Executive Summary

As robo-advisor platforms have increasingly pivoted from direct-to-consumer offerings to business-to-business offerings instead, financial advisors have had many new "robo-advisor-for-advisors" platforms to choose from. The appeal of these "digital advice" support platforms is the potential to expedite the onboarding process for clients - especially less affluent clients where the advisor can't necessarily afford to take as much time to work with the client directly - where the technology helps with everything from risk profiling to efficiently handle the administrative tasks of account opening. And increasingly, these advisor FinTech companies are actually trying to expand into full-scale end-to-end wealth management offerings. Yet ironically, as more and more digital advice platforms build out their capabilities, it's increasingly difficult to simply keep track of the varying list of feature and integrations.

In this guest post, Craig Iskowitz, CEO and founder of Ezra Group (a management consulting firm providing advice to the financial services industry on marketing and technology strategy) shares his thoughts on the best "robo-advisor-for-advisors" platforms for RIAs available, reviewing popular players like AdvisorEngine, Oranj, RobustWealth, Jemstep, and Riskalyze regarding everything from features and integrations, to the client experience, pricing, and more!

Notably, as these modern digital advice solutions become more and more capable, they're also beginning to shift from technology tools to assist with "just" an advisor's smaller clients, to platforms that are capable of supporting the full range of an advisor's clientele. After all, even "traditional" financial planning clients continue to have increasingly higher expectations with respect to the online experience their financial advisor provides... which in turn is expanding beyond just having a seamless digital experience for opening and managing accounts, and into areas such as proactive communication and tracking of financial planning progress.

So whether you have been wanting to look into your options for utilizing a robo-advisor-for-advisors platform, are currently using a solution and want to ensure that it's still the right platform for your firm, or are simply interested in staying on top of this rapidly expanding area of advisor FinTech... I hope that you find this guest post from Craig to be helpful!

If there is one trend that is a constant in the wealth management industry, it’s the rising expectations that advisors have from their technology. This is driven by both the relentless advances in consumer online experiences (raising the demands of client expectations), and also by wealth management software vendors themselves, who seem to be adding new features at an increasing rate and moving into tangential areas to try and differentiate themselves from the competition.

A modern financial advisor expects his technology to impress prospects, make the best use of the advisor’s valuable time, minimize the operational busywork, and help to facilitate the delivery of better client service.

The rise of “digital advice” platforms – a pivot of so-called “robo-advisors” from the direct-to-consumer channel to become B2B(2C) platforms instead – began to fill this void in recent years with tools that expedite the process of risk profiling, account opening, and other client onboarding functions. Now, though, many digital advice platform vendors are expanding beyond risk profiling and account opening, to offer more comprehensive portfolio management functionality, either through partnerships and integration, internal development, or targeted acquisitions.

In fact, digital advice platform functionality is expanding so quickly, that this may be our last review of pure digital advice platforms, as all of the vendors discussed here will probably have morphed into full end-to-end wealth management offerings in 2018.

What Exactly Is a Digital Advice Platform?

There is a lot of confusion among the advisors about what exactly a “digital advice platform” is. Most have heard the buzzword, and may have seen glimpses of sleek modern interfaces, but how does this new tool fit into an advisor’s existing workflow and technology stack?

The availability of all of these robust tools as a starting point makes the advisor’s choice that much tougher. We have attempted to help by highlighting unique features, notable strengths, or cool new features available or in development. No solution is 100% perfect, so we also mention shortcomings and functionality gaps in an effort to help you make an informed choice.

When we first started covering B2B(2C) digital advice platforms two years ago, electronic onboarding and account opening was the primary functionality. Now, all five of the vendors selected for this review have built out additional marketing and communication capabilities as well, encompassing all eight areas of functionality listed below (plus a lot more, which we describe in detail later on):

- Self-Guided Prospect Data Gathering

- Risk profiling

- Digital onboarding

- Account aggregation

- Portfolio construction

- Client portal

- Document vault

- Advisor dashboard

Digital advice can assist with risk assessment, portfolio construction, and connecting portfolios to basic financial planning goals (although many of the solutions only offer a “lite” version of the financial planning suite that does not have the comprehensive depth of eMoney Advisor or MoneyGuidePro). Some tools offer straight-through processing to RIA custodians via FIX connectivity.

In other words, a digital advice platform aims to be the unified client interface to facilitate the process of onboarding (connecting directly to RIA custodians to facilitate the necessary paperwork), portfolio construction and design (connecting directly to trading and rebalancing tools), and a central client portal to support on ongoing service needs (with an advisor dashboard that provides some business intelligence capacities as well).

What many of these tools are lacking is the robust performance reporting capabilities of an Orion or Black Diamond, and an integrated portfolio rebalancing engine of an iRebal or Tamarac. However, these gaps are being addressed by various vendors, generally in one of three ways: build their own, buy one, or offer deep integrations with one or more of the top products.

Is the overlap sufficient to eliminate the need to buy a separate CRM, portfolio management or financial planning software? The answer depends on the needs of your practice. Some of the products reviewed in this article offer an end-to-end solution that includes risk assessment, portfolio construction, models, basic financial planning, rebalancing and reporting. Although the depth of features varies (and sometimes the offering is downright “lite”), the basic capabilities are there and could be sufficient for some smaller RIAs that are primarily focused on asset gathering.

That being said, most digital advice platforms do not have the capabilities to fully replace the higher-end portfolio management or financial planning tools, at least not yet. But even higher-end firms may be interested in digital advice platforms simply to improve the client experience for their current onboarding and servicing process. And the good news is that every one offers integrations with a variety of industry favorites, and is designed to fit neatly into most existing RIA technology stacks between what custodians and performance reporting and rebalancing tools already provide (although unfortunately, with a limited amount of bi-directional data flows so far).

From Client Onboarding To Marketing And Client Communication

The most notable changes from early-stage digital advice tools to the modern versions available today is the expansion from “just” being onboarding tools, into the ability to leverage the platforms for a wider range of client communication and marketing capabilities as well, as software expands advisor-client interactions beyond just phone calls, emails, and annual in-person meetings, and client portals expand to create an entire communications hub to reinforce the advisor’s brand message and strengthen the client connection. For instance, in-app chat and compliant texting features put the advisor within easy reach, as does virtual meeting capabilities, all within the digital advice platform.

And digital advice tools aren’t just for better communication with existing clients; the tools are increasingly relevant for attracting new clients as well. Smart advisors realize that they need help to improve their prospecting, and that the digital experience is part of how prospective clients evaluate advisors.

Of course, most RIAs that have launched digital channels have realized by now that just adding a digital advice onboarding button on their website is not enough to drive new business (with Millennials or any other clients). After all, an automated offering may facilitate onboarding, but it doesn’t replace the need to market and invite prospects to a conversation in the first place. Nonetheless, digital platforms can help advisors nourish and impress leads. Effective and timely lead management is critical for creating new business opportunities, and having this as part of an integrated and fully actionable tool can make a difference.

Reviewing The Leading Digital Advice Platforms

The following digital advice vendors are included in this review:

(Click on the software name above to skip to that section below.)

AdvisorEngine Review And Pricing

The story of AdvisorEngine started in 2014, when industry veteran Rich Cancro teamed up with fintech futurist Alexey Sokolin. Previously known as Vanare, the RIA platform acquired Sokolin’s direct-to-consumer robo-advisor NestEgg and became one of the first companies to combine traditional wealth management services with digital advice functionality. Since then, the firm rebranded to AdvisorEngine and raised two fundraising rounds totaling $25 million from asset manager WisdomTree.

The story of AdvisorEngine started in 2014, when industry veteran Rich Cancro teamed up with fintech futurist Alexey Sokolin. Previously known as Vanare, the RIA platform acquired Sokolin’s direct-to-consumer robo-advisor NestEgg and became one of the first companies to combine traditional wealth management services with digital advice functionality. Since then, the firm rebranded to AdvisorEngine and raised two fundraising rounds totaling $25 million from asset manager WisdomTree.

AdvisorEngine used the infusion of capital to make two strategic acquisitions in 2017. One was Kredible, a research-driven practice management company that helps advisors find new clients by better managing their online presence. The other was Wealthminder, which provides goals-based financial planning software. Both companies are being integrated into the AdvisorEngine platform.

Notably, just as this article was being prepared for publication, we learned that AdvisorEngine was acquiring Junxure, a popular CRM system for RIAs that comes with a user base of 1,400 firms. On the face of it, the move is an effort by AdvisorEngine to build a more complete end-to-end digital platform. With an in-house CRM from Junxure, a financial planning solution from Wealthminder, a set of digital onboarding tools and automation around investments and rebalancing, AdvisorEngine is creating an ecosystem that is capable of addressing many of advisors’ needs in a single package.

Without doubt, Junxure’s existing user base will present a good opportunity for AdvisorEngine to grow. Whether or not the acquisition will create the anticipated synergies remains to be seen, though, especially because most of Junxure users are primarily financial planning-centric firms, while AdvisorEngine is more investment-centric and does not offer deep integrations with third-party financial planning software (like eMoney Advisor and MoneyGuidePro) used by many of those firms.

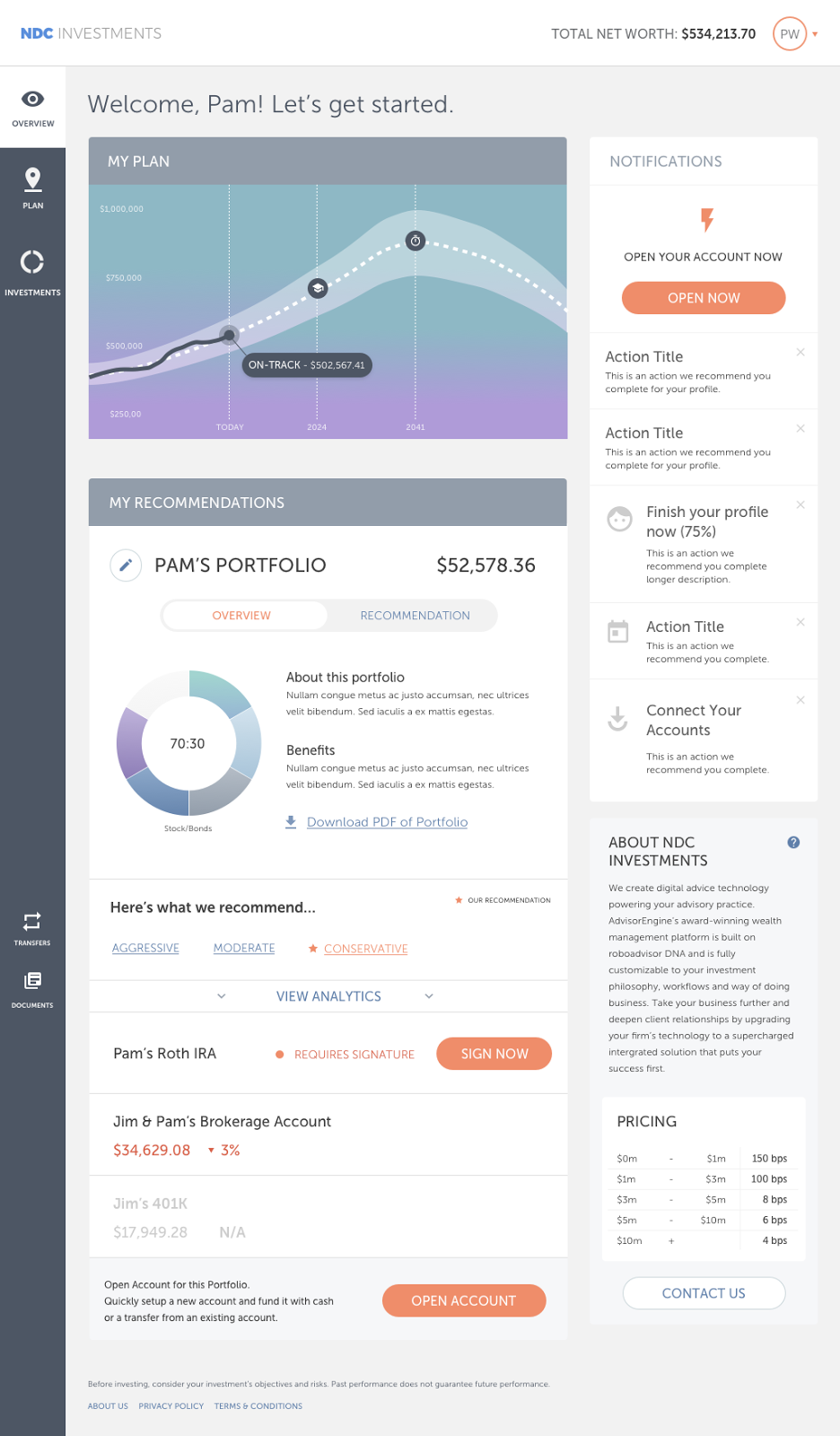

AdvisorEngine Client Portal

A big part of AdvisorEngine’s appeal is the way it can seamlessly power client-facing portals. Everything beyond the “Get Started” button is hosted by AdvisorEngine, which provides a consistent client experience.

Prospective clients can explore the offering from within a fully white-labeled platform (i.e., branded with the financial advisor’s logo). The portal’s primary focus is on goals, since AdvisorEngine absorbed Wealthminder’s goals-first philosophy into the redesign of the workflows and menus.

We really like the compact design of their portal, which does not overwhelm clients with a busy dashboard, but focuses on just three key pieces of information: notifications, portfolio value, and whether their plan is on track. The “My Plan” graphic is an eye-pleasing combination of the client’s goals, and a band showing high/low probability throughout the client’s lifetime. Only Riskalyze has something similar, but without the goals overlay.

Advisors can customize the text that is presented to the clients. For example, they can add comments that provide insights into the firm’s history and philosophy, as well as educational information such as the importance of proper asset allocation, or ways of thinking about risk. Changing the text is as easy as typing it into a box and hitting “update”. This is a nice way for an RIA to put their imprint on the client experience. It also helps to put a human face on what is, after all, an automated offering.

AdvisorEngine re-designed their portal, resulting in a sleek layout with new graphics.

AdvisorEngine’s recent acquisition of Wealthminder has significantly upgraded the combined platform’s toolbox for advisor-client collaboration. Advisors are struggling to define the optimal frequency of client touch points and demonstrate the value of financial planning while maintaining contact in a way that isn’t cost-prohibitive. The new AdvisorEngine interface addresses this problem by providing space for efficient two-way communication. Clients can create goals and advisors can provide feedback and insights – all in real time. This feature could be particularly attractive to Gen X and Millennial clients that value 24/7 access and are comfortable with checking into a technology portal. Although financial advisors already using full financial planning tools may find the Wealthminder modules to be redundant or distracting from the financial plan the advisor already prepared.

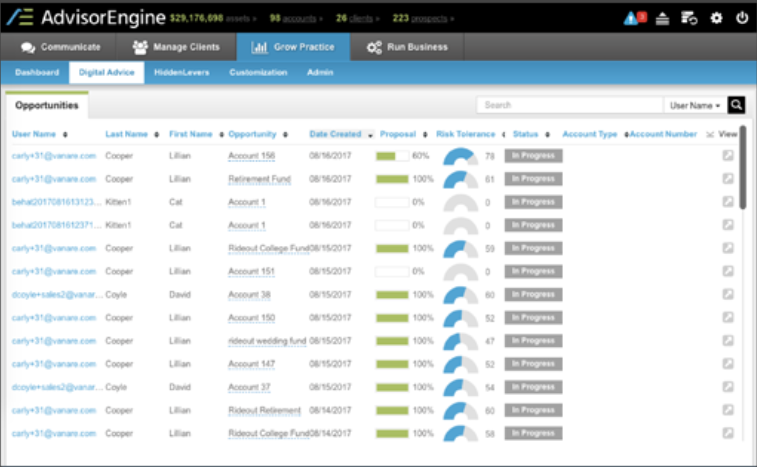

AdvisorEngine Advisor Dashboard

AdvisorEngine aims to give advisors and clients the ability to collaborate in real time. This begins with a mandate to be device-agnostic, and includes cross-device accessibility, which means that advisor and client can work remotely while viewing a mirror image of the same screens. And a virtual collaboration space allows the advisor to get started on a document, transition it to the client, then take it back after the client has added the information. This is similar to Jemstep’s “I drive, you drive” functionality.

The advisor dashboard is configurable at the enterprise level, where role-based settings define specific access levels. For example, advisors can only see their own clients, while supervisory-level professionals can across the broader client base. Access to models can also be controlled. Unfortunately, individual advisors cannot customize widgets on their own dashboard.

AdvisorEngine offers a sleek and well-designed advisor dashboard. The screenshot above illustrates visibility into the prospect pipeline.

AdvisorEngine’s dashboard provides visibility into household-level holdings, enables advisors to research outliers, as well as run reports. The opening screen presents alerts on a range of issues, from money movement to service alerts from custodians. This makes it possible for the advisor to efficiently manage their book of business by dealing with exceptions first.

AdvisorEngine also has compliance support capabilities. The compliance log has full review and approval functionality for account opening. The workflow is designed to help move the process along and everything is tracked for ease of monitoring and review. Notably, though, while Investment Policy Statements (IPS) can capture client restrictions and other limitations, there is no rules-based warning or hard stop in AdvisorEngine to block a recommended trade that violates any of them.

Digital Advice Table Stakes Features In AdvisorEngine

Digital Client Onboarding

Convenient onboarding workflow is a key selling point for any digital advice platform, and AdvisorEngine has recently updated its process from an email link to a single screen workflow. The upgrade makes onboarding seamless for the client.

As we expected, the interface is user-friendly with a layout that flows naturally. The platform makes good use of graphics to present visual cues to identify the current step in the process. A tangible presentation of progress made is a motivating feature as clients walk through initial account setup.

Electronic signatures and paperless account opening was once only available from a robo-platform, but is no longer a differentiator as the larger wealth management platforms caught up. As with most of their competitors, AdvisorEngine uses DocuSign to eliminate all paper documents.

Multiple documents can be bundled into a single signature workflow, then un-bundled once completed and directed through compliance review, and ultimately sent to their final recipients seamlessly. This “virtual envelope” functionality is similar to what other top 5 vendors offer.

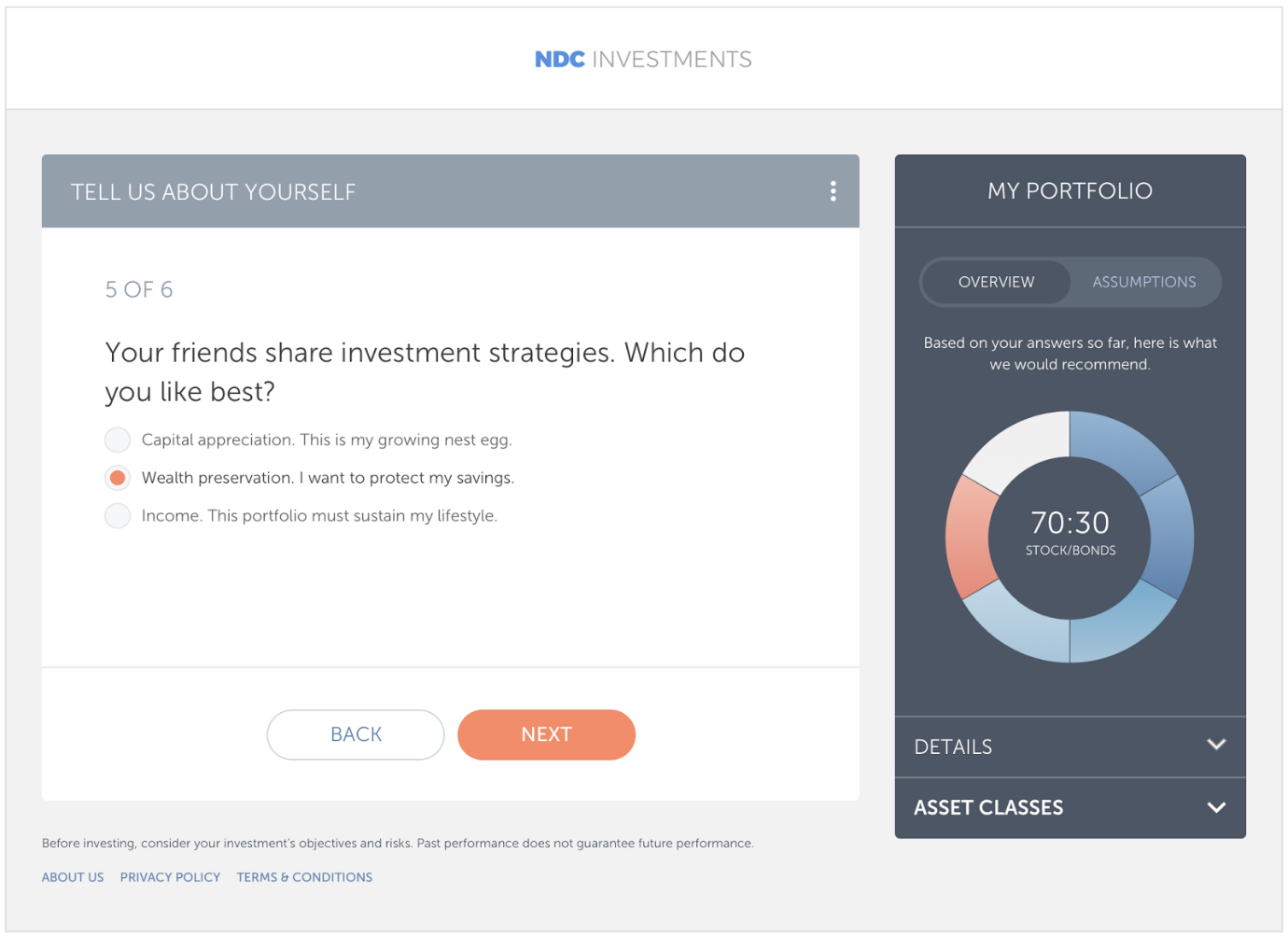

AdvisorEngine’s client onboarding workflow is clutter-free and inviting, with clear navigation and helpful visuals.

Risk Profiling

AdvisorEngine does not subscribe to a “one list of questions fits all” methodology, and allows the user to fully customize the risk tolerance questionnaire. In fact, advisors are not restricted to using this space just for risk tolerance assessment. They can add questions about capacity for risk, retirement and other goals, or any other data gathering data points they like. Although at this point, AdvisorEngine lacks the ability to port that information automatically out to other parts of the financial advisor technology stack (e.g., to the advisor’s CRM or financial planning software).

Portfolio Construction

Portfolio construction within the platform is straightforward. Advisors can construct their own model portfolios, and there are also a variety of pre-made models available in a Model Marketplace to fit clients of different size and complexity. AdvisorEngine leverages its strategic partnership with WisdomTree Investments to deliver access to WisdomTree models (which use WisdomTree’s ETFs) as well as other models from third parties, in its Model Marketplace.

It is worth noting that WisdomTree’s Portfolio Review service has been made available to AdvisorEngine users at no additional charge. The review includes stress tests and model analytics. Advisors who take advantage of this value-added service receive a set of recommendations on how they can capture more Smart Beta and improve their portfolios.

While AdvisorEngine does not have native portfolio rebalancing functionality, the models can be sent to one of the external rebalancing and trading engines that they are currently integrated with (currently Smartleaf, FolioDynamix, iRebal and Orion).

Account Aggregation

Account aggregation functionality is robust with 18 different account types fully supported (the list includes individual, joint, IRA and trust accounts among others). Quovo is AdvisorEngine’s aggregator of choice, and pulls in account balance and position information, which allows clients to track net worth changes over time (but without the transaction-level data that would be necessary to provide performance reporting on outside accounts). Clients also have the option to add accounts manually to track balances.

Document Vault

The platform has a robust document vault that’s meant to bridge the communications gap and help clients get organized. Some advisors utilize the vault as a replacement for sending documents via email attachment. Quarterly performance statements, trade confirmations, and invoices can all be stored in the vault for easy reference and access. The document vault can be made available to all clients of the advisory firm, including those who did not originally come in through the AdvisorEngine platform (i.e. existing/legacy clients).

Other AdvisorEngine Functionality

Rebalancing

Rebalancing capabilities within AdvisorEngine come in a range of flavors, all of which are delivered via integration with third-party applications, as AdvisorEngine does not include built-in rebalancing.

For advisors with simple needs, they can bring their models into the platform and perform basic rebalancing through a “lite” version of Smartleaf’s rebalancing software.

Those who need tax management and other advanced Smartleaf features can opt into a premium package for an additional fee. Models, drift and trade parameters are seamlessly passed from AdvisorEngine into Smartleaf to eliminate the need to re-enter the data.

TD Ameritrade users have the option of using iRebal instead of Smartleaf. Integrations with FolioDynamix and Orion are also available.

Financial Planning

AdvisorEngine’s financial planning capability has been expanded with the acquisition and integration of Wealthminder. A goals-based workflow is prominent on both advisor and client dashboards, and is meant to facilitate an in-depth planning conversation beyond just risk tolerance questionnaires and fund selections.

The financial planning module includes a suggestion engine that will automatically offer ideas to help clients meet goals. For example, if a client’s primary goal cannot be reached using the given set of assumptions, the algorithm will recommend that the client scale back on spending, or eliminate a secondary goal. Of course, the advisor does not have to use the built-in financial planning features and can simply ignore any suggestions (though AdvisorEngine doesn’t allow the financial planning module to be turned off or hidden for advisors already using their own financial planning tools). At this time, AdvisorEngine users do not have the ability to connect to an external financial planning package, although APIs to enable this are on the 2018 roadmap.

Chat/Communications Support

AdvisorEngine’s communication game plan stops short of offering native online chat functionality. That being said, a partnership with a FINRA-compliant solution (e.g., Olark) could potentially close that gap without the vendor having to build a solution from scratch.

Advanced Prospecting Support

The acquisition of Kredible will enable AdvisorEngine users to perform a high-level evaluation of their online presence, as well as curate and share relevant content with clients and prospects. These are aspects of marketing that many advisors do not understand. It usually requires hiring an experienced marketing professional to evaluate and improve an advisor’s online brand.

AdvisorEngine is in the process of integrating other Kredible digital marketing support tools (such as home office-level control of advisors’ LinkedIn profiles, ability to run e-mail marketing campaigns, and more). This will be an interesting differentiator for AdvisorEngine when available (depending of course on how well they can integrate the functionality into the advisor workflow).

Enterprise Dashboard

To support larger firms at the home office level, AdvisorEngine offers a fully-customizable role assignment dashboard. Permissions can be maintained and updated in a central location, which makes housekeeping easy.

Another enterprise feature allows all of a firm’s documents to be developed and maintained in a single workflow. For firms with multiple RIA’s and a combination of sub-brands, AdvisorEngine can maintain separate URLs, risk tolerance questionnaires, and workflows.

Billing is another function that most digital advice vendors avoid, but can be handled in AdvisorEngine. For those RIA’s interested in exploring their options, AdvisorEngine’s built-in solution provides a lot of control including billing in arrears or in advance, at a flat rate up to a minimum level or using a basis point-driven fee structure, etc.. The revenue workflow is robust, with visibility into revenue splits and detail calculations. Invoices can be placed straight into the document vault on the client portal, and a separate debit file can be generated for each custodian. With this range of functionality, there is no excuse to still be using spreadsheets for advisory fee billing!

Advisor Roadmap

What’s on the roadmap for AdvisorEngine in 2018?

In addition to expanding multi-custodian functionality, the AdvisorEngine development team is actively searching for innovative ways to extend the efficiency and automation into enterprise core systems. One idea is to take native data and make it more accessible, actionable, and reusable throughout the firm. Could the system pre-populate an SEC audit form with a single click of a button? It remains to be seen.

AdvisorEngine Integrations

A true litmus test of any FinTech solution is its ability to fit seamlessly into an existing workflow and technology stack. AdvisorEngine’s open architecture setup is well suited for the ease of integration.

CRM is a central part of most advisor’s workflow and a dashboard of choice for many. AdvisorEngine offers CRM integration with Redtail, Salesforce and WealthBox (integration with Junxure is on the roadmap). All CRM integrations are “push” only at this time (i.e. AdvisorEngine will push the collected data into the CRM, but won’t “pull” the CRM data into its own data fields). The “pull” functionality will be addeded soon, and will boost efficiency for keeping track of clients and prospects that do not have first advisor contact via AdvisorEngine (important for existing advisory firms with an existing client base that predates AdvisorEngine).

It will be interesting to see how AdvisorEngine chooses to prioritize deeper CRM integrations. Given the recent news of the Junxure acquisition, and the fact that converting Junxure users to AdvisorEngine will likely be a key part of the firm’s business development effort, it would not surprise us if the technology roadmap favors the Junxure user base.

The platform currently supports three custodians (Pershing, Raymond James and TD Ameritrade) with Apex Clearing coming soon and more negotiations underway. Supported CRMs include Redtail, Salesforce and WealthBox (with Junxure coming soon). For portfolio analysis and reporting, AdvisorEngine partners with FinMason, HiddenLevers, IDC and S&P.

AdvisorEngine Pricing

AdvisorEngine pricing is calculated as a basis point charge for the amount of assets that have been onboarding through and are being managed via the platform. Pricing starts at 10bps, and tiers downwards higher AUM levels, with some a la carte pricing for individual platform components.

Oranj Review and Pricing

Oranj is a not your father’s technology firm. It was launched in 2014 by former financial advisor David Lyon, when he couldn’t find practice management software for his RIA. What started out as a customized solution for internal consumption has expanded to be used by over 200 RIA’s around the country. Oranj moved from a digital-only offering into a full-featured platform with the acquisition of portfolio rebalancer TradeWarrior.

Oranj is a not your father’s technology firm. It was launched in 2014 by former financial advisor David Lyon, when he couldn’t find practice management software for his RIA. What started out as a customized solution for internal consumption has expanded to be used by over 200 RIA’s around the country. Oranj moved from a digital-only offering into a full-featured platform with the acquisition of portfolio rebalancer TradeWarrior.

At the recent T3 Enterprise Conference, Lyon launched the industry’s first “freemium” model that offers a complete advisor technology stack dubbed “MAX” at “no cost”, attached to a Model Marketplace with asset managers who pay Oranj for distribution of their ETFs via the available models.

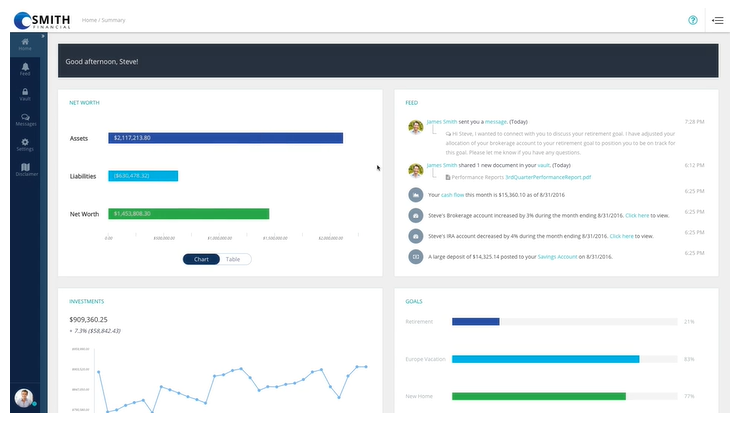

Oranj Client Portal

Oranj underwent an interface redesign in early 2017. In addition to streamlining the location of menus, the focus of the update was on improving advisor/client collaboration. New additions that improved advisor/client communication include in-app messaging and a revamped document vault. Combined, the two features have the potential to eliminate or decrease the need for phone calls, emails and in-person meetings.

Oranj website offers a link to a video that can be shared with clients in an effort to introduce the client dashboard and teach them to get the most out of it.

Oranj Advisor Dashboard

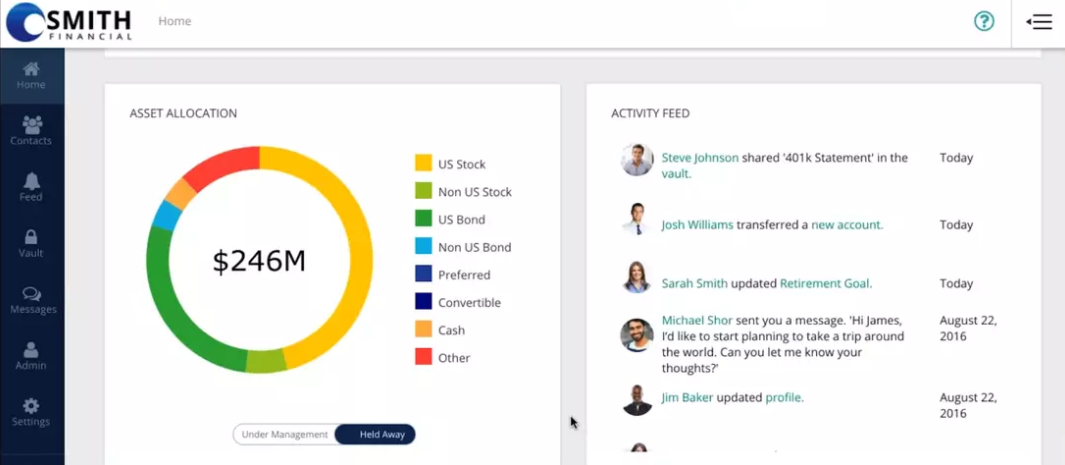

The Oranj advisor dashboard opens with an overview of the asset allocation and an activity feed reminiscent of social media platforms like Facebook or LinkedIn. There are alerts regarding both prospects and clients who need attention.

Advisors also have access to all the information in the client’s portal, such as net worth, liquidity, investments, insurance and more, as well as visibility into who has recently initiated an inquiry, ran a research query, or added a goal. The combination of feeds and alerts has the potential to be a great tool for helping advisors get a general sense of what’s happening across their client base and focus on the most urgent requests. It can also be white labeled to the advisor’s logo and branding.

Oranj advisor dashboard, with its column of navigation commands on the left and an activity feed to notify the advisor of recent actions, messages and alerts.

One of our favorite features of Oranj is its ability to streamline “behind the scenes” decisions to improve efficiency and automate the workflows that don’t require human decision-making. For example, some advisors might utilize several custodians, and prefer that certain accounts be custodied at a specific custodian due to a preferential fee structure. These routings and matchings can be automated in Oranj based on the advisor’s input of the relevant factors.

For example, one custodian may have better transactional pricing that’s advantageous for larger accounts, while another might offer better AUM-based pricing that benefits smaller accounts. Oranj supports a set of rules that will route new account paperwork to align with the appropriate custodian automatically based on the incoming account balance.

Digital Advice Table Stakes Features In Oranj

Digital Client Onboarding

Oranj can be used as a pre-engagement tool, which gives interested prospects an early taste of the digital experience that’s available to clients. Similar to Jemstep, Oranj allows for visibility into held-away accounts, that’s powered by a robust account aggregation engine that pulls together data feeds from Yodlee, Quovo and ByAllAccounts. 100% of accounts for new prospects are designated as “held away”, and both partial and full account transfers are supported.

Onboarding is now smoother with the long-awaited DocuSign integration, which has eliminated the need to print and sign any paperwork. The document package can combine custodian account opening paperwork with advisory agreements and Investment Policy Statements, then route the individual pieces to the right destinations after signatures.

Risk Profiling

The Oranj Risk Profile Questionnaire gives advisors the option to pick and choose up to 25 questions from a pre-approved library developed by Oranj. This allows advisors to tweak the RTQ experience, but stops short of AdvisorEngine’s capability to truly customize the questions by writing your own.

Portfolio Construction

Based on the client’s or prospect’s goals, financial resources and risk tolerance, he or she is automatically placed into one of preset model portfolios. Oranj offers advisors access to a Model Marketplace with pre-constructed models from leading asset management firms including BlackRock, Direxion, Morningstar Managed Portfolios, ETF Securities, and Frost Investment Advisors.

Advisors can also edit a third-party model and save it as their own with a considerable degree of control over how strictly those models are followed, as well as the timing of updates.

An upgrade to the newly announced “premium” version of the MAX platform unlocks the ability to add any security from the entire universe of mutual funds, ETF's and equities, for advisors who want to go beyond just using and modifying the pre-selected models in the MAX marketplace.

Account Aggregation

Oranj has managed to turn a table stakes feature, account aggregation, into a competitive advantage by becoming an “aggregator of aggregators”. They combine the data feeds from Yodlee, Quovo, and ByAllAccounts and pull the best data from each to support virtually every type of external account. Checking, credit cards, insurance policies, real estate valuations via Zillow, loans, artwork and more from over 25,000 institutions can be added with just a few clicks. However, transaction-level data for detailed performance reporting is not part of the Oranj account aggregation capabilities.

Document Vault

Oranj offers a secure document vault that can house important files, account statements, invoices and more.

Other Oranj Functionality

Rebalancing

With the April 2017 acquisition of TradeWarrior, Oranj undertook an effort to integrate the once-stand-alone rebalancer into the native workflows. Based on the feedback shared by company management, the integration has gone smoothly. That is not surprising, as we saw good potential for both cultural and functional alignment at the time of the acquisition (after all, both companies were started by former advisors). The new release of the combined platform allows advisors to customize drift tolerances, do-not-sell restrictions, account cash minimums, tax loss harvesting and more. At this time, there are no integrations with any other rebalancing tools.

Financial Planning

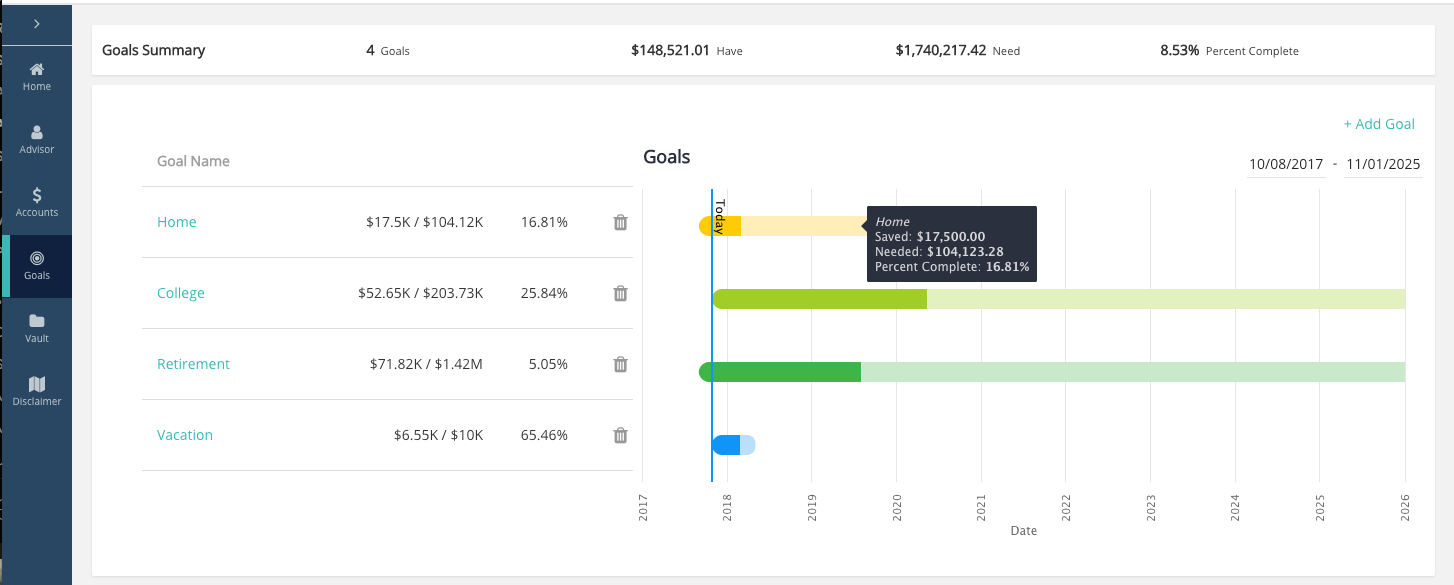

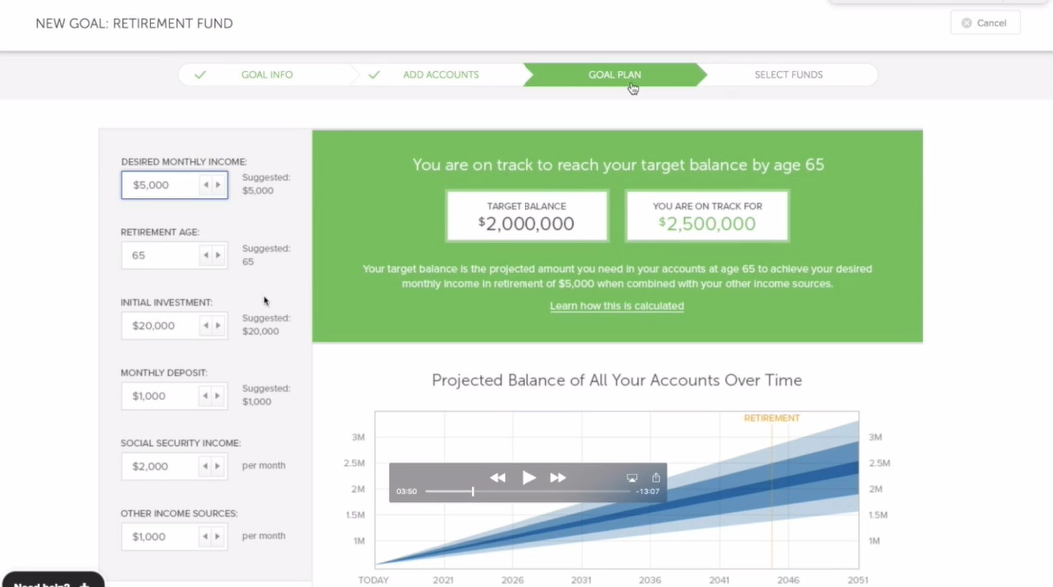

One of our favorite outcomes of the recent Oranj re-design is the robust set of graphics for goal-based planning. Clients can create new goals in a matter of a few clicks. Existing goals can be tweaked via sliders as clients re-consider goal priority and the amount of periodic contributions. Each goal can be linked to one or more accounts assigned to it. Additionally, one account can support multiple goals through an assignment of value percentages – a feature that some other platforms like RobustWealth do not offer.

Charts allow for a big-picture overview of progress towards multiple goals on the same graph. We like the way the goal charts look for multiple short-term goals, as the bars are relatively large to allow visibility into relative progress. The chart’s appearance is a bit less granular, especially if the client has two goals that are very far apart in timing. For example, a long-term goal (retire in 20 years) and a short-term goal (pay for next year’s vacation). We suggested adding a measure of percentage to indicate funds availability, and Oranj told us this functionality is forthcoming.

Advisors who already use a stand-alone financial planning application may find the Oranj goals-based planning tools to be redundant or even distracting to clients if it differs from their existing financial plan.

The ability to view progress towards multiple goals is a useful tool that reflects how clients think about their financial commitments and aspirations.

Chat/Communications Tools

Other advanced features include native chat and email functions. They are extensions of the virtual client “home base” where they can find key information, ask questions and update goals in one place. The in-app messaging tool connects the client to the advisor (and/or his staff). Advisors are alerted about the message via email and are able to reply completely in-app. In order to take full advantage of this feature, the advisor has to be accessible via email and available to respond. All chat messages and emails are automatically archived for compliance.

Oranj Enterprise Dashboard

For larger firms, the enterprise dashboard is a critical component of managing access permissions, ensuring standardization where it’s needed, and executing compliance-related workflows.

The enterprise dashboard from Oranj is robust. A home office can assign roles and access privileges for trading, rebalancing, the ability to create and alter models, access client or prospect contact records, upload documents and collaborate with other advisors. This is also the place they can manage their RTQ, assign clients and set firm-wide assumptions in the goals-based planning software tools regarding the average rate of return, life expectancy, inflation rates, and more.

Oranj End-to-End Functionality with MAX

The announcement of the MAX offering seems like a move that was a long time in coming since the freemium model has pervaded software products in almost every industry. MAX is end-to-end digital wealth management platform that is set to launch before the end this year. FinTech vendors of all specialties and sizes have been migrating towards full stack functionality as the Holy Grail to capture more advisor business. What is interesting is how Oranj has gone about accomplishing it.

In a first-ever for the wealth management industry, Lyon announced that the company’s new MAX platform will be free to all users.

Lyon shared that he decided to offer this model in an effort to increase the rate at which advisors adopt new technology. He cited an example of a recent conversation with a $1.5B RIA firm that is still rebalancing over 2,000 accounts in a spreadsheet because they don’t want to spend the $20-50K for an annual rebalancer license.

The freemium offering is an interesting one. To paraphrase marketing guru Seth Godin, the most dramatic price chance one might undergo is from offering a “free” product to charging one cent for it. Godin argues that once you have decided to charge a cent, you may as well charge $100 – the client’s inertia and reluctance is the same either way, at least up to a point. With MAX, Lyon is betting that advisors will flock to at least try Oranj’s “free” technology stack.

For advisors who are expecting hidden fees to make up the cost of the “free” software, Lyon is careful to emphasize that advisors and investors using partner models will not be charged more than they would if they were to purchase those them outside of the MAX platform. The initial response to the announcement has been positive, and Lyon shared that 200 firms have reserved a spot to be onboarded to MAX when the platform launches within 48 hours of the press release.

In practical terms, what is the expected impact on the company and its existing clients? Lyon shared that they anticipate some initial revenue attrition as certain current clients opt for a “freemium” model. On the other hand, MAX will include trading (with full FIX support) and rebalancing, as well as a model marketplace.

Oranj Integrations

With the addition of TradeWarrior, the Oranj platform now has fully integrated rebalancing and trading. FIX (Financial Information Exchange) connectivity allows for straight-through trade processing to custodians including TD Ameritrade, Schwab, Fidelity, Pershing, as well as Interactive Brokers and TradePMR for managed accounts.

Account data can be imported directly from Morningstar Office, Orion, Black Diamond, Portfolio Center, AssetBook, and FinFolio.

CRM integrations with Redtail and Salesforce are on the roadmap, although Oranj does not currently include any CRM integrations outside of its own native capabilities. Nor does Oranj provide any financial planning software integrations, beyond its own basic goals-based planning tools.

Oranj Pricing

Access to the baseline MAX platform is free, which includes the core Oranj onboarding, client portal, advisor dashboard, and rebalancing tools (but only for the models in the marketplace), as Oranj is compensated via the asset managers paying for distribution in the MAX Model Marketplace.

The upgrade to Premium Oranj is priced at $175/seat/month, and includes access to goal tracking, an unlimited document vault, integrated messaging, and advanced business intelligence reporting tools.

The upgrade to the Premium Marketplace feature set is $395/month per firm (not per advisor like the Premium license), which unlocks the ability to create the advisory firm’s own firm-wide models, rebalance, and trade using funds or securities that are not part of the standard MAX partner marketplace offering. In other words, advisors not using MAX models can expect to pay $175 per seat per month for Premium Oranj plus $395 per firm per month for access to Premium Marketplace.

Enterprise pricing is available for larger firms (50+ seats). There is a free “no-risk” 14-day trial period available for first-time users.

RobustWealth Review and Pricing

RobustWealth is another advisor tech startup founded by an industry insider (Michael Kerins) whose goal was to provide a fully-integrated wealth management platform for advisors.

RobustWealth is another advisor tech startup founded by an industry insider (Michael Kerins) whose goal was to provide a fully-integrated wealth management platform for advisors.

RobustWealth positions itself as an alternative to the common jigsaw puzzle of technology stacks used by many RIAs and targets advisors who reside inside of bank, insurance company and asset manager structures. Although this is a relatively new player, the company reports over 70 current RIA clients, with more in the pipeline. Most recently, RobustWealth became the engine behind XY Investment Solutions, the subsidiary TAMP for the 500+ advisors in the XY Planning Network.

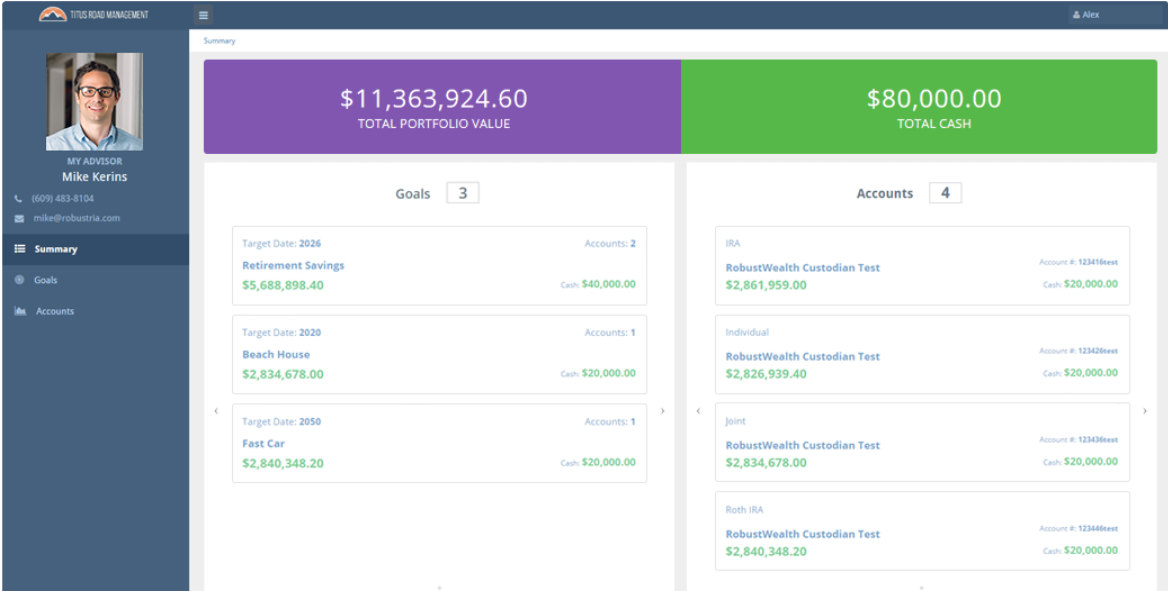

RobustWealth Client Portal

The RobustWealth client portal is clean and the design is pragmatic. The advisor’s brand is prominently displayed, and the advisor has control over the text and disclosures that are presented. The advisor’s picture and contact information are readily available at the top left of the screen, which is a nice touch. From the client’s standpoint, the platform feels like the extension of the advisor’s office, not an add-on.

There is a wide range of tools available to clients within the RobustWealth portal, from reviewing wealth projections to requesting checks from the account. That does not mean that every client gets the same set of capabilities, as advisors can segment what each client can see and do once they are using the platform. This is a useful feature since it does not presume that optimal client service is the same as total access.

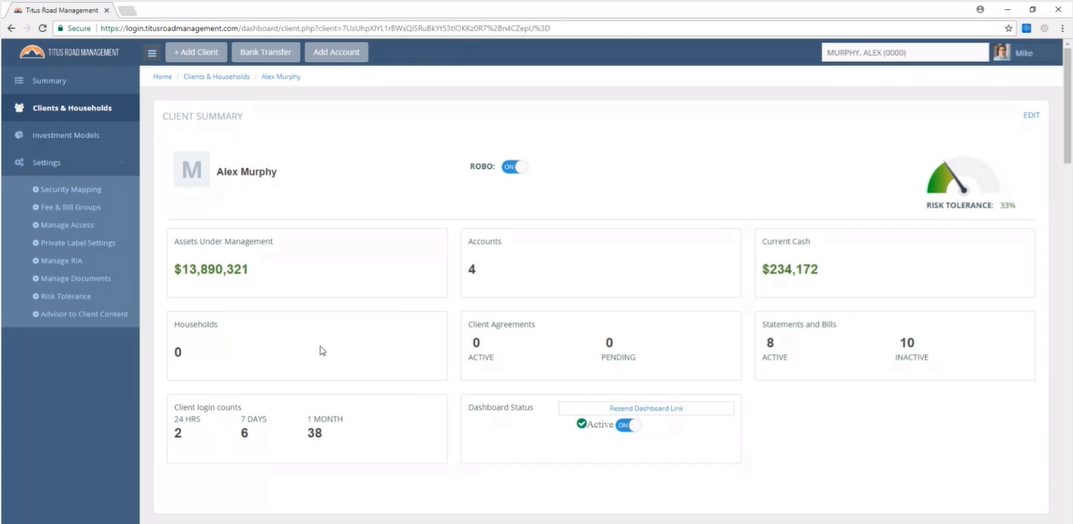

RobustWealth Advisor Dashboard

The RobustWealth dashboard for advisors opens with an overview of the advisor’s practice including standard AUM, automated (“robo”) AUM (being managed directly within RobustWealth), the total number of accounts, average account size, and other key performance metrics. While those data points are useful, we think that the dashboard looks text-heavy, and could benefit from additional graphics and visuals. Data visualization can be an effective way to engage advisors on a deeper level, communicate trends, and give insight into patterns.

Advisors have the ability to automatically track client/prospect onboarding progress and log-in activity.. If a client stops mid-process during onboarding, or has had a slew of log-ins to check on the account balances, the advisor can reach out and offer assistance.

Similar to other vendors, RobustWealth offers a streamlined workflow for multi-document signatures via DocuSign or RobustWealth’s native digital signature tool powered by Apex. Account openings require that some documents be delivered to the client (including advisory agreements, privacy policy and Investment Policy Statements), while others must go to the custodian. All of the top 5 vendors, including RobustWealth, present a single document package to the client for signature (they are in one virtual envelope). After the client signs the documents electronically, the package is automatically split up and delivered to the correct destinations without advisor involvement.

The Client & Household view of the advisor dashboard includes highlights by the number, but could benefit from the addition of dynamic graphics.

Digital Advice Table Stakes Features in RobustWealth

Digital Client Onboarding

New account opening is paperless using either DocuSign, or RobustWealth’s internally developed e-signature capability. The onboarding process is quick, allowing clients to enjoy a simple account linking process, and same-day account funding with Apex (“normal” transfer times apply for accounts with TD Ameritrade).

One of our favorite RobustWealth features is the ease with which the platform allows advisors to create customized workflows for different types of clients.

For example, an advisor’s website might present three options to an interested prospect. The pure digital service workflow may be appropriate for clients with the simplest needs, a blended service model will be for those who want a combination of value pricing and a human touch, and a traditional advisor model for clients with higher assets and more complexity. Each option leads to a different onboarding path that’s appropriate for the specific prospect. This automated client segmentation feature is similar to the Jemstep offering.

Risk Profiling

Risk profiling is a key part of client onboarding, and RobustWealth allows advisors to shape that part of the client experience. The risk tolerance questionnaire (RTQ) is completely customizable. New questions can be added, response options adjusted, and question relative weights changed.

Advisors can share the link to the RTQ with clients and prospects, monitor responses, and track different versions of the customized questionnaire. Robust Wealth’s ultimate long-term intention is to create a questionnaire that is both customizable and dynamic (i.e. client’s response to question # 1 determines which question they get next).

For those advisors who are more technically inclined, there is the option to enable a “shrinkage” option that automatically shifts inconsistent client answers towards the mean.

Portfolio Construction

RobustWealth users have access to goal- and risk-based investment portfolios through their own Model Marketplace. Portfolio construction is facilitated by the third-party asset manager models in the marketplace (BlackRock and Templeton, with more to be added in the future). Advisors can build their own models, tactical overlays, and SMAs as well. A wider range of third-party SMAs are expected to the added to their marketplace in the near future. Overall, the model functionality is similar to the Autopilot Store offering by Riskalyze, although Riskalyze makes a more direct trademark “risk number” connection between the client’s profile and the recommended models.

One unique feature of RobustWealth is its recent announcement of adding direct real estate investing via a partnership with Roofstock. Roofstock is an online marketplace for investing in single-family rental homes. The idea behind the partnership is to offer a unique diversification option to clients – direct real estate investing – without having to do due diligence, tracking and reporting outside of the main platform.

The Roofstock functionality is not available on the platform yet, but we think that being able to invest in real estate as easily as in a brokerage account could add value for the right clients.

Account Aggregation

The current account aggregation functionality of RobustWealth is fairly limited. Clients can add their bank accounts via direct sign-on, but there is no support for outside investment accounts, which is a glaring hole in their capabilities. An integration with aggregator ByAllAccounts (owned by Morningstar) is currently under development, and is expected to go live during Q1 2018.

Until data aggregation functionality is available, clients that log on to an advisor’s portal powered by RobustWealth will not see any of their held away investment accounts. This puts them at a disadvantage when trying to increase wallet share against advisors using one of the other digital platforms.

Document Vault

RobustWealth offers full document vault functionality. Clients and advisors can use the vault for uploading and storing documents. They also support automatic upload of tax and account statements from custodians.

Other RobustWealth Functionality

Rebalancing

Unlike Jemstep and Riskalyze, who are strictly technology platforms with rebalancing capabilities, RobustWealth both provides rebalancing software tools and can serve as a sub-advisor and take responsibility for executing trades directly.

However, the current version of the RobustWealth platform approaches rebalancing as its own “black box”, where advisors have no visibility and cannot review or edit the orders generated by the RobustWealth rebalancing algorithms. At the most, advisors can only manipulate the rebalancer via account settings (but cannot intervene on individual trades).

Nonetheless, the logic of the rebalancer can be customized in several important ways via the account settings. Users can set their own asset class bands, and individual security threshold limits for rebalancing. Daily tax loss harvesting can be turned on or off for each individual account. And the advisor can set tax efficiency parameters within the model setup, and the program’s algorithm will choose the security’s asset location based on the tax status of the account.

We also like that advisors have the option to assign alternative sub-allocations for taxable vs. non-taxable accounts. After assignments are made, the algorithm will select the correct investment automatically based on the tax status of the account. An upcoming release will give advisors some additional transparency into the algorithm logic behind the orders generated by the rebalancing software.

Advisors can also edit the default short-term and long-term tax rate assumptions used to evaluate the tax impact of rebalancing trades, as well as adjust the tax rate at the individual client level. RobustWealth does not offer global tax settings, although we think that smaller RIAs may be satisfied with the current functionality. As the client base grows, the platform will likely have to develop global tax settings to allow larger firms to scale their efforts.

Financial Planning

RobustWealth also offers “lite” financial planning capabilities. Clients and advisors can create new goals and assign accounts to support them. The platform generates projections, and advisors can change assumptions to demonstrate the impact of earlier retirement, higher savings or a change in retirement lifestyle.

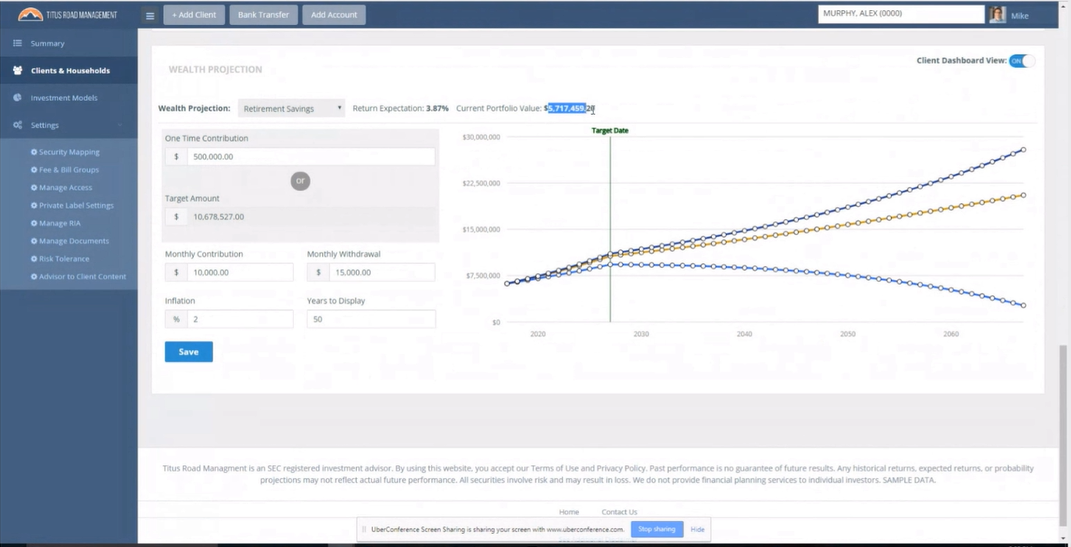

RobustWealth allows advisors to demonstrate the impact of changing planning assumptions.

When it comes to account-goal relationships, RobustWealth supports a one-to-one setup (one goal to one account), as well as multiple accounts to one goal. There is no capability to split an account across multiple goals, a feature that is available with Oranj’s offering.

In addition, similar to other digital advice tools, RobustWealth does not have any integrations with more established financial planning software solutions. Unlike AdvisorEngine and Oranj, though, RobustWealth advisor users do have the option to limit client visibility for the financial plan created within the platform. This is useful for advisors who already use their own more robust financial planning tools, to minimize client confusion in the event that the recommendations generated inside RobustWealth’s “lite” financial planning module differs from those produced by a more in-depth stand-alone software.

Chat/Communications Tools

A “chat with your advisor” feature is currently under development, that would allow clients to message their advisor (or his/her staff) directly from within the RobustWealth client portal. RobustWealth expects that advisors will be able to choose whether to offer this feature via a simple on/off toggle. The launch date is set for Q1 2018.

Enterprise Dashboard

The enterprise-level dashboard is robust, and firms with multi-brand offering will find that they get the level of support and customization they need. A single home office dashboard allows for easy control of custodians, models, client relationships, access roles and more.

Advisors will find that RobustWealth’s billing function is flexible and capable. Breakpoints can be established for a scaled basis-point fee. Advisors can bill monthly, quarterly, in arrears, or in advance. Bills can be created for individual clients, or groups of clients. When billing a group, breakpoints for the fee can be set up across the entire group (e.g., to household fee breakpoints across multiple clients in a shared household). Thanks to its sub-advisor trading capabilities, RobustWealth can actually do the necessary sales to generate cash to pay the advisory fee bills as well. Advisors have the ability to edit invoices and upload them to the client’s document vault. A full audit trail is available for review and compliance purposes.

RobustWealth Integrations

A fully integrated and seamless experience is the core of the RobustWealth offering, even if it means saying “no” to support for some of the largest custodians. Advisors who use TD Ameritrade or Apex Clearing can add RobustWealth and enjoy a fully integrated offering. However, the other big custodians, including Schwab, Fidelity, and Pershing are not supported, since they only offer pull-level data integration, according to RobustWealth.

RobustWealth’s “one platform” approach may be a good choice for RIAs that do not have the time to spend on researching vendors, solving API puzzles, and building their own technology stack. However, it can also alienate firms that have a long-standing preference for a particular rebalancer, risk profiling software, or financial planning platform. In that vein, RobustWealth is currently working on adding one or two CRM and financial planning software integrations in 2018.

RobustWealth recently announced support for up-and-coming RIA custodian Apex Clearing. AdvisorEngine is the only other vendor in our review to have Apex support on their short-term roadmap.

RobustWealth Pricing

RIA pricing is defined in part by the custodian, and follows a tiered structure. Advisors who use Apex Clearing can expect to pay between 17 and 25 basis points which includes trading costs as part of the wrap fee. Those who custody with TD Ameritrade have a slightly lower baseline price point of 15 to 20 basis points, although this fee is just for RobustWealth and advisors still have to pay their own ticket charges. The minimum quarterly fee is set at $1,500 regardless of the custodian.

The pricing for enterprises consists of a one-time launch fee, ongoing service fee, and the sub-advisor fee. Specific fees are determined on a case-by-case basis, and are driven by the number of brands to be supported, the complexity of the offering, and other parameters.

Jemstep Review and Pricing

California-based Jemstep was founded in 2008 to as a direct-to-consumer portfolio monitoring tool that would gather investment details through account aggregation, analyze the investor’s portfolio, and recommend changes they could implement themselves. The platform pivoted to a B2B model in 2014 with their Advisor Pro solution to help advisors scale their businesses though client engagement, onboarding and servicing. The company’s recent acquisition by Invesco had the industry wondering whether the leadership would be moving the newly combined company towards more TAMP-like capabilities (perhaps as a means to distribute Invesco’s PowerShares ETFs in one of their model portfolios).

California-based Jemstep was founded in 2008 to as a direct-to-consumer portfolio monitoring tool that would gather investment details through account aggregation, analyze the investor’s portfolio, and recommend changes they could implement themselves. The platform pivoted to a B2B model in 2014 with their Advisor Pro solution to help advisors scale their businesses though client engagement, onboarding and servicing. The company’s recent acquisition by Invesco had the industry wondering whether the leadership would be moving the newly combined company towards more TAMP-like capabilities (perhaps as a means to distribute Invesco’s PowerShares ETFs in one of their model portfolios).

Ultimately, Jemstep has taken an open architecture approach to investment options, and built a presence across the industry that has captured users at banks, broker-dealers, RIAs and insurance companies. The recent announcement of a partnership with Advisor Group points that way, with the platform’s new “global advisor dashboard” designed to bring together key advisor business intelligence data points, and serve as a powerful hub to manage an advisor’s day.

Jemstep Client Portal

Sleek, simple, and easy to use, Jemstep’s client portal checks all the boxes for a great user experience. Prospective clients get a taste of the platform with a free portfolio analysis and account aggregation (the roots of Jemstep’s original direct-to-consumer offering). Existing clients can enjoy single-sign-on functionality for Jemstep’s Investor Portal and Online Banking Portal, we well as the convenience of DocuSign for embedded electronic signatures.

Jemstep was originally built for a do-it-yourself investor, and the company has remained true to the spirit of empowering clients and giving them tools to understand their financial situations and take action. The portal is a robust one-stop shop for account status, performance, reporting, trade confirmations, statements, account maintenance activities and more. Clients can move money and set up one-time or recurring ACH transfers with just a few clicks.

We like the platform’s built-in chat feature powered by Olark (integrations to other chat services such as Zendesk and Salesforce are also available) that enables prospective clients to chat with a support person in the advisor’s office at any point in the onboarding process.

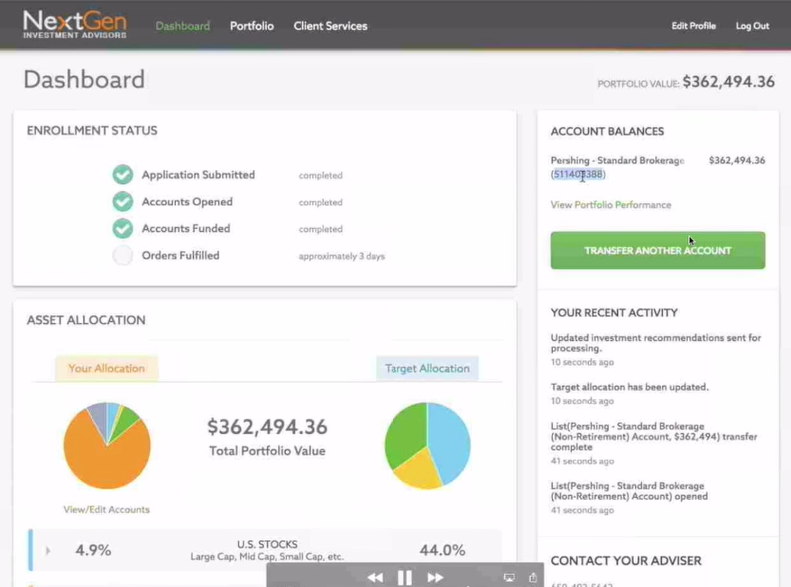

The Jemstep client portal is clean and easy to navigate. We like the “Contact your adviser” widget at the bottom of the screen.

Jemstep leverages CashEdge for aggregating held-away accounts, so they can be displayed on the client portal. Their portal offers a unique feature where clients can click a button next to a held-away account and initiate an account transfer to the advisor. Jemstep reports that their advisors have experienced a 6-8% increase in transfers since the feature was rolled out.

Jemstep Advisor Dashboard

While robo functionality alone is not enough to bring in prospects, automation can play a key role in converting prospects into clients after an initial attraction is made. In this vein, Jemstep shines with robust features to help advisors manage their business development efforts.

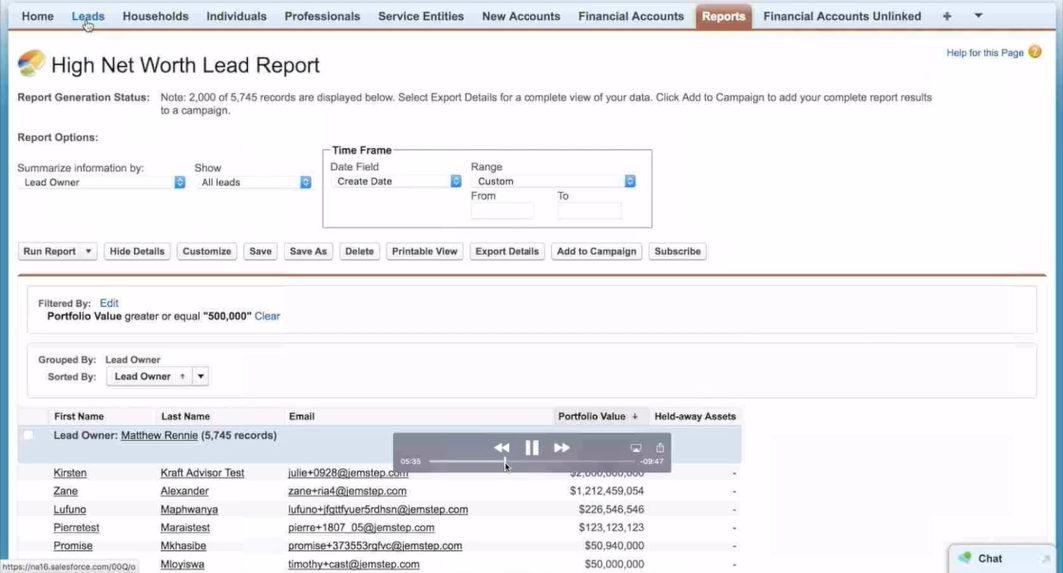

The Jemstep advisor dashboard allows users to quickly scroll through the working list of prospects (sorted into “enrolled” and “not enrolled” categories), which is a convenient way to survey the pipeline. However, the real meat of the offering is in how tightly Jemstep is integrated with Salesforce.

Jemstep’s advisor dashboard is well-designed for effective prospect follow-up.

To begin the process, a CRM contact record is automatically created when a prospect first registers on the advisor’s website. Next, the Lead Detail section in Salesforce is auto-filled with the data collected by Jemstep. This goes beyond name and date of birth to include risk levels, risk score, full RTQ responses, goal inputs, target retirement age, annual income, current portfolio value, held away assets and more. The Salesforce data can be used to auto-populate other applications, such as marketing automation software (Marketo, Eloquo), firm databases and analytics. Planning software can access Salesforce data directly as well. Having everything in one place saves time, prevents duplication of effort, and ultimately allows advisors to better manage their prospects.

Of course, this functionality is only available to advisors who use Salesforce. There is no word on whether other CRM’s will also be integrated in the same way, although it would seem advantageous to build out integration to the two top providers: Redtail and Junxure.

Another noteworthy feature is Jemstep’s dynamic proposal process. Users can take advantage of automated segmentation of incoming prospects by asset levels, and the platform’s workflows are flexible enough to recognize and support clients at different service tiers. After the initial sign-up, the workflow can automatically direct a prospect below a pre-set minimum to send an email, while a prospect with assets over a certain amount will be directed to schedule an appointment instead. This functionality is similar to the RobustWealth offering.

All dollar limits are customizable, and the automated appointment scheduling feature is powered by Timetrade and ScheduleOnce.

Digital Advice Table Stakes Features in Jemstep

Digital Client Onboarding

Best-in-class automated onboarding was a key value driver in Jemstep’s acquisition by Invesco, and the platform’s functionality in this area continues to get even better. A visual navigator bar at the top of the screen gives cues as to progress, and DocuSign makes account opening effortless. As is the case with other vendors reviewed here, advisors can combine custodian and advisory forms (including new account forms, ACAT/ACH transfer forms, IRA adoption agreements, advisor agreements, ADV disclosures and Investment Policy Statements) in one virtual envelope, to be delivered to various destinations post-signature.

Jemstep’s “Rapid Client Onboarding” workflow takes a new client from prospect to account opening in 10-12 minutes, with zero human intervention. That is a significant upgrade over the old paper and fax process, but it is not Betterment-fast because there is still the traditional custodian process hurdle to overcome. With traditional custodians, 10-12 minutes of hands-on onboarding get the client all the way up to custodian account number assignment. From there, the account may still need to complete supervisory review and AML/KYC review prior to being approved and formally open. Firms that custody at Pershing (where Jemstep has straight-through processing) will tend to have faster account opening process start to finish.

During a recent demo, we saw an example of the platform’s “I drive, you drive” functionality, where a client can start the process, transition it to the advisor, and the two are able to go back and forth with no loss of content or context. We imagine this feature is particularly useful for remote onboarding, although it would also work well with the advisor and the client using tablets side by side in a conference room.

Jemstep has put a lot of thought into designing its data collection process by optimizing the number of, and the language of, questions asked of the client. The goal is to get enough information to allow the advisor to do his work, while not overwhelming the client in the process. Users will find that Jemstep’s progressive disclosures are planned and timed carefully.

We also like the use of non-technical language that is easy for a non-financially-savvy prospect to understand. Instead of listing a string of acronyms, Jemstep might frame the question along the lines of “Is this account associated with your employer?” or “Which accounts do you consider to be your retirement accounts?” All the collected data flows through to the CRM, and identified accounts appear as available or “locked” based on the prospect’s responses.

Risk Profiling

The Risk Tolerance Questionnaire (RTQ) within Jemstep is fully customizable. Advisors can choose to create or replicate their existing RTQ and model mapping, or they can configure Jemstep’s RTQ to their own requirements and preferences.

Jemstep’s configurable RTQ provides deep insight into a client’s total risk score by two-dimensionally assessing both their willingness to accept risk, and their ability to take on risk, which is more robust than traditional approaches that only focus on a single factor. The Jemstep RTQ is scored multi-dimensionally, but although separate scores for ability and willingness to accept risk are generated by the system, the two are combined in the end so that the advisor and the client only see a single total risk score. Advisors have the flexibility to create an RTQ that meets their compliance requirements, and gives them the ability to test and validate their proposed risk scoring and client mapping against multiple use cases.

Lastly, risk tolerance can be assessed for individual goals, and can vary for an individual investor across different goals.

Portfolio Construction

Jemstep follows a goals-based approach to planning and portfolio construction. Clients can identify and define financial goals, which in turn are linked to accounts.

Jemstep uses its own security categorization framework that is similar to the Morningstar quadrant construct. Investment options for portfolio design follow an open architecture approach and include ETFs, mutual fund models, and combined models. Advisors can use home office-approved models, upload their own models, or take advantage of third party models through a Model Marketplace (which include models from Pershing-affiliated Lockwood Advisors, Envestnet, and of course Invesco’s own PowerShares ETFs), though notably Jemstep cannot actually execute the trading and rebalancing of these models within their software (as discussed in the rebalancing section below).

Responding to advisor requests for a better tool for filtering the universe of available models based on the client’s unique characteristics, Jemstep has developed a “Model Mapping” feature. The idea is to give professionals the ability to map clients to a model solution that best meets the needs and requirements of the different segments of an advisor’s client base. The appropriateness of a model solution may depend on many factors, such as,

- Risk profile (Conservative to Aggressive)

- Account size/investment amount

- Tax considerations (Taxable vs. tax-advantaged)

- Client investment preferences (Active vs. Passive)

- Level of sophistication (e.g. inclusion of Alternative)

- Level of cost sensitivity.

Using this tool means that it’s easier for advisors to use a wider range of portfolio models for specific client circumstances, without needing to remember a long list of which models are best matched to particular client types.

Account Aggregation

Jemstep’s account aggregation functionality is primarily powered by CashEdge, with the option to use other vendors if needed. Once linked, the account information is pulled directly from custodian, and data is fed into the portfolio analysis tool. This can be a useful proposal support tool if an advisor wished to walk a prospective client through a back-test comparing the client’s existing allocations to the recommended portfolio and an index like S&P 500.

Clients can also manually add accounts and type in their held-away account balances.

Document Vault

Jemstep retains DocuSign documents, statements, confirmations and tax documents in the document vault section of the client dashboard.

Other Jemstep Functionality

Rebalancing

Jemstep does not offer a native rebalancing tool at this time, but that feature is on the short-term technology roadmap.

Currently, the platform has the integration capability to “plug in” stand-alone rebalancing tools that an advisor might be using (such as Pershing’s Managed Investment, Orion, or Envestnet’s ENV2). The client is assigned to a model through Jemstep. All models are maintained on the rebalancer, and all model updates are made directly in the rebalancer (i.e. all trade signals generated by the rebalancer flow through the normal workflow to the trade order management system). Jemstep then receives the executed trade and updated holdings information directly from the custodian.

Financial Planning

Jemstep’s financial planning capability is “lite”. The company opted to give advisors a minimum viable financial planning product, as opposed to not having any functionality at all, which we think is a smart choice. Integrations with other financial planning tools are available indirectly through Jemstep’s data integration via Salesforce. Those who need a robust embedded financial planning tool will need to look elsewhere, though.

Jemstep users can perform basic Monte Carlo simulations and view or modify projection assumptions.

Chat/Communications Support

The built-in chat feature is powered by Olark by default. Other platforms (Zendesk, Salesforce) are also available. The advisor decides when the live chat function is made available to the clients based on staffing; for the rest of the time, clients are prompted to leave a message in the chatroom that can be responded to later. The chat functionality also enables screen sharing, so advisor staff can (with permission from the client) view what the client is viewing and guide them to take appropriate actions. This can be a helpful feature in guiding the less tech-savvy clients in locating a report, changing settings, or walking through any of the self-service actions inside the portal for the first time.

Enterprise Dashboard

Jemstep offers a robust enterprise dashboard, that includes user hierarchy, permission management, and integration with home office licensing and registration records. Individual advisor access can be limited to his or her book of clients, or even specific models for portfolio construction. We like that the system allows for multi-brand support, which is critical for larger firms (such as their Advisor Group broker-dealer relationship) as well as banks with multiple branches.

It is worth noting that Jemstep Advisor Pro provides embedded analytics to support enterprise-scale closed-loop marketing, including integrations with marketing automation services such as Marketo and Eloqua.

Jemstep Integrations

Jemstep’s strategy is to integrate with multiple rebalancing providers and overlay managers in an effort to offer users plenty of choices for creating a technology stack that suits their needs. This strategy is in contrast with Oranj, who purchased a rebalancing engine, and RobustWealth and Riskalyze, who built their own.

Jemstep has clients running operational integrations with TD Ameritrade’s iRebal, Pershing’s Managed Investments offering, Orion Advisor’s Eclipse rebalancer, and Envestnet’s ENV2 platform. No other digital vendor has as many live integrations with external portfolio management systems.

A recently announced deal with Advisor Group for their 5,000 reps to use Jemstep’s onboarding and client portal is testimony to the digital vendor’s success with large financial services firms, and is the largest enterprise deal announced to date by any of the digital advice platforms discussed here.

Current custodian integrations include Pershing’s Broker-Dealer platform as well as Pershing Advisor Services (PAS), TD Ameritrade, and Shareholders Service Group (SSG, which is built on the Pershing platform)), with additional custodians in the pipeline. Jemstep has invested in straight-through-processing to Pershing, which enables real-time API-driven account opening or advisory firm approval based workflow. DocuSign is used for electronic signatures and delivery of document envelopes directly to clients and custodians.

However, as noted earlier, Jemstep does not currently have any financial planning software integrations, beyond whatever data can be pushed there indirectly via the Salesforce integration.

Jemstep Pricing

Similar to AdvisorEngine, pricing for Jemstep is based on the amount of assets being reported on the digital advice platform. Pricing begins at 10bps, and steps down as low as 5bps at higher AUM levels, and may have additional implementation fees for first-time clients and customization fees for specialized deployments. The “assets under management” calculation for Jemstep’s purposes includes accounts that were enrolled through and/or are being serviced by Jemstep’s platform.

(This Jemstep section was written by Natalia Autenrieth, Partner, Autenrieth Advantage)

Riskalyze Autopilot Review and Pricing

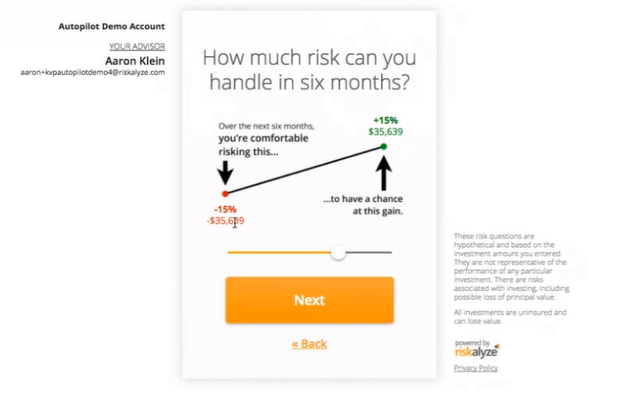

When Riskalyze’s risk profiling product was launched in 2013, the founders wanted to create a tool that would do a better job at capturing clients’ appetite and capacity for risk. They have engineered and marketed themselves into tremendous success as their “Risk Number®” is now in use by over 22,000 advisors and available on 100+ partner platforms.

When Riskalyze’s risk profiling product was launched in 2013, the founders wanted to create a tool that would do a better job at capturing clients’ appetite and capacity for risk. They have engineered and marketed themselves into tremendous success as their “Risk Number®” is now in use by over 22,000 advisors and available on 100+ partner platforms.

Since then, the company has shifted direction from risk profiling to developing an end-to-end wealth management platform. A perennial fixture on lists of most innovative FinTech companies, Riskalyze has been recognized with multiple industry awards for their pioneering technology.

In the context of digital advice tools, the company has recently announced the launch of the Riskalyze Autopilot store, a set of digital advice “robo” tools for onboarding and investing clients (consistent with their Risk Number) that maps portfolios to a series of investment models from various asset managers and fund strategies in their Model Marketplace (including default models that use Riskalyze’s own proprietary ETFs being run by First Trust).

Riskalyze Client Portal

The Riskalyze client-facing portal is clean, simple and functional. Their Risk Number is central to everything on the platform. Clients can update their Risk Number, and check their account balances and progress towards goals. If their accounts are on Autopilot, they can also update their goals and request changes to how they're invested.

Clients also have access to the Riskalyze Meetings functionality. They can launch a virtual meeting in a browser within a couple of clicks, which allows both the advisor and the client to have a quick face to face conversation without juggling busy schedules or commuting.

Riskalyze Advisor Dashboard

Part of Riskalyze’s journey from risk profiler to multi-function utility to portfolio management platform include the recent addition of investment models from asset managers and fund strategists available through their Autopilot Partner Store (Riskalyze’s Model Marketplace). Advisors can review recommended trades, approve them (one by one, or all at once), or even snooze them and have the system reminded them later.

The same methodology applies to model updates. When a model change is received by Riskalyze, a trade notification appears on the Advisor Dashboard. This alert includes the number of accounts that are affected, and the option to adopt the changes across all accounts, or review them one at a time. Once the trades are finalized, advisors receive step by step instructions for submitting the trade file to the corresponding custodian.

Because they are only a technology provider, unlike RobustWealth who is a sub-advisor, Riskalyze will never execute a trade without the advisor’s approval. Even for periodic and predictable withdrawals, Riskalyze will stop at automatically generating a trade recommendation. This is a great fit for professionals who are looking to improve efficiency while maintaining control over clients’ portfolios, but could present an issue for advisors with high trading volume.

In that vein, Riskalyze is planning to add FIX connectivity during Q1 2018. After approving the trades, advisors will be able to push them into straight-through processing, resulting in a simplified operational workflow, better efficiency and improved accuracy. Another advantage of using FIX connections for routing trades is that executions can be received and acknowledged intra-day. That means advisor dashboard can be updated with order status in real-time.

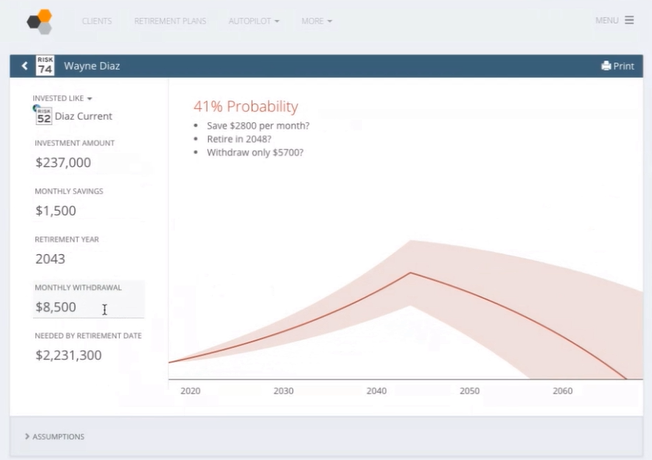

Advisor Dashboard “Retirement Map” view. The client’s projection shows a low probability of being able to meet the retirement goal. In this case, the system will recommend some changes to the underlying assumptions, or the advisor may have to raise the risk number to help the client meet the goal.

Riskalyze’s new Scenarios is another differentiator product that enables creation on “market scenarios” in order to highlight how specific market conditions would impact a client’s portfolio (i.e., a portfolio stress test). We believe that the graphics and multiple options will be very useful to advisors when they explain to clients the risk of past market conditions reoccurring. The Scenarios tool will also let advisors save favorite scenarios and reuse them for different clients.

Digital Advice Table Stakes Features in Riskalyze Autopilot

Digital Client Onboarding

The Riskalyze Autopilot onboarding process can be self-directed, or advisor-driven, and Riskalyze supports paperless electronic account opening.

For custodians TD Ameritrade and Trust Company of America, all of the necessary forms are filled out automatically, and sent out to be signed via DocuSign. Advisory agreements and Investment Policy Statements can be a part of the DocuSign process, although advisors have to set up the document form mapping in DocuSign (which is a one-time effort). This degree of hands-off automation is only available for custodian and RIA paperwork, though. Broker dealer forms require custom mapping, which is a manual process, according to Riskalyze. (We would guess that there is an additional fee to broker-dealers for this effort.)

Risk Profiling