Executive Summary

The common refrain from practice management consultants for years is that to survive and succeed, planning firms need to clearly define their target market. After all, if you don't know who you're trying to serve, you can't create unique value for them, and you can't focus your limited resources. The good news is that after years of this messages, a recent trend suggests that financial planners are finally getting it... sort of. Planners are saying that they've defined a target market in increasing numbers; the problem is, their target market is often defined as no more than "people who can afford my services" - and that is NOT a target market!

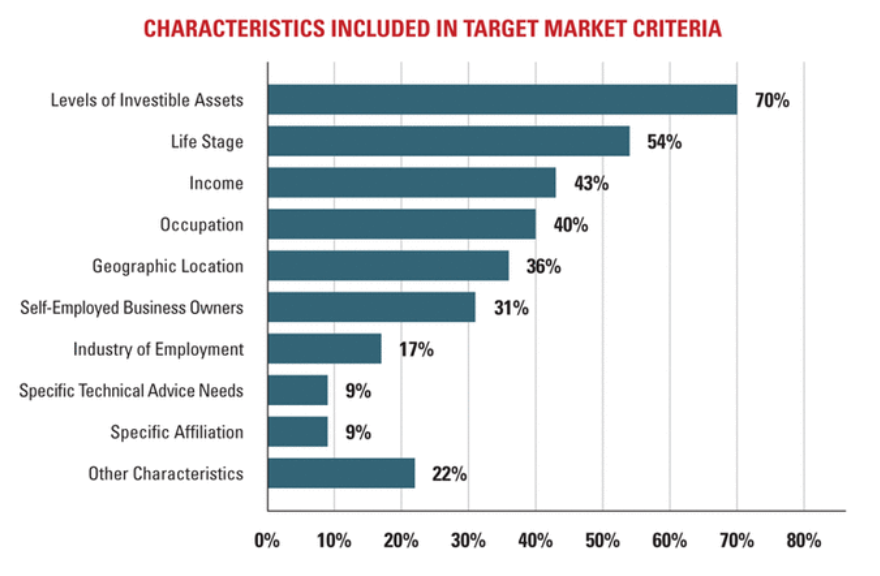

The inspiration for today's blog post comes from a recent article in the August 2011 issue of Investment Advisor magazine, entitled "Define & Conquer - Marketing Strategically to Achieve Growth." The article discusses a survey of advisors regarding various marketing activities for their firms and noted a whopping 72% of firms state that they have established a target market. The article further explains the breakdown of those targeted markets as follows:

There's just one major problem: most of these are not really much of a target market whatsoever! The most commonly reported target market characteristic - assets - does very little to actually distinguish or differentiate your services from your competitors. In fact, as far as I know, most advisors include assets as part of their target client for one simple reason: they want to be certain that the client can afford to pay them. Yes, I won't deny that is good business; it's just not a real target market. Similarly, the 3rd most popular characteristic - income - is often not much more than another way of saying "my target market is people who can afford to pay me." And #5 isn't much better: "Actually, my target market is people who can afford to pay me, AND who live in a geographic location close enough to my office that I don't have to drive very far for meetings." No wonder advisors are struggling to grow their businesses.

Because these target markets actually do virtually nothing to help you narrow the scope and focus of your business, and define a unique value, service, or experience you will deliver to your clients. And it does even less to make you easier for your clients to refer (i.e., to be "more referrable"). Envision one of these two conversations amongst your client and a potential referral:

Prospective Client Conversation A

Jim: Hey Roger, you should talk to my financial planner. He's great, and he works with people just like us.

Roger: Just like us? You mean he's familiar with how to handle the executive compensation benefits with our company?

Jim: No, I mean he works with people who have $5 million and live in our city. You have $5 million and live here, so you can afford to pay his fees; clearly you're a perfect fit!

Roger: Oh yeah, I can afford to pay a lot of fees. He must be right for me!

Is this the conversation you're promoting for your clients? Is it really going to win you any business? (Hint: no)

Prospective Client Conversation B

Jim: Hey Roger, you should talk to my financial planner. He's great, and he works with people just like us.

Roger: Just like us? You mean he's familiar with how to handle the executive compensation benefits with our company?

Jim: Exactly. He's done work with several members of the executive team already. When Harry retired last year, he swore that my guy must have saved him a million bucks in taxes. And he helped Harry finally make that decision to move to Hawaii like he always said he wanted.

Roger: Wow, that's great. Renee has been telling me that we have to figure out what to do now that the kids are out of the house and I'm probably around sticking around here for a few more years. Maybe we should give your guy a call.

In this case, Roger has a better understanding that you actually do have a niche. You provide unique value to people just like him (executives at his company with their particular executive compensation package who have to make difficult decisions in the retirement transition). You have a niche, that makes you more referrable.

I realize the first sample conversation is a bit tongue-in-cheek, but in all seriousness, which conversation do you think your clients are having about you with their friends and peers? Can your clients clearly articulate your target niche, and the value you provide, so that they can inspire their peers to actually contact you to do business? What can you do to shift the conversation of your clients from version A towards version B? Can you see how conversation B may help you grow your business, while conversation A leaves the door open to everyone, but makes it inviting for no one?

What do you think?

It’s the Willie Sutton approach to niche marketing: “We serve rich people because they can pay the most fees.” That does nothing to move the profession forward.

How about “My market niche is people who like me, who are not afraid of catching something from my handshake and laugh at my corny jokes”.

Michael,

EXACTLY! I’m thrilled that more advisors are getting the message of target marketing, but so few really understand what that means. You have done a great job emphasizing the biggest issues.

I have also written about this here http://bit.ly/mWGpA5 and discussed the disconnect between advisors stated target clients and their onboarding processes here http://bit.ly/kauiMj.

Great blog post as always!

AMEN!

I’ve got a similar example (in cartoon form!) of the two ways this conservation can go at the 3:50 mark of http://www.youtube.com/watch?v=0uTJGXMw0w0

Sometimes it’s slow progress, but I’m glad to hear the niche marketing conversation come up increasingly more often.