Executive Summary

With the U.S. economy predicted by many experts to slow down in the near future, many people’s thoughts have turned to the prospect of a recession. And along with those expectations may come concerns for those still in the workforce about the possibility of layoffs, and needing to get by without income for an unknown period of time. Such periods can be fraught with anxiety, since beyond 'just' the fear of losing one’s livelihood is the realization that there is little way to control whether or when one is laid off. This uncertainty makes it difficult to prepare for the possibility of a layoff, since there is often little real knowledge of what to prepare for.

Financial advisors with clients who are worried about being laid off can play a role in alleviating those worries by helping the client regain a sense of control over their future. And while there are many things to consider when planning for a layoff, these considerations can be grouped into two distinct types of conversations.

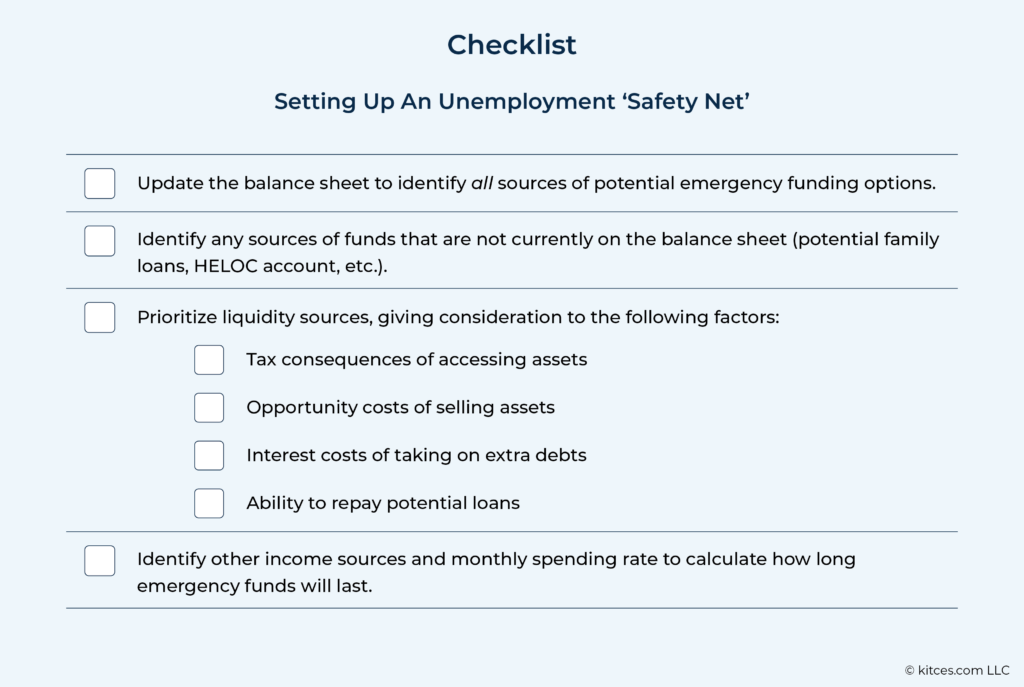

First, the advisor can help the client take stock of their current situation to assess their current preparedness for a layoff. This can include inventorying the client’s ‘safety net’ (i.e., the asset and debt options they have available to use if they aren’t employed), listing their essential expenses, and using those figures to estimate how long of a layoff they could potentially sustain. Additionally, there are some actions that may be best to get done before the client loses their employee benefits, such as getting medical work done, using FSA funds, and obtaining individual life and/or disability insurance.

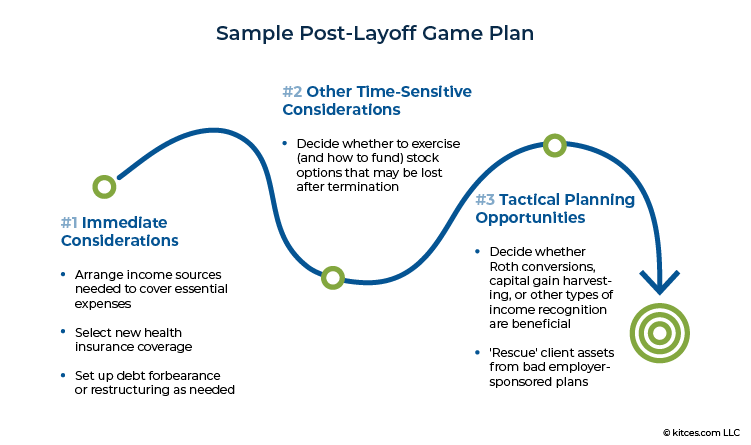

Next, the advisor and client can make a ‘game plan’ which would take effect if the client is actually laid off. These actions can go in order from most to least urgent: starting with immediate concerns (like setting up sources of liquidity, finding new health insurance, and reducing expenses), moving to less-urgent but still time-sensitive tasks (like exercising employee stock options), and finally taking advantage of potential tactical planning opportunities (like making Roth conversions to take advantage of a low-income year or rolling over assets from an undesirable 401(k) plan).

The key point is that although advisors can’t reduce the probability of a layoff themselves, they can reduce some of the feeling of stress and anxiety felt by clients who fear a layoff is coming. Because, even though the game plan for being laid off will ideally never be used because the client is never laid off to begin with, there is peace of mind in having a strategy for when things go wrong. And if the worst case does happen, having a plan already set up to ensure the client's financial security can help ensure they can focus on finding their next opportunity!

In recent months, the news has been full of predictions of an impending recession. And although the actual economic data is mixed – with some indicators like unemployment, job growth, and GDP data showing a healthy economy and job market, and others like the inverted yield curve strongly suggesting a downturn in the near future – the ongoing media coverage has left the thought of a recession near the top of many peoples’ minds.

For those who are still in the workforce, predictions of a recession might translate into worries about their own job security and what would happen to them if they found themselves without their main source of income. Some employees – particularly in the tech industry, which has been especially hard hit by rising interest rates – have already been laid off, and for many more workers, the mere prospect of unemployment is a source of fear and anxiety.

For financial advisors, the current backdrop provides an opportunity to start a conversation with clients who may be worried about the prospect of a layoff. Some clients may simply need someone to listen to their fears – otherwise, how would the advisor even know they are worried?. Others may perhaps need someone to talk them down from any rash actions like liquidating investments. A few, however, might value a more concrete set of steps – a plan, in other words, for handling a possible period of unemployment.

Obviously, it wouldn’t make sense to take any actions with major long-term consequences when unemployment is still just a possibility rather than a certainty. However, there are 2 main actions that advisors can take to help clients feel more prepared for a layoff:

- Take stock of the client’s current preparedness for a layoff and take some low-impact actions that could help improve that preparedness; and

- Make a game plan for the actions the client will take in the event that they are actually laid off.

Taking Stock: Actions To Take To Prepare For A Layoff

One of the reasons the prospect of being laid off can be so stressful is that an employee has almost zero control over whether (or when) they are let go. In the face of that uncertainty, it's common to want to take some action that creates some feeling of control over the situation. But while there’s a lot that a person can do to prepare for being laid off (e.g., socking away cash, paying down credit card debt, and postponing large purchases), it’s harder to figure out how prepared they should be. The risk of taking too little action is that, if a layoff does happen, the person may need to scramble to make up for their lost income – and on the flip side, being too prepared might mean delaying or dropping altogether other life goals in anticipation of a layoff that never occurs.

If a layoff is expected but hasn’t happened yet, then, the immediate focus can be on what the person can do to prepare themselves without significantly altering their long-term plan. This can involve assessing the person’s ‘safety net’ – the resources that would be available to them should they find themselves unemployed – and taking a few low-impact actions that can improve their situation if the layoff does happen (but won't significantly alter their course if it doesn't).

Setting Up A Safety Net

If an employee is laid off, the most immediate concern will be having funds available to sustain themselves until finding new employment. Which means a good way for an advisor to help a worried client would be to start by updating the client’s balance sheet and using it to create an inventory of potential emergency funding options. At this point, everything should be on the table – bank accounts, taxable investments, retirement accounts, credit cards, and anything else that the client can draw funds from. Prioritizing which funds can be tapped first and which should be used only as a last resort can come later, but for now, the point is just to know what exactly the client has available.

Notably, advisors can often help clients identify sources of emergency funds that might not (yet) be on their balance sheet. They could have a family member who they’d be comfortable reaching out to for a loan. They might have an unused Home Equity Line Of Credit (HELOC), which offers homeowners access to a loan backed by equity in their home, or a similar line of credit that they could access for emergency liquidity. Or if they don’t, now could be a good time to consider applying for such a loan since it would be much more likely to get approved now while the client is employed than it would be if they were to apply after getting laid off.

Prioritizing Potential Sources Of Liquidity

After inventorying all the potential sources of liquidity, next comes prioritizing them. For assets, the most important factor to weigh is usually the tax consequences of accessing the asset, along with the opportunity cost (i.e., the amount of potential future return being given up by using the funds today). For liabilities, it is the interest cost of taking on the extra debt, as well as the risk of being unable to pay the loan back. Advisors can help their clients weigh these factors in devising an order of withdrawal.

For example, the easiest sources of funds to withdraw from are likely the client’s checking and savings accounts, as well as any cash or money market funds they may hold in their taxable brokerage accounts. Additionally, they might have savings bonds that could be cashed in – such as Series I bonds that they may have bought as inflation ramped up in the last 2 years – though it’s important to note that Series I bonds can only be cashed in after being held for a minimum of 12 months, and that if the owner deferred paying tax on the bonds’ interest, all of the accumulated interest on the bonds would be taxable at ordinary income tax rates when they are cashed in.

Next up might be the client’s investment accounts. Taxable investment accounts are often used first since the investor’s principal can be liquidated tax-free while any gain on the investments is generally taxed at favorable capital gains rates. Retirement accounts, such as IRAs and 401(k) plans, can have harsh tax consequences for individuals who withdraw them before reaching age 59 ½ since the withdrawals are generally fully taxable and come with a 10% early-distribution penalty. However, advisors can guide their clients on whether they may qualify for one of the handful of exceptions to the rule:

- Individuals can make withdrawals from Roth IRAs up to the amount of total contributions they have made without owing taxes or penalties (although notably, distributions from Roth 401(k) plans are treated differently and are typically split between a tax-free return of contribution and taxable – and penalized – distribution of earnings).

- Individuals who have reached age 55 (or age 50 for certain public safety employees) and have ‘separated from service’ (e.g., have left or been let go by their employer) are allowed to make penalty-free withdrawals from their former employer’s 401(k) plan (although any pre-tax dollars are still taxable when making these withdrawals)

- Other individuals may make penalty-free withdrawals from their retirement accounts by initiating a series of “Substantially Equal Periodic Payments” (a.k.a. 72(t) payments) made annually for at least 5 years or until the individual reaches age 59 ½ (whichever is longer)

- Some medical expenses may also qualify for penalty-free withdrawals: Any unreimbursed medical expenses in excess of 10% of the taxpayer’s AGI, as well as health insurance premiums paid during a period of unemployment (though this exception applies only to withdrawals from IRAs, not from 401(k) plans).

It’s important to note that there might be no ‘good’ option here. If someone doesn’t have enough cash in their bank account to sustain a long period of unemployment, their remaining options might involve unfortunate tax consequences, selling an asset near its low point in value, or taking funds that were earmarked for some other, more exciting purpose. Sometimes the value of an advisor is in finding the ‘least-bad’ option that represents the smallest obstacle to the client’s long-term goals.

Using HELOCs As An Emergency Funding Option

If debt is a part of the emergency funds picture, there are other important questions to ask. The interest rate might lead the conversation, and a HELOC might appear more attractive than racking up higher-interest credit card debt. Typically there is a set period – often 10 years – during which funds can be borrowed, and only interest on borrowed funds needs to be repaid during this period. After the ‘draw’ period ends, the loan is paid back, similar to a traditional mortgage, over another set period (which might be 10, 15, or even 20 years).

The flexibility of HELOCs, where funds don’t have to be borrowed unless they’re actually needed, along with their comparatively low interest rates (as of this writing, HELOC rates average around 7.7%, as compared with credit cards that generally have rates of 20% or more), make them a viable source of emergency funds.

However, it’s also important to note that once the repayment period for a HELOC begins, there is much less flexibility in the payment terms, and the monthly minimum payments would likely be higher than a credit card. And because the loan is secured by home equity, failing to make the required payments could result in foreclosure of the home. So when considering debt as a way to bridge a potential gap between employers, it’s important to consider how long that gap might possibly be and to have a plan for how the debt would eventually be repaid once the client is on more stable footing.

Another consideration with HELOCs is that they are based on the borrower’s home equity at the time the HELOC is issued. If a home is assessed today at $400,000, and the homeowner has a $300,000 mortgage, they currently have $400,000 - $300,000 = $100,000 in equity. If they got a HELOC and borrowed $100,000 against that, then they would have no equity left. Let’s say that in a couple of years, they try to sell the home – but they find that it’s now worth only $350,000. With $400,000 in loans and $350,000 in home value, they would be underwater by $50,000.

It’s important when considering a HELOC to understand the client’s plans for moving or staying put because if they receive a line of credit based on their home’s value today and that value subsequently drops – as home values tend to do during a recession – then they could find themselves overextended if they try to sell the home later on.

When Taking An Intra-Family Loan Can Make Sense

Finally, intra-family loans are another potential option for those whose families are (1) in a financial position to loan funds and (2) are willing to do so. Family dynamics can make intra-family loans a tricky subject to navigate, but advisors can help their clients follow some best practices with family lending:

- Set down the loan terms in writing – the loan amount, interest rate, and payment schedule – to be signed by the lender and the borrower to give the loan a formal framework from the start.

- Ensure that the lender charges an interest rate equaling at least the Applicable Federal Rate for the loan period to avoid being taxed on “imputed” interest (i.e., the interest that the IRS determines the lender should have charged and which must be included in taxable income regardless of whether or not it actually was charged).

To add an additional layer of formality, as well as to ease the administrative burden of making the loan payments themselves as well as tax reporting for the loan, families can use services like National Family Mortgage to help implement and administer the loan. And it’s worth noting that advising on intra-family loans can apply not only to clients who want to borrow from family members, but also to those who are considering being a lender if their own family members are in need.

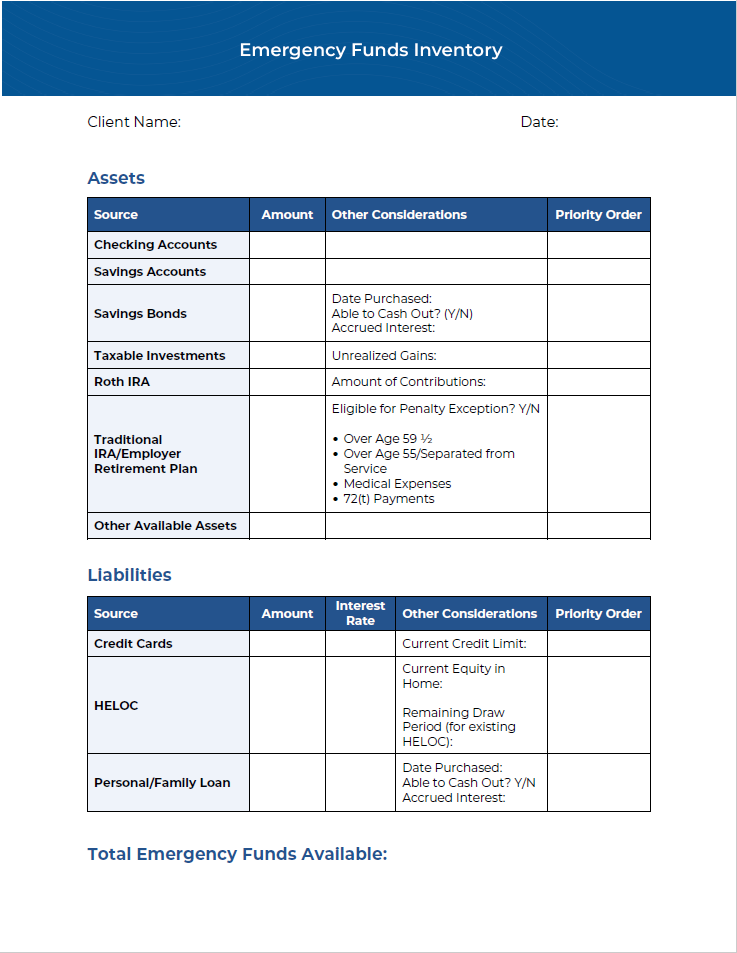

Discussing The Emergency Fund Inventory With Clients

One way for advisors to facilitate the conversation around possible sources of emergency funds is to have an actual document to record the current and potential ways that clients could access funds if needed.

The following is a template that advisors can use to list the available sources of client funds, note the tax and other considerations of each, and create an order of priority for each source for the client to draw from:

Click to download the Emergency Funds Inventory Template

Determining How Long Emergency Funds Will Last

After inventorying the amount of funds the client has available, the next step is figuring out how long those funds would actually sustain the client through a period of unemployment. This brings up 2 more points for the advisor and client to talk about:

- The client’s expenses during unemployment; and

- Other sources of income that would be available.

If the advisor and client have talked about the client’s expenses before, there may be an existing version of the client’s budget to work from; otherwise, they would need to create one from scratch. Either way, it’s important to note how the client’s expenses would look during a period of unemployment, which may be very different from what they are during ‘normal’ times. Some areas that might change could include the following:

- Discretionary expenses (dining out, vacation, shopping, etc.)

- Travel/commuting costs

- Childcare

- Health insurance/out-of-pocket costs

In addition to existing assets and/or loan options, the client may also have potential sources of income to draw from. The most obvious for married couples is if there is a spouse who is still working; though in the event of a bad recession, it’s important to plan for the possibility that both spouses would be laid off (particularly if they work for the same company, or even in the same industry, especially if it’s an area like technology that might be harder-hit than most).

There may also be unemployment benefits for workers who are laid off, which vary widely from state to state. Unemployment should only be considered a supplement to other sources of funds, however, given that (1) the benefits are usually far less than an individual’s actual working salary, particularly in higher-paying fields; and (2) they generally only last a maximum of 6 months. Finally, some laid-off workers might receive severance pay, which can also help extend the life of their emergency funds.

With those 3 pieces of information – the amount of emergency funds available, the client’s monthly expenses, and the other sources of income they have – it’s possible to calculate an ‘unemployment term’ for how long their emergency funds will sustain a period of unemployment:

Emergency Funds Available ÷ (Monthly Expenses – Monthly Income) = Unemployment Term

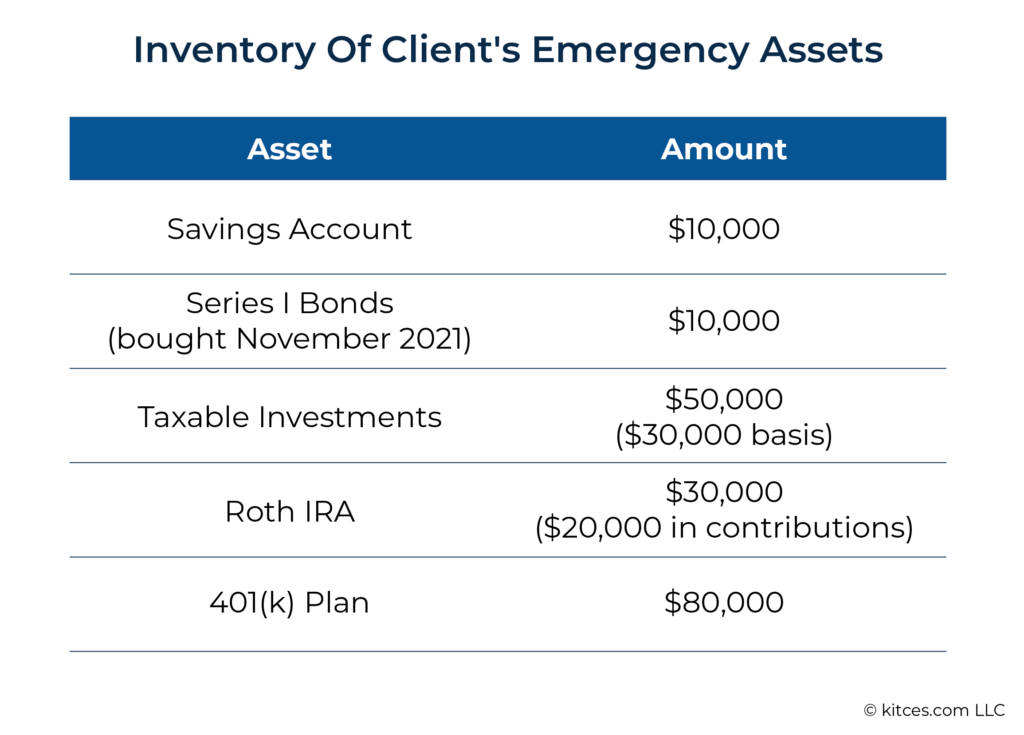

Example 1: Caroline is a single 38-year-old tech worker who has heard rumors of impending layoffs at her company and wants to start preparing for the possibility of a period of unemployment.

Caroline’s advisor helps her inventory her emergency assets as follows:

Caroline doesn’t own her home and can’t access a HELOC, and she would strongly prefer not to take on credit card debt or to ask her family for a loan, so the assets above make up the extent of her available emergency funds.

With her advisor, she determines that she could access the savings account, Series I Bonds, the taxable investments up to her cost basis, and the Roth IRA up to her total contribution amount, or $10,000 + $10,000 + $30,000 + $20,000 = $70,000 with minimal tax consequences.

The remaining $20,000 in unrealized gain in her taxable account would be taxable at capital gains rates, and the $10,000 of earnings in her Roth IRA and her entire $80,000 401(k) plan would be taxable at ordinary rates plus a 10% early withdrawal penalty since she does not qualify for an exception. In other words, $20,000 + $10,000 + $80,000 = $110,000 would be accessible but undesirable to use because of the tax consequences of accessing it.

Caroline estimates her expenses to run around $6,000 per month in the event of a layoff. Ignoring for a moment the possibility of a severance payment or unemployment benefits, it’s possible to calculate the following 2 different unemployment terms:

- Unemployment Term using only tax-free assets:

$70,000 (tax-free assets) ÷ $6,000 (monthly expenses) = 11.7 months

- Unemployment Term using all of the assets she has available:

$180,000 (total available assets) ÷ $6,000 (monthly expenses) = 30 months

In other words, Caroline would be able to sustain herself for just under 1 year without incurring major tax consequences for doing so. If she were to include all of her available assets (including the 'break glass in case of emergency' retirement funds), she would have over 2 years.

Notably, while the example above ignores the fact that some of Caroline’s assets would be needed to pay taxes for actually withdrawing them, it’s still enough information for her advisor to get a general sense of her position and help her decide what actions to take. After all, while assets like Series I bonds, Roth IRA contributions, and taxable investments all might be technically available, it would obviously be preferable not to need to tap into them.

In this case, since Caroline only has $10,000 in her savings account, building up her cash savings to a point where she could sustain at least a few months without drawing from her other assets would be a good idea while she is still earning income.

Using Employee Benefits While They’re Still Available

Once advisors put a plan in place to help clients survive through a possible period of unemployment, they can then look for other ways to prepare clients for a layoff. One of these ways is to identify any employee benefits they may have available – so that clients can take advantage of them while they still can.

Health Insurance

Health insurance is by far the most common benefit employers provide for their workers, and the coverage provided by an employer plan might be better than what the individual can find on the open market. If an individual has any planned or desired medical or dental procedures, it could be best to get them done soon, while they’re still covered by their employer plan.

Using FSA Funds

Flexible Spending Accounts (FSAs) are commonly used by employees to set aside funds tax-free for medical and/or dependent care expenses. Typically, the employee reduces a portion of their paycheck throughout the year (up to $2,850 annually in 2022, increasing to $3,050 in 2023) to fund the FSA, and the funds must be used to pay or reimburse the employee for qualified medical expenses (generally the same types of expenses that qualify to be deducted on Schedule A) before the end of the year.

The rules for FSAs state that when an employee leaves (or is terminated from) their employer, they can no longer incur expenses that can be reimbursed from the FSA – in other words, if an employee is laid off without having used their available FSA funds, those funds are lost. If an employee incurs qualified medical expenses before being laid off but hasn’t been reimbursed from the FSA yet, they have up to 90 days following the date of termination to do so. So for employees who have elected to use an FSA this year but are worried about being laid off, it would be smart to consider using up those funds.

How much FSA funds can an employee use if they’re worried about being laid off? A lesser-known fact about FSAs is that, per the Uniform Coverage Rule, the entire amount that the employee elects to contribute for the year is available at the start of the year, even though the employee only contributes to the account incrementally with each paycheck.

Example 2: Grace is an employee of a software company who elects to contribute the maximum of $3,050 to her FSA for 2023, reducing her paycheck in increments of $127.08 on the 15th and 31st of each month.

Once the calendar hits January 1, 2023, the entire $3,050 that Grace elected is available for reimbursement – even though she won’t contribute a single dollar until her first paycheck on January 15.

The Uniform Coverage Rule also provides that if an employee uses all of their available FSA funds for the year, and quits or is laid off before actually contributing the funds from their paychecks, the employer can’t go back and recoup the difference.

Example 3: Grace from the example above incurs a large medical expense in January and is reimbursed with the entire $3,050 available from her FSA during that month. On February 1, she is laid off from her job.

As of February 1, she has only contributed 1 month’s worth of contributions, or 2 × $127.08 = $254.16, while having received $3,050 in reimbursement for her qualified medical expenses. The difference between the two, $3,050 – $254.16 = $2,795.84, is simply tax-free income to her that doesn’t need to be repaid to her (now-former) employer!

The bottom line is that for employees who are worried about their immediate job security, it usually makes sense to use up FSA funds as soon as possible since they’ll be forfeited if they aren’t used before the layoff happens. Additionally, employees should use up the full amount they've elected – not just the amount they have contributed so far. While there’s a potential for some ‘free’ tax-free income if the layoff occurs early in the year, the main benefit is to prevent the employee from being caught off-guard and forfeiting the income they have already earned and contributed to their FSA if they are laid off.

Nerd Note:

The above rules are specific to health FSAs. Dependent-care FSAs, which employees can use to pay for certain dependent care-services like daycare, preschool, and summer camps, aren’t subject to the Uniform Coverage Rule, and employees can generally only reimburse themselves up to the amount they’ve actually contributed to the plan.

Life And Disability Insurance

Other popular benefits provided by employers are life and disability insurance. Because of their group pricing, these policies typically cost just a fraction of the amount per dollar of insurance that an individually owned policy would cost. Furthermore, employer-provided group policies typically don’t require physical exams or other extensive underwriting procedures – most of the time, they can be obtained by doing little more than checking a box at open enrollment time each year. As a result, it’s common for employees of businesses that offer life and disability coverage to use those policies rather than buying individual coverage.

The downside to relying on an employer-provided insurance policy, however, is that if that employment ends, the insurance coverage does too. There’s no guarantee that the next employer will provide a similar benefit, and regardless, any time spent between employers will result in a gap in coverage.

For clients who are nervous about losing their jobs, then, it would be a good time to discuss their life and/or disability coverage needs, and if they are relying on employer-provided policies, what (if any) coverage would be left if they were to lose those benefits. Some clients may be turned off by the cost of individually owned insurance – and age or health issues may preclude them from even getting a policy that requires more thorough underwriting. At that point, the conversation would turn to what other resources would be available if something were to happen to the client.

Stock Options

Employees with stock options from their employers could have some particularly thorny questions to answer. If an employee with company stock options is laid off, not only would they potentially lose their unvested or unexercised options, but the value of the options they do retain might also suffer because of the fact that the company is struggling enough to lay off employees.

There are some things that employees can control in this situation and other things they can't. For instance, employees have no control over the vesting date of their options (which is usually dictated by a vesting schedule in the company’s stock option plan), and if they are laid off before some of their options vest, there is little they can do to get them back.

On the other hand, employees can often control when (and whether) to exercise their options, as well as whether to sell any company stock they do hold. Shares of publicly traded company stock could be fair game to sell at the employee’s will unless they are an executive or officer or otherwise restricted by insider trading rules (however, holders of nonpublic company stock may have no such ability to liquidate their shares). Advisors in this situation can help break down which decisions the client can make, and which are out of their hands.

The first major decision for the employee will be whether to exercise any vested (but not yet exercised) options that they hold. In the majority of cases, the answer to this question will be “yes” unless the company’s stock price has already dropped so far that it is below the option’s exercise price. Otherwise, exercising vested options as quickly as possible reduces the risk of being laid off before such options can be exercised. And although there are some potential Alternative Minimum Tax (AMT) implications with exercising stock options, it’s almost always better to have income – even with an associated need to pay tax on it – than nothing.

Second, employees will need to decide whether to sell any shares of company stock that they own as a result of exercising options. This is less time-sensitive than the first decision since whether or not the person is still employed usually has no direct bearing on whether they can sell their company shares. However, it’s still an important step in setting up one’s financial life after a potential separation from their current employer.

There are 2 main reasons for selling shares of company stock: liquidity (i.e., selling the shares and keeping the proceeds in cash) and diversification (i.e., selling the shares and reinvesting the proceeds in a broader mix of assets in line with the client’s overall investing goals). For clients who need a bigger cushion of emergency savings to sustain a period of unemployment (as described earlier), it may make the most sense to liquidate shares and keep them in cash. For other clients who have adequate emergency savings, it may be better to reinvest after selling shares.

If the client chooses to liquidate some (but not all) of their company stock, advisors can also help their clients identify which shares are best to liquidate. This is mainly a tax planning decision: the gain on some shares may be taxable as ordinary income (such as those bought by exercising Incentive Stock Options (ISOs) that haven’t been held for the required holding period of 2 years past the date of the option grant or 1 year after the date of the exercise, whichever is later); while other shares are subject to tax at lower capital gains rates (e.g., ISO shares that have been held for the required period).

Making A Game Plan: Actions To Take When A Layoff Happens

Beyond helping the client get a sense of how prepared they are to handle a period of unemployment, advisors can also help with creating a plan of action in the event a layoff does happen. Like an insurance policy, the best-case scenario may be that this plan is never used, but there is still a lot of peace of mind in having it ready just in case. Additionally, clients who do get laid off will likely be challenged with a lot of distracting thoughts and emotions running through their minds immediately afterward; having a plan laid out in advance will help ensure that no important actions get missed.

An action plan can have 3 separate ‘layers’ of actions. First come the immediate steps that will ensure the client’s financial stability while they are out of work. Next are secondary but still time-sensitive considerations that could have long-term implications for the client’s plans. Finally, there may be tactical planning opportunities that take advantage of the client’s situation (e.g., tax strategies that recognize sources of income in a low-income year).

Immediate Considerations

The first and most basic need for a client immediately after being laid off will be to know how they will continue to support and protect themselves and their family. Though they may have already inventoried their possible resources as described above, now is the time to translate those resources into actual income. Whether it’s setting up a recurring transfer from a savings or brokerage account or cashing in some savings bonds, the first step is simply ensuring that there will be enough cash on hand to pay their necessary expenses for the next few months. Filing for unemployment benefits would also be a part of this stage.

The next immediate need will likely be to figure out where the client’s health insurance will be coming from. Do they have a spouse who can add them to their own employer’s plan? Are they eligible for Medicare? Is COBRA an option, where they can pay out-of-pocket premiums for their former employer’s healthcare plan for up to 18 months? Or will they need to find an individual policy through the Affordable Care Act marketplace? It would be best to rank all the options from most to least preferable, just in case a more favorable option becomes unavailable (e.g., the first choice may be to be added to the spouse’s health insurance plan, but then the spouse gets laid off, too).

Finally, if the client needs to stretch their resources for a longer period of time than they can currently sustain, they can look into options such as forbearance periods on mortgage and student loan payments to reduce their essential expenses.

Other Time-Sensitive Considerations

After taking care of the immediate needs of income, expenses, and healthcare, the conversation can move to other areas that might not be as pressing but still have time-sensitive elements and long-term repercussions.

Post-Termination Exercise Of Employer Stock Options

Once again, employees with stock options will have important decisions to make. Employers who grant options will often have a Post-Termination Exercise (PTE) window, usually lasting 90 days, during which terminated employees are allowed to exercise vested options before they expire and are lost to the former employee.

Laid-off employees with stock options have to decide whether or not exercising their options makes sense and, if it does, how they will pay for the options.

To decide whether or not they should exercise their options, employees will need to consider the current value of the option (i.e., the current stock price minus the cost to exercise the option), the liquidity of the stock, and the future prospects for the company.

For instance, if the option has a positive value (meaning the stock’s current price is higher than the cost of the option), and the employer is a well-established, publicly-traded company, making it easier to liquidate the shares if needed, then it might be a relatively easy choice to exercise the options.

But for private companies whose shares can’t be easily traded and are in bad enough financial shape to be laying off employees, spending the funds to exercise those illiquid options might present more risk than the now-former employee is willing to bear.

This brings us to the second decision, which is how to actually pay for the options if they are to be exercised. The relatively short PTE window can put a squeeze on former employees, particularly those who have been with their company for a long period of time and have accumulated a large number of options, because they may not have the funds built up to actually pay for the options (not to mention the taxes they could owe for doing so).

One option could be using companies like ESO Fund, which provide non-recourse loans to help former (and current) employees fund stock option purchases, payable when the stock is ultimately liquidated; otherwise, HELOCs or other loans could potentially help fund the purchase (although this would be very risky with an illiquid, volatile startup stock).

Importantly, the plan should prioritize these decisions to be put in motion soon after the layoff because once the PTE window ends, the options – and potentially a significant chunk of the former employee’s wealth – will vanish.

Tactical Planning Opportunities

The final consideration for advisors and their clients is whether there are any tactical moves that can be made to potentially turn the misfortune of a layoff to the client’s advantage. For example, if the layoff and subsequent period of unemployment lead to an uncharacteristically low-income year, the individual may be presented with opportunities for recognizing taxable income, such as converting pre-tax retirement funds to Roth and/or harvesting gains in taxable investment accounts, at lower tax rates than the client expects to have in the future.

Additionally, separation from an employer could be an opportunity to ‘rescue’ some of the client’s assets from bad employer-sponsored plans. If the client is stuck in a crummy 401(k) plan with high fees, for instance, or if their employer-sponsored HSA is particularly user-unfriendly, then leaving their previous employer creates space for the advisor to recommend better options.

There may not always be a reason to make changes – and with retirement plan rollovers in particular, advisors need to be mindful of complying with DOL regulations on recommending rollovers that would result in the client paying higher fees to the advisor – but in situations when it is in the client’s best interest to make a change, leaving their employer can provide the opportunity to do so.

Identifying tactical planning opportunities and how to leverage them will depend greatly on the client’s overall financial and tax situation as well as the timing of the layoff. And they clearly pale in importance to getting the more time-sensitive parts of the layoff plan set up. However, it’s always good to be on the lookout for less obvious planning opportunities, and there’s no reason for them to get lost amid the many other things the client will be thinking about.

Recessions don’t impact everyone in the same way at the same time, of course. But all the same, many individuals will have similar fears about how a recession could potentially affect their financial security. There are at least 3 ways that advisors can play a meaningful role in giving their clients peace of mind in such an uncertain environment.

The first is simply listening to what the client has to say. Clients may not have many outlets to air their anxieties about money. Holding space for the client to articulate what is stressing them out – giving them the chance to state their fears out loud – can have a powerful effect.

The second is taking some simple actions to prepare for a potential recession. There’s no point in doing a complete overhaul of someone’s financial situation just yet, but a few low-impact actions today could make a big difference if the client later loses their job.

The third is making contingency plans. There’s no way to predict exactly how a recession will affect any one individual, but it will make clients feel a lot better if there is a game plan for what will happen if they are impacted in some way.

There’s always the possibility that none of these actions will make a dollar of difference in anyone’s financial life. If a layoff serving as the main source of a person’s fears never comes to pass, these plans will have all been for naught – yet not needing to rely on a contingency plan for disaster is often the best-case scenario.

More importantly, working through these considerations will, at minimum, help increase the depth and trust in the relationship between the advisor and the client by addressing the source of deep anxiety. But if the client does lose their job and the game plan really is needed, it can help ensure that, rather than worrying about their own financial situation, the client can focus on finding their next opportunity!