Executive Summary

One of the hallmarks of recognized professions is that they have established Practice Standards that define the process that professionals of that discipline are expected to engage in to ensure that their clients/patients/etc. are well-served. The end result is not only a more consistent quality of service from that professional discipline – when everyone engages in a vetted process that has been refined by recognized best practices – but also an important means of protection for professionals themselves, who can point to the fact that the process was diligently followed, even and especially in scenarios where the outcome isn’t favorable (e.g., the doctor who can point to the fact that the processes were conducted appropriately, even if the patient themselves unfortunately didn’t survive).

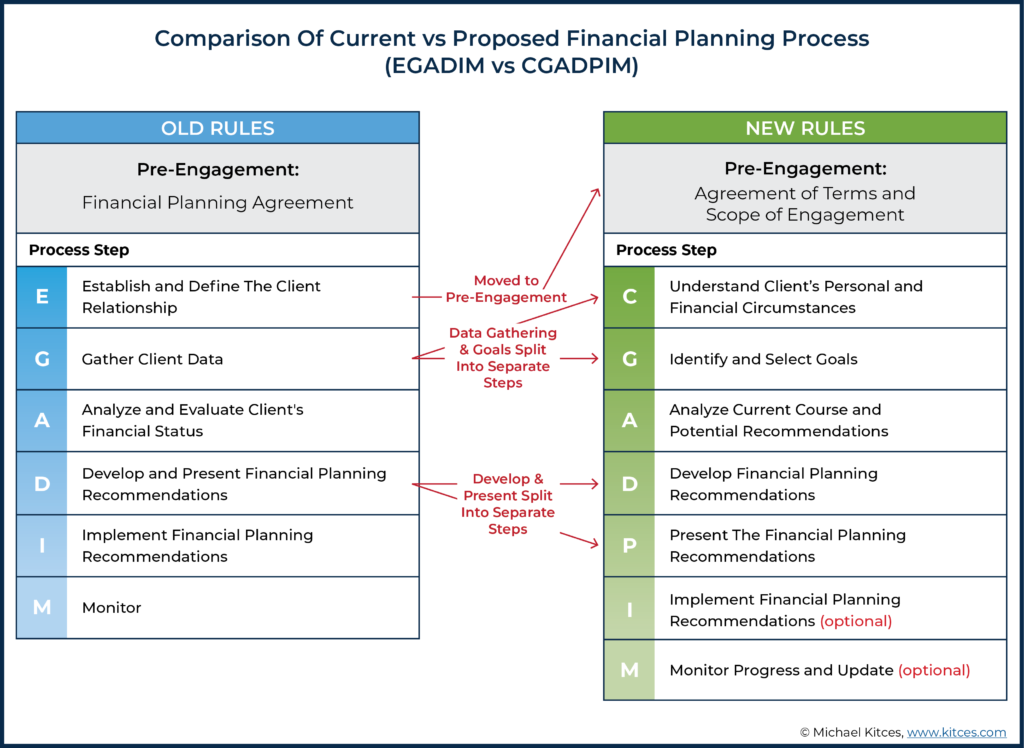

Accordingly, CFP® professionals have long had a version of “Financial Planning Practice Standards” that apply to the delivery of Financial Planning itself, known by the EGADIM acronym (short for Establish relationship, Gather data, Analyze the client situation, Develop and present planning recommendations, Implement the recommendations, and Monitor). But effective on October 1st of 2019 (which were first enforced starting on June 30th of 2020), CFP Board updated the Financial Planning Practice Standards to a new 7-step process of CGADPIM (understand Circumstances, Gather data, Analyze, Develop recommendations, Present recommendations, Implement, and Monitor).

CFP® professionals providing Financial Planning are expected to engage in the full 7-step Financial Planning process with clients, unless the Scope of Engagement specifically excludes the Implement and Monitor phases (e.g., for an hourly or project-planning-only engagement). In addition, the full Financial Planning Practice Standards will apply if the Client engages the CFP® professional for Financial Advice that broadly integrates a wide range of advice areas or otherwise requires Financial Planning based upon a weighing of factors that CFP Board specifically identified in the Code and Standards (i.e., “Financial Advice that Requires Financial Planning”), or in situations where the Client has a reasonable basis to believe the CFP® professional will provide or has provided Financial Planning (i.e., if the CFP® professional suggests the Client is going to receive Financial Planning based on how they market and hold out, they have to actually do so!).

Notably, though, CFP® professionals do not have to engage in comprehensive (7-step) Financial Planning with every client. In situations where clients do not engage for Financial Planning, or seek out only narrow-scope (i.e., non-integrated) Financial Advice – or where the Client outright refuses to engage in the comprehensive Financial Planning process after being warned of the consequences – CFP® professionals may still proceed in providing non-Financial-Planning (i.e., not comprehensive and following the full 7-step process) Financial Advice. However, in all cases, CFP® professionals will still be held to CFP Board’s new ‘fiduciary-at-all-times’ standard with respect to the advice itself (even if not delivered pursuant to the full 7-step process).

The key point, though, is simply to understand that whenever CFP® professionals are engaged in Financial Planning itself – or provide advice that is so comprehensive and integrated it necessitates the full scope of Financial Planning – they are expected to follow the full 7-step Financial Planning process. Which isn’t intended to be unduly burdensome, but simply to help ensure that when financial planning advice is given, the CFP® professional has fully considered all the relevant facts and circumstances, as well as Client goals and objectives, before coming to a fiduciary recommendation in the Client’s best interests!

Defining Financial Planning (And The Practice Standards That Apply)

CFP Board’s Code and Standards define Financial Planning as “a collaborative process that helps maximize a Client’s potential for meeting life goals through Financial Advice that integrates relevant elements of the Client’s personal and financial circumstances.”

In this context, it’s notable that Financial Planning is about a process (and not just the document/plan itself as a deliverable), and is broader than ‘just’ giving Financial Advice unto itself. Instead, “Financial Advice” constitutes the act of making a recommendation regarding a particular course of action, and Financial Planning occurs when that advice “integrates relevant elements of the Client’s personal and financial circumstances.”

In essence, Financial Advice is the tool by which Financial Planning is implemented. Or viewed another way, Financial Advice is more singular or narrow, while Financial Planning is more holistic and integrates the Client’s (relevant) personal and financial circumstances, which may include “the Client’s need for or desire to: develop goals, manage assets and liabilities, manage cash flow, identify and manage risks, identify and manage the financial effect of health considerations, provide for educational needs, achieve financial security, preserve or increase wealth, identify tax considerations, prepare for retirement, pursue philanthropic interests, and address estate and legacy matters.”

The significance of this distinction about when a CFP® professional is actually doing “Financial Planning” or not is that when Financial Planning is being provided, CFP® certificants are expected to adhere to specified Practice Standards about how financial planning is delivered and the process that is used. Whereas when providing non-financial-planning Financial Advice, the full breadth of the Practice Standards do not apply.

Though notably, in all cases, the CFP® professional is subject to a fiduciary duty (and all the other duties that apply to CFP® professionals under the new Code and Standards); the distinction of doing Financial Planning (or not) pertains only to when the CFP® professional may also be held accountable for actually engaging properly in the full financial planning process (or not).

Practice Standards For The Financial Planning Process

One of the hallmarks of financial planning being recognized as a bona fide profession is that it have an established process of how financial planning should be performed, not only as a measure of what constitutes Best Practices but also to understand when a CFP® professional may have failed to meet at least the basic standards of professional prudence and diligence. Because, just as in other professions like medicine, it’s not always possible to ensure that a favorable outcome occurs even when professional services are rendered; however, it should always be possible to determine if a professional process was followed (to maximize the likelihood that the desired professional outcome is achieved).

Accordingly, Financial Planning Practice Standards have been developed to identify the steps that CFP® professionals should engage in when actually doing financial planning. In the past, this Financial Planning Process was known by the acronym EGADIM (often pronounced egg’ -a -deem), short for Establish and define the Client Relationship, Gather client data, Analyze and evaluate client’s financial status, Develop and present financial planning recommendations, Implement financial planning recommendations, and Monitor the client on an ongoing basis thereafter.

However, in March of 2018, CFP Board approved a new Code and Standards – including new Practice Standards – that first took effect on October 1st of 2019 and were enforced as of June 30th of 2020. CFP Board’s new Code and Standards have adjusted what was historically a 6-step EGADIM Financial Planning process to a new CGADPIM (see’ -gad -pim) 7-step process instead:

1) Understand the Client’s personal and financial Circumstances (including gathering quantitative and qualitative information, analyzing the information, and identifying any pertinent gaps in the information);

2) Identify and select Goals (including a discussion on how the selection of one goal may impact other goals);

3) Analyze the current course of action and potential recommendations (evaluating based on the advantages and disadvantages of the current course of action, and the advantages and disadvantages of potential recommendations);

4) Develop financial planning recommendations (including not only what the Client should do, but the timing and priority of recommendations, and whether recommendations are independent or must be implemented jointly);

5) Present financial planning recommendations (and discuss how those recommendations were determined);

6) Implement recommendations (including which products or services will be used, and who has the responsibility to implement); and

7) Monitor progress and update (including clarifying the scope of the engagement, and which actions, products, or services, will be the CFP® professionals’ responsibility to monitor and provide subsequent recommendations).

The new CGADPIM process – Circumstances, Goals, Analyze, Develop, Present, Implement, Monitor – is similar in principle to the prior EGADIM process. But the prior Establish step is now considered a pre-engagement step (i.e., establishing and defining the scope of the Client relationship should be handled in creating an Engagement Agreement in the first place, not as a part of the financial planning process after the engagement begins), Gathering the Client’s data has been split into separately assessing the Client’s Circumstances and understanding the Client’s Goals (recognizing that the Circumstances step is largely about Data and where the Client currently stands, while the Goals step is a forward-looking process and discussion of where the Client hopes to be), and the prior Develop and present step (the D in EGADIM) has been split into separate Develop and Present steps (as the emergence of team-based financial planning, where a paraplanner or associate planner may help craft the plan and Develop the recommendations but a senior planner Presents them necessitated separating the steps that in practice are often done by different people).

However, it’s important to note that as part of a CFP® professional’s Duties to establish the terms and scope of Engagement with the Client, the obligation for Implementing and Monitoring (and Updating) may be excluded from the Engagement.

In other words, any time “Financial Planning” occurs, and the Practice Standards apply, by default the CFP® professional is presumed to be making a commitment to engage in all 7 steps of CGADPIM, but the CFP® professional can choose to narrow the scope of the Engagement to only the first five steps of CGADP (Circumstances, Goals, Analyze, Develop, and Present) and not the rest – for instance, in an hourly or project planning fee engagement where the Client is seeking financial planning advice upfront but only wants a limited-scope (not ongoing-with-monitoring) engagement, and is comfortable and willing to subsequently implement the plan themselves (and to monitor their own situation, choosing to come back to the CFP® professional if/when they want a follow-up advice engagement).

In addition, while “Financial Planning” under CFP Board’s Practice Standards is primarily about the process and not the financial planning document (e.g., “The Plan”), CFP Board also adopted a principles-based documentation standard that requires a CFP® professional to “act prudently in documenting information, as the facts and circumstances require, taking into account the significance of the information, the need to preserve the information in writing, the obligation to act in the Client’s best interests, and the CFP® professional’s Firm’s policies and procedures.” In light of this standard, a CFP® professional should consider documenting the following information:

- The qualitative and quantitative information the CFP® professional obtains from the Client;

- The Client’s selected goals;

- The CFP® professional’s analysis of the Client’s current course of action;

- The CFP® professional’s analysis of potential alternative courses of action;

- The assumptions and estimates used in developing the recommendations;

- The recommendations the CFP® professional selects and the rationale for the recommendations;

- The basis for the selection of actions, products, and services;

- Actions the Client takes that deviate from the CFP® professional’s recommendations;

- When engaged for monitoring, the CFP® professional’s analysis of the Client’s progress towards achieving goals; and

- When engaged for monitoring and updating, which actions, products, and services are and are not subject to the CFP® professional’s monitoring responsibility, how and when the CFP® professional will monitor the actions, products, and services, how the CFP® professional will be informed of any materials changes in the Client’s qualitative and quantitative information, and how and when a CFP® professional who is responsible for updating the Financial Planning recommendations will do so.

The 7-Step CGADPIM Financial Planning Process Under The New Financial Planning Practice Standards

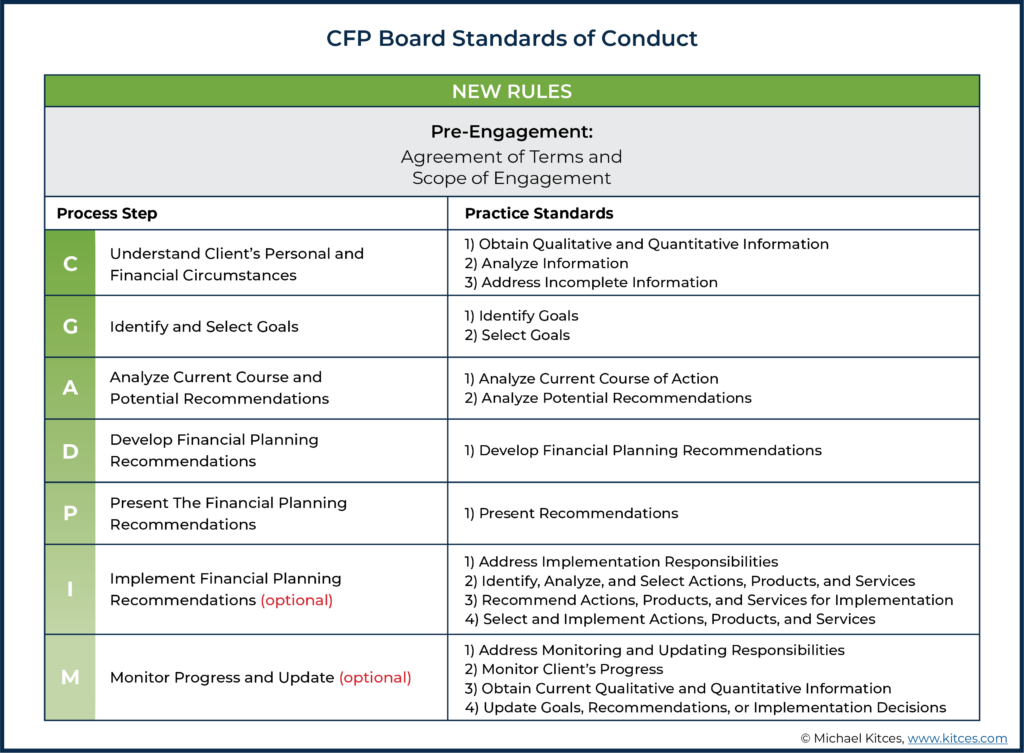

Building on the now-7-step CGADPIM process of Financial Planning, the Code and Standards go further to specify the sub-steps of each of the 7 Financial Planning process steps that CFP® professionals are expected to complete as part of a Financial Planning engagement.

Specifically, the Financial Planning Practice Standards require that CFP® professionals follow the expectations for each of the steps below.

Circumstances: Understanding The Client’s Personal And Financial Circumstances

CFP® professionals are expected to:

- Obtain Qualitative and Quantitative Information. Not only should CFP® professionals obtain relevant quantitative information (e.g., age, family situation, income, expenses, cash flow, assets, liabilities, employee benefits, government benefits, retirement accounts/benefits, insurance coverage, estate plans, capacity for risk, etc.) and relevant qualitative information (e.g., the Client’s health and life expectancy, family circumstances, values, attitudes, expectations, earnings potential, tolerance for risk, needs and goals, priorities, etc.), but CFP® professionals are also expected to clearly describe to the Client what quantitative and qualitative information will be required and collaborate with the Client to obtain that information.

- Analyze Qualitative and Quantitative Information. Once the relevant information has been gathered, the CFP® professional should analyze and assess the information to ensure they actually understand the Client’s circumstances.

- Address Incomplete Information. To the extent that the CFP® professional does not obtain the information necessary to fulfill the Scope of the Engagement, they are expected to collaborate further with the Client to gather that information, limit the Scope of Engagement based on what the CFP® professional was able to gather and therefore can provide (and where it is not feasible to obtain the requisite information nor appropriately limit the Scope of Engagement), or terminate the Engagement.

Goals: Identifying And Selecting Goals

CFP® professionals are expected to:

- Identify Potential Goals. A CFP® professional should help the Client identify potential goals (based on what is possible given a discussion of the Client’s financial and personal circumstances) and note the effect that pursuing certain goals may have on the Client’s other goals. In helping the Client to discuss and identify potential goals, the CFP® professional must use reasonable assumptions and estimates (e.g., with respect to life expectancy, inflation rates, tax rates, investment returns, etc.).

- Select and Prioritize Goals. Given the competing interests that often emerge when Clients identify a broad range of goals, the CFP® professional is expected to help the Client select and prioritize which goals to pursue. In addition, the CFP® professional must discuss with the Client any goals the Client has selected that the CFP® professional believes are not realistic.

Nerd Note:

CFP Board has provided Case Study examples for many common situations that may arise for CFP® practitioners under the Code and Standards. CFP Board’s applicable Case Study on Identifying and Selecting Goals can be found here.

Analyze: Analyzing The Client’s Current Course Of Action And Potential Alternative Course(s) Of Action

CFP® professionals are expected to:

- Analyze The Current Course Of Action. The starting point of Analyzing is to evaluate the Client’s current course of action, including the material advantages and disadvantages of the current course, and whether the current course maximizes the potential to actually meet the Goals that the Client has selected and prioritized (in the prior step of the process). In other words, is the Client already on track to achieve their goals with what they’re already doing (their current/existing course of action), or are there gaps?

- Analyze Potential Alternative Course(s) Of Action. In situations where the Client’s current course of action may not be fully effective, and/or there is the potential for a superior alternative course of action, the CFP® professional should consider and analyze such potential alternative courses of action, including the material advantages and disadvantages of each, whether each alternative helps better maximize the potential for the Client to meet their Goals, and how each alternative integrates the relevant elements of the Client’s personal and financial Circumstances (i.e., does each alternative fully consider all the relevant Client factors?).

Develop: Developing The Financial Planning Recommendation(s)

CFP® professionals are expected to:

Select One Or More Recommendations. Once the potential alternative courses of action have been analyzed, the CFP® professional must make recommendations of which the Client should pursue to maximize the potential to meet their stated Goals. Notably, the recommendation may be to continue the Client’s current course of action, rather than pursue an alternative course of action. Either way, when making a recommendation, the CFP® professional must be certain to consider:

-

- The assumptions and estimates used to develop the recommendation;

- The basis for making the recommendation, including how the recommendation is designed to maximize the potential to meet the Client’s goals, the anticipated material effects of the recommendation on the Client’s financial and personal circumstances, and how the recommendation integrates relevant elements of the Client’s personal and financial circumstances;

- The timing and priority of the recommendation; and

- Whether the recommendation is independent or must be implemented with another recommendation.

Present: Presenting The Financial Planning Recommendation(s)

CFP® professionals are expected to:

Present Recommendations And Supporting Information. Once recommendations have been developed by the CFP® professional, they must be Presented to the Client. Notably, when such recommendations are delivered, the CFP® professional must also provide the information that was considered when developing those recommendations (e.g., the supporting financial planning projections and analysis).

Implement: Implementing The Financial Planning Recommendation(s)

CFP® professionals are expected to:

- Address Implementation Responsibilities. When the Financial Planning Practice Standards apply to a Client Engagement, the first five steps are mandatory, but the last two – Implement and Monitor – might not apply if the Scope of the Engagement excludes them. Accordingly, the first obligation of a CFP® professional with respect to the implementation phase is simply to establish who has implementation responsibilities in the first place. And where the CFP® professional does have implementation responsibilities, they must communicate to the Client not only the recommendation(s) being implemented, but the responsibilities of both the CFP® professional themselves, the Client, and any third party (e.g., attorneys, accountants, or insurance agents who may need to be included), with respect to the implementation process.

- Identify, Analyze, And Select Actions, Products, and Services. In situations where the CFP® professional has taken on the implementation responsibilities, they must identify and analyze prospective actions, products, and/or services to fulfill the Implementation of the Client’s recommendations. In other words, the preceding Recommendation (and Present) stages are about determining Courses of Action; the Implementation phase is where product-specific recommendations occur. In the evaluation process for each potential implementation choice, the CFP® professional should consider both the design of the action, product, or service, and the advantages and disadvantages of each relative to reasonably available alternatives. Notably, the Financial Planning Practice Standards do not require CFP® professionals to find the ‘one and only best’ solution in existence (which could result in a never-ending process of due diligence), only that they must identify prospective solutions and evaluate them relative to “reasonably available” alternatives.

- Recommend Actions, Products, and Services for Implementation. Once prospective Actions, Products, or Services have been identified and analyzed, the CFP® professional who is responsible for Implementation should make a recommendation of specific solutions for the Client to implement. In the process of making implementation recommendations, the CFP® professional must discuss with the Client the basis for making the selection and the timing and priority of implementation, and disclose and manage any Material Conflicts of Interest that may exist with respect to the recommended action, product, or service.

- Select and Implement Actions, Products, or Services. After recommendations have been made for Implementation, the CFP® professional who is responsible for Implementation must actually help the Client to make a final selection and then implement the action, product, or service and discuss any Client selection that deviates from the CFP® professional’s recommendation.

Nerd Note:

For those who want to delve further into the dynamics of what, exactly, is expected by CFP Board in terms of documentation when providing financial planning recommendations, see their Case Study example here.

Monitor: Monitoring Progress And Updating

CFP® professionals are expected to:

- Define The Scope Of Monitoring And Updating Responsibilities. Like Implementing, the Monitoring step of the Financial Planning Practice Standards is optional, and whether the CFP® professional is responsible (or not) depends on the Scope of Engagement with the Client. Even in situations where the CFP® professional is responsible for Monitoring and Updating, they may only be responsible for a portion of the Client’s situation (e.g., Monitoring and Updating with respect to a managed portfolio) or the entire situation (e.g., Monitoring and Updating with respect to the Client’s entire financial plan). Accordingly, CFP® professionals should first and foremost clearly establish both whether they have Monitoring and Updating responsibilities, and the scope of those responsibilities, including:

- Which actions, products, and services are and are not subject to the CFP® professional’s Monitoring responsibility;

- How and when the CFP® professional will Monitor the actions, products, and services;

- The Client’s responsibility to inform the CFP® professional of any material changes to the Client’s qualitative and quantitative information;

- The CFP® professional’s responsibility to Update the Financial Planning recommendations; and

- How and when the CFP® professional will Update the Financial Planning recommendations.

- Monitor the Client’s Progress. When the CFP® professional has taken on Monitoring responsibilities, they must actually monitor – i.e., analyze, at appropriate intervals, the Client’s progress towards achieving their goals, and review the results of that analysis with the Client.

- Obtain Current Qualitative and Quantitative Information. Because a Client’s financial and other circumstances may change over time, a CFP® professional who has Monitoring responsibilities must collaborate with the Client in an attempt to obtain current/updated qualitative and quantitative information regarding the Client’s personal and financial circumstances.

- Update Goals, Recommendations, or Implementation Decisions. Where the ongoing Monitoring and analysis of the Client’s progress, paired with the updated Qualitative and Quantitative information about their situation, results in circumstances that warrant changes to the Client’s goals, recommendations, or selections of actions, products, or services, the CFP® professional must Update as appropriate (while remaining in accordance with the Practice Standards when subsequent actions are taken).

When The Financial Planning Practice Standards Apply

The financial planning process can be time-consuming, as even when the CFP® professional does not take on the responsibility for Implementation and Monitoring, the required thoroughness of gathering quantitative and qualitative data about the Client’s personal and financial Circumstances, helping them to select and prioritize Goals, Analyze the situation, Develop recommendations, and then Present those recommendations, may still result in one or more client meetings and additional time in between meetings.

In fact, a recent Kitces Research study found that the median time to create and deliver a comprehensive financial plan was 10 hours (including the time of both the advisor themselves, and administrative or professional support staff who may also be involved in the process).

As a result, not all clients may necessarily want to engage in a full financial planning process, either due to the time commitment of the Client to participate in the process, the cost of financial planning (as a result of the time it takes of a CFP® professional), or simply because they’ve already chosen a course of action and simply want someone from the financial services industry (who may happen to be a CFP® professional) to simply ‘take an order’ and facilitate the product implementation.

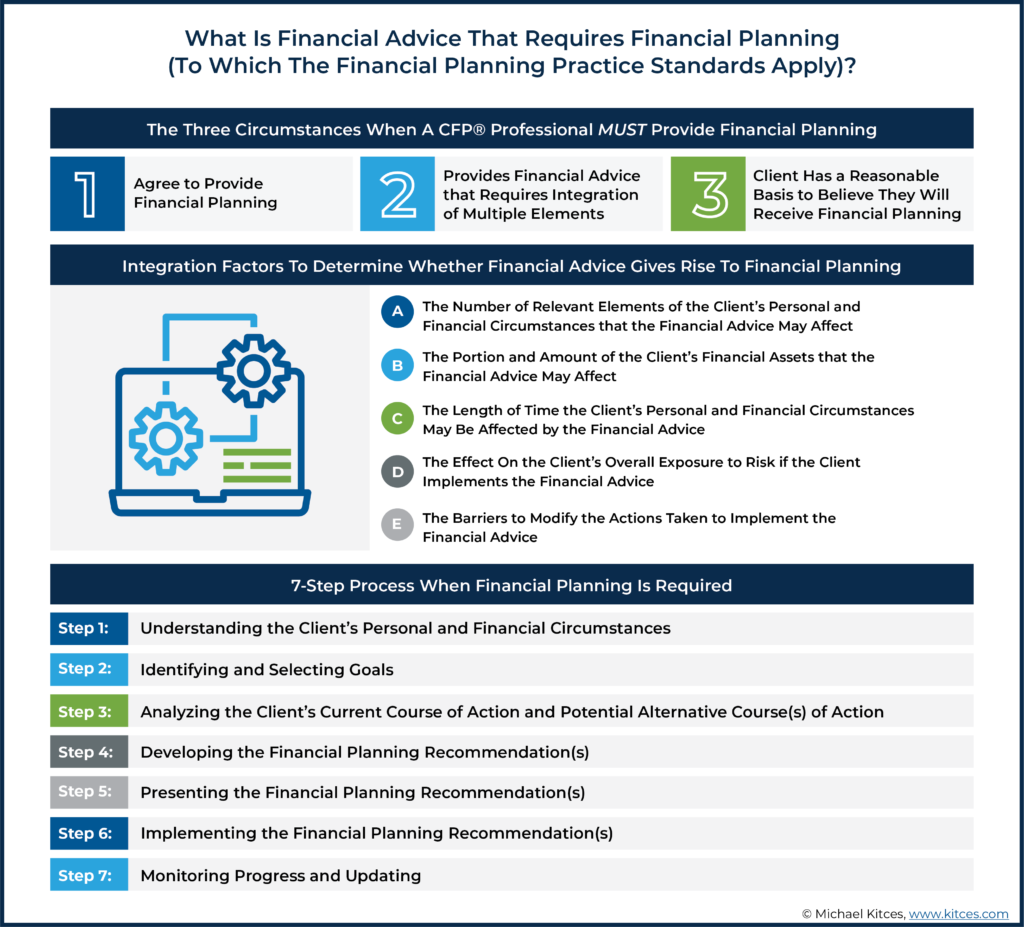

Accordingly, CFP Board’s Code and Standards specify when, exactly, the Financial Planning Practice Standards – i.e., the expectation of actually going through the full financial planning process – actually applies (or not), stipulating that:

A CFP® professional must comply with the Practice Standards when:

-

The CFP® professional agrees to provide or provides:

- Financial Planning; or

- Financial Advice that requires the integration of relevant elements of the Client’s personal and/or financial circumstances in order to act in the Client’s best interests (“Financial Advice that Requires Financial Planning”); or

-

The Client has a reasonable basis to believe the CFP® professional will provide or has provided Financial Planning.

In other words, the Practice Standards (and expectation to fulfill the full financial planning process) apply when the CFP® professional actually provides a financial plan, agrees to provide a financial plan, or gives the Client a reasonable basis to believe the CFP® professional will do so.

Notably, this framework means that any time a financial plan is actually delivered, the CFP® professional must have followed and met the Practice Standards in the creation of that plan. Furthermore, offering to provide such a plan, or creating a ‘reasonable basis’ for the Client to believe that the service will be provided, also triggers an obligation to actually do the financial planning process and meet the Practice Standards.

Which means a CFP® professional cannot hold out as providing comprehensive financial planning services, and then attempt to escape the obligation of meeting the Practice Standards by just not doing planning later; instead, creating an expectation that the Client will receive Financial Planning obligates the CFP® professional to actually do so if the Client does, in fact, move forward with an Engagement.

In addition to the obligation to meet the Practice Standards if the CFP® professional provides, offers to provide, or creates an expectation that Financial Planning will be or has been provided, CFP® professionals are also required to meet the Practice Standards in situations where the scope of the Financial Advice being engaged is so broad and multi-faceted, and integrates so many relevant factors, that the Client couldn’t reasonably receive a recommendation without a comprehensive (i.e., financial-planning-like) analysis and recommendation. In other words, providing the Financial Advice would effectively require doing Financial Planning to arrive at the appropriate recommendations.

Thus, for instance, a Client that simply asks “would be it better to create a SEP or a 401(k) plan to maximize my personal contributions to my small business retirement plan, and can you help me implement one” might engage the CFP® professional in a narrower not-fully-financial-planning engagement, but one that asks “which type of retirement plan would be best for my small business, balancing my needs to attract and retain talent, save for myself, minimize my tax obligations in retirement in coordination with the rest of my financial assets, and shift dollars to my children who also work in the business” is so broad-based that a CFP® professional providing such Financial Advice would have to engage in the full Financial Planning process just to craft an appropriate recommendation. Similarly, a Client who simply receives a packaged research report from their advisor’s brokerage firm may not necessarily be receiving financial advice, but an analysis of the client’s individual holdings and recommendations to sell a particular stock would.

To aid in the evaluation decision, CFP Board itself notes that the determination of whether the CFP® professional provided (or agreed to provide) “Financial Advice that Requires Financial Planning” may consider a number of “Integration Factors”, including:

- The number of relevant elements of the Client’s personal and financial circumstances that the Financial Advice may affect (focusing on what the Client needs or wants);

- The portion and amount of the Client’s financial assets that the Financial Advice may affect (the greater the portion and amount, the more likely it is that Financial Planning is required);

- The length of time the Client’s personal and financial circumstances may be affected by the Financial Advice;

- The effect on the Client’s overall exposure to risk if the Client implements the Financial Advice (the greater the risk, the more likely it is that Financial Planning is required); and

- The barriers to modifying the actions taken to implement the Financial Advice.

In any disciplinary proceeding in which a CFP® professional is accused of failing to comply with the Practice Standards as required, the presumption is that the CFP® professional was in fact required to do so, and the burden of proof will be on the CFP® professional to demonstrate that he/she was not required to comply with the Practice Standards for that particular Client Engagement.

When Clients Won’t Engage In Financial Planning

In some situations, a CFP® professional may become engaged in providing Financial Advice that requires Financial Planning (and must therefore comply with the Practice Standards), yet the Client refuses to engage in a full-scope financial planning relationship.

In these scenarios, the CFP® professional must either limit the Scope of Engagement to services that do not require application of the Practice Standards (i.e., a narrower Scope of Engagement that requires less integration of financial planning factors), or may proceed with the requested services after informing the Client how Financial Planning would benefit the Client and how the decision not to engage the CFP® professional to provide Financial Planning may limit the CFP® professional’s Financial Advice. In either case, the Practice Standards will not apply (as they either no longer apply to the narrower Scope of Engagement or are waived if the Client still refuses to engage in Financial Planning after being informed of the limitations of declining to do so).

Alternatively, CFP® professionals may always simply choose not to enter into the Engagement or to terminate the Engagement if the Client will not engage in the breadth of Financial Planning necessary to provide the appropriate advice recommendations, similar to situations where the Client engages in Financial Planning and then fails to provide complete information (where again the CFP® professional has an obligation to either limit the Scope of Engagement or terminate the Engagement).

However, while CFP® professionals must limit the Scope of Engagement or terminate in the event that they cannot obtain the requisite information to provide Financial Planning advice, if the matter is simply that the Client does not want to engage in full Financial Planning in the first place, the CFP® professional does have the option to narrow the Scope of Engagement or to proceed as the Client has requested in a non-Financial-Planning engagement (to which the Practice Standards don’t apply) as long as the Client has been informed of the limitations and potential consequences.

Providing comprehensive financial planning in every Client engagement is not required, and CFP® professionals are not obligated to refer clients to someone who is not a CFP® professional if they do not wish to receive Financial Planning.

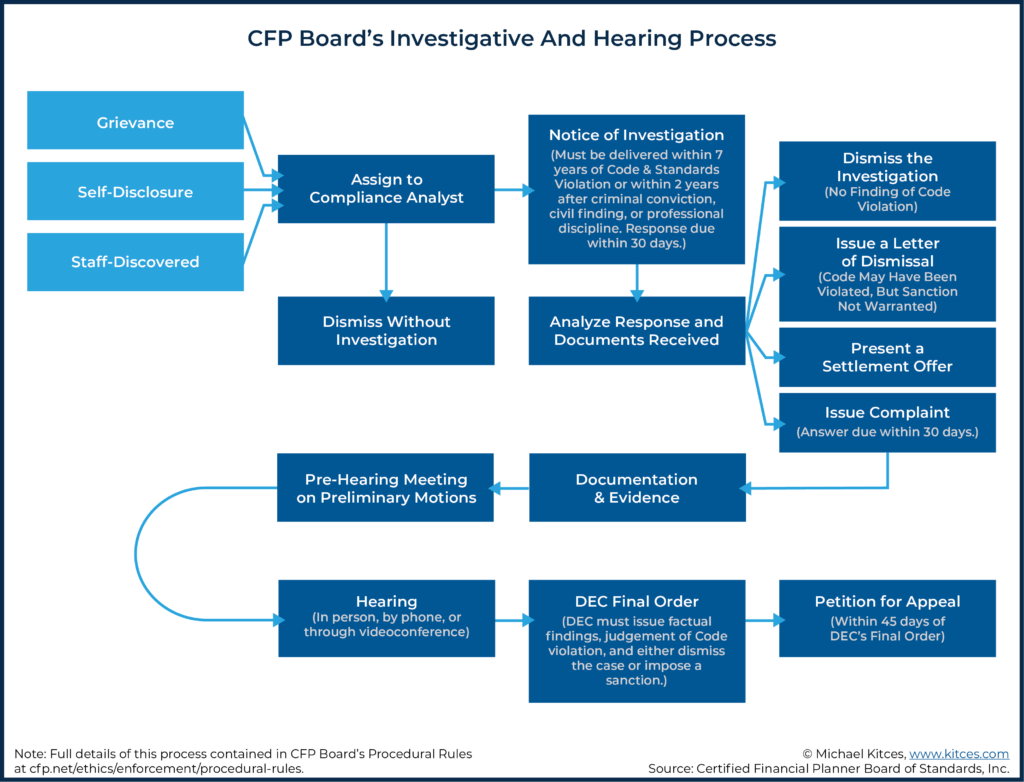

Disciplinary Consequences Of Failing To Adhere To CFP Board Code and Standards

As the organization that establishes and requires adherence to its Code and Standards, CFP Board is also the entity responsible for the enforcement of the Code and Standards and doling out disciplinary consequences for CFP® professionals who are found to have violated the Code and Standards.

CFP Board’s Disciplinary Process is driven by CFP Board staff that conduct investigations based on complaints received (or by identifying potential incidents based on public records or disciplinary actions of other regulators), and a CFP-peer-review-based Disciplinary and Ethics Commission (DEC) that hears the matter and adjudicates based on its evaluation of whether the CFP® professional properly adhered to the Code and Standards, with an Appeals process in situations where the Respondent CFP® professional disputes the DEC’s ruling.

Notably, though, CFP Board is not itself a Court of Law or a government-sanctioned regulator. As a result, it does not have the authority to send offenders to jail, issue fines or require remuneration to a Client, or revoke applicable financial services industry licenses issued by the state (e.g., the license to be a Registered Representative of a broker-dealer or the Investment Adviser Representative of an RIA).

Nonetheless, CFP Board does have ‘regulatory’ authority as it pertains to the CFP® marks themselves, and to those who can use them. Accordingly, CFP Board does have a number of disciplinary actions it can administer, including:

- Private Censure (a letter of warning to the CFP® professional, that is also held in their private file with CFP Board and may be considered in the event of future incidents);

- Public Censure;

- Suspension of the right to use the CFP® marks for a specified period of time (up to 5 years); and

- Permanent revocation of the right to use the CFP® marks.

As guidance for which of these disciplinary actions is merited based on various prospective violations of the Code and Standards, CFP Board has published Sanction Guidelines as guidance for its Disciplinary and Ethics Commission to use when adjudicating. For instance, Books and Records violations would typically result in a Private Censure, while Borrowing from a Client would result in a Public Censure; commingling assets with a Client would likely result in a one-year suspension of the CFP® marks, while a Ponzi scheme or other fraudulent activity would generally result in a full revocation of the CFP® marks.

The DEC also utilizes as guidance Anonymous Case Histories (ACHs), which are detailed summaries of cases decided by the DEC that the DEC uses as non-binding precedent. ACHs identify the issue or issues in the case, provide a detailed description of the DEC’s factual findings, and provide the DEC’s rationale for whether a rule was violated and its reasoning for the outcome.

While CFP Board’s ultimate punishment is (only) the revocation of the CFP® marks themselves – after which the financial advisor could simply continue to practice without the CFP® marks – in practice, the fact that CFP Board’s disciplinary actions are public, including the issuance of Press Releases to announce public disciplinary actions (i.e., all except a Private Censure), CFP® professionals face additional reputational risk in being found to have violated CFP Board’s Code and Standards and being sanctioned accordingly.

And of course, aggrieved Clients who file a complaint with CFP Board may also file complaints with government agencies (e.g., a State Securities regulator) or industry regulators (e.g., FINRA or the SEC) as well, that may take further action (including in extreme cases like fraud, the potential for jail time, fines, Client remuneration, or suspension or revocation of industry licenses).

On the other hand, given that CFP Board’s fiduciary standard is higher than many other regulatory standards (e.g., for insurance agents and broker-dealers), it’s also entirely possible that a CFP® professional’s conduct could violate CFP Board’s Code and Standards and not violate standards of other regulators.

Ultimately, the core purpose of having Financial Planning Practice Standards, and the prescribed 7-step Financial Planning process, is three-fold.

First and foremost, having professional practice standards and a clearly articulated process can help CFP® professionals ensure that they render services appropriately for clients, helping them to ensure they don’t accidentally miss any key steps that could result in poor advice. Simply put, standards of practice help ensure the consistent delivery (and therefore a higher average quality) of a professional service.

Second, having clear practice standards helps to make it clear when a CFP® professional has met their professional obligation to clients, even and especially when the final outcome may not be favorable. Just as doctors can defend against malpractice – even if the patient isn’t cured or doesn’t survive – and investment professionals can avoid being liable for inappropriate investment recommendations by demonstrating that they diligently followed a prudent professional process, so too can and should CFP® professionals have and be able to adhere to their own professional process to demonstrate that what they did was appropriate for the Client (regardless of the outcome).

Third, establishing these Financial Planning Practice Standards provides a framework to define when CFP® professionals are not expected to “do” Financial Planning and do not have to engage in a full-scope advice process. Which, again, helps to protect the CFP® professional and aids in reducing the cost of financial planning advice itself by not forcing CFP® professionals to engage in a timely process that the Client may not necessarily want or need. While at the same time recognizing that, if and when clients do want comprehensive financial planning… CFP® professionals are expected to follow all the steps of the process to ensure it is delivered appropriately!

Leave a Reply