Executive Summary

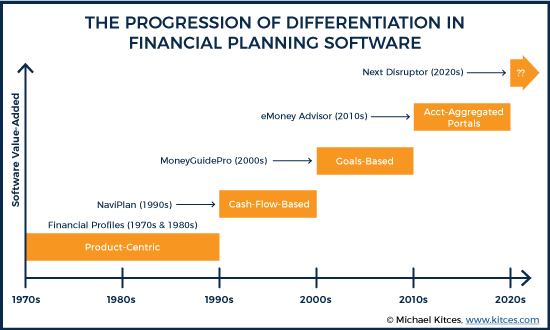

Financial planning software has changed substantially over the years, from its roots in demonstrating why a client might “need” certain insurance and investment products, to doing detailed cash flow projections, goals-based planning, and providing account-aggregation-driven portals. As the nature of financial planning itself, and how financial advisors get paid for their services, continues to evolve, so too does the software we use to power our businesses.

However, in the past decade, few new financial planning software companies have managed to gain traction and market share from today’s leading incumbents – MoneyGuidePro, eMoney Advisor, and NaviPlan. In part, that’s because the “switching costs” for financial advisors to change planning software providers is very high, due to the fact that client data isn’t portable and can’t be effectively migrated from one solution to another, which means changing software amounts to “rebooting” all client financial plans from scratch.

But perhaps the greatest blocking point to financial planning software innovation is that few new providers have really taken an innovative and differentiated vision of what financial planning software can and should be… and instead continue to simply copy today’s incumbents, adding only incremental new features while trying to forever be “simpler and easier” – without even any clear understanding of what, exactly, is OK to eliminate in the process.

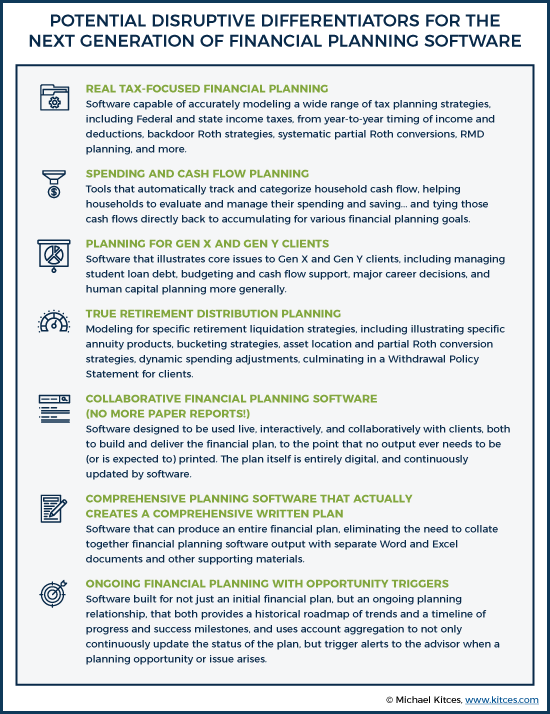

Nonetheless, tremendous opportunity remains for real innovation in financial planning software. From the lack of any financial planning software that facilitates real income tax planning, to the gap in effective household cash flow and spending tools, a lack of solutions built for the needs of Gen X and Gen Y clients, and a dearth of specialized financial planning software that illustrates real retirement distribution planning (using actual liquidation strategies and actual retirement products). In addition, most financial planning software is still written first and foremost to produce a physical, written financial plan – with interactive, collaborative financial planning often a seeming afterthought, and even fewer financial planning software solutions that are really built to do continuous ongoing planning with clients (not for the first year they work with the financial advisor, but the next 20 years thereafter), where the planning software monitors the client situation and tells the advisor when there’s a planning opportunity!

Fortunately, though, with industry change being accelerated thanks to the DoL fiduciary rule, the timing has never been better for new competitors to try to capture new market share for emerging new financial advisor business models. Will the coming years mark the onset of a new wave of financial planning software innovation?

The Evolutionary Progression of Financial Planning Software

In the early days of financial planning, the reality was that virtually no one actually got paid to deliver a financial plan. Instead, financial advisors were compensated by the financial planning products they implemented – i.e., insurance and investment solutions – and the role of the “financial plan” was actually to demonstrate the financial need. Thus why the early financial planning software tools like Financial Profiles (founded in 1969) focused on retirement projections (to show the investor he/she needed to save and invest more… with the financial advisor), insurance needs (to show a shortfall in insurance coverage), and estate tax exposure (as life insurance held inside of an Irrevocable Life Insurance Trust was a very common strategy when estate tax exemptions were lower). Financial planning software was product-centric.

By the 1980s, though, there was an emerging movement for financial planners to actually get paid for their financial plans, from the birth of NAPFA in 1983, to the rise of financial-planning-centric brokerage firms like Ameriprise (then IDS) and insurance companies like Connecticut General (later Cigna Financial Advisors, then Sagemark Consulting and now Lincoln Financial). The challenge, however, is that to get paid for a financial plan, the rigor of the financial planning analysis had to stand as a value unto itself, beyond just demonstrating a product need. Fortunately, though, the rise of the personal computer meant that financial advisors could purchase and use complex analytical tools that could analyze financial planning strategies with greater depth than what virtually any consumer to do themselves. Accordingly, 1990 witnessed the birth of EISI’s NaviPlan, the first “cash-flow-based” financial planning software, which was substantively differentiated from its predecessors in its ability to model detailed long-term cash flow projections.

The virtue of cash-flow-based financial planning software like NaviPlan was that it allows for incredible detail of every cash flow in the client household. Income, expenses, and savings could all be projected, along with the growth on those savings over time, creating a rigorous financial plan that substantiated a standalone financial planning fee. The problem, however, was that by modeling every cash flow, it was necessary to input and project every cash flow – as projecting income without the associated expenses would imply “extra” money for saving that might not really be there. And NaviPlan didn’t really have a means of just projecting the cash flows that were relevant to a particular goal; instead, it implicitly modeled all cash flows, and then showed whether all of the future goals could be supported. As a result, the arduous and time-consuming nature of inputting data into cash-flow-based financial planning tools led to the advent of MoneyGuidePro in 2000, and the birth of “goals-based” financial planning software, where the only cash flows that had to be inputted were the specific saving inflows and spending outflows of that particular goal.

The birth of goals-based financial planning software made it much easier for financial planners who wanted to just focus on a particular goal – most commonly, retirement – to create a financial plan around just that goal. Accordingly, the software was especially popular amongst the independent RIA community (which operates on an AUM model and is primarily paid for demonstrating a need to save and accumulate assets for retirement), along with retirement-planning-centric broker-dealers and insurance companies. The caveat, however, is that once a goals-based financial planning projection is delivered, there isn’t much to do with the software on an ongoing basis. As long as the client remains reasonably on track to the original plan in the first place, each updated planning projection will simply show the same retirement and wealth trajectory as the last. And from a practical perspective, a long-term multi-decade plan just doesn’t move much from year to year anyway (not to mention quarter-to-quarter or month-to-month). Consequently, a gap emerged for financial planning software that could actually show meaningful tracking of what is changing in the client’s plan on a year-to-year and more frequent basis… and thus was the rise of eMoney Advisor, which was also founded in 2000 but really gained traction in the 2010s as account aggregation tools like Mint.com made consumers (and financial advisors) increasingly aware of the value and virtue of continuously tracking and updating a household’s entire net worth and cash flows… a Personal Financial Management (PFM) dashboard that goes beyond just their portfolios, or their progress towards ultra-long-term goals.

From the perspective of financial planning software differentiation, this progression from product-needs-based to cash-flow-based to goals-based to account-aggregation-driven helps to define when and why certain companies have grown and excelled over the past several decades, while others have languished and struggled to gain market share. Because the reality is that as long as the client data in financial planning software isn’t portable and able to be migrated, changing financial planning software solutions is an absolutely massive and potentially firm-breaking risk (as it disrupts the foundation on which many advisors build their value), which means it takes substantial differentiation in tools and capabilities to attract advisors away from competing solutions. In other words, in a world where the switching costs of financial planning software are so high, it’s not enough to be 10% or 20% better, and barely sufficient to even be 10X better… it’s necessary to be fundamentally different, in a way that advisors can create new value propositions they simply couldn’t deliver in the past (as was the case in the progression from financial planning software focused on product needs, then cash flows, then goals, and then account aggregation).

Real Financial Planning Software Differentiators Of The Future

The reason it’s necessary to understand the progression of financial planning software differentiators of the past, is that it’s essential when trying to identify what prospective differentiators might allow financial planning software to break out in the future – which is one of the most common questions I’ve been receiving lately in my FinTech consulting engagements with various (new and existing) financial planning software firms.

Because the fundamental challenge is that, as noted earlier, it’s not enough to just be 10% better or faster or easier or more efficient. Due to the incredibly high switching costs for most financial advisors already using financial planning software, it’s crucial to be fundamentally different to grow and compete.

Fortunately, though, the reality is that there are still ample areas in which financial planning software providers could substantively compete and be meaningfully differentiated. Just a few of the options include:

Real Tax-Focused Financial Planning. One of the easiest ways for financial advisors to show clear value in today’s environment is through proactive income tax planning strategies, as real-dollar tax savings can easily more-than-offset most or all of a comprehensive financial planning fee. Yet unfortunately, most financial planning software today is very weak when it comes to detailed income tax planning, especially when considering the impact of state income taxes. A tax-focused financial planning software solution would project actual taxable income and deductions from year to year in the future, with future tax brackets (adjusting for inflation), and include the impact of state income taxes (which most financial planning software companies complain is “arduous” to program, despite the fact that companies like US Trust publish an annual tax guide with the state tax tables of all 50 states!). Of course, the reality is that the tax law can change in the future, and there is such thing as trying to be overly precise in estimating financial planning software inputs. Nonetheless, “simple” assumptions like an effective tax rate in retirement grossly miscalculate tax obligations over time, and utterly fail to represent the positive impact of prospective tax strategies; after all, how can you possibly show the value of the backdoor Roth contribution strategy, or systematic partial Roth conversions in low income years, if the software always assumes the same (static average) tax rate in retirement? How can any financial advisor illustrate strategies that minimize the adverse impact of RMDs, when the financial planning software assumes that the client’s tax rate won’t be going up when RMDs begin!? And failing to account for the fact that moving from New York or California to Texas or Florida in retirement saves nearly 10% in state income taxes is an egregious oversight. Simply put, tax planning has real value, and financial planners shouldn’t be constrained to illustrating the value of tax strategies in isolated software tools like BNA Income Tax Planner, when it could – and should – be part of the holistic financial plan.

Spending And Cash Flow Planning. Historically, financial advisors have focused their advice on investments and insurance, for the remarkably simple reason that that’s how most advisors get paid (either for implementing such products and solutions, or managing them on an ongoing basis), and as a result that’s where most financial planning software has focused. However, from the consumer perspective, the center of most people’s financial lives is not their long-term financial plan, nor their insurance and investments; it’s their household cash flow, which is their financial life blood. Thus why Mint.com grew to 10 million active users in just their first 5 years – which would be almost 10% of all US households – while the typical financial advisory firm struggles to get 20% - 30% of their clients to log into their (non-cash-flow-based) financial planning portal once or twice a year. And there’s substantial evidence that regular use of financial planning software to track spending matters – one recent study on Personal Capital’s mobile PFM app by noted behavioral finance researchers Shlomo Bernatzi and Yaron Levi found that the average Personal Capital user cut their household spending by 15.7% in the first four months after using the mobile app to track their spending. And that’s just from using the software, without the further support of a financial advisor (and without even specifically setting a budget of targeted spending cuts!)! Imagine the enhanced value proposition of the typical financial advisor if the average client boosted their savings rate by over 15% in just the first few months of the relationship, because the financial planning software gave them the tools to collaborate on the process! In today’s world, most financial advisors don’t work with clients on their cash flow – in part because it’s difficult to show value, and in part because it’s very challenging to get clients to track their spending in the first place… but as tools like Mint.com and Personal Capital have shown, software can effectively help to solve both of these challenges!

Planning For Gen X and Gen Y Clients. The overwhelming majority of financial advisors are focused on Baby Boomer and Silent Generation clients, for the remarkably obvious reason that “that’s where the money is”. Yet the end result of this generational focus is that virtually all financial planning software tools are built for the needs of Baby Boomers with assets, particularly when it comes to retirement planning – from illustrating the sustainability of retirement withdrawals, to the timing of when to begin Social Security. And as a result, not a single financial planning software solution can effectively illustrate the core financial planning issues of Gen X and Gen Y clients, such as strategies to manage the nearly $1.4 trillion of student loan debt (which is more than all credit card debt in the US across all generations, but student loan debt is concentrated almost entirely amongst just Gen X and especially Gen Y clients!). Similarly, financial planning software lacks other tools relevant for planning for younger clients, including other debt management tools, budgeting and cash flow support, and helping to project the financial consequences of major career decisions (e.g., how much does the primary breadwinner need to earn to stay on track if one spouse makes a change to stay home with children, or how much does a new career need to pay in salary to make up for the cost of taking time out of the work force to go back to school for a career change in the first place?). More generally, financial planning software is entirely devoid of any “human capital planning”, despite the fact that for most Gen X and Gen Y clients, their human capital is their single largest asset.

True Retirement Distribution Planning. While virtually all financial planning software solutions include “retirement planning” as a key module, most actually do very little to illustrate actual retirement distribution planning strategies. For instance, is it better to liquidate an IRA first, or a brokerage account, or use the brokerage account while simultaneously doing partial Roth conversions? How can an advisor really evaluate if a particular annuity product would be better for the client’s plan, when no financial planning software can actually illustrate specific annuity products (ditto for loan-based life insurance strategies for retirement income). Would the client be better off using a bucket strategy instead of a traditional total return portfolio? Will the retirement plan come out better if the equities are in the IRA or the brokerage account? If there was a severe market downturn, most clients would likely trim their retirement spending for a few years… so why doesn’t any financial planning software allow advisors to model dynamic spending strategies where clients plan, up front, to trim or increase their spending based on what the markets provide (or what the various Monte Carlo scenarios project), to help simulate how much (or how little) of an adjustment would be necessary to actually stay on track in a bear market (and then produce a Withdrawal Policy Statement for the client to sign). More generally, why doesn’t any comprehensive financial planning software illustrate strategies like the 4% rule or Guyton’s guardrails, despite the robust retirement research literature to support them? Simply put – financial advisors provide a tremendous range of specific, implementable retirement strategies that have to be illustrated and explained in a piecemeal process outside of financial planning software, because today’s tools aren’t capable of illustrating what advisors actually do.

Collaborative Financial Planning Software (No More Paper Reports!). Financial advisors have been going increasingly “paperless” and digital in recent years, aided in no small part by the explosion of digital onboarding tools as the advisory industry has stepped up to match robo-advisor innovations. However, today’s financial planning software tools are still built with a “printed report first” philosophy, leading the bulk of the output to be in the form of static page printouts, rather than created with a visually appealing on-screen interface that allows the advisor and client to collaboratively make changes on the spot. Yet the reality is that financial planning done collaboratively can both save time (avoid preparing alternative scenarios that turn out not to even be relevant!), and break down the fundamental flaw of goals-based financial planning (that most clients don’t even know what their goals are until they use planning software to explore the possibilities, first!). Similarly, the truth is that the greatest blocking point for doing financial planning with most clients is that they don’t even have the data to provide to the advisor to input into the software, and even for clients who provide the data, keying the data from paper statements it into the planning software is one of the most time-consuming steps of the process; a digital-first planning software could be built to collaboratively gather the data modularly over time, helping to draw clients proactively into the process by showing them incremental value as the plan is created before their eyes. What would financial planning software look like (and how much more efficient and engaging could it be) if the tools were designed to not generate any printed reports, and all of the information had to be engaged via a shared computer monitor, or a client portal?

Comprehensive Planning Software That Actually Creates A Comprehensive Written Plan. For financial advisors who do continue to produce written financial plans for clients, the primary challenge in today’s marketplace is that planning software doesn’t actually produce the entire financial plan… just the pages associated with the financial projections. Thus, financial planners who craft firm-branded financial plans must create and collate together a graphics template with firm colors and branding, a Word document with financial planning recommendations, Excel documents for customized charts, and financial planning software output itself, into either a physically printed document, or a cobbled-together PDF document. Ideally, financial planning software that is designed to produce holistic financial plans should also be a plan collating platform, that makes it easy for the advisor to integrate together the advisory firm’s branding and colors, the written aspects of the financial plan (e.g., plan recommendations, customized client education) along with any custom-created graphs and charts, all assembled into a single document with consistent visual elements. Otherwise, financial advisors who do produce comprehensive financial plans – where the advisor adds value beyond just the printed output of the financial planning software – will continue to face lost productivity and immense amounts of wasted time trying to put together the separate pieces of “the plan” since the planning software can’t do it directly.

Ongoing Financial Planning With Opportunity Triggers. In the past, “financial planning” was primarily about getting paid for the plan itself – either via a planning fee, or for the products implemented pursuant to the plan. As a result, financial planning software was (and still is) very focused on the upfront financial plan, with the occasional “updated” plan that occurs if the client indicates that his/her situation has substantively changed (and there might be a new opportunity to do business and earn a planning fee or product commission). Yet for financial planners that actually do ongoing comprehensive financial planning – most commonly as a planning-centric AUM fee, or an ongoing retainer fee – the bulk of the financial planning relationship is what happens in all the years after the first one, not the initial planning year! Unfortunately, though, no financial planning software is really built to do effective ongoing financial planning, where the client’s “plan” is a live, continuous plan that is perpetually updated (via account aggregation), and shows both progress towards goals over time, and the progress of goals already achieved (which is crucial to validate the ongoing planning relationship!). In other words, what would financial planning software look like if it was continuously updated via account aggregation, and clients could log in at any time and see trends over time, ongoing financial planning recommendations that still need to be implemented, and accomplishments of recommendations already implemented? Similarly, if the planning software was continuously updated, at what point could the planning software tell the advisor when there is a planning opportunity to engage the client about, from milestone birthdays (e.g., age 59 ½ when penalty-free withdrawals from IRAs can begin, age 65 when Medicare enrollment is available, or age 70 ½ when RMDs begin), to changes in client circumstances (where the planning software detects a promotion or job change because the monthly salary deposit changes), proactive planning opportunities (e.g., where interest rates fall to the point that the client can refinance a mortgage, or updated year-end tax projections notify the advisor of a capital loss or capital gains harvesting opportunity), or warning indicators for clients veering off track (e.g., where dollars saved this year are behind on the annual savings goal, or where spending rises precipitously, or if the portfolio falls below a critical threshold of success in retirement). In the end, financial planners shouldn’t have to meet with clients regularly just to find out if there are any new planning needs or opportunities… because ongoing financial planning software should be continuously monitoring the client’s situation, and notifying the advisor of the planning opportunity!

Pick A Focus To Differentiate (And Being Simpler And Easier Doesn’t Count)

Sadly, the reality is that today, most financial planning software companies will claim that they do most of the items listed above. Yet financial planners know in practice that most financial planning software doesn’t do (m)any of these things very well – thus why so many financial advisors still use Excel, and why the combination of “Other” or “None” categories is still the most common response to advisor surveys on “What Financial Planning Software Do You Use?” And the companies that try usually try to do them all, and end out with an excessive amount of feature bloat, with the associated decline in adoption and usability.

But the key point here is that true differentiator of financial planning software isn’t a feature issue. It’s a focus issue, that is expressed in clear features that support the differentiated vision. After all, building truly tax-focused planning software means the tax tables need to permeate every part of the software, from the input, to the analytical tools, to providing output that shows and communicates tax benefits and tax savings (since that’s what the tax-centric advisor will want to show). True retirement distribution software needs to invest heavily in integrations to bring in and accurately model all the various retirement products and strategies that exist today, which again is both a user interface, output, integration, and data analytics challenge. Collaborative-first software would have a substantially different UX/UI design if it was intended to never print a report, and be used solely in a collaborative nature. And so on and so forth for the other differentiation types.

The other reason why setting a differentiated vision is so crucial is that it escapes what has become the greatest malaise of financial planning software companies trying (and failing) to differentiate: the Quixotic effort to be the “best” software at being simpler and easier to use.

The problem with a financial planning software mission of being “simpler and easier to use” is that doing so requires making trade-off decisions and sacrifices, and without a clear understanding of the type of advisor the software is meant to actually serve, it ends out serving no one. Thus why NaviPlan made their software “easier to use” in their transition from the desktop to the cloud, and actually lost market share – because the complexity that was eliminated was a level of cash-flow and tax detail that its core users wanted, driving them to alternatives like eMoney Advisor and MoneyTree. While players like GoalGami Pro tried to create “simpler” financial planning software to distribute to broker-dealers whose reps were complaining that MoneyGuidePro and eMoney Advisor were “too hard to use” – only to discover that the real problem was those sales-oriented reps didn’t actually care about financial planning at all, and weren’t going to adopt any financial planning software, regardless of its ease of use (and consequently didn’t gain much market share, either). And why the new “simpler and easier to use” Figlo platform hasn’t grown much market share since Advicent bought it several years ago, either.

Not to say that it’s “bad” for software to try to make itself simpler and easier to use. But simpler and easier isn’t a real differentiator in today’s financial planning software landscape, because some advisors want “simpler” to mean shorter and faster, while others want “simpler” to mean easier to collaborate with clients and have less upfront data entry, still others want “easier to use” to mean easier to enter the complex detailed data inputs they want to model… and because the cost of switching software is exponentially higher than the improvements of “easier to use” in most cases anyway. Thus why most financial planning software newcomers continue to struggle with growth, and why shifting market shares of the leading providers change at a glacial pace.

Nonetheless, the good news is that, as discussed in this article, there are a substantial number of opportunities for financial planning software newcomers to meaningfully differentiate – both as an opportunity for reinvention amongst the large incumbents (MoneyGuidePro, eMoney Advisor, and NaviPlan), today’s still-nascent emerging players, and startups that are still building behind the scenes and haven’t even launched yet. But at the same time, for the sake of new company growth – and the betterment of the financial planner community itself – it’s time for financial planning software companies to take a bold step forward to the future of financial planning, and not keep building features to compete for enterprises, and against competitors, that are stuck in the past. On the plus side, though, with the DoL fiduciary rule as a catalyst, a large swath of financial advisors (and financial services institutions) are being driven to shift from simply distributing financial products, to truly getting paid for financial planning advice… which means the demand for financial planning software, including new solutions, should only rise from here!

So what do you think? What would it take for you to switch to a new financial planning software provider? Where do you see the biggest gaps? Which of the differentiated financial planning software solutions above would you want to buy? Please share your thoughts in the comments below!