Executive Summary

As the world of financial planning evolves, so too does the technology that supports it. And in the coming years, nothing may evolve in the world of advisor technology as much as financial planning software, as it continues its transition from simply being a ‘calculator’ to project the impact of financial planning strategies and recommendations, into an entire platform for ongoing collaborative financial planning for clients.

Yet the evolution of planning software is creating distinct new challenges from a software design perspective, as the tools are increasingly used in three distinct contexts: an interactive collaborative planning tool between advisors and clients in meetings, an ongoing monitoring and personal financial management (PFM) tool for clients, and an advisor support tool for everything from complex analyses to tracking and alerting which clients need assistance. Not to mention the increasing amount of ‘meta data’ available about the advisory business and its clients as well.

In fact, going forward financial planning software designers may need to increasingly view the use of the software through each of these distinct lenses – advisor, client, and advisor-client interaction, as well as business meta-data – to advance the efficacy of planning software, as each use case for planning software is creating its own unique needs and challenges for advisors to work with clients and enhance client outcomes!

The Changing Face(s) Of Financial Planning Software

Historically, financial planning software of the past was basically ‘just’ a calculator used to analyze a current client situation and trajectory, and project an outcome. In a world where not everyone had the tools to do that analysis themselves – or lacked the skillset to create it in a spreadsheet – planning software delivered tremendous time savings and efficiency improvements. It was the means to demonstrate how the financial planner’s advice would get the client on a better track, by literally showing the client what their planning trajectory was projected to be with and without the advice (which usually involved the sale of a product to implement that advice!).

In todays’ environment, though, financial planning software is meant to be more than just analyzing a client situation to see the impact of a planner’s recommendation – it’s actually becoming a collaborative tool that clients use in an ongoing decision-making process. In turn, this has shifted planning software from something that the advisor uses behind-the-scenes, to a tool that the advisor uses live, on-the-spot, with clients (e.g., on a giant monitor in the advisor’s conference room). Clients look to the planning software to illustrate the outcomes of various scenarios, so that clients can evaluate the prospective trade-offs, and make a decision on the spot.

In addition, planning software is increasingly becoming relevant for clients not only as an advisor-client collaboration tool, but also as an ongoing financial planning management tool for themselves. The rise of PFM (Personal Financial Management) software is not entirely new – Mint.com was founded in 2006 – but the adoption of PFM tools amongst financial advisors lagged significantly, and only this year has PFM finally become a “hot” area in the world of “Advisor FinTech” solutions. Going forward, though, it increasingly appears that a client-facing portal for financial planning software, built heavily around PFM solutions that assist the client in organizing their financial lives (and feeding that information into planning software to affirm that they’re on track to goals), will become the focal point for planning software from the client’s perspective (and an ongoing platform for the advisor-client planning relationship).

And beyond these dynamics, the reality is that as the planning software itself becomes the central platform for all client data – from their financial details to their progress towards financial planning goals – a “meta” level of business data will become available as well, providing insights about everything from the use of the planning software by the advisors, to the success of the clients working with those advisors.

In the context of financial planning software itself, though, the key distinction is that these three faces of financial planning software – a calculator for the advisor, a collaboration tool for the advisor-client meeting, and a client PFM solution, plus the ‘meta’ level of business data – means that in the future, financial planning software designers will have to focus separately in each of these areas, because the needs of each are very different from the other!

Interactive Financial Planning Software For Real-Time Client Collaboration

The most significant shift in financial planning software in the past decade (besides its migration to the cloud) has been the transition from using planning software as a behind-the-scenes calculator for advisors into a live advisor-client collaborative tool used in the client meeting. The purpose of the software in this context is to facilitate the process of looking at multiple scenarios and evaluating the possibilities that the client might achieve or at least pursue. After all, it’s hard determine which goals to set (and then pursue) if the client hasn’t even looked at the possibilities in the first place!

Yet the challenge of using planning software interactively in a client meeting is that the role of the software is fundamentally different than when it was used as a behind-the-scenes calculator, and it needs to be (re-)designed as such.

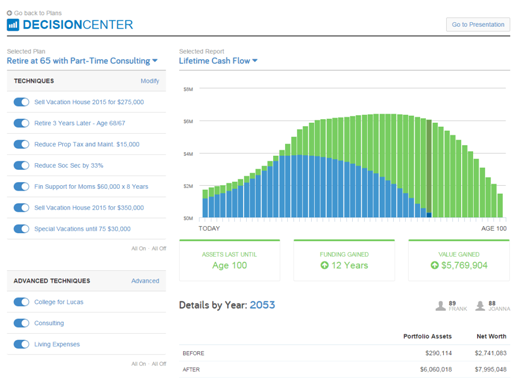

For instance, the role of planning software as a collaboration tool means that it needs to be very easy to adjust the inputs of the planning software, and see the effects immediately. In today’s planning tools, this often includes “slides” where the advisor (or even the client!) can adjust the factor, and see the impact of the plan on the spot. Though notably, this means the input slides and the output results need to be on the same screen, a crucial design element of the collaborative-planning approach, as seen below in a sample from the eMx Decision Center from eMoneyAdvisor.

Notably, the interactive nature of collaborative planning software is not just about illustrating the impact of changes to client goals (e.g., what happens if I save more, spend less, retire sooner/later, etc.) but also regarding changes to the underlying assumptions. In fact, a “sensitivity analysis” where planning software illustrates what happens if certain assumptions do not turn out as anticipated is a key enhancement for collaborative planning tools.

For example, planning software should be able to illustrate real-world planning risks like “What if inflation turns out to be higher than expected” or “What if the client lives longer than anticipated” or “What if Social Security benefits are cut in the future?” Again, the ultimate goal – as shown in an example below from MoneyGuidePro’s “What Are You Afraid Of?” module – is for the advisor and client to explore together what these future scenarios might be, and how the current strategy would be impacted if they played out, so that the client can then plan what might be done if that adverse scenario really does occur.

Of special importance in this context is the actual input process and output results of the planning software. In other words, the design and the “user experience” of the planning software matters in a collaborative advisor-client planning meeting, in a way that was simply never relevant with planning software of the past (which was only used by the advisor without having the client be present). This means a special focus on having an intuitive interface for the planner and the client to navigate the software and easily change the various inputs and assumptions (if the tool is laborious to use, it doesn’t facilitate that advisor-client planning conversation!). It also means a new focus on how best to present results and compare scenarios to each other, to really show how the scenarios differ and how the changes to the plan are impacting the outcomes. After all, if the client can’t easily understand the comparisons of the different scenarios, the software will not be effective in facilitating a decision about which plan/course to pursue.

Of course, in the end the ultimate goal of a collaborative planning session is still to come up with a plan – in other words, after using planning software to look at lots of different possible scenarios, the advisor and client need to be able to select one, commemorate it as the ‘final plan’ (at least for the time being), and save that as the plan that will be monitored going forward. In other words, while in the past the approach was for the advisor to do the analyses behind-the-scenes and bring “the plan” to the meeting, with collaborative planning software the goal is to bring a planning tool to the meeting and explore the possibilities to arrive at “the plan” at the end of the meeting instead.

The Client PFM Portal For Financial Planning Software

Once “the plan” has been selected at the end of an advisor-client collaborative session, clients (and their advisors) need to be able to track the progress of the plan over time. From the client’s perspective, this ‘portal’ to their financial plan will begin to look a lot like an entire Personal Financial Management (PFM) platform.

In the direct-to-consumer context, Mint.com has been the leading PFM tool for consumers to track the status of their net worth and balance sheet, and their ongoing cash flow and spending. The caveat to a solution like Mint.com, however, is that it has no means to be used collaboratively with advisors, and its capabilities to plan for goals are somewhat limited.

Nonetheless, the essence of what Mint.com represents – a central location for a client’s entire financial life to be managed, coordinated, and tracked over time – is essential to supporting the advisor-client relationship over time as well. After all, what better way for the advisor to demonstrate value, than to literally have a central platform that shows all the progress the client has made with the advisor over time, as net worth grows, milestones are reached, and progress is made towards goals that are being achieved! An example of this (from eMoney Advisor) is shown below.

In the context of client PFM, though, the design goals are again entirely different from what is needed when the planning software is used as a client collaboration tool in the meeting. Key elements of an ongoing advisor-client PFM solution might include tracking the client’s:

- Net Worth/Balance Sheet

- Ongoing spending

- Spending relative to budgeted goals

- How spending and net worth are trending over time

- Other key financial details, like insurance coverage information

- Progress relative to (longer-term) goals

- Action items and to-dos for planning implementation

- Tracking of completed action items and to-dos (as planning milestones that have been achieved!)

- Important ‘alerts’ and other client feedback tools (i.e., the initial steps towards gamification of financial planning goals)

With all of this information based in a client PFM in the cloud, this information would be expected to update automatically and continuously, becoming a portal that the client can check out 24/7/365 to see where they stand financially. And with shared access for the advisor as well, any time a client has a question, the client’s PFM portal becomes the shared information for a productive conversation. And because the PFM is part of the advisor’s underlying planning software, any changes to the plan can feed directly into the client’s PFM interface.

Notably, when it comes to client PFM, this is also a solution that needs to be accessible for clients on a range of devices. While the collaborative advisor-client planning software would generally only be used on a desktop (or maybe a large tablet or laptop), a client PFM portal needs to be available on a desktop or tablet and be mobile-friendly as well.

Financial Planning Software As An Advisor Calculator And Support Tool

Notwithstanding the increasingly client-centric role of planning software, as an advisor-client collaboration tool and an ongoing client PFM portal, there is still value in planning software functioning as a ‘calculator’ and in other advisor-support capacities.

For instance, the reality remains that long-term planning projections can still be highly complex, with many ‘moving parts’ from investment assumptions to planned cash flows in/out of the portfolio, to various annuity and other income streams, to modeling the ongoing impact of taxation across multiple tax brackets and tax rules at both the Federal and state level.

From this perspective, the “technical accuracy” of planning software as a calculator tool remains crucial, especially for advisors to model the results of sophisticated planning strategies and recommendations. For instance, if the advisor is trying to craft a recommendation about whether the client should do a Roth conversion during life or if it would be more effective to bequeath a pre-tax IRA to beneficiaries, the ensuing analysis is a complex calculation incorporating everything from Federal and state tax liabilities of the client and the beneficiaries, how tax rates will change as wealth accrues and compounds, Federal and state estate tax liabilities, and projections of how non-IRA assets would have grown with their own ongoing drag for interest, dividends, and capital gains.

Doing such an analysis, to craft the appropriate recommendation, requires a high degree of accuracy in an extremely complex modeling scenario – something for which a robust planning-software-as-calculator is still apropos. And may be similarly true in any number of other planning situations, including decisions about stock options and executive compensation, various estate planning strategies, the impact of whether or not to pursue insurance strategies, the use of annuities for retirement income guarantees, and more.

In fact, even to the extent that planning software has been used as a calculator, the ability to illustrate specific planning strategies, or the impact of various financial services products as a solution, has remained remarkably limited. In the long run, product illustrations for various insurance and annuity solutions should not exist as standalone illustrations, but ones that can be incorporated directly into the planning software, to show if/whether they will actually achieve improved results in the long run or not.

Notably, though, the potential for planning software in the times it is being used (solely) by an advisor still goes beyond ‘just’ using it as a calculator and an analytical tool. As the data in financial planning software becomes connected directly to inbound data feeds to become continuously updated, the software will increasingly become a tool for proactive financial planning engagement with clients as well. For instance, financial planning software might notify the advisor when a client is behind on their savings goal, or if an unusually large cash flow occurs in/out of their accounts, or if interest rates have shifted enough that it would be worthwhile to pursue a refinance, or (as shown in the sample below from InStream wealth) notify the advisor to conduct a plan review with the client if the retirement plan’s probability of success falls below a certain ‘danger’ threshold.

Though again, as with the prior contexts in which planning software might be used, the design needs for an advisor calculator and an advisor “dashboard” style monitoring tool are different than when used as a client interface or an advisor-client collaboration tool. In other words, once again, the design of planning software specifically to support the (behind-the-scenes) advisor functions has substantively different needs than in other use cases, and must be designed as such.

Financial Planning Software For 'Meta Data' As A Business Management Tool

Beyond the three “faces” of financial planning software – for advisors, for clients, and for the advisor-client collaborative meeting – it’s worth noting that ultimately planning software of the future will encompass a fourth role as well: as a business management tool.

This “meta” level of information about planning software will capture both how advisors are using the software (e.g., within a larger firm environment), and also the business opportunities of the clients that the advisors are working with.

For instance, business-based reporting that might be derived from planning software of the future includes:

- Advisor software utilization. How often are advisors actually logging into and using the software? Are some advisors using the planning software more than others? Do certain advisors (or the firm overall) use some modules of the software more than others (e.g., extensive use as a calculator, but rarely used in collaboration mode with clients?)?

- Client software utilization. Are clients actually logging into and using the software? Are there any potential ‘problem’ clients who are logging in unusually often, or who have never logged in at all and don’t seem to be engaged in the process?

- Business opportunities. Will there be additional opportunities to do more business with clients and expand “wallet share” soon? For instance, if the firm manages assets, what proportion of assets do clients have that are still unmanaged by the advisor? How much in assets are being held in outside 401(k) plans that might be managed in the future? What are the age demographics and retirement goals of those clients? How many clients have a financial planning goal to retire within two years, and at least $250,000 of assets in an outside 401(k) that may become available for management? In a large-firm context, this can provide significant business planning insights about potential organic growth of new assets from existing clients?

- Monitoring of plan implementation. If not just planning projections but planning action items and to-dos are captured in the software, how effectively are plan recommendations actually being implemented? Are some advisors doing a better job helping clients implement recommendations than others? Could the “quality” of an advisory firm someday be measured by the tracking in its financial planning software of how quickly and effectively clients actually implement their recommendations and achieve their planning goals?

As more and more data becomes housed in a central financial planning software platform – and integrated with other advisor CRM data – the potential for “big data” insights about how advisory firms and their clients are operating as a business, and helping clients progress towards their goals, will only continue to grow!

So what do you think? Are there gaps in planning software and how it is currently designed and developed? What else would you want planning software to do in the future that it isn’t currently doing? How else would you change the design of planning software – and in which contexts – to make it more useful for either the advisor or the client?

Yes! I’m almost paralyzed to not get started with software and use the free planning tools from the fund companies because I’m afraid to get all of my information on one platform then need to switch to another one. I want eMoney and MoneyGuidePro in the same system! I hate that MGP requires add-ons to store forms and I also think my clients found eMoney to be cumbersome and require a good bit of learning curve to properly utilize it… almost nobody did. I really need to solve this dilemma in my practice.

Josh, I have found MGP to be way too conservative, or perhaps it is operator error. Though other advisers have told me they came to the same conclusion. I too dream about a software that combines the best of the two you mentioned. My two cents.

Conservative in what way? The investment returns? If so, you can always modify the defaults.

Even if you increase expected returns quite a bit I would still get low withdrawal rates. If I run similar cma’s between emoney and mgp, I get much lower probability of success in mgp and would have to use a much lower withdrawal rate. I would love to use mgp, but they seem to use some form of distributions that in my opinion would cause a client to needlessly sacrifice the one life they get. However, it may be that I am doing something wrong but I don’t think so. That’s why I am interested in what others have found when comparing software.

Josh, I just got back from the Morningstar investment conference where I was able to speak with the reps from MoneyGuide Pro. I just went to check in to see what was new, get another quick demo to make sure our choice of eMoney was still the right solution for us, and they surprised me by informing me that they are in the final stages of integrating it into EMX. So, per your sentiments, we are adding MGP to eMoney as soon as I can get around to implement, probably next week…

Michael,

Great article…great topic. I have been an adviser for 31 years. I have a fairly strong (20-year) background in simulation. Can you weigh in on the fairly significant differences in output (or results) that the top financial planning software companies provide?

I have looked at all of the majors using a trial version and found some radically different lifestyle outcomes depending on which software I used. Some seem very conservative when it comes to running a simple spending analysis. Using the same allocations and even similar capital market assumptions, one of the major vendors would have clients spending as much as 35%-40% less than another major software provider.

I would love to see a study done using a variety of financial planning inputs (the same for each software) to see if you come to the same conclusion. Or if any of your readers are aware of such a study I would sure like to know about it.

Michael,

This is a great post.

Your sentiments are echoed here in Australia. Government reforms to end advisor trail commission (the Future of Financial Advice act) have placed new emphasis on ways of providing long-term value to planning clients. Software is certain to play an important role.

Like you, we’ve seen Australian advisors adopting “a [software] tool that the advisor uses live, on-the-spot, with clients”. However, also like you, we’ve found existing tools lacking. We agree the industry needs “a client-facing portal for financial planning software [that]… will become the focal point for planning software from the client’s perspective”.

As you point out, there’s currently a mismatch between the approaches taken by typical calculators/financial planning packages, and the sort of mass-market experiences consumers are used to (such as apps and games). We agree client-centric planning software needs “a special focus on having an intuitive interface for the planner and the client to navigate the software and easily change the various inputs and assumptions”.

Finally we share your view that “the reality remains that long-term planning projections can still be highly complex, with many ‘moving parts’”. In fact, we’d say most planning decisions are like this. For example “client has a home, mortgage, and growing family. Client would like to renovate to add room for new child. Would also like to send their two children to private school one day”. Such questions involve redrawing against home equity whilst balancing increased mortgage expenses over 5 or 10 years, and must be answered holistically.

In response to these points, a small group of us are trying to develop a product that is both ‘gamified’ (for the consumer experience) and ‘holistic’ (for real-world planning decisions). We’re in the process of launching it to an Australian audience, but we’d love your feedback if you could find time to try it out? There’s much to do, and we need help! You can try our product at https://www.wealthprojector.com, use coupon code NERDSEYE (gets you access to the client UI, although not the advisor UI).

Regards,

Richard.

Software should be comprehensive. I don’t want to use stand-alone tax

software (Tax Tools), retirement (and other) planning software, and separate

investment related software. If it is not integrated, then you can’t really see

the impact (for example) of modeling a series of Roth Conversions on financial

security, the current year tax situation (and therefore cash flow), and

investment selection (for the assets that will then reside in the Roth). There

should be ONE data entry point, and integrated calculations. We don’t want

separate software for tax planning, social security evaluation, stock option

planning, and detailed year by year tax planning. Currently, most software does

not perform detailed tax calculations (including the difference between tax

brackets and tax rates). This is crazy. Also, goals-based planning may work for

simple scenarios, but even for younger people who tell me “I plan to move

in two years, get a large bonus, sell my house, pay 6% commission, transfer

tax, moving costs, and pay-off my mortgage….how much should I finance? What

will my cash balances look like in two years?” You must have

cash-flow software, otherwise, you are just doing another “off-sheet”

separate excel calculation. Goal based software promotes simplicity, but over

the years even this software has grown more complex than cash-flow based

software (ironic).

Also, all the software out there provides ending wealth in future

dollars! So, if I model a Roth Conversion, I tell the client that the value provided by the conversion is $xxxxx (which includes the impact of inflation). This is unfair. All terminal wealth should be reported in today’s dollars. We should NOT be taking credit for inflation! Also, clients think in terms of today’s dollars. Ugh…

Fortunately, there is software that does all this. Even the folks at Social

Security Solutions helped to build the social security model within the

software. The software is called Integrate2000. Unfortunately, since it

lacks the collaborative features, and it is excel based, it is not

popular. Excel means that I can create an link any self-created (or

purchased software such as Keeblers tax bracket software) right up to the core

software. How cool is that? This software is so good, that anything can be

modeled. I can satisfy any engineer. And

the tax calculation are so good, they results match the results of my actual

tax preparation software. I don’t own

the software and receive no benefit for mentioning it. I mention it out of love

for it. More planners should desire robust calculation software….even if it

lacks sparkle.