Executive Summary

In the depths of the COVID-19 pandemic, many small businesses such as restaurants, entertainment venues, and retail stores experienced cratering revenues, either due to government lockdown orders that forced many non-essential businesses to temporarily shut their doors, or simply due to lack of demand since many of their customers decided to stay at home out of an abundance of caution. To stave off a wave of business closures and a subsequent surge in unemployment, the U.S. government designed a number of small business relief packages to incentivize companies to keep workers on their payrolls. One of these was the Employee Retention Credit (ERC), a tax credit that eligible small businesses could take against their employment taxes.

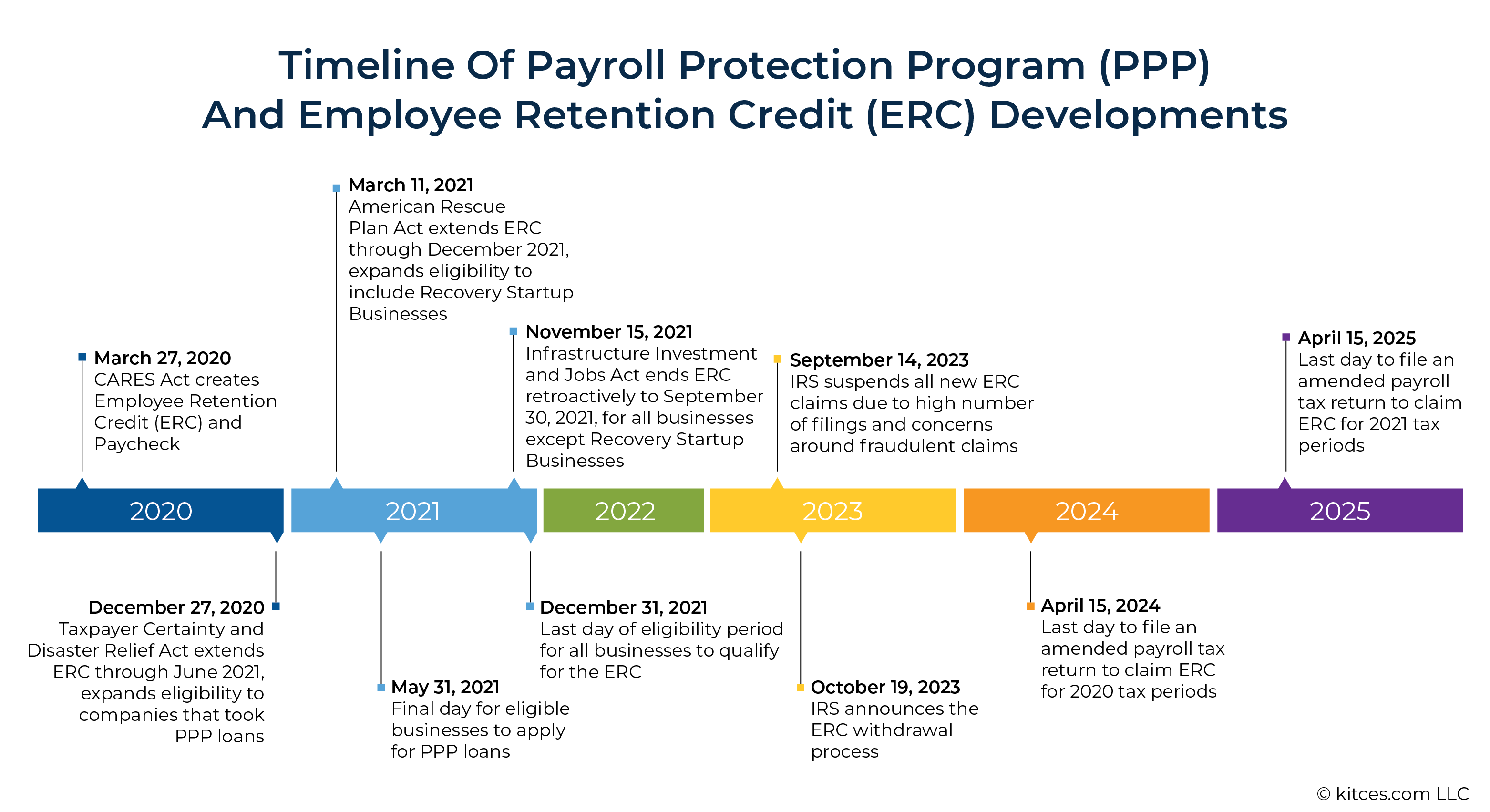

Although it was initially overshadowed by other relief measures such as the Paycheck Protection Program (PPP), more recently, the ERC – which technically ended after 2021, but which businesses have until as late as April 15, 2025, to claim – has attracted attention due to a pop-up industry of ERC vendors who purport to help small businesses claim the credit. The caveat is that many of these vendors encouraged businesses to apply for the ERC even when they weren't eligible, and the resulting wave of questionable ERC applications has caused the IRS to scrutinize businesses' claims of eligibility for the credit. As a result of this attention, advisors are seeing an uptick in questions from their clients – and may have questions about their own businesses – regarding whether or not the ERC is really legitimate, who can actually claim it, and whether it's worth pursuing either way.

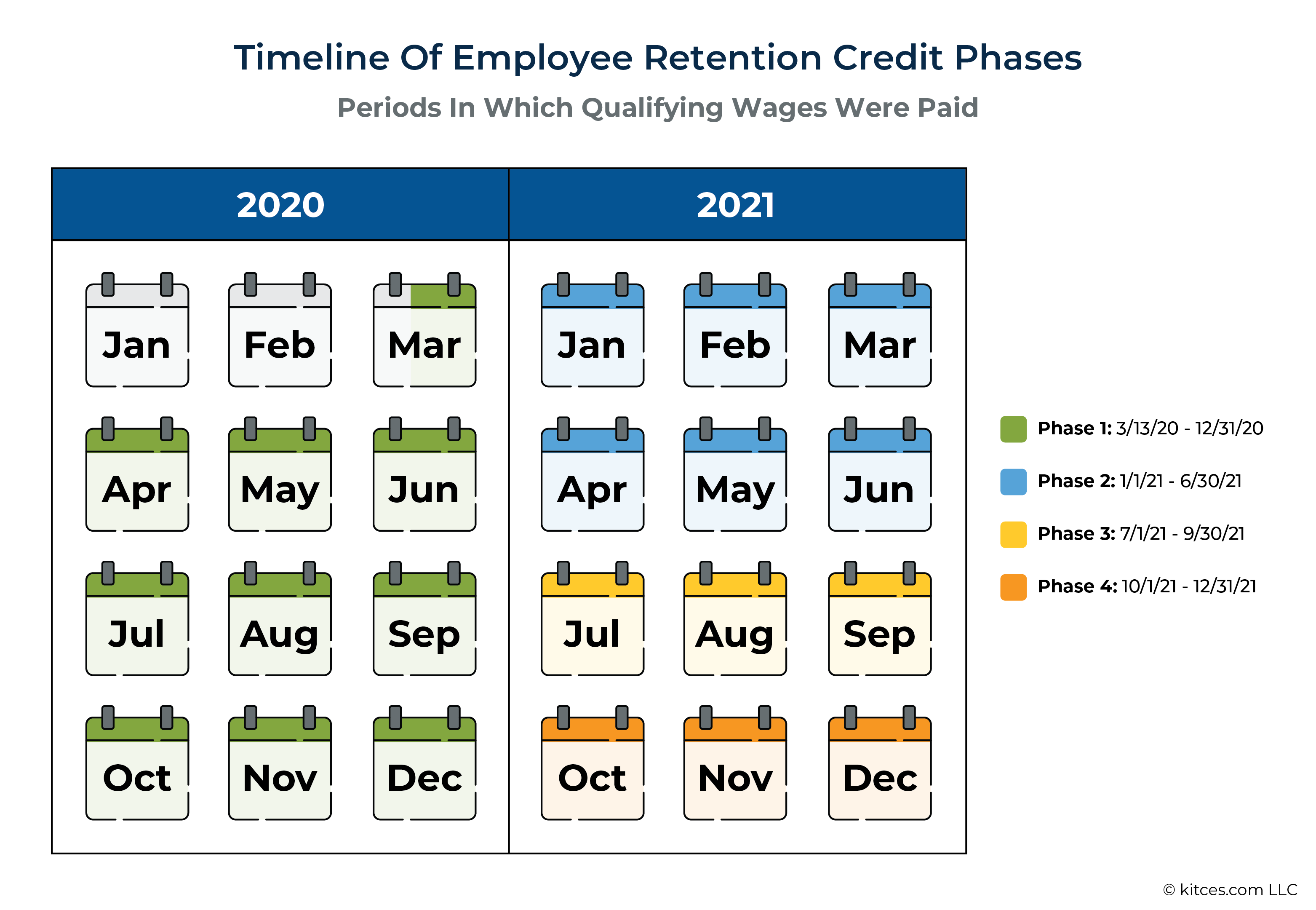

While the ERC is indeed legitimate, determining eligibility is complex largely due to its phased implementation across 4 separate 'phases' spanning most of 2020 and all of 2021. Each phase has slightly different rules about who can claim the ERC and how the credit is calculated. Businesses need to determine their eligibility for the ERC and the amount that they can claim on a quarterly basis, adhering to the specific rules of the 'phase' in which each quarter falls since these rules can shift from one quarter to the next!

In general, businesses can apply for the ERC if they were forced to partially or fully suspend their operations due to a government order, or if they experienced a "significant decline in gross receipts" between March 13, 2020, and September 30, 2021. A business could also qualify as a "recovery startup business" (as long as the business started after February 15, 2020, had annual gross receipts of under $1 million, and didn't otherwise qualify under the other criteria), which would allow it to claim the credit for the last 2 quarters of 2021. The credit itself is calculated as a percentage of the "qualified wages" paid to employees. Notably, many of the criteria used to determine the credit – including what constitutes a "significant decline in gross receipts", what is included in "qualified wages", and what percentage of qualified wages is used to calculate the credit – vary for different time periods, as well as for different sized businesses.

The key point is that, unlike the claims of many ERC vendors, determining a business's eligibility for the ERC is by no means a simple process and generally requires the expertise of a tax professional. And yet, many ERC vendors are not tax professionals themselves, often shifting the liability of complying with the complex eligibility requirements onto the business (even while the ERC vendor collects a substantial portion of the business's ERC as fees for itself). Financial advisors, then, can help by serving as an advocate for business owner clients, helping them preliminarily determine whether they may or may not qualify for the ERC and directing them to an expert tax professional to help them make the final decision of whether or not to claim it. Which has value even if the client isn't ultimately eligible, since the headache of applying for the ERC and being later found ineligible by the IRS could be far worse than not applying for the ERC in the first place!

In recent months, I've been bombarded with offers from promoters to help me 'take advantage' of the Employee Retention Credit (ERC). The solicitations have come via email:

On TV during primetime and sporting events:

And even through Instagram:

Not to mention the multiple phone calls each week from vendors seeking to reach me, either as a business owner (to help me claim the ERC myself, despite my business being ineligible for it) or as a financial advisor (to refer my clients to the ERC promoter in exchange for referral fees, in flat out contradiction of my professional obligation to avoid conflicts of interest).

"Don't leave money on the table!" some say. "You might qualify even if your accountant tells you otherwise!" exclaim others. "It's your money; you just need to ask for it – there's nothing to lose!" goes a third refrain.

Financial advisors, who often serve business-owner clients and who may be business owners themselves, have no doubt also noticed the increase in messaging around the ERC. The uptick in solicitations by ERC promoters has been covered by the media and flagged by the IRS as a sign of potential scams and fraudulent activity, and these warnings, along with the frankly scammy nature of many of these solicitations, make it reasonable to wonder whether the ERC is legitimate and, if it is, whether it's even worth pursuing.

While the ERC is indeed a legitimate tax credit, it is much more narrowly targeted and, therefore, more difficult for businesses to claim than many of the ERC promoters, such as the ones shown above, would make it seem. Still, because the ERC can be very valuable for the companies who are able to claim it – as often advertised, up to $26,000 per employee, though in the majority of cases, the actual per-employee amount is likely to be far less than that – it's worth taking a look at the ERC from a financial advisor's perspective to help answer the questions that many clients (and surely many advisors themselves) have about the credit.

Background Of The Employee Retention Credit

The explosion of COVID-19 cases that led to the global pandemic in early 2020 resulted in the temporary or permanent closure of many small businesses around the U.S. and globally. This happened either as a result of stay-at-home orders issued by state and local governments attempting to stop the virus's spread, or as voluntary closures to protect employees and customers of the many establishments where in-person interaction was necessary for doing business. These closures created the prospect of mass layoffs as businesses with drastically reduced revenue streams needed to cut expenses to stay afloat. As a result, one of the primary aims of the U.S. government's initial pandemic response was to provide incentives for businesses to keep employees on their payrolls and avoid a prolonged surge in unemployment.

One of the first legislative responses to COVID was the CARES Act, enacted in March 2020, which created multiple programs to aid individuals whose lives and finances were impacted by the pandemic. On the individual side, the CARES Act included cash Recovery Rebate checks for all U.S. taxpayers, a temporary expansion of unemployment benefits, and the suspension of Federal student loan repayments (which only recently resumed in the fall of 2023). But it also included a bevy of relief programs targeted at small businesses that would otherwise have been vulnerable to extended shutdowns.

At the time of the CARES Act's passage, the most notable and widely-publicized small business relief measure was the Paycheck Protection Program (PPP), which provided forgivable loans of 2.5 times a company's eligible monthly payroll costs, up to $10 million (but in practice averaged just under $70,000 per loan). These loans were guaranteed by the Small Business Association and were required to be spent on payroll, group health coverage, and other operational expenses by small businesses threatened by the economic conditions caused by COVID-19. Because the intent of PPP loans was to provide relief to vulnerable businesses as quickly as possible, the government allowed business owners to self-certify their eligibility for the loans and optimized the processes for disbursing and forgiving the loans for speed and simplicity.

However, the focus on expediting the distribution of funds meant that there wasn't stringent verification of businesses' eligibility for the loans or their use of the funds. As a result, while PPP loans undoubtedly provided a crucial lifeline to many businesses that would have likely needed to cut jobs (if not fold entirely) during the worst of the pandemic-related shutdowns, it also proved to be rife with opportunities for fraud. While the loan funds were nominally required to be used primarily on payroll costs for employees, later analysis showed that the program's benefits mostly accrued to the owners of businesses rather than the employees that they were meant to support.

All the publicity and controversy surrounding the PPP overshadowed another CARES Act program, which was also intended to incentivize small businesses to keep their employees on their payrolls during the pandemic: the Employee Retention Credit (ERC). The ERC was structured as a refundable tax credit against the Social Security tax that businesses pay on their employees' wages, and was calculated as a percentage of the "qualified wages" that a business paid to its employees during periods when it met specific eligibility criteria (discussed later).

As a tax credit that generally couldn't be claimed until after the business filed its quarterly payroll tax return (or an amended return for a previous quarter), the ERC's effects were relatively delayed when contrasted with the PPP's forgivable loan program that provided immediate cash to businesses (which could either be paid back later or, as in most cases, forgiven entirely).

Additionally, the CARES Act originally stipulated that employers who had received a PPP loan weren't even eligible for the ERC, and since an estimated 94% of eligible small businesses had applied for and received PPP funds, the ERC seemed destined to be a rarely used program available only to the few businesses that had slipped through the cracks of PPP.

That changed in December 2020, when another COVID stimulus bill, known officially as the Taxpayer Certainty and Disaster Tax Relief Act, was passed within the Consolidated Appropriations Act of 2021. The 'Coronavirus Stimulus 2.0' bill, in addition to bringing back a 2nd round of PPP loans, greatly expanded the scope of the ERC program while opening up its eligibility to businesses regardless of whether or not they had received PPP funds. And so, after the deadline to apply for PPP funds came and went on May 31, 2021, the spotlight began to shift over to the ERC, which businesses could (and can still) claim up until the amended payroll tax return deadlines of April 15, 2024 (for tax periods in 2020) and April 15, 2025 (for tax periods in 2021).

Starting in late 2021 and continuing into 2023, the trickle of ERC claims grew to a flood, and by September 2023, when the IRS suspended new ERC claims due to the sheer volume of incoming requests, the Treasury Department estimated that it had paid out over $230 billion of ERC claims. While significantly less than the estimated $800 billion disbursed through PPP, these ERC claims still represent one of the largest economic stimulus programs in history.

As noted above, the IRS has currently suspended the processing of new ERC claims, meaning that while eligible businesses can still submit a claim for the ERC, it won't be processed for approval or paid out until likely at least early 2024. But, since there is still time to file a claim for the ERC, financial advisors with business-owner clients who were operating during 2020 and 2021 can play a key role in helping those clients understand the credit and assess their potential eligibility.

Nerd Note:

On October 19, 2023, the IRS announced a process for taxpayers who have claimed – but not yet received – the ERC to withdraw their claim. Effectively, this gives business owners who may have filed ineligible ERC claims – either intentionally or unintentionally – the chance to hit the 'undo' button on the whole process without being charged penalties or interest by the IRS for receiving an improper ERC refund.

The caveat is that the taxpayer cannot have received their refund resulting from the ERC (or if they have gotten a refund check in the mail, they cannot have deposited it yet); if the taxpayer has received a refund, then they can still be audited and/or penalized by the IRS if their claim is later found to be ineligible, even if they voluntarily pay the money back.

While advising a client on whether or not to claim the ERC, calculating the amount of credit to claim, and preparing/filing the tax forms for the credit itself are the kinds of 'capital-T' Tax Advice that are the purview of credentialed tax professionals like CPAs, EAs, and attorneys. However, financial advisors can still provide a lot of value in helping to ensure that clients claim the credit properly. This is especially important at a time when countless promoters have arisen to solicit business owners to 'help' them claim the ERC, not all of whom take the requisite care to ensure that a business meets the ERC's eligibility requirements. There can even be value in guiding some clients not to claim the credit if they aren't eligible to do so but may have been otherwise persuaded by a less-than-scrupulous ERC vendor to try to claim it anyway.

Advisors who gain a deeper knowledge of how the ERC works (by understanding its eligibility requirements and how the credit itself is calculated) can help their clients navigate the maze of rules and regulations around the ERC and – for clients who do seem likely to qualify – direct them to a qualified tax professional who can work with them to claim the credit properly.

How The Employee Retention Credit Works

At a high level, the ERC provides a refundable tax credit against employment taxes (defined as the employer's portion of Social Security tax paid on employees' qualified wages) for certain businesses. To qualify, one of the following conditions must be met by the business:

- It either fully or partially suspended its operations due to a government order in 2020 or the 1st 3 quarters of 2021;

- It suffered significant declines in revenue in 2020 or the 1st 3 quarters of 2021; or

- It qualifies as a "startup recovery business" for the 3rd or 4th quarters of 2021.

If the description above sounds a little disjointed, it's because the ERC was created, expanded, extended, and modified by 4 separate pieces of legislation enacted over the course of 2020 and 2021:

- The original CARES Act, enacted on March 17, 2020;

- The Taxpayer Certainty and Disaster Tax Relief Act of 2020 (contained within the Consolidated Appropriations Act of 2021, a.k.a. the "Stimulus 2.0"), enacted on December 27, 2020;

- The American Rescue Plan (ARP) Act, enacted on March 11, 2021; and

- The Infrastructure Investment and Jobs Act, enacted on November 15, 2021.

The result of all this tinkering is that the rules that identify which businesses were eligible for the credit and the calculation that determines how much of the credit they could claim are different depending on the time period in which the wages used to calculate the credit were paid to employees. (Since payroll taxes are typically filed quarterly, the ERC is also calculated and claimed on a quarterly basis.)

The 4 Phases Of The Employee Retention Credit

The 4 ERC-related laws highlighted above are highly intertwined, with parts of old legislation being extended, added onto, amended, and/or repealed by subsequent legislation. But when looking at the time periods covered by those laws over the course of 2020 and 2021, a clearer picture emerges of which parts of each law applied at each point in time.

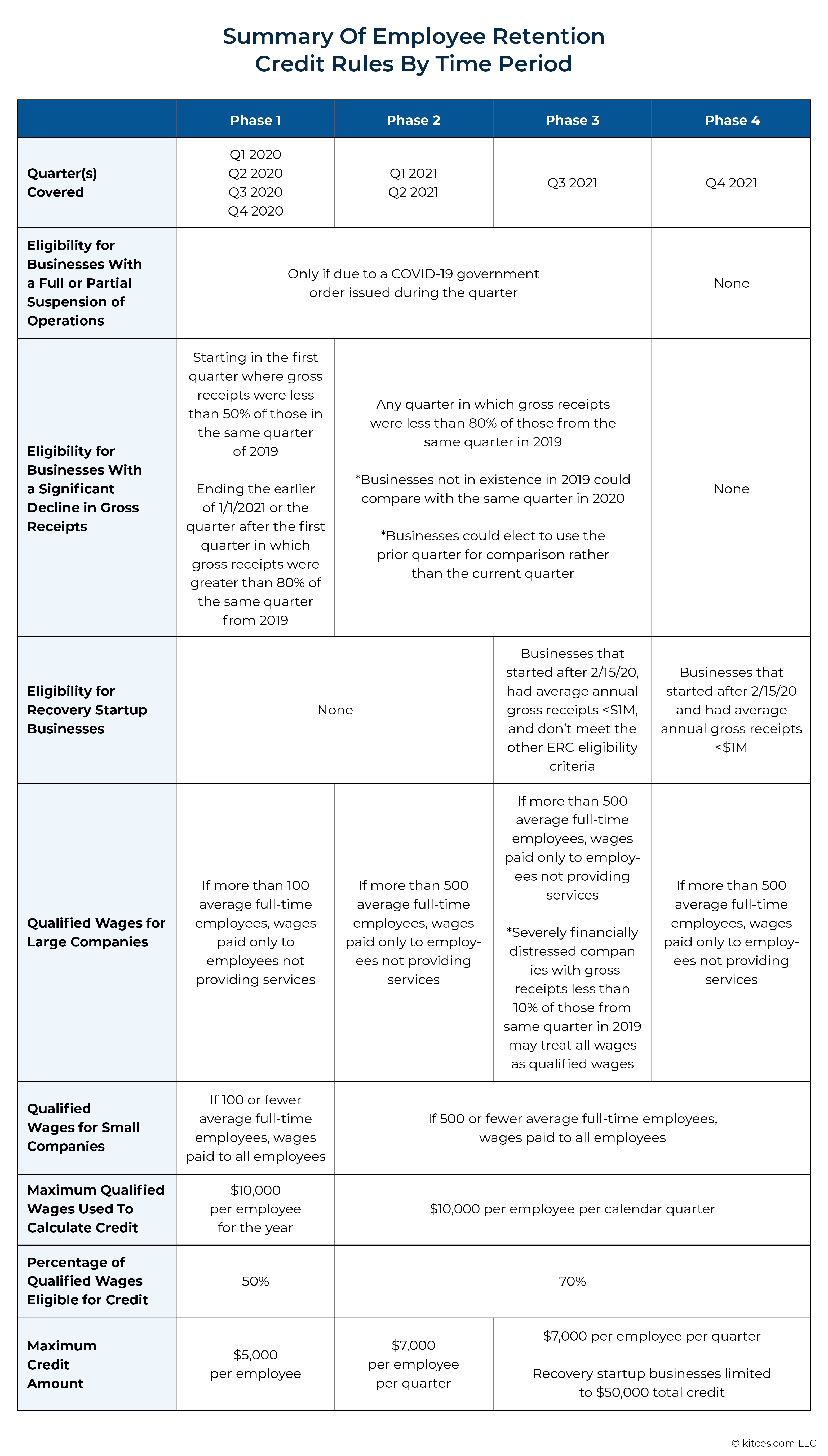

Specifically, there are 4 distinct time periods, each with its own set of ERC rules, which can be thought of as the different 'phases' of the ERC:

- Phase 1: March 13 through December 31, 2020 (created by the original CARES Act, as amended by the Stimulus 2.0 law)

- Phase 2: January 1 through June 30, 2021 (created by the Stimulus 2.0 law, extending and amending the CARES Act legislation)

- Phase 3: July 1 through September 30, 2021 (created by the ARP Act, further extending and amending the 2 prior laws)

- Phase 4: October 1 through December 31, 2021 (created by the Infrastructure Investment and Jobs Act, further amending the previous legislation)

To explain how the credit works, it's helpful to break each phase down separately, covering the 3 key pieces of information for each:

- How businesses qualify for the credit;

- Which wages paid to employees can be used to calculate the credit; and

- How the credit itself is determined.

ERC Phase 1: The Original ERC Timeline (3/13/20 – 12/31/20)

The ERC requirements for this time period are governed by Sec. 2301 of the CARES Act (as also amended by Sec. 206 of the Taxpayer Certainty and Disaster Relief Act), as well as subsequent guidance issued by the IRS in Notice 2021-20.

ERC Eligibility – Phase 1

To be an "eligible employer" for ERC purposes for any quarter during 2020, Notice 2021-20 states that a business needs to have been operating in 2020 for which either of the following applies:

(1) the operation of the trade or business… is fully or partially suspended due to orders from an appropriate governmental authority limiting commerce, travel, or group meetings (for commercial, social, religious, or other purposes) due to COVID-19, or (2) such calendar quarter is within the period in which the employer had a significant decline in gross receipts, as described in section 2301(c)(2)(B) of the CARES Act.

In other words, the business's operations need to have been fully or partially suspended due to a government order, or it needs to have experienced a "significant decline in gross receipts" during any quarter in 2020. Both of these criteria merit breaking down in further detail.

Full Or Partial Suspension Of Operations Due To Government Order

Many of the ERC claims that have been disputed by the IRS have hinged on whether or not the business really met the criteria of having been suspended due to a government order, so it's worth expanding on what this means.

A "full or partial suspension of operations due to a government order", as Notice 2021-20 makes clear, means that businesses really need to have been ordered to shut down or significantly limit their operations in order to qualify for the ERC on those grounds. A statement from a government official simply recommending individuals to stay at home wouldn't be sufficient; there needs to have been an enforceable mandate from Federal, state, or local government that directly affected the business in question.

Different states and municipalities had a wide range of stay-at-home orders, restrictions on non-essential businesses, and other decrees with varying degrees of comprehensiveness, so business owners need to be certain about whether their business operation was considered essential or non-essential by the jurisdiction in which they were operating, as well as what, if any, government-ordered shutdowns occurred in their area in 2020 and 2021, the dates that they were in effect, and how specifically they affected the business's operations.

Notably, while a shutdown order does need to have significantly limited a business's operations in some way, businesses were not required to completely shut their doors to be eligible for the ERC. If a business had more than a "nominal" portion of its operations suspended, then it is considered to have had a partial shutdown of operations, which is enough to qualify for the ERC.

The IRS defines what "nominal" means in Notice 2021-20, as follows:

Solely for purposes of this employee retention credit, a portion of an employer's business operations will be deemed to constitute more than a nominal portion of its business operations if either (i) the gross receipts from that portion of the business operations is not less than 10 percent of the total gross receipts (both determined using the gross receipts of the same calendar quarter in 2019), or (ii) the hours of service performed by employees in that portion of the business is not less than 10 percent of the total number of hours of service performed by all employees in the employer's business (both determined using the number of hours of service performed by employees in the same calendar quarter in 2019).

Put more simply, if the part of the business that was required to shut down constitutes at least 10% of its normal operations (as defined by either gross receipts or employee hours worked prior to the pandemic in 2019), then that part of the business is considered to be "more than a 'nominal' portion" of the business's operations for purposes of the ERC. Meaning that if that part of the business was required to shut down by government order during one of the qualifying periods for the ERC in 2020 or 2021, then the business could be eligible for the ERC (even if the entire business wasn't required to close).

Consider the following example:

Example 1: Annie's Arepas is a restaurant that, due to a local emergency mandate, was required to close its dining room from March 15 to May 1, 2020, impacting the business during Q1 and Q2 of 2020. It was still allowed to fill takeout orders during that time.

During Q1 and Q2 of 2019, sales in the dining room represented 75% of the restaurant's gross receipts. Because 75% exceeds the 10% threshold needed to qualify as more than a nominal portion of the restaurant's operation, the dining room closure is considered to represent a "partial shutdown" of operations.

And since the partial shutdown affected Annie's operations during both Q1 and Q2 of 2020, the restaurant would be potentially eligible for the ERC for both of those quarters.

Disruptions of operations due to other forms of safety mandates (e.g., social distancing requirements, curfews, and restrictions on concert and entertainment venues) could all qualify a business for the ERC as long as they were government-ordered and directly affected the business's operations in some way.

In contrast, voluntary closures by businesses to protect their employees or customers, or simply a lack of business due to people staying at home during the pandemic (if the business wasn't itself required to suspend its operations), would not have qualified a business to claim the ERC.

Significant Decline In Gross Receipts

If a business couldn't qualify for the ERC based on a government-ordered full or partial shutdown, however, it could still qualify if it encountered a significant decline in gross receipts. For the calendar year 2020 only, a significant decline in gross receipts is defined as a period:

- Starting in a quarter where the business earns gross receipts that are less than 50% of its gross receipts from the same calendar quarter of 2019; and

- Ending the earlier of January 1, 2021, or the quarter following the first quarter where its gross receipts are more than 80% of its gross receipts from the same calendar quarter in 2019.

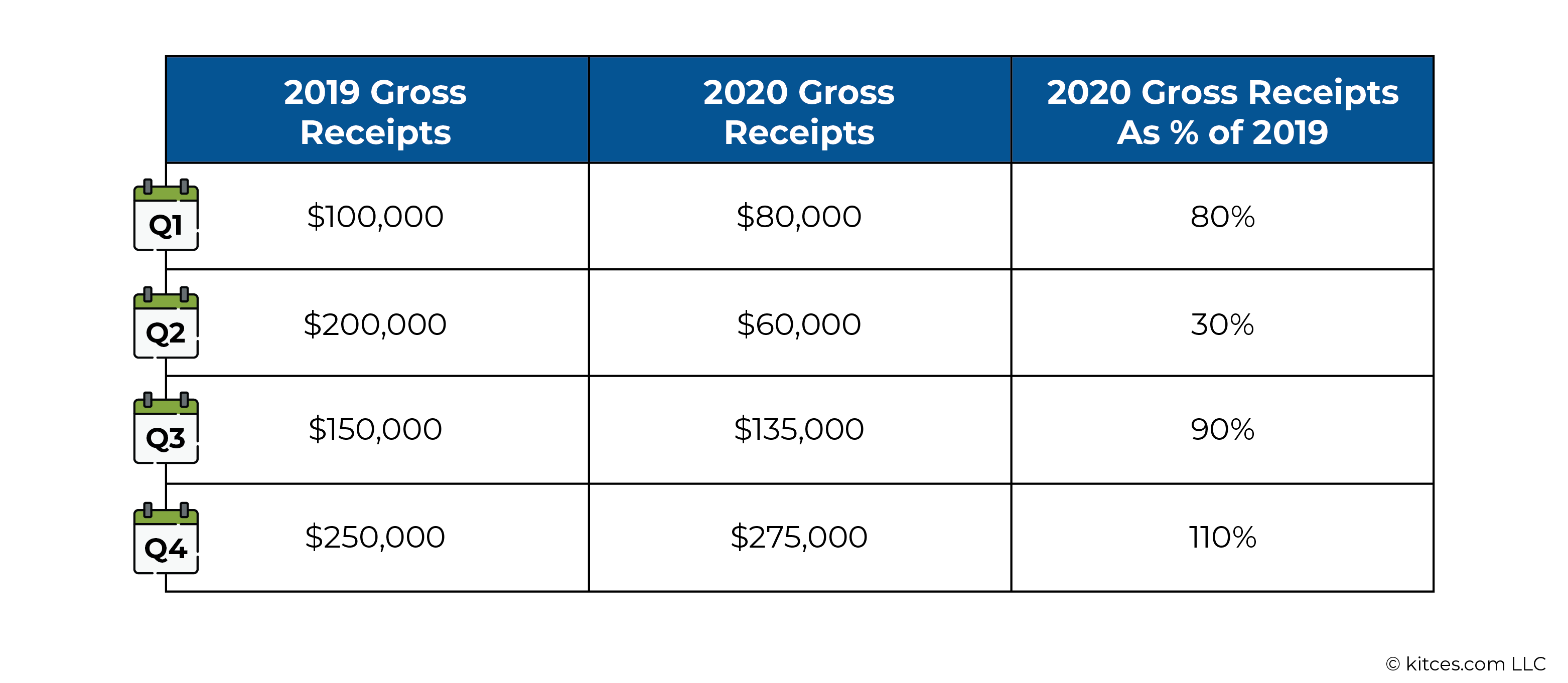

Example 2: Bella's Books is a used bookstore with the following gross receipts in 2019 and 2020:

In the 1st quarter of 2020, Bella's gross receipts were 80% of its receipts during the same quarter of 2019. Since this doesn't meet the 50%-or-less threshold to qualify for the ERC, Bella does not qualify for the ERC in Q1.

In the 2nd quarter, however, the store's gross receipts dropped to 30% of its receipts from the same quarter in 2019, which does meet the 50%-or-less threshold. This means it would begin to qualify for the ERC during that quarter.

In the 3rd quarter, receipts rose back up to 90% of the receipts from Q3 of 2019, which is above the 80%-or-more threshold for the end of the qualifying period – meaning, per the definition above, the bookstore's qualification based on the gross receipts test would end at the beginning of the next quarter, or Q4 of 2020.

In order to qualify for the ERC in the 4th quarter, the bookstore would have needed its gross receipts to again meet the 50%-or-less threshold in order to start a new qualifying period since the previous one ended after Q3. Instead, gross receipts for Q4 were 110% of the receipts from Q4 2019, so the business doesn't qualify for the ERC for Q4 2020.

In other words, the bookstore would qualify for the ERC based on the "significant decline in gross receipts" criteria in Q2 and Q3 of 2020, but not in Q1 or Q4.

If a business opened during 2019 and doesn't have Q1, Q2, and/or Q3 gross receipts from 2019 to compare its 2020 gross receipts with, it can instead use the first quarter for which it does have gross receipts to compare.

For instance, if a business opened in Q3 of 2019, it would use its Q3 2019 gross receipts to compare with its Q1, Q2, and Q3 2020 gross receipts to determine if it has a significant decline in any of those quarters. It can then use its Q4 2019 receipts to compare with Q4 of 2020.

ERC Qualified Wages – Phase 1

The ERC is calculated based on a business's "qualified wages" paid to its employees during either the dates that it was fully or partially shut down by government order, or during the quarters in which it experienced a significant decline in gross receipts.

The definition of what counts as qualified wages depends on whether the business was considered a "large employer" (which had an average of more than 100 employees in 2019) or a "small employer" (which had an average of 100 employees or less in 2019), as follows:

- For large employers, qualified wages were wages paid only to employees who were not actually working due to the government-ordered closure or decline in gross receipts during the dates of the government-ordered closure, or in the quarters with a significant decline in gross receipts.

- For small employers, qualified wages were wages paid to any employee, regardless of whether they were working or not, during the periods in question.

Significantly, qualified wages for the purposes of the ERC also include the cost to the employer of qualified health plan expenses, such as the cost of providing health insurance to employees (as long as those amounts were excluded from employees' gross income). It does not, however, include the cost of other employee benefits like employer matching contributions for 401(k) plans, HSA contributions, or dependent care assistance.

There is a host of other limitations on what can be treated as qualified wages for the purposes of the ERC. The following is a list of income sources that are not considered qualified wages for the calculation of the ERC:

- Wages that were paid with the proceeds of a Paycheck Protection Program loan, which were then used to apply for the loan's forgiveness (and that forgiveness was granted).

- Wages used to qualify for the Work Opportunity Tax Credit provided under IRC Section 51.

- Wages paid to a related person of the majority owner of the business (including any dependents, children, siblings, parents or grandparents, stepparents, nieces or nephews, in-laws, or other household members).

- Earnings from self-employment (e.g., ownership draws from a partnership or earnings from a sole proprietorship).

Nerd Note:

Because owners/employees of S corporations earn W-2 wages from their businesses rather than self-employment income, the question often comes up of whether an S-corporation owner/employee can count the wages that they pay themselves towards their qualified wages for the ERC – which leads me to one of my favorite pieces of absurd tax guidance.

The IRS tackles this question in Notice 2021-49, Section IV. D., where they note that because 1) wages paid to "related individuals" of the majority owner are disallowed from counting towards the ERC (as described above), while 2) IRC Sec. 267I states that stock in a corporation is "constructively-owned" by a family member when they are a sibling, spouse, ancestor, or lineal descendent, then 3) if the business owner (or their spouse) has a sibling, ancestor, or lineal descendent, those people will "constructively own" the majority owner's stock in the business – making the 'actual' business owner one of the disallowed relatives of the "constructive" majority owner, which means their wages must be excluded from the ERC calculation.

Put more simply, if the majority owner of the business (or their spouse) has any living siblings, parents, grandparents, children, or grandchildren, the owner's wages cannot be counted towards their qualified wages for the ERC, regardless of whether any of those relatives are involved with the business in any way. On the other hand, if the business owner (and their spouse, if they have one) doesn't happen to have any of those relatives, then they can use their wages to count towards the ERC.

It's hard to imagine that this was the intention of those who wrote the laws governing the ERC, but given that over 3 years and multiple revisions of the law have come and gone without any amendments or clarification from Congress… I guess they're fine with it?

For businesses deemed "large" employers (i.e., with an average of more than 100 employees in 2019), the amount of qualified wages paid for qualifying periods in 2020 also cannot exceed "the amount that the employee would have been paid for working an equivalent duration during the 30 days immediately preceding the period in which the qualified wages are paid or incurred." In other words, if an employer raised their wages just before going into a qualifying period, they would be required to calculate any ERC amounts for that period based on the old, lower wage level.

Finally, any wages used to calculate the ERC for 2020 cannot be taken into account for claiming the Employer Credit for Paid Family and Medical Leave provided under IRC Section 45S. If the employer already claimed that credit, they would need to exclude the wages used to calculate it from their qualified wages for claiming the ERC.

How To Calculate The ERC – Phase 1

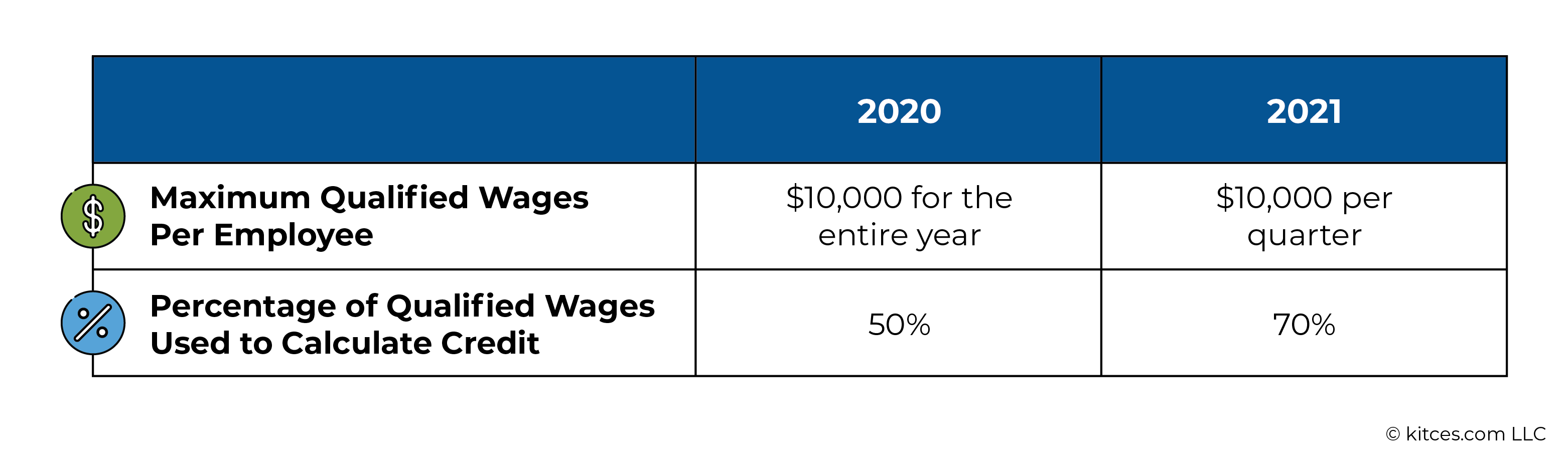

To calculate the credit for any quarter in which it was eligible for the ERC in 2020, the business would add up the qualified wages that it paid to each employee in that quarter and multiply that number by 50% to arrive at the ERC for each employee. Then, it would add up the credits for all of the individual employees to arrive at their total ERC for the quarter.

Notably, for 2020 only, the total amount of qualified wages per employee for the entire year cannot exceed $10,000 each – so the maximum ERC that a business can claim for each employee for all of 2020 is $10,000 × 50% = $5,000.

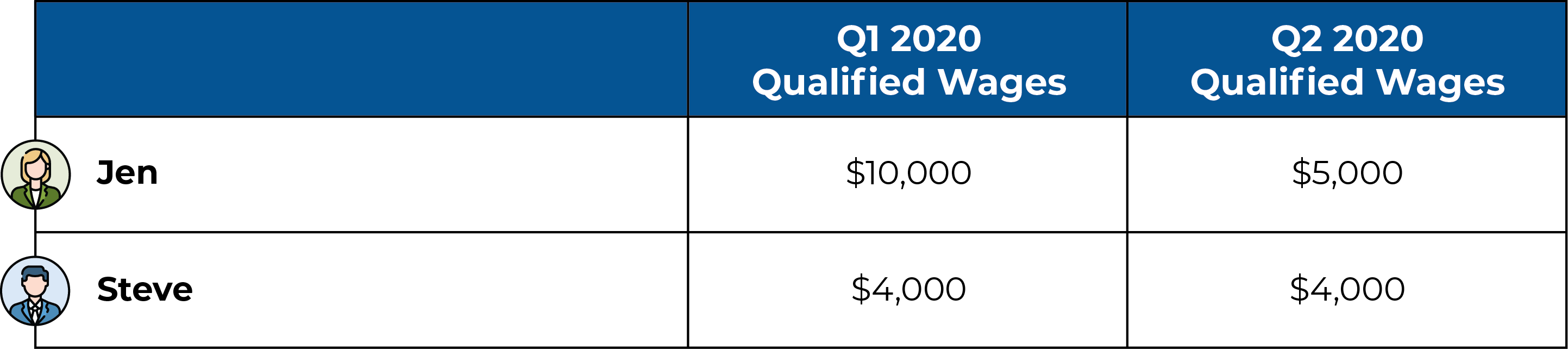

Example 3: Comfy Coffee is a coffee shop that has 2 employees, Jen and Steve. The business experienced a significant decline in gross receipts during Q1 and Q2 of 2020 and thus was eligible for the ERC. During those quarters, it paid its employees the following:

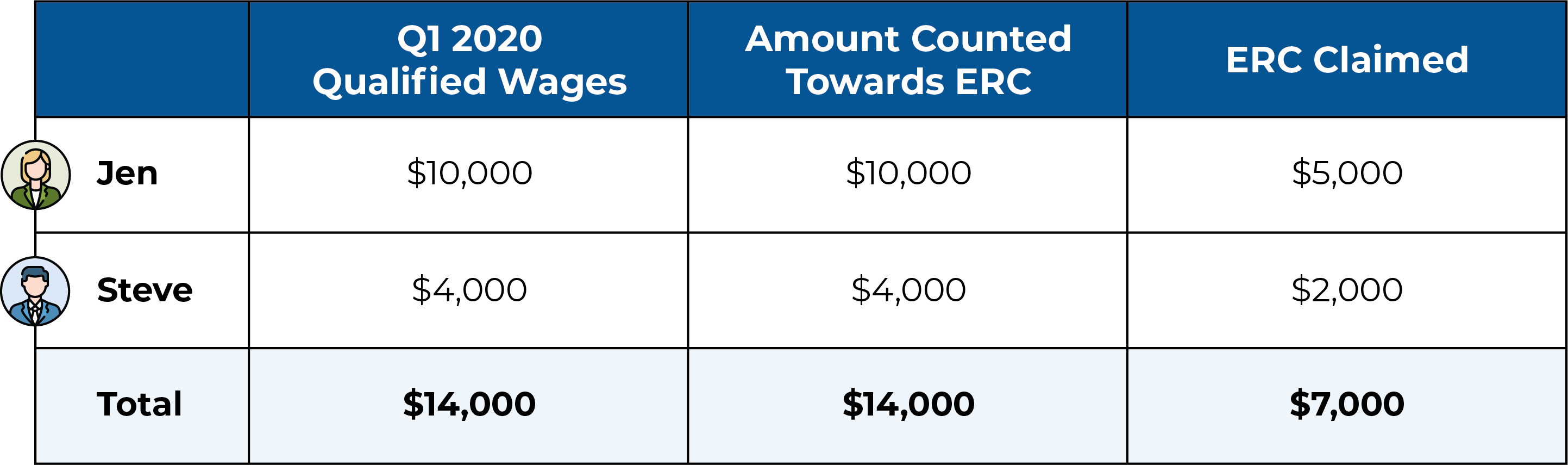

To calculate the Q1 ERC, the individual ERC amounts based on Jen and Steve's qualified wages are calculated by first multiplying each employee's qualified wages by 50%. Then, those numbers are added together to arrive at the total ERC allowed for Q1.

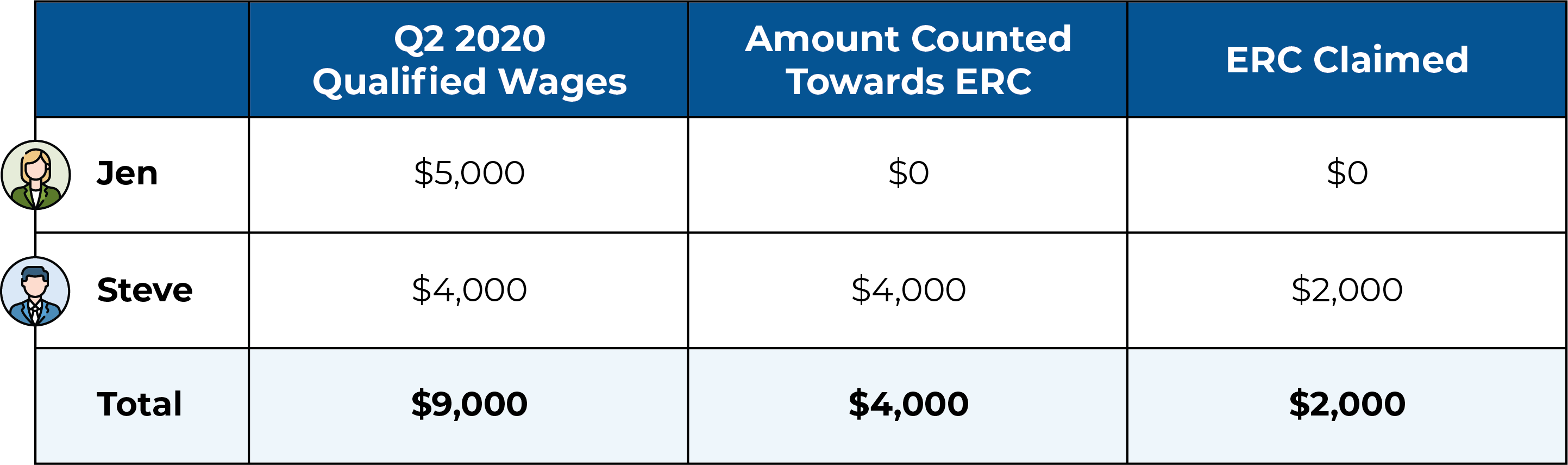

For the Q2 credit, it's the same calculation – however, because the total amount of qualified wages can't exceed $10,000 per employee, the business can't count any more of Jen's wages towards the ERC for the remainder of the year since they already used the maximum $10,000 of her qualified wages for Q1.

For Steve, however, since his qualified wages for Q1 and Q2 only totaled $4,000 in each quarter, thus only adding up to $8,000, Comfy Coffee can use all of his wages to count towards the ERC calculation in both quarters.

In total, the business can claim $7,000 in ERC for Q1 (using both Jen and Steve's wages) and $2,000 for Q2 (using only Steve's wages).

ERC Phase 2: Expanding The Size And Scope Of The Credit (1/1/21 – 6/30/21)

The good news for Phase 2 of the ERC, which is generally governed by Sec. 207 of the Taxpayer Certainty and Disaster Tax Relief Act (with guidance provided by the IRS in Notice 2021-23), is that it keeps generally the same framework as Phase 1. Employers that paid qualifying wages to employees while they were fully or partially shut down by government order, or who experienced a decline in gross receipts, between January 1 and June 30, 2021, were eligible to claim the ERC for the first 2 quarters of 2021.

However, there were some significant changes during this period, most notably including a change in the definition of what qualified as a significant decline in gross receipts, a different definition of "small" versus "large" employers for the purposes of determining qualified wages, and a change in the calculation of the credit which resulted in a big increase in the amount of credit that companies were allowed to claim.

Unless otherwise noted, the changes that follow only impact the ERC for credits claimed in 2021 – in other words, any ERC claimed for quarters in 2020 needs to follow the rules outlined in Phase 1 above, while credits claimed for quarters in 2021 follow the rules in Phases 2, 3, and 4 below.

ERC Eligibility – Phase 2

The rules around full and partial shutdowns by government order are largely the same in Phase 2 as in Phase 1, other than extending the qualifying periods for which the ERC can be claimed out to June 30, 2021.

However, the Phase 2 law significantly changed the definitions of what qualified as a "significant decline in gross receipts". While the original law used a period starting when the business earned less than 50% of gross receipts compared to the same quarter in 2019 and ending in the quarter after the business earned more than 80% of gross receipts, the new version created a simpler standard: A qualifying period was defined simply as any quarter in which gross receipts were less than 80% of the gross receipts from the same quarter in 2019. If a business opened in 2020, they could use the corresponding quarter in 2020 for comparison rather than 2019.

Additionally, the new law added a provision that allowed businesses to make an 'alternative' election to compare their previous quarter's gross receipts with those of the equivalent quarter in 2019 rather than using the 'standard' method of comparing the current quarter (i.e., the quarter for which the credit is being claimed).

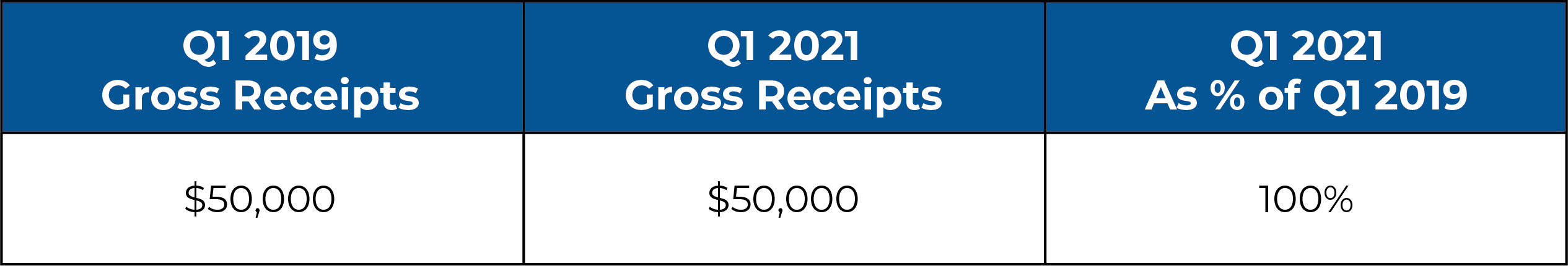

Example 4: Dave's Dogs is a pet shop that had the following gross receipts in Q1 of 2019 and Q1 of 2021:

Since there was no change in gross receipts between the 2 periods, Dave's Dogs wouldn't qualify for the ERC in Q1 of 2021 under the standard method of comparing the current quarter with the same quarter of 2019.

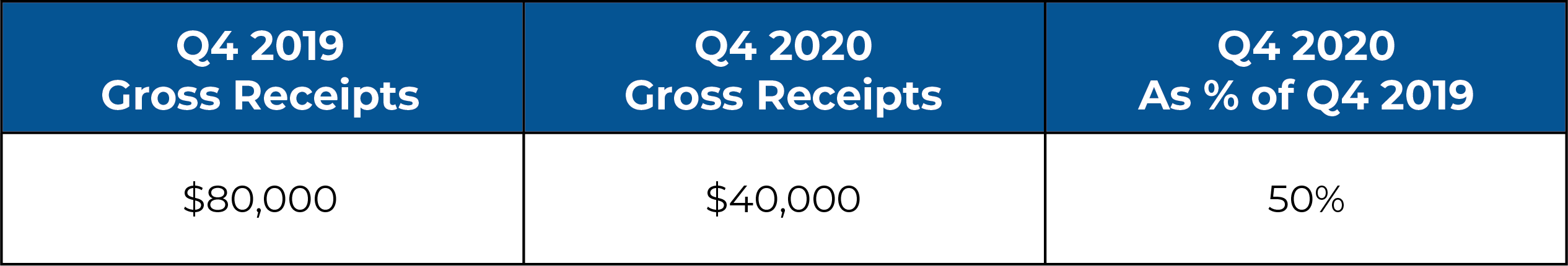

However, the 'alternative' election gives Dave's Dogs the option to instead compare its previous quarter (Q4 of 2020) with the equivalent quarter of 2019 (Q4 of 2019). Let's say that Dave's Dogs had the following gross receipts for those quarters:

Comparing the Q4 2020 gross receipts against those of Q4 2019, the Q4 2020 receipts are $40,000 ÷ $80,000 = 50% of the Q4 2019 receipts, below the threshold of 80% needed to qualify for the ERC.

In other words, while Dave's Dogs wouldn't qualify for the ERC for Q1 2021 based on the "standard" method used to determine ERC eligibility in Phase 2 (by comparing gross receipts from the same quarter of the previous year), it does qualify based on the "alternate" method, by using the election to compare the previous quarter's gross receipts earned in Q4 2020 against those of the equivalent quarter in 2019.

Phase 2 also added eligibility for certain government employers (such as public universities and hospitals, which weren't previously eligible to claim the ERC for any quarters in 2020) to claim the credit starting in 2021.

ERC Qualified Wages – Phase 2

The distinction between large employers and small employers for the purposes of determining qualified wages still exists in Phase 2, but unlike Phase 1, where the line between large and small was drawn at 100 employees, Phase 2 raises that bar and defines a large employer as one with more than 500 employees. Most companies must still use their average full-time employee count from 2019 to make this determination, but for any ERC claimed for quarters in 2021, companies that didn't exist in 2019 can use their average full-time employee count from 2020 to determine if they were a large or a small employer.

For any ERC claimed for quarters in 2021 (including those in Phases 2, 3, and 4), the new rules also eliminate the limitation on qualified wages for large employers to the amount that employees would have been paid for equivalent work during the preceding 30 days. However, it adds more restrictions on which other credits can be claimed at the same time as the ERC. In addition to the IRC Section 45S Employer Credit for Paid Family and Medical Leave (as detailed in Phase 1 above), wages that are used to calculate ERC amounts in 2021 cannot be used for claiming any of the following credits:

- Credit for increasing research activities (IRC Section 41);

- Indian employment credit (IRC Section 45A);

- Employer wage credit for employees who are active-duty members of the uniformed services (IRC Section 45P);

- Work opportunity credit (IRC Section 51); and

- Empowerment zone employment credit (IRC Section 1396).

How To Calculate The ERC – Phase 2

The changes above notwithstanding, the biggest difference between Phase 1 and Phase 2 and beyond is in how the credit itself is calculated. First, rather than limiting the amount of qualified wages per employee that can be used to calculate the credit to $10,000 per year, the Stimulus 2.0 legislation changed that number to $10,000 per quarter for Q1 and Q2 of 2021 (which was extended by subsequent legislation to Q3 as well).

On top of that, the law raised the actual credit amount from 50% to 70% of qualified wages.

In other words, while the maximum ERC for each employee that an employer could claim for all of 2020 was $5,000, the amount that it could claim just for Q1 and Q2 of 2021 was $10,000 per quarter × 2 quarters × 70% = $14,000 per employee.

ERC Phase 3: Introduction of The "Recovery Startup Business" (7/1/21 – 9/30/21)

While Phase 1 of the ERC effectively covered the whole of 2020 and Phase 2 covered the first half of 2021, Phase 3 really only covers a single quarter: Q3 of 2021.

Phase 3 is generally covered by Sec. 9651 of the American Rescue Plan (ARP) Act with IRS guidance provided in Notice 2021-49, which extended the ERC to Q3 and Q4 of 2021 (although as we'll later see, due to subsequent legislation Q3 of 2021 was the final quarter for which many companies were eligible for the credit).

Most of the Phase 2 rules described earlier also apply to Phase 3; however, this phase is most significant for adding an entirely new category of companies eligible for the ERC: the Recovery Startup Business.

ERC Eligibility – Phase 3

The ERC eligibility criteria from Phase 2 largely carry over into Phase 3, with businesses that either 1) fully or partially suspended operations due to a government order, or 2) experienced a significant decline in gross receipts being eligible to receive the credit.

However, the ARP created an additional 3rd category of business that was eligible for claiming the ERC in Q3 and Q4 of 2021, which, for the first time, allowed businesses that did not suspend operations due to a government order nor have a significant decline on gross receipts, to qualify for the ERC.

Instead, a business could qualify for the ERC as a "Recovery Startup Business" if it met the following 3 conditions:

- It began carrying on business starting after February 15, 2020;

- It had average annual gross receipts of under $1 million between the time it opened for business and the quarter for which the credit was claimed; and

- It did not otherwise qualify for the ERC under the full or partial shutdown or decline in gross receipts criteria.

As Notice 2021-49 notes, a business may qualify as a recovery startup business in one quarter and not in the next. For instance, if its average annual gross receipts were less than $1 million in Q3 2021 but had increased to surpass $1 million in Q4, it would qualify as a recovery startup business in Q3 but not in Q4.

Companies that may qualify as recovery startup businesses need to make that determination for each quarter in which the recovery startup business rules apply.

ERC Qualified Wages – Phase 3

The most significant change made in Phase 3 to the way qualified wages were determined with respect to the ERC was to add a category for "severely financially distressed employers", which essentially allows large employers (i.e., those with over 500 employees), whose gross revenues in Q3 2021 declined to less than 10% of their receipts from Q3 of 2019, to use the calculation of qualified wages used for small employers.

Which means that severely financially distressed employers are able to count their wages paid to all employees, not just those who aren't working (a limitation placed on all large employers in Phases 1 and 2), for the purposes of calculating the ERC – at least, for the single quarter of Q3 2021. Businesses could also elect to use the "alternative" method described in Phase 2 above of comparing the previous quarter's revenue with the equivalent quarter in 2019 for the purposes of determining if they were "severely financially distressed".

Additionally, the ARP stipulated that any payroll costs that were taken into account to receive a Shuttered Venue Operators Grant (an emergency assistance program established by the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act to aid certain businesses such as live venues and operators) may not be included in an employer's qualified wages for ERC purposes for Q3 or Q4 2021.

Calculating The ERC – Phase 3

For businesses that qualified for the ERC in Q3 2021 by fully or partially suspending operations due to a government order or experiencing a significant decline in gross receipts, the calculation of the credit is the same as in Phase 2 above, calculated as 70% of qualified wages up to a maximum credit of $7,000 per employee per quarter.

For recovery startup businesses, the same calculations apply, except that the maximum total amount of ERC that a recovery startup business can claim is $50,000 per quarter.

Example: Elaine's Eatery is a restaurant that qualified as a recovery startup business for Q3 2021. It has 8 employees, each of whom earned $20,000 in qualified wages during the quarter.

The maximum amount of qualified wages that can be applied to the ERC for each employee is $10,000, which results in a total ERC of $10,000 × 70% = $7,000 per employee.

However, because $7,000 of ERC per employee × 8 employees = $56,000, and the maximum total ERC for a recovery startup business is $50,000 per quarter, Elaine's may only claim $50,000 of ERC for Q3 2021.

ERC Phase 4: Winding Down The ERC (10/1/21 – 12/31/21)

Although the law, as written in the ARP, stated that the Phase 3 rules above would apply to both Q3 and Q4 of 2021, by the fall of 2021, Congress had begun to grasp the staggering cost of the ERC, which now allowed for a whopping $26,000 maximum refundable tax credit per employee for eligible employers going back to 2020. And in the wake of the widespread distribution of COVID-19 vaccines in the spring of 2021, government-ordered shutdowns were largely a thing of the past, and the economic recovery was chugging along nearly to the point of overheating, making small business recovery much less of a priority for government policymakers.

In an about-face, then, Section 80604 of the 2021 Infrastructure Investment and Jobs Act terminated the ERC as of October 1, 2021, for all businesses except those that qualified as recovery startup businesses, which would still be eligible for the ERC through Q4 of 2021.

IRS Notice 2021-65 added some additional guidance, but there really isn't much more to say on Phase 4: If a company qualified as a recovery startup business in Q4 2022, it could calculate and claim the credit as described in Phase 3 above (giving recovery startup businesses an additional $50,000 maximum credit, or $100,000 combined for Q3 and Q4).

Otherwise, companies that had qualified in previous quarters because of government-ordered shutdowns or reductions in gross receipts could no longer qualify for the ERC after Q3 of 2021.

Different ERC Rules For Different Quarters

As laid out above, the rules for businesses to qualify for and calculate the ERC differ between 2020 and 2021, and for different periods within 2021. For instance, a business claiming the ERC for Q1 of 2020 would need to determine their eligibility, add up their qualified wages, and calculate the total credit in a completely different way from another business claiming the credit for Q3 of 2021. And a business claiming the ERC for multiple quarters spanning 2 or more phases might need to calculate the credit in multiple different ways depending on which set of rules govern the quarter(s) they're claiming it for.

Below is a summary of the various rules around eligibility and calculating the credit for each time period in which the ERC can be claimed:

Adding the $5,000 per employee in ERC that businesses can claim for 2020 to the $7,000 per employee allowed for each of the first 3 quarters of 2021 sums up to the much-publicized maximum ERC of $26,000 per employee. Notably, however, in order to actually claim that amount of ERC, a business would need to be eligible for the credit during at least 1 quarter in 2020 and in each of the first 3 quarters of 2021 – meaning they would need to have experienced a full or partial shutdown and/or decline in gross receipts that lasted for nearly a year at minimum.

It's much more likely that a business would qualify for the ERC for only 1–2 quarters – however, even 'just' 1–2 quarters of eligibility could still add up to an ERC amount of $7,000–$14,000 per employee. For almost any business with employees, then, it's likely at least worth checking for each quarter in 2020 and 2021 whether the business may have met the ERC eligibility requirements for that quarter (noting that, as shown above, the requirements often shifted from quarter to quarter, and businesses that may not have qualified for the ERC in one quarter may actually qualify in the next quarter, or vice versa).

Advising Clients On The ERC

As noted above, advising a client on whether they are eligible for the ERC and filling out and/or filing forms on their behalf is beyond the purview of most financial advisors unless they are also credentialed tax professionals. So, the question remains of what advisors can do to assist clients with questions around the ERC and ensure that any clients who are eligible for the ERC are put on a path toward claiming it.

Assessing Clients' ERC Eligibility

The first thing advisors can do is identify clients who might be eligible for the ERC – i.e., those who own businesses with employees that operated in 2020 and 2021 – and do some preliminary fact-finding about their potential eligibility. Advisors with access to clients' business and personal tax returns can review those returns for a significant decline in income between 2019 and 2020/2021, which could indicate that the business may meet the decline-in-gross-receipts test. Reviews of the returns could also reveal whether the client has already claimed the credit and who may have assisted them in doing so.

Nerd Note:

A lesser-known fact about claiming the ERC – which is done on a business's quarterly payroll tax returns – also usually requires amending the business's income tax returns for the year(s) in question as well as the business owner's personal tax returns for those same years. This is because the business's deduction for wages paid to employees must be reduced by the amount of the credit claimed, which affects both the net income realized by the business and the amount of business income that subsequently flows to its owners' tax returns. And depending on the size of the business's credit, the fees for preparing and filing those amended returns (alongside the costs for filing the amended payroll tax returns to claim the credit itself) might eat up a significant amount of the credit's value!

Advisors can also do research as to whether a client's business may have been affected by a state or local shutdown order. The Council of State Governments has published a list of state-issued executive orders, while further searching at the local level could help determine whether the business was under a county or municipal order. A client's own records could also help clarify under what circumstances they may have fully or partially suspended their operations.

Evaluating Available ERC Filing Options

In addition to checking for eligibility, advisors can also help their clients evaluate their options around the ERC and, if it seems they may be eligible, direct them toward a tax professional who can help them confirm their eligibility and make the necessary filings to claim the credit. With the rise of ERC-related advertising in recent months, clients might have questions stemming from solicitations they've received and whether a particular vendor's offer is worth pursuing. Advisors can help ensure that clients don't get taken in by aggressive promoters who might claim more credit than the client is eligible for (if they're even eligible at all) in order to maximize their own fee.

Although many legitimate ERC claims have likely been made with the aid of third-party ERC consultants, many of the ERC solicitors that have popped up in the last 2 years treat the ERC as if it would provide quick access to cash with minimal verification. This fast-and-loose approach to filing ERC claims has raised red flags at the IRS, which has received large numbers of what it believes to be fraudulent or otherwise ineligible ERC claims coinciding with the uptick in solicitation efforts from ERC promoters. In the last year, the IRS has issued warnings to employers and tax professionals about the prevalence of third-party ERC promoters, and in 2023, ERC promotions made the IRS's annual 'Dirty Dozen' list of fraudulent or abusive tax schemes.

The IRS recommends that taxpayers be wary of ERC vendors that promise a quick determination of eligibility (since, as shown above, the eligibility rules are complex and can require extensive fact-finding), charge upfront fees and/or fees based on a percentage of ERC claimed (since the promoter will be more motivated to maximize the amount of ERC claimed than to calculate it accurately), and/or urge businesses to claim the ERC regardless of eligibility because there's "nothing to lose" in doing so (in reality the IRS is, in fact, taking a strict approach to verifying eligibility for the credit, and will order that any claims that are determined to be ineligible be paid back, potentially with penalties and interest).

It's also worth noting that, unlike a tax professional, many ERC firms don't actually prepare or sign the returns used to claim the credit, don't represent the client in the case of an audit, and use language in their agreements to shift any liability for misinterpretation of the tax code to the taxpayer rather than the ERC consultant. Which means that if a business owner uses an ERC vendor to help them claim the ERC, pays them an upfront fee, and then has the credit disallowed, in the worst-case scenario, they may find themselves out both the credit and the fee they paid to the ERC consultant, with penalties and interest to boot, and with little recourse to recover either.

In most cases, the best option for going through the process of claiming the ERC will be a tax professional such as a CPA, EA, and attorney, preferably one who already works with the client and/or their business and, therefore, would have the most access to the records that can help determine eligibility for the credit. If that isn't an option, however, advisors can help their clients vet tax professionals to find one who can help them legitimately claim the credit.

Questions to ask potential providers include:

- What is your process for verifying ERC eligibility?

- Do you prepare and sign the returns to claim the credit?

- What is your experience with preparing and filing ERC claims?

- What is your fee structure for claiming the ERC?

- Will you represent the client in the event of an IRS audit on their ERC claim?

- Will you also assist with amending business and/or personal income tax returns in coordination with the ERC as needed?

What's most unfortunate about the way that so many ERC vendors have treated the credit as a gold rush to be mined is that, at its core, the ERC is a legitimate credit that could, for some businesses and their owners, make the difference between shutting down and continuing to operate. But with the IRS flooded with questionable applications, it's all the more difficult for businesses with legitimate ERC claims to work their way through understanding their eligibility and claiming the credit itself.

Which is ultimately why financial advisors can be valuable as trusted partners in giving guidance to clients around the ERC. For clients who can claim the credit, the advisors' role in helping determine eligibility and recommending an expert tax professional to claim the credit has real, hard-dollar benefits for the client. But even for clients who don't end up claiming the ERC, helping them avoid fly-by-night ERC vendors – and attendant IRS headaches – is plenty valuable in its own right!

Leave a Reply