Executive Summary

Associate financial advisors play an important role within a financial planning firm, for both their work today (e.g., preparing financial plan drafts and notetaking in client meetings) and their potential to become the next generation of lead advisors at the firm. Which means their development (and desire to stay at the firm) can contribute to the firm's long-term health. At the same time, working as an associate advisor can come with frustrations based on the extent (and limits) of their job responsibilities and the freedom granted to them. For instance, because they have relatively less experience than lead advisors, their firm might not yet be confident in their ability to present 'live' in client meetings, as a mistake made by the associate in the meeting could reduce a prospect's or client's trust in the firm.

Perhaps reflecting these frustrations, data from Kitces Research on Advisor Wellbeing show that associate advisors are less likely to be "thriving" (and more likely to be "struggling") than more senior advisors and indicate that they are significantly more likely to leave their employer within the next year. Which suggests that creating a collaborative development plan that allows associate advisors to build and practice the needed skills to increase their client interactions and reach the next level could not only lead to more engaged associates, but also better leverage the investment the firm has made in them.

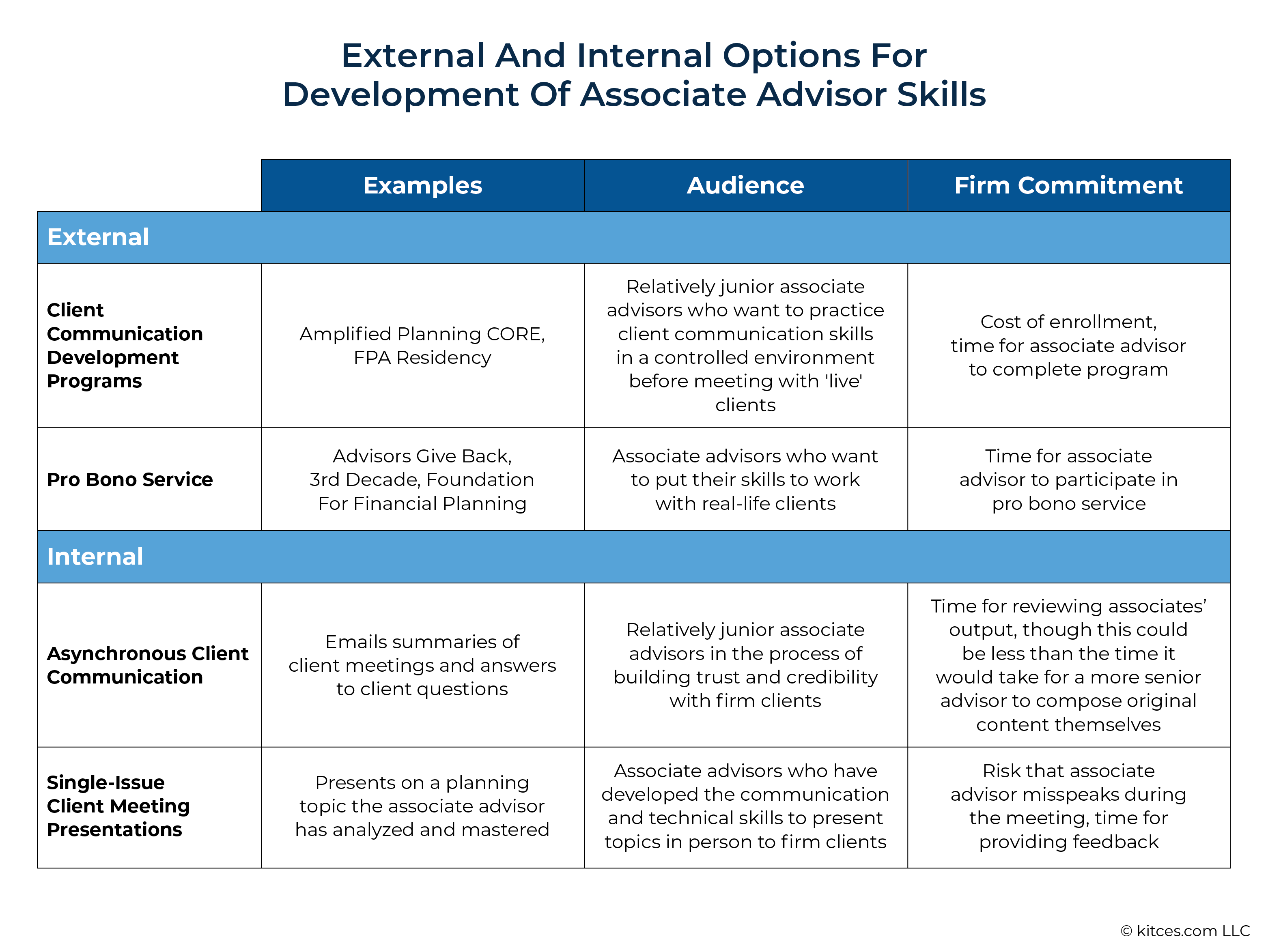

Advisory firms have a variety of ways to gradually increase associates' client interactions, including external training, client-facing practice, and opportunities to progress internally within the firm. This type of support can empower associate advisors and get them ready to advance within the firm, while minimizing the potential for making mistakes in front of clients. External training options include development programs that help advisors build client communication skills (e.g., Amplified Planning's CORE program and FPA Residency) as well as pro bono planning opportunities that can give associates practice working with 'live' clients and give back to the community in the process. Internally, creating a progression that starts with asynchronous client communication to demonstrate the associate's expertise (e.g., drafting substantive emails to clients and/or writing for the firm's blog or newsletter) and leads to the associate presenting during client meetings on a single topic that they have mastered can allow the firm and the associate to increase their responsibilities in a structured manner.

Ultimately, the key point is that while associate advisors tend to have lower overall wellbeing scores than more senior advisors, finding ways to increase their skills and responsibilities, as well as creating a growth path that shows how they can play a bigger part in client meetings and eventually manage their own client households, could give them the confidence and feeling of empowerment that could not only improve their sense of wellbeing (and perhaps the likelihood that they will stay with the firm), but also increase the chances that the investment the firm has made in the associate will pay off in the form of a more skilled (and happier!) advisor who can help the firm thrive for years to come!

Associate financial advisors play an important role within a financial planning firm, assisting senior advisors with financial planning tasks (e.g., financial plan preparation), participating in client meetings, and engaging in asynchronous communication with clients. Further, associate advisors not only bring value based on the work they can provide today, but also potentially represent the next generation of lead advisors at the firm. Which means their development (and desire to stay at the firm) can contribute to the firm's long-term health.

At the same time, working as an associate advisor can come with frustrations. For instance, while an associate advisor will likely play a major role in the preparation of a client's financial plan, they might not be seen as having sufficient skills and/or experience to deliver the plan (or even parts of it) during a client meeting. While a firm might be concerned that entrusting an associate advisor (with relatively less experience than the lead advisor) who might make a mistake could be costly to the firm (e.g., by reducing a prospect's or client's trust in the firm), restricting their client-facing activity without providing training and/or a plan to actively participate in substantive client interactions could hinder the associate's confidence, their sense of advancing within the firm, and their overall wellbeing. Which could prove even more costly to the firm if the associate decides to leave for another firm where they might have greater autonomy (or, perhaps, leave the industry altogether).

With this in mind, firms have a variety of available options to keep their associate advisors engaged, from having associates participate in external communication training programs (to obtain simulated or real-world client-facing experience) to creating internal progressions that build up their client-facing responsibilities over time (to minimize the chances of negative client interactions), in order to increase associate advisors' confidence, and perhaps ultimately, leverage the firm's investment in their associates.

Associate Advisors More Likely To Be "Struggling" Than Other Positions

For a financial planning firm, retaining staff is often a top priority, as the hiring and training processes for new employees can be costly in terms of time and/or money. However, some firms might not be aware that certain staff members are unhappy until they announce that they are leaving the firm. While a firm might have to conduct its own survey to gauge sentiment amongst its staff, Kitces Research on What Actually Contributes To Financial Advisor Wellbeing provides insights amongst the broader advisor population into how individuals in different positions assess their roles and wellbeing.

One of the key findings of the 2023 edition of this study is that associate advisors have the lowest mean wellbeing scores amongst the range of positions within the firm. Digging deeper, the study found that associate advisors are less likely than more senior advisors to report that they are effective in their job and are more likely to say they plan to leave their current employer within the next year, suggesting there is significant room for improving the associate advisor experience to ensure they develop into lead advisors within their firm.

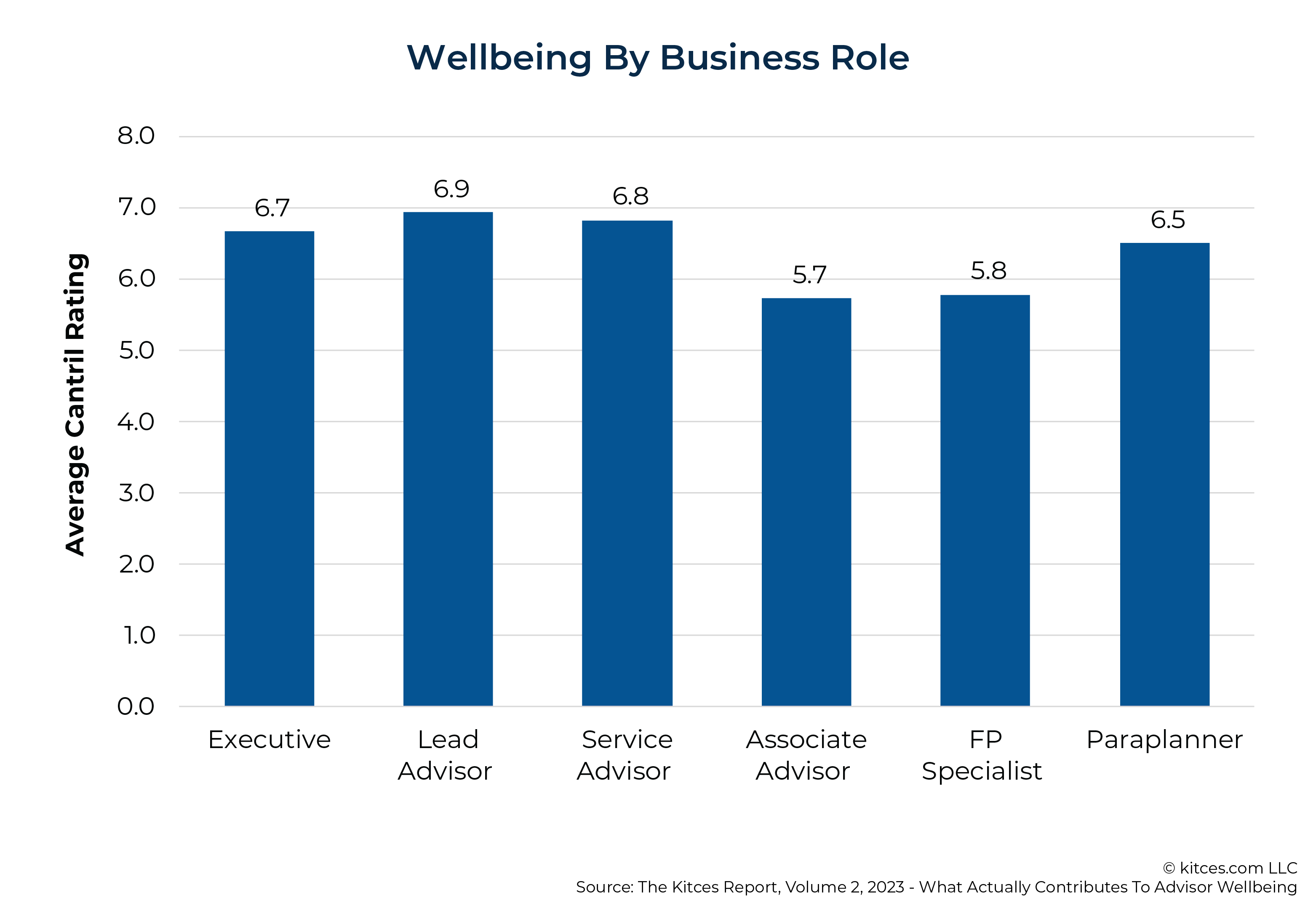

To measure overall advisor wellbeing, the Kitces Research study employed the "Cantril Ladder", whereby respondents are told to think of a ladder, with the best possible life being a 10 and the worst possible life being a 0, and then are asked to rate their own current lives on a scale of 0–10. Using this measure, associate advisors had the lowest mean wellbeing (5.7) of any positioned surveyed, more than a point behind lead advisors (i.e., advisors who manage a firm's more complex and valued client relationships and have business development responsibilities) who had the highest mean wellbeing score at 6.9.

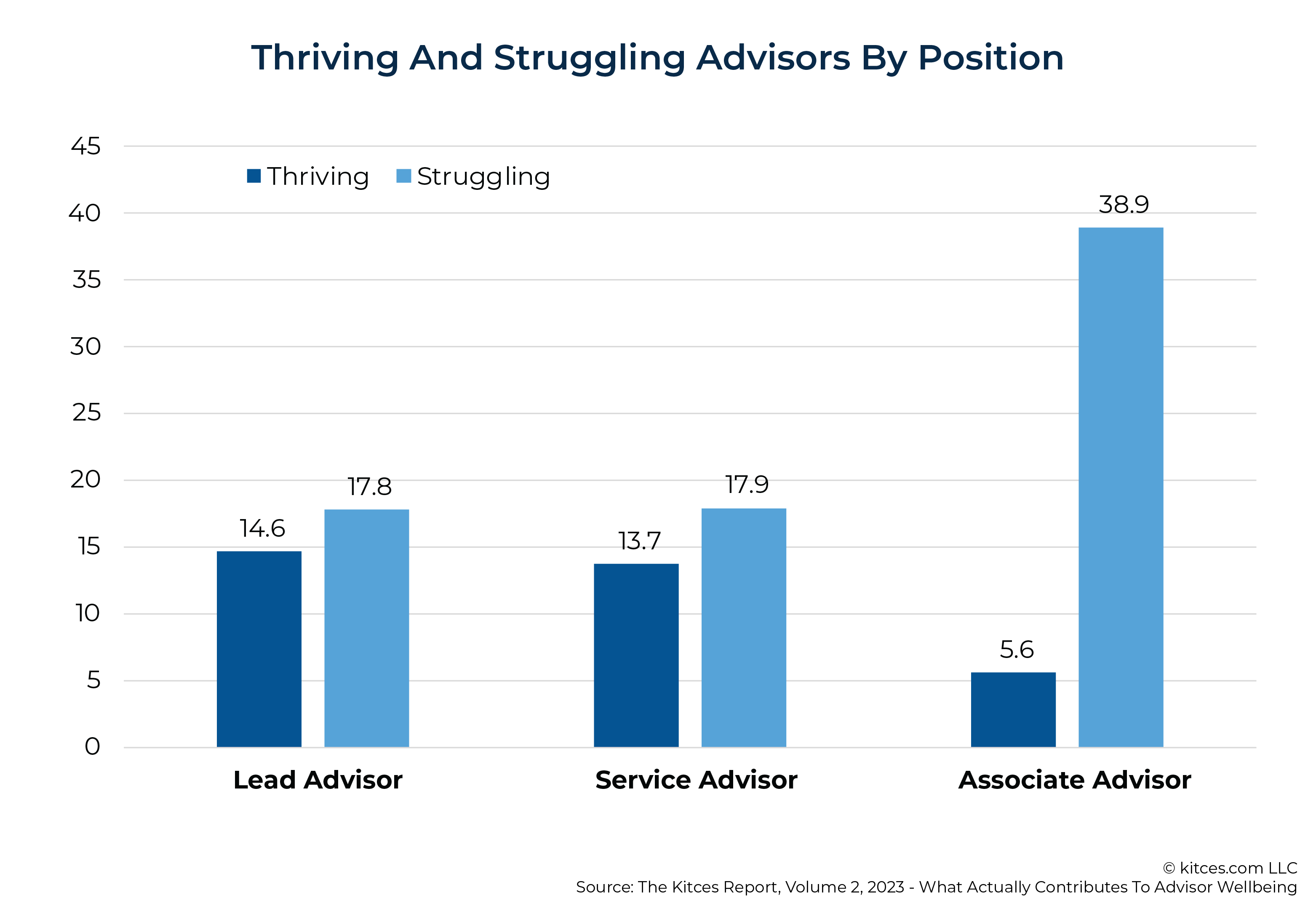

Breaking down the Cantril Ladder scores further, the Kitces Research study identified 14% of advisor respondents as "thriving" (defined as those who reported a wellbeing rating of 9 or 10) and another 14% of those surveyed as "struggling" (those with a wellbeing rating of 5 or less). Examining these results by business role, the study also found that 39% of associate advisors surveyed were "struggling", compared to 18% of lead advisors (further, only 5.6% of associates were found to be "thriving", compared to 15% of lead advisors).

Notably, associate advisors also fared worse than service advisors (i.e., advisors accountable for client relationships and in the position to which an associate would likely be promoted), as only 18% of these advisors were "struggling" (and 14% were "thriving"), indicating that having a role with client management responsibilities may be associated with greater advisor wellbeing.

One of the potential contributors to associate advisors' lower wellbeing scores could be a reduced self-perception of effectiveness in their job compared to more senior advisors. The Kitces Research study found that 22% of associates "strongly agreed" that they were effective at their job, compared to 28% of both lead and service advisors who reported the same (associate advisors also were more likely than lead or service advisors to "disagree" that they were effective at their job).

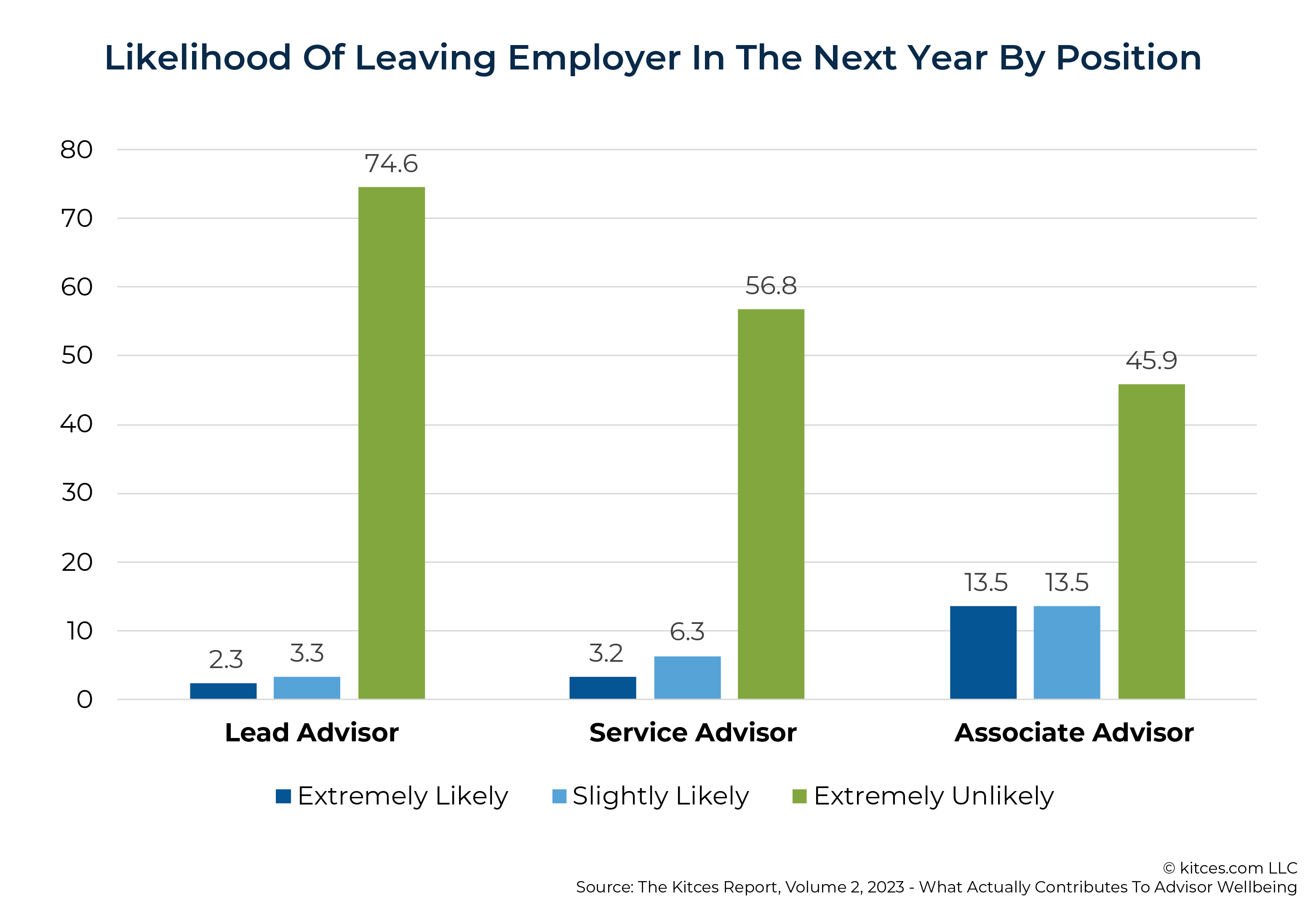

While having fewer years of client-facing experience could play a role in the relatively lower wellbeing of associate advisors (as the Kitces research study found that years of client-facing experience was positively correlated with wellbeing), firms that merely wait for their associate advisors to gain more experience in the firm could be taking a risk that the associate might leave before being promoted to a service advisor or a similar position.

For instance, the Kitces Research study found that 13.5% of associate advisors are "extremely likely" to leave their employer within the year (compared to only 3.2% of service advisors and 2.3% of senior advisors), with another 13.5% of associates reporting that they are "slightly likely" to do so (compared to 6.3% of service advisors and 3.3% of senior advisors).

Nerd Note:

Associate advisors also were less likely to "strongly agree" that they could be their true selves in front of clients, with 16% reporting this was the case, compared to 24% of service advisors and 39% of lead advisors, suggesting that associates might perceive they have less freedom to express their personalities when interacting with clients.

Notably, survey respondents who identified as racial or ethnic minorities (26% versus 36% for non-minorities) and female respondents (29% versus 38% for males) were also less likely to "strongly agree" that they could be their true selves in front of clients, suggesting that these associate advisors could be particularly susceptible to feeling like they can't express themselves authentically in front of clients, which could lead to feelings of reduced autonomy in their positions.

In sum, the Kitces Research data indicate that associate advisors tend to score lower than other advisors in terms of overall wellbeing, are more likely than other advisors to be "struggling" rather than "thriving", have less confidence in their job effectiveness, and are more likely to seek an opportunity at another firm within the next year. Which suggests that firms have an opportunity to seek ways to improve their associates' sense of effectiveness and autonomy in order to improve their sense of wellbeing and increase the chances that they will stay with the firm until they are ready to be promoted to the next level of managing client relationships.

Empowering Associate Advisors To Boost Their Skills And Wellbeing

With the primary difference between associate advisors and service advisors (the next level up) being the management of client households, increasing the number of associate advisors' client-facing interactions is the logical next step in their development. However, financial advisory firm owners are sometimes hesitant to give associates significant leeway in client interactions, perhaps because they are unsure the associate has the requisite experience and communication skills to handle sensitive or challenging client issues that arise (as a mistake during a meeting could reduce the client's trust in how the firm is serving them).

At the same time, limiting associates' interactions with clients to meeting attendance (and perhaps notetaking) and administrative-related communication could not only limit their development, but also frustrate them in the process (and perhaps incentivize them to seek a different opportunity that would allow them more leeway for substantive interactions with clients).

Nonetheless, given these competing factors, advisory firms have a variety of ways, including external training, client-facing practice, and opportunities to build an internal progression to gradually increase associates' client interactions, that can both empower associate advisors and get them ready to advance to the next level, while minimizing the potential for making mistakes in front of clients. Notably, taking a collaborative approach to creating this plan with the associate (rather than for them) can ensure that both the firm's and the associate's priorities are included in the plan (e.g., a firm owner might identify the key skills the associate will need to advance to the next level, while the associate might highlight particular areas that they want to develop) and that both parties are committed to its success!

Nerd Note:

While the following are all potential options for firms looking to develop their associates' skills, associate advisors who feel as though they are not receiving sufficient training or opportunities to put their skills to practice could take the initiative themselves, perhaps presenting their manager with the programs that best fit their interests and development needs and how the firm will benefit from the time and/or financial commitment needed to complete them. Which could not only demonstrate the associate's commitment to their own development, but also help save their manager time from having to initiate a plan themselves!

External Communication Training And Pro Bono Planning Opportunities

While a financial advisory firm owner might intuitively understand the need to provide training for their associate advisors, particularly with regard to client communication skills (that they might have less practice with compared to technical topics that can be learned more readily from textbooks), busy firm owners have plenty of other tasks on their plate, from meeting with clients and prospects to managing the business, and might not have enough time to conduct this training themselves (whether it is by offering play-by-play client debriefs or holding multiple mock meetings). With this in mind, external training and pro bono programs are available to help associates learn and practice client communication techniques.

Client Communication Skills Development Programs

A common responsibility of associate advisors is to attend client meetings and take notes (so that the lead advisor can focus on the client), which allows the associate to observe a seasoned advisor 'at work' in terms of how they run a meeting and communicate with clients. However, the lead advisor might not have sufficient time to go 'behind the scenes' with the associate to explain the nuances of why they may have said things to the client in a certain way.

With this in mind, Amplified Planning's CORE program offers participants the opportunity to view meetings that instructor Hannah Moore holds and records with actual financial planning clients. In these monthly training videos, the viewer gets a fly-on-the-wall perspective of the meetings, with clips of Hannah breaking down key moments as they happen and giving candid assessments of her own decisions and interactions with her clients. Not only do viewers watch the meeting itself unfold, but they also hear Hannah talk about parts of the meeting that went well (or not so well) and how parts of the meeting could have been handled differently.

For associate advisors who are confident in their technical skills (perhaps aided by specialized coursework) and want to put their client communication skills to the test, the FPA Residency is an intensive, week-long program where participants role-play real-life scenarios with 'clients' and receive immediate, individualized feedback from program instructors (who are veteran financial planners themselves). This allows participants to put their listening and communication skills to work in a simulated environment where any errors will not result in real-world consequences and benefit from the opportunity to refine their communication skills thanks to the real-time feedback they receive.

In sum, while these external training programs can come at a monetary cost for the advisory firm, the skills- and confidence-building they can provide to associate advisors, as well as the time saved for senior advisors in outsourcing this task (that could be used for business development or other tasks) could make these investments pay off in the form of associates who are better prepared to work with actual clients.

Pro Bono Planning Opportunities

After learning advisor-specific communication skills and putting them to work in a simulated environment, associate advisors might feel ready to meet with clients in the real world. One way to put their technical and communication skills to work (and to provide a valuable service to the community) is to engage in pro bono financial planning. Notably, there are many options for advisors to offer their services on a pro bono basis that can fit their schedule.

For example, the non-profit group Advisers Give Back (AGB) has created a virtual platform that allows advisors to participate in pro bono planning for as little as 1 hour per month. AGB allows advisors to meet with clients and develop recommendations while significantly reducing the potential friction involved in getting started with pro bono planning. Notably, AGB connects with pro bono clients, so advisors do not need to spend time advertising their services. It also offers dedicated assistants who help with administrative tasks like communicating with clients and tracking their progress between meetings, which saves advisors even more time.

Another virtual pro bono option is to serve as a volunteer financial mentor with 3rd Decade, an organization that provides free financial education and mentoring to young adults aged 18–35. Financial mentors are matched with program participants to create an accurate cash flow statement, identify financial goals and action items, and develop a one-page financial plan, meeting 3 times over the course of 2 years to allow both sides to track the participants' progress and adjust the plan as needed. And given the age demographic of participants, this could be a particularly attractive option for associate advisors in their 20s or 30s who want to work with clients of a similar age (though there are no age restrictions to be a volunteer mentor!).

More broadly, the Foundation for Financial Planning (FFP) partners with non-profits around the country to connect them with financial planning professionals, offering pro bono service through its Planner Match tool. Interested advisors can also browse through FFP's list of partner organizations seeking advisor support. This option could be good for associate advisors who want to serve clients in their local area (though many virtual options are available), have expertise with planning for certain groups (e.g., military veterans), or would like to volunteer on an ad hoc basis rather than making an ongoing commitment.

![]()

![]()

![]()

![]()

Author's Note:

I currently serve as a volunteer financial mentor with 3rd Decade and as a volunteer financial planner with an FFP grantee non-profit in my local area. Both of these experiences have been extremely rewarding and have improved my skills as a financial planner and public speaker as well. 3rd Decade allows volunteer mentors to have an ongoing relationship with the participants with whom they are matched, allowing for ongoing support as their financial circumstances change (similar to working with a client within a firm). In my local role, I conduct financial coaching sessions with clients from a wide range of backgrounds and teach personal finance workshops that allow me to sharpen my public speaking skills and better understand the questions and concerns that consumers have when it comes to managing their finances. I would recommend these experiences not only for associate advisors, but also for more senior advisors who are looking to give back to the community and work with clients different from those whom their firm typically serves.

Given the opportunity for skills development (and helping populations who are traditionally underserved by the planning industry), firm owners can support associates' professional growth by allowing them to take part in these activities during the workday (so that they don't have to take extra time during their off hours). Which could be further supplemented with a discussion between the associate and their manager about the associate's key takeaways from the experience and how the manager has handled similar client situations in the past. Altogether, while pro bono service can take some time away from the associates' other responsibilities at the firm, it can be worth it by boosting their confidence, empowering them with client communication skills, and showing them the importance and value of planning, all by serving 'real life' clients!

Creating An Internal Progression For Associate Advisors' Client-Facing Work

While external opportunities such as immersive training and pro bono service can build associates' client-meeting skills and confidence, working with their firm's own clients is likely to be their (and the firm's) ultimate goal. Importantly, this does not have to be an 'all or nothing' endeavor of having an associate either sit on the sidelines of meetings and other client interactions or lead a meeting themselves. Rather, by starting with asynchronous client communication and progressing to more challenging live interactions, a firm can provide associates with opportunities that match their skill level and, in conjunction with the associate, create a more formalized plan for their development tailored to their established and desired skillsets.

Asynchronous Client Communication

While a good amount of client communication occurs live (whether in person, over Zoom, or on the phone), advisors also have the opportunity to communicate with clients asynchronously, whether individually via email or to a broader audience through a newsletter or blog. Given that asynchronous communication allows for review before sending, associate advisors can draft these communications and have them reviewed by a more senior advisor before being sent to the client(s).

For instance, an associate advisor could draft and send (after the senior advisor reviews) a response when a client writes in with a substantive question that can be answered via email. Associates also could be charged with composing follow-up emails after client meetings (outlining action items and next steps). Doing so can give the associate practice in clearly communicating planning information to clients and save the senior advisor time (given that it typically takes less time to edit an email message compared to writing it from scratch, particularly as the associate becomes more adept at drafting these communications).

Another option is to have associate advisors create content for the firm's blog or client newsletter (perhaps with a technical edit from a senior advisor). Doing so can help associates sharpen their written communication skills and allow them to demonstrate their planning expertise to the firm's clients.

Single-Issue Presentations During Client Meetings

Even though an associate advisor might not have sufficient expertise to lead a full client meeting, a phased approach to increasing their live client communication could help them build experience and confidence while remaining under the supervision of a senior advisor. To start, having an associate write the first draft of client meeting summaries can allow a senior advisor to see whether the associate understood the key issues and client concerns discussed in the meeting. Once this skill is mastered, the associate could present this analysis to the client in a subsequent meeting (with the senior advisor there to supervise and provide support if necessary), reviewing what was discussed and what action steps were recommended.

Next, given that associates are often charged with putting together the first draft of financial planning analyses, over time, they will likely gain a good sense of the key messages being delivered in specific areas. This could provide the opportunity for associates to present on a single substantive topic (e.g., a potential tax savings opportunity uncovered in their analysis) during a client meeting, allowing them to demonstrate their expertise without having to be prepared to address the broader range of topics on the agenda. Over time, as they gain expertise in more areas, the associate could increase their 'topic load', contribute by answering client questions during the meeting, and inject more of their personality into meetings. Eventually, the associate could be ready to lead a meeting, putting them on the path to becoming a service advisor (or a firm's equivalent) and managing client households on their own.

Ultimately, the key point is that while associate advisors tend to have lower overall wellbeing scores than more senior advisors, finding ways to increase their skills and responsibilities, as well as creating a growth path that shows how they can move to the next level, could give them the confidence and feeling of empowerment that could improve their sense of wellbeing. Further, given that creating and implementing an associate advisor development plan requires both the buy-in of the associates themselves as well as a commitment of time/and or money on the part of the firm, creating this plan collaboratively (e.g., agreeing on the learning objectives and growth path) can increase the chances that the investment that each side is making will pay off both for the advisor and for the firm!

Leave a Reply