Executive Summary

Late last night, the House Ways and Means committee came to an agreement for key legislation to renew the so-called “Tax Extenders”, a series of tax provisions that have lapsed and been reinstated (i.e., “extended”) repeatedly over the past decade. The new legislation, entitled the Protecting Americans from Tax Hikes (PATH) Act of 2015, will once again retroactively reinstate for 2015 the tax extenders that were renewed for and then expired at the end of 2014.

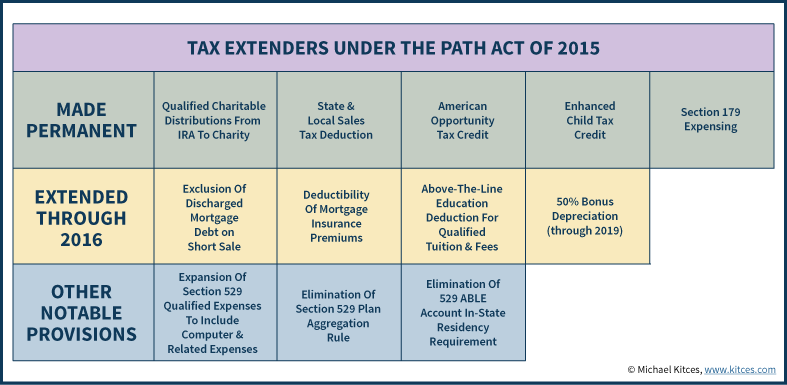

Unlike past tax extenders legislation, though, this time many of the provisions are permanently renewed. From the popular qualified charitable distribution (QCD) rules for making charitable contributions from an IRA for those over age 70 ½, to the American Opportunity Tax Credit for college, and the deduction for state and local sales taxes, this will be the last time that these key tax planning provisions remain in an end-of-year limbo!

However, not all tax extenders provisions were made permanent; a few, such as 50% bonus depreciation for businesses and the work opportunity tax credit, are only extended a few years. The legislation also includes a few new “tweaks”, from a slight expansion of how qualified distributions from section 529 plans can be used, to the elimination of in-state-plan requirement for the coming new 529-ABLE plans for disabled beneficiaries.

Although the PATH legislation has not quite passed yet – it still needs to be Omnibus Appropriations legislation that sets the government’s budget through September 30 of 2016 – the tax extenders expected to pass in its agreed-upon form in a matter of days, once the remainder of the rulemaking process is completed.

And notably, the final version of the Omnibus legislation will not include any changes to the Department of Labor’s fiduciary proposal, which remains intact and on track for the DoL to issue its final year in the coming months!

(Michael’s Note: This article will be updated throughout the day and week if/when/as any further changes occur to the legislation and the process of passing it into law. Stay tuned and check back for further updates as this is still not fully enacted “final” legislation.)

Summary Of Key Tax Extenders Under H.R. 2029, The Protecting Americans from Tax Hikes (PATH) Act Of 2015

In its final form, H.R. 2029 – also known as the Protecting Americans from Tax Hikes (PATH) Act of 2015 – retroactively reinstates and extends a wide range of individual and small business tax planning provisions that had previously expired at the end of 2014. An early projection from the Committee for a Responsible Federal Budget, based on prior scoring from the Joint Committee on Taxation, estimates the financial impact of the legislation at approximately $650B over the next 10 years (plus another $130B of interest on that debt).

Notably, unlike prior versions of the tax extenders legislation, the PATH Act will temporarily reinstate some provisions but permanently extend others. A list of the key provisions and changes is noted below.

(For a full list of the provisions, see the Section-By-Section Summary Of The PATH Act from the House Ways and Means Committee and the associated legislative text.)

Qualified Charitable Distributions (QCD) Directly From IRAs To Charities Made Permanent

Since 2006, taxpayers who are over age 70 ½ have been permitted to make a “Qualified Charitable Distribution” of up to $100,000 directly from an IRA to a charity. The contribution to the charity is not claimed as a tax deduction, but the distribution from the IRA is not taxed in income in the first place either, making it a “perfect” pre-tax charitable contribution. And the QCD counts towards the taxpayer’s Required Minimum Distribution (RMD) obligations, which would apply given that he/she must already be over the age of 70 ½. The QCD rules had lapsed at the end of 2014.

The new PATH tax extenders legislation makes the Qualified Charitable Distribution (QCD) rules permanent, at their existing levels and thresholds (still capped at $100,000 per taxpayer, and still must be over age 70 ½ at the time of the distribution).

For those who as I suggested had completed a QCD earlier this year in anticipation that the rules would be reinstated, this outcome ensures that they will receive favorable treatment. Any taxpayers who have already taken their Required Minimum Distribution for 2015, though, will not be able to “undo” their RMD to complete a QCD at this time, as it is not permitted to do an IRA rollover of an RMD to put it “back” in the IRA, and simply taking the proceeds of an RMD and contributing it to a charity does not qualify as a QCD (the distribution must have been done directly from the IRA to a charity); instead, the taxpayer will simply receive a normal charitable deduction that will hopefully at least mostly offset the tax impact of the RMD.

Notably, though, from a tax perspective it is still better to donate appreciated securities instead of doing a QCD for charitable giving in most cases; those who still want to donate appreciated securities this late in the year may wish to establish a donor-advised fund to facilitate the process given limited time.

State And Local Sales Tax Deduction Made Permanent

Each year, taxpayers may claim an itemized deduction for either the payment of state income taxes in the calendar year, or the payment of state sales taxes instead. The state sales tax deduction can be determined by adding up the actual state sales taxes paid (and validated by receipts), or the IRS provides a sales tax deduction calculator that provides an “estimate” that can be claimed as sales taxes paid based on the taxpayer’s income and zip code.

Generally, taxpayers will claim whichever amount is higher – state income taxes paid, or state sales taxes paid (based on receipts or the IRS estimate methodology) – to produce the largest deduction on Schedule A.

Notably, given that sales taxes apply only to goods that are purchased, while state income taxes apply to all income in the year, the state income tax deduction is typically higher in any states that have an income tax, and the state sales tax deduction is usually only claimed by those who live in states without an income tax (i.e., Florida, Texas, Nevada, South Dakota, Alaska, Washington, and Wyoming).

The new PATH tax extenders legislation makes the state and local sales tax deduction permanent. This change will primarily benefit those who itemize their deductions, and live in one of the aforementioned seven states that have no income tax (though individuals with low income and high expenses in other states, including retirees liquidating investment accounts in retirement, may still find the state sales tax deduction appealing).

Enhanced American Opportunity Tax Credit Made Permanent

In the past, college students were eligible for an $1,800 Hope Scholarship Credit for tuition and related expenses in the first two years of post-secondary education (and after the first two years, students and their families would claim the less-favorable Lifetime Learning Credit, which applied once per family tax return even with multiple children in school). The Hope Scholarship credit phased out at an Adjusted Gross Income of $96,000 (for married couples; $48,000 for individuals).

In 2009 under the American Recovery and Reinvestment Act, the Hope Scholarship Credit was changed to become the American Opportunity Tax Credit, expanding the credit to $2,500/year, allowing it for up to four years of post-secondary education, and raising the AGI phaseouts to $160,000 for married couples (and $80,000 for individuals).

The American Opportunity Tax Credit was scheduled to lapse (and revert back to the ‘old’ Hope Scholarship Credit) at the end of 2017.

The new PATH tax extenders legislation makes the American Opportunity Tax Credit permanent.

Enhanced Child Tax Credit Made Permanent

The child tax credit is a $1,000 credit available for each “qualifying child” in the household (for U.S. family members under age 17 who live with the taxpayer, are claimed as dependent children, and who do not provide for more than half of their own support). It phases out as (modified) Adjusted Gross Income exceeds $110,000 (for married couples, $75,000 for individuals).

For lower-income individuals, who do not even have a $1,000 tax liability, the child tax credit becomes a refundable credit (called the “additional child tax credit”) for 15% of earned income over a threshold amount. In the past, the threshold amount was $10,000 and annually indexed for inflation (it would have been approximately $14,000 in 2015), but since 2009 the threshold amount was reduced to $3,000 (and not indexed for inflation). It would have lapsed back to $3,000 at the end of 2017.

The new PATH tax extenders legislation makes the $3,000 threshold permanent for calculating the additional refundable portion of the child tax credit.

Example. For a lower income couple that has earned income of only $15,000 per year and no tax liability (due to the standard deduction and personal exemptions), the enhanced child tax credit makes it possible to receive the entire child tax credit of $1,000 (since $15,000 of earned income is $12,000 over the threshold, and 15% of $12,000 is more-than-enough to permit the $1,000 credit); under the “old” rules (were they to have been reinstated after 2017), a couple earning $15,000 would have only received less than a $150 child tax credit (15% of the $1,000 excess of their earned income over the $14,000 threshold which would have been higher with inflation indexing by 2018).

Schoolteacher Expense Deduction Enhanced And Made Permanent

Elementary and secondary school teachers are eligible for an above-the-line deduction for schoolteacher expenses, up to $250/year. This provision was scheduled to lapse at the end of 2015.

The new PATH tax extenders legislation makes the educator expense deduction permanent. In addition, the legislation also indexes the $250 cap for inflation beginning in 2016 (but rounded to the nearest $50, so the first increase may not happen until subsequent years), and also beginning in 2016 expands the eligible schoolteacher expenses to include professional development expenses in addition to in-classroom schoolteacher supplies.

Exclusion Of Discharged Mortgage Debt On Qualified Principal Residence Extended Through 2016

Under normal tax rules, when a taxpayer’s indebtedness is discharged (not pursuant to total insolvency), the cancelled debt is treated as taxable income. Thus, for instance, in scenarios where a taxpayer engaged in the short sale of an “underwater” residence (e.g., where the $300,000 mortgage exceeds the $250,000 value of the property), the “excess” debt that is discharged in the transaction would be taxable income (the taxpayer would have to report the $50,000 difference in income at the end of the year!).

To provide some relief for this situation as the real estate market started to decline (accelerated by the financial crisis), the Mortgage Debt Relief Act of 2007 changed these “cancellation-of-indebtedness income” rules to stipulate that up to $2,000,000 of cancelled debt associated with the mortgage of a primary residence could be discharged without tax consequences. However, this provision had expired at the end of 2014 (after having been reinstated for that year).

The new PATH legislation extends the discharge of mortgage debt on a qualified principal residence rules through the end of 2016 (but not permanently), and also provides that debt discharged in 2017 will qualify as long as it occurs pursuant to a written agreement entered into in 2016.

For those who engaged in the short sale of a home this year, the new provision will be a welcome (retroactive) relief. Anyone who is still facing an underwater mortgage and considering a sale of the primary residence in the future may still wish to consider whether to complete the sale in 2016 (or at least, enter into a contract to sell in 2016) to avoid potentially unfavorable tax consequences in 2017.

Deductibility Of Mortgage Insurance Premiums As Qualified Residence Interest Extended Through 2016

For those who pay mortgage insurance premiums (e.g., private mortgage insurance [PMI] for a mortgage that had a less-than-20% downpayment), current law has permitted those individuals to deduct the mortgage insurance as though it was interest on mortgage debt, as long as the mortgage was taken out after 2006 and was acquisition debt for the primary residence. The rule could even apply to mortgage insurance premiums for a reverse mortgage in limited scenarios.s

This mortgage insurance premiums deduction began to phase out once Adjusted Gross Income exceeded $100,000 (and was fully phased out at $110,000).

The new PATH legislation extends the mortgage insurance premiums deduction for qualifying mortgage insurance premiums through the end of 2016.

Above-The-Line Education Deduction For Qualified Tuition And Fees Extended Through 2016

For those with children in college, an alternative to claiming the American Opportunity Tax Credit or the Lifetime Learning Credit is to claim the “above-the-line education deduction” instead. This rule permits the deduction of up to $4,000 of tuition and related fees for an eligible student (generally, the taxpayer and his/her spouse or dependents). This $4,000 tuition-and-fees deduction is reduced to only $2,000 for married couples with AGI in excess of $130,000 (or individuals over $65,000), and is fully eliminated once AGI exceeds $160,000 for joint filers (or $80,000 for individuals).

In practice, the above-the-line education deduction is rarely claimed, because the deduction only provides a benefit based on the taxpayer’s marginal tax rate (which at these income levels would often be no more than 25%), while the American Opportunity Tax Credit is a $2,500 dollar-for-dollar credit at similar income levels (and “coordination” provisions prohibit taxpayers from claiming both in the same year). And both fully phase out at the same income thresholds.

Nonetheless, the new PATH legislation extends the above-the-line tuition and fees education deduction through the end of 2016.

Other Miscellaneous Tax Extenders Provisions Of The PATH Act Of 2015

Although not germane to most financial planners, other notable provisions extended or made permanent in the PATH legislation includes:

- Section 179 Expensing. The favorable Section 179 expensing limits, including the $500,000 maximum deduction amount and the $2,000,000 threshold for phasing out the deduction, are retroactively reinstated for 2015 (after having been reinstated and then lapsed at the end of 2014) and is made permanent. Special rules allowing expensing deductions for computer software and certain qualified real property are also made permanent. In addition, the new rules index the $500,000 maximum deduction and the $2M phase-out threshold for inflation beginning in 2016.

- 50% Bonus Depreciation. The rules are reinstated for 2015 and extended at current levels through 2017. In 2018 the bonus depreciation rules will continue but as 40% bonus depreciation. In 2019 the 40% will be reduced to 30%. Bonus depreciation would then end altogether after 2019.

- Work Opportunity Tax Credit. The work opportunity tax credit is extended through 2019 for businesses who hire certain targeted groups, including veterans and under the new legislation also qualified long-term unemployed individuals (those unemployed more than 27 weeks). The credit can be as much as $9,600 (which is 40% of the first $24,000/year of wages) for hiring of certain groups.

- Section 1202 Small Business Stock Capital Gains Exclusion. The favorable rules to exclude capital gains on qualifying small business stock acquired and held for more than 5 years under IRC Section 1202 is made permanent. The rules that eliminates such gain as an AMT preference item (allowing the favorable treatment to be preserved even for those subject to the AMT) is also made permanent.

- Qualified Conservation Contributions. Favorable rules allowing for the charitable deduction of contributions of real property for conservation purposes is made permanent.

Other Notable "Tax Extender" Provisions Of The PATH Act Of 2015

In addition to the “tax extenders” discussed above, the PATH Act of 2015 also includes a few additional changes that were included. Notably, many looming “crackdowns” on popular planning strategies, from eliminating GRATs and dynasty trusts to preventing the Roth conversion of after-tax dollars (which would have killed the “backdoor Roth contribution” strategy), do not appear in the legislation.

A few notable changes that were included are:

Improvements To Section 529 Accounts

Under new rules, qualified higher education expenses will now include computer equipment and related expenses (including computer software and even internet access), permitting distributions for such expenditures from a Section 529 plan to still qualify for tax-free treatment.

Also changed under the new rules is the elimination of the Section 529 plan aggregation rule, which required all 529 plans under IRC Section 529(b)(3)(D) to be aggregated together to determine the amount of each distribution that would be return-of-principal versus gain. Under the new rules, each 529 account distribution is taxed based only on the gains and principal in that account. For qualifying tax-free distributions from a 529 plan, this provision is a moot point, but would be relevant for those making a non-qualified distribution (taxable as ordinary income plus a potential 10% early/non-qualified withdrawal penalty for any "gains" in excess of original after-tax contributions).

In situations where there is a non-qualified distribution, it would be most desirable to specifically choose the account with the smallest gains and largest after-tax contributions (basis) relative to the size of the account. Conversely, for those who anticipate there may be non-qualified distributions in the future (e.g., it appears that the 529 plan is "over-funded" and may have an excess to liquidate as a non-qualified distribution at the end), this new account-by-account rule means qualified withdrawals should occur from the account with the largest gains and smallest basis relative to the size of the account, to whittle down exposure to potential non-qualified withdrawals in the future. (Hat tip to Jeff Levine of Ed Slott & Company for this strategy of liquidating high-gain 529 accounts first to preserve high-basis accounts for future non-qualified withdrawals.)

In situations where a 529 plan distribution is used to pay college tuition that is subsequently refunded and thus not actually used for college (which would render the distribution ineligible for tax-free treatment after the fact!), the new rules will permit such amounts to be re-contributed (i.e., “roll over”) back to the 529 account within 60 days.

Expansion Of 529 ABLE Accounts To Use Any State Plan (Residency Requirement Eliminated)

The Section 529 ABLE account rules were created under the 2014 Tax Extender legislation, establishing a new type of tax-free savings account to be used not for college but for disabled special needs beneficiaries instead (and without disqualifying the beneficiary from most types of financial aid). The 529 ABLE accounts are generally intended to be a supplement for special needs trusts, or possibly a lower cost replacement for small trusts that can be costly to set up relative to their account balance.

Under the original rules, though, the beneficiary of the 529 ABLE plan would have been required to use the plan in his/her state of residence. The original provision was there to facilitate the fact that after the beneficiary’s death, there is a “Medicaid payback” requirement that the state be repaid from any remaining 529 ABLE balance for prior Medicaid expenditures on the beneficiary’s behalf. Each state was expected to have its own single plan for special needs beneficiaries in its state, and states had the option to subcontract out their own state’s plan to another state (but the beneficiary was still “stuck” with whatever plan his/her home state offered).

Under the new rules, the residency requirement for these tax-qualified 529A plans is eliminated, and individuals will be permitted to choose any state’s 529 ABLE plan (allowing them to have more control over investment options and expenses, and even the state-based maximum account limits).

Ultimately, the good news of this tax extenders legislation is that with permanence for most key provisions, the repetitive here-gone-back-again process of planning with these rules is eliminated. In other words, don't expect 2016 tax extenders legislation, because it isn't really necessary anymore! This should be especially helpful for rules like the Qualified Charitable Distributions from IRAs, which have been plagued for years with challenging scenarios where retirees needed to take their RMDs, wanted to do a QCD, but weren’t certain whether the rules would be reinstated in time to do it. And of noted earlier, the permanence of the 2015 tax extenders was done without the looming potential of other “crackdowns” that may have adversely impacted planning strategies for clients.

With the conclusion of this 2015 PATH Act legislation, we are likely “done” for any tax laws through the end of President Obama’s presidency. It is no longer even clear if Congress will take up tax legislation again next December in a lame duck session, given that so few provisions have a looming lapse at the end of 2016 anyway (and even then, they would more likely be allowed to lapse in 2016 and then taken up as potential retroactive 2017 tax extenders instead).

Nonetheless, while this may be the last substantial tax legislation under after the next election and inauguration, the stage is still set for potentially significant tax reform legislation coming in 2017!

So what do you think? Any "surprises" in the legislation for you? Any last-minute end-of-year tax planning opportunities you'll now be reaching out to clients about? Was there something you were hoping would be included that wasn't?