Executive Summary

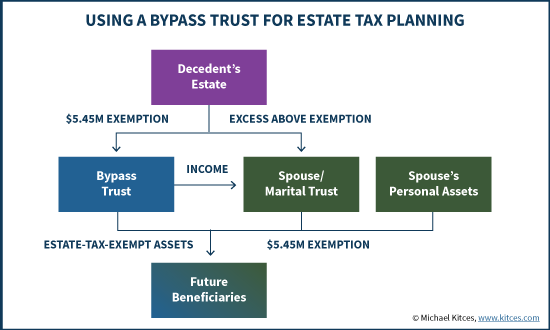

The bypass trust is a popular estate planning strategy used to reduce a couple’s exposure to estate taxes, by leaving the assets of the first spouse to die not to the surviving spouse, but to a trust for his/her beneficiary instead. If the surviving spouse doesn’t inherit the assets directly, they’re not subject to future estate taxes when the second spouse ultimately passes away.

However, while the bypass trust is effective for saving on estate taxes, it’s not very favorable for income tax planning, given that trusts reach a top 39.6% tax bracket (plus the 3.8% Medicare surtax on net investment income) at “just” $12,400 of taxable income. And at that threshold, long-term capital gains (and qualified dividends) are subject to a whopping 20% + 3.8% = 23.8% tax rate as well. Plus state income taxes to boot (if applicable).

Fortunately, though, the tax rules for bypass trusts (and other “non-grantor” trusts) allow trusts that distribute their income to beneficiaries to distribute the tax consequences to the beneficiaries as well – allowing those beneficiaries to claim the income on their own personal tax returns (and be subject to their far more favorable individual tax brackets) while the trust claims a “Distributable Net Income” (DNI) deduction to avoid any double taxation.

Of course, the caveat to passing through income from a trust to the beneficiary is that while distributing the income to the beneficiary may minimize income taxes, it just compounds the estate tax problem the bypass trust was designed to avoid (by pushing the income back into the spouse’s taxable estate). However, given the significant rise in the Federal estate tax exemption over the past 15 years – from “just” $1M in 2001 to $5.45M today – many bypass trusts are actually no longer necessary. Which means it has suddenly become a far more effective strategy to start deliberately making income distributions from a(n existing) bypass trust to the beneficiary, who may no longer face any estate taxes, but can materially reduce the family’s income tax exposure in the process!

Income Taxation Of A (Non-Grantor) Bypass Trust

For the past several decades, the bypass trust has been a staple estate planning strategy to minimize estate taxes. The basic concept is relatively straightforward. To avoid crowding all of a couple’s assets into a single person’s name after the death of the first spouse – which could potentially push him/her over the estate tax exemption amount – the spouse who passes away doesn’t actually leave his/her assets to the surviving spouse. Instead, the assets go to a “bypass trust” that can be used for the surviving spouse’s benefit, but with enough restrictions that the assets in the trust “bypass” the surviving spouse’s estate (i.e., are not included in his/her estate and therefore are not exposed to estate taxes in the future). Thus, whatever the surviving spouse doesn’t actually spend from the bypass trust can flow estate-tax-free to the future beneficiaries.

While the bypass trust can be very efficient to minimize a family’s estate tax exposure, though, a significant caveat of the strategy is that it’s not very efficient for income tax purposes. While many types of trusts – e.g., revocable living trusts – are treated as a “grantor” trust, where any income of the trust is simply reported as income of the grantor (at his/her tax rates), a bypass trust is different. The reason is that because the trust is created to be a separate standalone entity from the surviving spouse and other beneficiaries for estate tax purposes, it ends out being treated as a separate income taxpaying entity as well (a “non-grantor” trust).

As a result, a (non-grantor) bypass trust will typically file its own Form 1041 income tax return, reporting its own income (i.e., from the portfolio and other assets that it holds), claiming its own deductions, and paying its own trust tax bill.

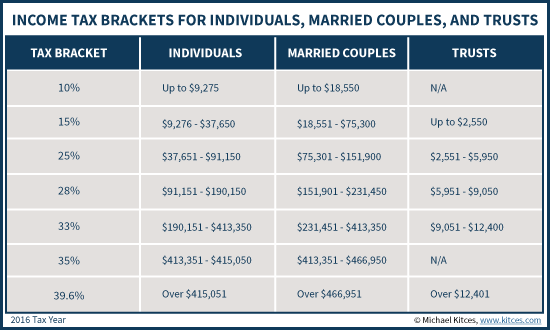

Unfortunately, though, the tax obligation on trusts is often higher than the tax obligation of individuals, due to the fact that trust tax brackets are “compressed” into a fairly narrow income range. As a result, while it takes as much as $415,050 for individuals to be subject to the top tax bracket, and $466,950 for married couples, it’s only $12,400 for a trust to reach the top 39.6% tax rate!

And notably, reaching the top (trust) tax bracket also means being subject to the additional taxes that apply for those at higher income levels. This includes the top 20% long-term capital gains and qualified dividend rates, and also the 3.8% Medicare surtax on net investment income. The end result is that at just $12,400 of income, trusts already face a long-term capital gains and qualified dividend rate of 23.8%, and an ordinary income tax rate at 43.4%!

Distributable Net Income From A Non-Grantor Bypass Trust

While the standard rule is that a non-grantor trust must report and pay taxes on any income it receives, trusts that make distributions to trust beneficiaries may pass through the income-tax-consequences of the trust’s income to those underlying beneficiaries as well.

Specifically, a non-grantor trust that makes income distributions to beneficiaries will pass through that income to the underlying beneficiary, who reports it on his/her own personal tax return instead. The character of the income (e.g., ordinary taxable vs tax-exempt bond interest vs qualified or non-qualified dividends) remains the same in the hands of the beneficiary. Any expenses associated with the income (e.g., an investment management fee for managing the property that produced the income) are passed through to the beneficiary as well. If only a portion of the trust’s total income is distributed, that pro-rata portion of the taxable income and deductible expenses go along with it. If there are multiple beneficiaries, then each beneficiary receives their own pro-rata share.

Example 1a. Betty is the beneficiary of a $1M bypass trust that was established for her by her late husband Donald. This year, the trust generated $47,000 of income, including $12,000 of (qualified) dividend income and $35,000 of (taxable) bond interest. In addition, the trust had an investment management fee of $7,000 for managing the trust’s assets. During the year, the trust made $2,000/month distributions to Betty to maintain her standard of living. In addition, the trust also made a $5,000 one-time distribution from income to Betty’s son Ralph for his education (which was permissible under the terms of the trust).

Ultimately, Betty received $24,000 of distributions, which constitutes 51.06% of the trust’s total income. As a result, she will report $6,128 of qualified dividend income (51.06% of the $12,000 total), $17,871 of the bond interest, and $3,575 of the management fee deduction, all of which are claimed on her own individual tax return (at her own individual tax rates). The dividends are still eligible for qualified dividend treatment, the bond interest is still taxable as ordinary income, and the investment management fee deduction will be claimed accordingly.

Similarly, Ralph’s $5,000 income distribution (which is 10.64% of the total trust income) will be reported as $1,277 of qualified dividend income, $3,724 of taxable bond interest, and a $745 deduction for investment management fees.

Notably, an important caveat of the “pass-through” nature of distributing income from a trust to the beneficiaries is that the income will potentially be taxed twice – once at the trust level, and again in the hands of the beneficiary when it passes through.

To avoid this outcome, trusts are permitted to claim an IRC Section 661 “Distributable Net Income” (DNI) deduction for the distributions that they make.

Example 1b. Continuing the prior example, the fact that the trust paid out $29,000 of income distributions (including $7,405 of qualified dividends and $21,595 of taxable bond interest) means the trust will receive a $29,000 DNI deduction. As a result, the trust will only report income taxes on the remaining $18,000 of undistributed trust income (and claim the remaining $2,680 of undistributed investment management fee deductions). In the extreme, if the trust had distributed all of its income, it would have distributed all of the associated income tax consequences as well, and the DNI deduction would reduce the trust’s taxable income all the way to zero.

From the tax reporting perspective, it’s important to recognize that even with the DNI deduction, a bypass trust is still supposed to report the income on its Form 1041 trust tax return. However, the DNI deduction effectively offsets that income, producing a net income (and therefore a net tax liability) of $0, while the pass-through of the income to the underlying beneficiaries – reported on Form K-1 – means that the beneficiaries claim the income tax consequences on their personal tax returns instead, and owe taxes based on their own tax brackets.

From the tax planning perspective, those individuals already in the top tax brackets will not necessarily benefit, but for the overwhelming majority of people who are in some less-than-top tax bracket, distributing the trust’s income so it can be claimed on their personal tax return and reducing the trust’s taxable income to $0 (thanks to the DNI deduction) can result in a significant income tax savings by shifting the income away from the trust’s compressed tax brackets and into the beneficiary’s more favorable tax rates.

Distributing Capital Gains And The DNI Deduction

Unfortunately, passing through capital gains from a trust to the underlying beneficiaries (and their individual tax brackets) is more complicated than with other forms of taxable income such as interest and dividends.

The reason is that by default, under the Uniform Principal and Income Act (UPIA), capital gains are treated as principal for fiduciary trust accounting purposes. This can be overridden if the trust document itself stipulates that capital gains will be treated as income (in which case the trust document supersedes the UPIA default provisions), or if the trustee is granted discretion to determine whether capital gains will be treated as income or principal. And if the trust allows capital gains to be treated as income, Treasury Regulation 1.643(a)-3(b) allows those capital gains to be eligible for the DNI deduction as well. However, if the trust is silent on these issues, and/or the trustee doesn’t have discretion to adjust the treatment, capital gains remained “principal” for trust accounting purposes (and therefore ineligible for the DNI deduction).

The significance of this treatment is two-fold. First, the fact that capital gains are “principal” for accounting purposes means that even if the trust states that “all income” should be distributed to the beneficiary, the “income” will only include interest and dividends and not the capital gains (which are taxable income but not accounting income). And since the capital gains are not distributed to the beneficiary, the tax consequences are not distributed either, which means the capital gain will remain taxable to the trust (at the trust’s tax rates).

Furthermore, if capital gains are allocated to principal and the trustee doesn’t have the discretion to adjust the treatment of principal and income, even if the trust makes a principal distribution of actual dollars, the taxable capital gains (and associated tax consequences) still do not pass through to the beneficiary and there is still no DNI deduction. Thus, for a trust document that does not allow for capital gains to be treated as income, nor provides the trustee any discretion to treat capital gains as income, the capital gains will be “stuck” in the trust – at the trust’s tax rates (which as noted earlier, quickly reach 20% plus the 3.8% Medicare surtax at the top tax bracket of only $12,400 of income).

Notably, this suggests that for tax purposes, it is more favorable for a bypass trust to treat capital gains as “income” for accounting purposes (which makes it possible for the trustee to distribute them for tax purposes), and/or to at least give the trustee discretion to adjust the income/principal treatment of capital gains. However, such provisions should be weighed carefully, as what may be appealing for income tax purposes, and the income beneficiary (who can receive the capital gains), may be adverse to the remainder beneficiary, who may not be so happy that all the trust’s growth was paid out of the trust and will not be received by that remainder beneficiary! Trustees still have an obligation to balance the interests of both income and remainder beneficiaries.

Discretionary And Automatic Income Distributions From Bypass Trusts

While a bypass trust can receive a DNI deduction for passing through income to an underlying beneficiary, the important caveat is that the DNI deduction is only available if dollars actually are distributed from the trust to the beneficiary. If no distributions occur (and there were no distributions required to occur), no tax consequences pass through, and there will generally be no DNI deduction, either.

And in the context of a bypass trust, whether distributions occur is not automatic. In some cases, a bypass trust will stipulate that all income is to be (automatically) distributed annually to a surviving spouse or other beneficiary. However, this is not common; after all, if the whole point of the bypass trust was to keep the assets left to the trust out of the surviving spouse’s estate, then mandating distributions to the spouse isn’t very helpful, as it just drives the growth of the bypass trust back into the estate it was meant to avoid!

Instead, more commonly a bypass trust allows distributions to the beneficiary made (or not) at the discretion of the trustee, typically based on an “ascertainable standard” like distributions of (income and/or principal) for health, education, maintenance, and support. And it’s up to the trustee to decide whether and how much to distribute to the beneficiary under this discretionary standard. (In addition to the fact that the trustee may have discretion to determine whether capital gains are treated as income or principal, depending on the terms of the trust document.)

Ultimately, then, for a trust to actually fully distribute its taxable income and the associated tax consequences to a beneficiary, the trustee will often need to exercise discretion (if available) to make those distributions (and to treat capital gains as income to be part of those distributions). And even if the trust mandates “income” distributions, the trustee may still need the discretion (or direct guidance from the trust document) to treat capital gains as income and pass those through as well. And if the trust doesn’t compel income distributions at all – which is more common – then it’s entirely up to the trustee’s discretion to make sufficient distributions in the first place, or not, to actually pass through at least the “income” portion of the trust (and its associated tax consequences as well).

Balancing Income Tax Planning Against Estate Taxes And Other Goals

Income tax planning for bypass trusts is important because a bypass trust generating (and retaining) taxable income can be highly unfavorable, due to the compressed trust tax brackets that trigger 23.8% tax rates on long-term capital gains and qualified dividends, and 43.4% tax rates on interest and other ordinary income, at “just” $12,400 of taxable income. And of course, state income taxes just add on top, if the trust is based in a state that taxes (trust) income.

Thus, to the extent the trust beneficiaries are in a lower tax bracket – which may be true even if they have far more total income, because the individual and married tax bracket thresholds are so much more favorable – distributing bypass trust income to the beneficiaries, to report at their lower tax rates (while claiming the DNI deduction for the trust), can generate significant family tax savings. (Though the benefit can be slightly reduced if the beneficiary has lower Federal tax brackets but is subject to a higher state income tax rate.)

On the other hand, the reality is that the whole reason for a bypass trust in the first place is to avoid having those assets – and their subsequent growth – included in the estate of the surviving spouse beneficiary. If a bypass trust systematically distributes all of the trust’s income into the hands (and estate) of a spouse who is over the Federal estate tax exemption already (or who crosses over the exemption because of those distributions), those distributions may be subject to lower income tax rates, but will ultimately face a 40% Federal estate tax rate! This can ultimately cause the family to finish with even less wealth in the long run – having lost far more in estate taxes than was saved in shifting income tax consequences from the trust to the beneficiary.

Example 2. Betty has a personal net worth of $7M which includes a portfolio generating $150,000 of annual income, and is the beneficiary of her husband’s $4M bypass trust that last year generated $120,000 of income. If Betty were to pass away today, her taxable estate is already in excess of the current $5.45M estate tax exemption, with the excess subject to a 40% Federal estate tax. Betty is currently in the 28% tax bracket as a single (widowed) individual, and distributing the trust’s income to her would cause it to be taxed at a blend of the 28% and 33% tax brackets, which is far more appealing than the trust’s 39.6% tax bracket (in addition to avoiding some 3.8% Medicare taxes on net investment income). However, the potential to save up to 11.6% in income taxes is overshadowed by the fact that the income, once in Betty’s name, may face a 40% estate tax in the future, causing the family to finish with even less money than “just” paying the income taxes at the trust level (and keeping the income out of Betty’s estate).

In addition, even if the surviving spouse beneficiary of the bypass trust is below the Federal $5.45M (in 2016) estate tax exemption, there’s still the possibility of state estate taxes in nearly a dozen states that still have an estate tax. For some states, the state-level exemption is the same $5.45M, which means driving assets into the surviving spouse’s estate can result in a whopping 56% estate tax (40% Federal plus 16% state rate). In other states, the exemption is lower, such as only $1M, which means a surviving spouse with “just” $2M of net worth would have no Federal estate tax exposure, but will still face a 16% state estate tax in the future on trust distributions received (in addition to the income tax consequences).

On the other hand, the fact that over the past 15 years, the Federal estate tax exemption has climbed from $1M to $5.45M, and only a handful of states actually still have a state estate tax (and many of those have recoupled to a $5.45M Federal exemption), means that many families who were once exposed to estate taxes (thus creating the bypass trust) find themselves no longer exposed. Which means while in the past it may have been preferable to keep the income in the trust – to avoid the beneficiary’s estate tax rates – without any estate tax exposure, it’s now more appealing to distribute the income to take advantage of the beneficiary’s income tax rates. (Though trustees should still be cognizant of whether it’s appealing to keep income in the trust for non-tax reasons, such as restricting access to the funds for a financially irresponsible beneficiary, or for asset protection purposes.)

At a minimum, though, the rise of the estate tax exemption means that distributing income from a bypass trust to a beneficiary has become far more desirable than it was in the past, given the number of beneficiaries who are not actually exposed to estate taxes and no longer “need” the bypass trust, and could save on income taxes by shifting the income from the trust to the beneficiary. However, for estates that do still face future estate tax exposure – Federal, or even state – or are concerned about the spendthrift, asset protection, or other benefits of a bypass trust, the final decision may actually be to keep the income in the trust anyway, and just pay the unfavorable tax rate!