisor status quo.

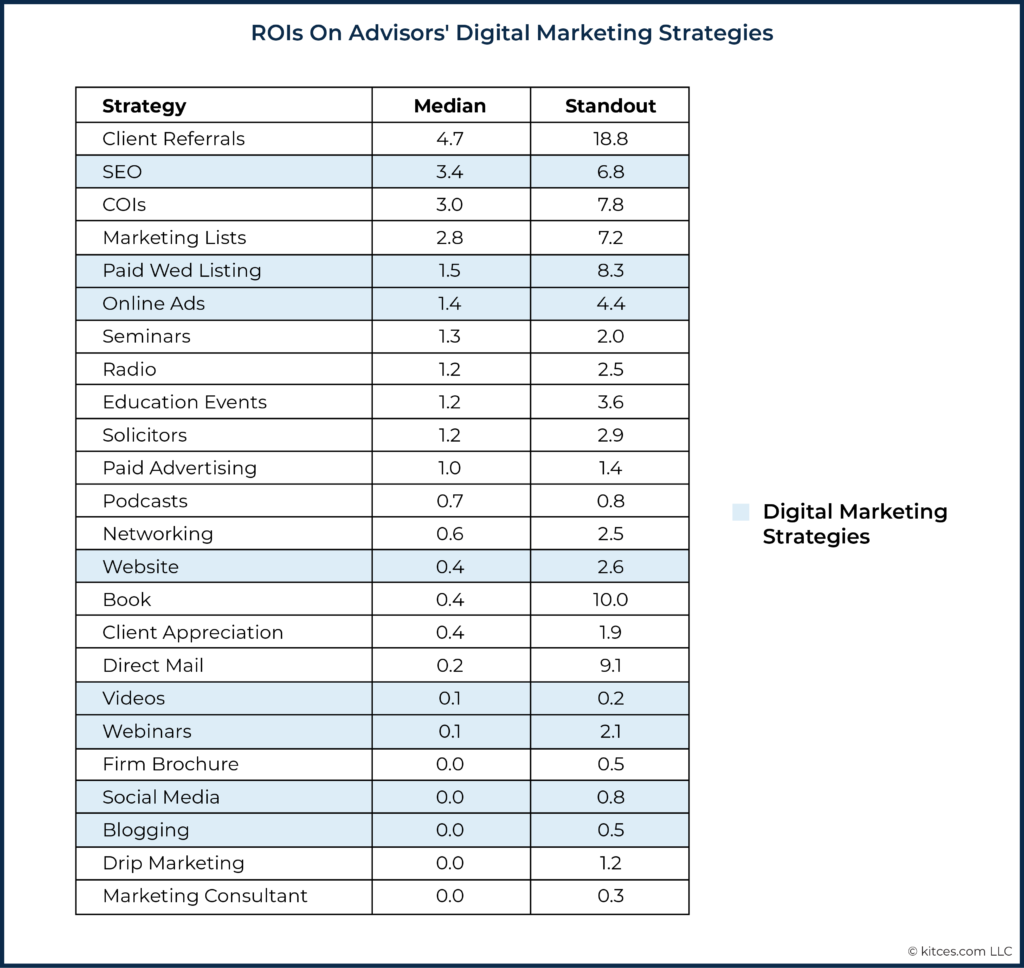

After all, as the latest Kitces Research on advisor marketing has previously shown, even before the pandemic it was a category of “digital” marketing in particular that showed the greatest disparity of “haves” and “have-nots”, of a select few firms that were having outsized marketing success while the remainder were struggling greatly. And even within the digital marketing strategies, some, like SEO and paid social media advertising, are showing far more success on average than others like blogging and social media. Which only raises even more questions in the current pandemic environment about what digital marketing strategies are really worth pursuing (or not).

In this context, we’re excited to announce the launch of the first Kitces Digital Marketing Summit – a virtual conference focused not on Telling financial advisors what they “should” be doing, but instead to simply Show what real advisory firms are actually doing that works in the realm of digital marketing. From SEO to paid social media advertising, to blogging and email marketing, online scheduling, and CRM systems to manage the sales process of turning prospects into clients in a digital world), this Kitces Summit will showcase what really works across the top, middle, and bottom of the digital marketing funnel. No sponsors. No vendors. Just advisors providing a behind-the-scenes look for other advisors about what they’re doing that’s driving real results. (Though we will provide some curated and crowdsourced recommendations at the end of potential vendors that advisors might use if they see something they do want to implement!)

This “Show, Don’t Tell”-styled Kitces Digital Marketing Summit will run for “just” an action-packed 4 hours on the afternoon of Thursday May 13th from noon to 4 PM EST (replays/recordings will be available for those who cannot attend live). So if you’re still curious about what it really takes to do digital marketing successfully, and want to actually see what success looks like, I hope you’ll check out our new Kitces Digital Marketing Summit, and “See What’s Possible!”

From Analog To Digital Marketing For Financial Advisors

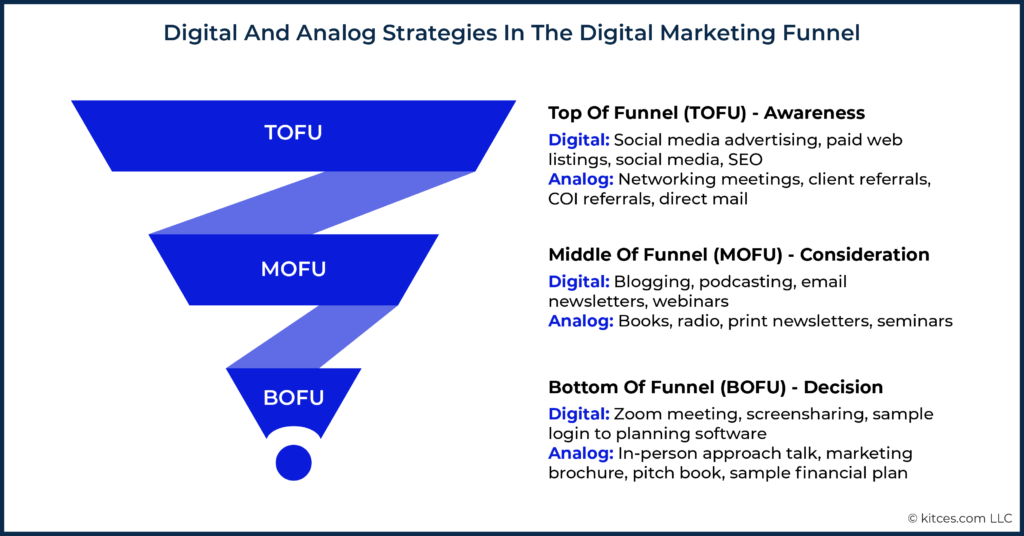

Historically, financial advisor marketing was very much an “in-person” endeavor. Cultivating referrals from clients or Centers Of Influence (COIs) was entirely reliant on developing (in-person) relationships. Finding new business opportunities often relied on attending networking meetings to develop even more (in-person) relationships. One-to-many marketing efforts were often built around direct mail, which aimed to bring leads to (in-person) seminar and educational events. Those who weren’t ready to do business would get added to a (physical, print) newsletter mailing list.

Then the internet showed up and began to digitize the marketing process for financial advisors. It started with the shift from physical print newsletters to drip marketing via email newsletters instead. Then it morphed into social media as the new networking approach to find prospects and build referral relationships. Then Search Engine Optimization (SEO) and social media advertising became the new (inbound) prospecting approach. Notably, even these digital marketing approaches still typically culminated in a physical in-person meeting to actually “sell” the prospect on doing business with the firm. But now, in the pandemic environment, even the advisor’s “approach talk” with a prospect is often now a digital Zoom-based meeting as well!

The caveat, though, is that even as some advisory firms are having great success with digital marketing strategies, our Kitces Research on Advisor Marketing finds that the “digital” approaches include both some of the most and some of the least effective marketing ROIs (Returns On Investments), both for the “typical” advisor and even for those who are “standouts” with the strategy.

In other words, not all digital marketing strategies are the same when it comes to which drive ROI (or not), what even the “best” standout advisors can scale effectively… and how they work with each other to facilitate an entire financial advisor marketing funnel.

The Financial Advisor Marketing Funnel

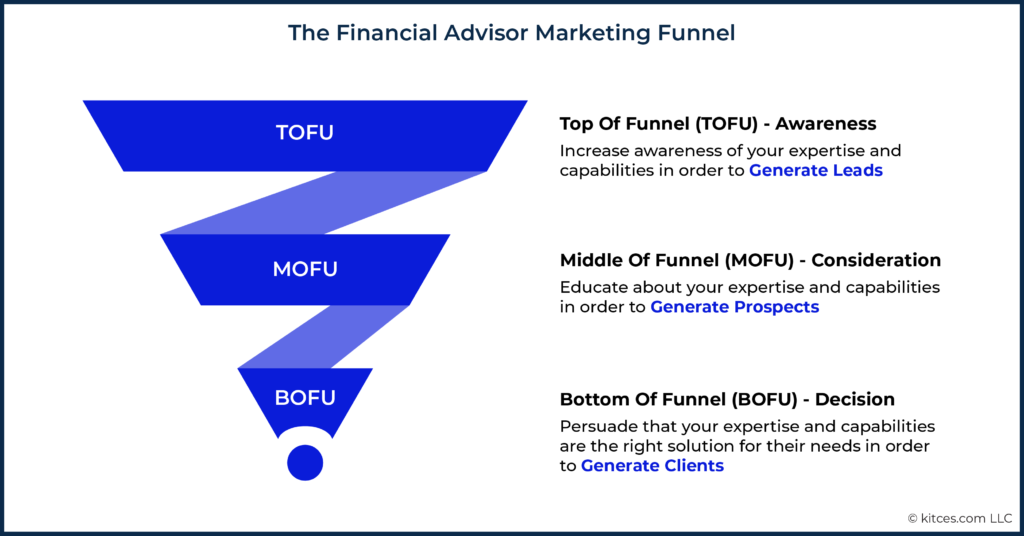

For the typical financial advisor, the “business development” process begins when a prospective client calls, emails, or otherwise reaches out and expresses interest in doing business with the advisor. Which typically results in some form of “approach talk” to explain the advisor’s services and the value the firm will provide for the fees that it charges, then attempt to convince the prospect to become a client.

But the reality is that the stage of trying to persuade a prospect to make the decision to become a client is really only the “bottom” of a marketing funnel that begins with gaining awareness from ‘strangers’ that the advisory business even exists, and engaging them as prospects during a Consideration phase as they decide whether they even want to (and are ready to) reach out to have the conversation about whether they want to “do” business… which only then culminates in the actual Decision stage about whether to move forward with the advisor (or not).

Which means it’s not enough to simply focus on what happens once the prospect is sitting across from the advisor and it’s time to “close” the business. Instead, business development and new client growth only happens if there’s also a steady stream of prospects to meet with in the first place. The entire marketing funnel only works when all the parts are working in concert together, whether in the analog world (prospecting before selling)… or the digital realm.

After all, building “top-of-funnel” awareness (e.g., search engine optimization or paid social media advertising) doesn’t help if the firm doesn’t have a strong website to explain its capabilities to leads that show up by clicking on the ads or the search result. A website with a great blog or high-quality email marketing newsletter that demonstrates the firm’s expertise isn’t going to generate results if there’s no top-of-funnel growth that gets people to visit the blog or sign up for the newsletter in the first place. And a great engaging blog content and a popular email newsletter still won’t generate results if prospects, when they’re actually interested in moving forward, don’t have a clear path to take the next steps and actually begin the conversation (e.g., a call-to-action to schedule a meeting with a convenient scheduling link?).

In other words, the issue is not simply that “digital marketing” works for some advisors but not for others, and that some strategies may drive a better ROI than others, but that marketing strategies like social media, blogging, podcasts, social media advertising, and the like are just components of the marketing funnel. Such that doing any one, alone, won’t generate much in the way of results, no matter how well it’s executed, in the absence of the others.

The Changing Landscape Of (Digital) Advisor Conferences

For financial advisors who want to learn something new – whether it’s a technical planning strategy, or executing a better financial planning process, or improving their financial advisor (digital) marketing – the ‘tried and true’ approach is to attend a financial advisor conference focused on that topic, where the advisor can both learn from experts on the topic, network with advisor peers who have a similar interest in the topic, and engage with vendors who provide solutions around the topic.

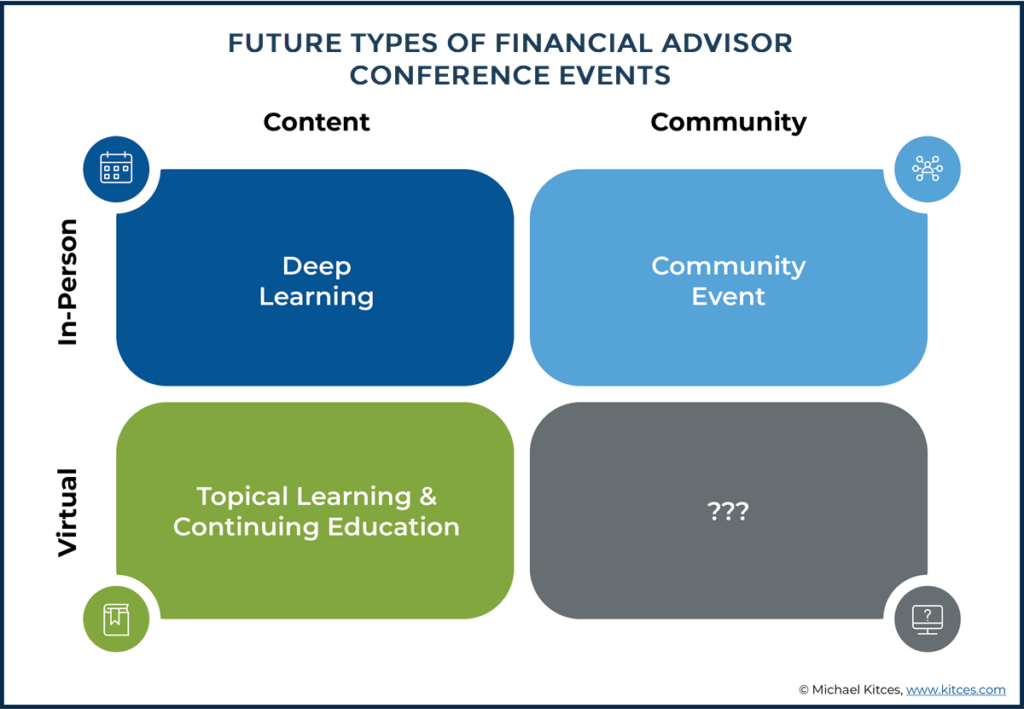

Except, of course, the outbreak of the coronavirus pandemic has largely shuttered traditional in-person financial advisor conferences for the past year, and forced them into a virtual world instead. Where, similar to digital marketing itself, the results have been… mixed, at best.

As some parts of virtual financial advisor events, such as the ‘pure’ educational content, have translated just fine to a virtual world (given that educational webinars were already around). But other aspects of the conference experience, like connecting with other members of the community, have been more challenging when it’s difficult to “mix” with others in the hallways. And certain parts of financial advisor conferences that were previously part of the core foundation – such as the exhibit hall – have struggled greatly in the virtual transition.

In addition, “Zoom fatigue” has also proven to be a real challenge – not only for client meetings and team meetings, but also and perhaps especially – when it comes to advisor conferences. Which has led to some events being split into multi-day events, so as not to run “too long” in a single day. Though in the end, doing so ends out being even more of a commitment for advisors themselves, splintering the event across multiple days of disrupted productivity, and undermining one of the core benefits of attending a conference in the first place: to be able to focus on a certain topic, in the hopes of getting to the next level.

In fact, as in-person financial advisor conferences begin to return in the coming months, the question is now arising as to which events will remain digital and which will return to in-person. As there is clearly still real value to going to an in-person event, especially to connect with your peers and community. But it’s still not necessarily an efficient use of time for the financial advisor who just wants to learn about a particular topic, and be focused in that area.

In other words, the future of financial advisor conferences appears to be both – targeted topical events that operate virtually and allow the advisor to maximize content received relative to time (and dollars) spent, along with deep-dive niche events and community events that will more likely revert to in-person for those who want to invest even more dollars or time into the experience.

Introducing The Kitces Digital Marketing Summit: A Focused “Show, Don’t Tell” Advisor Event

Given the ongoing challenges for financial advisors attempting to implement an entire digital marketing “funnel”, and the opportunities for focused virtual events on a singular topic, this week we’re excited to announce the latest Kitces initiative: the Kitces Digital Marketing Summit, an entirely virtual event that will take place on Thursday, May 13th.

As the name implies, our newly launched Kitces Summit is focused entirely on digital marketing, following the advisor marketing funnel from the top (SEO and social media advertising) to the middle (blogging and email marketing) to the bottom (systems and processes to turn prospects into clients in a digital world).

But what’s unique about our upcoming Summit is that it will entirely feature Guests who are really doing digital marketing, in real advisory firms, who will share what they’re actually doing that’s working. Co-hosted with Taylor Schulte of the AGC (Advisors Growing as a Community) and the Experiments In Advisor Marketing podcast (and a financial advisor successfully engaging in digital marketing strategies himself), this Kitces Summit will offer a behind-the-scenes look at how successful financial advisors are implementing their own digital marketing funnels!

In other words, unlike “traditional” advisor conferences that try to Tell financial advisors what they “should” be doing, the focus of this Kitces Summit is simply to Show what real financial advisors actually are doing. No vendors, no sponsored sessions, and no industry consultants Telling advisors what they “should” be doing. Just advisory firms showing, for 30 minutes each, what they’re actually doing… to help the rest of the advisor community to see what’s really possible when it comes to (successful) digital marketing.

This “Show, Don’t Tell”-styled Kitces Digital Marketing Summit will run for “just” an action-packed 4 hours on the afternoon of Thursday May 13th – from Noon to 4PM EST – featuring a brief presentation from yours-truly on the latest Kitces Research on financial advisor marketing strategies, and more than 3.5 hours of financial advisors simply sharing what they’re doing. (Though we will provide some curated and crowdsourced recommendations at the end of potential vendors that advisors might use if they see something they do want to implement!)

So if you’re still curious about what it really takes to do digital marketing successfully and want to actually see what success looks like, I hope you’ll check out our new Kitces Digital Marketing Summit and “See What’s Possible!”

Another awesome benefit from the Kitces team! There are very few events in our industry (I can think of less than 5) that are focused exclusively on what really works from people actually doing it.

Fingers crossed the event starts with showing each persons audited financial statements to make sure we’re not hearing fish stories. 🙂 But either way, this is awesome!

Thanks Matt! We didn’t quite go so far as to require audited financial statements from all of our guests, but we did try hard to find guests that really have something to SHOW for their marketing efforts! 🙂

– Michael

I can personally vouch for Taylor and Adam! Buying my ticket now.

Hello, Team Kitces.

I read that the digital marketing summit is not going to involve app vendors, but I am wondering if there is any place in this summit or with Team Kitces in general for Nest Egg Guru to get on your radar. We are one of the very few companies that makes 100% client-facing sofware for advisor websites to help FAs better educate and engage clients, build stickier relationships, and improve online visibility.

Our latest app, Password Guru, helps build client loyalty and make the FA’s website client hub by allowing FAs to give a free intuitive password management platform to their clients. To my knowledge, we are the only white labeled password management app for financial advisors. Any suggestions for how we may get on your radar would be sincerely appreciated. Note: We are a product sponsor at the upcoming Finlocity Advisor FinTech summit.

Mahalo & aloha,

JR

Michael,

Do the figures in the “ROI” table represent number of clients acquired per year?

Thanks,

Ted

No, sorry, we need to get a better explanation in there. It’s a ratio of marketing dollars spent relative to revenue generated from those clients (in the first 12 months).

So a ratio of 3 means $3 of revenue for every $1 of marketing. For instance, a $3,000 marketing spend got $9,000 of client revenue. (On average)

– Michael