Executive Summary

The Certified Financial Planner (CFP) designation is one of the most respected credentials for financial advisors and the process to earn it is rigorous. Candidates must fulfill education, experience, and ethics requirements, in addition to passing the comprehensive CFP Exam, a 170-question, multiple-choice test taken across two 3-hour sessions in one day. Material on the CFP Exam is categorized into the CFP Board’s eight principal knowledge topics, which range from retirement savings and income planning to investment planning, professional conduct, and regulation. With a general recommendation that exam takers study for at least 150 hours before the exam, the cost in time and money of failing can be high. Furthermore, given that the exam covers a broad range of financial planning topics, having an organized and disciplined study routine is a necessity to pass the exam.

Accordingly, CFP exam review courses can be a good option to help exam takers not only review the material that will be on the test but also develop strategies for preparing for and taking the exam. The core of most CFP exam review programs is based on instructor-led review sessions that typically come with extensive pre-study materials, which can include condensed reviews of the principal knowledge topics and practice questions, as well as questions and mock exams to help exam-takers gauge their progress and practice in similar conditions as the actual exam. While the core elements of most CFP exam review programs are similar, they differ in their method of delivery, level of personalization, and cost. Instructor-led sessions for some programs can be held synchronously, either in person or livestreamed virtually, while others are held asynchronously, with recorded lectures available to view on demand. Some programs also offer more personalized instruction, from one-on-one video coaching to email access to instructors. Certain programs also offer students some form of exam-pass guarantee, which can range from being able to retake the program for free, to receiving a refund of the program cost.

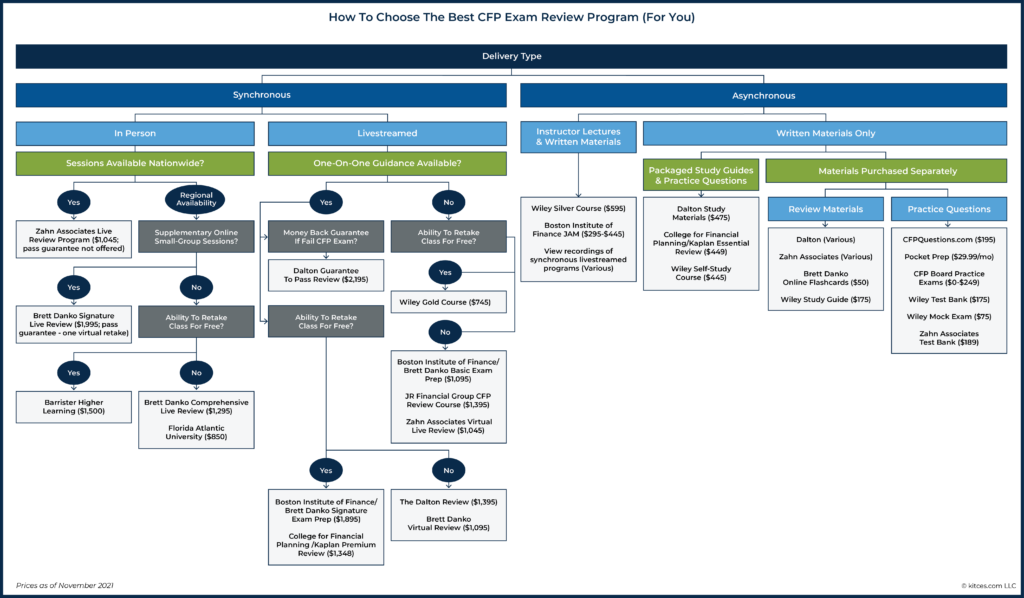

With more than twenty different CFP exam review options to choose from, exam takers can methodically approach selecting a program by first deciding whether to take a synchronous or asynchronous program. While synchronous programs can be good for exam takers who want (or need) the structure of set schedules, asynchronous programs can be useful for those with unpredictable schedules and the discipline to complete the program on their own. Individuals can then consider other important factors (e.g., group size, guarantees, and cost) that are most important to them based on their preferred learning style and budget. As an alternative, exam takers with very tight budgets can choose a self-study approach using printed review materials and practice questions without the lecture component.

Ultimately, the key point is that while there is no single ‘best’ CFP exam review program that will be suitable for all test takers, those taking the exam can consider their individual situation to narrow the field of available programs. And while there is no guarantee that an individual will pass the CFP exam after taking a review program, these programs can greatly improve the quality and efficiency of the strategy the exam taker chooses when preparing for the exam. Which is important, because passing the CFP exam requires a high level of commitment and hard work – and finding the right method to review and prepare can make a big difference in helping prospective test takers pass the exam!

The Certified Financial Planner (CFP) designation is one of the most respected credentials for financial advisors, and research has shown that advisors with the designation earn more income and bring in more revenue for their firms than those without it. The benefits of attaining the CFP designation are not just monetary, though, as there are psychological benefits as well. Advisors report that some of the top benefits of holding the designation are enhanced credibility, self-confidence with clients, and technical expertise.

Requirements To Earn CFP Certification

For those pursuing the CFP designation, a range of requirements must be met. These include fulfilling the “Four E’s” of meeting CFP Board’s standard for financial planning: completing a CFP Board Registered Program in financial planning and earning an undergraduate degree from an accredited college or university (Education); having sufficient professional work history related to the financial planning process, which typically consists of 6,000 hours, equivalent to approximately 3 years of full-time work (Experience); fulfilling an Ethics requirement; and passing the CFP Exam, a rigorous 170-question, multiple-choice test taken across two 3-hour sessions over one day.

The CFP exam is scored on a pass/fail basis, and in the July 2021 exam administration, 62% of all test takers passed; those taking the exam for the first time had a pass rate of 65%, and those who had taken the exam previously had a pass rate of 52%.

Nerd Note:

The CFP exam has been in its current form as a six-hour, 170-question, computer-based test since November 2014. Before that, the exam was 285 questions, paper-based, and given over ten hours. The changes not only reduced the time commitment to take the exam from two days to one, but also allowed for faster reporting of exam results; while those who took the exam before the 2014 changes had to wait five weeks for their results, exam-takers today now receive preliminary results immediately after completing the test!

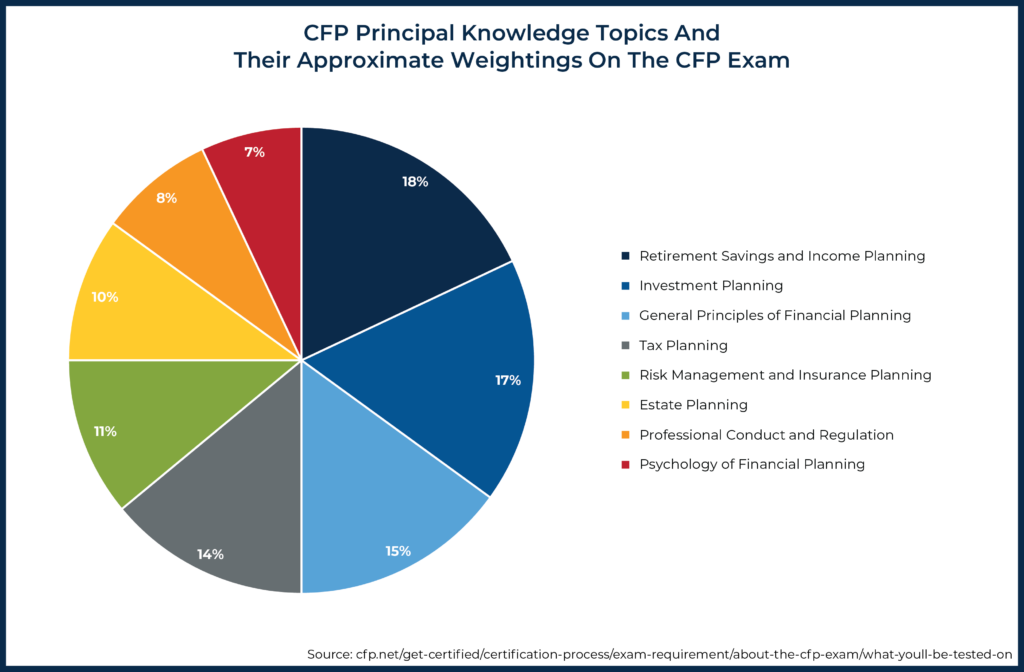

The test covers a broad range of financial planning topics, making an organized and disciplined study routine a necessity to pass the exam. The material is categorized into the CFP Board’s eight principal knowledge topics: retirement savings and income planning (approximately 18% of the exam questions); investment planning (17%); general principles of financial planning (15%); tax planning (14%); risk management and insurance planning (11%); estate planning (10%); professional conduct and regulation (8%); and psychology of financial planning (7%).

Nerd Note:

Following its 2021 Practice Analysis Study, CFP Board updated its list of principal knowledge topics, adding a new domain, The Psychology of Financial Planning, and consolidating the Education Planning category within the general financial planning principles category. The updated topics will begin to appear on the exam beginning with the March 2022 administration.

While some students might feel comfortable studying for the exam without outside assistance, a range of CFP exam review programs are also available. Many of these review programs offer participants an efficient, structured process to study for the exam, but the best program for a given individual will differ based on their budget, learning preferences, and study habits.

What CFP Exam Review Programs Provide

Those who are planning to take the CFP exam come with a variety of experiences and degrees of preparation. Some may be scheduled to take the exam coming right out of an undergraduate financial planning program, while others may take it soon after completing an adult education financial planning certificate program. Still others might have worked in the financial planning industry for several years between completing the education requirements and taking the exam.

In all of these cases, it is likely that prospective exam takers will benefit from reviewing the topics covered by the exam and familiarizing themselves with the specific types of questions they will face. CFP exam review programs can help fill these gaps through a combination of in-person or virtual instruction, written materials, and practice tests, offering participants useful strategies for approaching the different types of questions found on the exam in a variety of synchronous and asynchronous formats.

This can potentially lead to improved success on the CFP Exam, as some of the review programs (e.g., Dalton Education and Zahn Associates) claim that those who complete their programs pass the exam at a higher rate than the general pool of test-takers (although the type of person who completes a review program might differ from the full population of exam takers).

Instructor-Led CFP Exam Review Sessions

The core of most CFP exam review programs is based on instructor-led review sessions that typically provide a condensed review of the full range of topics on the exam, and also offer participants the opportunity to ask clarifying questions.

These sessions are typically taught by CFP professionals with extensive experience preparing students for the exam, not just by offering a review of subject matter material but also by helping students to study more efficiently by familiarizing them with the types of questions expected to appear on the exam.

Review programs also typically come with extensive pre-study materials, which can include condensed reviews of the principal knowledge topics and practice questions to help exam takers gauge their strengths and weaknesses among the range of subjects on the exam.

The programs expect students to spend between 100 and 140 hours working through these materials in advance of attending (or watching) the sessions, so that they are prepared for the intensity of the instructor-led sessions.

CFP Exam Test-Taking Strategies

While reviewing the principal knowledge topics is an essential part of preparing for the exam, it is also important for students to have a strategy for taking the test as efficiently as possible.

First-time CFP exam takers should be familiar with the different types of question formats, and the strict time constraints of the CFP exam.

The CFP exam includes standalone, short-scenario, and case-study questions (CFP Board provides ten free sample questions so prospective test takers can get an idea of the different types of questions that appear on the exam).

CFP Board offers descriptions of each type of question, as follows:

Stand-alone Questions: Stand-alone questions are typically 2-3 sentences long, with 4 answer options to select from.

Short Scenario Questions: Scenario-based questions are associated with multiple exam questions – typically 3 questions per scenario. You will see the scenario on the left side of the screen, with one question at a time shown on the right side of the screen.

Case Study Questions: Case study questions are like scenario-based questions but longer, with the case study scenario covering several pages, and typically 8-12 questions per case study.

The time it takes to solve each type of question varies significantly, but each question is worth the same amount.

The exam’s case studies – which require test takers to review information about a hypothetical client and answer related questions – can prove to be both challenging and time-consuming, making preparation for these question types particularly important. Review programs offer exam takers not only practice case studies to work on, but also strategies on how to approach them within the broader exam structure so that test takers can use their limited time more efficiently.

Other exam strategies include how best to answer questions when the exam taker is unsure of the answer (because there is no penalty for guessing), as well as how best to create a mental framework for studying and taking the exam. The review programs also often include guidance on approaching exam questions that require the use of a financial calculator.

CFP Exam Practice Questions And Mock Exams

CFP exam review programs often provide thousands of practice questions, as well as mock exams. The practice questions introduce participants to the style of exam questions (which can vary significantly from the types of questions exam takers might actually receive from their real-life clients!), and come with explanations to show why a certain answer was correct. The practice questions can help exam takers identify their strengths and weaknesses in certain subject areas, as they gauge their progress preparing for the exam, while at the same time familiarizing students with the formats in which exam questions will be asked.

Mock exams are particularly useful because they allow exam takers to practice questions on the full range of topics under the same time constraints they will face on the actual exam. Some exam takers using the mock exams will find that they run out of time well before finishing, while others will have significant time left over; in both cases, students can adjust their approach to the exam as needed.

In the end, review courses help students learn how to maximize their time when they take the actual exam, thereby reducing the risk of running out of time to answer all the questions!

How The CFP Exam Review Programs Differ

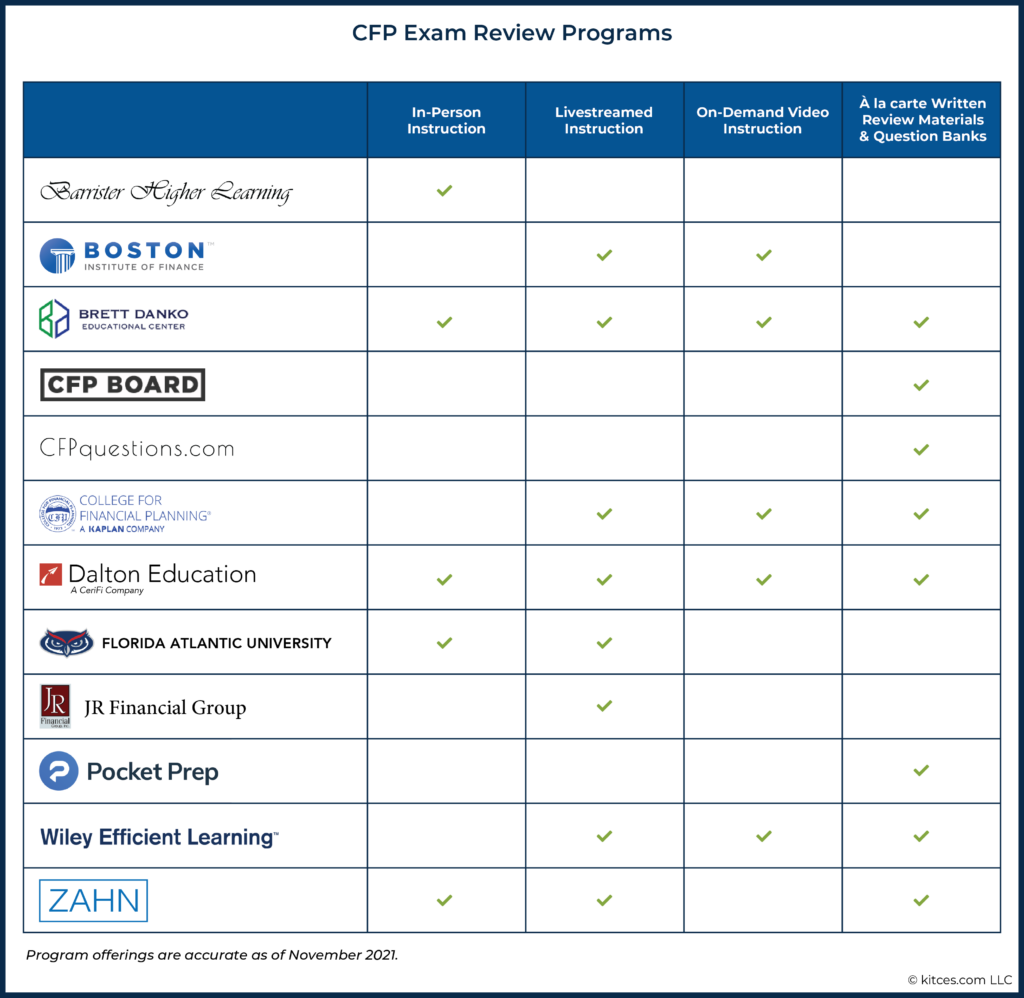

While pre-class study material, instructor-led sessions, and practice questions are common features of most comprehensive CFP exam review programs, the programs can vary across a few areas, such as whether they are synchronous or asynchronous, the amount of personalized feedback offered, and cost. Exam takers should consider the factors that are most important and impactful to them in each of these aspects when selecting a program.

Synchronous Vs Asynchronous CFP Exam Review Instruction

Individuals preparing for the CFP exam live throughout the United States (and the world!) and have a range of scheduling constraints and time available to study for the exam. With that in mind, the CFP exam review programs offer a range of options to fit the availability and schedules of the full range of exam takers.

Synchronous (Live) Instruction

Traditionally, CFP exam review classes have been held as real-time, in-person "synchronous” sessions, and several companies continue to offer this option through live review classes that are usually held over the course of four consecutive days, with a total of about 35 hours of instruction. Locations for the classes vary by company; for example, Barrister Higher Learning’s program is offered in Philadelphia, Brett Danko’s classes are taught in cities in the Northeastern United States, and Zahn Associates’ live sessions are available in cities throughout the country.

In-person live reviews are helpful for exam takers who learn best visually in an environment without distractions (which can be frequent for those self-studying at home!). This can also be a good option for those who may struggle with procrastination, as signing up for a live review program can serve as a commitment to help students stay on track with their course of exam preparation.

Live review programs allow exam takers to ask the instructors questions they had while studying the pre-review material, and those that arise during the review itself. The live sessions build on the pre-review study material and cover the range of principal knowledge topics on the exam. The sessions can also typically be accessed asynchronously (i.e., on the CFP candidate’s own time) after the fact, as they are also usually recorded to let exam takers review the lectures at home after the in-person review, or to give students who were not able to attend in-person a chance to view the recording.

For those exam takers who want to take part in a live review but do not have the flexibility or the budget to travel for in-person sessions, virtual live reviews offer an alternative. These are live-streamed review sessions and cover the same topics found in live reviews. Like the in-person review sessions, the virtual sessions are synchronous in nature – which means they happen at a set pre-scheduled time, and attendees are expected to join in and participate at that time – and thus again can serve as a commitment tool for those who might otherwise procrastinate getting through the pre-review study material. The virtual live sessions also offer the opportunity to ask questions and, like the in-person sessions, are usually recorded for those who want to view the lectures a second time or who are unable to attend any of the live days.

Asynchronous (Pre-Recorded) Instruction

Asynchronous instructor-led review sessions are also available for those who want to access video instruction material at any time (i.e., it is “asynchronous” because the time the instructor presents the material – to a video camera/recorder – is not synchronized with when the student watches the material, whenever they wish to view it on-demand).

This is particularly useful for exam takers who have busy or unpredictable schedules and cannot commit to specific days to attend a live (in-person or virtual) session.

However, one potential downside of watching recorded sessions is that exam takers are not able to ask questions in real time (although some programs offer email access to instructors). More generally, it also requires substantively more self-direction to be able to create one’s own study time independently in an asynchronous format – which may be fine for some CFP candidates, but can be a challenge for others, depending on their natural learning style.

Personalized CFP Exam Instruction

For some exam takers, instructor-led review sessions will be sufficient to clarify difficult concepts and answer their questions. Other exam takers might want more personalized instruction and feedback. Different exam review programs offer a variety of options to communicate with CFP exam experts and get additional instruction.

At the most personalized level, some programs offer one-on-one video sessions with instructors that allow individuals to dig deeper into their specific questions. Other programs offer smaller supplementary group classes that create a more intimate setting for additional review of the material on the exam, allowing students to ask questions in a smaller group setting (which might be particularly useful for those who might be nervous about asking questions in a larger group!). Several programs also offer an email option, or bulletin board access, for students to ask questions and get feedback from instructors.

In addition to more personalized instruction on the exam material and strategies, many programs also offer customized study plans that spell out exactly when exam takers should complete the pre-study work, live review, and practice questions for a given exam date to keep them on track for developing a firm grasp of the material and to feel more confident leading up to the day of the exam. A personalized approach can be particularly useful for those exam takers who might otherwise procrastinate or who study best with a structure to follow. Since the exam covers such a wide range of material, it is not a test that should be crammed for!

Differences in Cost For CFP Exam Prep Programs

The differences in the style of instruction and personalization lead CFP exam review programs to be available at a wide range of price points. While asynchronous instructor-led review programs are available for as low as $595 (and standalone written exam preparation materials and practice questions can be purchased for much less), premium offerings that include live instructor-led sessions and significant instructor access can cost more than $2,000 (although there are a number of scholarships available – not only for CFP exam review programs, but also for the exam itself – that can help defray the cost!).

Nerd Note:

Because registration for the CFP exam alone costs between $825 and $1,025 (depending on how close to the exam dates the test taker registers), some exam takers might question the value of review programs that cost just as much – or even more! – than the exam itself. While each person’s study needs are different, failing the exam can prove to be expensive in both the dollar cost in needing to sign up for the exam again, as well as the time cost of studying (not to mention the emotional distress one might experience, especially after investing so much time to prepare). With a general recommendation that exam takers study for at least 150 hours before the exam, the cost of failing would be at least $3,750 for someone who values their time at $25 per hour… and this does not even include the cost of the exam itself!

CFP Exam Review “Pass Guarantees”

Another differentiating feature between exam review programs is the various offers available for students who enroll in review programs but who don’t pass the actual CFP exam.

Notably, though, not all ‘guarantee-to-pass’ offers are the same; they can, in fact, range from the option to retake the review program at no cost if the student does not pass the CFP exam on their first attempt (e.g., Barrister, Boston Institute of Finance/Danko’s Signature Exam Prep, College For Financial Planning/Kaplan’s Premium Review, and Wiley) with no provision to return money already paid, to a full refund of the cost of the review program (e.g., Dalton’s Guarantee to Pass Review).

These guarantees do come at a cost, though, as programs that offer them are generally more expensive than those that do not. And for those ready to invest their time and energy into a CFP Exam Review program in the first place, ostensibly they’re committed enough to study and pass that the risk of not passing is diminished already. Though, on the other hand, some test-takers prefer CFP Exam Prep providers that have some ‘skin in the game’ themselves (as the provider shares in the financial risk if the CFP Candidate does not pass!).

How To Choose The Right CFP Exam Review Program For You

With more than 20 different options available, the number of CFP exam review programs to choose from can seem overwhelming, which often leads to haphazard internet searches or scanning forums like Reddit’s r/CFP for tips on who used (and passed with) which program. But exam takers can take a methodical approach to determine which of the differentiators among the programs are most important for them in particular, and then narrow down the field of possibilities among the available review programs.

At the same time, ‘à la carte’ study materials are also available for exam takers who are extremely budget-conscious, and for those who want to mix and match review questions from different exam review providers. Prospective exam takers can use the flow chart below to help them decide which review program(s) are most appropriate for their individual situation.

The first step is to decide whether to take a synchronous or asynchronous program. Factors to consider in this decision include whether the exam taker wants the structure and commitment of an in-person (or live virtual) session, or if they need the flexibility that asynchronous options provide. After all, if the reality is that the CFP candidate needs in-person instruction and a classroom setting to really focus and learn, a more-expensive synchronous in-person program that results in passing is still better than a less-expensive, self-directed program that is doomed to fail one’s personal study habits (or struggles thereof).

From there, exam takers can narrow down their choices by the specific features that are most important to them (e.g., location for live classes, the availability of one-on-one guidance, and whether the program comes with a Pass Guarantee).

A more detailed discussion of these factors follows in the sections below.

Choosing Between Synchronous Vs Asynchronous Lecture Formats

The first main choice for prospective CFP exam takers is whether they want to pursue a synchronous or asynchronous CFP exam prep offering. For individuals who want (or need) the structure of a live session and who have flexibility in their schedule, an in-person session can be a good choice.

Example 1: Polly Procrastinator knows that if she is not forced to attend review sessions on certain dates, she will put off studying until it is too late. She has plenty of vacation days to take off, and lives in a major city.

She decides that a synchronous in-person exam review program would work best for her, and thus narrows her choices down to Barrister Higher Learning, Brett Danko, or Zahn Associates.

For those with less flexibility in their schedule or ability to travel, a livestreamed virtual review session might be more appropriate. This allows the exam taker to get the benefits of a live session (including the ability to ask questions and to attend a structured class schedule) without the logistical rigidity of physically being in the right place at the right time for the in-person program.

Example 2: Pete Parent has child-care responsibilities and cannot take off four consecutive days to attend an in-person review class in another city.

He believes that a synchronous virtual review class would be his best choice, so that he can ask questions during the lectures, but still be able to watch recordings of the sessions later if he needs to miss one of the days.

Based on this, Pete narrows down his options to Boston Institute of Finance/Brett Danko, Brett Danko’s Virtual Live Review, College For Financial Planning/Kaplan, Dalton, Florida Atlantic University, JR Financial Group, Wiley, and Zahn Associates.

For exam takers who want maximum flexibility in when and where they view the instructor-led sessions, an asynchronous option (where CFP exam materials are simply available to study on-demand) could be the best choice. Taking an asynchronous review requires personal organization and discipline from the exam taker, though, as they will not be bound to finish pre-study material or view the lessons by any particular time.

They also will not be able to ask questions during the review sessions, so they should be confident in their ability to find answers on their own.

Example 3: Confident Crystal has strong study habits but is unsure of what her schedule will look like in the months leading up to the CFP exam. She also wants the option to watch video lectures in smaller one-hour chunks that she can manage around her busy schedule.

Crystal decides that an asynchronous option with instructor lectures is for her and chooses to sign up for Wiley’s Silver course.

Notably, the simple reality that some test-takers need to find a live-instruction synchronous program, while others may need to pursue an asynchronous self-study program based on their personal availability, is why it’s important to start with this factor first. And in practice, simply choosing between synchronous and asynchronous, and in-person versus virtual programming, can already winnow down more than half of the available CFP exam prep providers.

Other Important Features: Group Size, Guarantees, And Cost

Once the prospective CFP exam taker has made the decision to take a synchronous or asynchronous program, they can then consider other important features to help them choose the best CFP exam review program for their needs. As while some exam takers might prioritize the option to have additional live review sessions in smaller groups, others might find a guarantee to pass the exam to be important in their selection of a review program.

Cost will also be an important consideration, as the review programs generally increase in cost with more personal interaction with instructors and better guarantees. Though again, if the reality is that a prospective CFP candidate cannot manage a self-study process on their own, a more expensive live in-person program is better than a cheaper one that results in a failure instead of a pass!

Example 4: Nervous Nathan has signed up to take the CFP exam and, previously having failed the CFP exam once before, wants to do all he can to pass this time around.

He believes that he would benefit most from a synchronous livestreamed review program with significant opportunities to ask the instructor questions and one-on-one guidance available. Additionally, while the initial cost of the program is not a concern for him, he is nonetheless worried about not passing again, and wants the option to retake the review course for free if he fails the exam again this time.

Thus, Nathan considers synchronous programs that allow students to retake the course for free if they don’t pass, including Boston Institute of Finance/Brett Danko’s Signature Review, College for Financial Planning/Kaplan’s Premium Review, or Dalton’s Guarantee to Pass Review.

The No-Lecture Alternative

While the core part of most CFP exam review programs is the instructor-led live or recorded sessions, some exam takers might be most interested in taking a self-study approach using printed review materials and practice questions without the lecture component. This could be because they learn best by reading or repeatedly solving practice questions. Other exam takers might be especially budget-conscious, and choose these resources simply because they can be significantly less expensive than taking an all-in-one program (and if a more in-depth program simply isn’t economically feasible, ‘some’ CFP exam preparation materials that are affordable may be better than none at all).

In practice, some comprehensive CFP exam review programs offer stripped-down alternatives that include review textbooks, question banks, mock exams, and study plans, but without the lecture component. For example, the Essential Review package from College for Financial Planning/Kaplan and the CFP Self-Study Course from Wiley Efficient Learning are less expensive than the company’s full programs that include instructor-led review sessions.

Exam takers can also choose to purchase review materials and practice questions separately. This could be useful for an exam taker who knows exactly what they will need to study (e.g., someone who may need to get stronger on tax or estate planning in particular) and who has the discipline to follow through. These resources could also be useful for exam takers who are already in a comprehensive program, but want to review with even more questions from another source. For example, Dalton, Wiley, and Zahn Associates offer written study materials à la carte, and Boston Institute of Finance and Pocket Prep, among others, have question banks for purchase.

Example 5: Bonnie Bookworm learns best by reading material and applying it through questions and is confident in her knowledge of the exam material.

She decides to purchase Wiley’s CFP Study Guide, as well as question sets and mock exams from multiple sources (such as CFPQuestions.com or PocketPrep). This will allow her to refresh herself on the topics on the exam and review weaker areas using the practice questions.

Notably, CFP Board provides an extensive list of free exam preparation resources. These include an exam preparation checklist, a toolkit to help you map out a study strategy, an online forum for discussions with other exam takers, and an exam candidate handbook that has all of the logistical details exam takers should be aware of in advance of test day. The forum is particularly helpful for learning about the experiences of those who have previously taken different exam review programs and the exam itself.

CFP Board also offers two mock exams, with many of the questions having appeared on previous CFP exams. One mock exam comes free with registration for the CFP exam and the second can be purchased for $249 (as of November 2021). Regardless of whether an exam taker chooses to take a review program, CFP Board-provided resources can offer a helpful framework for approaching the exam.

List Of CFP Exam Review Providers

Below is a list of providers that offer CFP Exam review programs and materials:

Instructor-Led Reviews

Boston Institute of Finance/Brett Danko

Brett Danko Educational Center

College For Financial Planning/Kaplan

Written Review Materials And Question Banks

Brett Danko Educational Center

College For Financial Planning/Kaplan

Ultimately, there is no single best CFP exam review program that will be suitable for all exam takers. Given the wide range of programs available, it is up to the individual to consider their preferred learning styles, schedule, and budget and choose a study option accordingly.

While there is no guarantee that an exam taker will pass the CFP exam after taking a review program, the structure, body of knowledge, and practice that these programs provide can improve the quality and efficiency of the strategy the exam taker chooses when preparing for the exam. At the end of the day, the most important thing is to pass the CFP exam itself, no matter what path is taken to get there!

Thank you for this comprehensive, informative yet skillfully unopinionated review. Exactly why I’ve subscribed to Michael’s blog for years (I’m CFA+FRM but not CFP although I took the entire course, including the superfun capstone case study, but I didn’t sit for the exam). FYI, Dalton begins live instruction (in 10 cities) starting Jan 2022. This is on our (their) website at https://dalton-education.com/ . So I believe Dalton deserves a check mark also in the first column. (Disclosure : I run bionicturtle.com which is also a CeriFi company). I hope that minor correction is helpful to your audience. Thank you again!

https://uploads.disquscdn.com/images/ef4834939625e2488e347465af3774ac8d424fd152c1a6be2d7ddaabf625ded2.jpg

Hi bionicturtle, thanks for your gracious comment and for letting us know about the live class offering. We have updated the graphic.