Executive Summary

Financial advisors may often work with clients struggling to implement changes recommended by their financial plans. For many of these clients, moving forward can be difficult for a number of reasons. Fortunately, the Transtheoretical Model (TTM) of change is a research-based framework that gives advisors strategies to use with their clients who may be resistant to change. While the first stage of TTM is Pre-Contemplation, where clients may not yet have the awareness that change is important to their plan, the second stage of the TTM of change is known as the Contemplation stage. In this stage, clients have acknowledged the need for change and are beginning to think about the action needed to implement change. Perhaps more importantly, they begin to consider their own ability to carry out that action and what the action actually entails behaviorally (e.g., saving more) and emotionally (e.g., cutting down on buying new shoes, ordering coffee, and planning expensive vacations).

Like the other stages of TTM, the Contemplation stage has specific hallmarks. For instance, clients in this stage tend to display behavior characterized by what are known as the “two D’s”, Doubt and Delay. Clients may get stuck in this stage because they Doubt they have the requisite ability or knowledge to implement change (e.g., they may think that they can’t understand finances or that they don’t know enough to actually tackle the actions required), which can end their progress moving forward. Clients in this stage may also tend to Delay their progress. While Delay can sometimes be attributed to Doubts, fear of the future is another common reason for clients to Delay. Those who are stuck in the Contemplation stage must resolve their issues with Doubt and Delay before they can successfully move on to the next stage of change.

Financial advisors seeking ways to work with clients stuck in the Contemplation stage may find that worksheet tools, adapted from original research by James and Janice Prochaska, can be a useful way to help clients overcome resistance and gradually move through the next stages of change to accomplish their desired goals. These worksheets focus on reducing the negative ‘cons’ that clients have associated with the change and that hold them back from moving forward. They also aim to emotionally activate the clients by helping them understand how the impact of their actions affects others around them. These tools offer an easier, systematic process, so there is less guesswork for the advisor when trying to figure out how best to help clients move forward into the Preparation stage.

Ultimately, the key point is that there is a systematic process of implementing change, and by applying the research that's based on TTM, advisors can better understand what specific issues their clients may be struggling with and help them overcome these barriers. Additionally, with the aid of TTM worksheet tools designed for use with financial planning clients, advisors can more easily facilitate client discussions exploring goals and challenges, and encourage their clients to move through the stages of change with greater ease and self-awareness!

The Transtheoretical Model (TTM) of change, developed by James Prochaska, John Norcross, and Carlo DiClimente, dissects the process of change into six stages, where each stage addresses the key characteristics of what people are most likely to experience and where their challenges lie. While clients in the first stage, Pre-Contemplation, may not yet recognize the need to change, those in the second stage, Contemplation, will often struggle with feelings of doubt and the desire to delay those changes.

Financial advisors with clients who are struggling to take action on their financial plans can use principles from TTM to help their clients overcome roadblocks. Most often, these clients will be in one of the first two stages of change. Clients who have moved beyond the Pre-Contemplation stage to the Contemplation stage can be encouraged to stay the course by understanding that these early stages of change do not involve any action (yet!).

‘Broken-Record’ Meetings: Clients’ Self-Doubt And Desire To Delay Changing

Thankfully, clients in the Contemplation stage of the Transtheoretical Model (TTM) of change generally don’t lie to their advisors as it may sometimes seem like they do in the Pre-Contemplation stage, where they promise to change with no intention to change. Instead, clients in this stage often get stuck, persistently demanding that the advisor promise some level of certainty about the outcome of the change (which advisors simply cannot do!) – to the point that it feels like having the same meeting over and over again, without moving forward.

This ‘broken record’ phenomenon tends to happen because of two common behaviors we see in this stage of TTM, known as the two ‘D’s’ of Contemplation: Doubt and Delay. To keep clients moving forward through the change process, advisors can address these two issues to help clients by reducing their reasons not to change and encouraging them to envision how their change will (or won’t) impact those around them.

Doubt Inhibits The Confidence We Need To Take Action

Doubt can be related to how we feel about ourselves and our capacity (time, knowledge, ability) to carry out the change. People in the Contemplation stage may believe that they are incapable of making a change (pure and outright doubt of their skill level or ability to procure the required resources) or they may not yet have full confidence in our ability to actually implement change, preventing them from even trying because they are convinced they will fail.

Even though we might think we can do it, there is still enough doubt in our mind that makes us want to stay where we are without taking action. We don’t want to risk trying, failing, and facing the possibility that we were not ‘good’ or skilled enough to do it. Staying right where we are, just generating ideas, can feel a lot safer than trying to change and failing once again.

Doubt may also be based on a lack of understanding; for example, a client may think, “I doubt I can save more. I can’t even figure out where my money is going now!” This is related to one of the main reasons people can’t commit to change in the Pre-Contemplation stage, which is because they don’t know how to (don’t underestimate the power of knowledge!).

Finally, people also commonly doubt that the change idea itself is actually appropriate for us, or whether the change is really worth the effort. For example, they may think, “I know I can save more, and some of that money I want to save could come from the money that I give to my kids, but I am not sure that is worth the fight.” Because for some clients, changing their behavior to save more is not worth the emotional turmoil they associate with the change!

Delaying Action Can Arise From Doubt… But Is An Important Aspect Of The Preparation Stage

Another interesting tendency that people have is to delay because delaying can feel good – it lets us put aside certain things we don’t particularly want to get around to doing (though we know we eventually need to do those things), leaving space to spend time on more enjoyable activities.

For instance, individuals might enjoy having positive aspirations while staying right where they are, feeling resistant against disrupting the status quo (and the associated ‘good vibes’), and taking steps to achieve the goals that are the target of their positive aspirations. As while it can be pleasant to cling to positive aspirations and hopes for change, not actually doing anything to act upon those thoughts allows us to continue to enjoy imagining the realization of those ideals without risking failure (which can be scary).

Additionally, delay naturally often arises from having doubts. If we have doubts about taking action, it is easy to put off moving forward. The tendency to delay in the Contemplation stage is quite nuanced, though, as the inability to move forward might involve some of the technical reasons that doubts arise (e.g., lack of resources, ability, knowledge), it can also be rooted in psychological concerns, such as fear of simply taking that first step into action.

Example 1: Larry doubts he can keep his spending within his planned budget because, while he has generated idea after idea for how he can control his spending, he is afraid that the moment he implements one of his ideas, he will fail and all of his painstaking efforts to plan and stick to a budget would have been for nothing.

As such, Larry delays making any changes at all, and instead just continues to be positive, clinging to an optimistic outlook by generating more clever ideas to reduce his expenses.

However, because his doubt has fueled his fear of failure, he delays taking action and never implements any of his ideas to actually change his spending habits.

Luckily though, according to TTM, the next stage of change after Contemplation is Preparation – not Action. Because in order to successfully implement change, it is important first to prepare for that change once the client is on board with the fact that they want to change. If clients don’t fully understand that they need not take immediate action after successfully contemplating the change (and that it’s okay – in fact, encouraged! – to pause and prepare to take action), delaying may be their natural response. Expecting a client to take action without giving the Preparation stage its full due can be equivalent to setting up the client for failure.

Furthermore, change research indicates that the biggest defense used as a reason not to change often involves the time commitment required to implement the change. Advisors have all heard from clients that they don’t have time to learn how to budget, make appointments with a CPA or Estate Planning Attorney, fill out paperwork, or read through their enormous financial plan.

The other way delay creeps in – and advisors likely see this one a lot – is in our quest for certainty. The need for certainty is a human one, and when we can’t have it, the natural thing to do is to maintain the status quo through delay. The trouble is, change and uncertainty are probably our only certainty!

Example 2: Gena knows she has to make changes to her estate plan. Each time she meets with her advisor, though, the meeting ends the same way…

Advisor: Okay, we have another great idea here for dividing your wealth and what needs to be done after you are gone. Tell me, when next week can you meet with the estate planning attorney?

Gena: Yes, I totally agree we have another ‘good’ idea. But I still need to think about it. My children... you just do not know them the way that I do. I really, really have to get this right. It has to be perfect and I am not going to get in front of the attorney until I have the perfect solution.

In the example above, Gena and her advisor are going to go around in circles generating solution after solution, but not implementing any of the ideas because Gena cannot get past her need to have the ‘perfect’ failsafe plan.

Contemplation To Preparation: Reducing Client Defenses And Identifying How Their Actions Impact Others

While one of the objectives in the Pre-Contemplation stage is about increasing positive reasons for change, the Contemplation stage shifts the focus to addressing and reducing the negative reasons against change. These negative reasons, emanating from Doubt and Delay, are often used by clients as excuses to defend their current actions, even when they want to change those actions. Accordingly, it is important to address and eliminate as many of these reasons as is practical so that clients don’t have so many defenses that they find it impossible to implement the desired change (especially when doubt is also on the table).

Reducing The ‘Cons’ That Clients Use As Reasons Not To Change

So how do you know how many of these negatively based ‘con’ defenses we need to address and help clients eliminate? As a rough guideline, advisors can tally the client’s pros (which can include the pros uncovered in the Pre-Contemplation stage) and then aim to maintain twice as many pros as cons. The proportion of pros versus cons is similar to other positive versus negative conditioning ratios you may have heard recommended before. For example, for every negative comment, we usually need three or four positive comments to counteract the negative.

Nerd Note:

Why this strange ratio for positives and negatives? Why is it not 1:1? Loss, pain, or insult feels much worse than a gain or compliment of the same magnitude. This inconsistency between gains and losses and how we feel about them is captured in work by Daniel Kahneman and Amos Tversky in their now very famous theoretical framework, Prospect Theory. And it means for the feel-good ‘pros’ to outweigh the feels-much-worse ‘cons’, we need a much more favorable ratio of pros to cons than just 1:1!

This does not suggest that all cons must be eliminated; some cons simply cannot be removed and are here to stay. That is okay. Selecting the cons to eliminate can be an opportunity to work with the client to better understand their financial planning priorities.

The reason that some cons cannot be eliminated is that when it comes to our beliefs about money, the things we believe run deep. For example, it is not uncommon for some people to believe that life insurance planning can be the actual cause of death; they may believe that figuring out and setting up life insurance needs will result in an untimely death, either because someone may have wanted the insurance proceeds enough to plot the insured’s death, or because perhaps that is just how the irony of life goes.

If a client is clinging to a particular ‘con’ as a reason not to change, it can be very hard to convince them to consider that change and it won’t really matter to the client if you agree with them or not. Nor would it matter to the client if you are able to offer rational reasons for abandoning the con they are clinging to. In the instance of the life insurance example above, an advisor might be able to convince the client that their belief is not very realistic, but it wouldn’t really matter that they were convinced or not, what does matter is being able to remove enough of the other cons (e.g., the insecurity of not knowing if their loved ones would have what they need in place in the event of an untimely death, or feeling that family members would fight over insufficient resources) to the point that the balance of the scale lies in favor of getting life insurance.

Clients who feel strongly about their particular money issue may be very resistant to the idea of changing their beliefs. While working to reduce the negative ‘con’ reasons that prevent clients from changing will obviously be less enjoyable than identifying the more positive ‘pro’ reasons and can even result in disagreements, it does not mean that the process has to involve a fight. If a client will not let go of a particular con, let them keep it and try for another one. Trying to force someone to give up their con will likely only cause them to dig in deeper – and again, not all of them necessarily have to be removed to tip the scales in favor of changing. So choose your battles effectively, let clients cling to certain cons, and move on.

Example 3: Frank, Sally’s financial advisor, wants Sally to save more money so that she can start funding her retirement.

Frank believes that Sally can save by giving up the trips she makes to Cabo three times a year. Sally refuses, saying that those trips are an important way for her to take time out for herself. Giving up trips to Cabo is a huge ‘con’ for Sally when it comes to her saving more for retirement.

Instead of fighting with Sally about Cabo (which would be the most logical place to cut spending in Frank’s mind), Frank decides he will start working on other areas where Sally can save and that she feels less strongly about.

Frank knows that Cabo isn’t worth the fight – there are many other ways to solve this problem and, although Cabo would be the most technically efficient answer, it is not the right answer for Sally to begin a long-term savings habit.

The example above illustrates that it does not really matter if the advisor thinks that a particular con needs to be eliminated; it is more important to identify the cons that the client will be willing to abandon. If the client is dedicated to a certain con, the advisor can let that one go and choose another to address with the client. It is, after all, really just a numbers game – advisors need not die on any one hill as there are always more to climb up and back down before they get clients to the Action stage!

Showing Clients How Their Refusal To Change Can Impact Others

In addition to helping clients reduce the number of negative cons that keep them from changing, advisors can also help clients in the Contemplation stage by helping them understand how their actions (and failure to act) affect more than just themselves.

Sadly, people won’t always change for themselves, but because we are social creatures, we will often be motivated to change for others. Accordingly, before asking a client to focus on what the change will do for them (which we began to do in the Pre-Contemplation stage), advisors can first ask them to spend some time and energy to think about what their change will do for others.

For example, a person might not stop smoking for their own benefit because they enjoy smoking, it helps to calm them down, and they may feel they don’t do it frequently enough that it’s a real hazard to their health. (Perhaps they limit their smoking to one cigarette when they have a beer or when they are out with friends). However, they might stop smoking when they think about the impact on their relationship with their children and/or grandchildren. Perhaps by quitting, they may have more energy to play with their grandchildren, or that their adult children (who previously hadn’t wanted their own kids to be around second-hand smoke) may actually let the grandkids visit for a change. Or maybe stopping would make them a better role model for their loved ones; instead of being considered a bad influence, their loved ones may be very proud of them (and even inspired by them!) for being able to quit smoking.

Worksheet Tools For Advisors To Help Clients Address Cons And The Impact Of Change On Others

Addressing the cons that a client may use as defenses against changing isn’t about arguing, aggressively confronting, or putting down the client’s opinions. It doesn’t help to point out how ridiculous some of the reasons that clients have against implementing change are (no matter how tempting it may be!). That would be like telling someone they are an idiot… and we don’t want to do that to our clients (or anyone else, for that matter!). Instead, the art of addressing cons is really more about helping clients to see their defense from a different perspective.

Exploring Client Defensiveness With Contemplation Stage Worksheets

Instead of telling clients that their perspective or thinking is flawed, advisors can be more helpful by encouraging the client to think about what they have just said to help them understand how their thinking fits (or doesn’t fit) into their desire to realize goals.

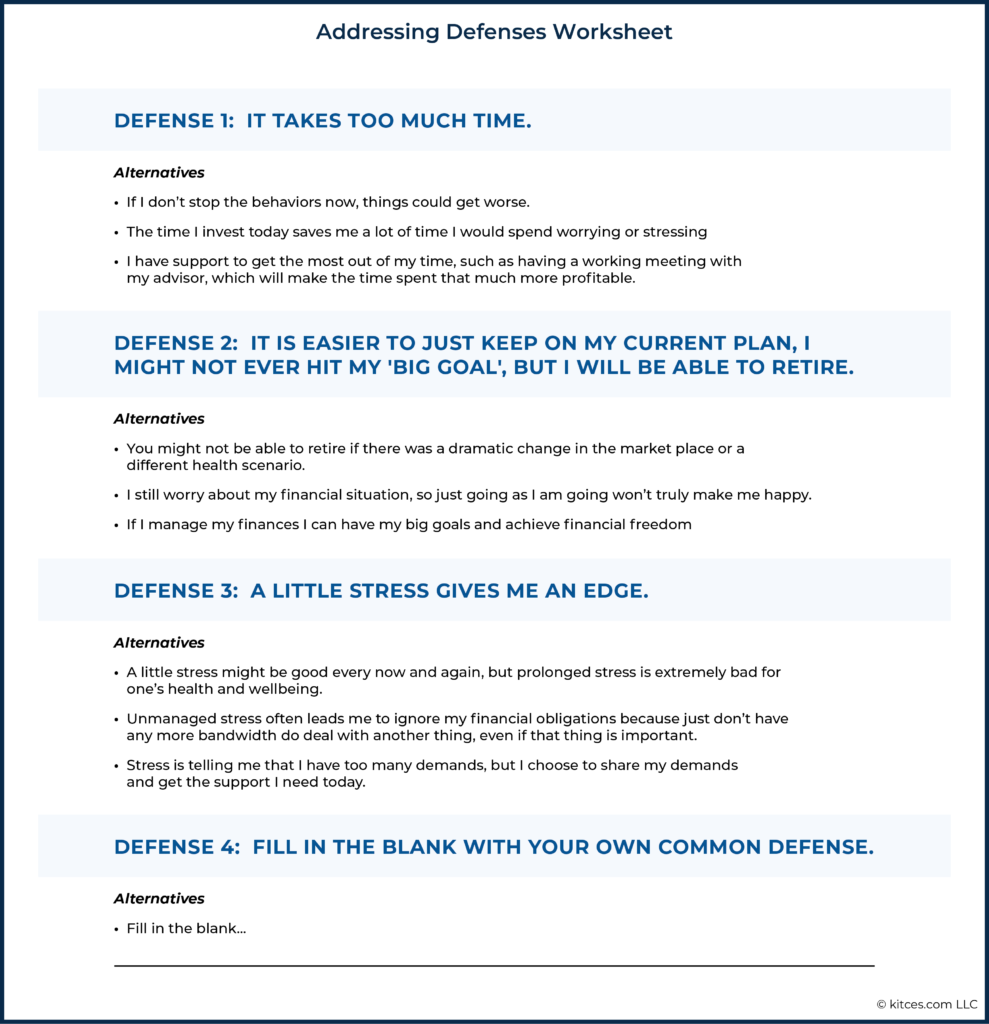

To facilitate these conversations, financial advisors can use a structured reflection exercise with the “Addressing Defenses” worksheet below, which research has shown works very well to help people address their own resistance.

Introducing Worksheets For The First Time During Client Meetings

If an advisor pushes a client too hard (often unintentionally), they can quickly become the enemy in their client’s eyes, which can result in more resistance. As such, this worksheet offers a list of common doubts and defenses that the advisor and client can go through together to better understand what situations and responses the client identifies with.

Remember, these exercises are not meant to change the clients’ minds! Instead, the worksheet delves into common defenses and is structured to make discussing defenses easier. Consider the following exchange for how to set this up.

Example 4: Frank, the Financial Advisor, and his client Sally are back at it, looking for areas where Sally can save more money.

While they have made progress, they still have a way to go. Frank has noticed that Sally is becoming increasingly more defensive about reasons not to save with each meeting. Thankfully, Frank reads the Nerd’s Eye View blog at Kitces.com and has a new idea.

During their next meeting, their conversation goes like this:

Frank: Hi Sally, welcome. Thanks for being here. I am really excited about our time together today.

Sally: Bah, well… I am not. More ‘fun’ spending cuts, here we come.

Frank: Sally, actually, I am glad you brought that up. I do not want to just dive into the budget today. We have been working really hard on that, and I think it is time for a breather. I want to spend today, if it is alright with you, learning more about you.

Sally: Okay…

Frank: I fully recognize that what you do and what you have done is hard. And I want to understand a bit more about how you are feeling about what we are doing and see if there are other ways to think about our work.

Sally: Well, if it does not mean making more cutbacks today… I am willing to give it a try. [Sally smiles.]

[Frank hands Sally the “Addressing Defenses” worksheet]

Frank: On this worksheet, you will find a list of common reasons why we struggle to move forward and why we doubt ourselves and even put up defenses. These are all natural things that people do, and I just want to understand which of these are more common for you. Let’s review this list and see what comes up as we talk about what does and does not resonate with you, one by one.

By providing an opportunity for the client to reflect on their reasons for resisting change, the advisor helps the client adopt a new perspective about resistance without actually encouraging more resistance to arise! And, as an added benefit, advisors may find that the client really enjoys the process of engaging with you and is open to discussing how a new viewpoint can be interesting or at least worth considering.

Reviewing this worksheet can be a good opportunity to explore the personal defenses they find themselves using and how they might replace those with alternative messaging included on the worksheet, or their own new reasons they provide and add to the list.

For instance, if Frank, the financial advisor in the example above finds that his client Sally seems to want to engage in reviewing the worksheet, he could ask her to think about their budgeting project specifically, to explore what doubts and defenses commonly come up for her when they talk about spending cuts.

How Normalizing Change Can Help Clients Move Forward

Another way to introduce the use of worksheets in practice with clients, especially for firms that haven’t used them with clients before, is by normalizing the process in the first place. By communicating the idea that change is hard, advisors can move on to stress that, because their firm understands how the difficulty to implement change is normal for clients, they utilize specialized worksheets designed to help clients see – and discuss – the change in new ways.

Example 5: Frank, the Financial Advisor, is meeting with his client Deborah who has come to see Frank for help with her estate planning after a divorce.

Frank: Awesome, we have quite the list of possible solutions. Where do you want to start? What seems to jump out as the most doable?

Deborah: Um, none?

Frank: Tell me more about what you mean by none.

Deborah: Well, I mean… we keep coming up with ideas, different technical and different emotional things we are trying to accomplish, but I haven’t found one yet that I really think I can do. I do want to update the estate plan, but I am really afraid of screwing up and ending up in a worse situation even compared to now – being divorced is just horrible, and I cannot take any more stress and failure right now.

Frank: Thank you for sharing that with me; if I hear you correctly, there is a lot of doubt floating around right now, and the desire to delay until that doubt is resolved is important.

Deborah: Yes, I want to make a change. I mean, that is why I am here. I have tried to change and think through what all needs to be done now that the divorce is finalized. But on my own, and I just can’t – I am getting professional advice because I clearly need it!

Frank: Well. I am glad you are here, and we are going to work together. If you don’t mind, I think it is important for you to know that I believe your being here means you are capable of change. Change is a process, and change is really hard. People say it is constant, and they don’t say that it is easy. And, as you note, you are already making some changes simply by being here.

Deborah: Yeah, I guess in some ways that is true.

Frank: That being said, I want to suggest something. At our firm, we do recognize that change is really hard, and, to that end, we have started using worksheets with clients that focus on different steps in the change process or, as I like to think of it, the change evolution. Like grief or even learning, change too has a common flow to it, and the worksheets help us to systematically address different things people need for change. It is pretty cool and has been really helpful for a number of clients. I have even used them myself. Would you be interested in giving it a try?

Deborah: Well, you are the professional…if you think it will help. It's just a worksheet; it probably can’t hurt. Sure, let’s try it.

[Frank gives Deborah the worksheet]

Frank: The first worksheet is about our natural defenses. We all have them, and we all do them – you actually even mentioned a common one, the fear that things could get worse. And while these beliefs may sometimes be true, they are not always true, and there might be other ways to see the concern. This “Addressing Defenses” worksheet will just help us talk in greater detail about how you are thinking and feeling – it helps me know how to support you. Let’s just start with number 1… “Taking too much time”. Do you ever find yourself saying that?

Deborah: Ha, yeah. I mean, that is what actually held me back from just calling an advisor out of the gate. I just thought working with you and all the paperwork you would make me do that the process of doing anything would just take so much longer.

Frank: Okay, now let’s look at these alternatives. Do any of these alternatives feel like other ways you think about that belief?

[Frank and Deborah continue talking as they more deeply explore Deborah’s reasons for resistance]

Using Worksheets With Clients Already Familiar With The Process

If you have used worksheets before – such as worksheets for clients in the Pre-Contemplation stage – the advisor can simply explain that this is the next stage of the process and introduce the worksheet using a dialogue similar to the one in the example below. There are no right or wrong answers or responses; it is just about creating a space and structure for an open dialogue.

Example 6: Frank, the Financial Advisor, is meeting with his client, Carol. In previous meetings over the past few months, Frank recognized that Carol was in the Pre-Contemplation stage and was struggling to accept that she needed to diversify her portfolio.

But by working with Pre-Contemplation worksheets to fuel conversations about her resistance, Carol is now open to the idea of letting Frank help her diversify her investments; she feels this is something she can do to set a good example for her children. However, she is still doubtful about the process and is uncertain about whether she can really achieve her greater goal of being a good role model for her kids.

Frank believes that Carol has successfully moved out of the Pre-Contemplation stage and is now in the Contemplation stage. He decides to try using the “Addressing Defenses” worksheet. Here is how their conversation goes.

Frank: I’m really glad we have been brainstorming again in this meeting. You are great at coming up with possible solutions, and I love scenario planning. Yet, I also want us to give some of these solutions a go – we can keep brainstorming, but I am interested in also putting together a plan. I am not saying that we need to take action just yet – but let’s get pen to paper and map out one of these ideas. Let’s commit to something and see what it would look like from start to finish.

Carol: Yeah, but the reason we keep brainstorming is that we still haven’t found answers I am comfortable with. I have doubts about my ability to carry out certain ideas. I don’t want to fail. And besides, I…I am not heading toward total financial ruin on my current path. I will agree with you that things could be better, but they could totally be worse. Like what if we choose the wrong way forward, and we are in a worse spot than we are now? What would my kids think of my ability to take care of my finances?

Frank: If I am understanding you, and correct me if I am not, you are feeling a lot of doubt, and that doubt is naturally leading to delay.

Carol: Yeah. I do have a lot of doubt, but I can’t say that I see myself as purposefully delaying. I mean, that is why I am here, to change. Again, I just don’t think we have the right solutions.

Frank: Well, how about this? Do you remember when we used those worksheets to talk about why the change was important?

Carol: Yeah, I found those conversations enlightening. They did help move me forward in some way… I mean, I realized how important it is for me to be a role model for my kids, but I clearly still haven’t made any changes I committed to making. But I want to work on those things.

Frank: Well, making change – putting our plans into action – we are not there yet, so let’s just take that off of the table for now. If you are open to it, though, I do have some more worksheets to help us think through and reflect on some of the things we are wrestling with right now, those feelings of doubt and their relationship with delay. Would you be interested in giving it a go?

Carol: Sure. I mean, we are just brainstorming. No harm can come from brainstorming … let’s try it.

Frank gets out the “Addressing Defenses” worksheet and hands it to Carol. They start to go through the common defenses – some related to finances and some to other areas of Carol’s life – and just talk about how the alternative suggestions do or do not make sense to Carol.

The result of any of these conversations, no matter how they start, is simply to get the client to see their own doubt and their own defenses in a new light. Again, it does not help to argue with the client over a defense or a doubt, but if they see alternate perspectives for themselves – many times, they will realize how unhelpful and even illogical their original beliefs are.

While clients probably won’t totally let go of their original beliefs, raising awareness of new perspectives may reduce their resistance and help them become more receptive to ideas about moving forward. Advisors cannot make clients stop doubting or defending; they can only show the client that doubt and defensiveness do surface and, through nonjudgmental conversations, give the client an opportunity to talk themselves out of clinging to their inhibiting beliefs.

Furthermore, this may take time. Some clients may let go of something right away; others won’t let go of anything for a while yet. The goal is really to have them contemplating and seeing their behavior for themselves. Clients do not want to be argumentative and go against your advice; after all, they know your advice is why they are paying you. Even so, change will always remain difficult. Clients will eventually get there, but it will not happen overnight.

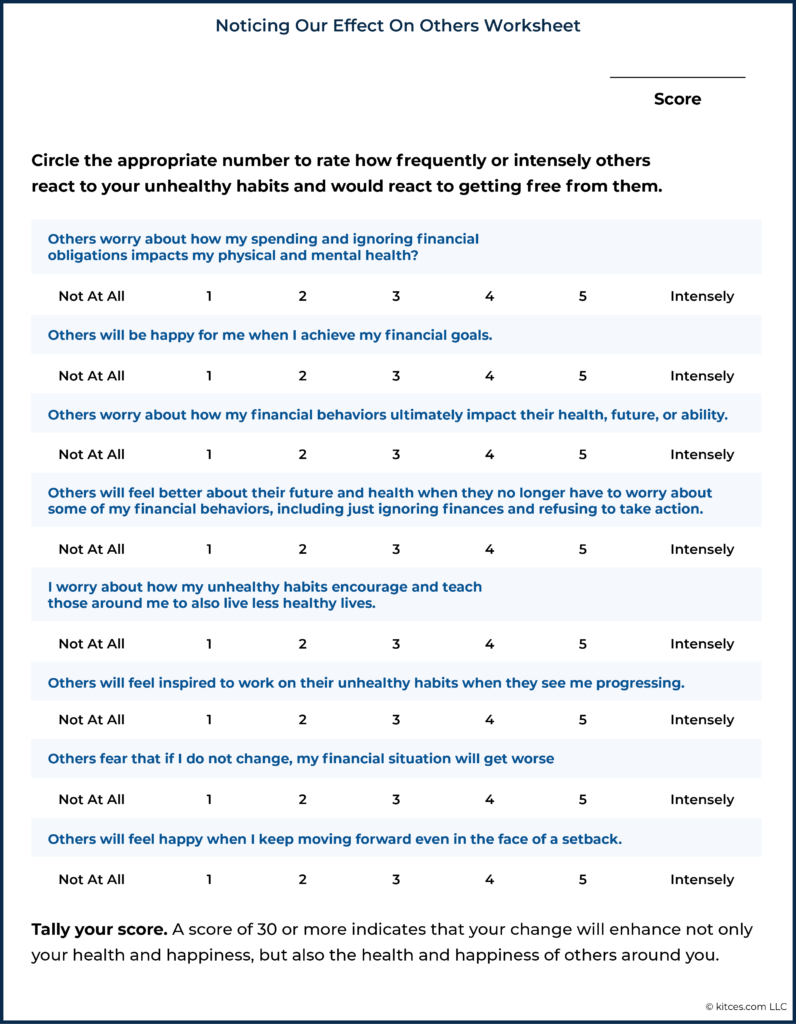

Showing Clients Their Impact On Others Can Help Reduce Their Resistance To Change

In order to help clients overcome their barriers to change, advisors can encourage them to look at how the change will impact others. To do this, advisors can use a worksheet with clients in the Contemplation Stage called, “Noticing Our Effect On Others”. It is often easier (and initially more motivating) to think about how our actions impact those around us. But how does this help with doubt and delay? Essentially, it relies on emotional activation to involve our bigger ‘emotional brain’, which involves more than just our own willpower driving us forward to change; instead, it ties into our natural desire to change for the sake of benefitting others we care about, helping us to recognize how our behavior can affect the health and happiness of others.

This process may help clients see their actions in a new light; perhaps they may identify their change more as a sign of bravery. For example, a client may choose to act on their plan even in light of knowing it could fail. But they are motivated to act because it will benefit their children one day, and anything related to their kids is what matters most to them. Emotional activation could also provide newfound strength or even a sense of pride; a client may think, “I am going to take this leap now because I know my family sees me and is watching me, and I want to make them proud!”

How To Introduce Worksheets To Help Clients Examine Their Impact On Others

Using emotional activation to help a client envision their relationships and identify how they will impact others around them is a form of environmental reevaluation. It is a key tool to help clients move from the Contemplation stage to the Preparation stage; as mentioned before, we don’t always want to change for ourselves, but we are often motivated to do so for others.

Instead of considering alternative responses for our defenses (which was the focus of the previous “Addressing Defenses” worksheet), the “Noticing Our Effect On Others” worksheet asks us to consider alternative outcomes for our relationships and our life circumstances once the change is implemented.

So how do you use the “Noticing Our Effect On Others” worksheet? Similar to the “Addressing Defenses” worksheet discussed earlier, how we use it depends in part on the client – are they already familiar with worksheets, and do they need to hear that it is normal to struggle with change? Advisors can talk about the worksheet and the stages of change, or they can introduce it to the client by normalizing the idea that change is difficult.

The “Noticing Our Effect On Others” worksheet can be used right after the “Addressing Defenses” worksheet. Since the first worksheet is meant to help the client pause and contemplate alternative possibilities, they are likely to be abuzz with thoughts, ideas, and new perspectives. As such, suggesting that they continue the exercise to envision how their actions may impact others won’t be difficult or weird – they were already doing it and are in the right contemplative mindset to continue.

Advisors can use both the “Addressing Defenses” and the “Noticing Our Effect On Others” worksheets in a single meeting; alternatively, they can review them one at a time in separate meetings. Because these worksheets were initially created as self-help tools, clients who are excited from the outcomes of the first “Addressing Defenses” worksheet could take home with them the “Noticing Our Effect On Others” as a follow-up worksheet to be reviewed on their own. The next meeting can then be used to discuss the worksheet results together, or it can be used to have an open discussion around alternative perspectives, but perhaps keeping the focus on the client’s relationships.

Example 7: Frank, the Financial Advisor, is meeting with his client Carol. In their last meeting together, Frank reviewed the “Addressing Defenses” worksheet with Carol and uncovered some new perspectives she had about her doubts about diversifying her portfolio as a first step in becoming a better role model for her children.

Today, Frank decides to continue their conversation by introducing the “Noticing Our Effect On Others” worksheet to help Carol explore her feelings about her potential impact on her family.

Frank: Thanks for being open to discussing and sharing your beliefs. It really helps me to understand where you are and how you see progression and change.

Carol: Yes, I…it was different, but I did find it interesting and self-insightful to really discuss why I think the things that I do and recognize that there are alternatives.

Frank: Great to hear – are you up for one more way to think about alternatives?

Carol: Sure, can’t hurt, I guess?

Frank: No, it isn’t going to hurt. This second worksheet is a lot about relationships. The last time we met, we did an exercise using a worksheet that looked at the way we talk to ourselves. This exercise helps us think about the others around us and their reactions to our change or not changing.

If you don’t mind me sharing, in my own life, there are times when it is just hard to get started, but then I think about my kids or my spouse and how they would be happy or proud and gives me a little extra oomph to try – this next worksheet is a lot like that – it helps to actually envision those around us and their feelings toward our change.

Carol: Yes, I have had stuff like that in my life too… sometimes you just gotta do it for the kids, as they say.

Frank: Exactly, we are going to do it for our loved ones.

Frank takes out the worksheet, and the two of them start to walk through it together.

When using these worksheets, remember that the goal is to move the client from the Contemplation stage to the next stage, which is Preparation. We want to move the client from just thinking about the change to actually preparing for the change by finding a specific way forward. We will not ask them to do anything just yet, but we must eventually leave the brainstorming phase and move to the planning stages.

‘Success’, then, is when the client says, “Okay, even in light of being scared [or some other con that they can’t yet abandon], I still really want to see my loved ones feeling proud/happy/safe/ content, and so I am going to really put effort into organizing what it will take to implement change.” If advisors can get their clients to say in some form that they are ready to prepare, then they have successfully navigated their clients to the Preparation stage!

Doubt and delay should not be reasons for clients to be derailed from their financial plans. Thanks to the Transtheoretical Model (TTM) of change, advisors have tools they can use to address (and lower) their clients’ defenses and emotionally activate clients by helping them to reimagine their environment and relationships.

Remember, advisors can – and will! – want to remind clients that the next stage doesn’t involve action. Instead, it is all about Preparation. Reminding clients of the steps involved in the process of change can lessen not just their anxiety and stress over the need to immediately come up with the answer but also any tendency to resist moving into the Preparation stage.

From the advisor’s perspective, it’s worth recognizing that the approach of coaching clients through change – and using worksheets as client tools – is new. Though just as most advisors probably didn’t feel totally comfortable explaining Modern Portfolio Theory or the ins and outs of a trust the first time – but practiced and got better, and now these conversations are old hat – so too does the use of such worksheet tools to facilitate better client conversations come with time.

Moreover, it can be helpful to practice with these tools and to have conversations with a spouse, friend, or colleague before actually getting in front of a client. For advisors who want to use these tools firm-wide, a lunch-and-learn can be a good way to introduce the tools and offer an opportunity for advisors to practice using them with each other.

Finally, there is a lot of power in going through these exercises for yourself, too. No one has a perfect financial life – so try this for yourself. Set a goal and walk through the stages, being aware of how the process makes you feel and what comes up for you. Which just gives an even better perspective of what it’s like for a client, and how to help them through the process, too.

Fantastic!!!