Executive Summary

A common service model for many financial advisory firms is to schedule annual client meetings throughout the year where the advisor meets with each client in the month they started working with the firm, and conducts a comprehensive review of all planning topics for the client. Which means that on any given workday, advisors might find themselves reviewing one client’s portfolio and another’s estate plan in the morning, and having a meeting with a third client later in the afternoon. However, by creating a systematic annual process to monitor and update client plans based on seasons, not only can advisors save time and work more efficiently, but they can also communicate the value of ongoing financial planning services to prospects and clients more effectively.

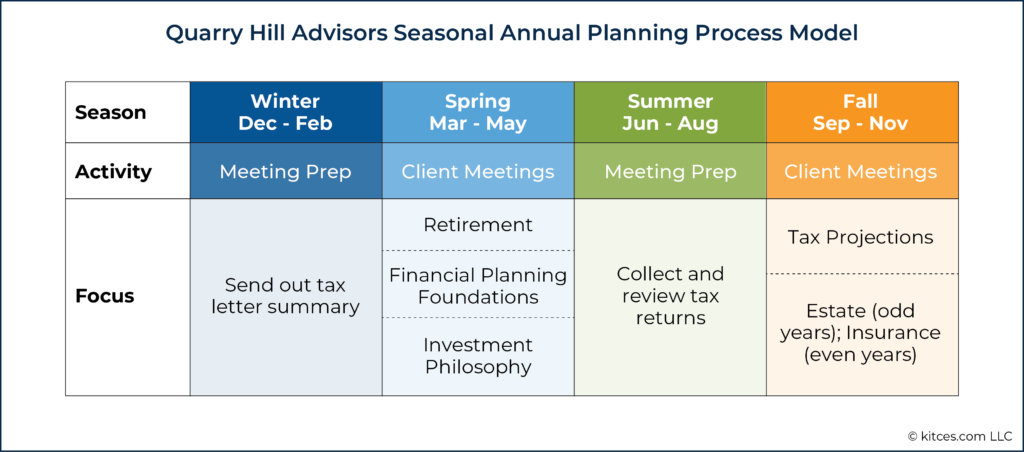

One way to implement a seasonal model is to group client meetings (and the requisite meeting prep) by topic, and then to thematically organize seasons throughout the calendar year. With this approach, the advisor can focus on particular planning areas (e.g., tax and estate planning) for all of their clients in each given time period, with designated seasons for meeting prep and separate seasons for client meetings. Which means there would be ample time to prepare for meetings that would cover only one set of planning topics – e.g., advisors would discuss tax and estate planning with clients in the fall and prepare for those meetings in advance over the summer, while discussing retirement and investments in the spring and preparing for those meetings in the winter.

This approach allows advisors to focus more deeply on each topic they discuss with clients and, because of the systematic nature of the schedule, can also save time while improving both efficiency and efficacy. Furthermore, advisors can adjust the annual calendar to accommodate their team members’ work-life balance needs. For example, with summers designated as meeting prep seasons, team members with children can have more workweek flexibility (given the lack of client meetings) and enjoy more days off while their kids are on summer vacation.

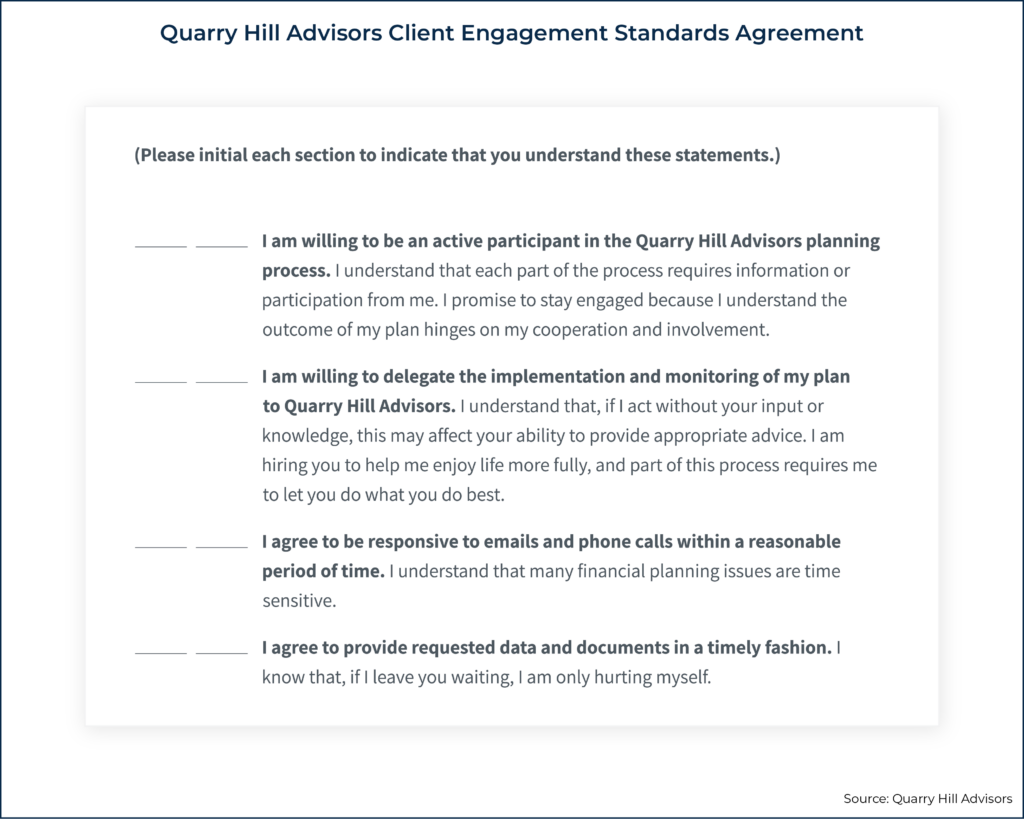

Importantly, implementing any new client meeting system also requires communicating to clients how the system works and setting clear expectations with them upfront. This may be done through a Client Engagement Standards document, which can ensure clients understand the process and their obligations to provide the advisor with the requested information. And by making sure that clients have this level of clarity, advisors and clients alike can have confidence that no part of their plan will slip through the cracks.

Ultimately, the key point is that by establishing a seasonal cadence of when and how clients’ financial plans are updated and monitored, advisors can improve efficiency while easily demonstrating to their clients the full range of work involved in monitoring and updating their plans. So for advisors who feel overwhelmed with the range of responsibilities they have in a given week, implementing a systematic annual planning process based on seasons can not only provide more structure to their processes, but also provide a better experience – not only for their clients, but also for their work teams – in the process!

For many financial advisors, demonstrating the value of creating an initial financial plan for prospects who have never worked with a financial advisor is often much easier than explaining the value of the services provided throughout an ongoing financial planning relationship. This is because, while financial advisors are often most confident analyzing client data and preparing a financial plan, they often lack the same level of clarity around developing a systematic process of monitoring and updating the plan over time once it has been created.

Furthermore, while many clients are interested in receiving a comprehensive financial plan, they simply don’t know why they should continue working with the advisor in an ongoing financial planning relationship once they receive their plan, especially when the advisor doesn’t provide a clear framework that illustrates how ongoing planning can provide any value to the client.

By adopting a proactive annual planning process designed to systematically monitor and update clients’ financial plans, advisors can more easily help prospects understand the value of ongoing financial planning – not just by outlining the specific steps needed to keep their plan on track on an ongoing basis to ensure they meet their goals, but also by stressing the importance of regular monitoring to ensure problems are prevented or caught while they are still small, and that no significant opportunities are missed.

The Value Of Systematizing Processes To Monitor And Update Client Plans

How easily can most advisors figure out the last time they reviewed their clients’ LTC, life, and disability needs? Or whether all Roth and backdoor Roth contributions were made by eligible clients? How confident are they that no year-end-tax-planning opportunities were missed across their entire client base? Especially as the advisor’s client base grows, it becomes more difficult for them to rely upon their own memory to serve their clients – a system must be developed to maximize efficiency opportunities for the firm as well as value opportunities for their clients.

Many firms fail to establish a consistent cadence of when and how they monitor and update their clients’ financial plans – each client might be on a different meeting schedule, and there is no uniformity among meeting agendas across the client base. As such, preparation for each client meeting is ad hoc, and the behind-the-scenes ‘shadow work’ of financial planning to prepare for meetings is disorganized and scattered.

To make matters worse, the lack of a systematic planning process almost guarantees that things will fall through the cracks for clients. And when updating a client’s financial plan depends on the client reaching out to schedule a meeting, it usually only happens in response to the client and rarely gets done on a regular basis. This can lead to problems when a client rarely (or never!) reaches out to schedule a meeting because then there is no trigger for the advisor to collect the client’s data and update the plan. The plan will become out of date, potentially resulting in lost opportunities or, perhaps even worse, mistakes.

By creating an annual planning process, advisors can ensure that every client’s plan is monitored and updated consistently, regardless of whether the client can come in for a meeting. So instead of always feeling busy, advisors and their staff only have certain busy seasons.

Increasing Efficiency And Output Using An Assembly Line Manufacturing Approach To Financial Planning

Before Henry Ford developed the assembly line method of automobile manufacturing in 1913, cars were built in their entirety one at a time. But with the assembly line, Ford Motor Company increased their output (from 25 cars per day in 1903 to 1,000 in 1918) and reduced costs (from $825 per car in 1908 to $260 in 1925), all while increasing worker pay, reducing their shift hours, and reducing the number of mistakes that were made, since each part of the process was broken down into repeatable steps, and each step was assigned to a particular person.

Financial advisors can take a similar (yet hopefully more humanistic) approach when it comes to monitoring and updating their clients’ financial plans – instead of updating the entire financial plan for each client one at a time, batching portions of the process (e.g., scheduling out tasks related to tax, insurance, estate, and foundational planning issues at different times of the year) across all of the firm’s clients can reduce errors and increase efficiency.

By adopting an annual schedule that applies the concept of ‘time blocking’ to the financial planning process and blocking specific periods of time throughout the year for client service tasks, advisors will have more free time and brain space and avoid the nagging feeling of not knowing off the top of their head when the last time they did important shadow work for the client.

For example, a necessary step in monitoring and updating a client’s financial plan is to ensure their estate documents still reflect their wishes and intent. Our firm conducts estate plan reviews in the fall of every odd year for all clients at the same time. And since we review each client’s estate plan flow chart, beneficiary summary, and key person outline during this designated review period, we can be confident that all of our clients’ estate plans reflect their current wishes. This year, through our review process, we had a client realize that they needed to update the listed guardian for their child because they were no longer in a close relationship due to political differences.

Before implementing this process, I was carrying around a burdensome mental load trying to keep track of when we had last updated different parts of our clients’ financial plans. When was the last time we reviewed LTC insurance for our retired clients? Every client was serviced differently on their own individual schedule, so it would take digging through long histories of CRM meeting notes to figure these things out. Now I immediately know that we reviewed LTC plans in the fall of the last even year.

Helping Prospective Clients Understand The Scope Of Ongoing Financial Planning

In addition to increasing the firm’s output capacity and efficiency, having a systematized financial planning system can also help advisors articulate the value of an ongoing financial planning relationship to prospective clients. This is because while most prospective clients know they need help with the creation of their financial plan, they often have no idea what they ought to be doing to keep their plan on track.

Asking a prospect the right questions, such as the ones below, can implicitly demonstrate the importance of proactive monitoring and updating:

- When was the last time you had your insurance needs reviewed to make sure your coverage is appropriate at the lowest cost?

- Who runs your tax projections to make sure you are not missing any opportunities?

- When was the last time your estate plan and beneficiary designations were reviewed to make sure they match?

Not only does this conversation help the client understand the importance of monitoring and updating their plan, but it also helps them understand the meaning of an ongoing financial planning relationship and what their advisor does to keep them on track over the long term.

For example, when I meet with prospects and review our monitoring and update process, I pull up a sample plan in RightCapital and walk prospects through how and when we would address their needs. I tell them that because of our systematic process of monitoring and updating our clients’ financial plans, mistakes are usually prevented or caught while they are still small, and all opportunities are taken advantage of.

By emphasizing the systematic approach we take and the detailed process we follow to ensure clients stay on track, we can successfully convey the scope of work involved in monitoring and updating. And then the prospect can then decide if they are willing to dedicate the time, energy, and interest to manage the ongoing needs of their plans themselves or if they want to delegate it to a professional firm like ours.

Very often, once the prospect has a clear understanding of the ongoing planning process, the thought of doing it themselves often makes them feel very anxious, and they are relieved to have someone else take this burden off their shoulders.

Demonstrating Value To Current Clients By Making The Invisible Work Visible

Not only does having a systematized annual planning process help advisors clarify how an ongoing financial planning relationship benefits new prospects, but it also continually confirms the advisor’s value for current clients, too. Because the shadow work of their financial planning is clearly evident through regular communication, requests for documents, and consistent follow-up communication, clients can see how their advisor is proactively working for them throughout the year.

We clearly communicate when and why different parts of clients’ plans will be covered, and our Client Engagement Standards also emphasize that they need to provide the requested information and complete the follow-up tasks we assign them. As a result, clients never feel the need to ask the question, “What do you do for me?”.

Because we consistently follow our planning calendar year-round, clients know that we are on top of their situation and that they can sit back and let us drive. Even if a client cannot come in for a scheduled meeting, we still send them a report and video summary of what we think they should know, along with relevant follow-up tasks. They can offload the mental burden of monitoring and updating their plan to us.

How Advisors Can Create Their Own Annual Planning Process

While the concept of ‘meeting surges’ has been gaining momentum in the RIA space recently, it doesn’t resonate with everyone. For advisors who may not like the idea of stacking 6 client meetings per day into intense meeting weeks every few months, it can still make sense to have ‘meeting seasons’ within a firm’s annual calendar. The purpose of a meeting season is not to maximize the number of client meetings in a short period of time; rather, it’s to allow an advisor to batch and organize their client service into themes throughout the year, maximizing efficiency and efficacy.

Importantly, by associating each season with a particular theme, the work required to prepare for client meetings and to update and monitor each plan will be optimized for each theme instead of being scattered across multiple planning areas.

At our firm, we use an annual process that is divided into segments that follow the 4 seasons – winter, spring, summer, and fall. Our process is thoughtfully planned around tax deadlines and includes meetings with our clients twice per year.

As such, client meeting seasons are held in both the spring (March through May) and the fall (September through November), with most meetings currently concentrated in April and October. As we add more clients, we can fill up the beginning and tail-end months of each meeting season. In winter and summer, we prepare for the next meeting season and implement larger firm projects (e.g., software changes).

Additional benefits of this seasonal approach include providing down periods in the summer and winter months, allowing us to work on the business, take on new clients, and execute the data gathering and shadow work of financial planning for our current clients. Since we don’t meet with many clients in the winter and summer, our team has much more flexibility to work remotely, and to work on the business rather than in the business.

Meeting seasons also allow for more flexibility for our team. If the firm calendar has 1 client meeting scheduled each day throughout the year, it’s more difficult for the team to work remotely. However, if meetings with all clients are bundled together in seasons, advisors and their teams have better control of organizing how and where they can work during the off-meeting periods.

Winter Season

We begin the winter by emailing a letter to all clients and their tax preparers in January that summarizes what we did during the year that impacted taxes and lets them know what tax forms they should expect. We add items to this letter throughout the year as they happen, instead of all at once at the end of the year, to help ensure that nothing is missed.

We use Holistiplan as our tax planning software, which makes it incredibly easy to create, update, and send this letter to clients, and we use features in our CRM system, Wealthbox, to include a final workflow step of noting tax-related transactions to make sure relevant items are added to the client tax letter in Holistiplan as they are completed (e.g., Donor Advised Fund contributions, backdoor Roth, Roth conversions, etc.).

During the winter season, we also use Wealthbox to run a report that tallies all Roth and other retirement contributions made by clients. This lets us see which clients still need to fund their accounts to maximize their contributions before the tax deadline so that we can avoid missing a Roth contribution for eligible clients.

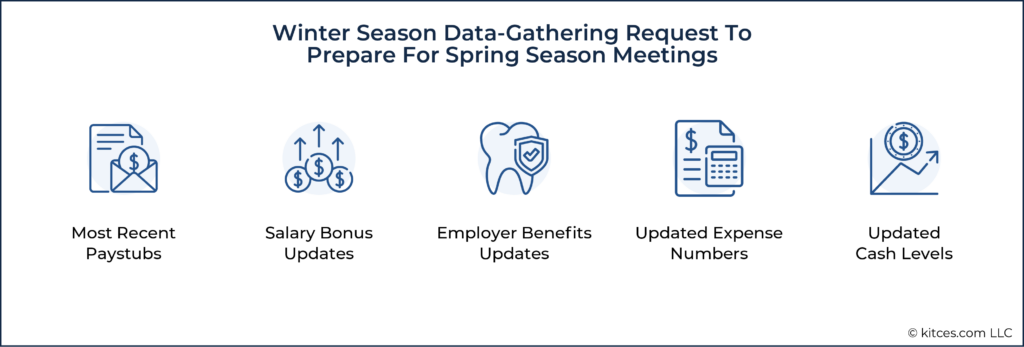

We spend the rest of the winter scheduling clients for upcoming spring client meetings and requesting data through task templates created through our financial planning software, RightCapital (which integrates with Wealthbox).

One valuable feature of RightCapital’s data-gathering tools is that personalized task templates can be applied to all clients at once, which lets us send out data-gathering requests simultaneously instead of having to send customized emails to each client. This way, our team members don’t need to spend time hounding clients for data; we simply let automated RightCapital tasks trigger email reminders every 2 weeks until the client completes the task.

Spring Season

In the spring, our client meetings all have the same themes: retirement projections, foundations of financial planning (cash reserves, savings rate, debt review), and reviewing our investment philosophy. To prepare for these meetings, we collect all of the data during the preceding winter season to update clients’ financial projections in advance of the meeting.

We also pull together a relevant investment presentation to educate clients on our investment philosophy and the strategy we use for their portfolio design, as it’s important to us that our clients understand why they are invested the way they are. Which is why we make sure to discuss this with them, year in and year out, regardless of the market environment.

During the meeting, we review with the client any follow-up tasks that need to be handled – by both the client and our own team – and make sure to set the right expectations with respect to turnaround time. While we handle all time-sensitive tasks right away, it may take a month or 2 before we get back to them on non-time-sensitive follow-up items. Notably, if any tax, estate, or insurance planning updates are brought up and need to be addressed in the spring meeting, we add those items to the spring meeting agenda for that particular client. If it’s not time sensitive, we will push it to the fall meeting and request info during the summer.

After the meeting, we go through all follow-up items, adding client tasks for RightCapital to send out to clients with due dates and adding our team’s own internal tasks to Wealthbox (often setting summer due dates on non-time-sensitive issues). While all of the follow-up tasks that a client meeting generates can be difficult to handle during the meeting season itself, anything that is not urgent is pushed out into the next season of our annual planning process: summer.

Summer Season

In addition to handling all of the outstanding follow-up tasks from client meetings remaining from the spring, the main focus of the summer season is to request tax returns from clients and review them for accuracy – because catching mistakes on a tax return (which can happen frequently!) can add up to substantial tax savings, and is a tremendous way for advisors to demonstrate their value to clients.

Once the returns are reviewed, they are uploaded into Holistiplan. We also project their income from pay stubs and any other tax-relevant information that we request through task templates generated by RightCapital later in the summer, all in preparation for tax projections in the fall.

In addition to tax documents, we also use RightCapital task templates to remind clients to send updated estate documents (if we don’t already have them) and a copy of their most recent insurance policy declaration pages, along with any other supporting documents that we might need to update the legacy and risk management parts of their plans.

While we have a physical office location, we mostly work remotely during the summer season and enjoy the flexibility our process allows us. And without regular client meetings scheduled, we can enjoy a great deal of time off to enjoy Minnesota summers! Our team takes Fridays off between Memorial Day and Labor Day, and vacations are encouraged.

Summer is also a great time to host a fun client event, which allows for another touchpoint with clients in a more social context.

Fall Season

In the fall, the final season of our annual planning process, our client meetings focus on taxes and either estate planning (in odd years) or insurance planning (in even years).

To ensure that our clients take advantage of any year-end tax opportunities, we don’t run tax projections until the fall, when we can be relatively confident in the accuracy of the projection while still having time to make adjustments. Then, during the client meeting, we walk clients through their tax projections to help them understand their current tax situation and discuss any potential changes to be made before the year's end.

For insurance reviews in even years, we analyze each client’s current coverage using RightCapital and pull in an independent agent to review certain policies (such as property & casualty, with our client’s permission) to ensure they are adequately insured at the right cost.

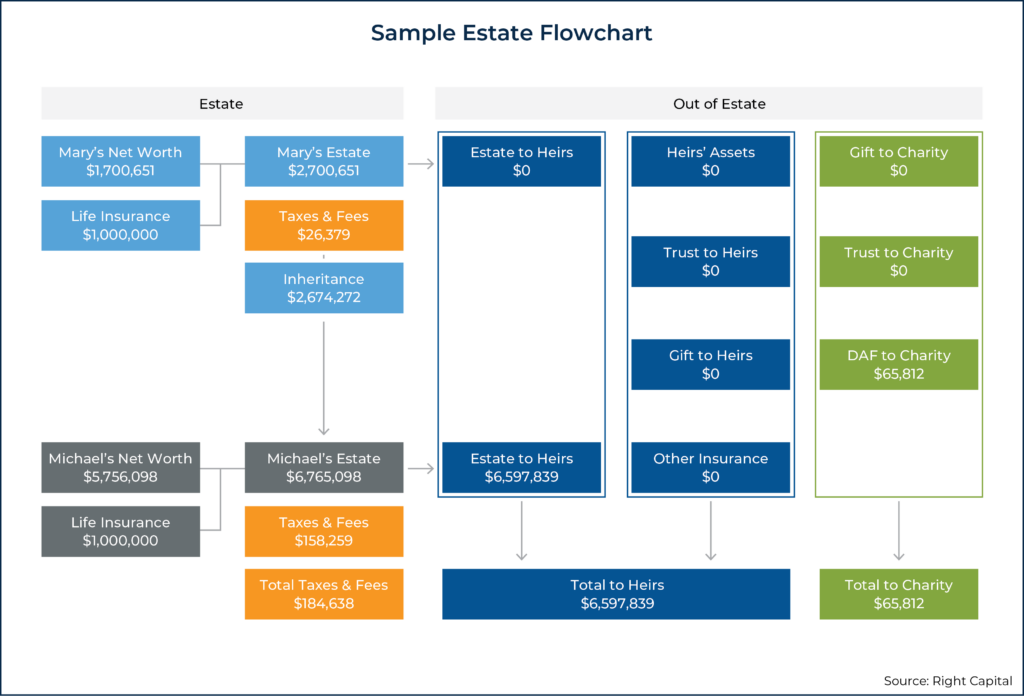

For estate reviews in odd years, we confirm the client’s current beneficiary designations for each of their accounts and go over their estate plan flowchart in RightCapital. The flowchart allows the client to see, in dollar terms, exactly how their estate would transfer to the surviving spouse and beneficiaries if they passed away either today or projected out at a future date (including assumed asset growth).

Being able to visually model a client’s estate plan brings it to life and allows the client to grasp the potential flow of their money depending on various scenarios (who dies first and when). This is a great opportunity to make sure the estate plan matches the client’s current wishes and intent – every client’s situation is fluid, but their estate plan is not!

Challenges Of Implementing An Annual Planning Process

Collecting Data

Adopting any process to be adopted firmwide can have its challenges. The most significant challenge of preparing for client meetings, regardless of the system in place, is collecting the relevant data to monitor and update clients’ financial plans. And when meetings are structured into seasonal cycles, it’s especially important for us to have all of the data prior to the start of the meeting season. Otherwise, we aren’t able to prepare before the season starts, and when our team has to prep during the meeting season due to late data gathering, the workload is too high and the team suffers. Which means that everything should ideally be collected prior to the client meeting; however, clients aren’t always the best at providing the requested data by their given deadlines.

This is why it’s especially important to explain to each client why the firm is adopting an annual planning process so that clients are aware of how it will work. Including an outline of their obligations in a Client Engagement Standards document – and discussing those obligations directly with the client – can help clients understand the importance of monitoring and updating their plan.

Figuring Out A Workable Meeting Cadence For The Firm

The first obstacle is migrating all clients into a seasonal meeting cadence. It can take up to 2 years to finalize a workable schedule where all clients can meet on the firm’s new schedule. Not only do clients need to be prepared for and adjusted to the new schedule, but the firm advisors also need to determine what works best for them.

Meeting surges that severely compress client meetings into short bursts are not for everyone, and it can take several iterations of trial and error to determine how many client meetings to hold in a single week and how many weeks to spread out the firm’s meeting season. Spreading out too thin throughout the meeting seasons can lead to burnout for advisors and their teams.

Currently, our meeting seasons last roughly 9 weeks, with 2 one-week-long breaks in the middle to stay caught up and rest. During meeting seasons, we hold client meetings Tuesday through Thursday and Friday mornings. We do not meet with clients on Mondays to allow time for final preparations for that week’s meetings. Also, we do not meet with clients on Friday afternoons to ensure we have time to complete or document the follow-up tasks generated from the week of meetings before a new week of meetings begins.

Adding To The Firm’s Workload

Since an annual planning process may produce more work than an advisor might be accustomed to during busier meeting seasons, there is a potential challenge of being understaffed during certain points in the cycle. For example, for an advisor who has always offered tax projections throughout the year and only for clients who requested them, concentrating all tax projections for all clients into a single season as part of a regular annual planning process can represent a significant increase to their workload. Which means that advisors need to assess how much they want to change their existing services to ensure that they have the capacity to take on any additional work.

Our firm does not hire seasonal staff for the concentrated workload created by our annual planning process; however, it may be the best option for advisors who do not yet have a full team established.

When Clients Can’t Meet

When advisors tie the shadow work of updating the client’s plan to preparations made in advance for a scheduled meeting, that work might never happen if the client is not consistent in scheduling meetings. But, by offering a “meet via email” option for busy clients, the important shadow work is decoupled from an actual meeting and won’t fall through the cracks.

Our firm established this practice this year so that even when we aren’t meeting with a client, we still hound them for their data so that we can keep their plan up to date. We send an email summary of everything we would have covered in the meeting with a short video explanation recorded through Loom.

Tasks to provide updated information are still sent out through RightCapital with due dates just as they normally would prior to a regular meeting, and if clients don’t provide the requested information, we will note that in their email summary, so the clients know they missed out. Sometimes, the email summary prompts clients to provide missing information later, in which case we run the analyses in the off-seasons (summer or winter) and send a Loom video and deliverables with our summary and recommendations. This ensures that the shadow work is done even if a client can’t meet!

Tracking The Process Across All Clients

Lastly, a challenge we have faced is figuring out the best way to track our work to make sure our whole team knows who is doing what and when. We found that using Wealthbox workflows was an insufficient way to track the sheer volume of work that needed to be done.

Since we apply the assembly line concept to our planning process, we do the same analyses across all clients and require the same information from everyone all at the same time. To keep track of where everything is in the pipeline, we rely on a spreadsheet that tracks each step of the process, from scheduling the client meeting to data collection to meeting preparation.

We meet weekly as a team and comment on any tasks that are held up in the spreadsheet. Since our meeting season prep is driven by when we receive data, we found that due dates and sequential logic in the CRM just didn’t work as well as having this more flexible spreadsheet. Now, instead of wading through individual CRM workflows for different clients, the whole team can work from the spreadsheet to see each step at a glance and to ensure that nothing is missed.

Some advisors might argue that their clients have different needs and they can’t possibly create the same agenda for every client meeting, but the reality is that having an annual process makes sure everything that needs to be done or reviewed happens in a systematic way, regardless of the fact that clients have different needs.

While the core of the meeting agenda used in the annual planning process can be pre-written to apply to all clients, the unique needs and planning implications for each client – whether they involve stock options, a home purchase, retirement, having a baby, etc. – can be added to their agendas for the meetings.

By following this approach, advisors can confidently communicate the value of an ongoing financial planning relationship by showing prospects and clients how the firm’s process is structured and that they cover everything in a client’s plan systematically. That way, whenever things come up in their lives between meetings, they can be there in an instant to help them assess the impact and identify the best course of action with an accurate and updated picture of their plan.

If you enjoyed this article, Kyle Moore will also be a speaker at the Kitces Financial Planning Value Summit, where he and other advisors will go behind-the-scenes on how they demonstrate ongoing value to their clients. More information here.

Excellent article. Lots of good things to consider implementing here. Thank you Kyle.