Executive Summary

One of the great “mysteries” to many in the independent RIA community is why more advisors at broker-dealers haven’t been breaking away to start their own independent firms. Yet a look at the recruiting landscape at broker-dealers helps to explain why: because top brokers, particularly at wirehouses, can get paid as much as 3X trailing revenue just to switch broker-dealers, in a world where the going rate for an independent RIA is “only” 2X revenue!

The caveat, however, is that the typical broker-dealer recruiting deal comes with far more strings attached, including an “upfront” payment that is actually a forgivable loan, and back-end bonuses that are paid out over time… all of which are only actually “earned” as the broker continues to hit specified asset and revenue hurdles on the new broker-dealer platform.

However, in a new FAQ regarding the details of the upcoming fiduciary rule, the Department of Labor has now declared that asset and production thresholds to earn recruiting bonuses are considered an “acute conflict of interest” that cannot merely be mitigated and must be avoided. In other words, all the typical contingencies that broker-dealers attach to the back end of recruiting deals will be banned in the future.

As a result of the announcement, broker-dealer recruiting deals have ground to a halt, as broker-dealers need to substantively re-assess what they can realistically pay for recruiting in a world where the broker can’t actually be held accountable for whether or how many clients come along in the switch. And while eventually recruiting deals will likely come back, the inevitable conclusion is that the typical payout rates for broker-dealer recruiting (at least for the retirement portion of the business) must fall below the typical purchase price of an independent RIA, which from the buyer’s perspective will now be a much “safer” purchase.

More broadly, though, the pressure on broker-dealer recruiting deals will also likely become pressure on broker-dealers themselves – particularly the wirehouses who historically have relied the most on recruiting and retention bonuses, but now may increasingly struggle to attract their top, most growth-oriented advisors, who in the future may “need” to become independent RIAs to maximize the value of the advisory business they build. Which in turn will be a boon to the vendors who serve independent RIAs, and those who provide “waypoints” in the transition (like Dynasty and HighTower)… unless the leading broker-dealers can transform themselves into RIA support platforms that retain the value of their business, while simultaneously allowing advisors to retain the value of theirs.

Understanding The Typical Broker-Dealer Recruiting Deal

Unlike an independent RIA, technically an advisor at a broker-dealer does not actually “own” his/her clients and the business revenue they generate; instead, the client is a client of the broker-dealer’s, for which the advisor is paid a percentage of the revenue the broker-dealer generates (in large part through the advisor’s efforts).

Nonetheless, given that the client relationship itself is typically with the advisor (and not the broker-dealer entity), competing broker-dealers will often pay substantial dollar amounts to attract top brokers (to get their clients along with them). In fact, the top recruiting deals from some wirehouses cumulatively add up to as much as 300% of trailing 12-month revenue, which means some brokers can actually get paid more to switch broker-dealers than an independent RIA is paid to sell the standalone business (which is typically “just” 2X or 200% of trailing 12-month revenue)!

Ultimately, though, the reason that top brokers can get paid more to switch broker-dealers than an independent RIA is paid to sell a standalone business is due to two key factors: 1) even after switching, top brokers may still only get to keep 40% to 50% of their gross revenue from the new broker-dealer (whereas standout independent RIA owners take home 60% to 75%+ of gross revenue) so the wirehouse can afford to pay more for the revenue because it keeps more of the revenue; and 2) because broker-dealer recruiting deals rely heavily on forgivable loans and payouts that are contingent on meeting specific asset or revenue/production hurdles, which means they only pay more when the upside actually occurs. (Michael’s Note: Broker-dealer recruiting deals are also typically paid out as ordinary income to the broker, rather than providing capital gains treatment that may be available when selling an RIA entity, and the less favorable tax treatment to the broker, which is also more favorable tax treatment to the broker-dealer buyer, also impacts the pricing of the deal.)

For instance, upon switching to Morgan Stanley, a broker has been able to get an upfront check for 100% to 140% of trailing revenue, but it is technically a 9-year forgivable loan. Which means the broker who had generated $1,000,000 of trailing revenue at the prior broker-dealer will get a $1,000,000+ check, but is then immediately on the hook for a $1,000,000 loan repayment! Each year that the broker stays, 1/9th of the repayment obligation is forgiven. Thus, if the broker leaves after 4 years (e.g., retires, quits, or simply fails to make production requirements), then $445,000 (which is 4/9ths) of the payment is actually earned, but the remaining $555,000 must be repaid. The whole $1,000,000 is retained only if the broker actually stays around for all 9 years after the switch.

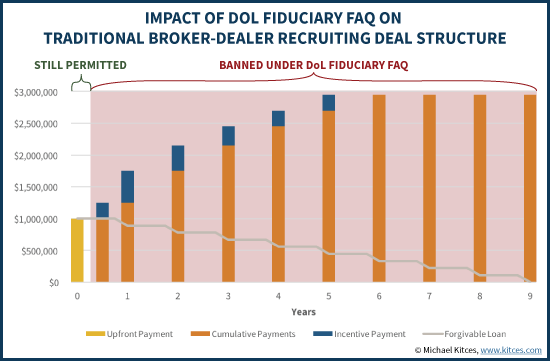

In addition, to earn the remainder of a 300%+ total payout (given that the upfront might be only 1/3rd of the total payments), the recruited broker has to meet ongoing hurdles as well. A typical structure, as embodied in the current Merrill Lynch deal, would entail that the broker has to get back to 65% of prior assets and revenue within 6 months to earn another 25%-of-revenue bonus, then 75% of prior assets and revenue by the end of year 1 to earn another 50% bonus, then to 95% of original assets and revenue after year 2 (for another 40% bonus), and then continue to grow to 115%, 125%, and 150% of assets and revenue in years 3, 4, and 5 to earn additional bonuses of 30%, 25%, and 25%.

The end result is that if the advisor actually does hit the required assets and revenue retention goals, a cumulative payment of as much as 300% or more is possible from some wirehouses. Regional and independent broker-dealers with higher payouts to the registered representative offer lower payouts, but can still run up to 200% and 100%, respectively. But all of those payouts are ultimately compensation that is entirely contingent on the broker sticking with the new broker-dealer, successfully transitioning clients away from the prior broker-dealer, and then subsequently growing the business from there.

How The DoL Fiduciary Rule Will Shatter Broker-Dealer Recruiting Deals

One of the fundamental tenets of the Department of Labor’s new fiduciary rule is that advisors must adhere to “impartial conduct standards”, which entails providing best interests advice, for reasonable compensation, while making no misleading statements. In addition, for advisors to receive “conflicted” compensation (i.e., commissions or similar incentive compensation), the Financial Institution must sign a Best Interests Contract with the end client to bind the firm’s fiduciary commitment, and the Financial Institution must implement policies and procedures to help mitigate material conflicts of interest and eliminate incentives that could compromise the objectivity of their advisors.

Given the nature of commissions and incentive compensation at broker-dealers, the DoL fiduciary rule’s original announcement last April led to numerous questions about whether and how everything from “grid” compensation to broker-dealer recruiting deals would be impacted by the rule. And in late October, the DoL responded with “clarification”, in the form of a Q&A style list of “Frequently Asked Questions” (and Answers) about the Best Interests Contract Exemption and potential conflicts of interest. And notably, in Q&A #12 of the FAQ, the Department of Labor stated unequivocally that several common aspects of broker-dealer recruiting deals would not be permissible under the new DoL fiduciary rule going forward.

Specifically, the DoL acknowledged that incentives involving a “signing” or “front-end” payment for recruiting will remain permissible, but only if they are not tied to the movement of accounts or assets or achieving particular targets. However, “back-end” awards that require advisors to reach certain sales/revenue or asset targets are deemed “acute conflicts of interest” that would, by their very existence, violate the Financial Institution’s obligation to mitigate material conflicts of interest and eliminate inappropriate incentives.

In other words, while a recruiting broker-dealer can pay an upfront recruiting bonus in the future, the payment cannot be contingent on actually persuading clients to switch along with the broker-dealer! In addition, back-end bonuses – which typically have been as much as 2/3rds of the recruiting deal, and where the real “upside” comes for most brokers who make a switch – are entirely prohibited going forward. While the DoL did note that payments can still be contingent on “the adviser’s continued service in good standing at the financial institution” – i.e., an upfront payment could potentially still be a forgivable loan that is earned out over time – a requirement to hit hurdles in order to earn the upfront loan forgiveness, or to receive additional bonuses, is banned!

And notably, while the DoL did acknowledge that existing broker-dealer recruiting deals already in force with back-end recruiting payments may continue even after the new rules take effect (given that they are already binding contractual commitments), it emphasized that any recruiting deals entered into after the date of the new FAQ guidance will be deemed a violation of the fiduciary rules once they take effect in April. As a result, broker-dealer recruiting has currently ground to a halt, with brokerage firms rescinding recruiting offers immediately after the fiduciary guidance was released, and now contemplating how to restructure broker recruiting deals in the future!

How DoL Fiduciary Will Change Broker-Dealer Recruiting (And Retention) Packages

Ultimately, the new DoL fiduciary rules will not end the practice of broker-dealers paying to recruit advisors away from other platforms. But it may permanently alter the payout landscape, and push broker-dealer recruiting deals well below the level of comparable acquisition deals for independent RIAs for the indefinite future.

The reason is that while the DoL fiduciary rule does not prohibit recruiting deals altogether, the elimination of any contingency payments, and the requirement that deals be paid either entirely upfront or on an earn-out basis that is solely contingent on continued service (but not continued production or how many clients switch over), means that broker-dealers face far too much risk in making substantial payments to broker-dealers who are switching.

After all, a broker-dealer who makes the ‘traditional’ recruiting payment deal but complies with the new DoL fiduciary rules would pay the recruited broker up to 300% of trailing 12-month revenue and face the risk that the broker does absolutely nothing thereafter. Why work hard to actually bring your clients over, when the 300% payday comes even if all the clients stay behind!?

Of course, many/most brokers who switch have a full intention of bringing their clients with them (at least, as many as possible/desirable), and want to run a continuing business thereafter. But when the terms of the recruiting deal cannot directly take that into account, the inevitable result is that recruiting payout deals will have to decline, likely quite dramatically.

Think of it from the buying broker-dealer’s perspective: if you buy an independent RIA, you get a bona fide ongoing business with clients and recurring revenue, but if you recruit a successful broker and him/her entirely upfront without any contingencies, there’s nothing to ensure that any clients or revenue will actually show up! Because the recruiting deal cannot place asset or revenue hurdle thresholds on the advisor… which basically means he/she is under no obligation whatsoever to actually bring any clients along!

How would you evaluate and “underwrite” the risk of a switching broker to figure out whether that person is one who will probably try to bring clients (even if not obligated to do so, simply because he/she wants to keep growing their practice), versus one who will simply be a “freeloader” and take the payday and sit around doing nothing but collecting the paychecks because there’s no real incentive to do anything more? Compared to simply buying an independent RIA, where you know as the buyer that you’re buying a legal right to the recurring revenue of the business?

Of course, the reality is that the DoL fiduciary rule only applies to retirement accounts, and the revenue and business associated with those accounts. Which means broker-dealers will be able to pay more for non-retirement accounts and revenue (albeit in exchange for attaching more contingencies to the deal) than for retirement-related business.

Still, it seems the inevitable conclusion is that if the head-to-head comparison of a broker-dealer recruiting deal is now more risky (for the buyer) than purchasing an independent RIA, the price of (now primarily upfront) recruiting deals for broker-dealers will have to fall below the RIA threshold. Which means, at least for retirement accounts, broker-dealer recruiting deals could almost immediately get cut in half… perhaps just 100% to 200% of trailing revenue at wirehouses, and for regional and independent broker-dealer recruiting deals could top out at no more than 100% and 50%, respectively. In addition, expect far more scrutiny on who gets a recruiting package at all, or not, given the risk to the recruiting broker-dealer of a broker who switches for the payment but doesn’t actually (try very hard to) bring his/her clients along!

Industry Implications For Advisors And Broker-Dealers

The fact that a subset of brokers have been “breaking away” from broker-dealers to form an independent RIA is not new. Some do it to get away from big financial services firms that no longer hold the perceived brand value they once did. Others realize that their firm is large enough that they could form their own firm, hire and pay staff, and still take home more pay that they’d get from a high-end broker-dealer payout. And some simply want to build a business with true economic value, that they can ultimately sell in an independent transaction.

And it is this latter group, in particular, that will likely be most directly affected by the impact of the new DoL fiduciary rule’s limitations on recruiting deals. Because the reality is that in the past, if you wanted to build a business at a broker-dealer and get paid for its implied enterprise value – even though you didn’t really own the clients or the business – the potential for lucrative broker-dealer recruiting deals made it possible to harvest the value of what you built. In fact, successful brokers could actually get paid 2-3 times for the exact same clients over the span of a career, simply by changing broker-dealers once every 10 years (after the prior broker-dealer’s recruiting deal had fully paid out), or conversely getting a retention bonus of a similar amount from an existing broker-dealer to persuade the broker not to leave (and get the same check anyway).

Going forward, however, the repricing of the risk of broker-dealer recruiting deals, which can no longer have asset and revenue production contingencies (or at best, only very mild ones that must be designed to not have a major incentive impact on behavior), means switching broker-dealers every decade to get a new recruiting deal will no longer be the most lucrative path to building and monetizing an advisory business. Instead, the strong financial option will be to actually form your own business entity, truly own your clients (or at least, the goodwill value of your client base), and sell that goodwill asset (or business entity) at the end of your career to monetize what you’ve built.

Accordingly, perhaps the biggest “winner” in the new DoL fiduciary rules on recruiting bonuses will be the firms that help brokers transition to independent RIA, from consultants to help departing brokers comply with the broker protocol, to compliance firms like MarketCounsel that help big wirehouse teams with the breakaway process and forming the new RIA, and platform businesses that support breakaway brokers going independent like Dynasty Financial Partners and HighTower. In the meantime, wirehouses – who previously have relied on higher payout rates to attract talent and large teams switching firms – will struggle the most, while independent broker-dealers may see a slight boost in interest (as their payouts may also fall, but likely not as much, and the gap between independent and employee broker-dealer models should shrink).

For brokers who are already fairly close to retirement, and realistically don’t want to break away and go out on their own at this point in their career, it’s worth recognizing that most broker-dealers do have internal succession planning platforms to facilitate an internal “sale” of clients to another broker at the company. The reality is that such deals often have lower payouts and greater risk than independent third-party transactions in the open market, but do still represent some opportunity to monetize the value of a client base. The transition to independent RIA status for a “bigger” potential sale in the future will be most preferable for advisors in their early 50s or younger, who still have a reasonable “runway” left to build the independent business before future sale.

In the meantime, it remains to be seen exactly how broker-dealer recruiting deals will be reformulated. In all likelihood, some version of the forgivable loan structure will continue – albeit based solely on continued employment, and not specific revenue and asset production targets – as it’s still a way to mitigate the risk for the broker-dealer of a broker switching firms as a quasi-retirement plan. Nonetheless, the total package rates must go lower from here, when the contingencies of the past can no longer be attached, which will permanently alter the competitive landscape between advisors at broker-dealers versus those who build independent RIAs!

So what do you think? Did you have a recruiting deal on the table that was rescinded after the DoL fiduciary FAQ was released? Were you thinking of switching broker-dealers in the coming year and are now reconsidering? Does this change the relative appeal of building as an independent RIA vs at a broker-dealer? Please share your thoughts in the comments below!