Executive Summary

The COVID-19 pandemic has led many workers to consider changing careers, perhaps for greater pay or flexibility. For those with an interest in personal finance and helping others, a career change into the financial advice industry could be an attractive option, particularly given that financial advisors generally report having a strong sense of wellbeing and that they have the potential to earn significantly more than the national median income. And with all of the ways that aspiring advisors can enter the profession, career changers have many factors to consider, including the type of work and career path they would ultimately like to pursue. Because the various financial advice career tracks come with different education and certification requirements, this decision will influence the career changer’s path as they pursue their first job in the industry.

For aspiring planners who want to work directly with clients but who don’t yet have leads of their own or experience with business-development strategies, one option is to start at a firm that assigns clients to advisors (so that the advisor can focus on practicing their financial planning advice skills as they learn how to generate new clients for the firm). Career changers who already have business-development experience (or who have access to many potential clients) might instead prefer to find a firm where they will be responsible for pursuing their own clients. Still, other career changers might want to eventually start their own firm; while this may allow for the greatest autonomy, this option also comes with the greatest financial risk (as the advisor will be entirely responsible for making up income lost after leaving their previous job!). For career changers who want to work in the industry but do not want to work directly with clients, pursuing a career track that allows them to construct financial plans and develop recommendations (without presenting them to the client) could be the best option.

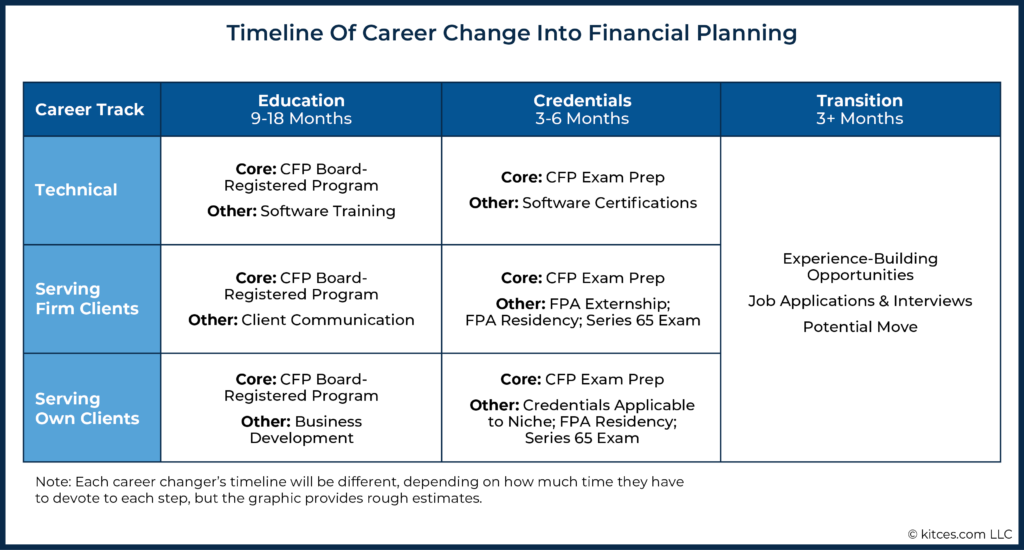

After deciding which career path best suits them, a career changer can pursue the education and credentials that will help them stand out to potential employers and clients. For many, the first step will be to complete a broad financial planning education program to gain the technical knowledge needed to be a successful advisor. There are also designations (e.g., the CFP certification) and specialized training programs that can serve as a signal to future employers and clients that they have the skills and dedication to be effective advisors. Next, constructing a plan that makes the transition as smooth as possible (e.g., scheduling out time for classes, training, and job hunting; and budgeting the financial costs of a transition into financial advising) can help the advisor manage a potential salary reduction (for those pursuing an employee position) or foregone income (for those starting their own firm) as they get up to speed in their new career.

Ultimately, the key point is that while a career change into financial planning can be a fulfilling decision, it is important to plan in advance to ensure a smooth transition, from considering what kind of role in the industry is of interest to the education and credentials needed for that career track. Because with proper preparation, the career changer can increase the chances that they will not only have a good first job in the industry, but also have a successful long-term career in financial advice!

The COVID-19 pandemic has led many workers to consider whether they are happy in their current jobs and whether there might be better options available. Accordingly, a record number of Americans have quit their jobs, with an average of 3.98 million workers quitting their jobs each month in 2021. For some workers who have taken (or are considering taking) part in the ‘Great Resignation’, this means finding a position in a similar field that offers better pay or flexibility. But for others, this could mean changing careers altogether. And while a career change can entail risks (from the time commitment of getting the training for the new job to a potential pay cut as a result of starting over in a new field), pursuing a job that aligns better with an individual’s interests and goals can be extremely rewarding.

For some career changers, getting a job in the financial advice industry can be an attractive option. Our 2020 Kitces Research study on Advisor Wellbeing demonstrates not only that the median income of an established financial advisor is almost 3 times the median household income ($192,000 versus $68,700, respectively), but also that financial advisors outscore the general population in all 18 subscales (including accomplishment and life satisfaction) of the Comprehensive Inventory of Thriving, which evaluates wellbeing! In addition, as the financial advice industry continues to expand and as long-time advisors retire (as of 2018, the average age of a financial advisor was over 50, with 1/3rd of all financial advisors projected to retire by 2028), there are many job opportunities available for those who want to make a career change into financial planning.

Career changers have many ways to enter the world of financial advice (from taking on a support role at an established firm to starting their own business right away), which require them to consider what kind of work and career path they would ultimately like to pursue. And because the various career tracks come with different education and certification requirements (and their associated time and financial costs), this decision will influence the career changer’s path as they pursue their first job in the industry. Furthermore, while experienced advisors, on average, tend to earn high incomes, a career changer’s first job in financial planning could actually result in a pay cut from their current position.

Given all of these factors, it is important for career changers to build a sensible plan for transitioning into a job in financial advice based on their individual circumstances.

Finding The Right Career Path In The Financial Advice Industry

Potential career changers with substantial work experience – even if not in financial advice – come to the financial advice industry with some advantages over new college graduates with relevant academic training but no work experience. Given their previous experience, career changers often have developed some skills that were useful in their former career but also can translate well into a job in financial advice.

For example, a career changer with previous sales experience is likely to have relationship-building and business-development skills that are difficult to gain through classroom learning alone and can otherwise take years to develop. Others might come with a mastery of Microsoft Excel or other software tools that could be useful as an advisor as well. The skills a career changer brings to the table can make them a more attractive candidate for potential employers who will not have to train them in these areas. In addition, considering one’s particular abilities and interests can be helpful when it comes to choosing a financial advising job, as various career paths have a range of day-to-day duties that may require different skills.

Considering Client-Facing Or Technical Planning Roles

The label of ‘financial advisor’ might conjure an image of a professional sitting across the table from clients presenting a financial plan. And while many career changers often enter the financial planning field because they want to work directly with clients, others might instead only be interested in the more technical side involving the inner workings of developing financial plans. Which is a viable interest, as getting to the point of actually presenting a plan to the client is often the end product of a rigorous plan preparation process that often relies on a team working behind the scenes to help the advisor create the plan. For some career-changers, these internal firm positions supporting the advisor could be more attractive than an actual client-facing role.

For example, a career changer with analytical experience might want to apply their skill to the financial plan’s construction and to the development of recommendations, but they may not necessarily want to engage in business development or develop personal relationships with clients. These individuals could pursue a paraplanner or planning specialist position with a firm or asset manager that allows them to process and analyze client data, construct plans, and suggest recommendations. This can be a valuable role in a financial advisory firm, as it can free up time for client-facing advisors to engage in business development and other revenue-raising activities. And as these career changers develop their technical acumen, their insights and skills can be applied beyond individual client cases and across the firm, increasing their value (and potentially compensation).

Options For The Client-Facing Advisor

Many career changers often enter the financial planning field because they want to work directly with clients. Perhaps they have an interest in personal finance and have given advice informally to friends and family. Others might have worked with clients in a related field and want to transfer those communication skills to a different industry.

For those who want to work with clients, potential career paths include working at a larger firm where the firm itself procures clients for the advisor to serve (meaning that the advisor has limited business-development responsibilities) or finding a position where the advisor generates their own clients, either as an employee or as an independent firm owner.

Serving Firm Clients As An Employee Advisor

For those who want to serve clients while having the stability of a salary, an attractive option can be to become an employee advisor at a large ensemble Registered Investment Advisor (RIA) or an asset manager (e.g., Schwab or Vanguard). In these positions, the employee is not necessarily responsible for prospecting or generating new clients but rather is tasked with serving the clients that the firm has already procured (or that may have been transferred from another advisor).

The upside of these positions is that the employee advisor has the opportunity to jump into financial planning and can work directly with clients (typically after a training period). On the downside, these clients are likely to ‘belong’ to the firm, so if the advisor decides to break off and start their own firm, they are unlikely to be able to bring these clients with them. But for the career changer whose primary goal is to work with clients (without having to procure them) rather than start their own firm, this kind of advisor position could be attractive.

Generating And Serving Own Clients

Some career changers (perhaps those with previous business-development experience) might prefer to procure and serve their own clients rather than to work with the clients assigned to them by a firm. One option for these individuals is a position where they will be firm employees but are responsible for bringing on their own clients. In this way, the career changer can typically earn some amount of base compensation and benefit from the firm’s infrastructure (e.g., technology and branding) while building their book of business. On the other hand, these individuals (and their clients) are still connected to the firm, and these advisors do not have total autonomy.

Other career changers might have found over the course of their career that they do not like working for an employer and see financial planning as an opportunity to gain independence and start their own firm. Of course, starting any business can be a challenge, and starting a financial planning firm requires both technical knowledge and business-operations acumen. But for aspiring advisors interested in establishing a niche practice, having a previous career in a different industry may actually provide them with opportunities to select a potentially suitable and fruitful niche.

For example, a career changer who worked at a large corporation (and knows the ins and outs of its employee benefits and retirement plan) could establish a natural niche in working with current employees and retirees from that company. Differentiating themselves from other advisors could dramatically accelerate a career changer’s timetable to gain sufficient clients and revenue to equal (or surpass) their income from their previous job.

No matter which path the career changer chooses, from serving in a planning support role to starting their own firm, getting started will take planning on their part. After the career changer has decided which path they would like to pursue, they can then work to get the education and credentials needed to be successful in that role.

How To Stand Out As a Career Changer

Changing to a career in financial planning is not typically something that can be done overnight. Some sales-focused jobs might bring on an employee without formal financial planning education or experience (particularly if they come with a built-in network of potential clients!), allowing them to take required licensing exams after coming on board. However, most firms looking to hire career changers tend to require that certain education and certification prerequisites have been met, or that the individual is at least on the path to meeting the prerequisites, to ensure that the person they hire can be successful in a career in financial advice.

Education Options For Different Career Paths

Many career changers will already have a bachelor’s degree, perhaps in the field of their previous career. And while a bachelor’s degree in financial planning is not necessary to enter the financial planning field, earning a certificate in financial planning can not only show that the career changer understands the technical side of financial planning but also demonstrates a commitment to pursuing the profession. Additionally, completing a Certified Financial Planner (CFP) Board-registered program is a requirement for those pursuing CFP certification. Having the proper education also demonstrates competence to clients (and can give the career changer more confidence that they will be able to handle the technical issues they will face in their new job!).

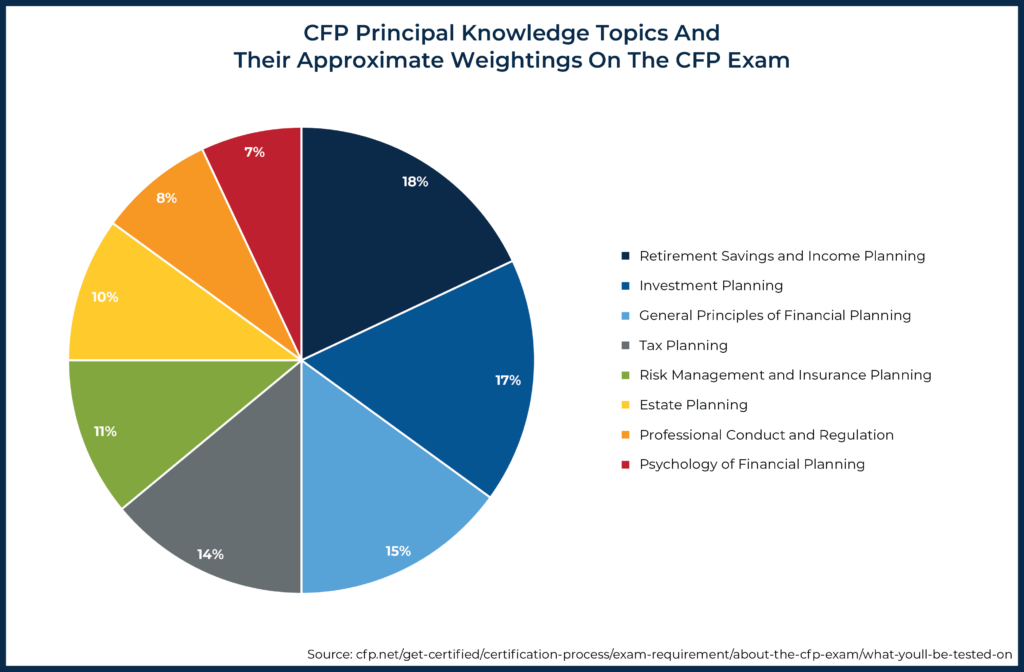

CFP Board-registered education programs cover the CFP Board's Principal Knowledge Domains and Topics, which include retirement planning, investment planning, insurance planning, and estate planning, among others. The programs typically are divided into six courses that cover these topic areas and an additional ‘capstone’ course where students apply the knowledge from their previous coursework to create a financial plan for a fictitious client.

In addition to the core education program, career changers can seek opportunities to learn how financial planning works in the ‘real world’ and develop both the technical and interpersonal skills needed to be successful on the job. Two options include the Financial Planning Association (FPA) Externship (which provides experiential learning in a virtual environment to help aspiring planners understand what the financial advice business is really about) and the FPA Residency (an intensive, week-long, in-person program designed to immerse future advisors in the ‘art’ of financial planning).

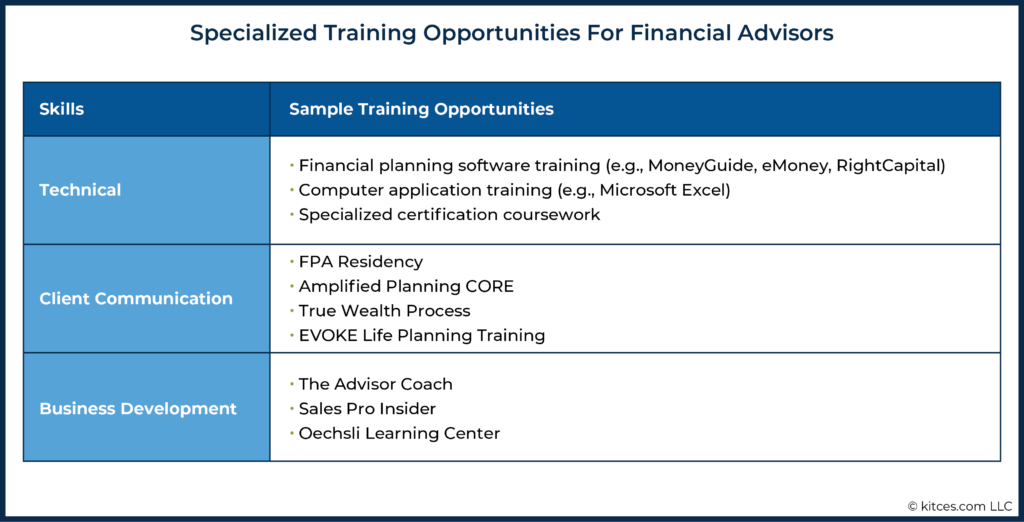

Career changers can also seek to take specialized training depending on their prospective career track. For example, those looking to take on a technical planning role could pursue training in common software applications that they are likely to use on the job (e.g., financial planning or tax analysis software). The software vendors themselves often offer this training, and there are many external options (e.g., Udemy) to learn about more broadly used software programs such as Microsoft Excel.

For career changers looking to work with clients directly, learning effective client meeting skills can make new advisors more valuable to prospective employers and more trusted in the eyes of future clients. This training is offered through a variety of modalities, from prepackaged virtual training courses that help refine client meeting skills (e.g., Amplified Planning CORE) to comprehensive training on a system of financial planning and client communication (e.g., Money Quotient’s True Wealth Process and the Kinder Institute’s EVOKE Life Planning Training Course). Career changers can also seek out opportunities with organizations like Toastmasters International to practice their communication skills.

Career changers who will be seeking out their own clients (whether as an employee or independent advisor) and do not come from a sales or prospecting background can seek to develop their marketing and networking skills before jumping into a job where their income depends on their success. To start, there is a wide range of books available that offer guidance on marketing, both in general and specifically for financial advisors. For those seeking a more interactive sales training experience, there are also courses and coaching opportunities available to help advisors improve their prospecting and sales skills to create an appropriate sales training approach tailored to fit their specific personality style.

For career changers looking to start their own firm, learning best practices for getting their firm up and running can help facilitate the transition. In addition to reading blog posts and listening to podcasts to learn lessons from advisors who started their own firms, career changers can also consider joining networks that support advisors in getting their firms off the ground, and that also help them to thrive once established (e.g., XY Planning Network and the Alliance of Comprehensive Planners).

Earning Credentials For Success

In addition to completing education programs, earning credentials can serve as a signal for future employers (and clients) that a career changer has the dedication and skills to be an effective advisor.

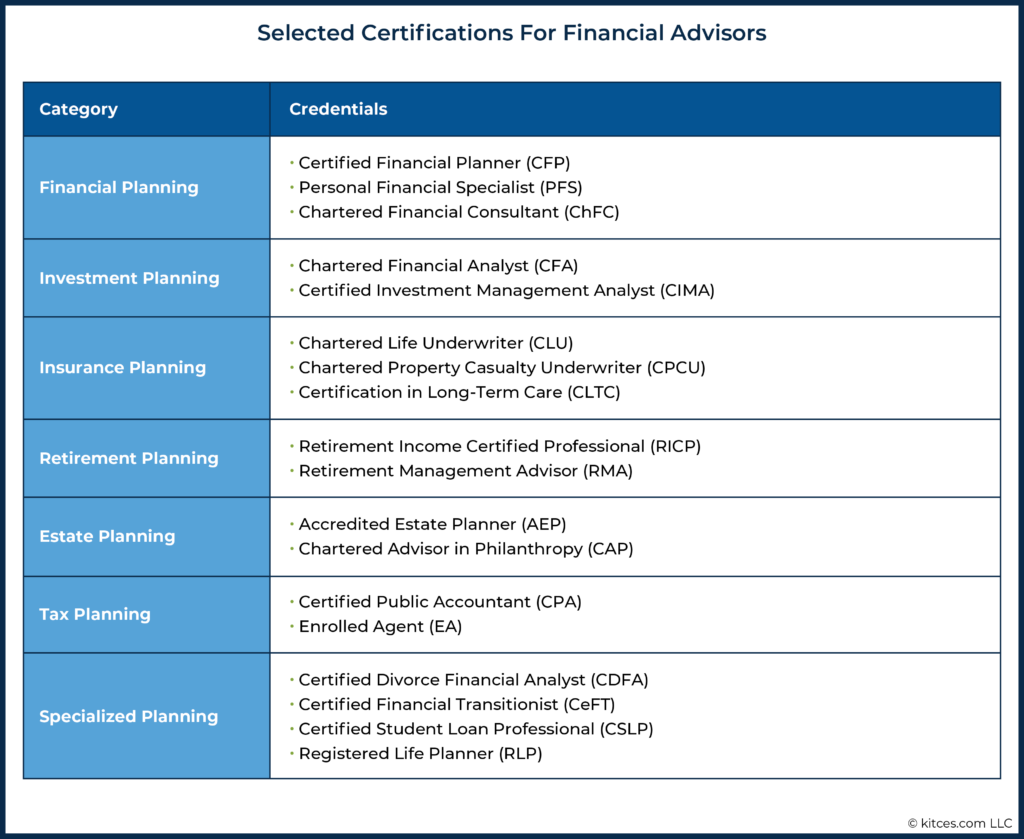

CFP certification is one of the most esteemed hallmarks for financial advisors and provides benefits for advisors both internally (through increased confidence in their competency) and externally (through improved credibility among potential clients). In addition, our 2020 Kitces Research Financial Planning Process Study found that CFP professionals can generally charge higher fees (and earn more income) than advisors without the certification.

The process to become a CFP professional (which requires candidates to meet the “4 E” requirements of education, exam, experience, and ethics) can potentially take several years, so career changers will benefit from creating a plan to fulfill the requirements in such a way that matches their preferences for moving into financial planning.

At the same time, becoming a CFP professional is often not a requirement for entry-level jobs at financial planning firms, which means that obtaining the CFP mark isn’t necessarily a prerequisite to getting started. Instead, career changers can fulfill the education and exam requirements even before making the switch into financial planning and can fulfill the experience requirement once they start their first position that qualifies to fulfill CFP Board’s financial planning experience requirement.

Career changers can also get started building up experience hours while working in their previous positions through volunteer financial planning, part-time financial planning work (which can sometimes be challenging to find), the FPA Residency, and the FPA Externship, among other qualifying activities (work in a previous job might qualify as well if it meets the CFP Board’s requirements if they do not already have sufficient qualifying experience). And once the other requirements are met, the career changer can fulfill the ethics requirement by submitting to a detailed background check and committing to the CFP Board’s ethical standards.

Other credentials can demonstrate expertise in a particular area of financial planning and can be particularly useful if pursuing a more focused or technical position. There are a wide range of certifications available focused on specific aspects of the planning process (e.g., insurance or investments) or certain client niches (e.g., clients going through the divorce process or clients who are physicians).

For example, career-changers looking to focus on the investment side of financial planning might pursue the Certified Investment Management Analyst (CIMA) certification, which covers issues such as portfolio construction and behavioral finance. And those looking to work with retirees might consider the Retirement Income Certified Professional (RICP) program, which focuses on the specific planning needs of retirees.

While many of these have an experience requirement to achieve the certification, going through the education program can help build the career changer’s technical knowledge and confidence in working on that specific part of the planning process as they work to earn the requisite experience.

Leveraging Experience And Networks

As noted earlier, some career changers already have relevant work experience that could be attractive to financial planning firms seeking new talent. For example, a career changer with an accounting background could have tax planning skills that would be valuable to a firm. Other career changers might come from the world of investments and have experience with portfolio construction and a range of investment products.

For career changers pursuing the path of getting their own clients, an important asset will be their own network for them to potentially tap as a source for prospective clients (which could include colleagues from their previous career as the career changer is likely to be familiar with the financial planning aspects of that profession). Having a list of potential clients in mind, rather than prospecting from scratch, could speed the process of gathering a client base and increasing their income.

Creating A Plan For A Career Change Into Financial Advice

Once a career changer has decided on the career path they want to follow and the education and credentials they will pursue, they can construct a plan that accounts for their personal circumstances that will help them make the transition as smooth as possible.

The career changer can first consider the time it will take them to meet any education requirements they will need before applying for financial planning jobs or launching their own firm. Luckily, career changers have many financial planning educational program options available to them. Different programs are offered in-person and online (which can be helpful for career changers who do not live near an in-person program) and also as synchronous and asynchronous options (which allow career changers to select a program based on their learning style and schedule needs).

The education programs also allow for flexibility in terms of scheduling time to completion (which is particularly useful for career changers completing the education requirement while still working in their previous job); as while completing an in-person or synchronous program will depend on course ability and the pre-set schedule (often taking 12-18 months), asynchronous programs may take significantly less time if the career changer is able to devote significant time to complete the program.

While many career changers might not have the experience necessary to complete the CFP certification process before applying for financial planning jobs, passing the CFP exam can be a good way to demonstrate both competency and the commitment to obtain CFP certification. And while the financial planning education programs will cover much of the material on the exam, many candidates find that the intensive nature of the exam requires a separate period of study (perhaps 3-5 months) to ensure they are prepared. In addition to self-study options, there is a range of CFP exam review programs that typically include instructor-led sessions, pre-study materials, and practice questions that help candidates focus on both the substantive material on the exam as well as test-taking strategies for success on the exam.

For career changers who are planning to work with clients right away before obtaining their CFP certification, passing the Series 65 exam could also demonstrate their knowledge and commitment to potential employers. Passing the exam is necessary to register as an Investment Advisor Representative of an RIA (a requirement for those who will be paid a fee for giving investing advice), although certain credentials such as the CFP and CFA can waive advisors from the exam requirement.

Career changers planning to eventually start their own firm can also plan to have the foundation of their firm set before launch. This includes everything from naming and registering the firm and organizing its banking and credit needs to building a tech stack and creating a marketing and branding strategy. And advisors who want to build their firm with a particular client niche in mind can also account for enough time to learn about the specific planning needs of their potential clients.

Accounting For The Financial Costs Of A Career Change

In addition to the time it takes to prepare for a career change into financial planning, there are also financial costs. These include both the direct costs of getting the education and credentials needed to transition into financial planning and the foregone income incurred by changing to a new industry.

The highest financial cost a career changer is likely to face is a potentially reduced salary (for those pursuing an employee position) or foregone income (for those starting their own firm). Depending on the career changer’s previous profession and experience, transitioning to an entry-level position at a financial planning firm could result in a significant pay cut.

For those on the path of starting their own firm, one of the biggest challenges can be to fill the income gap between launching the firm and building up a client base that will generate sustainable revenue. And while there are options to help fill the income gap (e.g., offering hourly planning services or preparing standalone financial plans), having sufficient savings or additional income support (e.g., from a spouse or partner) can help smooth the transition. And so, while the average established financial advisor earns significantly more than the median US household, it is important for career changers to have a plan to ensure their financial wellbeing while they establish themselves in their new career.

In terms of direct costs, CFP Board-registered education programs come with a range of price points, with self-paced online certificate programs typically being the least expensive (approximately $3,000-$5,000) and programs with instructor-led sessions typically costing more. In addition, for those who want to take a CFP exam review program, comprehensive, live, instructor-led programs typically cost between $1,000-$2,000, while a la carte self-paced review materials are also available for more budget-conscious exam takers.

And those taking the independent route will also have to consider the costs of starting up their own firm. These include everything from compliance to technology and altogether can come in around $10,000 in the advisor’s first year of business (although this can vary, especially if the advisor is renting office space!).

In addition, career changers who take employee positions might have moving costs to consider. While many advisory firms have moved their operations online during the COVID-19 pandemic (and some have always operated on a virtual basis), others have taken a hybrid approach or expect their employees to be back in the office. Career changers who live in an area with few financial planning firms might have to consider taking a position in another location. Such a move could require additional financial preparation if the career changer’s spouse or partner had to change jobs as well.

Choose With The End In Mind

When transitioning into financial planning, long-term goals can influence how a career changer enters the field. For instance, a career changer who wants to start as a junior-level employee with increasing responsibility over time might seek out a paraplanner or associate advisor position that offers promotion opportunities and increased responsibilities as they gain credentials and experience. Career changers who start as employees for a firm but who eventually want their own firms can consider how their initial employee jobs will impact their ability to build their client base in their future independent practice.

For example, an advisor who works with clients as a firm employee may have to start from scratch when they go independent, as the advisor might be restricted by their employer from bringing clients to their new firm. In this case, the career changer might face two income cliffs – one as they potentially face a pay cut when moving from their old position into a junior-level financial planning role, and then a second when they open their own firm as they work to build up a new client base.

For these career changers, one alternate path is to get a job in firm operations for a few years. This not only allows them to gain a better understanding of the nuts and bolts of running a firm along with more confidence when they eventually start their own firm, but also to gain the experience needed for credentials such as the CFP certification.

Ultimately, the key point is that while a career change into financial planning can be a fulfilling decision, it is important to plan in advance to ensure a smooth transition. From considering which roles in the industry are of interest to the education and credentials needed for that career track, career changers can consider both the time commitment and costs required to make the change.

Because with proper preparation, the career changer can increase the chances that they will not only have a good first job in the industry, but also have a successful long-term career in financial advice!